444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US protective coatings market represents a dynamic and rapidly evolving sector within the broader coatings industry, driven by increasing demand for advanced surface protection solutions across multiple industrial applications. Protective coatings serve as critical barriers against corrosion, weathering, chemical exposure, and mechanical wear, making them essential components in infrastructure maintenance, industrial operations, and manufacturing processes. The market encompasses a diverse range of coating technologies, including epoxy, polyurethane, acrylic, alkyd, and specialized formulations designed for specific environmental challenges.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 5.2% over the forecast period. This expansion is primarily attributed to increasing infrastructure investments, stringent environmental regulations, and growing awareness of asset protection benefits. The market serves various end-use industries, including oil and gas, marine, automotive, aerospace, construction, and power generation, each requiring specialized coating solutions tailored to their unique operational requirements.

Regional distribution shows significant concentration in industrial hubs across Texas, Louisiana, California, and the Gulf Coast region, where petrochemical facilities and marine infrastructure drive substantial demand. The market’s evolution reflects broader trends toward sustainability, with eco-friendly formulations capturing approximately 35% market share as manufacturers respond to environmental compliance requirements and customer preferences for low-VOC solutions.

The US protective coatings market refers to the comprehensive ecosystem of specialized coating products, application services, and related technologies designed to protect surfaces from environmental degradation, chemical attack, and physical damage across industrial and commercial applications. Protective coatings function as engineered barriers that extend asset lifespan, reduce maintenance costs, and ensure operational safety in challenging environments.

These coating systems encompass various chemical formulations, including solvent-based, water-based, and powder coatings, each engineered to address specific protection requirements. The market includes primer coatings for surface preparation, intermediate coats for enhanced barrier properties, and topcoats for final protection and aesthetic appeal. Advanced formulations incorporate nanotechnology, smart materials, and multi-functional properties that provide superior performance compared to traditional coating solutions.

Market participants include raw material suppliers, coating manufacturers, application contractors, and end-users across diverse industrial sectors. The ecosystem supports a complex supply chain involving specialty chemicals, equipment manufacturers, testing laboratories, and technical service providers who collectively ensure optimal coating performance and application quality.

The US protective coatings market demonstrates strong growth momentum driven by infrastructure modernization, industrial expansion, and increasing focus on asset protection strategies. Key market drivers include rising maintenance costs, environmental regulations, and technological advancements in coating formulations that deliver enhanced performance characteristics. The sector benefits from robust demand across multiple end-use industries, with oil and gas applications representing the largest market segment.

Technological innovation continues to reshape market dynamics, with manufacturers investing heavily in research and development to create next-generation coating solutions. Smart coatings with self-healing properties, anti-microbial characteristics, and real-time monitoring capabilities are gaining traction, representing approximately 12% of new product introductions. The market also witnesses increasing adoption of sustainable formulations, driven by regulatory requirements and corporate sustainability initiatives.

Competitive landscape features a mix of global chemical companies, specialized coating manufacturers, and regional players competing on innovation, quality, and service capabilities. Market consolidation through strategic acquisitions and partnerships continues to shape industry structure, enabling companies to expand product portfolios and geographic reach while achieving operational synergies.

Market segmentation reveals distinct patterns in product adoption and application preferences across different industrial sectors. The following key insights highlight critical market characteristics:

Market maturity varies significantly across application segments, with traditional industrial coatings showing steady demand while specialty applications experience rapid growth. Customer preferences increasingly favor comprehensive coating systems that provide multiple protection benefits, driving demand for multi-functional formulations that address corrosion, UV protection, and chemical resistance simultaneously.

Infrastructure aging across the United States creates substantial demand for protective coating solutions as facility owners seek cost-effective methods to extend asset lifespan and maintain operational efficiency. Corrosion costs in industrial facilities drive approximately 40% of coating demand, as companies recognize the economic benefits of proactive protection strategies compared to reactive maintenance approaches.

Environmental regulations continue to influence market dynamics, with stricter emissions standards and workplace safety requirements driving adoption of compliant coating formulations. Regulatory compliance necessitates investment in advanced coating technologies that meet or exceed environmental performance standards while maintaining protective effectiveness. The shift toward sustainable manufacturing practices creates opportunities for eco-friendly coating solutions that deliver comparable performance to traditional formulations.

Industrial expansion in key sectors including renewable energy, petrochemicals, and transportation infrastructure generates sustained demand for specialized protective coatings. Energy sector growth particularly drives demand for high-performance coatings capable of withstanding extreme operating conditions in offshore platforms, refineries, and pipeline systems. Additionally, increasing focus on preventive maintenance strategies across industries supports market growth as companies prioritize asset protection over reactive repair approaches.

Technological advancement in coating formulations enables development of superior protection solutions that offer enhanced durability, faster application times, and improved environmental compatibility. Innovation investments by major manufacturers continue to expand the performance envelope of protective coatings, creating new application opportunities and market segments.

High initial costs associated with premium protective coating systems can limit adoption, particularly among smaller industrial operators with constrained capital budgets. Cost considerations often lead customers to select lower-performance alternatives that may require more frequent reapplication, ultimately increasing total cost of ownership. The complexity of coating system selection and application requires specialized expertise that may not be readily available in all markets.

Skilled labor shortage in coating application services constrains market growth, as proper surface preparation and coating application require trained technicians with specialized knowledge. Application quality directly impacts coating performance, making skilled labor availability a critical factor in market development. Training and certification programs require significant investment and time, creating barriers to rapid workforce expansion.

Raw material price volatility affects coating manufacturer profitability and pricing strategies, particularly for petroleum-derived components used in many coating formulations. Supply chain disruptions can impact product availability and lead times, affecting customer satisfaction and market growth. Additionally, environmental regulations on raw materials may limit formulation options or increase production costs.

Economic uncertainty can delay infrastructure projects and maintenance activities, reducing demand for protective coatings across multiple end-use sectors. Budget constraints in both public and private sectors may defer coating projects, creating cyclical demand patterns that challenge market stability and growth planning.

Infrastructure modernization initiatives across the United States present significant growth opportunities for protective coating manufacturers and applicators. Government investment in transportation infrastructure, water treatment facilities, and energy systems creates sustained demand for high-performance coating solutions. The focus on infrastructure resilience and climate adaptation drives requirements for advanced coatings capable of withstanding extreme weather conditions and environmental stresses.

Renewable energy expansion generates new market opportunities, particularly in wind power and solar installations where protective coatings play critical roles in equipment longevity and performance maintenance. Offshore wind development represents a particularly attractive segment, requiring specialized marine-grade coatings with superior corrosion resistance and durability characteristics. The growing emphasis on energy storage infrastructure also creates demand for protective coatings in battery facilities and grid-scale storage systems.

Smart coating technologies offer substantial growth potential as industrial customers seek advanced monitoring and maintenance solutions. Digital integration capabilities that provide real-time coating condition assessment and predictive maintenance insights represent emerging market opportunities. These technologies enable proactive maintenance strategies that optimize coating performance and reduce total cost of ownership.

Sustainability initiatives drive demand for environmentally friendly coating formulations that meet performance requirements while reducing environmental impact. Green building standards and corporate sustainability commitments create market opportunities for low-VOC, bio-based, and recyclable coating solutions. The circular economy trend also supports development of coating systems designed for easy removal and recycling at end of life.

Supply chain integration continues to evolve as coating manufacturers seek to optimize raw material sourcing, production efficiency, and distribution networks. Vertical integration strategies enable better quality control and cost management while ensuring consistent product availability. Strategic partnerships between coating manufacturers and application contractors create comprehensive service offerings that address customer needs for turnkey protection solutions.

Technology convergence drives innovation in coating formulations, with manufacturers incorporating nanotechnology, advanced polymers, and smart materials to enhance performance characteristics. Research collaboration between coating companies, academic institutions, and end-users accelerates development of next-generation solutions tailored to specific application requirements. The integration of digital technologies with coating systems enables new service models and value propositions.

Customer expectations continue to evolve toward comprehensive solutions that provide multiple benefits beyond basic protection. Performance requirements increasingly emphasize durability, environmental compliance, and ease of application while maintaining cost-effectiveness. Customers also demand greater technical support and application expertise from coating suppliers, driving service-oriented business models.

Regulatory landscape influences market dynamics through environmental standards, workplace safety requirements, and product certification processes. Compliance costs affect product development investments and market entry strategies, while regulatory changes can create opportunities for innovative formulations that exceed standard requirements. The trend toward harmonized international standards facilitates market expansion for compliant coating systems.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, coating manufacturers, application contractors, and end-users across diverse market segments. Survey data collection from key stakeholders provides quantitative insights into market trends, purchasing behavior, and future requirements.

Secondary research encompasses analysis of industry publications, regulatory filings, patent databases, and technical literature to identify market trends and technological developments. Market data validation through multiple independent sources ensures accuracy and reliability of market size estimates, growth projections, and competitive landscape analysis. Trade association data and industry statistics provide additional validation for market assessments.

Expert consultation with industry specialists, technical experts, and market analysts provides qualitative insights into market dynamics and future trends. Focus group discussions with end-users reveal application-specific requirements and emerging needs that drive product development priorities. Technical advisory panels contribute specialized knowledge on coating performance, application methods, and industry best practices.

Data triangulation methods ensure consistency and accuracy across multiple information sources, while statistical analysis techniques identify significant trends and correlations within market data. Forecasting models incorporate historical trends, current market conditions, and identified growth drivers to project future market development scenarios.

Gulf Coast region dominates the US protective coatings market, accounting for approximately 42% of total demand due to concentrated petrochemical infrastructure and marine applications. Texas and Louisiana represent the largest state markets, driven by extensive refinery operations, offshore platforms, and chemical processing facilities that require specialized high-performance coatings. The region’s harsh environmental conditions and corrosive atmospheres create sustained demand for premium protective coating solutions.

West Coast markets show strong growth in aerospace and marine applications, with California leading demand for advanced coating technologies in defense and commercial aviation sectors. Pacific Northwest demonstrates increasing adoption of protective coatings in renewable energy applications, particularly wind power installations and hydroelectric facilities. The region’s environmental consciousness drives preference for sustainable coating formulations.

Northeast corridor exhibits steady demand driven by infrastructure maintenance and industrial applications, with particular strength in transportation and power generation sectors. Manufacturing concentration in the Great Lakes region creates opportunities for industrial protective coatings, while harsh winter conditions drive demand for weather-resistant formulations. The region’s aging infrastructure requires extensive coating maintenance and replacement programs.

Southeast markets benefit from growing industrial development and port infrastructure expansion, creating demand for marine and industrial protective coatings. Regional growth in automotive manufacturing and aerospace industries supports demand for specialized coating applications. According to MarkWide Research analysis, the Southeast region shows the highest growth potential, with projected expansion of 6.8% annually over the forecast period.

Market leadership is characterized by a combination of global chemical companies and specialized coating manufacturers competing on innovation, quality, and service capabilities. The competitive landscape features both established players with comprehensive product portfolios and emerging companies focused on niche applications or innovative technologies.

Competitive strategies emphasize product innovation, technical service excellence, and strategic partnerships to differentiate offerings and capture market share. Market consolidation through acquisitions enables companies to expand geographic reach, enhance product portfolios, and achieve operational synergies. The competitive environment drives continuous investment in research and development to maintain technological leadership.

Service integration becomes increasingly important as customers seek comprehensive solutions that include product supply, application services, and ongoing technical support. Digital capabilities provide competitive advantages through enhanced customer engagement, technical support, and predictive maintenance services.

Technology segmentation reveals distinct market preferences based on performance requirements and application conditions. Epoxy coatings maintain the largest market share due to excellent adhesion, chemical resistance, and versatility across multiple applications. Polyurethane coatings show strong growth in applications requiring UV resistance and aesthetic appeal, while acrylic formulations gain traction in architectural and infrastructure applications.

By Technology:

Application segmentation demonstrates the diverse end-use requirements driving market demand across multiple industrial sectors. Oil and gas applications represent the largest segment, requiring specialized coatings for extreme environments and chemical exposure. Marine applications show consistent growth driven by shipping industry expansion and offshore infrastructure development.

By Application:

High-performance coatings category demonstrates strongest growth potential, driven by increasing demand for solutions that provide superior protection in extreme environments. Premium formulations incorporating advanced polymer technologies and specialized additives command higher prices while delivering enhanced durability and performance characteristics. This category benefits from growing customer recognition of total cost of ownership advantages.

Eco-friendly coatings represent a rapidly expanding category, with waterborne and low-VOC formulations gaining market acceptance across multiple applications. Sustainable solutions address regulatory requirements while meeting performance standards, creating opportunities for manufacturers with advanced green chemistry capabilities. The category shows particular strength in architectural and infrastructure applications where environmental compliance is prioritized.

Smart coatings emerge as a promising category with integrated monitoring and self-healing capabilities that provide enhanced value propositions. Intelligent formulations incorporate sensors, indicators, or responsive materials that enable real-time performance assessment and predictive maintenance strategies. While currently representing a small market segment, smart coatings show significant growth potential as digital integration becomes more prevalent.

Specialty application coatings address specific industry requirements with customized formulations and performance characteristics. Niche solutions for aerospace, nuclear, and food processing applications command premium pricing while requiring specialized technical expertise and certification processes. This category benefits from limited competition and strong customer relationships built on technical performance and regulatory compliance.

Asset protection represents the primary benefit for end-users, with protective coatings extending equipment lifespan and reducing maintenance costs across industrial applications. Corrosion prevention delivers substantial economic benefits by avoiding costly repairs and unplanned downtime in critical infrastructure and industrial facilities. Studies indicate that proper coating application can extend asset life by 150-200% compared to unprotected surfaces.

Regulatory compliance benefits enable companies to meet environmental and safety standards while maintaining operational efficiency. Compliant formulations reduce regulatory risk and support corporate sustainability initiatives, providing competitive advantages in environmentally conscious markets. The ability to demonstrate environmental responsibility through coating selection supports corporate reputation and stakeholder relations.

Operational efficiency improvements result from reduced maintenance requirements, extended service intervals, and improved equipment reliability. Productivity gains from minimized downtime and maintenance activities provide significant economic benefits that justify coating investment costs. Advanced coating systems also enable operation in more challenging environments, expanding operational capabilities.

Innovation opportunities for manufacturers include development of next-generation coating technologies that address emerging market needs and regulatory requirements. Technology leadership provides competitive advantages and premium pricing opportunities while establishing strong customer relationships based on performance excellence. Investment in research and development creates barriers to entry and sustainable competitive positions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration continues to reshape market dynamics as manufacturers develop environmentally friendly formulations that meet performance requirements while reducing environmental impact. Bio-based coatings incorporating renewable raw materials gain market acceptance, particularly in applications where environmental considerations are prioritized. The trend toward circular economy principles drives development of coatings designed for easy removal and recycling.

Digital transformation influences coating technologies through integration of smart materials and monitoring capabilities that provide real-time performance data. IoT integration enables predictive maintenance strategies that optimize coating performance and reduce total cost of ownership. Digital color matching and application monitoring systems improve quality control and customer satisfaction.

Performance enhancement drives continuous innovation in coating formulations, with manufacturers developing solutions that provide multiple protection benefits in single applications. Multi-functional coatings that combine corrosion protection, UV resistance, and antimicrobial properties address diverse customer requirements while simplifying application processes. Advanced polymer technologies enable superior durability and performance characteristics.

Service integration becomes increasingly important as customers seek comprehensive solutions that include product supply, application services, and ongoing technical support. Turnkey solutions that combine coating products with professional application services provide competitive advantages and enhanced customer relationships. According to MWR analysis, service-integrated offerings show 25% higher customer retention rates compared to product-only approaches.

Technology advancement in nanotechnology applications enables development of coatings with enhanced barrier properties and self-healing capabilities. Nanoparticle integration improves corrosion resistance, UV protection, and mechanical properties while maintaining application characteristics. These developments create opportunities for premium-priced solutions that deliver superior performance in demanding applications.

Strategic partnerships between coating manufacturers and end-users accelerate development of application-specific solutions tailored to unique operational requirements. Collaborative innovation programs enable faster product development cycles and ensure solutions meet real-world performance needs. These partnerships also facilitate market penetration and customer relationship development.

Manufacturing optimization through process improvements and automation reduces production costs while improving product quality and consistency. Lean manufacturing principles and digital process control systems enhance operational efficiency and enable competitive pricing strategies. Investment in modern production facilities supports capacity expansion and technology advancement.

Regulatory developments continue to influence product formulations and market strategies, with new environmental standards driving innovation in compliant coating technologies. Proactive compliance strategies enable manufacturers to anticipate regulatory changes and develop solutions that exceed current requirements. These efforts provide competitive advantages and support market expansion opportunities.

Investment priorities should focus on sustainable coating technologies that address environmental regulations while maintaining performance standards. Research and development investments in bio-based formulations and low-VOC solutions position companies for long-term market success as regulatory requirements become more stringent. Companies should also prioritize development of smart coating technologies that provide enhanced value propositions through monitoring and predictive capabilities.

Market expansion strategies should emphasize service integration and technical support capabilities that differentiate offerings from commodity competitors. Value-added services including application training, technical consulting, and performance monitoring create competitive advantages and support premium pricing strategies. Geographic expansion into high-growth regions should prioritize markets with strong industrial development and infrastructure investment.

Partnership development with key end-users and application contractors enables better understanding of market requirements and accelerates product development cycles. Strategic alliances with complementary technology providers can enhance product offerings and create comprehensive solutions that address diverse customer needs. These partnerships also facilitate market penetration and customer relationship development.

Digital transformation initiatives should focus on customer engagement platforms, technical support systems, and predictive maintenance capabilities that enhance customer value and retention. Technology integration with coating systems enables new service models and revenue streams while providing competitive differentiation. Investment in digital capabilities supports long-term market positioning and customer relationship management.

Market growth prospects remain positive, driven by infrastructure investment, industrial expansion, and increasing focus on asset protection strategies. Long-term trends favor high-performance and sustainable coating solutions that address evolving customer requirements and regulatory standards. The market is expected to maintain steady growth with increasing emphasis on technology innovation and service integration.

Technology evolution will continue to drive market development through advanced formulations, smart materials, and digital integration capabilities. Next-generation coatings incorporating artificial intelligence, self-healing properties, and real-time monitoring will create new market segments and value propositions. These developments support premium pricing and competitive differentiation strategies.

Sustainability requirements will increasingly influence product development and market strategies, with environmentally friendly formulations becoming standard rather than premium offerings. Circular economy principles will drive development of coatings designed for recyclability and minimal environmental impact throughout their lifecycle. Companies that proactively address sustainability requirements will gain competitive advantages.

Market consolidation is expected to continue as companies seek to achieve scale advantages, expand geographic reach, and enhance technological capabilities through strategic acquisitions. Industry structure will likely evolve toward fewer, larger players with comprehensive product portfolios and global service capabilities. MarkWide Research projects that market concentration will increase, with the top five players controlling approximately 55% market share by the end of the forecast period.

The US protective coatings market demonstrates strong fundamentals and positive growth prospects driven by infrastructure investment, industrial expansion, and increasing recognition of asset protection benefits. Market dynamics favor companies that combine technological innovation with comprehensive service capabilities and strong customer relationships. The sector’s evolution toward sustainable, high-performance solutions creates opportunities for market leaders while challenging traditional approaches.

Success factors in this market include continuous innovation, regulatory compliance, technical expertise, and service integration capabilities that provide comprehensive customer solutions. Companies that invest in advanced coating technologies, sustainable formulations, and digital capabilities will be best positioned to capture growth opportunities and maintain competitive advantages. The market’s complexity and technical requirements create barriers to entry that protect established players while rewarding innovation and excellence.

Future market development will be shaped by infrastructure modernization, environmental regulations, and technological advancement in coating formulations and application methods. Strategic positioning requires balancing investment in core technologies with expansion into emerging segments such as smart coatings and renewable energy applications. The US protective coatings market offers substantial opportunities for companies that can effectively navigate evolving customer requirements, regulatory standards, and competitive dynamics while delivering superior value propositions to industrial customers seeking reliable asset protection solutions.

What is Protective Coatings?

Protective coatings are specialized materials applied to surfaces to protect them from corrosion, abrasion, and chemical damage. They are commonly used in industries such as construction, automotive, and marine to enhance durability and extend the lifespan of various substrates.

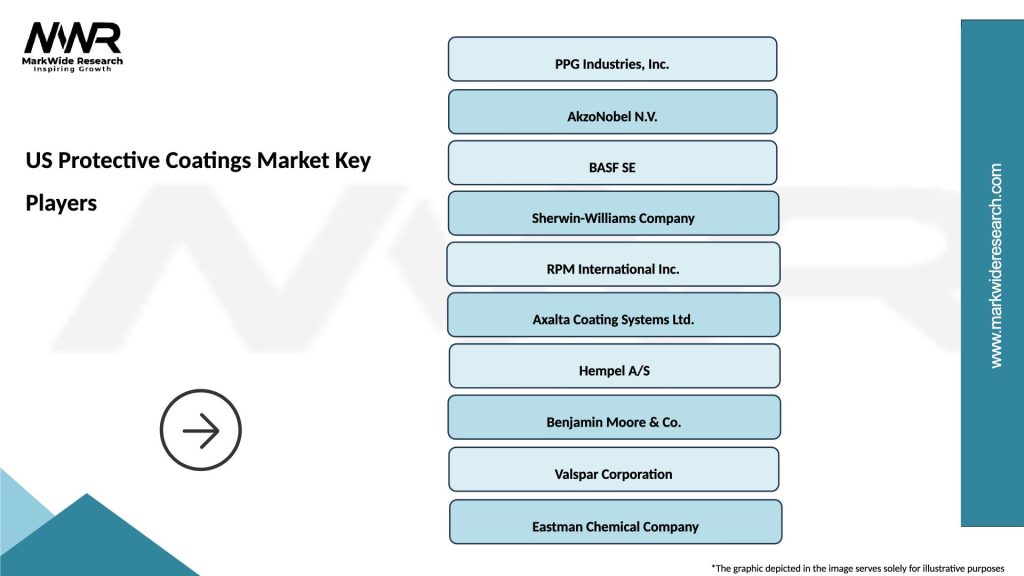

What are the key players in the US Protective Coatings Market?

Key players in the US Protective Coatings Market include PPG Industries, Sherwin-Williams, AkzoNobel, and BASF. These companies are known for their innovative products and extensive distribution networks, catering to various sectors such as industrial, automotive, and architectural applications.

What are the growth factors driving the US Protective Coatings Market?

The growth of the US Protective Coatings Market is driven by increasing demand from the construction and automotive industries, as well as the need for environmentally friendly coatings. Additionally, advancements in technology and the rising focus on infrastructure development contribute to market expansion.

What challenges does the US Protective Coatings Market face?

The US Protective Coatings Market faces challenges such as stringent environmental regulations and the volatility of raw material prices. These factors can impact production costs and limit the availability of certain coating materials, affecting overall market growth.

What opportunities exist in the US Protective Coatings Market?

Opportunities in the US Protective Coatings Market include the development of bio-based and sustainable coatings, as well as the increasing adoption of smart coatings with self-healing properties. These innovations can cater to evolving consumer preferences and regulatory requirements.

What trends are shaping the US Protective Coatings Market?

Trends in the US Protective Coatings Market include the growing demand for high-performance coatings and the shift towards eco-friendly products. Additionally, the integration of nanotechnology in coatings is gaining traction, enhancing their protective properties and functionality.

US Protective Coatings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Epoxy, Polyurethane, Acrylic, Alkyd |

| Application | Industrial, Marine, Automotive, Aerospace |

| End User | Construction, Manufacturing, Oil & Gas, Transportation |

| Technology | Waterborne, Solventborne, Powder Coating, UV-Cured |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Protective Coatings Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at