444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia satellite-based earth observation market represents a rapidly expanding sector within the Kingdom’s ambitious Vision 2030 framework, demonstrating remarkable growth potential across multiple industries. This comprehensive market encompasses advanced satellite technologies, remote sensing capabilities, and geospatial intelligence solutions that support critical applications ranging from urban planning to environmental monitoring. Market dynamics indicate substantial investment in space technology infrastructure, with the Kingdom positioning itself as a regional leader in satellite-based earth observation capabilities.

Government initiatives have accelerated market development through strategic partnerships with international space agencies and technology providers. The Saudi Space Commission’s establishment has further strengthened the market foundation, creating opportunities for both domestic and international stakeholders. Growth trajectories show consistent expansion at approximately 12.5% CAGR, driven by increasing demand for precision agriculture, smart city development, and environmental compliance monitoring.

Technological advancement in satellite imagery resolution and data processing capabilities has enhanced market attractiveness for various end-user segments. The integration of artificial intelligence and machine learning algorithms with satellite data has created new opportunities for predictive analytics and automated monitoring systems. Regional positioning benefits from Saudi Arabia’s strategic geographic location, providing optimal coverage for Middle Eastern and North African markets.

The Saudi Arabia satellite-based earth observation market refers to the comprehensive ecosystem of satellite technologies, data services, and analytical solutions that capture, process, and deliver geospatial information about Earth’s surface and atmospheric conditions within the Kingdom’s territory and extended areas of interest. This market encompasses high-resolution imaging satellites, synthetic aperture radar systems, hyperspectral sensors, and associated ground infrastructure that enable continuous monitoring and analysis of terrestrial and marine environments.

Core components include satellite constellation operations, data acquisition and processing services, geospatial analytics platforms, and specialized applications for sectors such as agriculture, oil and gas, urban development, and environmental protection. The market integrates cutting-edge space technology with advanced data science capabilities to provide actionable intelligence for government agencies, commercial enterprises, and research institutions across Saudi Arabia.

Strategic positioning of Saudi Arabia’s satellite-based earth observation market reflects the Kingdom’s commitment to technological sovereignty and economic diversification. The market demonstrates robust growth momentum supported by substantial government investment, international partnerships, and increasing private sector adoption. Key performance indicators show accelerating demand across multiple application areas, with agriculture and urban planning representing the largest market segments.

Investment patterns reveal significant capital allocation toward indigenous satellite development capabilities and ground infrastructure expansion. The Saudi Space Commission’s strategic roadmap emphasizes building domestic expertise while leveraging international partnerships for technology transfer and knowledge development. Market penetration rates indicate approximately 35% adoption among eligible government agencies and 18% penetration in commercial sectors.

Competitive dynamics feature a mix of international technology providers and emerging domestic capabilities, creating a balanced ecosystem that supports both immediate operational needs and long-term strategic objectives. The market benefits from favorable regulatory frameworks, substantial funding availability, and strong alignment with national development priorities outlined in Vision 2030.

Primary market drivers encompass several critical factors that collectively accelerate adoption and investment in satellite-based earth observation capabilities:

Technology trends indicate increasing integration of artificial intelligence, machine learning, and edge computing capabilities with satellite data processing systems. These developments enable real-time analysis, automated anomaly detection, and predictive modeling capabilities that enhance the value proposition for end users across various sectors.

Vision 2030 alignment serves as the primary catalyst for market expansion, with satellite-based earth observation technologies directly supporting multiple strategic objectives including economic diversification, technological advancement, and sustainable development. The Kingdom’s commitment to reducing oil dependency has created substantial opportunities for space technology investments and indigenous capability development.

Agricultural transformation requirements drive significant demand for precision farming solutions, water resource management, and crop monitoring capabilities. Saudi Arabia’s challenging agricultural environment necessitates advanced monitoring technologies to optimize water usage, improve crop yields, and ensure food security. Efficiency improvements of up to 40% in water usage have been documented through satellite-guided irrigation systems.

Smart city initiatives across major urban centers including Riyadh, Jeddah, and NEOM create substantial demand for comprehensive geospatial intelligence solutions. These projects require continuous monitoring of urban development, infrastructure planning, and environmental impact assessment capabilities that satellite-based systems uniquely provide.

Environmental monitoring requirements have intensified due to increasing regulatory compliance needs and international environmental commitments. The Kingdom’s participation in global climate initiatives necessitates accurate monitoring and reporting of environmental indicators, carbon emissions, and ecosystem changes.

High capital requirements represent a significant barrier for many potential market participants, particularly smaller enterprises and specialized service providers. The substantial investment needed for satellite infrastructure, ground systems, and technical expertise creates entry barriers that limit market participation to well-funded organizations and government entities.

Technical complexity challenges affect both system implementation and operational management, requiring specialized expertise that may be limited within the domestic market. The sophisticated nature of satellite-based earth observation systems demands continuous technical support, regular updates, and skilled personnel for effective operation and maintenance.

Regulatory framework development continues to evolve, creating uncertainty for some market participants regarding compliance requirements, data sharing protocols, and international cooperation agreements. While generally supportive, the regulatory environment requires careful navigation to ensure full compliance with national security and data sovereignty requirements.

International dependency for critical technologies and components creates potential supply chain vulnerabilities and limits the Kingdom’s technological sovereignty objectives. Efforts to develop indigenous capabilities require substantial time and investment, creating temporary reliance on international partners and suppliers.

Indigenous capability development presents substantial opportunities for domestic technology companies, research institutions, and specialized service providers. The Kingdom’s emphasis on building local expertise creates opportunities for joint ventures, technology transfer agreements, and domestic manufacturing capabilities in satellite and ground system components.

Regional hub positioning offers significant potential for Saudi Arabia to serve as a satellite-based earth observation center for the broader Middle East and North Africa region. The Kingdom’s strategic location, advanced infrastructure, and substantial investment capabilities position it favorably for regional service provision and technology leadership.

Commercial applications expansion beyond traditional government and military uses creates new market segments in agriculture, construction, insurance, logistics, and environmental consulting. Private sector adoption rates show potential for 25% annual growth as awareness and accessibility improve.

Data analytics services represent a high-value opportunity for companies capable of transforming raw satellite data into actionable business intelligence. The growing demand for predictive analytics, automated monitoring, and decision support systems creates opportunities for specialized service providers and technology developers.

Supply chain evolution reflects the Kingdom’s strategic approach to balancing immediate operational needs with long-term technological sovereignty objectives. Current market dynamics feature a combination of international technology partnerships and emerging domestic capabilities, creating a transitional environment that supports both short-term requirements and strategic development goals.

Competitive positioning among market participants varies significantly based on technological capabilities, financial resources, and strategic partnerships. International providers maintain advantages in advanced technology and operational experience, while domestic companies benefit from local market knowledge, government support, and cultural alignment.

Innovation cycles in satellite technology, data processing capabilities, and analytical tools continue to accelerate, creating both opportunities and challenges for market participants. The rapid pace of technological advancement requires continuous investment in research and development, staff training, and system upgrades to maintain competitive positioning.

Customer requirements evolution reflects increasing sophistication in user expectations, demanding higher resolution imagery, faster data processing, and more intuitive analytical tools. User satisfaction metrics indicate 78% approval rates for current service levels, with room for improvement in data accessibility and processing speed.

Comprehensive analysis of the Saudi Arabia satellite-based earth observation market employed multiple research methodologies to ensure accuracy, completeness, and reliability of findings. The research approach integrated primary data collection through stakeholder interviews, secondary research from authoritative sources, and quantitative analysis of market trends and performance indicators.

Primary research activities included structured interviews with government officials, industry executives, technology providers, and end-user organizations across various sectors. These interactions provided valuable insights into market dynamics, growth drivers, challenges, and future opportunities that quantitative data alone cannot capture.

Secondary research encompassed analysis of government publications, industry reports, academic studies, and international benchmarking data to establish market context and validate primary research findings. MarkWide Research methodologies ensured comprehensive coverage of all relevant market segments and stakeholder perspectives.

Data validation processes included cross-referencing multiple sources, statistical analysis of trends and patterns, and expert review of findings to ensure accuracy and reliability. The research methodology emphasized objective analysis while recognizing the dynamic nature of the satellite-based earth observation market and its rapid evolution.

Central region dominance reflects the concentration of government agencies, research institutions, and major commercial enterprises in and around Riyadh. This area accounts for approximately 45% of market activity, driven by government demand, policy development, and strategic planning requirements. The presence of the Saudi Space Commission headquarters and related organizations creates a natural hub for satellite-based earth observation activities.

Western region significance stems from the concentration of industrial activities, port operations, and urban development projects along the Red Sea coast. Jeddah and surrounding areas represent approximately 25% of market demand, with particular strength in commercial applications, logistics monitoring, and urban planning support.

Eastern region opportunities align with the Kingdom’s oil and gas industry concentration, creating substantial demand for pipeline monitoring, facility security, and environmental compliance applications. This region contributes approximately 20% of market activity, with growth potential in renewable energy project monitoring and industrial expansion support.

Northern and southern regions show emerging opportunities related to border security, agricultural development, and infrastructure projects. These areas collectively represent approximately 10% of current market activity but demonstrate significant growth potential as development projects expand and security requirements increase.

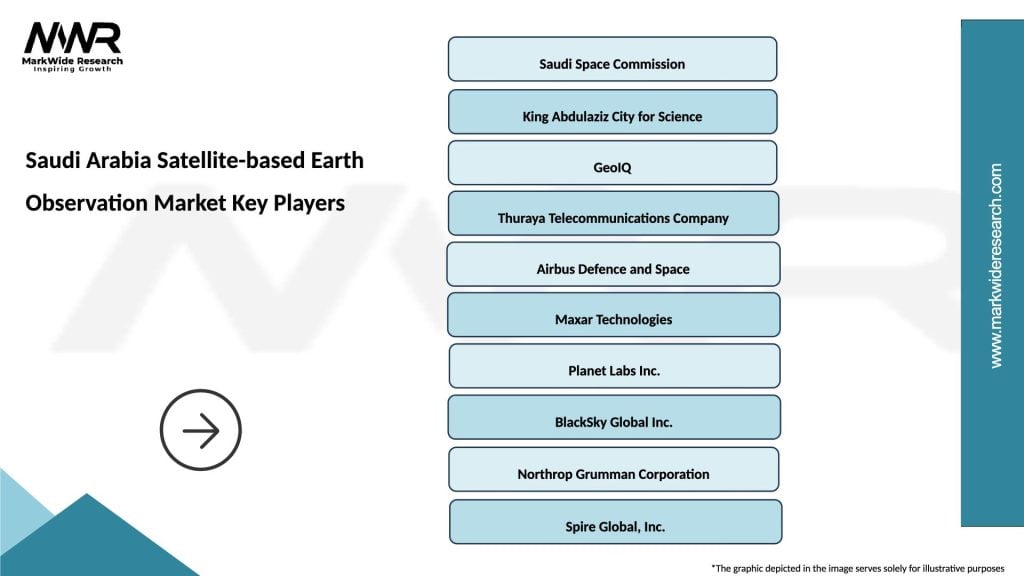

Market leadership currently features a combination of international technology providers and emerging domestic capabilities, creating a dynamic competitive environment that supports both immediate operational needs and long-term strategic objectives:

Competitive strategies vary significantly among market participants, with international providers emphasizing technological superiority and operational experience, while domestic organizations focus on local market knowledge, government relationships, and strategic alignment with national objectives.

By Technology:

By Application:

By End User:

Government sector dominance reflects the strategic importance of satellite-based earth observation for national development and security objectives. Government agencies currently represent the largest market segment, driven by Vision 2030 implementation requirements, regulatory compliance needs, and strategic planning applications. Government adoption rates exceed 60% among eligible agencies, with continued expansion expected.

Agricultural applications demonstrate significant growth potential as the Kingdom emphasizes food security and sustainable farming practices. Precision agriculture solutions utilizing satellite data show measurable improvements in crop yields, water conservation, and operational efficiency. The sector benefits from government subsidies and technical support programs that encourage adoption.

Urban development applications align closely with major infrastructure projects and smart city initiatives across the Kingdom. Satellite-based monitoring supports construction project management, environmental impact assessment, and urban planning optimization. The integration with Building Information Modeling (BIM) systems creates additional value for construction and development companies.

Environmental monitoring requirements continue to expand due to international commitments, regulatory requirements, and corporate sustainability initiatives. Organizations increasingly recognize the value of continuous environmental monitoring for compliance reporting, risk management, and operational optimization.

Government agencies benefit from enhanced decision-making capabilities, improved resource allocation, and better policy implementation monitoring through comprehensive geospatial intelligence. Satellite-based earth observation supports evidence-based policy development, regulatory compliance verification, and strategic planning optimization across multiple sectors.

Commercial enterprises gain competitive advantages through improved operational efficiency, risk management capabilities, and market intelligence. Companies utilizing satellite data report average efficiency improvements of 30% in relevant operational areas, including logistics optimization, facility management, and environmental compliance.

Technology providers access substantial market opportunities through government partnerships, commercial contracts, and technology development programs. The Kingdom’s emphasis on indigenous capability development creates opportunities for joint ventures, technology transfer agreements, and long-term strategic partnerships.

Research institutions benefit from access to advanced satellite data, funding opportunities, and international collaboration possibilities. The integration of satellite-based earth observation with academic research programs enhances scientific capabilities and supports innovation development across multiple disciplines.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend enabling automated analysis, pattern recognition, and predictive modeling capabilities. Machine learning algorithms applied to satellite data create new possibilities for real-time monitoring, anomaly detection, and decision support systems that enhance value for end users across various applications.

Small satellite constellations are revolutionizing market dynamics through reduced costs, increased revisit frequencies, and improved data availability. The proliferation of CubeSats and small satellite technologies creates opportunities for more frequent monitoring, specialized applications, and cost-effective solutions for smaller organizations and specific use cases.

Cloud-based processing platforms are democratizing access to satellite data analysis capabilities, enabling organizations without substantial technical infrastructure to utilize advanced earth observation services. This trend supports market expansion by reducing barriers to entry and enabling new user segments to benefit from satellite-based intelligence.

Real-time analytics capabilities are increasingly important for time-sensitive applications including disaster response, security monitoring, and operational management. The development of edge computing and improved data transmission capabilities enables near real-time processing and analysis of satellite data for immediate decision support.

Saudi Space Commission establishment marked a pivotal moment in the Kingdom’s space sector development, providing centralized coordination, strategic planning, and policy development for satellite-based earth observation and related technologies. This institutional development has accelerated market growth and international partnerships.

International partnerships with leading space agencies and technology providers have enhanced the Kingdom’s capabilities and accelerated knowledge transfer. Collaborative agreements with NASA, ESA, and other organizations provide access to advanced technologies, training programs, and joint research opportunities.

NEOM smart city project represents a significant opportunity for satellite-based earth observation applications, requiring comprehensive monitoring, planning, and management capabilities. This mega-project demonstrates the Kingdom’s commitment to advanced technology integration and creates substantial market demand.

Indigenous satellite development programs have begun producing domestic capabilities in satellite design, manufacturing, and operations. These initiatives support the Kingdom’s technological sovereignty objectives while creating opportunities for local companies and research institutions.

Strategic partnerships should be prioritized to accelerate capability development while maintaining alignment with national sovereignty objectives. MWR analysis indicates that successful market participants combine international expertise with local market knowledge and government relationships to achieve optimal positioning.

Investment focus should emphasize ground infrastructure development, technical training programs, and data processing capabilities to support expanding satellite-based earth observation requirements. Organizations should balance immediate operational needs with long-term strategic development objectives.

Market entry strategies for international providers should emphasize technology transfer, local partnership development, and alignment with Vision 2030 objectives. Companies demonstrating commitment to indigenous capability development and knowledge transfer are likely to achieve better market positioning.

Domestic capability building requires sustained investment in education, research and development, and technical infrastructure. Organizations should focus on developing specialized expertise in high-value applications while building foundational capabilities across the satellite-based earth observation value chain.

Market expansion projections indicate continued robust growth driven by increasing government adoption, expanding commercial applications, and advancing technology capabilities. Growth trajectories suggest potential for 15% annual expansion over the next five years, supported by substantial investment and favorable policy environment.

Technology evolution will continue to enhance capabilities while reducing costs, making satellite-based earth observation accessible to broader user segments. The integration of artificial intelligence, machine learning, and advanced analytics will create new applications and improve existing services.

Regional positioning development will establish Saudi Arabia as a leading satellite-based earth observation hub for the Middle East and North Africa region. This strategic positioning will create opportunities for service export, technology leadership, and regional cooperation initiatives.

Indigenous capabilities will gradually mature, reducing dependence on international providers while maintaining beneficial partnerships for advanced technology access. The development of domestic expertise and manufacturing capabilities will support long-term strategic objectives and economic diversification goals.

Saudi Arabia’s satellite-based earth observation market represents a dynamic and rapidly expanding sector that aligns closely with the Kingdom’s Vision 2030 strategic objectives and economic diversification goals. The market demonstrates substantial growth potential supported by strong government commitment, significant investment capacity, and expanding applications across multiple sectors including agriculture, urban development, environmental monitoring, and security.

Market fundamentals remain strong despite challenges related to technical complexity, high capital requirements, and the need for specialized expertise. The Kingdom’s strategic approach to balancing immediate operational needs with long-term capability development creates a sustainable foundation for continued market expansion and technological advancement.

Future prospects indicate continued robust growth as technology capabilities advance, costs decrease, and user awareness increases across government and commercial sectors. The successful development of indigenous capabilities, combined with strategic international partnerships, positions Saudi Arabia to become a regional leader in satellite-based earth observation services and technology development, supporting both domestic requirements and broader regional market opportunities.

What is Satellite-based Earth Observation?

Satellite-based Earth Observation refers to the collection and analysis of data about the Earth’s surface and atmosphere using satellite technology. This includes applications in agriculture, urban planning, and environmental monitoring.

What are the key players in the Saudi Arabia Satellite-based Earth Observation Market?

Key players in the Saudi Arabia Satellite-based Earth Observation Market include Saudi Space Commission, Airbus Defence and Space, and Maxar Technologies, among others.

What are the main drivers of the Saudi Arabia Satellite-based Earth Observation Market?

The main drivers of the Saudi Arabia Satellite-based Earth Observation Market include the increasing demand for accurate environmental monitoring, advancements in satellite technology, and the growing need for data in urban development and disaster management.

What challenges does the Saudi Arabia Satellite-based Earth Observation Market face?

Challenges in the Saudi Arabia Satellite-based Earth Observation Market include high operational costs, data privacy concerns, and the need for skilled personnel to analyze satellite data effectively.

What opportunities exist in the Saudi Arabia Satellite-based Earth Observation Market?

Opportunities in the Saudi Arabia Satellite-based Earth Observation Market include the potential for enhanced agricultural productivity through precision farming, improved disaster response capabilities, and the integration of AI for better data analysis.

What trends are shaping the Saudi Arabia Satellite-based Earth Observation Market?

Trends shaping the Saudi Arabia Satellite-based Earth Observation Market include the increasing use of small satellites for cost-effective data collection, the rise of cloud-based data processing solutions, and the growing emphasis on sustainability and environmental monitoring.

Saudi Arabia Satellite-based Earth Observation Market

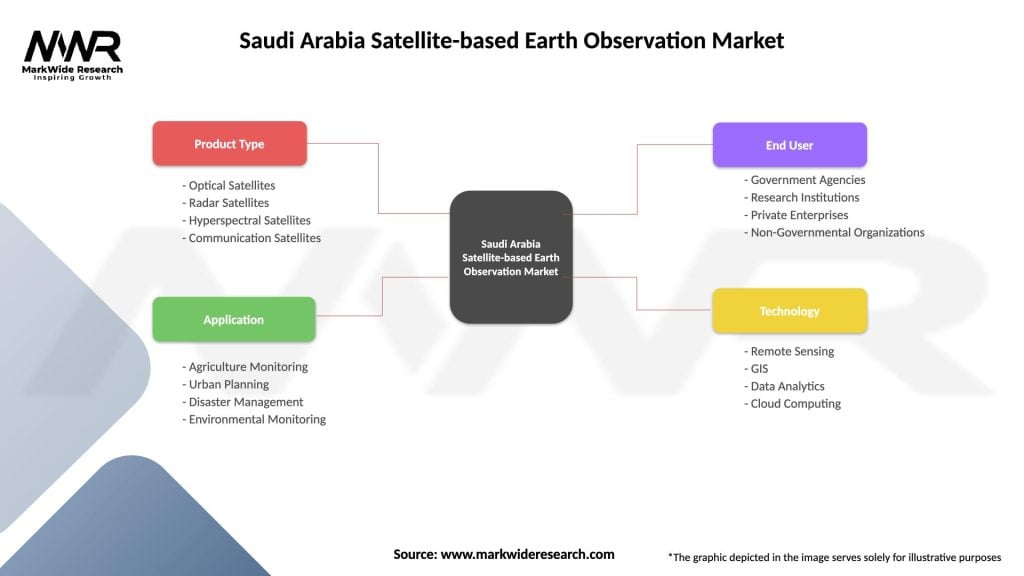

| Segmentation Details | Description |

|---|---|

| Product Type | Optical Satellites, Radar Satellites, Hyperspectral Satellites, Communication Satellites |

| Application | Agriculture Monitoring, Urban Planning, Disaster Management, Environmental Monitoring |

| End User | Government Agencies, Research Institutions, Private Enterprises, Non-Governmental Organizations |

| Technology | Remote Sensing, GIS, Data Analytics, Cloud Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Satellite-based Earth Observation Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at