444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada credit cards market represents a dynamic and rapidly evolving financial services sector that continues to experience substantial growth across multiple consumer segments. Canadian financial institutions are witnessing unprecedented demand for innovative payment solutions, driven by changing consumer behaviors and digital transformation initiatives. The market demonstrates robust expansion with a projected CAGR of 6.2% over the forecast period, reflecting strong consumer confidence and increasing adoption of cashless payment methods.

Market dynamics indicate significant shifts toward premium card offerings and rewards-based programs, with Canadian consumers increasingly seeking value-added services beyond traditional payment capabilities. The integration of advanced security features, contactless payment technologies, and personalized financial management tools has become essential for market participants seeking competitive advantage. Digital-first approaches are reshaping customer acquisition strategies, with approximately 78% of new applications now processed through online channels.

Regional variations across provinces demonstrate distinct consumer preferences, with urban centers showing higher adoption rates of premium credit products compared to rural markets. The market landscape encompasses traditional banking institutions, credit unions, and emerging fintech companies, all competing for market share through innovative product offerings and enhanced customer experiences.

The Canada credit cards market refers to the comprehensive ecosystem of credit card products, services, and related financial solutions offered to Canadian consumers and businesses by licensed financial institutions. This market encompasses various card categories including standard credit cards, premium rewards cards, secured credit cards, business credit cards, and specialized co-branded offerings designed to meet diverse consumer needs and spending patterns.

Credit card products in Canada operate under federal and provincial regulatory frameworks, ensuring consumer protection while enabling financial institutions to offer competitive lending products. The market includes both revolving credit facilities and charge card products, with varying interest rates, credit limits, and reward structures tailored to different customer segments and risk profiles.

Market participants range from major chartered banks to credit unions, trust companies, and specialized financial service providers, each contributing to a competitive landscape that drives innovation and consumer choice across the Canadian financial services sector.

Canada’s credit card market demonstrates remarkable resilience and growth potential, supported by strong consumer spending patterns and increasing preference for electronic payment methods. The market benefits from a stable regulatory environment, robust banking infrastructure, and high consumer confidence in financial institutions. Digital transformation initiatives have accelerated market evolution, with contactless payments representing 85% of all card transactions in major metropolitan areas.

Key market trends include the rising popularity of cashback and travel rewards programs, increased focus on environmental sustainability through eco-friendly card materials, and enhanced fraud protection measures utilizing artificial intelligence and machine learning technologies. Canadian consumers are demonstrating growing sophistication in credit product selection, with 62% of cardholders actively comparing rewards programs before making application decisions.

Competitive dynamics continue to intensify as traditional banks face challenges from fintech disruptors and international payment companies seeking to establish Canadian market presence. The market outlook remains positive, supported by demographic trends, urbanization patterns, and continued economic growth across key Canadian provinces.

Strategic market analysis reveals several critical insights shaping the Canadian credit card landscape. Consumer behavior patterns indicate strong preference for multi-benefit card products that combine rewards programs with comprehensive insurance coverage and financial management tools.

Market intelligence suggests that successful credit card providers are those adapting quickly to changing consumer expectations while maintaining strong risk management practices and regulatory compliance standards.

Consumer spending patterns represent the primary driver of credit card market expansion in Canada, with increasing preference for cashless transactions across all demographic segments. The shift toward digital commerce, accelerated by recent global events, has fundamentally altered payment behaviors and created sustained demand for versatile credit solutions.

Economic factors supporting market growth include stable employment rates, rising disposable income levels, and continued urbanization trends that favor electronic payment adoption. Canadian consumers demonstrate strong credit discipline, with national delinquency rates remaining below historical averages, encouraging lenders to expand credit availability and introduce innovative product offerings.

Technological advancement continues driving market evolution, with artificial intelligence, blockchain technology, and enhanced security protocols creating new opportunities for product differentiation and customer engagement.

Regulatory compliance requirements present ongoing challenges for credit card providers, with evolving consumer protection legislation and data privacy regulations requiring significant operational adjustments and compliance investments. The complexity of federal and provincial regulatory frameworks can limit product innovation speed and increase operational costs for market participants.

Economic uncertainties including inflation pressures, interest rate volatility, and potential economic downturns create risk management challenges that may constrain credit expansion and affect consumer spending patterns. Rising cost of living concerns may impact consumer ability to maintain credit card balances and could influence payment behaviors across different income segments.

Consumer behavior shifts toward more conscious spending and debt management may influence credit utilization patterns and affect revenue generation from interest income and interchange fees.

Emerging market segments present significant growth opportunities for innovative credit card providers willing to address underserved consumer needs and demographic trends. The expanding newcomer population in Canada represents a substantial opportunity for financial institutions offering specialized credit building products and culturally relevant financial services.

Technology integration opportunities include the development of AI-powered personal financial management tools, enhanced mobile banking capabilities, and integration with emerging payment technologies such as cryptocurrency and central bank digital currencies. These innovations can create competitive advantages and drive customer acquisition in increasingly competitive markets.

Market consolidation opportunities may emerge as smaller players seek partnerships or acquisition by larger institutions, potentially creating economies of scale and expanded service capabilities for surviving market participants.

Competitive forces within the Canadian credit card market continue evolving as traditional banking institutions adapt to challenges from fintech companies, international payment processors, and alternative lending platforms. The market demonstrates increasing consolidation among smaller players while larger institutions invest heavily in digital transformation and customer experience enhancement.

Consumer expectations have shifted dramatically toward seamless digital experiences, real-time transaction monitoring, and personalized financial insights. Credit card providers must balance innovation investments with risk management requirements while maintaining profitability in an increasingly competitive environment. MarkWide Research analysis indicates that customer satisfaction scores correlate strongly with digital service quality and rewards program value proposition.

Regulatory dynamics continue shaping market structure through consumer protection measures, data privacy requirements, and open banking initiatives that may alter competitive landscapes. The introduction of new payment rails and real-time payment systems creates both opportunities and challenges for traditional credit card business models.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Canadian credit card market trends, consumer behaviors, and competitive dynamics. Primary research includes extensive consumer surveys, industry expert interviews, and focus group discussions across major Canadian metropolitan areas.

Secondary research components encompass analysis of regulatory filings, financial institution annual reports, industry publications, and government statistical data sources. Market sizing and forecasting utilize econometric modeling techniques that incorporate macroeconomic indicators, demographic trends, and historical market performance data.

Data validation processes ensure research accuracy through triangulation of multiple data sources, statistical significance testing, and peer review by industry specialists with extensive Canadian financial services experience.

Ontario market dynamics dominate the Canadian credit card landscape, representing approximately 38% of national market activity due to high population density, strong economic activity, and concentration of financial services headquarters. The province demonstrates sophisticated consumer preferences for premium credit products and innovative payment solutions.

Quebec’s unique characteristics include distinct regulatory requirements, language preferences, and cultural factors that influence credit card product design and marketing strategies. The province shows strong preference for local financial institutions and co-branded products with Quebec-based retailers and service providers.

Western Canada markets including British Columbia and Alberta demonstrate robust growth potential driven by resource sector employment, international trade activities, and growing technology sectors. These regions show higher adoption rates of business credit products and international payment capabilities.

Regional market share distribution reflects population density and economic activity patterns, with urban centers accounting for 72% of premium credit card adoption while rural markets show growth potential for basic credit products and financial inclusion initiatives.

Major market participants include established Canadian chartered banks, credit unions, and international financial services companies, each competing through differentiated product offerings, rewards programs, and customer service excellence. The competitive environment continues intensifying as new entrants challenge traditional business models.

Competitive strategies focus on customer experience enhancement, digital innovation, and strategic partnerships that expand market reach and service capabilities. Market leaders invest heavily in technology infrastructure, data analytics, and personalized marketing to maintain competitive advantages.

Product segmentation within the Canadian credit card market encompasses multiple categories designed to serve diverse consumer needs, spending patterns, and risk profiles. Each segment demonstrates distinct growth characteristics and competitive dynamics that influence overall market development.

By Card Type:

By Customer Segment:

Rewards credit cards represent the fastest-growing segment, with Canadian consumers showing 67% preference for cards offering cashback or points programs over basic credit products. This category benefits from increasing consumer sophistication and desire to maximize spending value through strategic credit card usage.

Premium credit card adoption continues expanding among high-income consumers seeking comprehensive travel benefits, exclusive access programs, and enhanced customer service. These products generate higher revenue per customer through annual fees and increased spending volumes, making them attractive for financial institutions despite higher acquisition costs.

Business credit cards demonstrate strong growth potential as Canadian entrepreneurship rates increase and small businesses seek specialized financial tools for expense management, cash flow optimization, and rewards earning on business purchases. This segment shows particular strength in technology and professional services sectors.

Category performance varies significantly based on economic conditions, consumer confidence levels, and competitive promotional activities that influence customer acquisition and retention rates across different product segments.

Financial institutions benefit from credit card operations through multiple revenue streams including interest income, interchange fees, annual fees, and cross-selling opportunities that enhance overall customer relationships. The credit card business provides valuable customer data and spending insights that support targeted marketing and product development initiatives.

Consumer benefits include convenient payment methods, purchase protection, rewards earning opportunities, and credit building capabilities that support financial goal achievement. Modern credit cards offer comprehensive financial management tools, spending analytics, and budgeting assistance that enhance personal financial wellness.

Stakeholder alignment creates a sustainable ecosystem where all participants benefit from market growth, innovation, and improved customer experiences that drive continued adoption and usage of credit card products across Canadian markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first customer experiences are reshaping credit card market dynamics, with consumers expecting seamless mobile applications, real-time notifications, and integrated financial management tools. MWR research indicates that 89% of new credit card applications now originate through digital channels, reflecting fundamental shifts in customer acquisition strategies.

Sustainability initiatives are gaining prominence as environmental consciousness influences consumer purchasing decisions and corporate responsibility expectations. Credit card providers are introducing eco-friendly card materials, carbon offset programs, and rewards for sustainable spending behaviors to appeal to environmentally conscious consumers.

Personalization trends continue advancing through data analytics and machine learning technologies that enable customized product recommendations, targeted marketing campaigns, and individualized rewards programs that enhance customer engagement and loyalty.

Recent market developments include significant investments in payment technology infrastructure, strategic partnerships between traditional banks and fintech companies, and regulatory initiatives aimed at enhancing consumer protection and market competition. These developments are reshaping competitive dynamics and creating new opportunities for market participants.

Technology partnerships between established financial institutions and innovative technology companies are accelerating product development cycles and enabling rapid deployment of advanced features such as artificial intelligence, blockchain integration, and enhanced mobile capabilities.

Innovation initiatives focus on improving customer experiences, reducing operational costs, and creating new revenue opportunities through value-added services and strategic partnerships that expand market reach and service capabilities.

Strategic recommendations for credit card providers include prioritizing digital transformation investments, developing comprehensive customer data analytics capabilities, and creating differentiated product offerings that address specific consumer segments and needs. Market leaders should focus on building sustainable competitive advantages through technology innovation and customer experience excellence.

Risk management enhancement remains critical as economic uncertainties and cybersecurity threats continue evolving. Financial institutions should invest in advanced fraud detection systems, strengthen credit underwriting processes, and develop comprehensive crisis management protocols to maintain market stability and consumer confidence.

Market positioning strategies should emphasize unique value propositions, superior customer service, and comprehensive product portfolios that meet diverse consumer needs while maintaining strong risk management practices and regulatory compliance standards.

Long-term market prospects remain positive for the Canadian credit card industry, supported by demographic trends, continued economic growth, and increasing consumer preference for electronic payment methods. The market is expected to maintain steady growth with a projected CAGR of 5.8% over the next five years, driven by innovation, customer experience improvements, and expanding market segments.

Technological evolution will continue reshaping market dynamics through artificial intelligence, blockchain technology, and enhanced security protocols that improve customer experiences while reducing operational risks. The integration of emerging payment technologies and digital currencies may create new opportunities for market expansion and revenue generation.

Demographic shifts including aging populations, increasing immigration, and changing consumer behaviors will influence product development strategies and market segmentation approaches. Financial institutions must adapt to serve diverse customer needs while maintaining competitive positioning in evolving market conditions.

Success factors for future market leadership will include adaptability to changing consumer preferences, investment in technology innovation, and maintenance of strong risk management practices that support sustainable growth and profitability in competitive market conditions.

The Canada credit cards market demonstrates remarkable resilience and growth potential, positioned to benefit from favorable demographic trends, technological advancement, and continued consumer preference for electronic payment solutions. Market participants who successfully navigate competitive challenges while investing in innovation and customer experience will capture the greatest opportunities for sustainable growth and market leadership.

Strategic success in this evolving market requires balancing innovation investments with risk management excellence, regulatory compliance, and customer-centric service delivery. The integration of advanced technologies, personalized product offerings, and comprehensive financial wellness tools will distinguish market leaders from competitors in increasingly competitive environments.

Future market development will be shaped by continued digital transformation, evolving consumer expectations, and regulatory initiatives that enhance consumer protection while promoting healthy market competition. Financial institutions that maintain focus on customer value creation, operational excellence, and strategic adaptability will thrive in Canada’s dynamic credit card marketplace, contributing to overall financial system stability and economic growth across the nation.

What is Canada Credit Cards?

Canada Credit Cards refer to various financial products issued by banks and financial institutions that allow consumers to borrow funds for purchases, repayable with interest. These cards often come with various features such as rewards programs, cashback offers, and travel benefits.

What are the key players in the Canada Credit Cards Market?

The Canada Credit Cards Market is competitive, featuring major players such as Royal Bank of Canada, TD Bank, and Scotiabank. These companies offer a range of credit card products tailored to different consumer needs, among others.

What are the growth factors driving the Canada Credit Cards Market?

The Canada Credit Cards Market is driven by factors such as increasing consumer spending, the rise of e-commerce, and the growing preference for cashless transactions. Additionally, innovative rewards programs and promotional offers are attracting more users.

What challenges does the Canada Credit Cards Market face?

The Canada Credit Cards Market faces challenges such as rising consumer debt levels and regulatory scrutiny regarding lending practices. Additionally, competition from alternative payment methods and fintech solutions poses a threat to traditional credit card usage.

What opportunities exist in the Canada Credit Cards Market?

The Canada Credit Cards Market presents opportunities for growth through the development of digital wallets and contactless payment solutions. Furthermore, targeting niche markets with specialized credit card offerings can enhance customer acquisition.

What trends are shaping the Canada Credit Cards Market?

Trends in the Canada Credit Cards Market include the increasing adoption of mobile payment technologies and the integration of artificial intelligence for personalized customer experiences. Additionally, sustainability initiatives are becoming more prominent as consumers seek eco-friendly financial products.

Canada Credit Cards Market

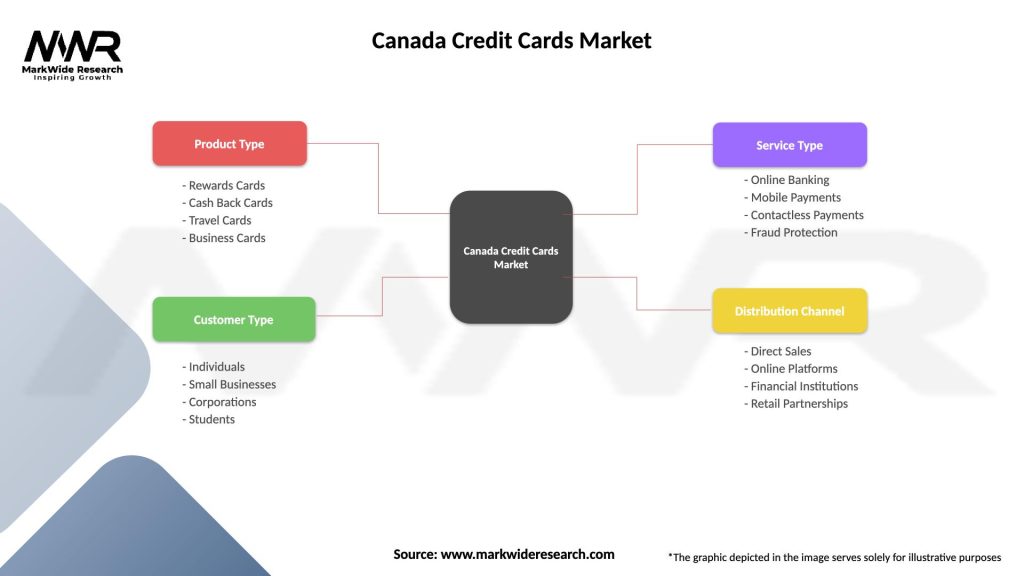

| Segmentation Details | Description |

|---|---|

| Product Type | Rewards Cards, Cash Back Cards, Travel Cards, Business Cards |

| Customer Type | Individuals, Small Businesses, Corporations, Students |

| Service Type | Online Banking, Mobile Payments, Contactless Payments, Fraud Protection |

| Distribution Channel | Direct Sales, Online Platforms, Financial Institutions, Retail Partnerships |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Credit Cards Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at