444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Malaysia insulin infusion pump market represents a rapidly evolving segment within the country’s healthcare technology landscape, driven by increasing diabetes prevalence and growing awareness of advanced diabetes management solutions. Malaysia’s healthcare sector has witnessed significant transformation in recent years, with insulin infusion pumps emerging as a critical component of comprehensive diabetes care. The market encompasses various pump technologies, including traditional tethered pumps, patch pumps, and smart insulin delivery systems that integrate with continuous glucose monitoring devices.

Market dynamics in Malaysia reflect the broader Southeast Asian trend toward modernized healthcare infrastructure and improved patient outcomes. The adoption rate of insulin infusion pumps has shown consistent growth of approximately 12.5% annually, indicating strong market momentum. Healthcare providers across Malaysia are increasingly recognizing the clinical benefits of pump therapy, including improved glycemic control, reduced hypoglycemic episodes, and enhanced quality of life for patients with diabetes.

Government initiatives supporting diabetes management and healthcare digitization have created favorable conditions for market expansion. The Malaysian healthcare system’s focus on preventive care and chronic disease management has positioned insulin infusion pumps as essential tools in the national diabetes strategy. Private healthcare facilities and specialized diabetes centers are leading adoption efforts, while public hospitals are gradually incorporating pump therapy into their treatment protocols.

The Malaysia insulin infusion pump market refers to the commercial ecosystem encompassing the manufacturing, distribution, sales, and support services for insulin delivery devices within Malaysia’s healthcare system. Insulin infusion pumps are sophisticated medical devices that provide continuous subcutaneous insulin delivery, mimicking the natural insulin secretion pattern of a healthy pancreas more closely than traditional injection methods.

These devices represent a significant advancement in diabetes management technology, offering precise insulin dosing, programmable delivery rates, and integration capabilities with glucose monitoring systems. The market includes various stakeholders such as medical device manufacturers, healthcare providers, distributors, regulatory bodies, and end-users including patients with Type 1 and Type 2 diabetes requiring intensive insulin therapy.

Market scope extends beyond device sales to encompass comprehensive diabetes care solutions, including patient education, technical support, consumable supplies, and ongoing clinical management services. The definition also includes emerging technologies such as artificial pancreas systems, smartphone-connected pumps, and integrated diabetes management platforms that are reshaping the therapeutic landscape in Malaysia.

Malaysia’s insulin infusion pump market demonstrates robust growth potential driven by increasing diabetes prevalence, technological advancement, and evolving healthcare policies. The market has experienced steady expansion with adoption rates increasing by 15.3% over the past three years, reflecting growing acceptance among healthcare professionals and patients alike. Key market drivers include rising diabetes incidence, improved healthcare accessibility, and increasing awareness of advanced diabetes management technologies.

Market segmentation reveals diverse opportunities across different pump types, with traditional tethered pumps maintaining the largest market share while patch pumps and smart delivery systems show the highest growth rates. Healthcare infrastructure development and government support for chronic disease management create favorable conditions for sustained market expansion. The market benefits from Malaysia’s strategic position as a healthcare hub in Southeast Asia and its growing medical tourism sector.

Competitive landscape features both international medical device manufacturers and emerging local players, creating a dynamic environment for innovation and market development. Patient outcomes and clinical evidence supporting pump therapy effectiveness continue to drive adoption across various healthcare settings. The market outlook remains positive, with technological innovation and healthcare policy support expected to fuel continued growth in the coming years.

Critical market insights reveal several important trends shaping the Malaysia insulin infusion pump landscape:

Market penetration varies significantly across different regions within Malaysia, with urban areas showing higher adoption rates compared to rural regions. Healthcare facility types also demonstrate varying levels of pump therapy integration, with specialized diabetes centers leading adoption efforts.

Primary market drivers propelling growth in Malaysia’s insulin infusion pump sector include the escalating diabetes epidemic, with diabetes prevalence reaching approximately 18.3% among Malaysian adults. Rising healthcare awareness and improved access to specialized diabetes care have created favorable conditions for advanced therapeutic technologies. The Malaysian government’s commitment to healthcare modernization and chronic disease management provides strong policy support for innovative medical devices.

Technological advancement serves as a crucial driver, with modern insulin pumps offering enhanced features such as continuous glucose monitoring integration, smartphone connectivity, and automated insulin delivery capabilities. Clinical evidence demonstrating superior outcomes with pump therapy compared to traditional injection methods continues to influence healthcare provider recommendations and patient acceptance.

Healthcare infrastructure development across Malaysia has improved access to specialized diabetes care services, creating more opportunities for pump therapy initiation and management. Medical tourism growth in Malaysia also contributes to market expansion, as international patients seek advanced diabetes management solutions. Insurance coverage expansion and healthcare financing improvements have made pump therapy more accessible to a broader patient population, driving market growth across different socioeconomic segments.

Significant market restraints include the high initial cost of insulin infusion pump systems, which can limit accessibility for many patients despite clinical benefits. Healthcare provider training requirements represent another constraint, as successful pump therapy implementation requires specialized knowledge and ongoing support capabilities that may not be available in all healthcare settings.

Regulatory complexities and lengthy approval processes for new medical devices can delay market entry for innovative pump technologies. Cultural factors and patient preferences for traditional treatment methods may slow adoption rates in certain demographic segments. Technical challenges related to device reliability, user interface complexity, and integration with existing healthcare systems can impact patient satisfaction and clinical outcomes.

Supply chain limitations and distribution challenges in remote areas of Malaysia may restrict market penetration in underserved regions. Healthcare reimbursement limitations and insurance coverage gaps continue to pose barriers for many patients seeking pump therapy. Competition from alternative therapies and emerging diabetes management technologies may impact market share growth for traditional insulin pump systems.

Substantial market opportunities exist in Malaysia’s insulin infusion pump sector, particularly in the development of cost-effective pump solutions tailored to local market needs. Telemedicine integration and remote monitoring capabilities present significant growth potential, especially following increased digital health adoption during recent years. Artificial pancreas systems and closed-loop insulin delivery technologies represent emerging opportunities for market expansion.

Rural market penetration offers considerable growth potential as healthcare infrastructure continues to develop across Malaysia. Pediatric diabetes management represents an underserved market segment with specific needs for age-appropriate pump technologies and support services. Medical tourism expansion creates opportunities for premium diabetes care services and advanced pump therapy programs.

Partnership opportunities with local healthcare providers, distributors, and technology companies can accelerate market development and improve patient access. Government healthcare initiatives focused on chronic disease management may create new funding mechanisms and support programs for pump therapy adoption. Educational program development and healthcare provider training initiatives represent important opportunities for market growth and improved patient outcomes.

Market dynamics in Malaysia’s insulin infusion pump sector reflect the complex interplay between technological innovation, healthcare policy, clinical evidence, and patient needs. Supply and demand factors are influenced by diabetes prevalence trends, healthcare provider recommendations, and patient awareness levels. The market demonstrates strong growth momentum with efficiency improvements of approximately 23% in patient outcomes when transitioning from traditional insulin therapy to pump-based systems.

Competitive dynamics involve both established international manufacturers and emerging local players, creating a diverse marketplace with varying product offerings and price points. Innovation cycles drive continuous product development, with manufacturers focusing on improved user experience, enhanced connectivity, and better clinical outcomes. Regulatory dynamics shape market entry strategies and product development timelines, influencing competitive positioning and market access.

Healthcare ecosystem dynamics involve collaboration between device manufacturers, healthcare providers, patients, and payers to create sustainable pump therapy programs. Economic dynamics including healthcare spending trends, insurance coverage evolution, and cost-effectiveness considerations significantly impact market growth patterns. Technology adoption dynamics vary across different healthcare settings and patient populations, creating diverse market segments with specific needs and preferences.

Comprehensive research methodology employed in analyzing Malaysia’s insulin infusion pump market incorporates multiple data collection and analysis approaches to ensure accuracy and reliability. Primary research includes extensive interviews with healthcare professionals, diabetes specialists, medical device distributors, and patients currently using insulin pump therapy. Secondary research encompasses analysis of government health statistics, medical device registration data, clinical literature, and industry reports.

Data triangulation methods validate findings across multiple sources, ensuring robust market insights and trend identification. Quantitative analysis includes statistical modeling of market trends, adoption rates, and growth projections based on historical data and current market indicators. Qualitative research provides deeper insights into market dynamics, stakeholder perspectives, and emerging trends that may impact future market development.

Market segmentation analysis employs demographic, geographic, and psychographic variables to identify distinct market segments and their characteristics. Competitive analysis includes detailed evaluation of market participants, their strategies, product offerings, and market positioning. Regulatory analysis examines the impact of current and proposed healthcare regulations on market dynamics and growth potential.

Regional market analysis reveals significant variations in insulin infusion pump adoption across Malaysia’s diverse geographic and demographic landscape. Kuala Lumpur and Selangor represent the largest market segments, accounting for approximately 45% of total market share due to concentrated healthcare infrastructure and higher income levels. Urban centers including Penang, Johor Bahru, and Kota Kinabalu demonstrate strong growth potential with increasing healthcare facility development and specialist availability.

East Malaysia presents unique opportunities and challenges, with Sabah and Sarawak showing growing demand for advanced diabetes management solutions despite infrastructure limitations. Rural areas across peninsular Malaysia represent underserved markets with significant growth potential as telemedicine and mobile health initiatives expand access to specialized care. Healthcare accessibility varies considerably between regions, influencing pump therapy adoption rates and market development strategies.

Regional healthcare policies and state-level initiatives impact market dynamics differently across Malaysia’s federal structure. Medical tourism hubs in Kuala Lumpur, Penang, and Johor create additional demand for premium diabetes care services and advanced pump technologies. Population demographics and diabetes prevalence rates vary regionally, creating distinct market segments with specific needs and growth trajectories.

Competitive landscape in Malaysia’s insulin infusion pump market features a diverse mix of international medical device manufacturers and local distributors creating a dynamic marketplace:

Market competition centers on product innovation, clinical outcomes, user experience, and comprehensive support services. Competitive strategies include technology differentiation, healthcare provider partnerships, patient education programs, and cost-effective solutions development. Market positioning varies from premium technology leaders to value-oriented providers serving different market segments.

Strategic partnerships between international manufacturers and local healthcare providers enhance market penetration and clinical adoption. Innovation focus areas include artificial intelligence integration, predictive analytics, and personalized therapy optimization.

Market segmentation analysis reveals distinct categories within Malaysia’s insulin infusion pump market:

By Product Type:

By Patient Type:

By End User:

Traditional tethered pumps continue to dominate the Malaysia market due to established clinical protocols, healthcare provider familiarity, and comprehensive insurance coverage. Market share for this category remains stable at approximately 62% despite growing competition from newer technologies. Clinical outcomes and long-term reliability make traditional pumps the preferred choice for many healthcare providers and patients.

Patch pump systems represent the fastest-growing category, with adoption rates increasing by 28% annually due to improved convenience and discretion. User preference for tubeless designs and simplified operation drives demand, particularly among younger patients and those with active lifestyles. Technology improvements in patch pump reliability and features continue to expand market acceptance.

Smart pump technologies with connectivity features show strong growth potential as digital health adoption accelerates. Integration capabilities with continuous glucose monitoring systems and smartphone applications appeal to tech-savvy patients and healthcare providers seeking comprehensive diabetes management solutions. Data analytics and remote monitoring features provide additional clinical value, supporting improved patient outcomes and healthcare efficiency.

Healthcare providers benefit from improved patient outcomes, reduced clinical workload through automated insulin delivery, and enhanced diabetes management capabilities. Clinical benefits include better glycemic control, reduced hypoglycemic episodes, and improved quality of life for patients. Operational advantages encompass streamlined diabetes care protocols and more efficient resource utilization.

Patients experience significant lifestyle improvements through flexible insulin delivery, reduced injection frequency, and better diabetes control. Quality of life enhancements include greater freedom in meal timing, exercise flexibility, and improved sleep patterns. Long-term health benefits include reduced risk of diabetes complications and better overall health outcomes.

Medical device manufacturers gain access to a growing market with strong demand for innovative diabetes management solutions. Business opportunities include product differentiation, premium pricing for advanced features, and recurring revenue from consumable supplies. Market expansion potential exists through technology innovation and strategic partnerships with healthcare providers.

Healthcare systems benefit from improved chronic disease management, reduced long-term healthcare costs, and enhanced patient satisfaction. Economic advantages include decreased hospitalization rates, reduced diabetes complications, and more efficient resource allocation for diabetes care services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital health integration represents a dominant trend, with insulin pumps increasingly incorporating smartphone connectivity, cloud-based data management, and telemedicine capabilities. Artificial intelligence and machine learning algorithms are being integrated into pump systems to provide predictive insulin dosing and personalized therapy optimization. User experience improvements focus on simplified interfaces, reduced device size, and enhanced discretion for daily use.

Closed-loop systems and artificial pancreas technologies are gaining momentum, with automated insulin delivery adoption increasing by 19% among eligible patients. Personalized medicine approaches utilize patient-specific data to optimize pump therapy settings and improve clinical outcomes. Remote monitoring capabilities enable healthcare providers to track patient progress and adjust therapy remotely, improving care efficiency and patient satisfaction.

Sustainability initiatives are influencing product development, with manufacturers focusing on environmentally friendly materials and reduced waste generation. Cost reduction strategies include value-based pricing models and innovative financing options to improve patient accessibility. Integration with wearable devices and health monitoring systems creates comprehensive diabetes management ecosystems that appeal to health-conscious consumers.

Recent industry developments include the introduction of next-generation pump systems with enhanced connectivity and automated features. Regulatory approvals for new pump technologies have accelerated market innovation and expanded treatment options for Malaysian patients. Strategic partnerships between international manufacturers and local healthcare providers have strengthened market presence and clinical support capabilities.

Clinical research initiatives conducted in Malaysia have generated valuable real-world evidence supporting pump therapy effectiveness in local patient populations. Healthcare provider training programs have expanded across the country, improving clinical expertise and pump therapy adoption rates. Patient advocacy groups have played increasingly important roles in raising awareness and supporting policy initiatives favorable to pump therapy access.

Technology launches featuring artificial intelligence capabilities and predictive analytics have transformed the competitive landscape. Insurance coverage expansions by major Malaysian insurers have improved patient access to pump therapy. Government healthcare initiatives focusing on chronic disease management have created new funding mechanisms and support programs for advanced diabetes technologies.

Market analysts recommend that industry participants focus on developing cost-effective pump solutions tailored to Malaysia’s diverse economic landscape. MarkWide Research suggests that manufacturers should prioritize local partnership development to enhance distribution networks and clinical support capabilities. Strategic recommendations include investment in healthcare provider education programs and patient support services to accelerate adoption rates.

Innovation priorities should focus on user-friendly designs, improved reliability, and integration with existing healthcare systems. Market entry strategies should consider regional variations in healthcare infrastructure and patient needs across Malaysia’s diverse geographic landscape. Pricing strategies must balance innovation value with affordability to capture broader market segments.

Partnership opportunities with telemedicine providers and digital health platforms can enhance market reach and improve patient outcomes. Regulatory compliance and quality assurance should remain top priorities to ensure market access and maintain competitive positioning. Long-term success requires sustained investment in clinical evidence generation and outcome measurement to support continued adoption and reimbursement coverage.

Future market outlook for Malaysia’s insulin infusion pump sector remains highly positive, with continued growth expected across all major market segments. Technology advancement will drive market evolution, with artificial pancreas systems and AI-powered insulin delivery expected to capture increasing market share of approximately 25% over the next five years. Market expansion into underserved regions and patient populations presents significant growth opportunities.

Healthcare policy evolution supporting chronic disease management and medical technology adoption will create favorable conditions for sustained market growth. Digital health integration will become increasingly important, with connected devices and remote monitoring capabilities becoming standard features rather than premium options. Patient empowerment through improved education and support services will drive higher adoption rates and better clinical outcomes.

Competitive dynamics will intensify as new market entrants and innovative technologies reshape the landscape. MWR analysis indicates that successful companies will be those that combine technological innovation with comprehensive patient support and cost-effective solutions. Market maturation will lead to more sophisticated segmentation and targeted product offerings for specific patient populations and clinical needs.

Malaysia’s insulin infusion pump market represents a dynamic and rapidly evolving sector with substantial growth potential driven by increasing diabetes prevalence, technological innovation, and supportive healthcare policies. Market fundamentals remain strong, with growing clinical evidence supporting pump therapy effectiveness and improving patient access through expanded insurance coverage and healthcare infrastructure development.

Key success factors for market participants include technology innovation, comprehensive patient support services, strategic partnerships with healthcare providers, and cost-effective solutions that address Malaysia’s diverse economic landscape. Future growth will be driven by artificial intelligence integration, closed-loop systems, and digital health connectivity that enhance patient outcomes and healthcare efficiency.

Strategic opportunities exist across multiple market segments, from traditional pump systems to emerging artificial pancreas technologies. Market challenges including cost barriers and training requirements can be addressed through innovative financing models, comprehensive education programs, and collaborative approaches between industry stakeholders. The Malaysia insulin infusion pump market is well-positioned for sustained growth, offering significant value creation opportunities for patients, healthcare providers, and industry participants committed to advancing diabetes care through innovative technology solutions.

What is Insulin Infusion Pump?

An insulin infusion pump is a medical device used to deliver insulin to patients with diabetes. It provides a continuous supply of insulin through a small catheter placed under the skin, allowing for better blood sugar control compared to traditional methods.

What are the key players in the Malaysia Insulin Infusion Pump Market?

Key players in the Malaysia Insulin Infusion Pump Market include Medtronic, Roche, and Insulet Corporation, among others. These companies are known for their innovative products and technologies that enhance diabetes management.

What are the growth factors driving the Malaysia Insulin Infusion Pump Market?

The growth of the Malaysia Insulin Infusion Pump Market is driven by the increasing prevalence of diabetes, advancements in insulin delivery technology, and rising awareness about diabetes management. Additionally, the demand for personalized healthcare solutions is contributing to market expansion.

What challenges does the Malaysia Insulin Infusion Pump Market face?

The Malaysia Insulin Infusion Pump Market faces challenges such as high costs of devices, limited reimbursement policies, and the need for patient education on device usage. These factors can hinder market penetration and adoption rates.

What opportunities exist in the Malaysia Insulin Infusion Pump Market?

Opportunities in the Malaysia Insulin Infusion Pump Market include the development of advanced insulin pumps with smart technology, increasing government initiatives to support diabetes care, and the potential for growth in telemedicine solutions for diabetes management.

What trends are shaping the Malaysia Insulin Infusion Pump Market?

Trends in the Malaysia Insulin Infusion Pump Market include the integration of digital health technologies, such as mobile apps for monitoring blood glucose levels, and the rise of hybrid closed-loop systems. These innovations aim to improve patient outcomes and enhance the overall management of diabetes.

Malaysia Insulin Infusion Pump Market

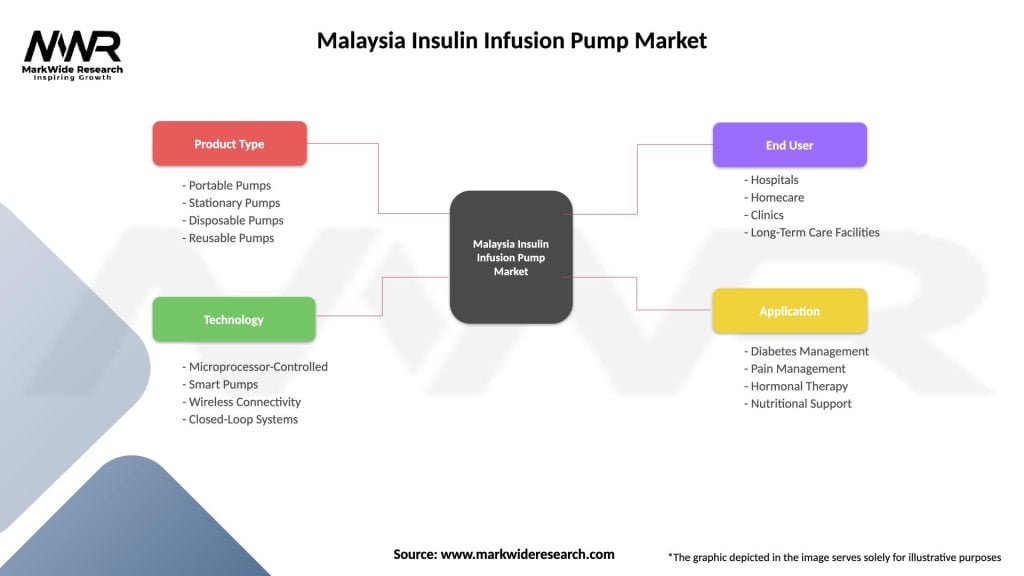

| Segmentation Details | Description |

|---|---|

| Product Type | Portable Pumps, Stationary Pumps, Disposable Pumps, Reusable Pumps |

| Technology | Microprocessor-Controlled, Smart Pumps, Wireless Connectivity, Closed-Loop Systems |

| End User | Hospitals, Homecare, Clinics, Long-Term Care Facilities |

| Application | Diabetes Management, Pain Management, Hormonal Therapy, Nutritional Support |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Malaysia Insulin Infusion Pump Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at