444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam insulin drug and delivery device market represents a rapidly evolving healthcare segment driven by increasing diabetes prevalence and growing awareness of advanced treatment options. Vietnam’s healthcare landscape is experiencing significant transformation as the country addresses the rising burden of diabetes mellitus, particularly Type 2 diabetes, which affects a substantial portion of the population. The market encompasses various insulin formulations including rapid-acting, long-acting, and intermediate-acting insulin products, alongside sophisticated delivery systems such as insulin pens, pumps, and continuous glucose monitoring devices.

Market dynamics indicate robust growth potential, with the sector expanding at a compound annual growth rate (CAGR) of 8.2% as healthcare infrastructure improvements and increased healthcare spending drive adoption of modern diabetes management solutions. Government initiatives supporting diabetes care, combined with rising disposable income and urbanization trends, create favorable conditions for market expansion. The integration of digital health technologies and telemedicine platforms further enhances treatment accessibility and patient compliance rates.

Healthcare providers across Vietnam are increasingly adopting evidence-based diabetes management protocols, leading to higher prescription rates of premium insulin products and advanced delivery devices. Patient education programs and diabetes awareness campaigns contribute to improved treatment adherence, with approximately 73% of diagnosed patients now actively managing their condition through prescribed insulin therapy regimens.

The Vietnam insulin drug and delivery device market refers to the comprehensive ecosystem of pharmaceutical products and medical devices specifically designed for diabetes management within Vietnam’s healthcare system. This market encompasses all forms of insulin medications, from traditional human insulin to modern analog formulations, alongside the delivery mechanisms that ensure precise dosing and patient convenience.

Insulin drugs in this context include rapid-acting insulin analogs for mealtime glucose control, long-acting basal insulin for sustained glucose management, and combination insulin products that provide both rapid and extended action profiles. Delivery devices comprise traditional insulin syringes, modern insulin pen systems, insulin pumps for continuous subcutaneous insulin infusion, and emerging smart delivery technologies that integrate with mobile health applications.

Market scope extends beyond product sales to include associated services such as patient training programs, device maintenance support, and digital health platforms that facilitate remote monitoring and treatment optimization. The market serves both Type 1 and Type 2 diabetes patients, with particular emphasis on addressing the growing Type 2 diabetes population that represents the majority of insulin-dependent patients in Vietnam.

Vietnam’s insulin market demonstrates exceptional growth momentum driven by demographic shifts, lifestyle changes, and healthcare system modernization. The market benefits from increasing diabetes prevalence, with current estimates suggesting that diabetes affects approximately 6.1% of Vietnam’s adult population, creating substantial demand for effective insulin therapy solutions.

Key market drivers include rapid urbanization leading to sedentary lifestyles, dietary pattern changes toward processed foods, and an aging population more susceptible to Type 2 diabetes. Government healthcare reforms and insurance coverage expansion improve patient access to premium insulin products and advanced delivery devices, supporting market growth across all socioeconomic segments.

Technological advancement plays a crucial role in market evolution, with smart insulin pens, continuous glucose monitoring systems, and integrated diabetes management platforms gaining traction among tech-savvy Vietnamese consumers. Healthcare digitization initiatives further accelerate adoption of connected diabetes care solutions, with approximately 42% of urban diabetes patients now utilizing some form of digital health tool for condition management.

Market challenges include price sensitivity among certain patient populations, regulatory complexities for new product introductions, and the need for extensive healthcare provider training on advanced delivery systems. However, these challenges are being addressed through strategic partnerships between international pharmaceutical companies and local healthcare organizations.

Market segmentation analysis reveals distinct patterns in product adoption and usage preferences across Vietnam’s diverse healthcare landscape. The following insights provide comprehensive understanding of market dynamics:

Demographic transformation serves as the primary catalyst for Vietnam’s insulin market expansion. The country’s rapidly aging population, combined with urbanization trends, creates ideal conditions for diabetes prevalence increase. Lifestyle modifications associated with economic development, including reduced physical activity and dietary pattern changes, contribute significantly to Type 2 diabetes incidence rates.

Healthcare infrastructure development plays a crucial role in market growth, with government investments in hospital modernization and medical equipment procurement improving diabetes care capabilities across the country. Medical education initiatives enhance healthcare provider competency in diabetes management, leading to more appropriate insulin prescribing patterns and better patient outcomes.

Economic prosperity enables increased healthcare spending, both at government and individual levels. Rising disposable income allows patients to access premium insulin products and advanced delivery devices previously considered unaffordable. Health insurance expansion further reduces financial barriers to optimal diabetes care, with coverage improvements driving adoption of evidence-based treatment protocols.

Technological advancement in diabetes care creates new market opportunities through innovative product offerings. Smart insulin delivery systems, continuous glucose monitoring devices, and integrated diabetes management platforms appeal to increasingly sophisticated Vietnamese consumers who value convenience and treatment optimization.

Regulatory environment improvements facilitate faster market entry for new insulin products and delivery devices, encouraging international pharmaceutical companies to expand their Vietnam operations and invest in local market development initiatives.

Price sensitivity remains a significant challenge in Vietnam’s insulin market, particularly among rural populations and patients with limited insurance coverage. Cost considerations often influence treatment decisions, with some patients opting for less expensive insulin formulations or delivery methods that may not provide optimal glycemic control.

Healthcare access disparities between urban and rural areas create market development challenges. Rural healthcare infrastructure limitations, including shortage of specialized diabetes care providers and limited availability of advanced insulin products, restrict market penetration in certain geographic regions.

Regulatory complexities associated with new product approvals can delay market entry for innovative insulin formulations and delivery devices. Registration processes for medical devices and pharmaceutical products require substantial documentation and clinical evidence, potentially slowing the introduction of breakthrough diabetes technologies.

Healthcare provider training requirements present ongoing challenges, particularly for advanced insulin delivery systems and continuous glucose monitoring technologies. Knowledge gaps among healthcare professionals regarding optimal insulin therapy protocols may limit appropriate product utilization and patient outcomes.

Cultural factors and traditional medicine preferences in some patient populations can influence acceptance of modern insulin therapy approaches. Patient education needs require substantial investment in awareness programs and behavior change initiatives to maximize treatment adherence and market growth potential.

Digital health integration presents substantial opportunities for market expansion through connected diabetes management solutions. Mobile health applications, telemedicine platforms, and remote monitoring systems can improve patient engagement and treatment outcomes while creating new revenue streams for market participants.

Biosimilar insulin development offers opportunities to address price sensitivity concerns while maintaining treatment efficacy. Local manufacturing initiatives for insulin products could reduce costs and improve market accessibility, particularly for price-conscious patient segments.

Healthcare system partnerships with government agencies and insurance providers create opportunities for market expansion through improved coverage policies and diabetes care program development. Public-private collaborations can facilitate large-scale diabetes screening and treatment initiatives that drive market growth.

Medical tourism potential positions Vietnam as a regional hub for diabetes care, attracting patients from neighboring countries seeking high-quality, cost-effective treatment options. International patient services could generate additional market demand and support healthcare infrastructure development.

Preventive care emphasis creates opportunities for early intervention programs and prediabetes management solutions. Population health initiatives focusing on diabetes prevention and early detection can expand the addressable market while improving overall public health outcomes.

Supply chain evolution significantly influences market dynamics, with pharmaceutical companies establishing local distribution networks and cold chain infrastructure to ensure insulin product quality and availability. Logistics optimization reduces product costs and improves market accessibility, particularly in remote geographic areas.

Competitive landscape shifts occur as international pharmaceutical companies increase their Vietnam market presence through direct investments and strategic partnerships with local healthcare organizations. Market consolidation trends may emerge as companies seek to achieve economies of scale and improve operational efficiency.

Regulatory harmonization with international standards facilitates faster product approvals and market entry for innovative insulin therapies. Policy alignment with global diabetes care guidelines supports evidence-based treatment protocols and optimal patient outcomes.

Healthcare provider behavior evolves as medical education programs and clinical experience improve diabetes management competencies. Prescribing pattern changes toward more sophisticated insulin regimens and delivery systems reflect growing clinical confidence and patient demand for optimal care.

Patient empowerment trends drive demand for self-management tools and educational resources. Consumer health awareness increases as diabetes education programs and media coverage improve public understanding of the condition and available treatment options.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Vietnam’s insulin drug and delivery device market. Primary research activities include structured interviews with key stakeholders across the healthcare ecosystem, including endocrinologists, diabetes educators, hospital administrators, and pharmaceutical company executives.

Secondary research components encompass analysis of government healthcare statistics, medical literature review, regulatory documentation examination, and competitive intelligence gathering from public sources. Data triangulation methods validate findings across multiple information sources to ensure research accuracy and reliability.

Market sizing methodologies utilize bottom-up and top-down approaches, incorporating patient population estimates, treatment penetration rates, and product pricing analysis. Forecasting models consider demographic trends, economic indicators, and healthcare policy developments to project future market evolution.

Stakeholder engagement includes participation in medical conferences, healthcare industry events, and professional association meetings to gather real-time market intelligence and validate research findings. Expert panel discussions provide qualitative insights into market trends and future development scenarios.

Data quality assurance processes include peer review of research findings, cross-validation of statistical data, and sensitivity analysis of key assumptions. Continuous monitoring of market developments ensures research currency and relevance for strategic decision-making purposes.

Northern Vietnam demonstrates strong market potential, with Hanoi serving as the primary healthcare hub and government administrative center. Healthcare infrastructure in the region benefits from proximity to national medical institutions and research facilities, supporting adoption of advanced insulin therapies and delivery systems. The region accounts for approximately 32% of national insulin consumption, reflecting both population density and healthcare accessibility factors.

Southern Vietnam leads market development, with Ho Chi Minh City representing the largest single market for insulin products and delivery devices. Economic prosperity in the region enables higher adoption rates of premium insulin formulations and advanced diabetes management technologies. Commercial healthcare facilities in the south demonstrate greater willingness to invest in cutting-edge diabetes care equipment and patient services.

Central Vietnam presents emerging market opportunities as healthcare infrastructure development accelerates and diabetes awareness increases. Regional medical centers in cities like Da Nang and Hue are expanding their diabetes care capabilities, creating demand for comprehensive insulin therapy solutions. The region shows growth rates of 12.4% annually in insulin product adoption.

Rural market segments across all regions face unique challenges related to healthcare access and affordability. Government initiatives targeting rural healthcare improvement create opportunities for market expansion through subsidized diabetes care programs and mobile health services. Telemedicine adoption in rural areas shows promising growth, with 28% of rural diabetes patients now accessing remote consultation services.

Border regions with Cambodia, Laos, and China present cross-border healthcare opportunities, with Vietnamese medical facilities attracting patients seeking high-quality diabetes care. Medical tourism potential in these areas could drive additional market demand and support regional healthcare infrastructure development.

Market leadership in Vietnam’s insulin sector is dominated by established international pharmaceutical companies with strong local presence and distribution networks. The competitive environment reflects global diabetes care trends while addressing specific Vietnamese market requirements and preferences.

Competitive strategies focus on product differentiation through advanced formulations, delivery system innovation, and comprehensive patient support programs. Market access initiatives include partnerships with healthcare providers, insurance companies, and government agencies to improve product accessibility and affordability.

Product-based segmentation reveals distinct market dynamics across different insulin categories and delivery device types. Market analysis by product segment provides insights into growth patterns, competitive positioning, and future development opportunities.

By Insulin Type:

By Delivery Device:

By Patient Type:

Rapid-acting insulin category demonstrates strong growth momentum driven by increasing awareness of postprandial glucose control importance. Patient preference trends favor insulin analogs over regular human insulin due to improved pharmacokinetic profiles and reduced hypoglycemia risk. Market penetration of rapid-acting insulin reaches 54% among urban diabetes patients, with continued expansion expected as healthcare provider education improves.

Long-acting insulin segment represents the most dynamic market category, with newer formulations like insulin degludec gaining market share through superior duration of action and flexibility in dosing timing. Basal insulin optimization becomes increasingly important as healthcare providers recognize the foundation role in diabetes management. Patient satisfaction rates with long-acting insulin products exceed 82% according to recent adherence studies.

Insulin pen delivery systems continue market dominance through user-friendly design and accurate dosing capabilities. Smart pen technology integration with mobile applications creates new value propositions for tech-savvy patients seeking comprehensive diabetes management solutions. Adoption rates of connected insulin pens reach 23% among patients under 40 years of age.

Continuous glucose monitoring category shows exceptional growth potential as awareness of glucose variability importance increases among healthcare providers and patients. Integration capabilities with insulin delivery systems create comprehensive diabetes management ecosystems that improve clinical outcomes and patient quality of life.

Biosimilar insulin development presents emerging category opportunities as patents expire for major insulin brands. Cost-effectiveness considerations drive interest in biosimilar alternatives, particularly among healthcare systems seeking to optimize diabetes care budgets while maintaining treatment quality.

Pharmaceutical companies benefit from Vietnam’s expanding diabetes market through increased sales opportunities and market share growth potential. Revenue diversification across multiple product categories and patient segments provides stability and growth prospects in an evolving healthcare landscape.

Healthcare providers gain access to advanced diabetes management tools that improve patient outcomes and clinical efficiency. Treatment optimization through modern insulin formulations and delivery systems enhances provider satisfaction and professional reputation while reducing long-term complications and healthcare costs.

Patients experience improved quality of life through better glycemic control, reduced injection burden, and enhanced treatment convenience. Clinical outcomes improve significantly with access to appropriate insulin therapy regimens and advanced delivery systems tailored to individual needs and preferences.

Healthcare systems benefit from reduced long-term diabetes complications and associated healthcare costs through optimal diabetes management. Economic advantages include decreased hospitalization rates, reduced emergency department visits, and lower overall healthcare utilization among well-controlled diabetes patients.

Insurance providers realize cost savings through improved diabetes management and reduced claims for diabetes-related complications. Risk management improves as patients achieve better glycemic control and experience fewer acute diabetes events requiring expensive medical interventions.

Government agencies achieve public health objectives through improved diabetes care accessibility and outcomes. Healthcare policy goals align with market development as private sector investments complement public health initiatives and infrastructure development programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalized diabetes management emerges as a dominant trend, with insulin therapy regimens increasingly tailored to individual patient characteristics, lifestyle factors, and glycemic patterns. Precision medicine approaches utilize genetic testing, continuous glucose monitoring data, and artificial intelligence algorithms to optimize insulin dosing and delivery timing for maximum therapeutic benefit.

Digital health integration accelerates across all market segments, with smart insulin pens, mobile health applications, and telemedicine platforms becoming standard components of comprehensive diabetes care. Data analytics capabilities enable real-time treatment adjustments and predictive modeling for hypoglycemia prevention and glycemic optimization.

Biosimilar insulin adoption increases as healthcare systems seek cost-effective alternatives to branded insulin products without compromising treatment quality. Regulatory pathways for biosimilar approvals streamline market entry processes while maintaining safety and efficacy standards.

Patient-centric care models emphasize convenience, flexibility, and quality of life improvements through advanced delivery systems and comprehensive support programs. Shared decision-making between patients and healthcare providers becomes standard practice in insulin therapy selection and management protocols.

Preventive care emphasis expands market scope to include prediabetes management and diabetes prevention programs. Early intervention strategies create new market opportunities while addressing the growing diabetes epidemic through proactive healthcare approaches.

Regulatory milestone achievements include approval of next-generation insulin formulations and advanced delivery devices that enhance patient outcomes and treatment convenience. MarkWide Research analysis indicates that regulatory harmonization efforts facilitate faster market entry for innovative diabetes care technologies.

Strategic partnerships between international pharmaceutical companies and Vietnamese healthcare organizations accelerate market development and improve product accessibility. Joint ventures focus on local manufacturing capabilities, distribution network expansion, and healthcare provider education programs.

Technology innovation breakthroughs include development of ultra-long-acting insulin formulations, needle-free delivery systems, and artificial pancreas technologies that revolutionize diabetes management approaches. Research and development investments in Vietnam-specific diabetes care solutions address unique population needs and market requirements.

Healthcare infrastructure investments by government agencies and private organizations improve diabetes care capabilities across urban and rural areas. Medical facility upgrades include specialized diabetes centers, advanced diagnostic equipment, and comprehensive patient education resources.

Insurance coverage expansions improve patient access to premium insulin products and advanced delivery devices. Policy developments support evidence-based diabetes care protocols and reduce financial barriers to optimal treatment regimens.

Market entry strategies should prioritize partnership development with established local healthcare organizations and distribution networks. Successful market penetration requires comprehensive understanding of Vietnamese healthcare dynamics, regulatory requirements, and patient preferences across diverse geographic and socioeconomic segments.

Product portfolio optimization should balance premium insulin formulations with cost-effective alternatives to address varying patient needs and price sensitivity levels. Value-based pricing strategies that demonstrate clinical and economic benefits will support market acceptance and sustainable growth.

Healthcare provider engagement through comprehensive education programs and clinical support services is essential for optimal product utilization and patient outcomes. Medical education initiatives should focus on evidence-based diabetes management protocols and advanced delivery system training.

Digital health integration represents a critical success factor for future market leadership. Technology investments in connected diabetes management solutions, mobile health applications, and data analytics capabilities will differentiate market participants and create competitive advantages.

Regulatory compliance and quality assurance systems must meet international standards while addressing local market requirements. Supply chain optimization should ensure product availability, cold chain integrity, and cost-effective distribution across Vietnam’s diverse geographic landscape.

Market evolution over the next decade will be characterized by continued growth driven by demographic trends, healthcare infrastructure development, and technology innovation. MWR projections indicate sustained market expansion with growth rates exceeding 8% annually through 2030, supported by increasing diabetes prevalence and improving healthcare access.

Technology advancement will transform diabetes care delivery through artificial intelligence integration, predictive analytics, and personalized treatment protocols. Smart insulin delivery systems and continuous glucose monitoring technologies will become standard care components, improving patient outcomes and quality of life.

Healthcare system integration will enhance diabetes care coordination across primary care, specialist services, and patient self-management programs. Comprehensive care models will incorporate insulin therapy optimization, lifestyle intervention, and complication prevention strategies.

Market accessibility will improve through biosimilar insulin development, local manufacturing initiatives, and expanded insurance coverage. Cost-effectiveness improvements will enable broader patient access to optimal diabetes management solutions across all socioeconomic segments.

Regional market leadership potential positions Vietnam as a hub for diabetes care innovation and medical tourism within Southeast Asia. International collaboration opportunities will drive knowledge transfer, technology adoption, and market development acceleration.

Vietnam’s insulin drug and delivery device market represents a compelling growth opportunity driven by fundamental demographic and healthcare trends. The convergence of increasing diabetes prevalence, healthcare infrastructure development, and economic prosperity creates favorable conditions for sustained market expansion and innovation adoption.

Market participants who successfully navigate the unique characteristics of Vietnam’s healthcare landscape while delivering value-based solutions will achieve significant growth and market leadership positions. Strategic focus on patient-centric care, technology integration, and comprehensive healthcare provider support will differentiate successful market entrants from competitors.

Future market success will depend on balancing premium product offerings with cost-effective alternatives, ensuring broad market accessibility while maintaining treatment quality and clinical outcomes. The Vietnam insulin drug and delivery device market is positioned for exceptional growth, offering substantial opportunities for stakeholders committed to improving diabetes care and patient outcomes across this dynamic Southeast Asian healthcare market.

What is Insulin Drug and Delivery Device?

Insulin Drug and Delivery Device refers to the medications and tools used to manage diabetes by delivering insulin to patients. This includes various forms of insulin, such as rapid-acting and long-acting types, as well as delivery devices like syringes, pens, and pumps.

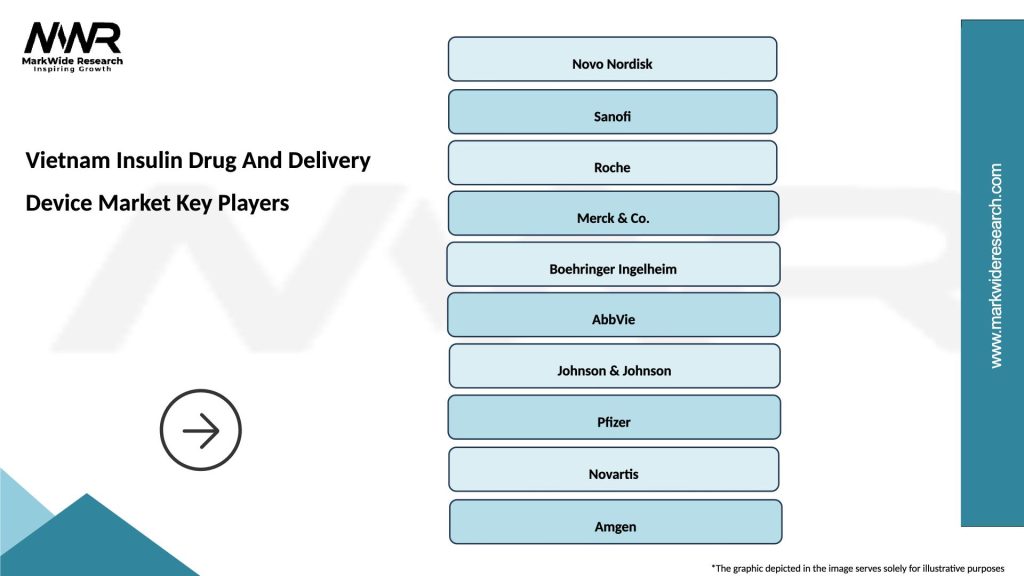

What are the key players in the Vietnam Insulin Drug And Delivery Device Market?

Key players in the Vietnam Insulin Drug And Delivery Device Market include Novo Nordisk, Sanofi, and Eli Lilly, among others. These companies are known for their innovative insulin formulations and advanced delivery systems.

What are the growth factors driving the Vietnam Insulin Drug And Delivery Device Market?

The growth of the Vietnam Insulin Drug And Delivery Device Market is driven by the increasing prevalence of diabetes, rising awareness about diabetes management, and advancements in insulin delivery technologies. Additionally, government initiatives to improve healthcare access contribute to market expansion.

What challenges does the Vietnam Insulin Drug And Delivery Device Market face?

Challenges in the Vietnam Insulin Drug And Delivery Device Market include high costs of advanced delivery devices, regulatory hurdles, and the need for patient education on diabetes management. These factors can hinder market growth and accessibility.

What opportunities exist in the Vietnam Insulin Drug And Delivery Device Market?

Opportunities in the Vietnam Insulin Drug And Delivery Device Market include the development of smart insulin delivery systems, increasing investment in diabetes care, and the potential for partnerships between healthcare providers and technology companies. These trends can enhance patient outcomes and market growth.

What trends are shaping the Vietnam Insulin Drug And Delivery Device Market?

Trends shaping the Vietnam Insulin Drug And Delivery Device Market include the rise of digital health solutions, personalized medicine approaches, and the integration of artificial intelligence in diabetes management. These innovations are expected to improve patient adherence and treatment efficacy.

Vietnam Insulin Drug And Delivery Device Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin Syringes, Insulin Pens, Insulin Pumps, Continuous Glucose Monitors |

| Delivery Mode | Subcutaneous, Intravenous, Inhalation, Oral |

| End User | Hospitals, Clinics, Home Care, Pharmacies |

| Technology | Smart Insulin Pens, Automated Delivery Systems, Wearable Devices, Mobile Apps |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Insulin Drug And Delivery Device Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at