444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America fluoropolymer market represents a dynamic and rapidly evolving sector within the region’s chemical industry landscape. Fluoropolymers, renowned for their exceptional chemical resistance, thermal stability, and unique properties, have established themselves as critical materials across diverse industrial applications throughout South America. The market encompasses countries including Brazil, Argentina, Chile, Colombia, and Peru, each contributing to the region’s growing demand for these specialized polymer materials.

Market dynamics in South America reflect a robust growth trajectory, driven by expanding industrial sectors and increasing adoption of advanced materials. The region’s fluoropolymer market is experiencing significant expansion, with growth rates reaching approximately 8.2% CAGR over recent years. This growth is particularly pronounced in Brazil and Argentina, which collectively account for over 70% of regional market share.

Industrial applications spanning automotive, electronics, chemical processing, and construction sectors are fueling demand for fluoropolymer materials. The region’s growing manufacturing base, coupled with increasing foreign investment in industrial infrastructure, has created substantial opportunities for fluoropolymer suppliers and manufacturers. Technology adoption rates in key industries have accelerated, with approximately 45% of major industrial facilities now incorporating fluoropolymer-based solutions in their operations.

The South America fluoropolymer market refers to the comprehensive ecosystem of production, distribution, and consumption of fluorinated polymer materials across South American countries. Fluoropolymers are synthetic polymers containing fluorine atoms that exhibit extraordinary resistance to chemicals, heat, and environmental degradation, making them invaluable for demanding industrial applications.

These specialized materials encompass various types including polytetrafluoroethylene (PTFE), fluorinated ethylene propylene (FEP), perfluoroalkoxy (PFA), and ethylene tetrafluoroethylene (ETFE). Each variant offers distinct properties tailored to specific applications, from non-stick coatings and electrical insulation to chemical processing equipment and architectural membranes.

Market significance extends beyond traditional chemical applications, encompassing emerging sectors such as renewable energy, advanced electronics, and sustainable construction materials. The South American market’s unique characteristics include growing domestic production capabilities, increasing technological sophistication, and expanding end-user industries that drive consistent demand for high-performance fluoropolymer solutions.

The South America fluoropolymer market demonstrates remarkable resilience and growth potential, positioning itself as a key component of the region’s industrial transformation. Market expansion is characterized by increasing domestic production capabilities, growing end-user demand, and strategic investments in manufacturing infrastructure across major economies.

Key growth drivers include the region’s expanding automotive sector, which accounts for approximately 35% of fluoropolymer consumption, and the rapidly developing electronics industry. Brazil emerges as the dominant market, contributing over 55% of regional demand, followed by Argentina and Chile as significant growth markets.

Technological advancement and increasing awareness of fluoropolymer benefits are accelerating adoption across traditional and emerging applications. The market benefits from growing investments in chemical processing, oil and gas exploration, and renewable energy projects throughout the region. Supply chain development has improved significantly, with local production facilities reducing dependence on imports and enhancing market accessibility for regional manufacturers.

Future prospects remain highly positive, supported by continued industrial growth, infrastructure development, and increasing adoption of advanced materials across diverse sectors. The market’s evolution reflects broader economic trends toward industrialization, technological sophistication, and sustainable development practices throughout South America.

Strategic market insights reveal several critical factors shaping the South America fluoropolymer landscape. Industrial diversification across the region has created multiple growth vectors, with traditional sectors like automotive and chemical processing being joined by emerging applications in renewable energy and advanced electronics.

Market maturation is evident through increasing sophistication of end-user requirements and growing demand for customized fluoropolymer solutions. Competitive dynamics reflect a healthy balance between international suppliers and emerging regional players, fostering innovation and competitive pricing structures.

Industrial expansion across South America serves as the primary catalyst for fluoropolymer market growth. Manufacturing sector development in countries like Brazil, Argentina, and Colombia has created substantial demand for high-performance materials capable of withstanding harsh operating conditions and chemical exposure.

Automotive industry growth represents a significant market driver, with regional vehicle production increasing and manufacturers seeking advanced materials for improved performance and durability. Fluoropolymer applications in automotive include fuel system components, electrical insulation, and specialized coatings that enhance vehicle reliability and longevity.

Electronics sector expansion throughout the region drives demand for fluoropolymer materials in cable insulation, semiconductor manufacturing, and electronic component protection. Growing consumer electronics production and increasing adoption of advanced technologies create consistent demand for specialized fluoropolymer solutions.

Chemical processing industry growth, particularly in petrochemicals and specialty chemicals, requires fluoropolymer materials for equipment lining, gaskets, and seals that can withstand aggressive chemical environments. Infrastructure development projects across the region also contribute to market growth through demand for fluoropolymer-based construction materials and protective coatings.

Environmental regulations and sustainability initiatives are driving adoption of fluoropolymer solutions that offer longer service life and reduced maintenance requirements. Energy sector development, including renewable energy projects, creates additional demand for specialized fluoropolymer applications in solar panels, wind turbines, and energy storage systems.

High material costs represent a significant constraint for the South America fluoropolymer market, particularly affecting price-sensitive applications and smaller manufacturers. Raw material availability and pricing volatility can impact market accessibility and limit adoption in cost-conscious sectors.

Technical complexity associated with fluoropolymer processing and application requires specialized knowledge and equipment, creating barriers for some potential users. Limited local expertise in certain regions can restrict market penetration and slow adoption rates among smaller industrial users.

Regulatory challenges related to fluorinated materials and environmental concerns may impact certain applications and require compliance with evolving environmental standards. Import dependencies for specialized fluoropolymer grades can create supply chain vulnerabilities and affect market stability.

Economic volatility in some South American countries can impact industrial investment and reduce demand for premium materials like fluoropolymers. Currency fluctuations affecting import costs and pricing stability present ongoing challenges for market participants.

Competition from alternative materials in certain applications may limit fluoropolymer adoption where performance requirements allow for less expensive substitutes. Limited recycling infrastructure for fluoropolymer materials may create sustainability concerns and regulatory pressures in environmentally conscious markets.

Emerging applications in renewable energy sectors present substantial opportunities for fluoropolymer market expansion throughout South America. Solar energy development requires specialized fluoropolymer films and coatings for photovoltaic modules, while wind energy applications demand high-performance materials for turbine components and electrical systems.

Infrastructure modernization projects across the region create opportunities for fluoropolymer applications in construction, transportation, and utilities. Smart city initiatives and urban development projects require advanced materials for telecommunications, electrical systems, and architectural applications.

Local production development offers significant opportunities for reducing costs and improving market accessibility. Manufacturing partnerships between international fluoropolymer producers and regional companies can establish local production capabilities and enhance supply chain resilience.

Specialty applications in aerospace, medical devices, and advanced electronics represent high-value market segments with growing demand. Customization opportunities for region-specific applications can create competitive advantages and premium pricing opportunities.

Export potential from South America to other regions presents opportunities for market expansion beyond domestic consumption. Technology transfer and knowledge sharing initiatives can accelerate market development and create new application opportunities across diverse industrial sectors.

Supply and demand dynamics in the South America fluoropolymer market reflect a complex interplay of regional industrial growth, global supply chains, and evolving application requirements. Demand patterns show strong correlation with industrial production cycles and economic growth trends across major South American economies.

Pricing dynamics are influenced by raw material costs, import dependencies, and competitive pressures from both international and emerging regional suppliers. Market consolidation trends indicate increasing collaboration between global fluoropolymer producers and local distributors to enhance market penetration and customer service.

Technology adoption rates vary significantly across different industries and countries, with more developed markets showing faster integration of advanced fluoropolymer solutions. Innovation cycles are accelerating as manufacturers develop specialized products tailored to regional climate conditions and application requirements.

Competitive intensity is increasing as market opportunities attract new entrants and existing players expand their regional presence. Customer sophistication is growing, with end-users demanding higher performance standards and more specialized fluoropolymer solutions for their applications.

Regulatory evolution continues to shape market dynamics, with environmental considerations and safety standards influencing product development and application approvals. Supply chain optimization efforts focus on reducing lead times and improving product availability across the diverse South American market landscape.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the South America fluoropolymer market. Primary research includes extensive interviews with industry executives, manufacturers, distributors, and end-users across major South American countries to gather firsthand market intelligence.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and identify trends. Data triangulation methods ensure consistency and accuracy across multiple information sources and research approaches.

Market sizing methodologies combine top-down and bottom-up approaches, analyzing both macro-economic indicators and specific industry consumption patterns. Forecasting models incorporate historical trends, current market conditions, and projected economic and industrial developments across the region.

Regional analysis involves detailed examination of individual country markets, including Brazil, Argentina, Chile, Colombia, and Peru, to understand local dynamics and growth drivers. Application segmentation analysis provides insights into specific end-use industries and their fluoropolymer consumption patterns.

Competitive intelligence gathering includes analysis of major market participants, their strategies, market positioning, and regional presence. Technology assessment evaluates current and emerging fluoropolymer technologies and their potential impact on market development and application expansion.

Brazil dominates the South America fluoropolymer market, accounting for approximately 55% of regional consumption due to its large industrial base and diverse manufacturing sectors. São Paulo and Rio de Janeiro serve as major consumption centers, with strong demand from automotive, electronics, and chemical processing industries.

Argentina represents the second-largest market, contributing roughly 20% of regional demand, driven by its automotive manufacturing sector and growing electronics industry. Buenos Aires and surrounding industrial areas concentrate much of the country’s fluoropolymer consumption, particularly in automotive and industrial applications.

Chile’s market shows strong growth potential, representing approximately 12% of regional consumption, with mining, renewable energy, and construction sectors driving demand. Mining applications for fluoropolymer-lined equipment and components represent a unique regional opportunity given Chile’s significant copper and lithium production.

Colombia’s emerging market accounts for about 8% of regional demand, with growth driven by expanding manufacturing capabilities and infrastructure development projects. Bogotá and Medellín serve as primary industrial centers with increasing fluoropolymer adoption across diverse applications.

Peru and other markets collectively represent the remaining 5% of regional consumption, showing growth potential as industrial development accelerates. Mining sector applications and infrastructure projects drive demand in these emerging markets, creating opportunities for market expansion.

The competitive landscape of the South America fluoropolymer market features a mix of global leaders and emerging regional players, creating a dynamic and evolving market structure. Market leadership is established through technological expertise, distribution capabilities, and customer relationships across diverse industrial sectors.

Strategic partnerships between global suppliers and regional distributors enhance market penetration and customer service capabilities. Local manufacturing initiatives by international companies aim to reduce costs and improve supply chain responsiveness for regional customers.

Competitive differentiation focuses on technical expertise, application support, and customized solutions for specific regional requirements. Innovation leadership remains crucial for maintaining market position and developing new application opportunities across diverse industrial sectors.

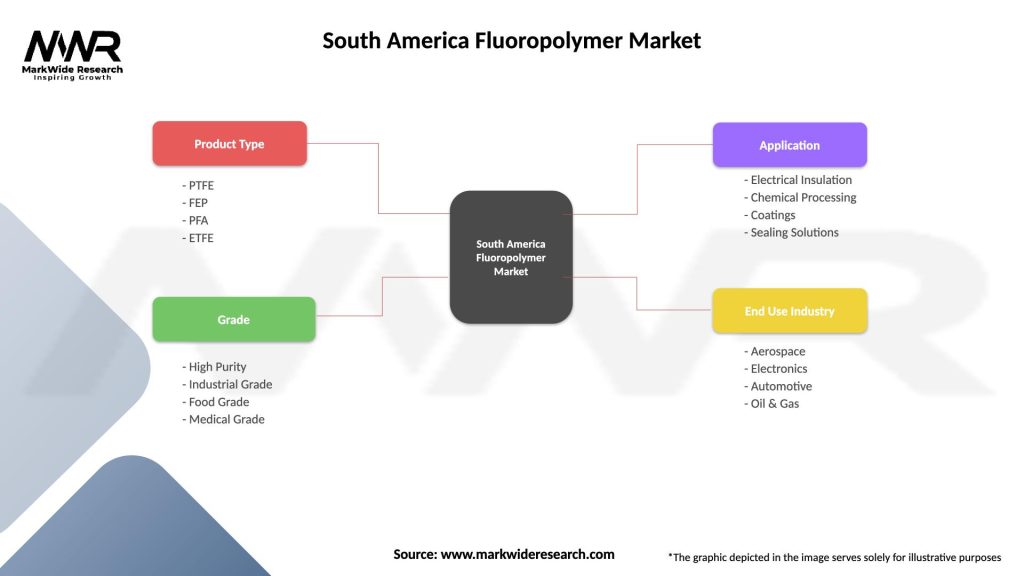

Product type segmentation reveals diverse fluoropolymer categories serving different application requirements across the South American market. PTFE (Polytetrafluoroethylene) represents the largest segment due to its versatility and widespread industrial applications, particularly in chemical processing and automotive sectors.

By Product Type:

By Application:

By End-User Industry:

PTFE category maintains market leadership through its exceptional chemical resistance and thermal stability, making it indispensable for chemical processing applications throughout South America. Industrial adoption continues expanding as manufacturers recognize the long-term cost benefits of PTFE components despite higher initial investment requirements.

FEP segment growth is driven by increasing demand for high-performance wire and cable applications in the region’s expanding electronics and telecommunications sectors. Processing advantages of FEP over PTFE make it attractive for applications requiring complex shapes and precise manufacturing tolerances.

PFA applications are gaining traction in pharmaceutical and semiconductor industries as South America develops more sophisticated manufacturing capabilities. High-purity requirements in these sectors drive demand for PFA’s superior chemical resistance and low extractable properties.

ETFE adoption is accelerating in architectural applications, particularly for large-scale construction projects and sports facilities across major South American cities. Transparency and durability characteristics make ETFE attractive for innovative architectural designs and sustainable building solutions.

Specialty fluoropolymers represent emerging opportunities as regional industries develop more sophisticated application requirements. Customization capabilities for specific regional conditions and applications create premium market segments with higher value propositions.

Manufacturers benefit from fluoropolymer adoption through improved product reliability, reduced maintenance requirements, and enhanced performance characteristics. Operational efficiency gains from fluoropolymer components often justify higher initial costs through extended service life and reduced downtime.

End-users experience significant advantages including superior chemical resistance, thermal stability, and electrical insulation properties that enhance equipment performance and safety. Long-term cost savings result from reduced replacement frequency and lower maintenance requirements compared to conventional materials.

Suppliers and distributors benefit from growing market demand and opportunities for value-added services including technical support and application development. Market expansion creates opportunities for establishing stronger customer relationships and developing specialized product offerings.

Regional economies benefit from industrial development and technology transfer associated with fluoropolymer adoption and local production initiatives. Employment opportunities in manufacturing, distribution, and technical services support economic growth and skills development.

Environmental benefits include reduced material consumption through longer service life and improved efficiency of industrial processes using fluoropolymer components. Sustainability advantages from reduced maintenance and replacement cycles contribute to environmental protection and resource conservation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus is driving development of more environmentally friendly fluoropolymer formulations and recycling technologies. Manufacturers are investing in research and development of sustainable production processes and end-of-life solutions for fluoropolymer materials.

Digitalization trends in manufacturing are creating new opportunities for fluoropolymer applications in sensors, electronic components, and smart manufacturing systems. Industry 4.0 adoption across South American manufacturing sectors drives demand for high-performance materials in advanced production systems.

Customization demand is increasing as end-users seek specialized fluoropolymer solutions tailored to specific regional conditions and application requirements. Application engineering services are becoming more important for market differentiation and customer satisfaction.

Local partnership strategies are evolving as global fluoropolymer suppliers establish stronger relationships with regional distributors and manufacturers. Technology transfer initiatives aim to develop local capabilities and reduce dependence on imports.

Emerging applications in renewable energy, electric vehicles, and advanced electronics are creating new growth vectors for the fluoropolymer market. Innovation focus on developing products for these high-growth sectors represents a key strategic trend across the industry.

Manufacturing expansion initiatives by major fluoropolymer producers include establishment of regional production facilities and distribution centers to better serve South American markets. Investment announcements indicate growing confidence in regional market potential and long-term growth prospects.

Technology partnerships between international fluoropolymer companies and regional manufacturers are facilitating knowledge transfer and local capability development. Joint ventures and licensing agreements enable faster market penetration and reduced operational costs.

Product innovations specifically designed for South American climate conditions and application requirements are being introduced by leading manufacturers. Regional customization efforts focus on developing solutions for unique environmental and operational challenges.

Regulatory developments across South American countries are establishing clearer frameworks for fluoropolymer use and environmental compliance. Standardization efforts aim to harmonize regulations and facilitate trade across regional markets.

Market consolidation activities include strategic acquisitions and partnerships aimed at strengthening regional market positions and expanding product portfolios. Distribution network enhancements improve market coverage and customer service capabilities across diverse geographic regions.

MarkWide Research recommends that market participants focus on developing local production capabilities to reduce costs and improve supply chain resilience. Strategic partnerships with regional manufacturers and distributors can accelerate market penetration and enhance customer relationships.

Investment priorities should emphasize application development and technical support capabilities to differentiate offerings and create value for end-users. Market education initiatives can accelerate adoption by demonstrating the long-term benefits of fluoropolymer solutions.

Product development efforts should focus on emerging applications in renewable energy, electric vehicles, and advanced electronics where growth potential is highest. Customization capabilities for regional requirements can create competitive advantages and premium pricing opportunities.

Supply chain optimization through regional distribution networks and inventory management can improve customer service and reduce lead times. Technology transfer initiatives can develop local expertise and reduce dependence on imported technical knowledge.

Sustainability initiatives including recycling programs and environmentally friendly product development can address regulatory concerns and customer preferences. Long-term planning should consider evolving environmental regulations and their potential impact on market dynamics.

The South America fluoropolymer market is positioned for sustained growth driven by continued industrial development and expanding application opportunities. Market expansion is expected to accelerate with projected growth rates reaching 9.1% CAGR over the next five years, supported by robust industrial activity and infrastructure investment.

Emerging sectors including renewable energy, electric vehicles, and advanced electronics will drive significant demand growth, with these applications potentially accounting for 40% of market growth over the forecast period. Technology advancement and increasing performance requirements across industries will favor high-quality fluoropolymer solutions.

Regional production development is expected to accelerate, with several major manufacturers planning local manufacturing facilities to serve the growing South American market. Supply chain localization will improve market accessibility and reduce costs for regional customers.

Market maturation will be characterized by increasing sophistication of end-user requirements and growing demand for specialized solutions. Innovation focus on sustainable products and advanced applications will drive market differentiation and premium positioning opportunities.

Long-term prospects remain highly positive, supported by fundamental economic growth trends, industrial development, and increasing adoption of advanced materials across diverse sectors. MWR analysis indicates that the market will continue evolving toward higher-value applications and more sophisticated customer requirements, creating opportunities for market participants who can adapt to these changing dynamics.

The South America fluoropolymer market represents a dynamic and rapidly expanding sector with substantial growth potential across diverse industrial applications. Market fundamentals remain strong, supported by continued industrial development, infrastructure investment, and increasing adoption of advanced materials throughout the region.

Key success factors for market participants include developing local capabilities, establishing strong customer relationships, and focusing on emerging high-growth applications. Strategic positioning in renewable energy, automotive, and electronics sectors will be crucial for capturing future growth opportunities.

Regional diversity provides multiple growth vectors while Brazil’s market leadership offers a stable foundation for expansion across South America. Technology advancement and increasing performance requirements favor high-quality fluoropolymer solutions that can deliver superior value to end-users.

Future market evolution will be characterized by increasing sophistication, local production development, and growing emphasis on sustainability and environmental compliance. Market participants who can adapt to these evolving requirements while maintaining competitive positioning will be best positioned to capitalize on the substantial opportunities ahead in the South America fluoropolymer market.

What is Fluoropolymer?

Fluoropolymer refers to a type of polymer that contains fluorine atoms in its molecular structure, which imparts unique properties such as high chemical resistance, thermal stability, and low friction. These materials are widely used in various applications, including coatings, electrical insulation, and gaskets.

What are the key players in the South America Fluoropolymer Market?

Key players in the South America Fluoropolymer Market include companies like DuPont, Solvay, and 3M, which are known for their innovative fluoropolymer products used in industries such as automotive, aerospace, and electronics, among others.

What are the growth factors driving the South America Fluoropolymer Market?

The South America Fluoropolymer Market is driven by increasing demand for lightweight materials in the automotive sector, the growth of the electronics industry, and the rising need for chemical-resistant coatings in various applications.

What challenges does the South America Fluoropolymer Market face?

Challenges in the South America Fluoropolymer Market include environmental concerns related to the production and disposal of fluoropolymers, regulatory pressures, and competition from alternative materials that may offer similar properties.

What opportunities exist in the South America Fluoropolymer Market?

Opportunities in the South America Fluoropolymer Market include the development of bio-based fluoropolymers, advancements in manufacturing technologies, and the increasing adoption of fluoropolymers in renewable energy applications, such as solar panels.

What trends are shaping the South America Fluoropolymer Market?

Trends in the South America Fluoropolymer Market include a growing focus on sustainability, innovations in product formulations to enhance performance, and the expansion of applications in industries like healthcare and food processing.

South America Fluoropolymer Market

| Segmentation Details | Description |

|---|---|

| Product Type | PTFE, FEP, PFA, ETFE |

| Grade | High Purity, Industrial Grade, Food Grade, Medical Grade |

| Application | Electrical Insulation, Chemical Processing, Coatings, Sealing Solutions |

| End Use Industry | Aerospace, Electronics, Automotive, Oil & Gas |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Fluoropolymer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at