444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Kuwait oilfield services market represents a critical component of the nation’s petroleum industry, encompassing a comprehensive range of specialized services essential for oil exploration, drilling, production, and maintenance operations. Kuwait’s position as one of the world’s leading oil producers has created a robust demand for advanced oilfield services, driving significant growth in this sector. The market encompasses various service categories including drilling services, well completion, production optimization, enhanced oil recovery, and field maintenance operations.

Market dynamics in Kuwait’s oilfield services sector are characterized by substantial investments in upstream activities, technological advancement adoption, and increasing focus on maximizing production efficiency from existing fields. The country’s proven oil reserves and strategic importance in global energy markets have attracted numerous international service providers, creating a competitive landscape that drives innovation and service quality improvements. Growth projections indicate the market is expanding at a steady CAGR of 6.2%, supported by Kuwait’s ambitious production targets and infrastructure modernization initiatives.

Technological integration has become increasingly important, with digital oilfield solutions, artificial intelligence applications, and advanced drilling technologies gaining significant traction. The market benefits from Kuwait’s stable political environment, well-established petroleum infrastructure, and government support for oil sector development. Service diversification trends show growing demand for specialized services including horizontal drilling, hydraulic fracturing, and enhanced oil recovery techniques, reflecting the industry’s evolution toward more sophisticated extraction methods.

The Kuwait oilfield services market refers to the comprehensive ecosystem of specialized technical services, equipment, and expertise required to support oil and gas exploration, development, and production activities within Kuwait’s petroleum sector. This market encompasses all service activities from initial geological surveys and seismic studies through drilling operations, well completion, production optimization, and field maintenance throughout the lifecycle of oil and gas assets.

Service categories within this market include upstream services such as drilling and completion, midstream services including pipeline and transportation support, and various specialized technical services like reservoir engineering, production enhancement, and environmental compliance. The market serves both Kuwait Petroleum Corporation and its subsidiaries, as well as international oil companies operating in the country through various partnership arrangements and service contracts.

Market participants range from large multinational oilfield service companies to specialized local providers, creating a diverse service ecosystem that supports Kuwait’s position as a major global oil producer. The market’s significance extends beyond direct service provision to include technology transfer, local capacity building, and economic diversification initiatives aligned with Kuwait’s long-term development objectives.

Kuwait’s oilfield services market demonstrates robust growth potential driven by sustained oil production targets, infrastructure modernization requirements, and increasing adoption of advanced technologies. The market benefits from Kuwait’s strategic position in global energy markets and the government’s commitment to maintaining and expanding oil production capacity. Key growth drivers include aging field revitalization projects, enhanced oil recovery implementations, and digital transformation initiatives across the petroleum sector.

Market segmentation reveals strong demand across multiple service categories, with drilling services, well completion, and production optimization representing the largest segments. The competitive landscape features a mix of international service giants and emerging local providers, creating opportunities for technology transfer and local content development. Regional analysis indicates that northern Kuwait fields account for approximately 45% of service demand, while offshore operations contribute a growing share of market activity.

Investment trends show increasing focus on sustainable practices, environmental compliance, and operational efficiency improvements. The market faces challenges including skilled workforce development, technology adoption costs, and regulatory compliance requirements. However, growth opportunities remain substantial, particularly in areas such as digitalization, enhanced oil recovery, and renewable energy integration within traditional oilfield operations.

Strategic insights from the Kuwait oilfield services market reveal several critical trends shaping industry development. The following key insights provide comprehensive understanding of market dynamics:

Market intelligence indicates that service providers focusing on innovation, local partnership development, and comprehensive service offerings are achieving the strongest market positions. The insights demonstrate the market’s evolution toward more sophisticated, technology-driven service delivery models that align with Kuwait’s long-term energy sector objectives.

Primary market drivers in Kuwait’s oilfield services sector stem from the country’s strategic importance in global oil markets and ambitious production expansion plans. Government initiatives to maintain and increase oil production capacity create sustained demand for comprehensive oilfield services across all operational phases. The drive to maximize recovery from existing fields while developing new reserves provides continuous growth opportunities for service providers.

Technological advancement requirements represent a significant driver as operators seek to improve efficiency, reduce costs, and enhance safety standards. The adoption of digital oilfield technologies, artificial intelligence applications, and advanced drilling techniques creates demand for specialized services and technical expertise. Infrastructure aging in mature fields necessitates extensive maintenance, upgrade, and enhancement services, driving consistent market demand.

Economic diversification goals under Kuwait’s development vision create opportunities for local service provider development and technology transfer initiatives. The focus on building domestic capabilities while maintaining world-class service standards drives investment in training, equipment, and facility development. Environmental compliance requirements and sustainability initiatives create new service categories and drive demand for environmentally responsible operational practices.

International market dynamics and oil price stability provide favorable conditions for sustained investment in oilfield services. The strategic importance of maintaining production capacity and operational readiness drives continuous investment in service capabilities, equipment modernization, and technical expertise development across the petroleum sector.

Market restraints in Kuwait’s oilfield services sector include several challenges that impact growth potential and operational efficiency. Skilled workforce limitations represent a primary constraint, as the specialized nature of oilfield services requires extensive technical expertise and experience that may be limited in the local market. This creates dependency on international expertise and increases operational costs for service providers.

Regulatory complexity and compliance requirements can create barriers for new market entrants and increase operational costs for existing providers. The need to meet stringent safety, environmental, and technical standards requires significant investment in compliance systems and procedures. Capital intensity of oilfield services operations presents challenges for smaller providers seeking to compete with established international companies.

Technology adoption costs and the rapid pace of technological change create ongoing investment requirements that may strain resources for some service providers. The need to continuously upgrade equipment, systems, and capabilities to remain competitive requires substantial capital commitments. Market concentration among major operators can limit opportunities for smaller service providers and create dependency relationships.

Economic volatility in global oil markets can impact investment decisions and service demand, creating uncertainty for long-term planning and capacity development. Geopolitical factors and regional stability concerns may influence international investment and partnership decisions, potentially limiting access to advanced technologies and expertise.

Significant opportunities exist within Kuwait’s oilfield services market, driven by the country’s strategic position and ongoing development initiatives. Digital transformation presents substantial opportunities for service providers offering advanced digital oilfield solutions, artificial intelligence applications, and data analytics services. The growing focus on operational efficiency and cost optimization creates demand for innovative service delivery models and technology-enabled solutions.

Enhanced oil recovery represents a major opportunity area as Kuwait seeks to maximize production from existing fields. Service providers with expertise in advanced recovery techniques, reservoir optimization, and production enhancement technologies are well-positioned for growth. Local content development initiatives create opportunities for domestic service providers and international companies seeking local partnerships.

Environmental services and sustainability solutions represent emerging opportunities as the industry focuses on reducing environmental impact and improving operational sustainability. The integration of renewable energy solutions into oilfield operations creates new service categories and market segments. Infrastructure modernization projects provide opportunities for comprehensive service packages combining multiple specialties.

Regional expansion opportunities exist for Kuwait-based service providers to serve other Gulf markets, leveraging their regional expertise and established capabilities. Technology transfer and knowledge sharing initiatives create opportunities for international providers to establish long-term partnerships and market presence in Kuwait while contributing to local capability development.

Market dynamics in Kuwait’s oilfield services sector are characterized by the interplay of government policy, international market conditions, and technological advancement trends. Demand patterns show strong correlation with Kuwait’s oil production targets and infrastructure development plans, creating predictable growth trajectories for service providers. The market demonstrates resilience to short-term volatility due to the strategic nature of oil production and long-term service contracts.

Competitive dynamics feature intense competition among international service providers while creating opportunities for local content development and partnership formation. Price competition is balanced by quality requirements and technical complexity, favoring providers with proven capabilities and comprehensive service offerings. The market shows increasing consolidation trends as smaller providers seek partnerships or acquisition opportunities with larger companies.

Supply chain dynamics are influenced by global equipment availability, international logistics, and local content requirements. Service providers must balance cost efficiency with local partnership obligations and capability development requirements. Innovation cycles drive continuous technology adoption and service evolution, with successful providers investing approximately 8-12% of revenue in research and development activities.

Regulatory dynamics continue evolving with increasing focus on safety, environmental protection, and local content development. MarkWide Research analysis indicates that regulatory compliance costs represent approximately 15-20% of total operational expenses for major service providers, highlighting the importance of efficient compliance management systems.

Research methodology for analyzing Kuwait’s oilfield services market employs a comprehensive approach combining primary and secondary research techniques to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, service providers, regulatory officials, and key stakeholders across the petroleum sector to gather firsthand insights into market conditions, trends, and future prospects.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, and regulatory documents to establish market baselines and validate primary research findings. Data triangulation methods ensure accuracy by cross-referencing information from multiple sources and validating findings through different analytical approaches.

Market sizing methodology utilizes bottom-up and top-down approaches to establish comprehensive market understanding, focusing on service category analysis, regional distribution patterns, and competitive landscape assessment. Quantitative analysis includes statistical modeling, trend analysis, and growth projection calculations based on historical data and forward-looking indicators.

Qualitative analysis incorporates expert opinions, industry insights, and strategic assessments to provide context and interpretation for quantitative findings. Validation processes include peer review, expert consultation, and cross-referencing with established industry benchmarks to ensure research reliability and accuracy. The methodology ensures comprehensive coverage of all market segments, geographic regions, and stakeholder perspectives.

Regional analysis of Kuwait’s oilfield services market reveals distinct geographic patterns reflecting the distribution of petroleum resources and infrastructure development. Northern Kuwait represents the largest regional market, accounting for approximately 45% of total service demand, driven by major oil fields including Raudhatain and Sabriya. This region features mature field operations requiring extensive maintenance, enhancement, and optimization services.

Western Kuwait contributes approximately 30% of market activity, centered around the Burgan field complex, one of the world’s largest oil fields. Service demand in this region focuses on production optimization, enhanced recovery techniques, and infrastructure modernization projects. The region benefits from established infrastructure and proximity to major processing facilities.

Offshore operations represent a growing segment, accounting for approximately 15% of current market share but showing the highest growth potential. Kuwait’s offshore fields require specialized services including marine logistics, subsea operations, and offshore drilling support. The development of offshore resources creates opportunities for specialized service providers with marine capabilities.

Southern regions contribute the remaining 10% of market activity, primarily focused on exploration activities and new field development projects. This region offers growth opportunities as Kuwait expands its resource base and develops previously unexplored areas. Regional service distribution patterns reflect infrastructure availability, field maturity levels, and development priorities, with northern and western regions maintaining dominant positions while offshore and southern areas show increasing activity levels.

Competitive landscape in Kuwait’s oilfield services market features a diverse mix of international service giants, regional specialists, and emerging local providers. The market structure reflects the complex requirements of petroleum operations and the strategic importance of maintaining world-class service capabilities. Market leadership is distributed among several key categories of service providers:

Competitive strategies focus on technology leadership, local partnership development, and comprehensive service offerings. Market differentiation occurs through specialized capabilities, digital solutions, and ability to deliver integrated service packages. The competitive environment encourages innovation, efficiency improvements, and local content development initiatives.

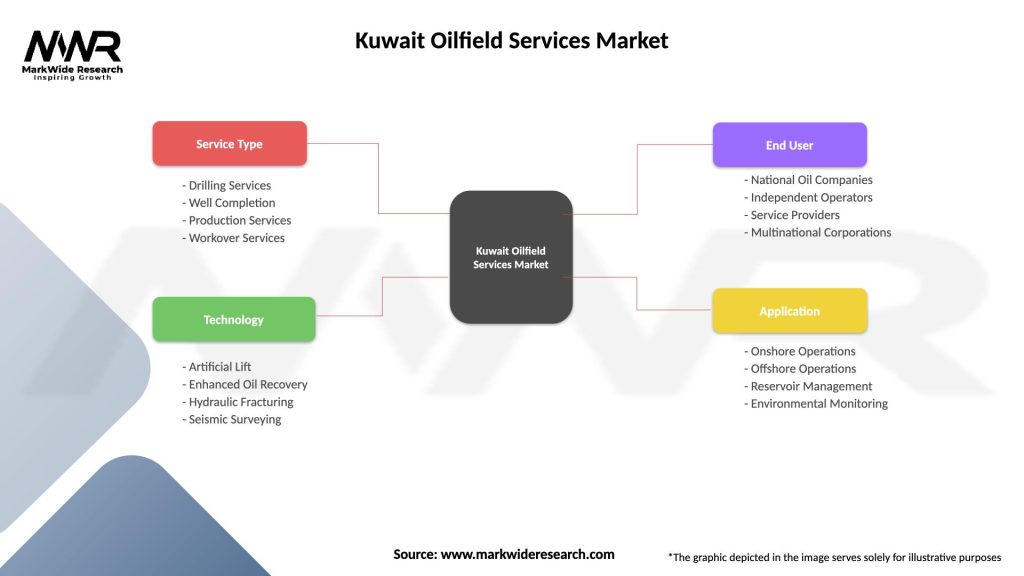

Market segmentation in Kuwait’s oilfield services sector reveals distinct categories based on service type, application area, and operational phase. By Service Type, the market encompasses several major segments with varying growth characteristics and market dynamics:

Drilling Services represent the largest segment, including rotary drilling, directional drilling, and specialized drilling techniques. This segment benefits from ongoing field development and well maintenance requirements. Well Completion Services include casing, cementing, and completion equipment installation, representing a critical phase in well development operations.

Production Services encompass artificial lift systems, production optimization, and well intervention services designed to maximize output from existing wells. Enhanced Oil Recovery services include water flooding, gas injection, and chemical recovery techniques to improve field productivity. Maintenance and Workover services provide ongoing support for well and facility maintenance requirements.

By Application Area, segmentation includes Onshore Services representing the majority of current market activity, and Offshore Services showing the highest growth potential. By Operational Phase, services are categorized into Exploration, Development, Production, and Abandonment phases, each requiring specialized service capabilities and expertise.

Technology-based segmentation includes Conventional Services and Digital/Advanced Services, with the latter category experiencing rapid growth as operators adopt digital oilfield technologies and automation solutions.

Category-wise analysis reveals distinct characteristics and growth patterns across different service segments in Kuwait’s oilfield services market. Drilling Services demonstrate consistent demand driven by ongoing development activities and well maintenance requirements. This category benefits from technological advancement in drilling techniques and equipment, with horizontal drilling and extended reach drilling showing particular growth.

Production Optimization Services represent a high-growth category as operators focus on maximizing output from existing assets. Artificial lift systems, well stimulation, and production monitoring services show strong demand growth, supported by the need to maintain production levels from aging fields. Enhanced Oil Recovery services are experiencing significant growth as Kuwait implements advanced recovery techniques to extend field life and improve recovery rates.

Digital Services represent the fastest-growing category, with data analytics, remote monitoring, and predictive maintenance solutions gaining rapid adoption. According to MarkWide Research analysis, digital service adoption rates have increased by 40% annually over the past three years. Environmental Services show emerging growth as operators focus on sustainability and regulatory compliance.

Maintenance and Support Services provide stable, recurring revenue streams with growth tied to field maturity and infrastructure age. Logistics and Supply Chain services benefit from the complex requirements of petroleum operations and the need for efficient material and equipment management across multiple field locations.

Industry participants in Kuwait’s oilfield services market benefit from multiple value propositions that support business growth and operational success. Service providers gain access to a stable, well-funded market with long-term growth potential driven by Kuwait’s strategic importance in global oil markets. The market offers opportunities for technology deployment, capability development, and regional expansion.

International companies benefit from Kuwait’s stable political environment, established petroleum infrastructure, and government support for foreign investment in the energy sector. Local partnerships provide access to regional expertise, regulatory knowledge, and established business relationships that facilitate market entry and expansion.

Oil operators benefit from access to world-class service capabilities, advanced technologies, and specialized expertise that enhance operational efficiency and production optimization. Competitive service markets drive innovation, cost efficiency, and service quality improvements that benefit end users.

Government stakeholders benefit from job creation, technology transfer, local content development, and economic diversification opportunities. Local communities benefit from employment opportunities, skills development programs, and economic activity generated by oilfield services operations.

Investors benefit from stable returns, growth potential, and exposure to Kuwait’s strategic petroleum sector. The market provides opportunities for both direct investment and partnership arrangements that align with various risk and return profiles.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key trends shaping Kuwait’s oilfield services market reflect the broader evolution of the global petroleum industry and specific regional development priorities. Digital transformation represents the most significant trend, with operators increasingly adopting artificial intelligence, machine learning, and Internet of Things technologies to optimize operations and reduce costs. Predictive maintenance solutions are gaining traction, with implementation rates increasing by 25% annually.

Sustainability focus is becoming increasingly important, with service providers developing environmentally responsible solutions and operators demanding reduced environmental impact from service activities. Carbon footprint reduction initiatives and waste minimization programs are becoming standard requirements in service contracts.

Local content development continues as a major trend, with government initiatives driving increased participation of Kuwaiti companies in oilfield services provision. Technology transfer requirements and local partnership mandates are reshaping competitive strategies and market entry approaches for international providers.

Automation advancement is accelerating across all service categories, from automated drilling systems to robotic inspection and maintenance solutions. Remote operations capabilities have become increasingly important, enabling efficient service delivery while reducing personnel exposure and operational costs. Integrated service delivery models are gaining preference as operators seek comprehensive solutions from fewer, more capable service providers.

Recent industry developments in Kuwait’s oilfield services market demonstrate the dynamic nature of the sector and ongoing evolution toward more advanced, efficient service delivery models. Technology partnerships between international service providers and local companies have accelerated, facilitating knowledge transfer and capability development while meeting local content requirements.

Digital platform implementations have gained momentum, with major operators deploying comprehensive digital oilfield solutions that integrate multiple service categories and provide real-time operational visibility. Artificial intelligence applications in drilling optimization, production forecasting, and predictive maintenance have moved from pilot projects to commercial deployment.

Enhanced oil recovery projects have expanded significantly, with several major initiatives launched to improve recovery rates from mature fields. Water flooding programs, gas injection projects, and chemical recovery techniques are being implemented across multiple field locations, creating substantial service opportunities.

Environmental compliance initiatives have intensified, with new regulations and standards driving investment in environmental protection services and sustainable operational practices. Workforce development programs have expanded through partnerships between service providers, educational institutions, and government agencies to build local technical capabilities.

Infrastructure modernization projects have accelerated, with significant investments in upgrading aging facilities, implementing advanced control systems, and improving operational efficiency across Kuwait’s petroleum infrastructure.

Strategic recommendations for success in Kuwait’s oilfield services market emphasize the importance of balancing international expertise with local partnership development and capability building. Service providers should prioritize establishing strong local partnerships that provide regulatory knowledge, cultural understanding, and access to local talent while maintaining world-class technical capabilities.

Technology investment should focus on digital solutions, automation technologies, and data analytics capabilities that demonstrate clear value propositions in terms of operational efficiency, cost reduction, and safety improvement. MWR analysis suggests that companies investing 10-15% of revenue in technology development achieve superior market positioning and growth rates.

Local content strategy development is essential for long-term success, requiring comprehensive approaches to workforce development, local supplier integration, and technology transfer. Training programs, apprenticeship initiatives, and knowledge sharing arrangements should be integral components of market entry and expansion strategies.

Service integration opportunities should be pursued to provide comprehensive solutions that address multiple operator requirements through single-source relationships. Environmental compliance capabilities should be developed proactively to meet evolving regulatory requirements and operator sustainability objectives.

Regional expansion strategies should leverage Kuwait-based capabilities to serve broader Gulf markets, creating economies of scale and diversifying revenue sources. Partnership strategies should balance local content requirements with the need to maintain technical excellence and competitive positioning.

Future outlook for Kuwait’s oilfield services market remains highly positive, supported by the country’s strategic importance in global oil markets and ongoing commitment to maintaining and expanding production capacity. Growth projections indicate sustained expansion driven by infrastructure modernization, enhanced recovery implementations, and digital transformation initiatives across the petroleum sector.

Technology evolution will continue driving market development, with artificial intelligence, machine learning, and automation technologies becoming standard components of service delivery. Digital oilfield adoption is expected to reach 75% penetration across major operators within the next five years, creating substantial opportunities for technology-enabled service providers.

Enhanced oil recovery will become increasingly important as Kuwait seeks to maximize production from existing fields while developing new resources. Production optimization services and advanced recovery techniques will experience the strongest growth rates, supported by government initiatives and operator investment priorities.

Local content development will continue evolving, with increasing sophistication in local capabilities and growing participation of Kuwaiti companies in complex service provision. Sustainability requirements will drive demand for environmentally responsible service solutions and carbon footprint reduction initiatives.

Market consolidation trends may accelerate as smaller providers seek partnerships or acquisition opportunities with larger companies to access capital, technology, and market reach. Regional integration opportunities will expand as Kuwait-based service providers leverage their capabilities to serve broader Gulf markets, creating additional growth avenues and market diversification opportunities.

Kuwait’s oilfield services market represents a dynamic and strategically important sector within the global petroleum industry, characterized by strong fundamentals, growth potential, and evolving service requirements. The market benefits from Kuwait’s position as a major oil producer, stable political environment, and government support for petroleum sector development. Growth drivers including infrastructure modernization, enhanced oil recovery, and digital transformation create substantial opportunities for service providers across multiple categories.

Market dynamics reflect the complex interplay of international expertise, local content development, and technological advancement requirements. The competitive landscape features established international providers alongside emerging local companies, creating a diverse ecosystem that supports innovation and capability development. Regional analysis reveals distinct geographic patterns with northern and western Kuwait maintaining dominant positions while offshore and southern regions show increasing activity levels.

Future prospects remain highly favorable, with sustained growth expected across all major service categories. The market’s evolution toward more sophisticated, technology-enabled service delivery models aligns with global industry trends while addressing Kuwait’s specific operational requirements and development objectives. Success factors for market participants include technology leadership, local partnership development, comprehensive service capabilities, and alignment with sustainability and local content objectives. The Kuwait oilfield services market continues to offer attractive opportunities for both international and local service providers committed to delivering world-class capabilities while contributing to the country’s long-term energy sector development goals.

What is Kuwait Oilfield Services?

Kuwait Oilfield Services refers to the range of services provided to support oil exploration, extraction, and production activities in Kuwait. This includes drilling, well completion, maintenance, and other technical services essential for efficient oilfield operations.

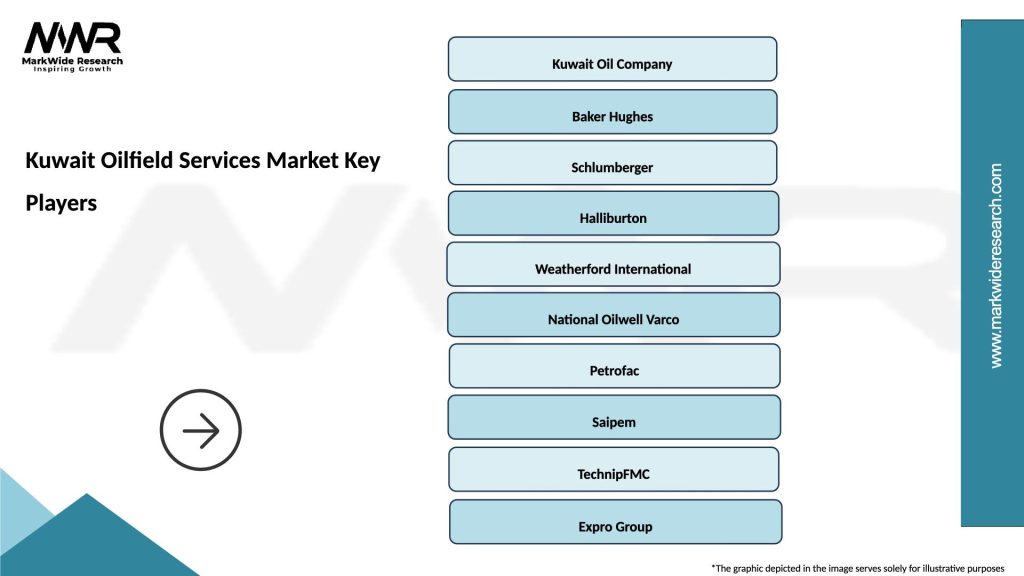

What are the key companies in the Kuwait Oilfield Services Market?

Key companies in the Kuwait Oilfield Services Market include Kuwait Oil Company, Schlumberger, Halliburton, and Baker Hughes, among others. These companies provide various services such as drilling, reservoir management, and production optimization.

What are the growth factors driving the Kuwait Oilfield Services Market?

The growth of the Kuwait Oilfield Services Market is driven by increasing oil production activities, the need for advanced drilling technologies, and the rising demand for energy. Additionally, investments in infrastructure and enhanced oil recovery techniques contribute to market expansion.

What challenges does the Kuwait Oilfield Services Market face?

The Kuwait Oilfield Services Market faces challenges such as fluctuating oil prices, regulatory compliance issues, and environmental concerns. These factors can impact investment decisions and operational costs for service providers.

What opportunities exist in the Kuwait Oilfield Services Market?

Opportunities in the Kuwait Oilfield Services Market include the adoption of digital technologies, such as IoT and AI, to enhance operational efficiency. Additionally, the push for sustainable practices and renewable energy integration presents new avenues for service providers.

What trends are shaping the Kuwait Oilfield Services Market?

Trends shaping the Kuwait Oilfield Services Market include the increasing use of automation in drilling operations, a focus on reducing carbon emissions, and the integration of advanced data analytics for better decision-making. These trends are influencing how services are delivered and managed.

Kuwait Oilfield Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Drilling Services, Well Completion, Production Services, Workover Services |

| Technology | Artificial Lift, Enhanced Oil Recovery, Hydraulic Fracturing, Seismic Surveying |

| End User | National Oil Companies, Independent Operators, Service Providers, Multinational Corporations |

| Application | Onshore Operations, Offshore Operations, Reservoir Management, Environmental Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Kuwait Oilfield Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at