444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan sensor market represents one of the most sophisticated and technologically advanced sensor ecosystems globally, driven by the country’s leadership in automotive manufacturing, industrial automation, and consumer electronics. Japan’s sensor industry has experienced remarkable growth, with the market expanding at a 6.2% CAGR over recent years, positioning the nation as a critical hub for sensor innovation and production in the Asia-Pacific region.

Japanese sensor manufacturers have established themselves as global leaders in precision sensing technologies, particularly in automotive applications where sensors play crucial roles in advanced driver assistance systems (ADAS) and autonomous vehicle development. The market encompasses diverse sensor types including temperature sensors, pressure sensors, motion sensors, optical sensors, and emerging technologies such as LiDAR and radar sensors.

Industrial automation continues to drive significant demand for sensors across Japan’s manufacturing sector, with companies increasingly adopting Internet of Things (IoT) solutions and smart factory technologies. The integration of sensors in robotics, quality control systems, and predictive maintenance applications has created substantial opportunities for market expansion, with industrial sensor adoption rates reaching 78% among major manufacturers.

The Japan sensor market refers to the comprehensive ecosystem of sensor technologies, manufacturing capabilities, and applications within Japan’s domestic and export-oriented industries. This market encompasses the development, production, and deployment of various sensing devices that convert physical, chemical, or biological phenomena into measurable electrical signals for monitoring, control, and automation purposes.

Sensor technologies in Japan span multiple categories including MEMS (Micro-Electro-Mechanical Systems) sensors, image sensors, environmental sensors, and specialized automotive sensors. The market includes both traditional sensing applications and cutting-edge developments in artificial intelligence-enabled sensors, quantum sensors, and biomedical sensing devices that support Japan’s aging society initiatives.

Market participants range from established electronics giants to innovative startups, creating a dynamic ecosystem that supports both domestic consumption and global export markets. The Japanese sensor market serves as a critical component in the country’s broader strategy to maintain technological leadership in key industries while addressing societal challenges through advanced sensing solutions.

Japan’s sensor market demonstrates exceptional resilience and innovation capacity, with the industry maintaining strong growth momentum despite global economic uncertainties. The market benefits from Japan’s established manufacturing expertise, robust research and development infrastructure, and strategic positioning in high-value sensor applications across automotive, industrial, and consumer electronics sectors.

Key growth drivers include the accelerating adoption of electric vehicles, expansion of industrial IoT implementations, and increasing demand for healthcare monitoring solutions to support Japan’s aging population. Automotive sensors represent the largest application segment, accounting for approximately 42% of total sensor demand, followed by industrial automation applications at 28% market share.

Technological advancement remains a cornerstone of market development, with Japanese companies investing heavily in next-generation sensor technologies including AI-enhanced sensors, miniaturized MEMS devices, and advanced materials for harsh environment applications. The market’s export orientation continues to strengthen, with Japanese sensor manufacturers supplying critical components to global automotive and electronics manufacturers.

Future prospects appear highly favorable, supported by government initiatives promoting digital transformation, smart city development, and sustainable manufacturing practices. The integration of sensors with 5G networks and edge computing capabilities presents significant opportunities for market expansion and technological differentiation.

Strategic market insights reveal several critical factors shaping Japan’s sensor market trajectory and competitive positioning:

Automotive industry transformation serves as the primary catalyst for Japan’s sensor market growth, with the shift toward electric vehicles and autonomous driving technologies creating unprecedented demand for advanced sensing solutions. Japanese automotive manufacturers require sophisticated sensor arrays for battery management systems, collision avoidance, lane departure warning, and autonomous navigation capabilities.

Industrial automation expansion continues to drive substantial sensor adoption across Japan’s manufacturing sector, where companies implement smart factory initiatives to enhance productivity and quality control. The integration of sensors in robotic systems, conveyor monitoring, and predictive maintenance applications has resulted in 35% improvement in operational efficiency among early adopters.

Aging population demographics create significant opportunities for healthcare and wellness sensors, as Japan addresses the challenges of providing care for an increasingly elderly population. Wearable sensors, home monitoring systems, and medical diagnostic devices experience growing demand as healthcare providers seek innovative solutions for remote patient monitoring and early disease detection.

Government digital transformation initiatives support sensor market growth through smart city projects, infrastructure monitoring programs, and environmental sustainability measures. Public sector investments in sensor networks for traffic management, energy optimization, and disaster prevention create substantial market opportunities for Japanese sensor manufacturers.

Consumer electronics innovation drives demand for miniaturized, high-performance sensors in smartphones, wearable devices, and smart home applications. Japanese companies leverage their expertise in precision manufacturing to develop sensors that meet stringent size, power consumption, and performance requirements for next-generation consumer products.

High development costs present significant challenges for sensor manufacturers, particularly for specialized applications requiring extensive research and development investments. The complexity of advanced sensor technologies, combined with stringent quality and reliability requirements, creates substantial barriers to entry for smaller companies and limits rapid market expansion.

Supply chain vulnerabilities have emerged as critical concerns following global disruptions, with sensor manufacturers facing challenges in securing reliable access to specialized materials and components. The concentration of certain raw materials and manufacturing processes in specific geographic regions creates potential risks for production continuity and cost stability.

Intense global competition from lower-cost manufacturers in other Asian countries pressures Japanese sensor companies to continuously innovate and differentiate their offerings. Price competition in commodity sensor segments challenges traditional business models and requires strategic repositioning toward higher-value applications and technologies.

Regulatory complexity across different application sectors creates compliance challenges for sensor manufacturers, particularly in automotive and medical applications where safety and performance standards continue to evolve. The need to meet multiple international certification requirements increases development timelines and costs for global market access.

Technology obsolescence risks require continuous innovation investments to maintain competitive positioning, as sensor technologies evolve rapidly and customer requirements become increasingly sophisticated. Companies must balance current product optimization with future technology development to avoid market displacement.

Autonomous vehicle development presents extraordinary opportunities for Japanese sensor manufacturers, as the transition to fully autonomous driving requires sophisticated sensor fusion technologies combining LiDAR, radar, cameras, and inertial measurement units. The global autonomous vehicle sensor market offers substantial growth potential for companies with advanced sensing capabilities.

Smart city initiatives across Japan and internationally create significant demand for environmental monitoring sensors, traffic management systems, and infrastructure health monitoring solutions. Government investments in urban digitization and sustainability programs provide long-term market opportunities for sensor technology providers.

Healthcare digitization accelerates demand for medical sensors, wearable health monitoring devices, and telemedicine solutions that support remote patient care and preventive healthcare strategies. Japan’s expertise in precision manufacturing and miniaturization positions the country well for healthcare sensor market expansion.

Industrial IoT proliferation offers substantial opportunities for sensor manufacturers as companies across various industries implement connected systems for operational optimization, energy management, and predictive maintenance. The integration of artificial intelligence with sensor networks enhances value propositions and market potential.

Emerging applications in areas such as augmented reality, virtual reality, and advanced robotics create new market segments for specialized sensors with unique performance characteristics. Japanese companies can leverage their technological expertise to capture leadership positions in these developing markets.

Market dynamics in Japan’s sensor industry reflect the complex interplay between technological innovation, competitive pressures, and evolving customer requirements across multiple application sectors. The market demonstrates strong cyclical patterns aligned with automotive production cycles, consumer electronics product launches, and industrial capital investment trends.

Competitive intensity continues to increase as global sensor manufacturers expand their presence in Japan while domestic companies face pressure to maintain technological leadership and market share. This dynamic environment drives continuous innovation and strategic partnerships between sensor manufacturers and end-user industries.

Technology convergence creates both opportunities and challenges as traditional sensor boundaries blur with the integration of artificial intelligence, edge computing, and advanced materials. Companies must navigate evolving technology landscapes while maintaining focus on core competencies and customer relationships.

Customer consolidation in key sectors such as automotive and consumer electronics concentrates purchasing power among fewer, larger customers, requiring sensor manufacturers to develop strategic relationships and customized solutions. This trend influences pricing dynamics and product development priorities across the market.

Regulatory evolution shapes market development as governments implement new standards for automotive safety, environmental monitoring, and data privacy. Sensor manufacturers must anticipate regulatory changes and incorporate compliance requirements into product development strategies to maintain market access.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Japan’s sensor market dynamics, competitive landscape, and growth prospects. The research approach combines quantitative data analysis with qualitative industry expertise to provide actionable market intelligence.

Primary research activities include extensive interviews with industry executives, technology experts, and key stakeholders across the sensor value chain. These discussions provide insights into market trends, competitive strategies, and future development priorities that inform market projections and strategic recommendations.

Secondary research sources encompass industry publications, government statistics, patent databases, and financial reports from publicly traded sensor manufacturers. This information supports market sizing estimates, competitive analysis, and technology trend identification across different sensor categories and applications.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project market growth rates, segment development, and regional trends. The models incorporate economic indicators, industry drivers, and technological advancement patterns to generate reliable market projections.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review, and sensitivity analysis of key assumptions. This rigorous approach maintains research quality and provides confidence in market insights and recommendations.

Tokyo metropolitan area dominates Japan’s sensor market landscape, hosting major sensor manufacturers, research institutions, and technology development centers. The region benefits from proximity to automotive manufacturers, electronics companies, and government agencies, creating a concentrated ecosystem for sensor innovation and commercialization with approximately 45% of national sensor production.

Kansai region represents a significant sensor manufacturing hub, particularly for automotive and industrial applications, with established companies leveraging the area’s strong manufacturing heritage and skilled workforce. The region’s strategic location and transportation infrastructure support efficient distribution to domestic and international markets.

Chubu region serves as a critical center for automotive sensor development and production, benefiting from proximity to major automotive manufacturers and suppliers. The region’s concentration of precision manufacturing capabilities and automotive industry expertise creates synergies that drive sensor technology advancement and market growth.

Kyushu region has emerged as an important semiconductor and sensor manufacturing location, attracting investments from both domestic and international companies seeking cost-effective production capabilities. The region’s government incentives and infrastructure development support sensor industry expansion and technology transfer initiatives.

Regional specialization patterns reflect historical industrial strengths and strategic development initiatives, with different areas focusing on specific sensor types and applications. This geographic distribution creates resilience in the national sensor supply chain while enabling specialized expertise development in key technology areas.

Market leadership in Japan’s sensor industry is characterized by a mix of established electronics giants and specialized sensor manufacturers, each leveraging unique technological capabilities and market positioning strategies:

Competitive strategies focus on technological differentiation, customer relationship management, and strategic partnerships to maintain market position and drive growth in an increasingly competitive environment.

By Technology:

By Application:

By End-User Industry:

Automotive sensors represent the largest and most dynamic segment of Japan’s sensor market, driven by the country’s leadership in automotive manufacturing and the global transition toward electric and autonomous vehicles. This category experiences the highest growth rates, with automotive sensor demand increasing by 8.5% annually as vehicles incorporate more sophisticated sensing capabilities for safety, efficiency, and autonomous operation.

Industrial automation sensors demonstrate steady growth patterns aligned with Japan’s manufacturing sector modernization and Industry 4.0 initiatives. Companies increasingly deploy sensor networks for predictive maintenance, quality control, and operational optimization, resulting in improved productivity and reduced downtime across manufacturing facilities.

Consumer electronics sensors face intense competition and rapid technology evolution, requiring continuous innovation to meet demanding size, power, and performance requirements. Japanese manufacturers maintain competitive advantages through advanced miniaturization techniques and integration capabilities that enable next-generation consumer device functionality.

Healthcare sensors emerge as a high-growth category driven by Japan’s aging population and healthcare system digitization initiatives. Wearable health monitors, remote patient monitoring systems, and medical diagnostic devices create substantial opportunities for sensor manufacturers with appropriate regulatory compliance and clinical validation capabilities.

Environmental monitoring sensors gain importance as Japan addresses climate change challenges and implements smart city initiatives. Government investments in air quality monitoring, disaster prevention systems, and energy management create stable demand for specialized environmental sensing solutions.

Sensor manufacturers benefit from Japan’s strong domestic market demand, advanced manufacturing infrastructure, and export opportunities to global markets. The country’s reputation for quality and reliability provides competitive advantages in premium sensor segments, while government support for technology development reduces innovation risks and accelerates commercialization timelines.

Automotive companies gain access to cutting-edge sensor technologies that enable advanced safety features, autonomous driving capabilities, and electric vehicle optimization. Japanese sensor suppliers provide reliable, high-quality components that meet stringent automotive standards while supporting innovation in next-generation vehicle systems.

Industrial manufacturers achieve operational improvements through sensor-enabled automation, predictive maintenance, and quality control systems. The deployment of advanced sensors results in 25% reduction in unplanned downtime and significant improvements in production efficiency and product quality.

Healthcare providers enhance patient care capabilities through advanced medical sensors that enable remote monitoring, early disease detection, and personalized treatment approaches. Sensor technologies support Japan’s healthcare system in addressing aging population challenges while improving care quality and reducing costs.

Government agencies leverage sensor networks for smart city development, environmental monitoring, and public safety enhancement. Sensor deployments provide real-time data for informed decision-making and enable more efficient public service delivery across urban and rural areas.

Research institutions benefit from collaboration opportunities with industry partners, access to advanced sensor technologies for research applications, and commercialization pathways for innovative sensing solutions. The strong university-industry partnership ecosystem accelerates technology transfer and innovation development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration transforms sensor capabilities by enabling edge computing, predictive analytics, and autonomous decision-making within sensor systems. This trend creates opportunities for Japanese manufacturers to differentiate their offerings through intelligent sensor solutions that provide enhanced functionality and value to customers.

Miniaturization advancement continues to drive sensor development as applications demand smaller form factors without compromising performance. Japanese companies leverage their expertise in precision manufacturing and MEMS technology to create increasingly compact sensors for wearable devices, medical implants, and space-constrained automotive applications.

Wireless connectivity expansion enables sensor networks and IoT applications through 5G, WiFi 6, and other advanced communication technologies. This trend supports the development of distributed sensing systems for smart cities, industrial monitoring, and environmental applications that require real-time data transmission and remote management capabilities.

Multi-sensor fusion becomes increasingly important as applications require comprehensive environmental awareness and decision-making capabilities. Japanese manufacturers develop integrated sensor platforms that combine multiple sensing modalities to provide enhanced accuracy, reliability, and functionality for autonomous systems and advanced automation applications.

Sustainability focus drives demand for sensors that support energy efficiency, environmental monitoring, and circular economy initiatives. This trend creates opportunities for sensor manufacturers to develop solutions that help customers achieve sustainability goals while meeting regulatory requirements for environmental performance and reporting.

Customization demand increases as customers seek specialized sensor solutions tailored to specific applications and performance requirements. Japanese manufacturers leverage their engineering expertise and flexible manufacturing capabilities to provide customized sensors that meet unique customer needs and create competitive differentiation.

Strategic partnerships between Japanese sensor manufacturers and global automotive companies accelerate the development of next-generation vehicle sensing systems. These collaborations combine Japanese precision manufacturing expertise with automotive industry knowledge to create innovative solutions for autonomous driving and electric vehicle applications.

Research and development investments in quantum sensors, biomedical sensing, and advanced materials demonstrate Japan’s commitment to maintaining technological leadership in emerging sensor technologies. Government funding programs and industry-university partnerships support these initiatives and accelerate commercialization timelines.

Manufacturing capacity expansion occurs across multiple regions as sensor demand grows and companies seek to diversify production locations. Japanese manufacturers invest in new facilities and production technologies to meet increasing demand while maintaining quality standards and operational efficiency.

Acquisition activities consolidate market positions and expand technological capabilities as larger companies acquire specialized sensor manufacturers and technology startups. These transactions accelerate innovation development and provide access to new markets and customer relationships.

International standardization efforts led by Japanese companies help establish global standards for automotive sensors, industrial IoT devices, and medical sensing applications. These initiatives support market development and create competitive advantages for companies that influence standard development processes.

Sustainability initiatives focus on developing environmentally friendly sensor manufacturing processes, recyclable materials, and energy-efficient sensor designs. These efforts respond to customer demands and regulatory requirements while supporting Japan’s environmental goals and corporate responsibility objectives.

MarkWide Research recommends that Japanese sensor manufacturers focus on high-value applications and emerging technologies to maintain competitive advantages in an increasingly competitive global market. Companies should prioritize investments in artificial intelligence integration, advanced materials, and specialized applications that leverage Japan’s technological strengths and manufacturing expertise.

Strategic diversification across multiple application sectors reduces dependence on cyclical industries and creates more stable revenue streams. Sensor manufacturers should explore opportunities in healthcare, environmental monitoring, and emerging IoT applications while maintaining leadership positions in automotive and industrial markets.

International expansion strategies should focus on markets with strong growth potential and limited local competition, particularly in developing countries implementing smart city initiatives and industrial modernization programs. Japanese companies can leverage their quality reputation and technological capabilities to capture market share in these emerging markets.

Partnership development with software companies, system integrators, and end-user industries creates opportunities for integrated solutions that provide enhanced customer value. These collaborations enable sensor manufacturers to participate in higher-value system sales while reducing commodity pricing pressures.

Talent development initiatives should address workforce aging challenges and ensure continued innovation capabilities. Companies should invest in training programs, university partnerships, and international talent recruitment to maintain technological leadership and manufacturing excellence.

Sustainability integration into product development and manufacturing processes becomes increasingly important for customer acceptance and regulatory compliance. Companies should develop environmental strategies that support customer sustainability goals while creating competitive differentiation opportunities.

Long-term growth prospects for Japan’s sensor market remain highly favorable, supported by technological leadership, strong domestic demand, and expanding global opportunities in emerging applications. The market is projected to maintain robust growth rates of 6.8% CAGR over the next five years, driven by automotive industry transformation, industrial automation expansion, and healthcare digitization initiatives.

Technological evolution will continue to create new market opportunities as sensors become more intelligent, connected, and capable of autonomous operation. Japanese manufacturers are well-positioned to capitalize on these trends through their expertise in precision manufacturing, advanced materials, and system integration capabilities.

Market expansion into emerging applications such as augmented reality, advanced robotics, and space exploration provides significant growth potential for companies with appropriate technological capabilities and market development strategies. These new applications often require specialized sensor performance characteristics that align with Japanese manufacturing strengths.

Global competitiveness will depend on continued innovation, cost optimization, and strategic positioning in high-value market segments. Japanese sensor manufacturers must balance quality and performance advantages with competitive pricing to maintain market share in an increasingly competitive global environment.

Industry consolidation may accelerate as companies seek scale advantages and complementary technologies to compete effectively in global markets. Strategic mergers and acquisitions will likely reshape the competitive landscape while creating opportunities for enhanced innovation and market access.

Regulatory evolution will continue to influence market development as governments implement new standards for automotive safety, environmental monitoring, and data privacy. Companies that anticipate and adapt to regulatory changes will maintain competitive advantages and market access opportunities.

Japan’s sensor market stands at the forefront of global sensor technology development, combining decades of manufacturing excellence with cutting-edge innovation capabilities to serve diverse applications across automotive, industrial, healthcare, and consumer electronics sectors. The market’s strong growth trajectory, supported by domestic demand and global export opportunities, positions Japanese sensor manufacturers for continued success in an evolving technological landscape.

Strategic advantages including technological leadership, quality reputation, and advanced manufacturing capabilities provide Japanese companies with competitive positioning in premium sensor segments. The industry’s focus on innovation, customer relationships, and emerging applications creates sustainable differentiation opportunities that support long-term market growth and profitability.

Future success will depend on continued investment in research and development, strategic partnerships, and market diversification initiatives that leverage Japan’s core strengths while addressing evolving customer requirements and competitive challenges. The sensor market’s evolution toward intelligent, connected, and autonomous systems aligns well with Japanese technological capabilities and market positioning strategies, ensuring continued relevance and growth potential in the global sensor industry.

What is a sensor?

A sensor is a device that detects and responds to physical stimuli such as light, heat, motion, moisture, or pressure. In the context of the Japan Sensor Market, sensors are widely used in various applications including automotive, industrial automation, and consumer electronics.

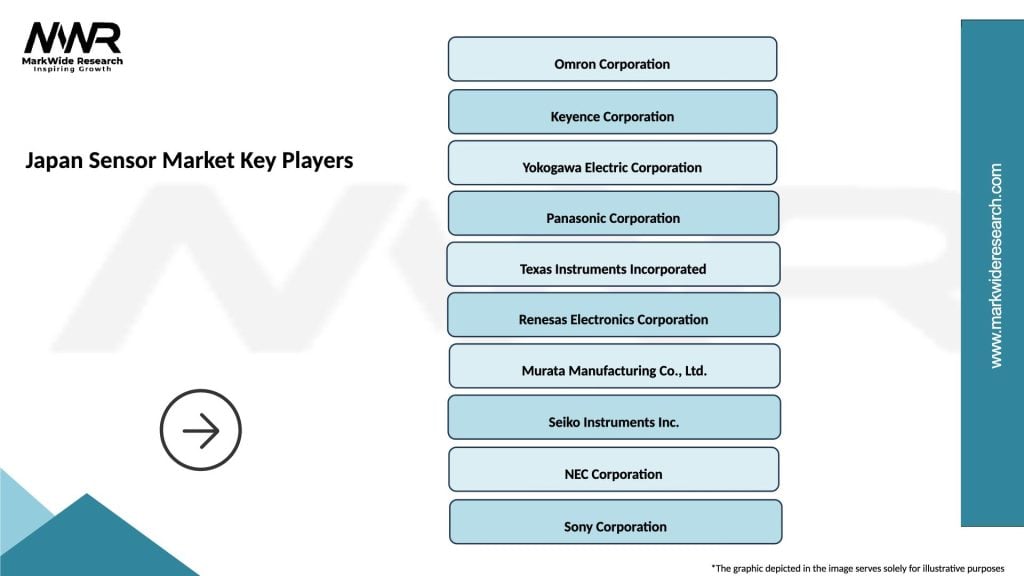

What are the key players in the Japan Sensor Market?

Key players in the Japan Sensor Market include companies like Omron Corporation, Panasonic Corporation, and Sony Corporation, which are known for their innovative sensor technologies and applications in various sectors, among others.

What are the main drivers of growth in the Japan Sensor Market?

The main drivers of growth in the Japan Sensor Market include the increasing demand for automation in manufacturing, the rise of smart home technologies, and advancements in automotive safety features that require sophisticated sensor systems.

What challenges does the Japan Sensor Market face?

The Japan Sensor Market faces challenges such as the high cost of advanced sensor technologies and the need for continuous innovation to keep up with rapidly changing consumer demands and technological advancements.

What opportunities exist in the Japan Sensor Market?

Opportunities in the Japan Sensor Market include the growing adoption of Internet of Things (IoT) devices, the expansion of smart city initiatives, and the increasing focus on environmental monitoring and sustainability.

What trends are shaping the Japan Sensor Market?

Trends shaping the Japan Sensor Market include the integration of artificial intelligence in sensor technologies, the development of miniaturized sensors for portable devices, and the increasing use of sensors in healthcare applications for remote patient monitoring.

Japan Sensor Market

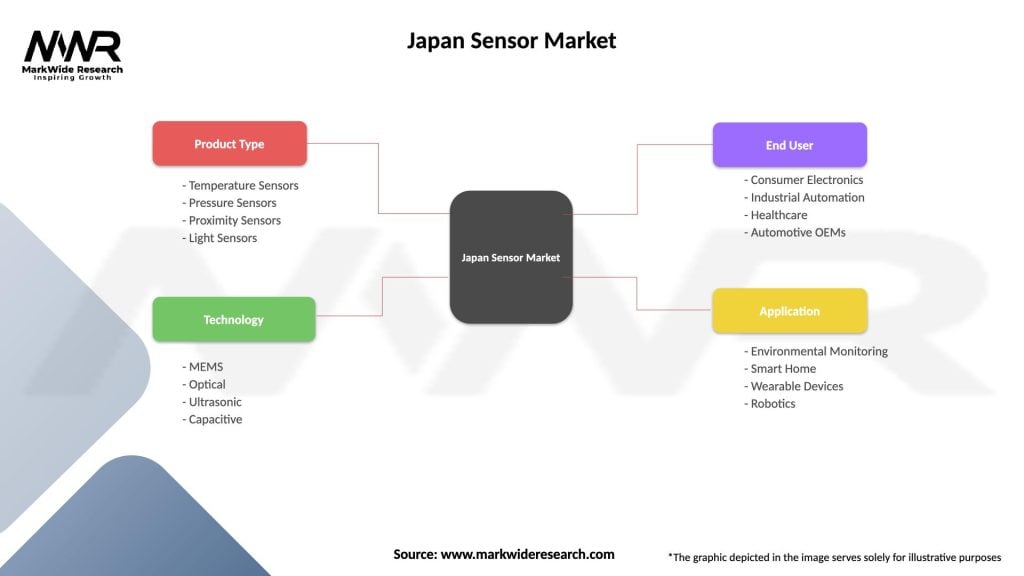

| Segmentation Details | Description |

|---|---|

| Product Type | Temperature Sensors, Pressure Sensors, Proximity Sensors, Light Sensors |

| Technology | MEMS, Optical, Ultrasonic, Capacitive |

| End User | Consumer Electronics, Industrial Automation, Healthcare, Automotive OEMs |

| Application | Environmental Monitoring, Smart Home, Wearable Devices, Robotics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Sensor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at