444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil agricultural biologicals market represents one of the most dynamic and rapidly expanding segments within the country’s agricultural sector. Brazil, as the world’s largest producer of soybeans and a major exporter of agricultural commodities, has increasingly embraced biological solutions to enhance crop productivity while maintaining environmental sustainability. The market encompasses a comprehensive range of biological products including biopesticides, biofertilizers, and biostimulants that are revolutionizing traditional farming practices across the nation.

Market dynamics indicate robust growth driven by increasing awareness of sustainable agriculture practices and stringent regulatory frameworks governing chemical pesticide usage. The Brazilian agricultural sector, which contributes significantly to the national economy, is witnessing a paradigm shift toward biological alternatives that offer effective crop protection while minimizing environmental impact. This transformation is particularly evident in major agricultural regions including Mato Grosso, Rio Grande do Sul, and Goiás, where large-scale farmers are increasingly adopting biological solutions.

Growth projections for the Brazilian agricultural biologicals market demonstrate exceptional momentum, with the sector experiencing a compound annual growth rate of 12.5% over the forecast period. This expansion is supported by favorable government policies, increasing investment in research and development, and growing consumer demand for sustainably produced agricultural products. The market’s trajectory reflects Brazil’s commitment to maintaining its position as a global agricultural powerhouse while addressing environmental concerns and regulatory requirements.

The Brazil agricultural biologicals market refers to the comprehensive ecosystem of naturally derived or nature-based products used in agricultural applications to enhance crop productivity, protect plants from pests and diseases, and improve soil health. These biological solutions include living organisms such as beneficial bacteria, fungi, viruses, and naturally occurring substances that provide alternatives to synthetic chemical inputs in farming operations.

Agricultural biologicals encompass three primary categories: biopesticides that control harmful insects, weeds, and plant diseases; biofertilizers that enhance nutrient availability and uptake; and biostimulants that improve plant growth and stress tolerance. These products work through various mechanisms including biological control, nutrient cycling, plant growth promotion, and enhancement of natural plant defense systems. The Brazilian market specifically focuses on solutions adapted to tropical and subtropical agricultural conditions prevalent across the country’s diverse farming regions.

Brazil’s agricultural biologicals market stands at the forefront of sustainable agriculture innovation, driven by the country’s massive agricultural production capacity and increasing environmental consciousness. The market demonstrates exceptional growth potential, supported by favorable regulatory frameworks, substantial research investments, and widespread adoption among progressive farmers seeking sustainable alternatives to conventional chemical inputs.

Key market drivers include the growing demand for organic and sustainably produced food, increasing resistance to chemical pesticides among target pests, and supportive government policies promoting biological agriculture. The market benefits from Brazil’s advanced agricultural research infrastructure, including world-class institutions like Embrapa, which continues to develop innovative biological solutions tailored to local agricultural conditions.

Market penetration varies significantly across different crop segments, with soybean cultivation showing the highest adoption rates at approximately 35% of total planted area, followed by corn and cotton production. The market structure includes both multinational corporations and domestic companies, with Brazilian firms demonstrating particular strength in developing region-specific biological solutions that address local agricultural challenges and climatic conditions.

Strategic market insights reveal several critical trends shaping the Brazilian agricultural biologicals landscape. The market demonstrates strong regional concentration in major agricultural states, with Mato Grosso accounting for the largest share of biological product consumption, followed by Rio Grande do Sul and Paraná.

Environmental sustainability concerns represent the primary driver propelling Brazil’s agricultural biologicals market forward. Growing awareness of the environmental impact of synthetic pesticides and fertilizers has created substantial demand for biological alternatives that maintain agricultural productivity while reducing ecological footprint. This shift is particularly significant in Brazil, where agricultural exports face increasing scrutiny regarding sustainability practices from international markets.

Regulatory pressures continue to intensify, with Brazilian environmental agencies implementing stricter controls on chemical pesticide usage and promoting biological alternatives through favorable registration processes. The regulatory framework provides expedited approval pathways for biological products, reducing time-to-market compared to synthetic alternatives. Additionally, international trade requirements increasingly favor sustainably produced agricultural commodities, creating market incentives for biological product adoption.

Economic advantages of biological products are becoming increasingly apparent to Brazilian farmers. While initial adoption costs may be higher, biological solutions often provide long-term economic benefits through reduced input costs, improved soil health, and premium pricing for sustainably produced crops. The development of resistance to chemical pesticides among target pests has also created economic pressure to adopt alternative control methods, with biological solutions offering effective resistance management strategies.

Technical challenges continue to limit broader adoption of agricultural biologicals in Brazil. Many biological products require specific storage conditions, have shorter shelf lives compared to chemical alternatives, and may show variable efficacy under different environmental conditions. These technical limitations create logistical challenges in Brazil’s vast agricultural regions, where products may need to travel long distances and be stored in varying climatic conditions.

Knowledge gaps among farmers represent a significant market restraint. Many agricultural producers lack comprehensive understanding of biological product mechanisms, application timing, and integration with existing farming practices. This knowledge deficit is particularly pronounced among smaller farmers who may lack access to technical support and training resources. The complexity of biological systems requires more sophisticated management approaches compared to conventional chemical inputs.

Cost considerations remain a barrier for many Brazilian farmers, particularly smaller operations with limited capital resources. While biological products may offer long-term economic benefits, the initial investment and potential yield risks during transition periods can deter adoption. Additionally, the need for more frequent applications and specialized equipment for some biological products can increase operational costs and complexity.

Export market premiums present substantial opportunities for Brazilian agricultural producers adopting biological solutions. International markets, particularly in Europe and North America, increasingly demand sustainably produced agricultural commodities and are willing to pay premium prices for products certified as environmentally friendly. This trend creates significant revenue opportunities for Brazilian farmers who can demonstrate sustainable production practices through biological product usage.

Technology integration offers transformative opportunities for the agricultural biologicals market. The combination of biological products with precision agriculture technologies, including drones, sensors, and artificial intelligence, can optimize application timing, reduce costs, and improve efficacy. Brazil’s advanced agricultural technology sector provides an ideal platform for developing integrated solutions that maximize the benefits of biological products.

Research and development opportunities abound in Brazil’s diverse agricultural ecosystem. The country’s unique biodiversity provides access to novel microorganisms and natural compounds that can be developed into innovative biological products. Collaboration between Brazilian research institutions, universities, and private companies continues to generate breakthrough technologies adapted to local agricultural conditions and challenges.

Supply chain evolution is fundamentally reshaping the Brazilian agricultural biologicals market. Traditional chemical distribution networks are adapting to accommodate biological products’ unique requirements, including cold storage, shorter shelf lives, and specialized handling procedures. This transformation is creating new business models and partnership opportunities throughout the agricultural value chain.

Competitive dynamics reflect a market in transition, with established multinational corporations competing alongside innovative Brazilian startups and research spin-offs. Domestic companies often demonstrate advantages in understanding local agricultural conditions and developing region-specific solutions, while international players bring advanced research capabilities and global market access. This competitive landscape is driving innovation and improving product quality across the market.

Adoption patterns vary significantly across different agricultural segments and regions. Large-scale commercial farmers in major agricultural states typically lead adoption, with adoption rates reaching 40% in some progressive farming communities. Smaller farmers and traditional agricultural regions show lower adoption rates but represent significant growth opportunities as awareness and technical support improve.

Comprehensive market analysis for the Brazilian agricultural biologicals sector employs multiple research methodologies to ensure accuracy and reliability. Primary research includes extensive interviews with key market participants, including farmers, distributors, manufacturers, and regulatory officials across major agricultural regions. This approach provides direct insights into market trends, challenges, and opportunities from stakeholders throughout the value chain.

Secondary research incorporates analysis of government statistics, industry reports, academic publications, and regulatory filings to establish market baselines and validate primary research findings. Data sources include the Brazilian Ministry of Agriculture, state agricultural departments, industry associations, and research institutions. This comprehensive approach ensures robust data foundation for market analysis and projections.

Market modeling utilizes advanced analytical techniques to project future market trends and identify growth opportunities. The methodology incorporates macroeconomic factors, agricultural production forecasts, regulatory developments, and technology adoption patterns to generate reliable market projections. Regular validation against actual market performance ensures ongoing accuracy and relevance of research findings.

Mato Grosso dominates the Brazilian agricultural biologicals market, accounting for approximately 28% of national consumption. The state’s massive soybean and corn production, combined with progressive farming practices and strong technical support infrastructure, creates ideal conditions for biological product adoption. Major agricultural companies in the region actively promote sustainable farming practices and provide comprehensive technical assistance to farmers transitioning to biological solutions.

Rio Grande do Sul represents the second-largest regional market, with strong adoption in soybean, corn, and rice production systems. The state’s cooperative agricultural structure facilitates knowledge sharing and collective purchasing of biological products, reducing costs and improving adoption rates. Regional research institutions collaborate closely with farmers to develop locally adapted biological solutions.

São Paulo and Paraná demonstrate significant market potential, particularly in sugarcane, coffee, and diversified crop production systems. These states benefit from proximity to research institutions, established distribution networks, and progressive regulatory environments that support biological product adoption. The regions show annual growth rates of 15% in biological product usage, driven by increasing environmental awareness and export market requirements.

Emerging regions including Bahia, Goiás, and Minas Gerais represent substantial growth opportunities as agricultural production expands and farmers seek sustainable intensification strategies. These areas benefit from government support programs promoting sustainable agriculture and increasing investment in agricultural infrastructure and technical support services.

Market leadership in Brazil’s agricultural biologicals sector reflects a diverse competitive environment combining multinational corporations, domestic companies, and innovative startups. The competitive landscape demonstrates the market’s dynamic nature and significant growth potential across multiple participant categories.

Product segmentation reveals distinct market dynamics across different biological product categories. Biopesticides represent the largest segment, accounting for approximately 45% of market share, driven by increasing resistance to chemical pesticides and regulatory pressures. This segment includes bacterial, fungal, and viral biopesticides targeting various agricultural pests and diseases.

By Application:

By Crop Type:

Biopesticides category demonstrates the strongest growth momentum, driven by increasing pest resistance to chemical alternatives and regulatory restrictions on synthetic pesticides. Microbial biopesticides, particularly those based on Bacillus and Trichoderma species, show exceptional performance in Brazilian agricultural conditions. The category benefits from extensive research support and favorable regulatory pathways that expedite product registration compared to chemical alternatives.

Biofertilizers segment shows steady growth, particularly in nitrogen fixation and phosphorus solubilization applications. Brazilian farmers increasingly recognize the long-term soil health benefits and cost savings associated with biological nutrient management. The segment demonstrates particular strength in soybean production, where nitrogen-fixing bacteria provide substantial economic benefits and environmental advantages.

Biostimulants category represents the fastest-growing segment, with annual growth rates exceeding 18%. These products address increasing concerns about climate change impacts on agricultural production by enhancing plant stress tolerance and resilience. The category includes diverse products ranging from seaweed extracts to amino acid formulations, each targeting specific plant physiological processes.

Farmers benefit from agricultural biologicals through multiple value propositions including reduced input costs, improved crop quality, and access to premium markets for sustainably produced commodities. Biological products often provide more durable pest control solutions by avoiding resistance development, ensuring long-term effectiveness and economic viability. Additionally, biological solutions contribute to soil health improvement, creating cumulative benefits over multiple growing seasons.

Environmental advantages extend beyond individual farm operations to broader ecosystem benefits. Biological products reduce chemical residues in soil and water, support beneficial insect populations, and contribute to biodiversity conservation. These environmental benefits align with Brazil’s international commitments to sustainable development and help maintain the country’s reputation as a responsible agricultural producer.

Economic stakeholders including input suppliers, distributors, and service providers benefit from the growing biological products market through new business opportunities and value-added services. The market creates demand for specialized storage, handling, and application services, generating employment and economic activity throughout agricultural regions. Export markets increasingly reward sustainable production practices with premium pricing, benefiting the entire agricultural value chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Precision agriculture integration represents a transformative trend reshaping biological product applications in Brazilian agriculture. Advanced technologies including drones, sensors, and artificial intelligence enable precise timing and targeting of biological applications, maximizing efficacy while minimizing costs. This integration demonstrates efficiency improvements of up to 25% compared to traditional application methods.

Customized solutions are increasingly important as farmers seek biological products tailored to specific crops, regions, and production systems. Companies are developing localized formulations that address unique Brazilian agricultural conditions, including tropical climate challenges and specific pest pressures. This trend toward customization is driving innovation and creating competitive advantages for companies that understand local market needs.

Sustainable intensification emerges as a key trend, with biological products enabling increased agricultural productivity while maintaining environmental sustainability. This approach aligns with Brazil’s need to meet growing global food demand while preserving natural resources and reducing environmental impact. MarkWide Research indicates that sustainable intensification practices incorporating biological products show productivity gains of 15-20% compared to conventional systems.

Strategic partnerships between multinational corporations and Brazilian research institutions are accelerating innovation in agricultural biologicals. These collaborations combine global research capabilities with local market knowledge, resulting in products specifically adapted to Brazilian agricultural conditions. Recent partnerships have focused on developing biological solutions for tropical crop diseases and pest management challenges unique to Brazilian agriculture.

Investment expansion in biological product manufacturing facilities demonstrates growing market confidence. Several major companies have announced significant investments in Brazilian production capacity, reducing import dependence and improving product availability. These investments include state-of-the-art fermentation facilities and quality control laboratories that meet international standards.

Regulatory streamlining continues to improve market access for biological products. Brazilian regulatory agencies have implemented fast-track approval processes for biological products that demonstrate safety and efficacy, reducing time-to-market compared to chemical alternatives. These regulatory improvements encourage innovation and investment in the biological products sector.

Market participants should focus on developing comprehensive farmer education programs to address knowledge gaps and accelerate adoption of biological products. Successful companies invest heavily in technical support services, demonstration programs, and training initiatives that help farmers understand proper biological product usage and integration with existing farming practices.

Technology integration represents a critical success factor for biological product companies. Organizations should develop partnerships with precision agriculture technology providers to create integrated solutions that optimize biological product performance. This integration can significantly improve efficacy while reducing application costs and complexity.

Regional expansion strategies should prioritize emerging agricultural regions where biological product adoption remains limited but growth potential is substantial. Companies should establish local distribution networks, technical support capabilities, and partnerships with regional agricultural organizations to effectively serve these markets. MWR analysis suggests that emerging regions offer growth rates 30% higher than established markets.

Long-term market prospects for Brazil’s agricultural biologicals sector remain exceptionally positive, driven by continued agricultural expansion, increasing environmental awareness, and supportive regulatory frameworks. The market is expected to maintain robust growth rates as biological products become increasingly integrated into mainstream agricultural practices across all major crop systems.

Technology advancement will continue driving market evolution, with next-generation biological products offering improved efficacy, longer shelf life, and easier application methods. Advances in biotechnology, including genetic engineering and synthetic biology, are creating opportunities for developing more effective and targeted biological solutions adapted to Brazilian agricultural conditions.

Market maturation is expected to bring increased standardization, quality assurance, and professional service offerings that will further accelerate adoption among Brazilian farmers. As the market develops, biological products will become increasingly integrated with digital agriculture platforms, creating comprehensive crop management solutions that optimize both productivity and sustainability outcomes.

Brazil’s agricultural biologicals market stands at a pivotal moment in its development, with exceptional growth potential driven by the convergence of environmental sustainability demands, regulatory support, and technological advancement. The market demonstrates strong fundamentals including robust demand from progressive farmers, supportive government policies, and substantial research and development capabilities that position Brazil as a global leader in agricultural biological innovation.

Strategic opportunities abound for market participants who can effectively address current challenges including farmer education, technical support, and product optimization for Brazilian agricultural conditions. Success in this market requires deep understanding of local agricultural practices, strong technical capabilities, and commitment to long-term relationship building with farmers and agricultural stakeholders throughout Brazil’s diverse agricultural regions.

Future market development will be characterized by continued innovation, expanding applications across diverse crop systems, and increasing integration with precision agriculture technologies. As Brazil maintains its position as a global agricultural powerhouse while addressing sustainability challenges, the agricultural biologicals market will play an increasingly critical role in ensuring productive, profitable, and environmentally responsible agricultural production systems that meet both domestic and international market requirements.

What is Agricultural Biologicals?

Agricultural Biologicals refer to products derived from natural materials, including microorganisms, plant extracts, and other organic substances, used to enhance agricultural productivity and sustainability. These products are utilized in pest control, soil health improvement, and crop growth stimulation.

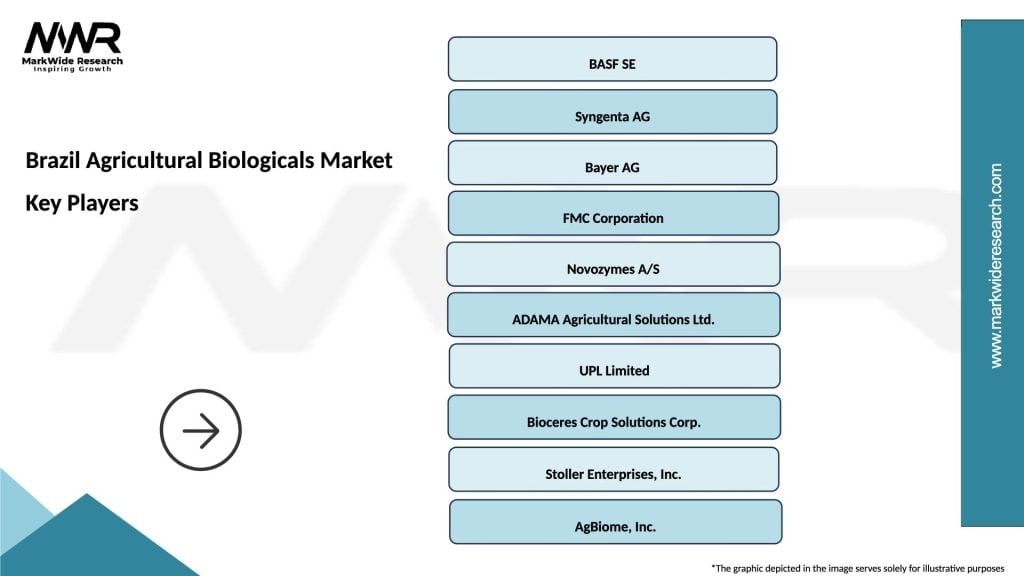

What are the key companies in the Brazil Agricultural Biologicals Market?

Key companies in the Brazil Agricultural Biologicals Market include BASF, Bayer, and Syngenta, which are known for their innovative biological products and solutions for agriculture. Other notable players include FMC Corporation and Novozymes, among others.

What are the growth factors driving the Brazil Agricultural Biologicals Market?

The Brazil Agricultural Biologicals Market is driven by increasing demand for sustainable farming practices, the need for effective pest management solutions, and the rising awareness of environmental impacts associated with chemical fertilizers. Additionally, government initiatives promoting organic farming contribute to market growth.

What challenges does the Brazil Agricultural Biologicals Market face?

Challenges in the Brazil Agricultural Biologicals Market include regulatory hurdles, limited awareness among farmers about biological products, and competition from traditional chemical inputs. These factors can hinder the adoption and growth of agricultural biologicals in the region.

What opportunities exist in the Brazil Agricultural Biologicals Market?

The Brazil Agricultural Biologicals Market presents opportunities for innovation in product development, particularly in biopesticides and biofertilizers. There is also potential for growth in niche markets such as organic farming and precision agriculture, which are gaining traction among farmers.

What trends are shaping the Brazil Agricultural Biologicals Market?

Trends in the Brazil Agricultural Biologicals Market include the increasing integration of technology in agriculture, such as the use of drones and data analytics for precision farming. Additionally, there is a growing focus on sustainability and eco-friendly practices, driving the demand for biological solutions.

Brazil Agricultural Biologicals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Biofungicides, Biopesticides, Biofertilizers, Biostimulants |

| Application | Crops, Soil Treatment, Seed Treatment, Foliar Application |

| End User | Farmers, Agricultural Cooperatives, Distributors, Research Institutions |

| Distribution Channel | Online Retail, Direct Sales, Agricultural Stores, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Agricultural Biologicals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at