444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The America Intelligence, Surveillance, and Reconnaissance (ISR) market represents a critical component of national security infrastructure, encompassing advanced technologies and systems designed to gather, process, and analyze information for military, homeland security, and civilian applications. This dynamic market spans across North America, Central America, and South America, with the United States leading technological advancement and market adoption.

Market dynamics indicate robust growth driven by increasing security threats, technological modernization initiatives, and the integration of artificial intelligence and machine learning capabilities. The market encompasses various platforms including unmanned aerial vehicles, satellite systems, ground-based sensors, and maritime surveillance technologies. Growth projections suggest the market will expand at a compound annual growth rate (CAGR) of 4.8% through the forecast period, driven by defense modernization programs and homeland security investments.

Regional distribution shows North America commanding approximately 78% market share, with significant contributions from defense contractors, government agencies, and private security firms. The market’s evolution reflects changing threat landscapes, including cyber warfare, terrorism, border security challenges, and the need for enhanced situational awareness across multiple domains.

The America Intelligence, Surveillance, and Reconnaissance market refers to the comprehensive ecosystem of technologies, systems, and services designed to collect, process, analyze, and disseminate critical information for national security, defense, and civilian safety applications across the Americas region. This market encompasses hardware platforms, software solutions, data analytics capabilities, and integrated systems that enable real-time monitoring, threat detection, and strategic decision-making.

ISR capabilities integrate multiple sensing technologies including electro-optical systems, radar, signals intelligence, and communication intercept systems. The market includes both traditional military applications and emerging civilian uses such as border patrol, disaster response, critical infrastructure protection, and law enforcement support. Modern ISR systems leverage advanced technologies including artificial intelligence, machine learning, and big data analytics to enhance information processing and reduce analyst workload.

Strategic analysis reveals the America ISR market experiencing significant transformation driven by technological advancement, evolving threat landscapes, and increased defense spending across the region. The market demonstrates strong growth potential with defense modernization programs accounting for approximately 65% of market demand, while homeland security and civilian applications represent emerging growth segments.

Key market drivers include rising geopolitical tensions, border security challenges, counter-terrorism operations, and the need for enhanced maritime domain awareness. The integration of next-generation technologies such as artificial intelligence, edge computing, and advanced sensor fusion capabilities is reshaping market dynamics and creating new opportunities for innovation.

Competitive landscape features established defense contractors, emerging technology companies, and specialized ISR solution providers. Market participants are focusing on developing multi-domain ISR capabilities, improving data processing speeds, and enhancing interoperability between different systems and platforms. Investment trends show increased funding for autonomous systems, space-based ISR platforms, and cybersecurity integration.

Market intelligence reveals several critical insights shaping the America ISR market landscape:

Primary growth drivers propelling the America ISR market include escalating security threats, technological advancement, and increased defense spending across the region. Geopolitical tensions and evolving threat landscapes necessitate enhanced surveillance capabilities, driving demand for sophisticated ISR systems.

Border security challenges across North and South America are creating substantial demand for integrated surveillance solutions. The need to monitor vast border regions, detect illegal crossings, and prevent smuggling activities requires advanced sensor networks, unmanned aerial systems, and real-time data processing capabilities. Government initiatives focusing on border security are allocating significant resources toward ISR technology deployment.

Counter-terrorism operations continue driving market growth as agencies require enhanced intelligence gathering capabilities to identify and neutralize threats. The integration of artificial intelligence and machine learning technologies enables more effective pattern recognition, threat assessment, and predictive analytics. Maritime domain awareness requirements are also expanding, driven by concerns about illegal fishing, drug trafficking, and potential security threats in coastal waters.

Technological advancement in sensor technologies, data processing capabilities, and communication systems is enabling more sophisticated ISR solutions. The development of smaller, more efficient sensors, improved battery technologies for extended operations, and enhanced data transmission capabilities are making ISR systems more effective and cost-efficient.

Significant challenges facing the America ISR market include high development and procurement costs, complex regulatory environments, and technical integration difficulties. Budget constraints at federal, state, and local government levels can limit procurement of advanced ISR systems, particularly for smaller agencies and organizations.

Regulatory compliance requirements present ongoing challenges, as ISR systems must adhere to strict privacy laws, data protection regulations, and airspace restrictions. The complexity of obtaining necessary approvals for ISR operations, particularly in civilian airspace, can delay deployment and increase operational costs. International regulations governing cross-border surveillance activities add additional complexity for multinational operations.

Technical integration challenges arise when attempting to integrate legacy systems with modern ISR technologies. Many existing defense and security infrastructures require significant upgrades to accommodate advanced ISR capabilities, creating additional costs and implementation delays. Interoperability issues between different systems, platforms, and agencies can limit the effectiveness of ISR operations.

Cybersecurity concerns represent growing challenges as ISR systems become increasingly connected and data-dependent. The risk of cyber attacks, data breaches, and electronic warfare targeting ISR systems requires substantial investment in cybersecurity measures and ongoing security updates.

Emerging opportunities in the America ISR market include the expansion of commercial applications, integration of next-generation technologies, and development of cost-effective solutions for smaller organizations. Commercial sector adoption presents significant growth potential as private companies recognize the value of ISR technologies for asset protection, supply chain monitoring, and operational efficiency.

Artificial intelligence integration offers substantial opportunities for market expansion through enhanced data processing, automated threat detection, and predictive analytics capabilities. The development of AI-powered ISR systems can significantly reduce analyst workload while improving accuracy and response times. Machine learning algorithms can continuously improve system performance through pattern recognition and adaptive learning capabilities.

Space-based ISR systems represent a growing opportunity as satellite technology becomes more accessible and cost-effective. Small satellite constellations, commercial space platforms, and advanced imaging technologies are creating new possibilities for persistent surveillance and global coverage. Public-private partnerships in space-based ISR development offer opportunities for innovation and cost sharing.

International market expansion provides opportunities for American ISR companies to export technologies and services to allied nations and friendly countries. The growing global demand for security solutions, combined with American technological leadership, creates export opportunities while supporting diplomatic and security cooperation initiatives.

Market dynamics in the America ISR sector reflect the complex interplay between technological innovation, security requirements, regulatory frameworks, and budget considerations. Supply chain dynamics are influenced by the specialized nature of ISR technologies, limited supplier base, and long development cycles required for advanced systems.

Demand patterns show cyclical variations based on government budget cycles, threat assessments, and geopolitical events. Emergency situations and security incidents can create sudden spikes in demand for specific ISR capabilities, while budget constraints during economic downturns can reduce procurement activities. Technology refresh cycles typically span 5-10 years, creating predictable replacement demand for existing systems.

Competitive dynamics feature intense competition among established defense contractors, emerging technology companies, and international suppliers. Companies are differentiating through technological innovation, cost reduction, and specialized capabilities for specific market segments. Consolidation trends show larger companies acquiring specialized ISR technology firms to expand capabilities and market reach.

Regulatory dynamics continue evolving as governments balance security needs with privacy concerns, budget constraints, and international cooperation requirements. Changes in export control regulations, privacy laws, and operational authorities can significantly impact market dynamics and business strategies.

Comprehensive research methodology employed for analyzing the America ISR market combines primary research, secondary data analysis, and expert consultation to provide accurate market insights. Primary research activities include interviews with industry executives, government officials, end-users, and technology experts to gather firsthand insights about market trends, challenges, and opportunities.

Secondary research encompasses analysis of government reports, industry publications, company financial statements, and technical documentation to understand market size, competitive landscape, and technology trends. Data validation processes ensure accuracy through cross-referencing multiple sources and expert verification of findings.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market forecasts and growth projections. Segmentation analysis examines market dynamics across different technology categories, application areas, and geographic regions to identify specific growth opportunities and challenges.

Expert consultation with industry specialists, former government officials, and academic researchers provides additional validation and insights into market dynamics, technology trends, and future developments. Regular updates ensure research findings reflect current market conditions and emerging trends.

North America dominates the America ISR market with approximately 78% market share, driven by substantial defense spending, advanced technology infrastructure, and comprehensive security requirements. The United States leads regional market development through major defense contractors, government agencies, and research institutions. Canadian market participation focuses on border security, Arctic surveillance, and peacekeeping operations support.

Central America represents an emerging market segment with growing demand for border security, counter-narcotics operations, and disaster response capabilities. Countries in this region are increasingly investing in ISR technologies to address security challenges including drug trafficking, illegal immigration, and natural disaster preparedness. Regional cooperation initiatives are driving demand for interoperable ISR systems.

South America shows significant growth potential driven by border security needs, natural resource protection, and counter-terrorism operations. Brazil leads regional market development with substantial investments in Amazon surveillance, border monitoring, and maritime domain awareness. Regional market growth is supported by increasing defense budgets and technology transfer agreements with North American suppliers.

Market distribution patterns show concentration in major metropolitan areas, border regions, and strategic locations. Coastal areas demonstrate high demand for maritime ISR capabilities, while inland regions focus on border surveillance and critical infrastructure protection. Technology adoption rates vary by region based on budget availability, threat levels, and technical infrastructure capabilities.

Competitive environment in the America ISR market features established defense contractors, specialized technology companies, and emerging innovators competing across multiple market segments. Market leaders leverage extensive experience, established customer relationships, and comprehensive product portfolios to maintain competitive advantages.

Key market participants include:

Competitive strategies emphasize technological innovation, cost reduction, and specialized capabilities development. Companies are investing in artificial intelligence, machine learning, and autonomous systems to differentiate their offerings and improve operational efficiency.

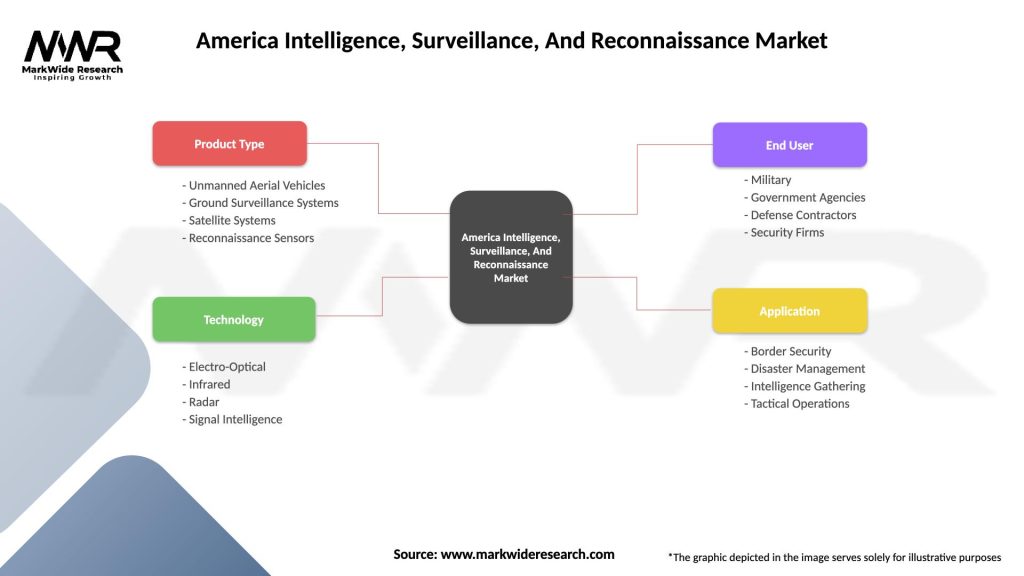

Market segmentation analysis reveals distinct categories based on platform type, technology, application, and end-user requirements. Platform-based segmentation includes airborne systems, ground-based platforms, maritime systems, and space-based assets, each serving specific operational requirements and mission profiles.

By Platform Type:

By Technology Category:

By Application Area:

Airborne ISR systems represent the largest market segment, driven by operational flexibility, rapid deployment capabilities, and advanced sensor integration. Unmanned aerial vehicles show particularly strong growth with adoption rates increasing by 35% annually as organizations recognize their cost-effectiveness and reduced risk to personnel. Advanced UAV platforms offer extended endurance, multiple sensor payloads, and autonomous operation capabilities.

Ground-based ISR systems provide persistent surveillance capabilities for fixed locations, border areas, and critical infrastructure. These systems offer advantages in terms of power availability, sensor size, and data processing capabilities. Integration trends show increasing connectivity between ground-based sensors and mobile command centers for enhanced situational awareness.

Space-based ISR capabilities are experiencing rapid growth driven by reduced launch costs, miniaturized satellite technologies, and commercial space industry development. Small satellite constellations provide cost-effective global coverage while reducing dependency on large, expensive satellite systems. Commercial space companies are increasingly partnering with government agencies to provide ISR services.

Maritime ISR systems address growing concerns about maritime security, illegal fishing, and drug trafficking in coastal waters. Autonomous underwater vehicles and unmanned surface vessels are expanding surveillance capabilities in challenging maritime environments. Integration with coastal radar systems and satellite communications enhances maritime domain awareness.

Government agencies benefit from enhanced situational awareness, improved threat detection capabilities, and more efficient resource allocation through advanced ISR systems. Operational benefits include reduced personnel risk, extended surveillance coverage, and faster response times to emerging threats. Cost savings result from automated data processing, reduced false alarms, and improved operational efficiency.

Defense contractors gain opportunities for long-term contracts, technology development partnerships, and international market expansion. Innovation benefits include access to cutting-edge research, government funding for technology development, and opportunities to influence future system requirements. Market stability comes from consistent government demand and multi-year procurement programs.

Technology companies benefit from access to specialized markets, opportunities for rapid scaling, and partnerships with established defense contractors. Commercial applications of ISR technologies create additional revenue streams and market diversification opportunities. Research and development investments in ISR technologies often have applications in civilian markets.

End-users including military personnel, law enforcement officers, and security professionals benefit from improved tools, enhanced safety, and more effective mission execution. Training benefits include simulation capabilities, reduced training costs, and improved skill development through advanced ISR systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the America ISR market, with AI-powered systems improving data processing efficiency by 55% while reducing analyst workload. Machine learning algorithms enable automated pattern recognition, threat assessment, and predictive analytics capabilities that enhance operational effectiveness.

Multi-domain integration is becoming increasingly important as organizations seek comprehensive situational awareness across air, land, sea, space, and cyber domains. Sensor fusion technologies combine data from multiple sources to provide unified operational pictures and improved decision-making capabilities. Integration challenges are driving development of standardized data formats and communication protocols.

Autonomous operations are expanding rapidly with unmanned systems operating with minimal human intervention. Autonomous ISR platforms can conduct extended missions, adapt to changing conditions, and coordinate with other systems to optimize coverage and efficiency. Edge computing capabilities enable real-time decision-making without constant communication with command centers.

Commercial space utilization is revolutionizing ISR capabilities through cost-effective satellite systems, rapid deployment capabilities, and innovative service models. Small satellite constellations provide persistent global coverage while reducing costs and improving system resilience. Commercial partnerships are enabling government agencies to access advanced space-based ISR capabilities.

Cybersecurity integration is becoming essential as ISR systems face increasing cyber threats and electronic warfare challenges. Secure communication protocols, encrypted data transmission, and resilient system architectures are being integrated into ISR platforms to ensure operational security and data protection.

Recent industry developments highlight the dynamic nature of the America ISR market and ongoing technological advancement. Major contract awards for next-generation ISR systems demonstrate continued government investment in advanced surveillance capabilities and technology modernization programs.

Technology partnerships between traditional defense contractors and emerging technology companies are accelerating innovation and bringing commercial technologies into defense applications. These collaborations combine established system integration expertise with cutting-edge artificial intelligence, machine learning, and sensor technologies.

International cooperation agreements are expanding ISR capabilities through shared development costs, technology transfer, and operational coordination. Allied nations are increasingly collaborating on ISR system development and intelligence sharing to address common security challenges and reduce individual program costs.

Regulatory developments include updated privacy guidelines, revised export control regulations, and new operational authorities for ISR systems. These changes reflect evolving security requirements, technological capabilities, and public policy considerations affecting ISR operations.

Commercial sector adoption is accelerating with private companies investing in ISR technologies for asset protection, supply chain monitoring, and operational efficiency. This trend is creating new market opportunities and driving technology development for dual-use applications.

Strategic recommendations for market participants include focusing on artificial intelligence integration, developing modular system architectures, and expanding commercial market presence. MarkWide Research analysis suggests companies should prioritize investments in AI-powered data processing capabilities to maintain competitive advantages and meet evolving customer requirements.

Technology development priorities should emphasize autonomous operations, cybersecurity integration, and multi-domain capabilities. Organizations should invest in edge computing technologies, secure communication systems, and standardized data interfaces to enable seamless integration with existing systems and future platforms.

Market expansion strategies should include commercial sector development, international partnerships, and specialized niche markets. Companies should explore opportunities in disaster response, environmental monitoring, and critical infrastructure protection to diversify revenue sources and reduce dependence on government contracts.

Partnership recommendations include collaborations with technology companies, academic institutions, and international partners to accelerate innovation and share development costs. Strategic alliances can provide access to specialized technologies, new markets, and complementary capabilities.

Investment priorities should focus on research and development, workforce development, and manufacturing capabilities to maintain technological leadership and meet growing market demand. Companies should also invest in cybersecurity capabilities and compliance systems to address evolving regulatory requirements.

Future market prospects for the America ISR market appear highly positive, driven by continued security challenges, technological advancement, and expanding applications. Growth projections indicate sustained expansion with annual growth rates of 4.8% expected through the next decade, supported by defense modernization programs and homeland security investments.

Technology evolution will continue transforming ISR capabilities through artificial intelligence, quantum computing, and advanced materials. Next-generation systems will offer improved performance, reduced costs, and enhanced operational flexibility. Autonomous systems will become increasingly sophisticated, capable of complex mission execution with minimal human oversight.

Market expansion into commercial sectors will create new opportunities and drive technology development for dual-use applications. Commercial adoption rates are expected to increase by 25% annually as private sector organizations recognize the value of ISR technologies for business operations and security.

International market development will provide growth opportunities through technology exports, partnership agreements, and collaborative development programs. Allied nations will increasingly seek American ISR technologies and expertise to enhance their security capabilities and maintain interoperability with U.S. systems.

Regulatory evolution will continue shaping market dynamics through updated privacy protections, operational authorities, and international agreements. MWR projections suggest regulatory frameworks will adapt to accommodate technological advancement while maintaining appropriate oversight and public accountability.

The America Intelligence, Surveillance, and Reconnaissance market represents a dynamic and rapidly evolving sector driven by technological innovation, security requirements, and expanding applications. With sustained growth prospects supported by defense modernization programs, homeland security investments, and commercial sector adoption, the market offers significant opportunities for established companies and emerging technology providers.

Key success factors include technological leadership, strategic partnerships, and adaptability to changing customer requirements and regulatory environments. Companies that invest in artificial intelligence, autonomous systems, and cybersecurity capabilities will be best positioned to capitalize on market opportunities and maintain competitive advantages.

Market transformation through AI integration, multi-domain operations, and commercial applications will continue reshaping the competitive landscape and creating new business models. Organizations must balance innovation investments with operational requirements while maintaining focus on customer needs and regulatory compliance.

Future market leadership will depend on the ability to deliver cost-effective, technologically advanced solutions that address evolving security challenges and operational requirements. The integration of commercial technologies, international partnerships, and innovative business models will be essential for sustained growth and market success in the America ISR market.

What is Intelligence, Surveillance, And Reconnaissance?

Intelligence, Surveillance, and Reconnaissance (ISR) refers to the processes and technologies used to gather, analyze, and disseminate information about potential threats or operational environments. It encompasses various methods, including satellite imagery, drone surveillance, and human intelligence, to support military and security operations.

What are the key players in the America Intelligence, Surveillance, And Reconnaissance Market?

Key players in the America Intelligence, Surveillance, And Reconnaissance Market include companies like Northrop Grumman, Lockheed Martin, and Raytheon Technologies. These companies are known for their advanced ISR technologies and systems that support defense and security operations, among others.

What are the main drivers of the America Intelligence, Surveillance, And Reconnaissance Market?

The main drivers of the America Intelligence, Surveillance, And Reconnaissance Market include the increasing demand for national security, advancements in drone technology, and the need for real-time data analysis. These factors contribute to the growth of ISR capabilities across military and civilian sectors.

What challenges does the America Intelligence, Surveillance, And Reconnaissance Market face?

Challenges in the America Intelligence, Surveillance, And Reconnaissance Market include concerns over data privacy, the high costs of advanced ISR systems, and the complexity of integrating new technologies with existing infrastructure. These issues can hinder the adoption and effectiveness of ISR solutions.

What opportunities exist in the America Intelligence, Surveillance, And Reconnaissance Market?

Opportunities in the America Intelligence, Surveillance, And Reconnaissance Market include the growing use of artificial intelligence for data processing, the expansion of commercial drone applications, and increased collaboration between government and private sectors. These trends can enhance ISR capabilities and efficiency.

What trends are shaping the America Intelligence, Surveillance, And Reconnaissance Market?

Trends shaping the America Intelligence, Surveillance, And Reconnaissance Market include the integration of machine learning for predictive analytics, the rise of autonomous systems, and the increasing focus on cybersecurity measures. These innovations are transforming how ISR operations are conducted.

America Intelligence, Surveillance, And Reconnaissance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Unmanned Aerial Vehicles, Ground Surveillance Systems, Satellite Systems, Reconnaissance Sensors |

| Technology | Electro-Optical, Infrared, Radar, Signal Intelligence |

| End User | Military, Government Agencies, Defense Contractors, Security Firms |

| Application | Border Security, Disaster Management, Intelligence Gathering, Tactical Operations |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the America Intelligence, Surveillance, And Reconnaissance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at