444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The vegetable oil market in Europe represents a dynamic and essential segment of the continent’s food processing and agricultural industry. European vegetable oil consumption continues to demonstrate robust growth patterns, driven by increasing health consciousness, culinary diversity, and industrial applications across multiple sectors. The market encompasses various oil types including sunflower, rapeseed, olive, soybean, and palm oil, each serving distinct consumer preferences and industrial requirements.

Market dynamics indicate that Europe maintains its position as one of the world’s largest vegetable oil consuming regions, with annual consumption growth averaging approximately 3.2% CAGR over recent years. The region’s sophisticated food processing industry, combined with evolving dietary patterns and sustainable sourcing initiatives, continues to shape market trajectories. Premium quality oils and organic variants are experiencing particularly strong demand, reflecting European consumers’ willingness to invest in healthier and environmentally conscious products.

Regional production capabilities vary significantly across European countries, with major producing nations including Spain, Italy, France, and Germany leading in specific oil categories. The market benefits from advanced processing technologies, stringent quality standards, and well-established distribution networks that ensure consistent supply to both retail and industrial customers. Import dependencies for certain oil types create unique market dynamics, particularly for tropical oils and specialty variants not produced domestically.

The vegetable oil market in Europe refers to the comprehensive ecosystem encompassing production, processing, distribution, and consumption of plant-derived oils across European Union member states and associated countries. This market includes both edible oils for culinary applications and industrial-grade oils used in manufacturing, cosmetics, and biofuel production.

Market scope extends beyond traditional cooking oils to include specialty products such as cold-pressed oils, organic variants, and functional oils enriched with vitamins or omega fatty acids. The European market is characterized by stringent regulatory frameworks governing food safety, labeling requirements, and sustainability standards that influence product development and market entry strategies.

Consumer preferences in Europe emphasize quality, traceability, and health benefits, creating distinct market segments for premium products. The market also encompasses business-to-business transactions where vegetable oils serve as raw materials for food manufacturers, restaurant chains, and industrial processors. Sustainability considerations increasingly influence purchasing decisions, with consumers and businesses prioritizing responsibly sourced oils with minimal environmental impact.

European vegetable oil market demonstrates remarkable resilience and growth potential, supported by diverse consumer demands and robust industrial applications. The market benefits from technological innovations in processing methods, sustainable sourcing initiatives, and evolving dietary trends that favor healthier oil options. Premium segment growth outpaces conventional products, with organic and specialty oils capturing increasing market share.

Key market drivers include rising health awareness, expanding food service industry, and growing demand for plant-based alternatives. The market faces challenges from price volatility in raw materials, regulatory compliance costs, and competition from alternative fat sources. However, innovation opportunities in product development and sustainable sourcing continue to create new growth avenues.

Regional variations across Europe create diverse market conditions, with Mediterranean countries showing strong preference for olive oil, while Northern European markets demonstrate higher consumption of rapeseed and sunflower oils. Market consolidation trends among major processors and distributors are reshaping competitive dynamics, while emerging brands focusing on specialty and organic products gain market traction.

Strategic market insights reveal several critical trends shaping the European vegetable oil landscape. Consumer behavior analysis indicates increasing preference for oils with proven health benefits, driving demand for products rich in omega-3 fatty acids and antioxidants. The market shows strong correlation between economic prosperity and premium oil consumption patterns.

Primary market drivers propelling European vegetable oil demand stem from evolving consumer lifestyles and industrial requirements. Health consciousness represents the most significant driver, with consumers increasingly seeking oils that support cardiovascular health and provide essential nutrients. This trend has resulted in premium product adoption growing at approximately 5.8% annually across major European markets.

Culinary diversity expansion across Europe drives demand for specialty oils traditionally associated with specific regional cuisines. Immigration patterns and cultural exchange have introduced new cooking methods and oil preferences, creating niche markets for products like sesame oil, coconut oil, and various nut-based oils. Restaurant industry growth further amplifies this trend, with professional kitchens requiring diverse oil options.

Industrial applications continue expanding beyond traditional food processing into cosmetics, pharmaceuticals, and renewable energy sectors. Biofuel mandates across European Union member states create consistent demand for specific oil types, while cosmetic industry growth drives consumption of high-quality oils suitable for personal care products. Sustainable sourcing initiatives by major corporations create additional demand for certified sustainable oils.

Market constraints affecting European vegetable oil industry include raw material price volatility that creates uncertainty for both producers and consumers. Weather-dependent agricultural production leads to supply fluctuations, particularly affecting locally produced oils like sunflower and rapeseed. These variations impact pricing stability and long-term planning capabilities for market participants.

Regulatory compliance costs represent significant barriers, particularly for smaller producers seeking market entry. European Union regulations regarding food safety, labeling, and environmental standards require substantial investments in quality control systems and documentation processes. Import restrictions and sustainability certification requirements add complexity to international sourcing strategies.

Health concerns surrounding certain oil types, particularly those high in saturated fats or associated with deforestation, create market challenges. Consumer skepticism regarding palm oil sustainability has led to product reformulations and increased demand for alternative oils. Competition from alternative fats including animal-based products and synthetic alternatives limits market expansion in certain applications.

Emerging opportunities in the European vegetable oil market center around product innovation and sustainable sourcing initiatives. Functional oil development presents significant potential, with products fortified with vitamins, probiotics, or specialized fatty acid profiles addressing specific health needs. Organic market expansion continues offering premium pricing opportunities for certified producers.

E-commerce growth creates new distribution channels, particularly for specialty and premium oils that benefit from direct-to-consumer sales models. Subscription services and online marketplaces enable smaller producers to reach broader audiences without traditional retail partnerships. Digital marketing strategies allow brands to educate consumers about oil benefits and build brand loyalty.

Industrial diversification opportunities include expanding applications in biodegradable packaging, advanced cosmetics, and pharmaceutical applications. Circular economy initiatives create potential for oil by-product utilization, while technology partnerships enable development of specialized processing methods. Export opportunities to emerging markets provide growth potential for European producers with established quality reputations.

Market dynamics in the European vegetable oil sector reflect complex interactions between supply-side factors, consumer preferences, and regulatory influences. Supply chain integration continues evolving, with major players pursuing vertical integration strategies to ensure quality control and cost management. Seasonal production patterns create predictable market cycles that experienced players leverage for competitive advantage.

Price discovery mechanisms increasingly rely on futures markets and international commodity exchanges, creating transparency while introducing volatility. Currency fluctuations significantly impact import costs, particularly for oils sourced from non-European Union countries. Energy costs affect both production and transportation expenses, influencing final product pricing across all market segments.

Consumer loyalty patterns vary significantly by product category, with premium oils showing stronger brand loyalty compared to commodity products. Private label growth challenges traditional brands while offering retailers higher margins. Sustainability certifications increasingly influence purchasing decisions, with certified sustainable products achieving approximately 12% higher consumer acceptance rates compared to conventional alternatives.

Comprehensive research methodology employed for European vegetable oil market analysis incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry stakeholders, including producers, distributors, retailers, and end consumers across major European markets. Survey methodologies capture quantitative data on consumption patterns, preferences, and purchasing behaviors.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and academic publications. Market intelligence gathering includes monitoring of pricing trends, production statistics, and import-export data from official European Union sources. Competitive analysis involves detailed examination of major market players’ strategies, product portfolios, and market positioning.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Statistical analysis employs advanced modeling techniques to identify trends and project future market developments. Regional analysis considers country-specific factors including regulatory environments, consumer preferences, and economic conditions that influence market dynamics.

Regional market analysis reveals distinct patterns across European countries, with Western Europe maintaining the largest market share at approximately 42% of total regional consumption. Germany leads in overall vegetable oil consumption, driven by its large population and robust food processing industry. Industrial applications in Germany account for significant consumption volumes, particularly in biodiesel production and chemical manufacturing.

Mediterranean countries including Spain, Italy, and Greece demonstrate unique consumption patterns heavily weighted toward olive oil, which represents approximately 68% of total vegetable oil consumption in these markets. Premium olive oil segments show particularly strong performance, with extra virgin varieties commanding substantial market shares. Export activities from these countries contribute significantly to intra-European trade flows.

Eastern European markets exhibit rapid growth potential, with consumption increases averaging 4.7% annually as economic development drives dietary improvements. Poland and Czech Republic lead regional growth, while traditional preferences for sunflower and rapeseed oils remain strong. Market penetration of premium and organic products continues expanding as disposable incomes increase across the region.

Competitive landscape in the European vegetable oil market features a mix of multinational corporations, regional processors, and specialized premium brands. Market concentration varies by product category, with commodity oils dominated by large-scale processors while specialty segments support numerous smaller players.

Strategic positioning varies significantly among competitors, with some focusing on cost leadership in commodity segments while others pursue differentiation strategies through premium products, sustainability initiatives, or specialized applications. Vertical integration strategies enable major players to control costs and ensure quality throughout the supply chain.

Market segmentation analysis reveals multiple classification approaches that help understand consumer preferences and market dynamics. Product-based segmentation represents the primary classification method, distinguishing between different oil types and their specific market characteristics. Application-based segmentation provides insights into end-use patterns and growth opportunities across various sectors.

By Oil Type:

By Application:

Category analysis provides detailed understanding of performance variations across different vegetable oil segments. Premium oil categories consistently outperform commodity segments in terms of growth rates and profitability, driven by consumer willingness to pay higher prices for perceived quality and health benefits. Organic certification adds significant value across all oil types, with certified products achieving price premiums of approximately 25-40% compared to conventional alternatives.

Olive oil category demonstrates the most sophisticated market structure, with clear differentiation between extra virgin, virgin, and refined grades. Protected designation of origin products command premium pricing while building strong consumer loyalty. Single-origin oils and estate-bottled products represent the fastest-growing olive oil subsegments, appealing to consumers seeking authenticity and traceability.

Specialty oil categories including avocado, coconut, and various nut oils show exceptional growth potential despite smaller market sizes. Health positioning drives adoption of these products, with consumers attracted to specific nutritional profiles and functional benefits. Cold-pressed variants within each category typically achieve higher margins and stronger brand loyalty compared to refined alternatives.

Industry participants in the European vegetable oil market benefit from multiple value creation opportunities across the supply chain. Producers can leverage premium positioning strategies to achieve higher margins while building sustainable competitive advantages through quality differentiation and brand development. Vertical integration opportunities enable control over quality and costs while ensuring consistent supply for downstream operations.

Distributors and retailers benefit from category growth and increasing consumer willingness to pay premium prices for quality oils. Private label development offers retailers opportunities to capture higher margins while providing consumers with value alternatives. E-commerce expansion creates new revenue streams and enables direct consumer relationships.

End consumers benefit from product innovation that delivers improved nutritional profiles, better taste characteristics, and enhanced cooking performance. Sustainability initiatives enable consumers to align purchasing decisions with environmental values. Transparency improvements in labeling and sourcing provide consumers with better information for informed decision-making. Competitive pricing resulting from market efficiency ensures accessibility across different income segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the European vegetable oil landscape reflect evolving consumer preferences and technological advancements. Health-focused consumption continues driving demand for oils with proven nutritional benefits, particularly those rich in omega-3 fatty acids and natural antioxidants. Clean label trends favor minimally processed oils with transparent ingredient lists and clear sourcing information.

Sustainability integration has become a fundamental market requirement rather than a differentiating factor. Carbon footprint reduction initiatives influence sourcing decisions, while circular economy principles drive innovation in packaging and waste reduction. Blockchain technology adoption enables enhanced traceability and authenticity verification, particularly important for premium oil segments.

Convenience-oriented packaging innovations address changing consumer lifestyles, with portion-controlled formats and easy-pour designs gaining popularity. Multi-functional products that serve both culinary and wellness purposes represent emerging opportunities. Personalization trends create demand for specialized oil blends targeting specific dietary requirements or cooking applications. Digital engagement through mobile apps and online platforms enables brands to build stronger consumer relationships and provide usage guidance.

Recent industry developments highlight the dynamic nature of the European vegetable oil market. Merger and acquisition activity continues reshaping competitive dynamics, with major players pursuing strategic acquisitions to expand product portfolios and geographic reach. Capacity expansion projects across multiple countries indicate strong confidence in long-term market growth prospects.

Technology investments focus on processing efficiency improvements and quality enhancement capabilities. Cold-pressing technology adoption enables production of premium oils with superior nutritional profiles. Automation integration reduces production costs while improving consistency and food safety standards. Sustainable sourcing initiatives include direct farmer partnerships and certification program development.

Regulatory developments include updated labeling requirements and sustainability reporting standards that influence market dynamics. New product launches emphasize functional benefits and innovative packaging solutions. Partnership agreements between producers and retailers create exclusive distribution arrangements and co-branded product development opportunities. Research collaborations with academic institutions advance understanding of oil health benefits and processing innovations.

Strategic recommendations for market participants emphasize the importance of differentiation strategies in an increasingly competitive environment. MarkWide Research analysis suggests that companies should prioritize premium product development and sustainability initiatives to capture growing consumer demand for high-quality, responsibly sourced oils. Brand building investments become crucial for establishing consumer loyalty and justifying price premiums.

Supply chain optimization represents a critical success factor, with companies advised to develop diversified sourcing strategies that reduce dependency on single suppliers or regions. Vertical integration opportunities should be evaluated for their potential to improve margins and quality control. Technology investments in processing capabilities and digital marketing platforms can provide competitive advantages.

Market expansion strategies should focus on underserved segments and emerging applications rather than competing solely on price in commodity markets. Partnership development with food service operators and industrial users can provide stable demand and higher margins. Export market development offers growth opportunities for companies with established quality reputations and production capabilities.

Future market outlook for European vegetable oil indicates continued growth driven by demographic trends and evolving consumer preferences. Population growth and urbanization patterns support sustained demand increases, while aging populations drive interest in health-focused oil products. Immigration trends continue introducing new culinary preferences and oil consumption patterns.

Technology advancement will enable development of next-generation oil products with enhanced nutritional profiles and functional benefits. Precision agriculture adoption improves raw material quality and consistency while reducing environmental impact. Processing innovations enable extraction of bioactive compounds that add value beyond basic nutritional content.

Market projections indicate that premium segments will continue outpacing commodity products, with organic and specialty oils achieving growth rates of approximately 6.5% annually over the next five years. Sustainability requirements will become increasingly stringent, creating opportunities for certified producers while challenging conventional suppliers. MWR forecasts suggest that digital commerce will represent approximately 18% of total vegetable oil sales by 2028, requiring traditional players to develop online capabilities.

European vegetable oil market demonstrates robust fundamentals and promising growth prospects across multiple segments and applications. Consumer health consciousness and sustainability awareness continue driving market evolution toward premium products and responsibly sourced alternatives. Technological innovations in processing and packaging create opportunities for product differentiation and value creation.

Market participants who successfully navigate regulatory requirements, invest in quality and sustainability, and develop strong brand positions are well-positioned to capture growth opportunities. Regional diversity across Europe provides multiple market entry strategies and expansion possibilities. Industry consolidation trends create both challenges and opportunities for companies at different scales.

Long-term success in the European vegetable oil market requires balancing operational efficiency with innovation capabilities while maintaining focus on consumer needs and regulatory compliance. Sustainability integration has evolved from optional to essential, requiring strategic investments in responsible sourcing and environmental stewardship. The market’s continued evolution toward premium positioning and functional benefits offers substantial opportunities for companies willing to invest in quality, innovation, and brand development.

What is Vegetable Oil?

Vegetable oil refers to any oil derived from plants, commonly used in cooking, food production, and industrial applications. It includes oils such as olive, sunflower, and canola, which are extracted from various seeds and fruits.

What are the key players in the Vegetable Oil in Europe Market?

Key players in the Vegetable Oil in Europe Market include companies like Unilever, Cargill, and Bunge, which are involved in the production and distribution of various vegetable oils. These companies play a significant role in shaping market trends and consumer preferences.

What are the growth factors driving the Vegetable Oil in Europe Market?

The Vegetable Oil in Europe Market is driven by increasing consumer demand for healthy cooking oils, the rise of plant-based diets, and the growing use of vegetable oils in food processing and biofuels. Additionally, sustainability trends are pushing for more eco-friendly oil production methods.

What challenges does the Vegetable Oil in Europe Market face?

The Vegetable Oil in Europe Market faces challenges such as fluctuating raw material prices, regulatory pressures regarding sustainability, and competition from alternative oils and fats. These factors can impact profitability and market stability.

What opportunities exist in the Vegetable Oil in Europe Market?

Opportunities in the Vegetable Oil in Europe Market include the development of innovative oil blends, expansion into emerging markets, and increasing demand for organic and non-GMO oils. These trends can lead to new product offerings and market growth.

What trends are shaping the Vegetable Oil in Europe Market?

Trends shaping the Vegetable Oil in Europe Market include a shift towards healthier oil options, increased transparency in sourcing, and the rise of plant-based food products. Additionally, advancements in extraction technologies are enhancing oil quality and yield.

Vegetable Oil in Europe Market

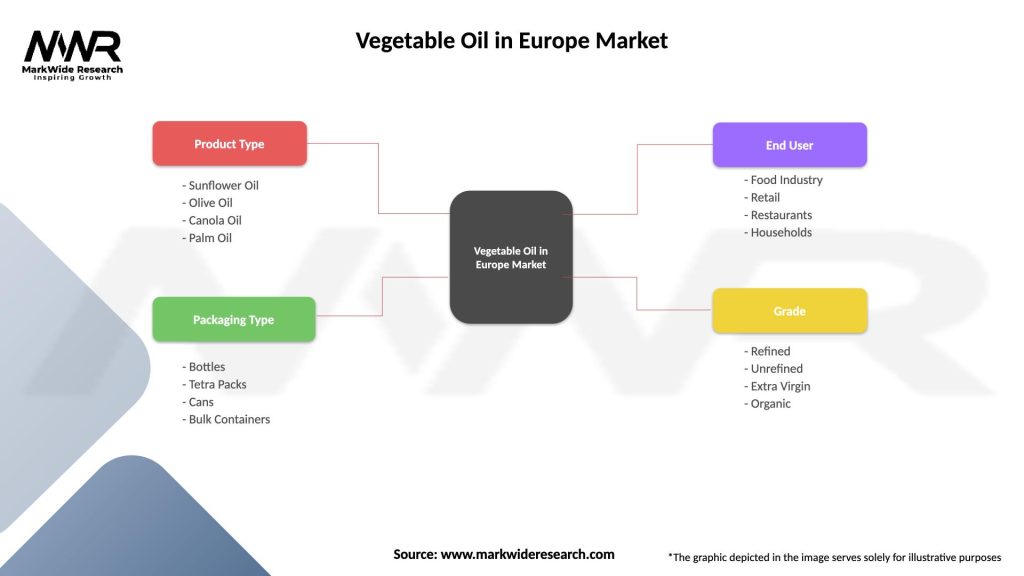

| Segmentation Details | Description |

|---|---|

| Product Type | Sunflower Oil, Olive Oil, Canola Oil, Palm Oil |

| Packaging Type | Bottles, Tetra Packs, Cans, Bulk Containers |

| End User | Food Industry, Retail, Restaurants, Households |

| Grade | Refined, Unrefined, Extra Virgin, Organic |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vegetable Oil in Europe Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at