444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE furniture market represents one of the most dynamic and rapidly evolving sectors in the Middle East region, characterized by robust growth driven by urbanization, population expansion, and increasing disposable income. Market dynamics indicate sustained demand across residential, commercial, and hospitality segments, with the sector experiencing significant transformation through digital integration and sustainable practices. The market encompasses a diverse range of products including residential furniture, office furniture, outdoor furniture, and specialized commercial installations.

Growth trajectories in the UAE furniture market reflect the country’s position as a regional hub for trade and tourism, with major cities like Dubai and Abu Dhabi driving substantial demand for both luxury and mid-market furniture solutions. The sector benefits from the UAE’s strategic location, serving as a gateway between European manufacturers and Asian markets, while also catering to the sophisticated preferences of local consumers and expatriate communities.

Market penetration of international brands alongside emerging local manufacturers has created a competitive landscape that emphasizes quality, design innovation, and customer service excellence. The furniture market is experiencing a notable shift toward smart furniture solutions and eco-friendly materials, reflecting changing consumer preferences and environmental consciousness among UAE residents.

The UAE furniture market refers to the comprehensive ecosystem of furniture manufacturing, importing, distribution, and retail activities within the United Arab Emirates, encompassing all categories of furniture products designed for residential, commercial, and institutional use. This market includes traditional furniture retailers, online platforms, custom furniture manufacturers, and specialized commercial furniture suppliers serving the diverse needs of the UAE’s multicultural population and thriving business environment.

Market scope extends beyond simple furniture sales to include interior design services, furniture rental solutions, and after-sales support services that cater to the unique requirements of both permanent residents and the significant expatriate population. The market serves various customer segments, from budget-conscious consumers seeking functional furniture solutions to high-net-worth individuals demanding luxury and bespoke furniture pieces.

Strategic analysis of the UAE furniture market reveals a sector poised for continued expansion, driven by ongoing infrastructure development, population growth, and evolving lifestyle preferences. The market demonstrates remarkable resilience and adaptability, with businesses successfully navigating challenges while capitalizing on emerging opportunities in digital commerce and sustainable furniture solutions.

Key performance indicators highlight the market’s strength across multiple dimensions, including product diversification, channel expansion, and technological integration. The sector has shown exceptional adaptability to changing consumer behaviors, particularly the accelerated adoption of online furniture shopping and the growing demand for multifunctional furniture solutions that maximize space efficiency in urban environments.

Market leadership is distributed among established international brands, regional players, and innovative local companies that understand the unique cultural and climatic requirements of UAE consumers. The competitive landscape continues to evolve with new entrants bringing fresh perspectives on design, sustainability, and customer experience.

Consumer behavior analysis reveals several critical insights that shape market dynamics and growth opportunities:

Population growth serves as a fundamental driver for the UAE furniture market, with the country’s expanding resident population creating sustained demand for residential furniture across all price segments. The continuous influx of expatriate professionals and families generates consistent market demand, particularly for ready-to-move furniture solutions and rental furniture services.

Infrastructure development projects throughout the UAE, including new residential communities, commercial complexes, and hospitality facilities, create substantial demand for furniture across multiple categories. Major developments in Dubai and Abu Dhabi, along with emerging projects in other emirates, contribute to market expansion through both direct procurement and indirect residential demand.

Economic diversification efforts have strengthened the UAE’s position as a regional business hub, driving demand for office furniture and commercial installations. The growth of various economic sectors, including technology, finance, and tourism, creates diverse furniture requirements that support market expansion across different product categories.

Lifestyle evolution among UAE residents, influenced by global trends and local cultural preferences, drives demand for innovative furniture solutions that combine functionality with aesthetic appeal. Changing work patterns, including remote work adoption, have created new demand patterns for home office furniture and flexible living solutions.

Import dependency represents a significant challenge for the UAE furniture market, as the majority of furniture products are imported, making the market vulnerable to global supply chain disruptions and currency fluctuations. This dependency affects pricing stability and product availability, particularly during periods of international trade tensions or logistical challenges.

High real estate costs in prime locations impact both retailers and consumers, with expensive retail space affecting furniture store operations and high housing costs influencing consumer spending patterns on furniture. The cost structure challenges particularly affect smaller retailers and limit market accessibility for some consumer segments.

Climate considerations pose unique challenges for furniture durability and material selection, requiring specialized treatments and materials that can withstand high temperatures and humidity levels. These requirements often increase product costs and limit material options, affecting both pricing and design flexibility.

Market saturation in certain segments, particularly in Dubai’s established retail areas, creates intense competition that pressures margins and requires continuous innovation in product offerings and customer experience. The proliferation of furniture retailers has made market differentiation increasingly challenging.

Smart furniture integration presents significant growth opportunities as UAE consumers embrace technology-enabled living solutions. The market potential for furniture incorporating IoT capabilities, wireless charging, and smart storage solutions aligns with the country’s smart city initiatives and tech-savvy population preferences.

Sustainable furniture demand creates opportunities for manufacturers and retailers focusing on environmentally responsible products. The growing environmental consciousness among UAE residents, combined with government sustainability initiatives, supports market development for eco-friendly furniture solutions using recycled materials and sustainable manufacturing processes.

E-commerce expansion offers substantial growth potential, particularly in reaching underserved geographic areas and providing enhanced customer experiences through virtual showrooms, augmented reality applications, and personalized online shopping experiences. Digital platform development can significantly expand market reach and operational efficiency.

Commercial sector growth driven by economic diversification creates opportunities in office furniture, hospitality furniture, and specialized commercial installations. The expansion of various business sectors generates demand for innovative commercial furniture solutions that support productivity and brand identity.

Supply chain evolution continues to reshape the UAE furniture market, with companies adapting to global disruptions by diversifying supplier bases and developing more resilient logistics networks. The market has demonstrated remarkable adaptability in managing supply chain challenges while maintaining product availability and competitive pricing.

Consumer preferences are evolving toward more sustainable, functional, and aesthetically pleasing furniture solutions that reflect both global design trends and local cultural values. This evolution drives continuous innovation in product development and marketing strategies across the furniture industry.

Technology integration is transforming both customer experience and operational efficiency, with furniture retailers investing in digital showrooms, virtual reality experiences, and advanced inventory management systems. These technological advances enhance customer engagement while improving business operations and market responsiveness.

Competitive intensity continues to drive innovation and service excellence, with market participants differentiating through unique product offerings, superior customer service, and comprehensive solution packages that address diverse consumer needs and preferences.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UAE furniture market dynamics. Primary research includes extensive surveys of furniture retailers, manufacturers, and consumers across different emirates, providing direct insights into market trends, preferences, and challenges.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and economic indicators that influence furniture market performance. This approach ensures comprehensive coverage of market factors and provides context for primary research findings.

Data validation processes include cross-referencing multiple sources, conducting expert interviews with industry professionals, and analyzing market data trends over multiple time periods to ensure accuracy and reliability of market insights and projections.

Market segmentation analysis examines various dimensions including product categories, price segments, distribution channels, and geographic regions to provide detailed understanding of market structure and growth opportunities across different market segments.

Dubai emirate dominates the UAE furniture market, accounting for approximately 45% of total market activity, driven by its large population, robust tourism industry, and position as a regional commercial hub. The emirate’s diverse consumer base, including both residents and tourists, creates demand across all furniture categories from budget-friendly to ultra-luxury segments.

Abu Dhabi represents the second-largest market segment with approximately 30% market share, characterized by strong demand for high-quality residential and commercial furniture. The capital’s focus on cultural development and government sector growth drives consistent demand for both residential and institutional furniture solutions.

Sharjah and Northern Emirates collectively account for approximately 25% of market activity, with growing importance as residential areas for Dubai and Abu Dhabi workers. These regions show strong demand for value-oriented furniture solutions and are becoming increasingly important for furniture retailers seeking market expansion opportunities.

Regional distribution patterns reflect the UAE’s urban concentration, with major furniture retailers maintaining flagship stores in Dubai and Abu Dhabi while developing satellite locations and online delivery networks to serve other emirates. The geographic distribution strategy continues to evolve with changing population patterns and infrastructure development.

Market leadership in the UAE furniture sector is distributed among several categories of players, each serving different market segments and customer needs:

Competitive strategies focus on differentiation through product quality, design innovation, customer service excellence, and comprehensive solution offerings that address diverse consumer needs and preferences in the dynamic UAE market environment.

By Product Category:

By Price Segment:

By Distribution Channel:

Residential furniture represents the largest market segment, driven by continuous population growth and housing development across the UAE. Consumer preferences in this category emphasize durability, climate resistance, and space efficiency, with modular and multifunctional furniture gaining particular popularity among urban residents.

Office furniture demand reflects the UAE’s position as a regional business hub, with companies investing in ergonomic and collaborative workspace solutions. The segment shows strong growth in flexible furniture systems that support hybrid work models and adaptable office environments.

Outdoor furniture benefits from the UAE’s favorable climate and outdoor lifestyle culture, with weather-resistant materials and innovative designs driving market expansion. This segment shows particular strength in luxury residential and hospitality applications.

Smart furniture represents an emerging category with significant growth potential, incorporating technology features such as wireless charging, IoT connectivity, and automated functionality. This category appeals particularly to tech-savvy consumers and modern commercial environments.

Manufacturers benefit from the UAE’s strategic location as a gateway to regional markets, enabling efficient distribution across the Middle East and Africa. The country’s advanced logistics infrastructure and free trade zones provide operational advantages for furniture manufacturing and assembly operations.

Retailers gain access to a diverse, affluent consumer base with sophisticated preferences and strong purchasing power. The UAE’s multicultural population creates demand for varied furniture styles and price points, enabling retailers to develop comprehensive product portfolios.

Consumers benefit from extensive product choice, competitive pricing due to market competition, and access to international furniture brands and designs. The market’s maturity ensures high service standards and comprehensive after-sales support across most furniture categories.

Investors find attractive opportunities in a stable, growing market supported by favorable economic conditions and government infrastructure investments. The furniture market’s resilience and growth potential make it an attractive sector for both local and international investment.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable furniture adoption represents a major trend reshaping the UAE furniture market, with consumers increasingly prioritizing environmentally responsible products. This trend drives demand for furniture made from recycled materials, sustainable wood sources, and eco-friendly manufacturing processes, creating opportunities for brands that emphasize environmental responsibility.

Smart home integration continues to gain momentum, with furniture incorporating technology features such as wireless charging capabilities, IoT connectivity, and automated functionality. This trend aligns with the UAE’s smart city initiatives and appeals to tech-savvy consumers seeking integrated living solutions.

Customization and personalization trends reflect consumer desire for unique furniture solutions that reflect individual preferences and space requirements. This trend supports growth in custom furniture services and modular systems that allow consumers to create personalized configurations.

Space optimization remains a critical trend driven by urban living patterns and smaller living spaces, particularly among younger demographics. Multifunctional furniture, storage solutions, and compact designs continue to gain popularity as consumers seek to maximize space efficiency.

Online shopping acceleration has fundamentally changed furniture retail, with consumers increasingly comfortable purchasing furniture online. This trend drives investment in digital showrooms, augmented reality applications, and enhanced delivery services that support online furniture shopping experiences.

Digital transformation initiatives across the furniture industry have accelerated, with major retailers investing in e-commerce platforms, virtual showrooms, and augmented reality applications that enhance customer experience. These developments enable consumers to visualize furniture in their spaces and make more informed purchasing decisions.

Sustainability programs have been implemented by leading furniture companies, including initiatives to reduce packaging waste, implement recycling programs, and source materials from sustainable suppliers. These programs respond to growing environmental consciousness among UAE consumers and government sustainability objectives.

Supply chain diversification efforts have intensified as companies seek to reduce dependency on single-source suppliers and build more resilient logistics networks. These developments include establishing relationships with multiple suppliers across different regions and investing in local assembly capabilities.

Customer experience enhancement programs focus on improving service quality through staff training, technology integration, and comprehensive after-sales support. These developments aim to differentiate companies in the competitive market through superior customer service and satisfaction.

MarkWide Research analysis suggests that furniture companies should prioritize digital transformation initiatives to capture the growing online furniture shopping segment. Investment in e-commerce capabilities, virtual showrooms, and digital marketing strategies will be essential for maintaining competitive positioning in the evolving market landscape.

Sustainability integration should be a strategic priority for furniture companies seeking long-term market success. Developing eco-friendly product lines, implementing sustainable business practices, and communicating environmental benefits effectively will appeal to increasingly conscious consumers and support brand differentiation.

Market diversification strategies should consider expansion into underserved segments such as smart furniture, outdoor furniture, and commercial installations. These segments offer growth potential and reduced competition compared to traditional residential furniture categories.

Customer experience optimization through technology integration, personalized service, and comprehensive support offerings will be crucial for building customer loyalty and commanding premium pricing in the competitive market environment.

Growth projections for the UAE furniture market remain positive, supported by continued population expansion, infrastructure development, and evolving consumer preferences. MWR analysis indicates that the market is expected to maintain steady growth momentum, with particular strength in sustainable furniture, smart furniture, and e-commerce segments.

Technology integration will continue to reshape the furniture industry, with smart furniture solutions, augmented reality shopping experiences, and AI-powered personalization becoming standard market features. These technological advances will enhance both customer experience and operational efficiency across the furniture value chain.

Sustainability focus will intensify as environmental consciousness grows among consumers and government regulations evolve. Furniture companies that successfully integrate sustainable practices and communicate environmental benefits will gain competitive advantages in the evolving market landscape.

Market consolidation trends may emerge as smaller players face increasing competition and operational challenges, while larger companies with strong digital capabilities and diverse product portfolios strengthen their market positions. This consolidation could lead to improved operational efficiency and enhanced customer service standards across the industry.

Regional expansion opportunities will continue to develop as the UAE serves as a gateway to broader Middle Eastern and African markets. Companies established in the UAE furniture market will be well-positioned to capitalize on regional growth opportunities and expand their geographic footprint.

The UAE furniture market demonstrates remarkable resilience and growth potential, supported by favorable demographic trends, economic stability, and evolving consumer preferences. The market’s diversity across product categories, price segments, and distribution channels creates opportunities for various business models and strategic approaches.

Strategic success in this market requires understanding of local consumer preferences, investment in digital capabilities, and commitment to sustainability and innovation. Companies that effectively balance these priorities while maintaining operational excellence will be well-positioned for long-term success in the dynamic UAE furniture market.

Future market development will be shaped by technology integration, sustainability trends, and changing lifestyle patterns among UAE residents. The market’s continued evolution presents both challenges and opportunities for industry participants, requiring adaptive strategies and continuous innovation to maintain competitive positioning and capture emerging growth opportunities.

What is Furniture?

Furniture refers to movable objects intended to support various human activities such as seating, eating, and sleeping. It includes items like chairs, tables, beds, and storage units, which are essential for both residential and commercial spaces.

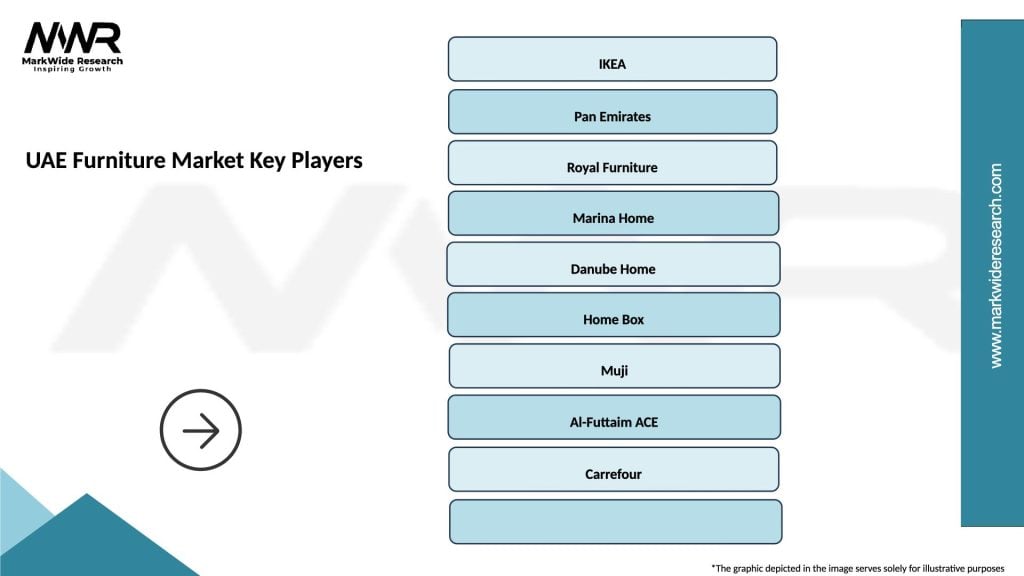

What are the key players in the UAE Furniture Market?

Key players in the UAE Furniture Market include IKEA, Home Centre, and Pan Emirates. These companies offer a wide range of furniture products catering to different consumer preferences and styles, among others.

What are the growth factors driving the UAE Furniture Market?

The growth of the UAE Furniture Market is driven by factors such as increasing urbanization, a growing population, and rising disposable incomes. Additionally, the expansion of the real estate sector and a surge in home renovations contribute to market growth.

What challenges does the UAE Furniture Market face?

The UAE Furniture Market faces challenges such as intense competition among local and international brands, fluctuating raw material prices, and changing consumer preferences. These factors can impact profitability and market stability.

What opportunities exist in the UAE Furniture Market?

Opportunities in the UAE Furniture Market include the growing demand for sustainable and eco-friendly furniture, the rise of e-commerce platforms, and the potential for customization in furniture design. These trends can attract a broader customer base.

What trends are shaping the UAE Furniture Market?

Trends shaping the UAE Furniture Market include the increasing popularity of minimalist and multifunctional furniture, the integration of smart technology in home furnishings, and a focus on sustainable materials. These trends reflect changing consumer lifestyles and preferences.

UAE Furniture Market

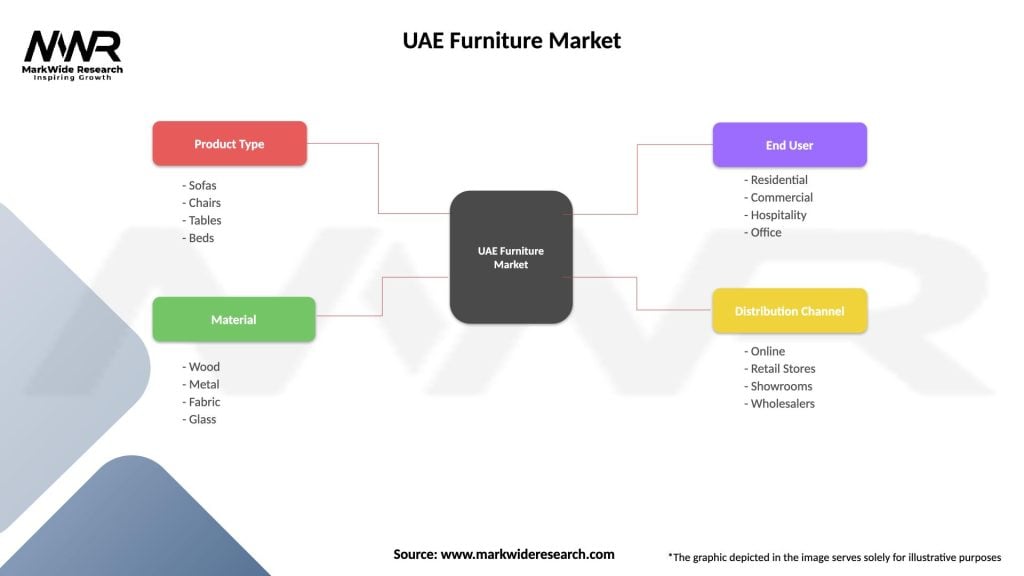

| Segmentation Details | Description |

|---|---|

| Product Type | Sofas, Chairs, Tables, Beds |

| Material | Wood, Metal, Fabric, Glass |

| End User | Residential, Commercial, Hospitality, Office |

| Distribution Channel | Online, Retail Stores, Showrooms, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Furniture Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at