444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US floriculture market represents a vibrant and dynamic sector within the broader agricultural industry, encompassing the cultivation, production, and distribution of flowering plants, cut flowers, and ornamental plants. This market has experienced remarkable transformation over the past decade, driven by evolving consumer preferences, technological advancements in greenhouse operations, and innovative distribution channels. The sector demonstrates robust growth potential with an estimated CAGR of 4.2% projected through the forecast period, reflecting increasing demand for both fresh cut flowers and potted flowering plants across residential and commercial applications.

Market dynamics indicate a significant shift toward sustainable growing practices, with approximately 38% of producers now implementing eco-friendly cultivation methods. The industry encompasses diverse segments including cut flower production, potted plant cultivation, bedding plant manufacturing, and specialty ornamental varieties. Regional concentration remains strong in states like California, Florida, and Oregon, which collectively account for over 65% of total production capacity. The market benefits from year-round demand patterns, seasonal peak periods, and growing interest in locally-sourced floral products among environmentally conscious consumers.

The US floriculture market refers to the comprehensive ecosystem of businesses and activities involved in the commercial production, processing, marketing, and distribution of flowering plants, cut flowers, potted plants, and ornamental vegetation within the United States. This market encompasses greenhouse operations, field cultivation, wholesale distribution networks, retail florists, garden centers, and direct-to-consumer sales channels that collectively serve both individual consumers and commercial clients seeking floral products for decorative, ceremonial, and landscaping purposes.

Floriculture operations span from small-scale specialty growers focusing on niche varieties to large commercial enterprises utilizing advanced greenhouse technologies and automated production systems. The market includes traditional cut flower varieties such as roses, carnations, and chrysanthemums, alongside emerging trends in exotic species, organic cultivation, and sustainable growing practices. Distribution channels range from traditional wholesale flower markets to modern e-commerce platforms, reflecting the industry’s adaptation to changing consumer purchasing behaviors and technological innovations.

Market performance in the US floriculture sector demonstrates consistent growth momentum, supported by diversified demand sources and expanding application areas. The industry has successfully navigated challenges including supply chain disruptions, labor shortages, and competitive pressures from international imports through strategic investments in technology, sustainable practices, and direct-to-consumer marketing initiatives. Current market trends favor locally-grown products, with 42% of consumers expressing preference for domestically-produced flowers and plants.

Key growth drivers include increasing urbanization, rising disposable income levels, growing interest in home gardening and indoor plants, and expanding commercial applications in hospitality, events, and corporate environments. The market benefits from strong seasonal demand patterns, particularly during major holidays and celebration periods, while also experiencing steady baseline demand for everyday floral needs. Technological innovations in greenhouse automation, climate control systems, and precision agriculture techniques continue to enhance production efficiency and product quality across the sector.

Strategic market analysis reveals several critical insights shaping the US floriculture landscape. The sector demonstrates remarkable resilience and adaptability, with producers increasingly adopting diversified crop portfolios to mitigate seasonal fluctuations and market risks. Consumer behavior patterns show growing sophistication, with buyers seeking unique varieties, sustainable production methods, and convenient purchasing options through multiple channels.

Consumer lifestyle trends serve as primary catalysts for market expansion, with increasing emphasis on home beautification, wellness activities, and experiential purchases driving demand for floral products. The growing popularity of social media platforms has amplified visual culture, creating heightened demand for photogenic floral arrangements and unique plant varieties suitable for sharing online. Additionally, the wellness movement has elevated interest in indoor plants and gardening activities as stress-relief mechanisms and air purification solutions.

Economic factors contribute significantly to market growth, including rising household incomes, increased spending on discretionary items, and growing investment in home improvement projects. The expansion of urban populations creates concentrated demand centers while simultaneously driving interest in bringing natural elements into urban living spaces. Commercial sectors including hospitality, events, and corporate environments continue expanding their use of floral displays for ambiance enhancement and brand differentiation purposes.

Technological advancement enables producers to achieve greater efficiency, quality consistency, and production scalability through automated greenhouse systems, precision irrigation, climate control technologies, and data-driven cultivation practices. These innovations reduce labor costs, minimize resource waste, and enable year-round production capabilities that enhance market competitiveness against imported products.

Labor challenges represent significant constraints for the floriculture industry, including seasonal worker shortages, increasing wage costs, and difficulties in attracting skilled greenhouse technicians and plant care specialists. The specialized nature of flower cultivation requires experienced personnel capable of managing delicate growing conditions, pest control, and quality maintenance throughout the production cycle.

Competition from imports creates ongoing pressure on domestic producers, particularly from countries with lower labor costs and favorable growing climates that enable year-round outdoor cultivation. International suppliers often offer competitive pricing on standard flower varieties, challenging domestic growers to differentiate through quality, freshness, sustainability credentials, and specialized varieties not readily available from overseas sources.

Infrastructure limitations include high capital requirements for modern greenhouse facilities, energy costs associated with climate-controlled environments, and transportation challenges in maintaining cold chain integrity for perishable floral products. Additionally, regulatory compliance costs related to pesticide use, worker safety, and environmental protection add operational complexity and expense for producers across all market segments.

Emerging market segments present substantial growth opportunities, particularly in therapeutic horticulture applications, corporate wellness programs, and educational institutions seeking to incorporate living plants into learning environments. The growing recognition of plants’ psychological and air quality benefits creates demand for specialized varieties and professional consultation services in commercial and institutional settings.

Technology integration offers opportunities for market expansion through e-commerce platforms, subscription box services, virtual reality garden planning tools, and mobile applications that connect consumers directly with local growers. Smart greenhouse technologies, IoT sensors, and artificial intelligence applications enable producers to optimize growing conditions, predict market demand, and reduce operational costs while improving product quality.

Sustainability initiatives create differentiation opportunities for producers willing to invest in organic certification, renewable energy systems, water conservation technologies, and biodegradable packaging solutions. Consumer willingness to pay premium prices for environmentally responsible products enables sustainable producers to achieve higher profit margins while building brand loyalty among environmentally conscious customers.

Supply chain evolution continues reshaping the floriculture market through direct-to-consumer sales channels, regional distribution networks, and technology-enabled logistics solutions. Traditional wholesale markets maintain importance while adapting to digital ordering systems and improved cold storage facilities. The integration of local producers with national retail chains creates opportunities for consistent product placement and brand recognition development.

Consumer preferences demonstrate increasing sophistication, with buyers seeking unique varieties, sustainable production methods, educational content about plant care, and convenient purchasing options. The trend toward experiential retail encourages garden centers and florists to offer workshops, design services, and interactive displays that enhance customer engagement and increase average transaction values.

Seasonal patterns remain influential but show gradual smoothing as year-round demand for indoor plants and everyday floral needs grows alongside traditional holiday and event-driven purchases. According to MarkWide Research analysis, baseline demand now accounts for approximately 55% of annual sales, reducing the industry’s historical dependence on peak seasonal periods and creating more stable revenue streams for producers and retailers.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the US floriculture sector. Primary research includes extensive surveys of producers, distributors, retailers, and end consumers across diverse geographic regions and market segments. In-depth interviews with industry executives, agricultural extension specialists, and market analysts provide qualitative insights into trends, challenges, and strategic directions.

Secondary research incorporates analysis of government agricultural statistics, trade association reports, import/export data, and academic studies related to horticultural production and consumer behavior. Market sizing and forecasting utilize econometric modeling techniques that account for seasonal variations, economic cycles, and demographic trends affecting demand patterns across different consumer segments and geographic regions.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews with key stakeholders, and employing statistical analysis to identify and resolve inconsistencies. The research methodology ensures comprehensive coverage of all major market segments while maintaining focus on actionable insights that support strategic decision-making for industry participants and stakeholders.

California dominates the US floriculture landscape, accounting for approximately 35% of total production due to favorable climate conditions, established infrastructure, and proximity to major population centers. The state specializes in cut flower production, particularly roses, carnations, and specialty varieties, while also maintaining significant potted plant operations. California producers benefit from year-round growing seasons and advanced greenhouse technologies that enable consistent quality and production volumes.

Florida represents the second-largest production region with roughly 22% market share, focusing primarily on tropical and subtropical varieties, foliage plants, and seasonal flowering plants. The state’s warm climate enables outdoor cultivation for many species while supporting a robust greenhouse industry for climate-sensitive varieties. Florida’s strategic location facilitates distribution to southeastern markets and export opportunities to Caribbean and Latin American destinations.

Oregon and Washington collectively contribute approximately 18% of national production, specializing in nursery stock, perennial plants, and unique varieties suited to Pacific Northwest growing conditions. These states emphasize sustainable production practices, organic certification, and direct-to-consumer sales channels that capitalize on environmentally conscious consumer preferences in regional markets.

Northeastern states including New York, Pennsylvania, and New Jersey focus on serving dense urban populations through greenhouse operations, seasonal bedding plants, and specialty cut flowers. These regions benefit from proximity to major metropolitan markets while facing higher operational costs due to climate control requirements and real estate expenses.

Market structure encompasses diverse participants ranging from large commercial greenhouse operations to small specialty growers, creating a competitive environment that supports innovation and market segmentation. Leading companies differentiate through production scale, technological capabilities, distribution networks, and specialized product offerings that serve distinct customer segments and geographic markets.

Competitive strategies focus on technological innovation, sustainable production methods, brand development, and strategic partnerships with retail chains and distribution networks. Companies increasingly invest in automation, data analytics, and direct-to-consumer platforms to enhance operational efficiency and market reach while building customer relationships and brand loyalty.

Product segmentation reveals distinct market categories with unique characteristics, growth patterns, and consumer preferences. Cut flowers maintain traditional importance while potted plants experience accelerated growth due to indoor gardening trends and wellness applications. Bedding plants serve seasonal landscaping needs while specialty ornamentals cater to collectors and enthusiasts seeking unique varieties.

By Product Type:

By Application:

Cut flower segment maintains steady demand despite competition from artificial alternatives and imported products. Premium varieties and locally-grown options command higher prices while standard varieties face pricing pressure. Innovation focuses on extending vase life, developing unique colors and forms, and creating sustainable packaging solutions that appeal to environmentally conscious consumers.

Potted plant category experiences robust growth driven by indoor gardening trends, air purification awareness, and social media influence promoting plant parenthood among younger demographics. Houseplants particularly benefit from urban living trends and remote work arrangements that encourage home environment enhancement. Specialty varieties including succulents, tropical plants, and flowering houseplants show strong performance.

Bedding plant segment serves seasonal landscaping needs with strong spring sales periods and growing interest in native plant varieties, pollinator-friendly species, and low-maintenance options. Climate change awareness drives demand for drought-tolerant varieties and regionally-adapted species that require minimal water and chemical inputs while providing aesthetic and ecological benefits.

Foliage plant category benefits from wellness trends emphasizing air purification, stress reduction, and biophilic design principles in residential and commercial spaces. Large-scale installations in corporate environments and public spaces create opportunities for specialized growers while retail demand remains strong for easy-care varieties suitable for beginning plant enthusiasts.

Producers benefit from diversified revenue streams, technological advancement opportunities, and growing market demand across multiple segments and applications. Investment in modern greenhouse facilities and automation technologies enables improved efficiency, quality consistency, and production scalability while reducing labor dependency and operational costs. Sustainable production practices create differentiation opportunities and premium pricing potential.

Retailers gain from expanding product categories, higher margin opportunities, and increased customer engagement through educational content and experiential offerings. Garden centers and florists can leverage plant care expertise to build customer relationships, increase repeat purchases, and develop service-based revenue streams including design consultation, maintenance contracts, and educational workshops.

Consumers enjoy improved product quality, greater variety selection, convenient purchasing options, and enhanced educational resources supporting successful plant care and enjoyment. Direct-to-consumer channels provide access to specialty varieties and local producers while traditional retail maintains importance for immediate needs and hands-on product selection.

Commercial users benefit from professional-grade products, technical support services, and customized solutions for specific applications including interior landscaping, event decoration, and therapeutic horticulture programs. Bulk purchasing options and maintenance services enable cost-effective implementation of plant-based design elements in various commercial and institutional settings.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability movement drives significant changes in production practices, packaging solutions, and consumer preferences throughout the floriculture industry. Organic certification, renewable energy adoption, water conservation technologies, and biodegradable packaging materials become increasingly important for market differentiation and consumer appeal. Producers investing in sustainable practices report premium pricing opportunities of 15-25% above conventional products.

Digital transformation reshapes customer engagement, sales channels, and operational management across the industry. E-commerce platforms, social media marketing, virtual garden planning tools, and mobile applications create new opportunities for customer acquisition and retention. Online sales channels show particularly strong growth in subscription services, rare plant varieties, and educational content that supports customer success with plant care.

Indoor plant popularity continues expanding beyond traditional houseplant categories to include air-purifying species, low-light varieties, and decorative containers that complement modern interior design trends. The wellness movement emphasizes plants’ psychological benefits, air quality improvement, and stress reduction properties, creating demand for therapeutic horticulture applications in healthcare, education, and workplace environments.

Local sourcing preference grows among consumers seeking fresh products, reduced environmental impact, and support for regional agricultural communities. Farm-to-consumer sales channels, farmers’ markets, and community-supported agriculture programs provide direct marketing opportunities while building customer relationships and brand loyalty through personal connections and educational experiences.

Technological innovations continue advancing greenhouse automation, climate control systems, and precision agriculture applications that enhance production efficiency and product quality. Smart sensors, artificial intelligence, and data analytics enable optimized growing conditions, predictive maintenance, and resource conservation while reducing labor requirements and operational costs.

Consolidation activity increases as larger companies acquire specialized growers, distribution networks, and retail operations to achieve vertical integration and market expansion. Strategic partnerships between producers and retail chains create opportunities for consistent product placement, brand development, and supply chain optimization while maintaining focus on quality and customer service.

Research and development efforts focus on developing climate-resilient varieties, extending product shelf life, and creating unique characteristics that differentiate products in competitive markets. Breeding programs emphasize disease resistance, environmental adaptability, and consumer-preferred traits including fragrance, color intensity, and ease of care for various applications and growing conditions.

Infrastructure investment expands production capacity, improves distribution efficiency, and enhances product quality through modern greenhouse facilities, cold storage systems, and transportation networks. Public-private partnerships support agricultural research, workforce development, and market promotion activities that benefit the entire industry while addressing challenges including labor shortages and international competition.

Strategic positioning requires producers to focus on differentiation through quality, sustainability, unique varieties, and customer service rather than competing solely on price against international suppliers. Investment in brand development, direct-to-consumer channels, and value-added services creates competitive advantages while building customer loyalty and premium pricing opportunities.

Technology adoption should prioritize automation solutions that address labor challenges while improving production efficiency and product consistency. Greenhouse environmental controls, irrigation systems, and post-harvest handling equipment offer immediate returns on investment through reduced costs and improved quality. Digital marketing platforms and e-commerce capabilities become essential for reaching younger consumers and expanding market reach.

Market diversification across product categories, customer segments, and geographic regions reduces risk while capturing growth opportunities in emerging applications including therapeutic horticulture, corporate wellness programs, and educational institutions. Partnerships with landscape contractors, interior designers, and event planners create consistent demand sources beyond traditional retail channels.

Sustainability initiatives should encompass production practices, packaging solutions, and energy systems that appeal to environmentally conscious consumers while potentially reducing operational costs. MWR analysis indicates that sustainable producers achieve higher customer retention rates and premium pricing opportunities that justify initial investment costs and ongoing operational changes.

Market growth prospects remain positive through the forecast period, supported by demographic trends, lifestyle changes, and technological innovations that expand applications and improve accessibility. The industry expects continued evolution toward sustainable practices, digital integration, and specialized product offerings that serve diverse customer needs and preferences across residential and commercial segments.

Consumer behavior trends indicate sustained interest in indoor gardening, wellness applications, and locally-sourced products that support the domestic floriculture industry. Younger demographics show particular enthusiasm for plant ownership, social media sharing, and educational content that builds confidence in plant care while creating opportunities for premium products and services.

Production innovations will continue advancing through automation, precision agriculture, and breeding programs that enhance efficiency, quality, and environmental sustainability. Climate-controlled facilities enable year-round production while reducing weather-related risks and improving product consistency. Advanced varieties with improved characteristics including disease resistance, extended shelf life, and unique aesthetic properties support market differentiation and premium positioning.

Distribution evolution encompasses expanded e-commerce capabilities, improved cold chain logistics, and direct-to-consumer channels that reduce intermediary costs while enhancing customer relationships. Regional distribution networks and local sourcing initiatives create opportunities for smaller producers while supporting community economic development and environmental sustainability goals. The industry projects continued growth at approximately 4.5% annually through the next five years, driven by expanding applications and increasing consumer appreciation for plants’ aesthetic and wellness benefits.

The US floriculture market demonstrates remarkable resilience and growth potential, supported by diverse product segments, expanding applications, and evolving consumer preferences that favor quality, sustainability, and local sourcing. Industry participants who embrace technological innovation, sustainable practices, and customer-focused strategies are well-positioned to capitalize on emerging opportunities while addressing traditional challenges including labor costs, seasonal fluctuations, and international competition.

Strategic success factors include investment in modern production facilities, development of unique product offerings, implementation of sustainable practices, and creation of direct customer relationships through digital platforms and experiential retail concepts. The industry’s future depends on continued adaptation to changing consumer needs while maintaining focus on quality, innovation, and environmental responsibility that differentiate domestic producers in an increasingly competitive global marketplace.

What is Floriculture?

Floriculture refers to the cultivation and management of flowering and ornamental plants for gardens, landscaping, and floral arrangements. This sector includes the production of cut flowers, potted plants, and bedding plants, contributing significantly to the horticultural industry.

What are the key companies in the US Floriculture Market?

Key companies in the US Floriculture Market include The Sun Valley Group, 1-800-Flowers.com, and FTD Companies, among others. These companies are involved in various aspects of floriculture, from production to retail distribution.

What are the growth factors driving the US Floriculture Market?

The US Floriculture Market is driven by increasing consumer demand for ornamental plants and flowers, the rise of online flower delivery services, and growing interest in gardening and landscaping. Additionally, events such as weddings and holidays significantly boost flower sales.

What challenges does the US Floriculture Market face?

The US Floriculture Market faces challenges such as fluctuating weather conditions affecting plant growth, competition from imported flowers, and labor shortages in the agricultural sector. These factors can impact production and supply chain efficiency.

What opportunities exist in the US Floriculture Market?

Opportunities in the US Floriculture Market include the growing trend of sustainable and eco-friendly floral products, the expansion of e-commerce platforms for flower sales, and the increasing popularity of indoor plants. These trends can lead to new market segments and consumer engagement.

What trends are shaping the US Floriculture Market?

Trends shaping the US Floriculture Market include the rise of subscription flower services, the popularity of unique and exotic plant varieties, and a focus on sustainable practices in production. Additionally, social media influences consumer preferences for floral arrangements.

US Floriculture Market

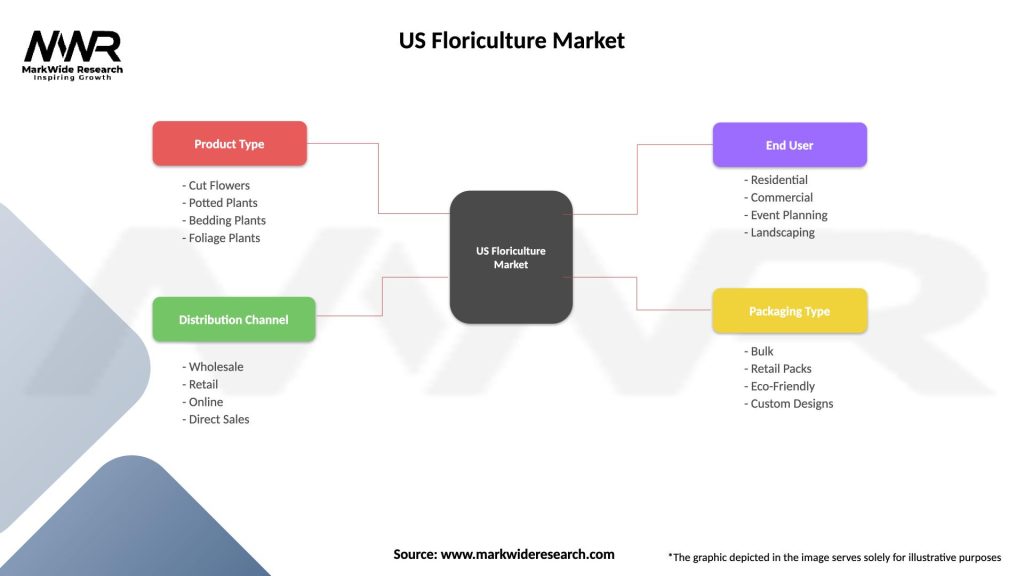

| Segmentation Details | Description |

|---|---|

| Product Type | Cut Flowers, Potted Plants, Bedding Plants, Foliage Plants |

| Distribution Channel | Wholesale, Retail, Online, Direct Sales |

| End User | Residential, Commercial, Event Planning, Landscaping |

| Packaging Type | Bulk, Retail Packs, Eco-Friendly, Custom Designs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

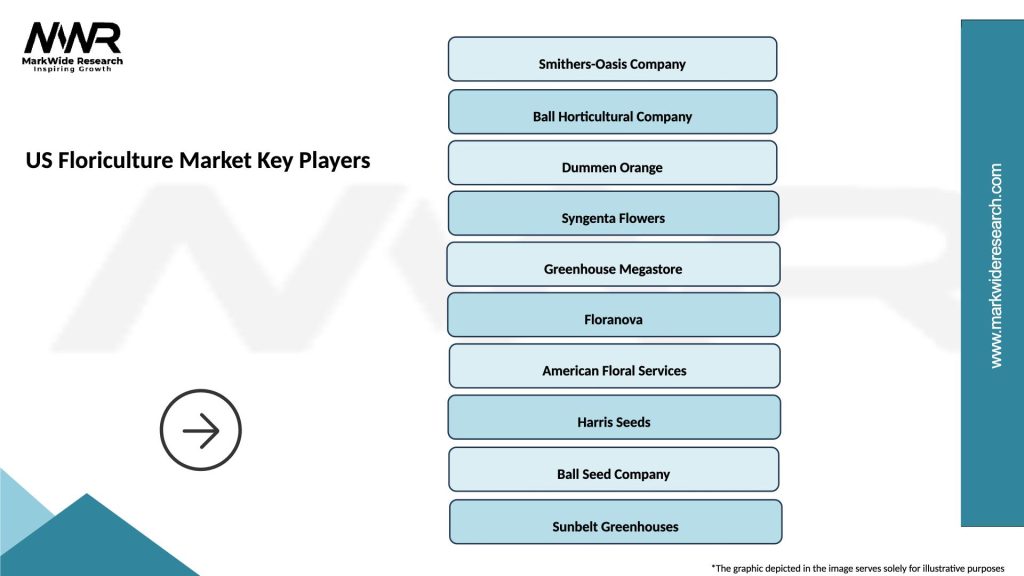

Leading companies in the US Floriculture Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at