444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The military aviation maintenance, repair, and overhaul market represents a critical sector within the global defense industry, encompassing comprehensive services essential for maintaining operational readiness of military aircraft fleets worldwide. This specialized market focuses on ensuring the airworthiness, safety, and performance optimization of various military aircraft platforms, including fighter jets, transport aircraft, helicopters, and unmanned aerial vehicles.

Market dynamics indicate robust growth driven by increasing defense expenditures, aging aircraft fleets requiring extensive maintenance, and technological advancements in maintenance procedures. The sector is experiencing significant transformation through digitalization, predictive maintenance technologies, and advanced materials integration. Growth projections suggest the market will expand at a CAGR of 4.2% over the forecast period, reflecting sustained demand for comprehensive MRO services.

Regional distribution shows North America commanding approximately 38% market share, followed by Europe at 28%, and Asia-Pacific demonstrating the fastest growth trajectory. The market encompasses various service categories including scheduled maintenance, unscheduled repairs, component overhaul, and modernization programs. Technology adoption rates indicate that 65% of military MRO facilities are implementing digital maintenance solutions to enhance operational efficiency.

The military aviation maintenance, repair, and overhaul market refers to the comprehensive ecosystem of services, technologies, and capabilities dedicated to maintaining the operational readiness, safety, and performance of military aircraft throughout their service lifecycle. This market encompasses preventive maintenance, corrective repairs, component overhaul, system upgrades, and lifecycle extension programs specifically designed for military aviation platforms.

Core components include airframe maintenance, engine overhaul, avionics systems repair, component replacement, structural modifications, and compliance with military airworthiness standards. The market serves various stakeholders including defense forces, government agencies, prime contractors, and specialized MRO service providers who collectively ensure military aircraft maintain peak operational capability while adhering to stringent safety and performance requirements.

Strategic analysis reveals the military aviation MRO market is experiencing unprecedented transformation driven by evolving threat landscapes, budget optimization pressures, and technological innovation. The sector demonstrates resilience despite defense spending fluctuations, with sustained demand for maintenance services supporting aging aircraft fleets and emerging platform requirements.

Key market drivers include increasing aircraft utilization rates, growing complexity of modern military systems, and emphasis on operational readiness. Digital transformation initiatives are reshaping traditional maintenance approaches, with 72% of military organizations investing in predictive maintenance technologies. The market benefits from long-term service contracts, government partnerships, and increasing outsourcing of non-core maintenance activities.

Competitive landscape features established aerospace giants, specialized MRO providers, and emerging technology companies offering innovative solutions. Market consolidation trends indicate strategic partnerships and acquisitions aimed at expanding service capabilities and geographic reach. Future outlook suggests continued growth supported by fleet modernization programs, international military cooperation, and advancement in maintenance technologies.

Market intelligence reveals several critical insights shaping the military aviation MRO landscape. The sector demonstrates remarkable adaptability to changing operational requirements while maintaining focus on cost optimization and performance enhancement.

Primary growth drivers propelling the military aviation MRO market encompass various strategic, operational, and technological factors that collectively sustain demand for comprehensive maintenance services across global defense organizations.

Fleet modernization requirements represent a fundamental driver as military forces worldwide seek to extend the operational life of existing aircraft while integrating advanced technologies. Aging aircraft fleets require increasingly sophisticated maintenance approaches to maintain airworthiness standards and operational effectiveness. Budget optimization pressures encourage military organizations to maximize aircraft availability through efficient maintenance strategies rather than costly fleet replacement programs.

Operational tempo increases across various military missions demand higher aircraft availability rates, necessitating more frequent and comprehensive maintenance interventions. Technology complexity in modern military aircraft systems requires specialized expertise and advanced diagnostic equipment, driving demand for sophisticated MRO capabilities. Regulatory compliance requirements and evolving safety standards mandate continuous investment in maintenance infrastructure and personnel training.

Geopolitical tensions and emerging security challenges increase the importance of maintaining ready aircraft fleets, supporting sustained investment in MRO capabilities. International cooperation and alliance requirements create opportunities for shared maintenance resources and standardized procedures across partner nations.

Significant challenges constrain market growth and operational efficiency within the military aviation MRO sector, requiring strategic approaches to overcome barriers and optimize service delivery capabilities.

Budget constraints represent the most significant restraint, as defense organizations face pressure to reduce operational costs while maintaining readiness levels. Skilled workforce shortages create bottlenecks in maintenance operations, with experienced technicians retiring faster than new personnel can be trained and certified. Supply chain complexities and long lead times for specialized components can significantly impact maintenance schedules and aircraft availability.

Technology integration challenges arise when implementing new maintenance systems alongside legacy infrastructure, requiring substantial investment and operational disruption. Regulatory compliance requirements can slow maintenance processes and increase costs, particularly when dealing with multiple international standards and certification requirements.

Security concerns limit outsourcing opportunities and require extensive vetting of service providers, potentially restricting access to specialized capabilities. Infrastructure limitations at military bases may constrain the implementation of advanced maintenance technologies and procedures. Obsolescence issues with older aircraft platforms create challenges in sourcing parts and maintaining technical documentation.

Emerging opportunities within the military aviation MRO market present significant potential for growth, innovation, and strategic positioning across various segments and geographic regions.

Digital transformation initiatives offer substantial opportunities for companies developing advanced maintenance technologies, including artificial intelligence, machine learning, and predictive analytics solutions. Additive manufacturing presents revolutionary possibilities for on-demand parts production, reducing supply chain dependencies and inventory costs while improving maintenance turnaround times.

International market expansion provides growth opportunities as emerging economies invest in military aviation capabilities and seek reliable MRO partnerships. Public-private partnerships create opportunities for innovative service delivery models that combine government oversight with private sector efficiency and expertise.

Sustainability initiatives drive demand for environmentally friendly maintenance practices and technologies, creating opportunities for companies offering green solutions. Training and simulation markets present growth potential as organizations invest in workforce development and skills enhancement programs. Cybersecurity integration within maintenance systems creates opportunities for specialized security solution providers.

Unmanned systems maintenance represents an emerging opportunity as military drone fleets expand and require specialized maintenance approaches different from traditional manned aircraft.

Complex market dynamics shape the military aviation MRO landscape through interconnected forces that influence demand patterns, competitive positioning, and strategic decision-making across the defense ecosystem.

Demand-supply equilibrium fluctuates based on military operational requirements, budget allocations, and geopolitical developments. Technology evolution continuously reshapes maintenance requirements, with advanced aircraft systems demanding increasingly sophisticated support capabilities. Competitive pressures drive innovation and efficiency improvements while maintaining strict quality and safety standards.

Regulatory environment influences market dynamics through evolving airworthiness standards, safety requirements, and international cooperation frameworks. Economic factors including defense spending patterns, currency fluctuations, and economic stability affect long-term market growth trajectories.

Innovation cycles in maintenance technologies create opportunities for early adopters while potentially disrupting established service models. Partnership dynamics between government agencies, prime contractors, and specialized service providers shape market structure and competitive relationships. Risk management considerations influence outsourcing decisions and service provider selection criteria.

Comprehensive research methodology employed in analyzing the military aviation MRO market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research involves extensive interviews with industry executives, military officials, maintenance professionals, and technology providers to gather firsthand insights into market trends, challenges, and opportunities. Secondary research encompasses analysis of government reports, industry publications, financial statements, and regulatory documents to establish market baselines and historical trends.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market growth patterns and segment performance. Qualitative assessment incorporates expert opinions, case studies, and strategic analysis to understand market dynamics and competitive positioning.

Data triangulation methods ensure consistency and accuracy across multiple information sources, while validation processes involve cross-referencing findings with industry experts and market participants. Continuous monitoring of market developments ensures research findings remain current and relevant to evolving industry conditions.

Geographic distribution of the military aviation MRO market reveals distinct regional characteristics, growth patterns, and strategic priorities that influence service demand and competitive dynamics across major defense markets worldwide.

North America maintains market leadership with approximately 38% global market share, driven by substantial defense spending, large aircraft fleets, and advanced maintenance infrastructure. The region benefits from established aerospace industry presence, technological innovation, and comprehensive MRO capabilities supporting both domestic and allied nation requirements.

Europe represents the second-largest market with 28% market share, characterized by multinational cooperation programs, shared maintenance facilities, and emphasis on standardization across NATO allies. Regional initiatives focus on cost optimization through collaborative maintenance approaches and technology sharing agreements.

Asia-Pacific demonstrates the fastest growth trajectory, with expanding defense budgets and modernization programs driving increased MRO demand. Countries including India, Japan, Australia, and South Korea are investing heavily in indigenous maintenance capabilities and technology transfer programs.

Middle East and Africa show growing market potential driven by regional security concerns and military modernization efforts. Latin America presents emerging opportunities as countries upgrade aging fleets and seek cost-effective maintenance solutions.

Market competition within the military aviation MRO sector features a diverse ecosystem of established aerospace manufacturers, specialized service providers, and emerging technology companies competing across various service segments and geographic markets.

Market segmentation analysis reveals distinct categories within the military aviation MRO market, each characterized by specific service requirements, technology needs, and growth dynamics that influence strategic positioning and competitive approaches.

By Aircraft Type:

By Service Type:

By End User:

Detailed analysis of market categories reveals specific trends, challenges, and opportunities within each segment of the military aviation MRO market, providing strategic insights for stakeholders and service providers.

Fighter Aircraft Maintenance represents the most technically demanding segment, requiring specialized expertise in advanced avionics, weapons systems, and stealth technologies. Maintenance complexity continues increasing with next-generation fighter platforms incorporating sophisticated electronic systems and materials requiring specialized handling procedures.

Transport Aircraft Services emphasize reliability and availability, with maintenance strategies focused on minimizing downtime and maximizing operational readiness. Cargo aircraft maintenance benefits from standardization opportunities and economies of scale across large fleets.

Helicopter Maintenance presents unique challenges due to complex rotor systems, diverse mission configurations, and harsh operating environments. Rotary-wing MRO requires specialized facilities and equipment different from fixed-wing aircraft maintenance capabilities.

UAV Maintenance represents an emerging category with distinct requirements for autonomous systems, sensor packages, and ground control equipment. Unmanned systems maintenance is evolving rapidly as technology advances and operational experience grows.

Engine Overhaul Services constitute a critical high-value segment requiring specialized facilities, equipment, and expertise. Propulsion system maintenance often involves long-term service agreements and performance-based logistics contracts.

Strategic advantages within the military aviation MRO market provide significant value propositions for various stakeholders, creating opportunities for enhanced operational efficiency, cost optimization, and competitive positioning.

Defense Organizations benefit from improved aircraft availability, reduced lifecycle costs, and enhanced operational readiness through optimized maintenance strategies. Cost savings result from predictive maintenance approaches, supply chain optimization, and strategic outsourcing of specialized services.

MRO Service Providers gain access to stable, long-term revenue streams through government contracts and partnership agreements. Technology integration opportunities enable service differentiation and premium pricing for advanced maintenance capabilities.

Technology Companies find substantial market opportunities in developing innovative maintenance solutions, digital platforms, and automation technologies. Partnership opportunities with established MRO providers create pathways for technology commercialization and market penetration.

Supply Chain Partners benefit from stable demand patterns and long-term relationships with military customers. Inventory optimization and strategic positioning create competitive advantages in parts supply and logistics services.

Training Organizations capitalize on growing demand for skilled maintenance personnel through specialized certification programs and technology training services. Workforce development initiatives create sustainable business models supporting industry growth.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping the military aviation MRO landscape reflect technological advancement, operational evolution, and strategic shifts in defense priorities across global military organizations.

Predictive Maintenance Adoption represents the most significant trend, with MarkWide Research indicating widespread implementation of IoT sensors, data analytics, and machine learning algorithms to anticipate maintenance needs and optimize scheduling. Digital twin technology enables virtual modeling of aircraft systems for enhanced maintenance planning and training applications.

Additive Manufacturing Integration is revolutionizing parts production and supply chain management, enabling on-demand manufacturing of components and reducing inventory requirements. 3D printing applications extend beyond prototyping to production of flight-critical components with appropriate certification processes.

Augmented Reality Implementation enhances maintenance procedures through digital overlays providing real-time guidance, technical documentation, and remote expert assistance. Virtual training platforms improve technician skills development while reducing training costs and time requirements.

Sustainability Initiatives drive adoption of environmentally friendly maintenance practices, including eco-friendly cleaning agents, waste reduction programs, and energy-efficient facilities. Circular economy principles promote component refurbishment and material recycling within maintenance operations.

Recent industry developments demonstrate the dynamic nature of the military aviation MRO market, with significant investments, partnerships, and technological breakthroughs shaping future market direction and competitive positioning.

Strategic partnerships between major aerospace manufacturers and technology companies are accelerating digital transformation initiatives across maintenance operations. Collaborative agreements focus on developing integrated maintenance platforms combining traditional MRO expertise with advanced digital capabilities.

Government initiatives promoting public-private partnerships are creating new business models for military aviation maintenance, enabling private sector efficiency while maintaining government oversight and security requirements. Performance-based logistics contracts are becoming increasingly common, shifting risk and responsibility to service providers.

Technology investments in artificial intelligence, blockchain, and advanced materials are creating new possibilities for maintenance optimization and supply chain management. Cybersecurity enhancements address growing concerns about digital maintenance system vulnerabilities and data protection requirements.

International cooperation programs are standardizing maintenance procedures and enabling shared resources across allied nations. Training initiatives address workforce development challenges through innovative education programs and technology-enhanced learning platforms.

Strategic recommendations for military aviation MRO market participants emphasize the importance of technology adoption, partnership development, and operational excellence in navigating evolving market conditions and competitive pressures.

Technology Investment Priorities should focus on predictive maintenance capabilities, digital platform integration, and automation technologies that demonstrate clear return on investment. MWR analysis suggests prioritizing solutions that address specific operational pain points while providing scalable implementation pathways.

Partnership Strategy Development requires careful evaluation of potential collaborators, including technology providers, academic institutions, and international partners. Strategic alliances should complement existing capabilities while providing access to new markets or technologies.

Workforce Development Initiatives must address current skills gaps while preparing for future technology requirements. Training programs should incorporate digital tools, hands-on experience, and continuous learning approaches to maintain competitive advantage.

Market Expansion Opportunities exist in emerging defense markets and specialized service segments. International growth strategies should consider regulatory requirements, local partnerships, and cultural factors affecting business development success.

Operational Excellence Focus remains critical for maintaining competitive positioning and customer satisfaction. Quality management systems, safety protocols, and continuous improvement processes provide foundation for sustainable growth.

Market projections indicate continued growth and transformation within the military aviation MRO sector, driven by technological advancement, evolving operational requirements, and strategic shifts in defense priorities across global military organizations.

Growth trajectory suggests sustained expansion at 4.2% CAGR over the forecast period, supported by aging aircraft fleets, increasing operational tempo, and technology integration requirements. Digital transformation will accelerate, with 85% of military MRO operations expected to implement advanced digital maintenance solutions within the next decade.

Technology evolution will continue reshaping maintenance approaches, with artificial intelligence, machine learning, and autonomous systems becoming integral to maintenance operations. Predictive maintenance adoption rates are projected to reach 90% penetration across major military fleets by 2030.

Market consolidation trends suggest continued merger and acquisition activity as companies seek to expand capabilities and geographic reach. Partnership models will evolve to address complex technology integration requirements and international cooperation needs.

Sustainability considerations will increasingly influence maintenance practices, with environmental regulations and corporate responsibility driving adoption of green technologies and procedures. Workforce transformation will continue as digital natives enter the industry and experienced technicians retire, requiring innovative training and knowledge transfer approaches.

The military aviation maintenance, repair, and overhaul market stands at a critical juncture, balancing traditional operational requirements with transformative technological opportunities. Market fundamentals remain strong, supported by sustained defense spending, aging aircraft fleets, and increasing operational demands across global military organizations.

Technology integration represents both the greatest opportunity and challenge facing industry participants, requiring substantial investment while promising significant operational improvements and competitive advantages. Digital transformation initiatives are reshaping traditional maintenance approaches, creating new business models and service delivery mechanisms that enhance efficiency and effectiveness.

Strategic positioning for success requires careful balance of technology investment, partnership development, and operational excellence while maintaining focus on safety, quality, and regulatory compliance. Market participants who successfully navigate these complex requirements while adapting to evolving customer needs will capture the greatest share of future growth opportunities in this essential defense sector.

What is Military Aviation Maintenance, Repair, and Overhaul?

Military Aviation Maintenance, Repair, and Overhaul refers to the processes and services involved in maintaining, repairing, and overhauling military aircraft to ensure their operational readiness and safety. This includes routine inspections, repairs of damaged components, and complete overhauls of aircraft systems.

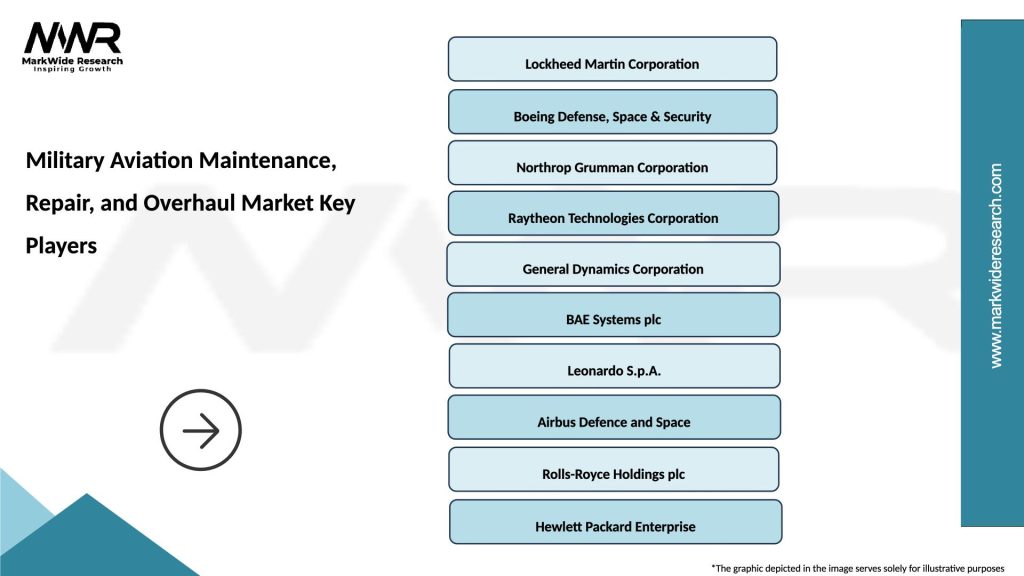

What are the key players in the Military Aviation Maintenance, Repair, and Overhaul Market?

Key players in the Military Aviation Maintenance, Repair, and Overhaul Market include companies like Lockheed Martin, Northrop Grumman, and Boeing, which provide extensive MRO services for military aircraft. These companies are known for their advanced technologies and capabilities in maintaining various military aircraft types, among others.

What are the growth factors driving the Military Aviation Maintenance, Repair, and Overhaul Market?

The growth of the Military Aviation Maintenance, Repair, and Overhaul Market is driven by increasing defense budgets, the need for modernization of aging aircraft fleets, and advancements in aviation technology. Additionally, geopolitical tensions and the rising demand for military readiness contribute to market expansion.

What challenges does the Military Aviation Maintenance, Repair, and Overhaul Market face?

The Military Aviation Maintenance, Repair, and Overhaul Market faces challenges such as budget constraints, regulatory compliance issues, and the complexity of integrating new technologies into existing systems. These factors can hinder timely maintenance and increase operational costs.

What opportunities exist in the Military Aviation Maintenance, Repair, and Overhaul Market?

Opportunities in the Military Aviation Maintenance, Repair, and Overhaul Market include the adoption of predictive maintenance technologies and the expansion of MRO services to unmanned aerial vehicles (UAVs). Additionally, partnerships between private companies and government agencies can enhance service capabilities.

What trends are shaping the Military Aviation Maintenance, Repair, and Overhaul Market?

Trends in the Military Aviation Maintenance, Repair, and Overhaul Market include the increasing use of digital technologies such as data analytics and artificial intelligence for maintenance optimization. Furthermore, there is a growing emphasis on sustainability practices within MRO operations to reduce environmental impact.

Military Aviation Maintenance, Repair, and Overhaul Market

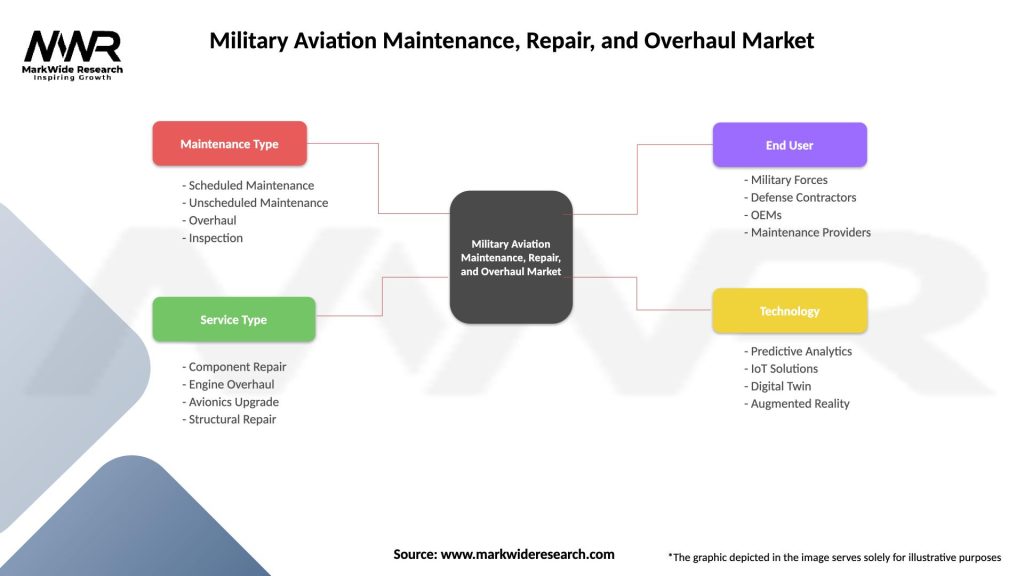

| Segmentation Details | Description |

|---|---|

| Maintenance Type | Scheduled Maintenance, Unscheduled Maintenance, Overhaul, Inspection |

| Service Type | Component Repair, Engine Overhaul, Avionics Upgrade, Structural Repair |

| End User | Military Forces, Defense Contractors, OEMs, Maintenance Providers |

| Technology | Predictive Analytics, IoT Solutions, Digital Twin, Augmented Reality |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Military Aviation Maintenance, Repair, and Overhaul Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at