444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Slovenia property and casualty insurance market represents a dynamic and evolving sector within the broader European insurance landscape. This market encompasses comprehensive coverage solutions including property insurance, motor insurance, liability coverage, and various casualty protection products tailored to meet the diverse needs of Slovenian consumers and businesses. Market dynamics indicate robust growth potential driven by increasing awareness of risk management, regulatory compliance requirements, and evolving consumer preferences toward comprehensive protection.

Slovenia’s insurance sector has demonstrated remarkable resilience and adaptability, particularly in response to changing economic conditions and emerging risk factors. The market benefits from a well-established regulatory framework that promotes stability while encouraging innovation in product development and service delivery. Digital transformation initiatives have significantly enhanced customer experience and operational efficiency, with insurers investing heavily in technology-driven solutions to streamline claims processing and policy management.

Growth projections for the Slovenia property and casualty insurance market indicate a steady expansion rate of 4.2% CAGR over the forecast period, supported by increasing penetration rates and enhanced product sophistication. The market’s evolution reflects broader European insurance trends while maintaining distinct characteristics shaped by local economic conditions, regulatory requirements, and consumer behavior patterns unique to the Slovenian market environment.

The Slovenia property and casualty insurance market refers to the comprehensive ecosystem of insurance products and services designed to protect individuals and businesses against financial losses arising from property damage, liability claims, and various casualty events within Slovenia’s territorial boundaries. This market encompasses multiple insurance categories including residential and commercial property coverage, motor vehicle insurance, general liability protection, and specialized casualty insurance products.

Property insurance components within this market provide coverage for physical assets such as residential homes, commercial buildings, industrial facilities, and personal property against risks including fire, theft, natural disasters, and other specified perils. Casualty insurance elements focus on liability protection, covering legal obligations arising from bodily injury or property damage caused to third parties, along with various forms of accident and health-related coverage.

Market participants include domestic and international insurance companies, reinsurance providers, insurance intermediaries, and regulatory bodies that collectively create a structured environment for risk transfer and financial protection. The market operates under Slovenia’s insurance regulatory framework, ensuring consumer protection while promoting competitive practices and financial stability across all participating entities.

Slovenia’s property and casualty insurance market demonstrates strong fundamentals characterized by steady growth, increasing digitalization, and evolving consumer expectations. The market benefits from a stable regulatory environment, competitive landscape, and growing awareness of insurance benefits among both individual and corporate customers. Key performance indicators reveal consistent premium growth, improved loss ratios, and enhanced customer satisfaction metrics across major insurance categories.

Digital adoption rates have accelerated significantly, with 68% of new policies now initiated through digital channels, reflecting changing consumer preferences and insurer investments in technology infrastructure. This digital transformation has enabled more efficient underwriting processes, faster claims settlement, and improved customer engagement throughout the insurance lifecycle.

Market concentration remains moderate, with the top five insurers holding approximately 72% market share, creating a balanced competitive environment that promotes innovation while maintaining stability. Regulatory developments continue to shape market dynamics, with recent initiatives focusing on consumer protection, solvency requirements, and sustainable insurance practices aligned with European Union directives.

Future prospects appear favorable, supported by economic growth, infrastructure development, and increasing recognition of insurance as an essential financial planning component. The market is well-positioned to capitalize on emerging opportunities while addressing evolving risk landscapes and customer expectations in the coming years.

Market penetration analysis reveals significant growth opportunities across various insurance segments, with motor insurance maintaining the largest share while property insurance demonstrates the highest growth potential. Consumer behavior studies indicate increasing sophistication in insurance purchasing decisions, with customers seeking comprehensive coverage options and value-added services beyond traditional policy benefits.

Economic growth momentum serves as a fundamental driver for Slovenia’s property and casualty insurance market, with increasing disposable income levels enabling higher insurance penetration rates across both personal and commercial segments. GDP expansion correlates directly with insurance demand, as individuals and businesses recognize the importance of protecting their growing assets and income streams against potential losses.

Regulatory mandates continue to drive market expansion, particularly in motor insurance where mandatory coverage requirements ensure consistent demand. European Union directives influence local regulations, promoting standardization and consumer protection while encouraging cross-border insurance activities and competitive pricing structures.

Technological advancement accelerates market growth through improved product accessibility, enhanced customer experience, and operational efficiency gains. Digital platforms reduce distribution costs while expanding market reach, enabling insurers to serve previously underserved segments and geographic areas more effectively.

Risk awareness evolution among consumers and businesses drives demand for comprehensive coverage solutions. Climate change impacts, cyber security threats, and evolving liability exposures create new insurance needs while highlighting the importance of adequate protection against emerging risk factors.

Infrastructure development throughout Slovenia increases insurable asset values and creates new coverage requirements. Real estate market growth, commercial expansion, and industrial development generate additional demand for property and liability insurance products across various sectors.

Economic uncertainty poses challenges to market growth, with potential economic downturns affecting consumer spending patterns and business investment decisions. Price sensitivity among consumers may limit premium growth and influence purchasing decisions toward basic coverage options rather than comprehensive protection packages.

Regulatory complexity creates compliance burdens that increase operational costs and may limit market entry for smaller insurers. Solvency requirements demand significant capital investments, potentially constraining growth initiatives and product development activities for some market participants.

Market saturation in certain insurance segments limits organic growth opportunities, requiring insurers to focus on market share competition rather than market expansion. Mature market characteristics in traditional insurance lines necessitate innovation and differentiation strategies to maintain competitive positioning.

Fraud concerns impact market profitability and consumer trust, requiring ongoing investments in fraud detection and prevention systems. Claims inflation pressures profitability margins, particularly in motor and property insurance segments where repair costs and medical expenses continue to escalate.

Talent shortage in specialized insurance skills affects market development capabilities and service quality. Digital skills gaps may limit the pace of technological transformation and innovation implementation across the insurance value chain.

Digital transformation acceleration presents significant opportunities for market expansion and efficiency improvement. Artificial intelligence and machine learning applications enable enhanced underwriting accuracy, personalized product offerings, and improved customer service delivery, creating competitive advantages for early adopters.

Product innovation potential exists in addressing emerging risk categories including cyber insurance, climate-related coverage, and sharing economy protection. Parametric insurance solutions offer opportunities to serve previously uninsurable risks while providing faster claims settlement and improved customer experience.

Market penetration expansion opportunities exist among underserved segments including small and medium enterprises, young professionals, and rural populations. Cross-selling initiatives can increase customer lifetime value while providing comprehensive risk management solutions.

Partnership opportunities with technology companies, automotive manufacturers, and financial institutions enable market reach expansion and product innovation. Ecosystem development creates value-added services that differentiate insurance offerings and enhance customer relationships.

Sustainability focus opens new market segments interested in environmentally responsible insurance solutions. Green insurance products addressing renewable energy, electric vehicles, and sustainable building practices align with evolving consumer values and regulatory priorities.

Competitive intensity within Slovenia’s property and casualty insurance market continues to evolve, with established domestic insurers facing increased competition from international entrants and digital-native insurance providers. Market dynamics reflect a balance between traditional relationship-based business models and emerging technology-driven approaches that prioritize efficiency and customer convenience.

Pricing pressures influence market dynamics, with insurers balancing competitive positioning against profitability requirements. Rate adequacy remains a critical consideration, particularly in motor insurance where claims frequency and severity trends impact underwriting results and pricing strategies.

Customer expectations drive market evolution, with demands for seamless digital experiences, transparent pricing, and rapid claims settlement influencing product development and service delivery approaches. Omnichannel strategies become essential for maintaining customer satisfaction and competitive positioning.

Regulatory evolution shapes market dynamics through changing capital requirements, consumer protection measures, and reporting obligations. Compliance costs influence operational strategies while regulatory initiatives promote market stability and consumer confidence.

Technology integration transforms traditional insurance processes, with automation rates reaching 78% for routine underwriting tasks and claims processing activities. This technological advancement enables cost reduction while improving service quality and response times across customer touchpoints.

Comprehensive research approach employed for analyzing Slovenia’s property and casualty insurance market incorporates multiple data sources and analytical methodologies to ensure accuracy and reliability of findings. Primary research activities include structured interviews with industry executives, regulatory officials, and key market participants to gather firsthand insights into market trends and dynamics.

Secondary research components encompass analysis of regulatory filings, financial statements, industry reports, and statistical databases maintained by relevant authorities. Data validation processes ensure information accuracy through cross-referencing multiple sources and verification with industry experts.

Quantitative analysis techniques include statistical modeling, trend analysis, and comparative assessments to identify market patterns and growth trajectories. Qualitative research methods provide contextual understanding of market dynamics, competitive positioning, and strategic considerations affecting industry participants.

Market segmentation analysis examines various insurance categories, distribution channels, customer segments, and geographic regions to provide comprehensive market understanding. Competitive landscape assessment evaluates market share, strategic positioning, and performance metrics of key industry participants.

Forecasting methodologies incorporate historical data analysis, economic indicators, and industry expert opinions to develop realistic market projections. Scenario analysis considers various economic and regulatory conditions to assess potential market outcomes and risk factors.

Ljubljana metropolitan area dominates Slovenia’s property and casualty insurance market, accounting for approximately 45% of total premium volume due to higher population density, economic activity concentration, and elevated asset values. Urban insurance penetration rates exceed national averages across all major insurance categories, reflecting higher income levels and greater risk awareness among metropolitan consumers.

Coastal regions including Koper and surrounding areas demonstrate strong growth in property insurance demand, driven by tourism development, real estate investment, and commercial activity expansion. Seasonal variations in insurance needs reflect the tourism industry’s impact on local economic conditions and risk exposures.

Industrial centers throughout Slovenia generate significant commercial insurance demand, with manufacturing facilities, logistics operations, and technology companies requiring comprehensive coverage solutions. Industrial insurance growth correlates with foreign direct investment and export-oriented business development.

Rural areas present both challenges and opportunities, with lower insurance penetration rates but growing awareness of coverage benefits. Agricultural insurance represents a specialized segment with unique risk characteristics and coverage requirements tailored to farming operations and rural property exposures.

Cross-border influences from neighboring countries affect market dynamics, particularly in border regions where economic integration and labor mobility create unique insurance needs. Regional market share distribution reflects economic development patterns and demographic characteristics across Slovenia’s diverse geographic areas.

Market leadership in Slovenia’s property and casualty insurance sector is characterized by a mix of established domestic insurers and international companies with strong local presence. Competitive positioning varies across insurance segments, with different companies maintaining leadership positions in specific product categories or customer segments.

Competitive strategies focus on digital transformation, customer experience enhancement, and product innovation to differentiate market offerings. Market share dynamics remain relatively stable, with gradual shifts reflecting strategic initiatives and performance variations among key competitors.

Product segmentation within Slovenia’s property and casualty insurance market reveals distinct characteristics and growth patterns across major insurance categories. Motor insurance represents the largest segment by premium volume, driven by mandatory coverage requirements and high vehicle ownership rates throughout the country.

By Insurance Type:

By Customer Segment:

By Distribution Channel:

Motor insurance category demonstrates mature market characteristics with stable growth patterns and increasing focus on telematics-based pricing models. Usage-based insurance adoption rates have reached 23% among new policies, reflecting consumer acceptance of technology-driven pricing approaches and insurer efforts to improve risk assessment accuracy.

Property insurance segment shows strong growth potential driven by real estate market development and increasing property values. Natural catastrophe coverage gains importance as climate change impacts become more evident, with insurers developing specialized products addressing flood, earthquake, and severe weather risks.

Liability insurance category experiences growth driven by increasing litigation trends and regulatory requirements. Professional liability coverage becomes essential for service-based businesses, while cyber liability emerges as a critical coverage area addressing digital risk exposures.

Commercial insurance lines benefit from economic growth and business expansion, with small and medium enterprise segments showing particular growth potential. Package policies combining multiple coverage types gain popularity among commercial customers seeking simplified insurance solutions.

Specialty insurance products address niche market needs including marine insurance, aviation coverage, and environmental liability protection. Product innovation focuses on emerging risks and changing customer needs, with insurers developing customized solutions for specific industry sectors and risk profiles.

Insurance companies benefit from market stability, regulatory clarity, and growing demand for comprehensive coverage solutions. Operational efficiency improvements through digital transformation enable cost reduction while enhancing customer service quality and competitive positioning in the marketplace.

Consumers gain access to comprehensive risk protection, competitive pricing, and improved service delivery through technological advancement. Product variety ensures coverage options suitable for diverse needs and risk profiles, while regulatory protection maintains fair treatment and claims settlement standards.

Intermediaries including agents and brokers benefit from market growth and increasing demand for professional insurance advice. Technology tools enhance sales capabilities and customer service delivery, while product innovation creates new business opportunities and revenue streams.

Regulatory authorities maintain market stability and consumer protection through effective oversight and policy implementation. Solvency monitoring ensures financial stability while promoting competitive practices that benefit consumers and market development.

Economic stakeholders benefit from risk transfer mechanisms that support business development, investment activities, and economic growth. Insurance availability enables entrepreneurship and innovation by providing protection against potential losses that might otherwise inhibit business activities.

Technology providers find opportunities in supporting digital transformation initiatives across the insurance value chain. Innovation partnerships with insurers create mutual benefits through improved operational efficiency and enhanced customer experience delivery.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration represents the most significant trend shaping Slovenia’s property and casualty insurance market. Artificial intelligence integration enables automated underwriting, claims processing, and customer service delivery, with AI adoption rates reaching 56% among major insurers for routine operational tasks.

Personalization trends drive product development and pricing strategies, with insurers leveraging data analytics to create customized coverage options and risk-based pricing models. Customer experience focus influences all aspects of insurance operations, from policy purchase to claims settlement processes.

Sustainability integration becomes increasingly important, with insurers developing green insurance products and incorporating environmental, social, and governance considerations into business strategies. Climate risk assessment influences underwriting practices and product development across property insurance categories.

Ecosystem partnerships expand beyond traditional insurance boundaries, with collaborations involving technology companies, automotive manufacturers, and financial institutions. Platform business models emerge as insurers seek to provide comprehensive risk management solutions rather than standalone insurance products.

Regulatory technology adoption streamlines compliance processes and reporting requirements, enabling more efficient regulatory interaction and reduced administrative burdens. Data privacy protection becomes paramount as digital transformation increases data collection and processing activities.

Parametric insurance growth addresses coverage gaps in traditional insurance products, particularly for weather-related and catastrophic risks. Blockchain technology exploration focuses on improving claims processing efficiency and reducing fraud potential across various insurance applications.

Regulatory modernization initiatives have streamlined licensing procedures and enhanced consumer protection measures throughout Slovenia’s insurance market. Solvency II implementation continues to influence capital management strategies and risk assessment practices among insurance companies operating in the market.

Digital platform launches by major insurers have transformed customer interaction patterns and operational efficiency metrics. Mobile application adoption has reached 82% penetration rates among active policyholders, reflecting successful digital engagement strategies and changing consumer preferences.

Product innovation initiatives address emerging risk categories including cyber insurance, sharing economy coverage, and climate-related protection. Telematics integration in motor insurance has expanded significantly, with participating insurers reporting improved loss ratios and customer satisfaction scores.

Market consolidation activities include strategic acquisitions and partnerships aimed at enhancing market position and operational capabilities. International expansion efforts by domestic insurers focus on regional markets with similar regulatory and economic characteristics.

Technology infrastructure investments have modernized core systems and enabled advanced analytics capabilities across major insurance operations. Cybersecurity enhancements address growing digital risks and regulatory requirements for data protection and system security.

Sustainability initiatives include development of green insurance products and implementation of environmentally responsible business practices. Social responsibility programs enhance community engagement and support broader societal objectives beyond traditional insurance functions.

Strategic recommendations for market participants focus on leveraging digital transformation opportunities while maintaining strong risk management practices. MarkWide Research analysis suggests that insurers should prioritize customer experience enhancement and operational efficiency improvement to maintain competitive positioning in the evolving market landscape.

Investment priorities should emphasize technology infrastructure modernization, data analytics capabilities, and cybersecurity protection to support sustainable growth and regulatory compliance. Talent development initiatives become critical for building capabilities in digital technologies, data science, and customer experience management.

Product development strategies should address emerging risks and underserved market segments while maintaining profitability and risk management standards. Partnership opportunities with technology providers and other ecosystem participants can accelerate innovation and market reach expansion.

Market expansion approaches should consider both domestic penetration improvement and selective international opportunities in compatible markets. Distribution channel optimization requires balancing digital efficiency with personal service quality to meet diverse customer preferences.

Risk management enhancement should incorporate climate change impacts, cyber threats, and evolving liability exposures into underwriting and pricing practices. Regulatory engagement remains important for influencing policy development and maintaining favorable operating conditions.

Customer retention strategies should leverage data insights to provide personalized service and proactive risk management advice. Operational excellence in claims processing and customer service delivery creates competitive advantages and supports premium pricing strategies.

Long-term prospects for Slovenia’s property and casualty insurance market appear favorable, supported by economic growth expectations, increasing risk awareness, and continued digital transformation momentum. Market evolution will likely accelerate as insurers adapt to changing customer expectations and emerging risk landscapes.

Growth projections indicate sustained expansion across major insurance categories, with particular strength expected in commercial lines and specialty insurance products. Premium growth rates are anticipated to maintain steady progression of 4.5% annually over the medium term, reflecting both volume increases and pricing improvements.

Technology integration will continue reshaping market dynamics, with artificial intelligence, machine learning, and automation becoming standard operational components. Customer experience improvements through digital channels will drive competitive differentiation and market share dynamics.

Regulatory evolution may introduce new requirements related to sustainability reporting, cyber risk management, and consumer protection enhancement. MWR projections suggest that regulatory changes will generally support market stability while promoting innovation and competitive practices.

Market structure changes may include further consolidation among smaller insurers and increased presence of international companies seeking regional expansion opportunities. Product innovation will focus on emerging risks, personalized coverage options, and integrated risk management solutions.

Sustainability considerations will increasingly influence business strategies, product development, and investment decisions across the insurance industry. Climate adaptation requirements will drive innovation in catastrophe modeling, risk assessment, and coverage design for weather-related exposures.

Slovenia’s property and casualty insurance market demonstrates strong fundamentals and promising growth prospects supported by stable regulatory environment, increasing digitalization, and evolving consumer needs. Market dynamics reflect successful adaptation to changing economic conditions while maintaining competitive balance and consumer protection standards.

Digital transformation has emerged as a key differentiator, enabling operational efficiency improvements and enhanced customer experience delivery across major insurance categories. Technology adoption rates continue accelerating, with insurers investing significantly in artificial intelligence, data analytics, and automated processing capabilities.

Future success in this market will depend on insurers’ ability to balance innovation with risk management, customer service excellence with operational efficiency, and growth ambitions with regulatory compliance requirements. Strategic positioning should emphasize sustainable competitive advantages through technology leadership, customer relationship strength, and operational excellence.

Market opportunities exist across multiple dimensions including product innovation, market penetration improvement, and ecosystem partnership development. MarkWide Research analysis indicates that companies positioning themselves effectively for digital-first customer engagement while maintaining strong risk management capabilities will achieve superior long-term performance in Slovenia’s evolving property and casualty insurance landscape.

What is Property And Casualty Insurance?

Property and casualty insurance refers to a type of coverage that protects individuals and businesses from financial losses related to property damage and liability claims. This includes various policies such as homeowners, auto, and commercial insurance.

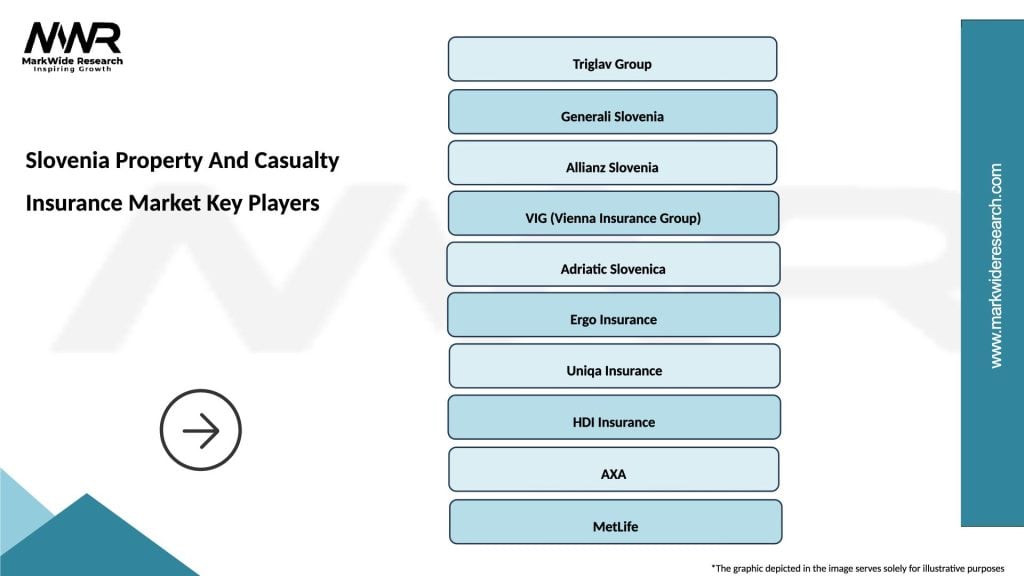

What are the key players in the Slovenia Property And Casualty Insurance Market?

Key players in the Slovenia Property And Casualty Insurance Market include Zavarovalnica Triglav, Generali Slovenia, and Allianz Slovenia, among others. These companies offer a range of insurance products tailored to meet the needs of consumers and businesses.

What are the growth factors driving the Slovenia Property And Casualty Insurance Market?

The growth of the Slovenia Property And Casualty Insurance Market is driven by increasing awareness of insurance products, a growing economy, and rising property values. Additionally, the expansion of digital insurance solutions is enhancing accessibility for consumers.

What challenges does the Slovenia Property And Casualty Insurance Market face?

Challenges in the Slovenia Property And Casualty Insurance Market include regulatory changes, intense competition among insurers, and the impact of natural disasters on claims. These factors can affect profitability and operational efficiency for insurance providers.

What opportunities exist in the Slovenia Property And Casualty Insurance Market?

Opportunities in the Slovenia Property And Casualty Insurance Market include the development of innovative insurance products, the integration of technology for better customer service, and the potential for growth in niche markets such as cyber insurance and environmental liability.

What trends are shaping the Slovenia Property And Casualty Insurance Market?

Trends in the Slovenia Property And Casualty Insurance Market include the increasing use of artificial intelligence for underwriting and claims processing, a shift towards personalized insurance products, and a growing emphasis on sustainability and ESG factors in insurance offerings.

Slovenia Property And Casualty Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Home Insurance, Auto Insurance, Liability Insurance, Travel Insurance |

| Customer Type | Individuals, Small Businesses, Corporations, Non-Profits |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| Coverage Type | Comprehensive, Third-Party, Fire, Theft |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Slovenia Property And Casualty Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at