444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The fermented food and ingredients market represents one of the fastest-growing segments in the global food industry, driven by increasing consumer awareness of health benefits and growing demand for functional foods. Fermentation technology has evolved from traditional preservation methods to sophisticated biotechnological processes that enhance nutritional value, flavor profiles, and shelf life of various food products. The market encompasses a diverse range of products including fermented dairy products, beverages, bakery items, condiments, and specialized ingredients used in food manufacturing.

Market dynamics indicate robust growth potential with the sector experiencing a compound annual growth rate (CAGR) of 7.2% across key regions. Consumer preferences are shifting toward natural, organic, and probiotic-rich foods, creating substantial opportunities for manufacturers and ingredient suppliers. The integration of advanced fermentation technologies with traditional processes has enabled the development of innovative products that meet evolving dietary requirements and lifestyle preferences.

Regional distribution shows significant variation, with Asia-Pacific maintaining approximately 42% market share due to strong cultural traditions of fermented foods, while North America and Europe demonstrate rapid adoption rates of 65% and 58% respectively for functional fermented products. The market’s expansion is supported by increasing investments in research and development, strategic partnerships between food manufacturers and biotechnology companies, and growing retail distribution networks.

The fermented food and ingredients market refers to the comprehensive ecosystem of products, technologies, and services involved in the production, processing, and distribution of foods that undergo controlled microbial fermentation processes. Fermentation is a metabolic process where microorganisms such as bacteria, yeasts, or molds convert organic compounds into acids, gases, or alcohol, resulting in enhanced nutritional profiles, improved digestibility, and extended shelf life.

This market encompasses traditional fermented foods like yogurt, kefir, sauerkraut, kimchi, and kombucha, as well as modern fermented ingredients including enzymes, organic acids, amino acids, and specialized cultures used in food manufacturing. The scope extends beyond finished products to include fermentation equipment, starter cultures, processing technologies, and quality control systems that enable large-scale commercial production.

Key characteristics of this market include the integration of biotechnology with food science, emphasis on probiotic and prebiotic benefits, focus on clean-label ingredients, and alignment with sustainable food production practices. The market serves diverse end-user segments including food and beverage manufacturers, dietary supplement companies, and direct consumers seeking health-conscious food options.

The fermented food and ingredients market demonstrates exceptional growth momentum driven by converging trends in health consciousness, functional nutrition, and sustainable food production. Consumer demand for probiotic-rich foods has increased by 78% over the past five years, reflecting growing awareness of gut health benefits and immune system support provided by fermented products.

Market segmentation reveals diverse opportunities across product categories, with fermented dairy products maintaining the largest share, followed by fermented beverages and bakery applications. Ingredient suppliers are experiencing particularly strong growth as food manufacturers increasingly incorporate fermented components into conventional products to enhance nutritional value and appeal to health-conscious consumers.

Technological advancement plays a crucial role in market expansion, with innovations in controlled fermentation processes, strain development, and preservation techniques enabling manufacturers to create products with consistent quality, extended shelf life, and enhanced functional benefits. Strategic partnerships between traditional food companies and biotechnology firms are accelerating product development and market penetration.

Regional analysis indicates strong performance across all major markets, with emerging economies showing particularly robust growth rates due to increasing disposable income, urbanization, and exposure to international food trends. The market’s resilience during economic uncertainties demonstrates the fundamental shift in consumer preferences toward functional and health-promoting foods.

Market intelligence reveals several critical insights that shape the fermented food and ingredients landscape. Consumer behavior analysis shows that health benefits rank as the primary purchase driver for 73% of consumers, followed by taste preferences and natural ingredient appeal. This trend has prompted manufacturers to invest heavily in research and development to create products that deliver both functional benefits and superior sensory experiences.

Competitive dynamics show increasing consolidation as larger companies acquire specialized fermentation technology firms and traditional food manufacturers expand their probiotic product portfolios. Market entry barriers include significant capital requirements for fermentation facilities, regulatory compliance costs, and the need for specialized technical expertise in microbiology and food science.

Health consciousness trends represent the primary driver of market expansion, with consumers increasingly seeking foods that provide functional health benefits beyond basic nutrition. Scientific research supporting the connection between gut health and overall wellness has elevated consumer awareness of probiotic benefits, driving demand for fermented products across all demographic segments.

Demographic shifts contribute significantly to market growth, particularly the aging population’s focus on digestive health and immune system support. Millennials and Generation Z consumers demonstrate strong preference for natural, organic, and minimally processed foods, creating substantial opportunities for fermented product manufacturers who can position their offerings as clean-label alternatives to conventional processed foods.

Technological advancement in fermentation processes enables manufacturers to develop products with improved taste, texture, and nutritional profiles while maintaining cost-effectiveness. Precision fermentation technologies allow for consistent production of high-quality ingredients and finished products, reducing variability and enhancing consumer confidence in fermented food categories.

Regulatory support for functional foods and health claims provides manufacturers with opportunities to communicate product benefits effectively to consumers. Government initiatives promoting healthy eating and preventive healthcare create favorable market conditions for fermented foods positioned as wellness-supporting products.

Production complexity presents significant challenges for manufacturers entering the fermented food market, requiring specialized knowledge of microbiology, fermentation kinetics, and quality control processes. Contamination risks associated with fermentation processes demand substantial investments in facility design, equipment, and personnel training to ensure product safety and consistency.

Shelf life limitations of many fermented products create logistical challenges for distribution and retail management, particularly in regions with limited cold chain infrastructure. Temperature sensitivity and the need for refrigerated storage increase operational costs and limit market reach in certain geographic areas.

Consumer education requirements represent an ongoing challenge, as many consumers remain unfamiliar with fermented foods beyond traditional products like yogurt and cheese. Taste preferences and cultural acceptance barriers can limit market penetration for certain fermented products, particularly those with strong or unfamiliar flavors.

Regulatory complexity varies significantly across regions, creating compliance challenges for companies seeking to expand internationally. Health claim substantiation requirements demand extensive research and documentation, increasing product development costs and time-to-market for new fermented food products.

Emerging market expansion presents substantial growth opportunities as developing economies experience rising disposable incomes, urbanization, and increased exposure to international food trends. Asia-Pacific markets show particularly strong potential due to existing cultural familiarity with fermented foods combined with growing health consciousness among urban consumers.

Product diversification opportunities exist across multiple food categories, with manufacturers exploring fermented alternatives to conventional products in segments such as plant-based proteins, functional beverages, and specialty condiments. Innovation potential in fermented ingredients for food manufacturing creates opportunities for B2B suppliers to develop specialized cultures, enzymes, and flavor compounds.

E-commerce growth enables direct-to-consumer marketing strategies that allow fermented food producers to build brand loyalty, educate consumers about product benefits, and capture higher margins compared to traditional retail channels. Subscription models for fermented products create recurring revenue streams and improve customer lifetime value.

Sustainability positioning offers competitive advantages as consumers increasingly prioritize environmentally responsible food choices. Fermentation processes can be positioned as sustainable alternatives to conventional food production methods, particularly for protein production and food preservation applications.

Supply chain evolution reflects the growing sophistication of the fermented food industry, with manufacturers investing in vertical integration strategies to control quality and reduce costs. Raw material sourcing has become increasingly strategic, with companies developing relationships with organic and specialty ingredient suppliers to ensure consistent supply of high-quality inputs for fermentation processes.

Technology integration drives operational efficiency improvements, with manufacturers adopting automated fermentation systems, real-time monitoring technologies, and data analytics platforms to optimize production processes. Quality control systems have evolved to include advanced testing methods and continuous monitoring capabilities that ensure product safety and consistency.

Market consolidation trends show larger food companies acquiring specialized fermentation technology firms and probiotic manufacturers to expand their functional food portfolios. Strategic partnerships between ingredient suppliers and food manufacturers create integrated value chains that improve product development capabilities and market responsiveness.

Consumer engagement strategies have evolved beyond traditional marketing approaches to include educational content, social media campaigns, and experiential marketing that helps consumers understand fermented food benefits. Brand differentiation increasingly focuses on specific health benefits, ingredient sourcing stories, and production process transparency.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the fermented food and ingredients market. Primary research includes extensive interviews with industry executives, manufacturers, suppliers, and distributors across key geographic regions to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and academic publications related to fermentation technology and functional foods. Market data validation involves cross-referencing information from multiple sources to ensure accuracy and reliability of market size estimates, growth projections, and competitive landscape analysis.

Quantitative analysis includes statistical modeling of market trends, regression analysis of growth drivers, and correlation studies between consumer behavior patterns and market performance. Qualitative assessment incorporates expert opinions, industry trend analysis, and evaluation of regulatory developments that impact market dynamics.

Data collection protocols ensure consistency and reliability across all research activities, with standardized questionnaires, interview guides, and data verification procedures. Market segmentation analysis employs clustering techniques and demographic analysis to identify distinct consumer groups and their preferences for fermented food products.

Asia-Pacific region dominates the global fermented food market with approximately 42% market share, driven by strong cultural traditions of fermented foods and increasing health consciousness among urban populations. China and Japan represent the largest markets within the region, with traditional products like miso, kimchi, and fermented soy products maintaining strong consumer loyalty while modern probiotic products gain market traction.

North America demonstrates rapid growth in fermented food adoption, with the market expanding at 8.5% annually as consumers increasingly seek functional foods and beverages. United States market shows particular strength in fermented beverages, probiotic supplements, and plant-based fermented products, driven by health-conscious millennials and aging baby boomers focused on digestive health.

European markets exhibit strong performance across traditional and innovative fermented products, with Germany, France, and United Kingdom leading in market development. Regulatory support for functional food claims and organic certification creates favorable conditions for premium fermented products, while traditional fermented foods maintain steady demand across all demographic segments.

Latin America shows emerging growth potential with increasing urbanization and rising disposable incomes driving demand for functional foods. Brazil and Mexico represent key markets with growing interest in probiotic products and traditional fermented beverages, supported by expanding retail distribution networks and increasing health awareness campaigns.

Market leadership is distributed among several categories of companies, including traditional food manufacturers, specialized probiotic companies, and biotechnology firms focused on fermentation technologies. Competitive positioning varies significantly based on product categories, geographic focus, and target market segments.

Competitive strategies include product innovation, geographic expansion, strategic acquisitions, and vertical integration initiatives. Market differentiation focuses on specific health benefits, organic certification, unique flavor profiles, and sustainable production practices that appeal to target consumer segments.

Product segmentation reveals diverse market categories with distinct growth patterns and consumer preferences. Fermented dairy products maintain the largest market share, including yogurt, kefir, cheese, and specialty cultured products that appeal to health-conscious consumers seeking probiotic benefits and natural nutrition.

By Product Type:

By Application:

Fermented dairy products continue to dominate market share due to established consumer acceptance, extensive distribution networks, and continuous product innovation. Greek yogurt and specialty kefir products show particularly strong growth as consumers seek high-protein, probiotic-rich alternatives to conventional dairy products.

Fermented beverages represent the fastest-growing category with kombucha sales increasing 35% annually as consumers embrace functional drinks that provide health benefits beyond basic hydration. Innovation opportunities exist in flavor development, packaging formats, and functional ingredient additions that enhance the appeal of fermented beverages.

Fermented vegetables benefit from growing interest in plant-based nutrition and traditional food preservation methods. Kimchi and sauerkraut show strong growth in Western markets as consumers discover the flavor and health benefits of fermented vegetables, supported by increasing availability in mainstream retail channels.

Fermented ingredients serve as a critical growth driver for the B2B market, enabling food manufacturers to incorporate fermentation benefits into conventional products. Enzyme applications in baking, brewing, and food processing create substantial opportunities for specialized ingredient suppliers focused on fermentation technologies.

Manufacturers benefit from growing consumer demand for functional foods, enabling premium pricing strategies and brand differentiation opportunities. Product innovation in fermented foods allows companies to expand their portfolios with health-focused products that appeal to diverse consumer segments and create competitive advantages in crowded food markets.

Retailers experience increased foot traffic and higher margins from fermented food categories, particularly in organic and specialty product sections. Category management opportunities include cross-merchandising strategies that connect fermented products with other health-focused foods and beverages, creating comprehensive wellness shopping experiences.

Ingredient suppliers benefit from growing demand for specialized cultures, enzymes, and fermentation equipment as food manufacturers expand their fermented product offerings. Technical expertise in fermentation processes creates opportunities for value-added services including product development support and quality assurance consulting.

Consumers gain access to diverse, health-promoting food options that support digestive health, immune function, and overall wellness. Educational resources from manufacturers and retailers help consumers understand fermented food benefits and make informed purchasing decisions that align with their health and lifestyle goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Plant-based fermentation emerges as a dominant trend with manufacturers developing fermented alternatives to traditional dairy products using nuts, seeds, and plant proteins. Innovation focus includes creating products that match the taste, texture, and nutritional profiles of conventional fermented foods while appealing to vegan and lactose-intolerant consumers.

Personalized nutrition drives development of targeted fermented products designed for specific health conditions, age groups, and lifestyle requirements. Probiotic strain specificity enables manufacturers to create products with documented benefits for particular health concerns, supported by clinical research and regulatory approval for health claims.

Functional ingredient integration combines fermentation with other health-promoting compounds such as adaptogens, vitamins, minerals, and botanical extracts. Product development focuses on creating synergistic formulations that enhance the bioavailability and effectiveness of functional ingredients through fermentation processes.

Sustainable packaging innovations address environmental concerns while maintaining product quality and shelf life requirements. Packaging solutions include biodegradable materials, reduced plastic usage, and innovative designs that preserve fermented product integrity during distribution and storage.

Strategic acquisitions reshape the competitive landscape as major food companies acquire specialized fermentation technology firms and probiotic manufacturers to expand their functional food capabilities. Recent transactions demonstrate the industry’s consolidation trend and the premium valuations placed on fermentation expertise and market-leading brands.

Research partnerships between food manufacturers and academic institutions accelerate innovation in fermentation science, strain development, and product applications. Collaborative projects focus on developing new probiotic strains, optimizing fermentation processes, and validating health benefits through clinical studies.

Regulatory approvals for new health claims and probiotic strains create market opportunities for manufacturers to differentiate their products and communicate specific benefits to consumers. According to MarkWide Research, regulatory developments in major markets support continued expansion of functional fermented food categories.

Technology investments in automated fermentation systems, quality control equipment, and supply chain management platforms improve operational efficiency and product consistency. Digital transformation initiatives include implementation of IoT sensors, data analytics platforms, and predictive maintenance systems that optimize production processes.

Market entry strategies should focus on product differentiation through unique health benefits, superior taste profiles, or innovative packaging solutions that address specific consumer needs. New entrants should consider partnerships with established distribution networks and ingredient suppliers to accelerate market penetration and reduce operational complexity.

Investment priorities should emphasize research and development capabilities, quality control systems, and supply chain infrastructure that support consistent product quality and scalable production. Technology adoption in fermentation processes and quality assurance systems provides competitive advantages and operational efficiency improvements.

Geographic expansion opportunities exist in emerging markets with growing middle-class populations and increasing health consciousness. Market development strategies should include consumer education initiatives, local partnership development, and product adaptation to regional taste preferences and cultural requirements.

Product portfolio optimization should balance traditional fermented products with innovative offerings that address evolving consumer preferences for plant-based, organic, and functional foods. Brand positioning should emphasize health benefits, quality ingredients, and sustainable production practices that resonate with target consumer segments.

Long-term growth prospects remain highly favorable for the fermented food and ingredients market, supported by demographic trends, increasing health consciousness, and continued innovation in fermentation technologies. Market expansion is projected to continue at robust rates with compound annual growth exceeding 7% across major geographic regions through the next decade.

Technology evolution will drive significant improvements in production efficiency, product quality, and cost-effectiveness of fermented food manufacturing. Precision fermentation technologies and biotechnology advances will enable development of novel products with enhanced functional benefits and improved consumer appeal.

Consumer adoption patterns indicate continued mainstream acceptance of fermented foods beyond traditional demographics, with younger consumers driving demand for innovative products and flavors. MWR analysis suggests that fermented food consumption will increase by 45% over the next five years as awareness of health benefits expands and product availability improves.

Market maturation in developed regions will drive innovation toward premium products, specialized applications, and personalized nutrition solutions. Emerging market development will focus on affordable, culturally appropriate products that introduce fermented food benefits to new consumer populations while respecting local preferences and traditions.

The fermented food and ingredients market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by converging trends in health consciousness, functional nutrition, and sustainable food production. Market fundamentals remain strong across all major geographic regions, supported by increasing consumer awareness of probiotic benefits, expanding product availability, and continuous innovation in fermentation technologies.

Industry participants are well-positioned to capitalize on growing demand through strategic investments in product development, quality control systems, and market expansion initiatives. Success factors include maintaining product quality consistency, developing effective consumer education strategies, and building strong distribution partnerships that ensure broad market access for fermented food products.

Future market development will be characterized by continued product innovation, geographic expansion into emerging markets, and integration of advanced technologies that improve production efficiency and product functionality. MarkWide Research projects sustained growth momentum as fermented foods transition from niche health products to mainstream food categories with broad consumer appeal and significant market presence across diverse demographic segments.

What is Fermented Food and Ingredients?

Fermented food and ingredients refer to products that have undergone fermentation, a process where microorganisms like bacteria, yeast, or molds convert sugars and starches into acids, gases, or alcohol. Common examples include yogurt, sauerkraut, kimchi, and fermented beverages like kombucha.

What are the key players in the Fermented Food and Ingredients Market?

Key players in the Fermented Food and Ingredients Market include companies like Danone, Kraft Heinz, and Nestlé, which produce a variety of fermented products. Other notable companies include General Mills and Unilever, among others.

What are the growth factors driving the Fermented Food and Ingredients Market?

The growth of the Fermented Food and Ingredients Market is driven by increasing consumer awareness of health benefits associated with fermented foods, such as improved gut health and enhanced nutrition. Additionally, the rising demand for plant-based and probiotic-rich products is contributing to market expansion.

What challenges does the Fermented Food and Ingredients Market face?

The Fermented Food and Ingredients Market faces challenges such as regulatory hurdles regarding food safety and labeling, as well as competition from non-fermented alternatives. Additionally, consumer preferences can shift rapidly, impacting demand for specific fermented products.

What opportunities exist in the Fermented Food and Ingredients Market?

Opportunities in the Fermented Food and Ingredients Market include the potential for innovation in product development, such as new flavors and health-focused formulations. There is also a growing trend towards sustainable and organic fermentation practices that appeal to environmentally conscious consumers.

What trends are shaping the Fermented Food and Ingredients Market?

Trends in the Fermented Food and Ingredients Market include the increasing popularity of functional foods that offer health benefits beyond basic nutrition, as well as the rise of ethnic and artisanal fermented products. Additionally, the use of technology in fermentation processes is enhancing product quality and consistency.

Fermented Food and Ingredients Market

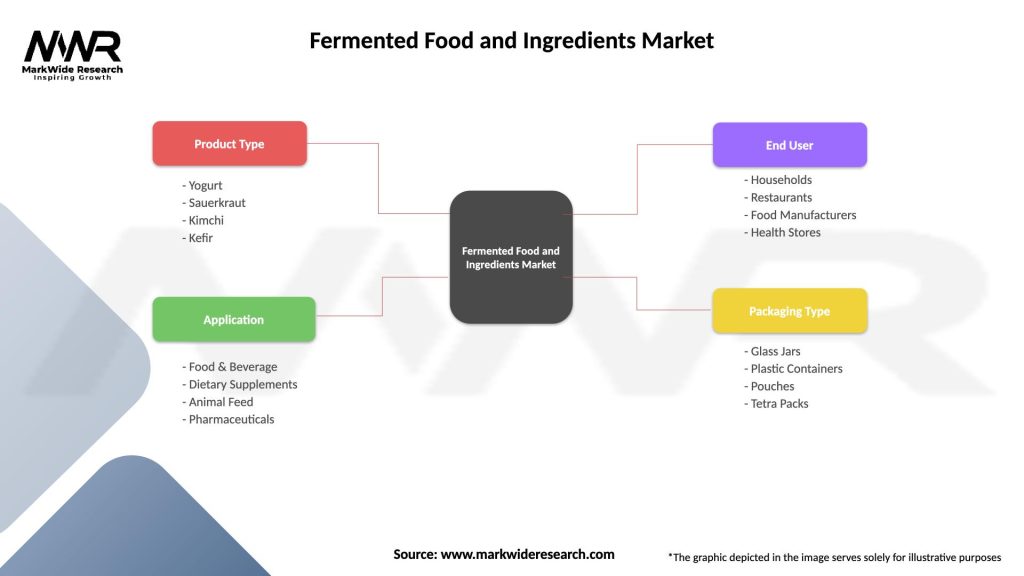

| Segmentation Details | Description |

|---|---|

| Product Type | Yogurt, Sauerkraut, Kimchi, Kefir |

| Application | Food & Beverage, Dietary Supplements, Animal Feed, Pharmaceuticals |

| End User | Households, Restaurants, Food Manufacturers, Health Stores |

| Packaging Type | Glass Jars, Plastic Containers, Pouches, Tetra Packs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Fermented Food and Ingredients Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at