444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Taiwan retail market represents one of Asia’s most dynamic and technologically advanced retail ecosystems, characterized by a unique blend of traditional shopping culture and cutting-edge digital innovation. Taiwan’s retail landscape has undergone significant transformation over the past decade, driven by changing consumer preferences, technological adoption, and evolving shopping behaviors. The market demonstrates remarkable resilience and adaptability, with retailers successfully integrating omnichannel strategies to meet diverse consumer demands.

Digital transformation has become a cornerstone of Taiwan’s retail evolution, with e-commerce penetration reaching 12.8% of total retail sales and continuing to expand rapidly. The market benefits from Taiwan’s advanced digital infrastructure, high smartphone penetration rates, and tech-savvy consumer base. Traditional retail formats including department stores, convenience stores, and specialty retailers continue to maintain strong market presence while adapting to digital-first consumer expectations.

Consumer spending patterns in Taiwan reflect a sophisticated market with strong purchasing power and diverse preferences across age demographics. The retail sector encompasses various channels including hypermarkets, supermarkets, convenience stores, department stores, specialty retailers, and rapidly growing online platforms. Convenience store density in Taiwan remains among the highest globally, with approximately one store per 2,200 residents, highlighting the market’s unique retail infrastructure.

The Taiwan retail market refers to the comprehensive ecosystem of businesses and channels involved in selling goods and services directly to consumers within Taiwan’s domestic market. This market encompasses both physical retail establishments and digital commerce platforms that facilitate the distribution of consumer products ranging from daily necessities to luxury goods. Taiwan’s retail sector includes traditional brick-and-mortar stores, modern retail formats, e-commerce platforms, and hybrid omnichannel operations that serve the island’s population of approximately 23.5 million consumers.

Market dynamics within Taiwan’s retail landscape are influenced by factors including consumer behavior patterns, technological adoption rates, regulatory frameworks, and competitive pressures from both domestic and international retailers. The sector plays a crucial role in Taiwan’s economy, contributing significantly to employment, GDP, and overall economic activity while serving as a key indicator of consumer confidence and spending patterns.

Taiwan’s retail market continues to demonstrate robust growth and innovation, positioning itself as a regional leader in retail technology adoption and consumer experience excellence. The market has successfully navigated recent global challenges while maintaining steady expansion across multiple retail categories and channels. Key growth drivers include increasing disposable income, urbanization trends, and accelerated digital adoption following the pandemic period.

E-commerce growth has been particularly notable, with online retail sales growing at 15.2% annually over the past three years. Traditional retailers have responded by investing heavily in digital transformation initiatives, creating seamless omnichannel experiences that blend physical and digital touchpoints. Mobile commerce represents an increasingly important segment, accounting for 68% of all e-commerce transactions in Taiwan.

Competitive landscape features a mix of established local retailers, international chains, and emerging digital-native brands. The market shows strong preference for convenience-oriented retail formats, with convenience stores maintaining exceptional market penetration and customer loyalty. Sustainability initiatives and social responsibility have become important differentiators, with 73% of consumers indicating preference for environmentally conscious retailers.

Consumer behavior analysis reveals several critical insights shaping Taiwan’s retail landscape. Digital-savvy consumers increasingly expect seamless integration between online and offline shopping experiences, driving retailers to invest in sophisticated omnichannel capabilities. Social commerce has emerged as a significant trend, with platforms integrating social media features to enhance customer engagement and drive sales conversion.

Economic prosperity serves as a fundamental driver of Taiwan’s retail market expansion, with rising disposable income levels enabling increased consumer spending across various retail categories. The island’s strong economic fundamentals, including low unemployment rates and stable currency, create favorable conditions for retail growth. Urbanization trends continue to concentrate population in metropolitan areas, creating dense consumer markets that support diverse retail formats and specialized offerings.

Technological advancement represents another crucial driver, with Taiwan’s position as a global technology hub facilitating rapid adoption of retail innovations. The widespread availability of high-speed internet, 5G networks, and advanced mobile devices creates an ideal environment for digital retail experiences. Government initiatives supporting digital transformation and smart city development further accelerate retail technology adoption.

Demographic shifts including an aging population and changing household structures influence retail demand patterns. Younger consumers drive demand for experiential retail, sustainable products, and digital-first shopping experiences. Cultural factors including Taiwan’s gift-giving traditions, food culture, and fashion consciousness create sustained demand across multiple retail categories throughout the year.

Intense competition presents significant challenges for retailers operating in Taiwan’s mature market environment. The presence of numerous domestic and international players creates pricing pressures and requires substantial investment in differentiation strategies. Real estate costs in prime retail locations, particularly in Taipei and other major cities, represent a substantial operational expense that impacts profitability for physical retail operations.

Regulatory complexity surrounding food safety, product standards, and cross-border trade creates compliance challenges for retailers, particularly those dealing with imported goods. Labor shortages in certain retail sectors, combined with rising wage costs, pressure operational efficiency and profit margins. The market’s small geographic size limits scalability opportunities for some retail concepts.

Consumer price sensitivity in certain categories constrains pricing flexibility, while the prevalence of promotional activities and discount expectations among consumers can erode margins. Supply chain disruptions and logistics challenges, particularly for international sourcing, create operational complexities that retailers must navigate effectively.

Digital transformation initiatives present substantial opportunities for retailers to enhance customer experiences and operational efficiency. The integration of artificial intelligence, machine learning, and data analytics enables personalized marketing, optimized inventory management, and improved customer service delivery. Omnichannel expansion allows traditional retailers to capture online market share while leveraging existing physical infrastructure.

Cross-border e-commerce opportunities enable Taiwanese retailers to access regional and global markets, particularly in Southeast Asia where Taiwan brands enjoy strong recognition. Sustainability-focused retail concepts align with growing environmental consciousness and can command premium pricing while building brand loyalty among younger consumers.

Health and wellness retail segments offer significant growth potential as consumers increasingly prioritize personal health and wellbeing. Experiential retail concepts that combine shopping with entertainment, dining, or educational experiences can differentiate retailers in competitive markets. The growing senior population creates opportunities for specialized retail services and products tailored to aging consumers.

Competitive dynamics in Taiwan’s retail market are characterized by rapid innovation cycles and continuous adaptation to changing consumer preferences. Market consolidation trends see larger retailers acquiring smaller competitors or forming strategic partnerships to achieve scale advantages. The entry of international e-commerce giants has intensified competition while also raising consumer expectations for service quality and convenience.

Technology adoption continues to reshape market dynamics, with retailers investing in automation, artificial intelligence, and advanced analytics to improve operational efficiency and customer insights. Supply chain optimization becomes increasingly important as retailers seek to reduce costs and improve delivery times in response to consumer demands for faster fulfillment.

Consumer behavior evolution drives continuous adaptation in retail strategies, with growing emphasis on personalization, sustainability, and social responsibility. Seasonal fluctuations remain significant, with major shopping periods including Chinese New Year, summer festivals, and year-end holidays driving substantial sales volumes. According to MarkWide Research analysis, these seasonal patterns account for 35% of annual retail sales concentration during peak periods.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Taiwan’s retail market dynamics. Primary research includes extensive surveys of consumers across different demographic segments, in-depth interviews with retail executives, and focus groups examining shopping behavior patterns. This direct data collection provides current insights into consumer preferences, spending patterns, and emerging trends.

Secondary research incorporates analysis of government statistics, industry reports, company financial statements, and trade association data to establish market context and validate primary findings. Quantitative analysis utilizes statistical modeling to identify correlations, trends, and predictive indicators that inform market projections and strategic recommendations.

Field research involves on-site observation of retail operations, mystery shopping exercises, and competitive analysis of store formats, pricing strategies, and customer service approaches. Digital analytics examine online retail performance, social media engagement, and e-commerce platform data to understand digital market dynamics. The methodology ensures comprehensive coverage of both traditional and digital retail channels.

Northern Taiwan dominates the retail landscape, with the Taipei metropolitan area accounting for approximately 42% of total retail activity. This region benefits from high population density, elevated income levels, and concentration of international businesses that drive premium retail demand. Taipei’s retail infrastructure includes numerous department stores, shopping districts, and flagship locations for major brands, making it the primary destination for luxury and international retail concepts.

Central Taiwan represents a significant retail market centered around Taichung, Taiwan’s third-largest city. This region shows strong growth in modern retail formats including shopping malls and hypermarkets, while maintaining traditional market culture. Manufacturing concentration in central Taiwan supports steady employment and consumer spending, creating opportunities for both value-oriented and premium retail concepts.

Southern Taiwan features distinct retail characteristics influenced by local culture and economic structure. Kaohsiung serves as the regional retail hub, with growing emphasis on experiential retail and entertainment-integrated shopping centers. The region shows strong preference for local brands and traditional retail formats, while gradually adopting digital retail innovations.

Eastern Taiwan represents a smaller but unique retail market characterized by tourism-driven demand and emphasis on local products and crafts. Rural retail areas throughout Taiwan rely heavily on convenience stores and traditional markets, with limited penetration of modern retail formats but growing adoption of e-commerce for product access.

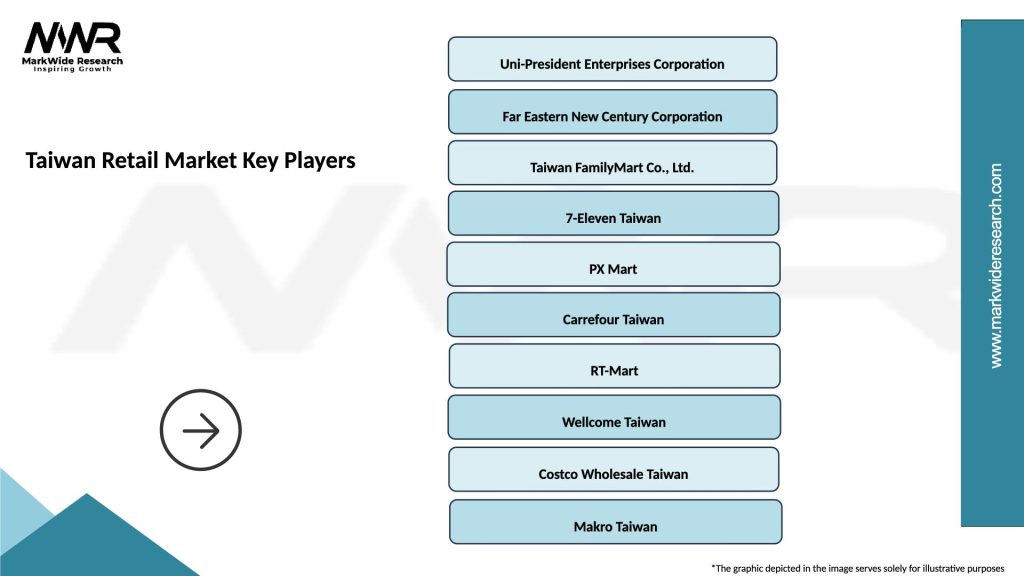

Market leadership in Taiwan’s retail sector is distributed among several key players across different categories and formats. The competitive environment features both established local retailers with deep market knowledge and international chains bringing global best practices and brand recognition.

Competitive strategies focus on customer experience enhancement, technology integration, and supply chain optimization. Innovation leadership becomes crucial for maintaining market position, with retailers investing in mobile applications, loyalty programs, and personalized marketing capabilities.

By Retail Format: Taiwan’s retail market encompasses diverse formats serving different consumer needs and preferences. Convenience stores maintain the largest market share by location count and transaction frequency, offering essential products and services with extended operating hours. Hypermarkets and supermarkets serve bulk purchasing needs and family shopping requirements, while department stores focus on premium and luxury retail segments.

By Product Category: Food and beverages represent the largest retail category, driven by Taiwan’s vibrant food culture and frequent purchasing patterns. Fashion and apparel constitute a significant segment with strong seasonal variations and trend-driven demand. Electronics and technology products benefit from Taiwan’s tech-savvy consumer base and high adoption rates of new technologies.

By Consumer Demographics: Millennial and Gen Z consumers drive digital retail adoption and sustainable product preferences, while Generation X represents the highest spending power segment. Senior consumers show growing retail participation with specific needs for convenience and service quality.

By Geographic Distribution: Urban markets account for 78% of retail sales volume, with concentrated population and higher income levels supporting diverse retail formats. Suburban and rural areas rely more heavily on convenience stores and e-commerce for product access.

Food and Beverage Retail dominates Taiwan’s retail landscape, reflecting the island’s strong culinary culture and frequent food purchasing patterns. Fresh food categories including produce, meat, and seafood show consistent demand with emphasis on quality and safety. Convenience food segments grow rapidly as urbanization and busy lifestyles drive demand for ready-to-eat options.

Fashion and Apparel retail demonstrates strong seasonal patterns with significant sales concentration during festival periods and seasonal transitions. Fast fashion concepts perform well among younger consumers, while premium and luxury segments serve affluent demographics in major metropolitan areas. Online fashion retail grows rapidly with improved sizing technology and return policies.

Electronics and Technology retail benefits from Taiwan’s position as a global technology hub and high consumer adoption rates. Mobile devices and consumer electronics show consistent demand driven by product innovation cycles. Gaming and entertainment technology represents a growing segment among younger consumers.

Health and Beauty retail shows strong growth driven by increasing wellness consciousness and aging population needs. Skincare and cosmetics perform particularly well with Korean and Japanese brands gaining significant market share. Health supplements and wellness products demonstrate consistent growth across age demographics.

Retailers operating in Taiwan’s market benefit from a sophisticated consumer base with high purchasing power and openness to innovation. The market’s compact geographic size enables efficient distribution networks and supply chain management. Advanced digital infrastructure supports omnichannel retail strategies and customer engagement initiatives.

Suppliers and manufacturers gain access to a quality-conscious market that values product innovation and brand reputation. Taiwan’s strategic location provides access to broader Asian markets, while the domestic market serves as an effective testing ground for new products and concepts. Regulatory environment generally supports business operations with clear guidelines and intellectual property protection.

Technology providers find opportunities in Taiwan’s retail sector’s embrace of digital transformation and automation. The market’s willingness to adopt new technologies creates demand for retail technology solutions including point-of-sale systems, inventory management, and customer analytics platforms.

Investors benefit from Taiwan’s stable economic environment and growing retail market. Real estate investors find opportunities in retail property development, while private equity and venture capital can support retail innovation and expansion initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Omnichannel Integration represents the most significant trend reshaping Taiwan’s retail landscape, with successful retailers creating seamless experiences across physical stores, e-commerce platforms, and mobile applications. Social commerce gains momentum as retailers integrate social media features into shopping experiences, enabling peer recommendations and community-driven purchasing decisions.

Sustainability initiatives become increasingly important competitive differentiators, with retailers implementing eco-friendly packaging, carbon-neutral delivery options, and sustainable product sourcing. Personalization technology enables retailers to deliver customized product recommendations, targeted promotions, and individualized shopping experiences based on consumer data analytics.

Contactless retail solutions continue expanding beyond pandemic-driven adoption, with consumers embracing self-checkout systems, mobile payments, and automated retail formats. Micro-fulfillment centers and dark stores support rapid delivery expectations while optimizing logistics costs for online retail operations.

Health and wellness focus influences product selection and store design across retail categories, with emphasis on organic products, wellness services, and health-conscious lifestyle support. Live streaming commerce emerges as a significant sales channel, particularly for fashion, beauty, and lifestyle products targeting younger demographics.

Technology partnerships between traditional retailers and fintech companies accelerate digital payment adoption and customer data analytics capabilities. Major convenience store chains expand financial services offerings including bill payment, money transfers, and insurance products, creating additional revenue streams and customer touchpoints.

Sustainability certifications and green retail initiatives gain prominence as retailers respond to environmental consciousness among consumers. Supply chain transparency becomes a competitive advantage, with retailers providing detailed product sourcing information and ethical sourcing commitments.

Automation investments in warehouse operations, inventory management, and customer service improve operational efficiency while addressing labor shortage challenges. Artificial intelligence applications in demand forecasting, pricing optimization, and customer service enhance retail performance across multiple operational areas.

Cross-border partnerships enable Taiwanese retailers to access international markets while facilitating foreign brand entry into Taiwan. MWR analysis indicates that 62% of major retailers have established international partnerships or expansion initiatives within the past two years, demonstrating the industry’s global orientation.

Digital transformation acceleration should remain a top priority for traditional retailers seeking to maintain competitive position in Taiwan’s evolving market. Investment in data analytics capabilities enables better customer insights, inventory optimization, and personalized marketing effectiveness. Retailers should focus on creating integrated customer experiences that leverage both physical and digital touchpoints.

Sustainability integration across operations, product sourcing, and customer communications will become increasingly important for brand differentiation and customer loyalty. Supply chain resilience investments help mitigate risks from global disruptions while ensuring consistent product availability and quality standards.

Customer experience innovation through technology adoption, service enhancement, and convenience improvements can drive competitive advantage in saturated market conditions. Strategic partnerships with technology providers, logistics companies, and complementary retailers can accelerate capability development while sharing investment costs.

Market expansion strategies should consider both domestic market penetration in underserved areas and international expansion opportunities in regional markets where Taiwan brands have strong recognition and appeal.

Taiwan’s retail market is positioned for continued growth and innovation over the next five years, driven by technological advancement, changing consumer preferences, and economic stability. E-commerce penetration is projected to reach 18-20% of total retail sales by 2028, with mobile commerce accounting for an increasing share of digital transactions.

Demographic shifts including population aging and urbanization will create new retail opportunities while requiring adaptation of existing retail formats. Cross-border retail activities are expected to expand significantly, with Taiwanese retailers accessing regional markets and international brands increasing their Taiwan presence.

Technology integration will deepen across all retail formats, with artificial intelligence, automation, and data analytics becoming standard operational tools. Sustainability requirements will influence retail operations, product selection, and customer expectations, creating both challenges and opportunities for market participants.

MarkWide Research projects that successful retailers will be those that effectively balance digital innovation with human-centered customer service, creating differentiated experiences that build long-term customer loyalty in an increasingly competitive environment.

Taiwan’s retail market demonstrates remarkable resilience and adaptability, successfully integrating traditional retail strengths with cutting-edge digital innovations to serve sophisticated consumer demands. The market’s unique characteristics including high convenience store density, advanced digital infrastructure, and tech-savvy consumers create a dynamic environment for retail innovation and growth.

Future success in Taiwan’s retail market will depend on retailers’ ability to embrace omnichannel strategies, leverage technology for customer experience enhancement, and respond to evolving consumer preferences for sustainability and personalization. The market’s strategic position in Asia, combined with strong domestic fundamentals, provides excellent opportunities for both local and international retail participants willing to invest in long-term market development and customer relationship building.

What is Taiwan Retail?

Taiwan Retail refers to the sector involved in the sale of goods and services to consumers in Taiwan. This includes various formats such as supermarkets, convenience stores, online retail, and specialty shops.

What are the key players in the Taiwan Retail Market?

Key players in the Taiwan Retail Market include companies like PX Mart, Carrefour, and 7-Eleven. These companies dominate various segments such as grocery, convenience, and e-commerce, among others.

What are the growth factors driving the Taiwan Retail Market?

The Taiwan Retail Market is driven by factors such as increasing consumer spending, the rise of e-commerce, and changing shopping habits. Additionally, the growing demand for convenience and quality products plays a significant role.

What challenges does the Taiwan Retail Market face?

Challenges in the Taiwan Retail Market include intense competition, changing consumer preferences, and regulatory hurdles. Retailers must adapt to these dynamics to maintain market share.

What opportunities exist in the Taiwan Retail Market?

Opportunities in the Taiwan Retail Market include the expansion of online shopping platforms, the growth of health and wellness products, and the increasing popularity of sustainable and local products. These trends present avenues for innovation and market entry.

What trends are shaping the Taiwan Retail Market?

Trends in the Taiwan Retail Market include the rise of omnichannel retailing, the integration of technology in shopping experiences, and a focus on sustainability. Retailers are increasingly leveraging data analytics to enhance customer engagement.

Taiwan Retail Market

| Segmentation Details | Description |

|---|---|

| Product Type | Apparel, Electronics, Home Goods, Beauty Products |

| Price Tier | Luxury, Mid-Range, Discount, Value |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Department Stores |

| Customer Type | Millennials, Families, Seniors, Professionals |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Taiwan Retail Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at