444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

China’s wind power market stands as the world’s largest and most dynamic renewable energy sector, representing a cornerstone of the nation’s ambitious clean energy transition strategy. The market has experienced unprecedented growth over the past decade, establishing China as the global leader in wind energy capacity and manufacturing. Wind power installations across China have transformed the energy landscape, with both onshore and offshore developments contributing to substantial capacity additions annually.

Market dynamics indicate that China’s wind power sector continues to expand at remarkable rates, driven by supportive government policies, technological advancements, and declining costs. The sector benefits from strong policy support through renewable energy mandates, feed-in tariffs, and grid integration initiatives. Provincial governments across China have implemented aggressive renewable energy targets, creating a favorable environment for wind power development.

Technological innovation remains a key differentiator in China’s wind power market, with domestic manufacturers leading global developments in turbine efficiency, capacity factors, and grid integration solutions. The market encompasses various segments including onshore wind farms, offshore wind developments, distributed wind systems, and advanced energy storage integration. Manufacturing capabilities have positioned Chinese companies as dominant players in the global wind turbine supply chain, contributing to cost reductions and technological advancement worldwide.

The China wind power market refers to the comprehensive ecosystem of wind energy generation, manufacturing, installation, and operation activities within China’s borders. This market encompasses the development, construction, and operation of wind farms, manufacturing of wind turbines and components, grid integration infrastructure, and supporting services required for wind energy deployment. Wind power development in China includes both utility-scale projects and distributed generation systems, covering onshore and offshore installations across diverse geographical regions.

Market participants include wind turbine manufacturers, project developers, utility companies, component suppliers, engineering firms, and financial institutions. The market operates within China’s broader renewable energy framework, contributing significantly to national energy security, carbon reduction goals, and economic development objectives. Grid integration and energy storage solutions form integral components of the market, ensuring reliable power delivery and system stability.

China’s wind power market continues to demonstrate exceptional growth momentum, driven by strong government support, technological innovation, and favorable economic conditions. The market has achieved remarkable scale, with China accounting for approximately 50% of global wind capacity additions in recent years. Onshore wind development remains the dominant segment, while offshore wind is experiencing rapid expansion along China’s extensive coastline.

Key market drivers include aggressive renewable energy targets, carbon neutrality commitments, and supportive policy frameworks. The market benefits from mature manufacturing capabilities, with Chinese companies dominating global wind turbine production and achieving significant cost reductions. Grid integration challenges and curtailment issues have been substantially addressed through improved transmission infrastructure and market mechanisms.

Future prospects remain highly positive, with continued capacity additions expected across all segments. The market is transitioning toward grid parity and market-based mechanisms, reducing dependence on subsidies while maintaining growth momentum. Offshore wind development represents a significant growth opportunity, with substantial pipeline projects under development along China’s coastal regions.

Strategic insights reveal several critical factors shaping China’s wind power market evolution:

Government policy support serves as the primary driver for China’s wind power market expansion. The Chinese government has implemented comprehensive renewable energy policies, including renewable portfolio standards, feed-in tariffs, and carbon neutrality commitments. National energy security concerns and air quality improvement objectives have accelerated wind power deployment as a clean alternative to coal-fired generation.

Technological advancements continue driving market growth through improved turbine efficiency, larger rotor diameters, and enhanced grid integration capabilities. Chinese manufacturers have achieved significant breakthroughs in turbine design, materials science, and manufacturing processes, resulting in cost reductions and performance improvements. Digitalization and smart grid technologies enable better wind resource utilization and grid stability management.

Economic competitiveness has emerged as a crucial driver, with wind power achieving cost parity with conventional generation in many regions. Declining turbine costs, improved capacity factors, and optimized project development processes have enhanced project economics. Carbon pricing mechanisms and environmental regulations provide additional economic incentives for wind power development.

Industrial development objectives support wind power expansion as part of China’s advanced manufacturing strategy. The wind power sector contributes to employment creation, technology innovation, and export competitiveness. Regional economic development benefits from wind power projects, particularly in less developed areas with excellent wind resources.

Grid integration challenges continue to pose constraints on wind power development, particularly in regions with limited transmission capacity. Despite improvements, some areas still experience curtailment issues during peak wind generation periods. Grid stability concerns related to wind power’s variable nature require ongoing investment in grid flexibility and storage solutions.

Land use constraints and environmental considerations limit wind farm development in certain regions. Competition for land use with agriculture, urban development, and conservation areas creates challenges for project siting. Social acceptance issues in some communities regarding visual impact, noise, and wildlife concerns can delay project development.

Financing challenges may emerge as the market transitions from subsidized to market-based mechanisms. Project developers must adapt to changing financial structures and risk profiles. Supply chain constraints occasionally impact project timelines, particularly during periods of rapid capacity expansion.

Regulatory complexity and approval processes can create development delays and increase project costs. Coordination between national, provincial, and local authorities requires careful navigation. Technical standards and grid code requirements continue evolving, requiring ongoing adaptation by market participants.

Offshore wind development presents the most significant growth opportunity in China’s wind power market. With extensive coastline and excellent offshore wind resources, China has the potential to become the world’s largest offshore wind market. Floating wind technology could unlock deeper water resources and expand development possibilities.

Energy storage integration offers substantial opportunities for enhancing wind power value and grid services. Battery storage systems, pumped hydro storage, and other technologies can address intermittency challenges while creating new revenue streams. Hybrid renewable projects combining wind, solar, and storage present attractive development opportunities.

International expansion opportunities exist for Chinese wind power companies through technology export, project development, and manufacturing partnerships. The Belt and Road Initiative provides frameworks for international wind power cooperation. Technology licensing and joint ventures can expand market reach globally.

Distributed wind systems and behind-the-meter applications offer growth potential in industrial and commercial segments. Small-scale wind turbines for rural electrification and remote applications present niche opportunities. Wind-hydrogen integration could create new market segments for renewable hydrogen production.

Competitive dynamics in China’s wind power market are characterized by intense competition among domestic manufacturers and increasing consolidation. Leading Chinese companies have achieved global scale and technological capabilities, competing effectively in international markets. Innovation competition focuses on turbine efficiency, reliability, and cost reduction.

Supply chain dynamics reflect China’s dominant position in wind turbine manufacturing and component production. Vertical integration strategies among major players have enhanced cost control and quality management. Raw material availability and pricing fluctuations impact manufacturing costs and project economics.

Market structure evolution shows increasing participation from private investors and international partnerships. State-owned enterprises continue playing important roles, while private companies contribute innovation and efficiency. Financial market development supports diverse funding mechanisms including green bonds, project finance, and equity investments.

Regulatory dynamics continue evolving toward market-based mechanisms and reduced subsidy dependence. Grid parity achievement in many regions enables sustainable growth without government support. Environmental regulations and carbon pricing mechanisms provide ongoing support for wind power development.

Market research methodology employed comprehensive primary and secondary research approaches to analyze China’s wind power market. Primary research included interviews with industry executives, government officials, project developers, and technology providers across multiple regions. Secondary research encompassed analysis of government publications, industry reports, financial statements, and regulatory documents.

Data collection methods utilized multiple sources including government statistics, industry associations, company reports, and market databases. Field research conducted across major wind power regions provided insights into operational challenges and market conditions. Expert consultations with industry specialists validated findings and provided forward-looking perspectives.

Analytical frameworks included market sizing methodologies, competitive analysis, technology assessment, and policy impact evaluation. Quantitative analysis focused on capacity additions, investment flows, and performance metrics. Qualitative analysis examined market trends, regulatory developments, and strategic implications.

Validation processes ensured data accuracy and reliability through cross-referencing multiple sources and expert review. Market projections incorporated scenario analysis and sensitivity testing. MarkWide Research analytical standards maintained consistency and objectivity throughout the research process.

Northern China remains the dominant region for wind power development, accounting for approximately 45% of national wind capacity. Provinces including Inner Mongolia, Xinjiang, and Gansu benefit from excellent wind resources and available land. Grid connectivity improvements have reduced curtailment issues and enhanced project viability in these regions.

Eastern coastal regions demonstrate strong growth in both onshore and offshore wind development. Provinces such as Jiangsu, Shandong, and Zhejiang lead offshore wind deployment with favorable policies and grid access. Load center proximity provides advantages for power consumption and grid integration.

Central China regions are experiencing increased wind power development as technology improvements enable economic projects in moderate wind resource areas. Provinces including Henan, Hubei, and Hunan are expanding wind capacity. Distributed wind applications show particular promise in these regions.

Southern China focuses primarily on offshore wind development along the extensive coastline. Guangdong, Fujian, and Hainan provinces are developing substantial offshore wind pipelines. Typhoon-resistant technology development addresses regional weather challenges.

Western regions including Tibet and Qinghai are exploring high-altitude wind resources with specialized technology solutions. These areas present unique technical and logistical challenges but offer substantial resource potential. Grid infrastructure development remains crucial for accessing these remote resources.

Market leadership in China’s wind power sector is dominated by several major domestic manufacturers and developers:

Competitive strategies emphasize technology innovation, cost reduction, and international expansion. Companies invest heavily in research and development to maintain technological leadership. Vertical integration strategies help control costs and quality throughout the value chain.

Market consolidation trends show increasing concentration among leading players while smaller companies focus on niche segments or regional markets. Strategic partnerships and joint ventures facilitate technology sharing and market access. International expansion efforts by Chinese companies are reshaping global wind power markets.

By Technology:

By Turbine Capacity:

By Application:

By Ownership Structure:

Onshore Wind Category: This segment continues dominating China’s wind power market with mature technology, established supply chains, and proven project development processes. Technology improvements focus on larger rotor diameters, higher hub heights, and enhanced grid integration capabilities. Cost reductions have enabled grid parity in many regions, supporting continued growth without subsidies.

Offshore Wind Category: Representing the fastest-growing segment with exceptional potential along China’s coastline. Technology development emphasizes larger turbines, floating platforms, and typhoon-resistant designs. Government support through dedicated policies and grid infrastructure investment accelerates development.

Manufacturing Category: Chinese wind turbine manufacturers have achieved global leadership through scale, innovation, and cost competitiveness. Export opportunities continue expanding as Chinese companies establish international operations and partnerships. Technology licensing and joint ventures facilitate global market penetration.

Services Category: Operation and maintenance services, project development, and engineering consulting represent growing market segments. Digital solutions including predictive maintenance, remote monitoring, and performance optimization create value-added opportunities.

Grid Integration Category: Smart grid technologies, energy storage systems, and transmission infrastructure development support wind power integration. Flexibility services and grid balancing capabilities enhance wind power value proposition.

Wind Power Developers benefit from supportive policy frameworks, mature supply chains, and proven technology solutions. Access to financing, streamlined approval processes, and grid connectivity support project development. Revenue diversification through ancillary services and energy storage integration enhances project economics.

Turbine Manufacturers gain from large domestic market scale, technology innovation opportunities, and export potential. Strong domestic demand provides stable revenue base for research and development investments. Supply chain integration enables cost control and quality management.

Utility Companies achieve renewable energy compliance, carbon reduction goals, and long-term cost stability through wind power procurement. Grid services from modern wind farms contribute to system reliability and flexibility.

Government Stakeholders realize energy security improvements, environmental benefits, and economic development through wind power deployment. Industrial development and employment creation support broader economic objectives.

Local Communities benefit from economic development, employment opportunities, and infrastructure improvements associated with wind power projects. Land lease revenues provide additional income for rural communities.

Financial Institutions access growing market opportunities in renewable energy financing with improving risk profiles and stable returns. Green finance initiatives support portfolio diversification and sustainability objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology Supersizing Trend: Wind turbines are becoming increasingly larger with higher capacity ratings, longer rotor diameters, and taller hub heights. This trend improves capacity factors and reduces levelized costs of energy. Offshore applications particularly benefit from larger turbines that can capture more energy from consistent marine winds.

Grid Parity Achievement: Wind power has achieved cost competitiveness with conventional generation in many regions, reducing dependence on government subsidies. Market-based mechanisms are increasingly replacing feed-in tariffs and other support schemes.

Digitalization and Smart Operations: Advanced digital technologies including artificial intelligence, machine learning, and IoT sensors are transforming wind farm operations. Predictive maintenance and performance optimization reduce costs and improve reliability.

Offshore Wind Acceleration: Offshore wind development is rapidly expanding with government support, technology improvements, and cost reductions. Floating wind platforms are enabling access to deeper water resources.

Energy Storage Integration: Wind farms are increasingly incorporating battery storage systems to provide grid services and improve project economics. Hybrid renewable projects combining wind, solar, and storage are becoming more common.

International Expansion: Chinese wind power companies are aggressively expanding internationally through technology exports, project development, and manufacturing partnerships. Belt and Road Initiative projects facilitate international cooperation.

Technology Breakthroughs: Chinese manufacturers have achieved significant milestones in turbine technology, including development of ultra-large offshore turbines exceeding 15MW capacity. Advanced materials and manufacturing processes continue improving turbine performance and reliability.

Policy Evolution: The Chinese government has implemented new policies supporting offshore wind development, grid integration, and market-based mechanisms. Carbon neutrality commitments provide long-term policy certainty for renewable energy investment.

Infrastructure Investment: Major transmission line projects and grid infrastructure improvements are enhancing wind power integration capabilities. Ultra-high voltage transmission lines connect remote wind resources to major load centers.

International Partnerships: Chinese companies are forming strategic partnerships with international firms for technology development and market access. Joint ventures and licensing agreements facilitate global expansion.

Financial Innovation: Green bonds, renewable energy certificates, and other financial instruments are supporting wind power development. Carbon trading mechanisms provide additional revenue streams for wind power projects.

Manufacturing Expansion: Chinese wind turbine manufacturers are establishing international production facilities to serve global markets and avoid trade barriers. Supply chain localization strategies support international competitiveness.

Strategic Focus Areas: Industry participants should prioritize offshore wind development, energy storage integration, and international expansion opportunities. Technology innovation remains crucial for maintaining competitive advantages in increasingly competitive markets.

Investment Priorities: Companies should invest in larger, more efficient turbine technologies, digital solutions, and grid integration capabilities. Supply chain optimization and vertical integration strategies can enhance cost competitiveness.

Market Positioning: Manufacturers should focus on high-value segments including offshore wind, large-capacity turbines, and international markets. Service capabilities and digital solutions can differentiate offerings and create recurring revenue streams.

Risk Management: Companies should diversify geographically and technologically to reduce concentration risks. Supply chain resilience and raw material security require ongoing attention.

Partnership Strategies: Strategic alliances with international partners can facilitate market access and technology sharing. Joint ventures and licensing agreements provide pathways for global expansion.

Regulatory Engagement: Active participation in policy development and industry standards creation can influence favorable regulatory environments. MarkWide Research analysis suggests that companies maintaining close government relationships achieve better market outcomes.

Growth Trajectory: China’s wind power market is projected to maintain strong growth momentum through the next decade, driven by continued capacity additions and technology improvements. Offshore wind development is expected to accelerate significantly, potentially representing over 25% of new capacity additions by 2030.

Technology Evolution: Wind turbine technology will continue advancing toward larger, more efficient designs with enhanced grid integration capabilities. Floating wind platforms and ultra-large offshore turbines will unlock new development opportunities.

Market Structure Changes: The transition toward market-based mechanisms will continue, with wind power competing directly with conventional generation. Grid parity achievement across most regions will support sustainable growth without subsidies.

International Expansion: Chinese wind power companies are expected to capture increasing shares of global markets through technology exports and project development. Belt and Road Initiative countries represent significant growth opportunities.

Integration Challenges: Grid integration and system flexibility will require ongoing investment in transmission infrastructure, energy storage, and smart grid technologies. Hybrid renewable systems will become increasingly important for grid stability.

Environmental Impact: Wind power will play a crucial role in China’s carbon neutrality goals, potentially providing over 20% of total electricity generation by 2035. MWR projections indicate continued strong policy support for renewable energy development.

China’s wind power market represents a remarkable success story in renewable energy development, achieving global leadership through supportive policies, technological innovation, and manufacturing excellence. The market has demonstrated resilience and adaptability, transitioning from subsidy-dependent growth to market-competitive development while maintaining strong expansion momentum.

Future prospects remain exceptionally positive, with offshore wind development, energy storage integration, and international expansion providing substantial growth opportunities. The market’s evolution toward grid parity and market-based mechanisms ensures sustainable long-term development while supporting China’s carbon neutrality objectives.

Strategic implications for industry participants emphasize the importance of technology innovation, international expansion, and value chain optimization. Companies that successfully navigate the transition to market-based competition while capturing emerging opportunities in offshore wind and energy storage integration will achieve sustainable competitive advantages in this dynamic and rapidly evolving market.

What is Wind Power?

Wind power refers to the process of generating electricity using wind turbines that convert kinetic energy from wind into mechanical power. This renewable energy source is increasingly utilized in various applications, including electricity generation for homes, businesses, and industries.

What are the key players in the China Wind Power Market?

Key players in the China Wind Power Market include Goldwind, Sinovel, and Dongfang Electric, which are prominent manufacturers of wind turbines and developers of wind farms. These companies contribute significantly to the growth and innovation within the sector, among others.

What are the main drivers of the China Wind Power Market?

The main drivers of the China Wind Power Market include the increasing demand for renewable energy, government incentives for clean energy projects, and advancements in wind turbine technology. These factors are fostering a more sustainable energy landscape in China.

What challenges does the China Wind Power Market face?

The China Wind Power Market faces challenges such as regulatory hurdles, land acquisition issues, and competition from other energy sources. These factors can hinder the pace of development and investment in wind energy projects.

What opportunities exist in the China Wind Power Market?

Opportunities in the China Wind Power Market include the expansion of offshore wind farms, technological innovations in turbine efficiency, and increasing investments in energy storage solutions. These trends are expected to enhance the overall capacity and reliability of wind energy.

What trends are shaping the China Wind Power Market?

Trends shaping the China Wind Power Market include the integration of smart grid technologies, the rise of floating wind turbines, and a focus on sustainability practices. These innovations are driving the evolution of wind energy and its role in the national energy strategy.

China Wind Power Market

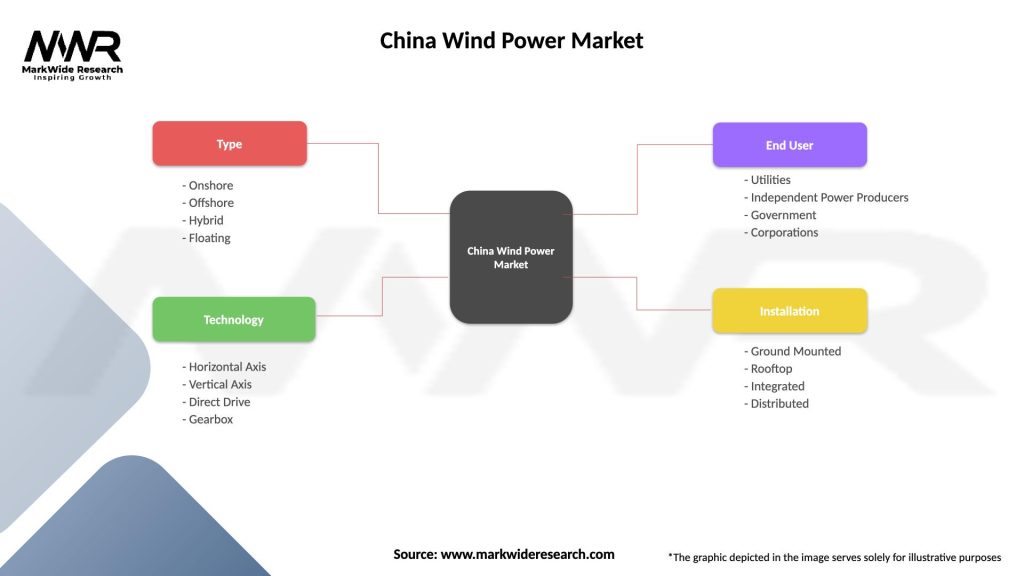

| Segmentation Details | Description |

|---|---|

| Type | Onshore, Offshore, Hybrid, Floating |

| Technology | Horizontal Axis, Vertical Axis, Direct Drive, Gearbox |

| End User | Utilities, Independent Power Producers, Government, Corporations |

| Installation | Ground Mounted, Rooftop, Integrated, Distributed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Wind Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at