444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea transportation infrastructure market represents a dynamic and rapidly evolving sector that forms the backbone of the nation’s economic development and urban mobility solutions. South Korea’s commitment to modernizing its transportation networks has positioned the country as a global leader in innovative infrastructure technologies, including high-speed rail systems, smart highways, and integrated urban transit solutions. The market encompasses various segments including road infrastructure, railway systems, airports, ports, and emerging smart transportation technologies.

Government initiatives continue to drive substantial investments in transportation infrastructure, with a particular focus on sustainable and technologically advanced solutions. The market demonstrates robust growth potential, supported by urbanization trends, increasing population density in metropolitan areas, and the nation’s strategic position as a key logistics hub in Northeast Asia. Digital transformation and smart city initiatives are increasingly influencing infrastructure development patterns, creating opportunities for advanced traffic management systems and intelligent transportation solutions.

Market dynamics indicate strong growth momentum, with the sector experiencing a compound annual growth rate of 6.2% driven by continuous government funding and private sector participation. The integration of cutting-edge technologies such as artificial intelligence, Internet of Things, and 5G connectivity is reshaping traditional infrastructure approaches, making South Korea’s transportation network increasingly efficient and user-centric.

The South Korea transportation infrastructure market refers to the comprehensive ecosystem of physical and technological assets designed to facilitate the movement of people and goods throughout the Korean Peninsula. This market encompasses the planning, development, construction, maintenance, and modernization of various transportation modes including roads, railways, airports, seaports, and associated digital infrastructure systems.

Transportation infrastructure in South Korea extends beyond traditional physical structures to include intelligent transportation systems, traffic management technologies, and integrated mobility platforms that enhance connectivity and operational efficiency. The market involves multiple stakeholders including government agencies, construction companies, technology providers, and transportation operators working collaboratively to create seamless mobility solutions.

Modern infrastructure development in South Korea emphasizes sustainability, resilience, and technological integration, reflecting the country’s commitment to creating world-class transportation networks that support economic growth while addressing environmental concerns and improving quality of life for citizens.

South Korea’s transportation infrastructure market demonstrates exceptional growth potential driven by strategic government investments, technological innovation, and increasing demand for efficient mobility solutions. The market benefits from strong policy support through the Korean New Deal initiative, which allocates substantial resources toward infrastructure modernization and digital transformation projects.

Key market segments include road infrastructure development, high-speed rail expansion, airport modernization, port facility upgrades, and smart transportation systems integration. The railway segment particularly shows promising growth, with high-speed rail adoption increasing by 18% annually as the government expands the KTX network to connect more cities across the peninsula.

Technology integration represents a significant market driver, with smart infrastructure solutions gaining 35% market penetration in major metropolitan areas. The convergence of traditional infrastructure with digital technologies creates new opportunities for system optimization, predictive maintenance, and enhanced user experiences across all transportation modes.

Regional development patterns show concentrated investment in the Seoul Capital Area while simultaneously promoting balanced national development through improved connectivity to secondary cities. This dual approach ensures comprehensive network coverage while addressing regional economic disparities through enhanced transportation access.

Strategic market insights reveal several critical trends shaping South Korea’s transportation infrastructure landscape:

Market maturation is evident in the shift from basic infrastructure development to sophisticated system optimization and user-centric service delivery. This evolution reflects South Korea’s transition from infrastructure catch-up to innovation leadership in transportation solutions.

Primary market drivers propelling South Korea’s transportation infrastructure development include robust government commitment to modernization, rapid urbanization patterns, and increasing demand for efficient mobility solutions. The Korean government’s comprehensive infrastructure investment strategy, supported by the Green New Deal initiative, provides sustained funding for major transportation projects across multiple sectors.

Urbanization trends create significant pressure on existing transportation networks, necessitating capacity expansion and system upgrades. With urban population concentration reaching 81.4%, metropolitan areas require sophisticated transportation solutions to manage increasing passenger volumes and maintain service quality standards.

Economic growth and industrial development drive freight transportation demand, requiring enhanced port facilities, improved road networks, and efficient rail cargo systems. South Korea’s position as a major manufacturing hub and export economy creates continuous demand for robust logistics infrastructure supporting international trade flows.

Technological advancement opportunities enable infrastructure modernization through smart systems integration, automated operations, and data-driven optimization. The convergence of 5G networks, artificial intelligence, and Internet of Things technologies creates new possibilities for intelligent transportation system deployment.

Environmental regulations and sustainability commitments drive investment in clean transportation infrastructure, including electric vehicle charging networks, renewable energy integration, and low-emission public transit systems. These initiatives align with South Korea’s carbon neutrality goals and green growth strategies.

Significant market restraints include high capital investment requirements, complex regulatory approval processes, and geographical constraints that limit infrastructure expansion options. Large-scale transportation projects require substantial upfront investments with long payback periods, creating financial challenges for both public and private sector participants.

Land acquisition difficulties in densely populated areas present ongoing challenges for infrastructure development, particularly in metropolitan regions where available space is limited and property values are high. These constraints often lead to increased project costs and extended development timelines.

Regulatory complexity involving multiple government agencies and approval processes can delay project implementation and increase administrative costs. Coordination between national, regional, and local authorities requires extensive consultation and consensus-building, potentially slowing infrastructure development progress.

Environmental impact assessments and compliance requirements, while necessary for sustainable development, can extend project timelines and increase costs. Balancing infrastructure development needs with environmental protection creates additional complexity in project planning and execution.

Technology integration challenges arise from the need to modernize existing infrastructure while maintaining operational continuity. Legacy system compatibility and workforce training requirements create additional implementation hurdles for advanced transportation technologies.

Substantial market opportunities emerge from South Korea’s commitment to becoming a global leader in smart transportation infrastructure and sustainable mobility solutions. The integration of advanced technologies with traditional infrastructure creates new business models and revenue streams for industry participants.

Smart city initiatives across major metropolitan areas present opportunities for comprehensive transportation system integration, including intelligent traffic management, automated public transit, and integrated mobility-as-a-service platforms. These developments support efficiency improvements of up to 25% in urban transportation networks.

International expansion opportunities allow South Korean infrastructure companies to export their expertise and technologies to emerging markets, leveraging their experience in high-speed rail, smart highways, and integrated transportation systems. This global market expansion potential supports domestic industry growth and technological advancement.

Sustainability-focused projects create opportunities for green infrastructure development, including electric vehicle charging networks, renewable energy integration, and carbon-neutral transportation solutions. The government’s commitment to achieving carbon neutrality by 2050 drives substantial investment in clean transportation infrastructure.

Public-private partnership models enable innovative financing approaches for large-scale infrastructure projects, allowing private sector expertise and efficiency to complement public sector resources and oversight. These collaborative arrangements facilitate accelerated project delivery and risk sharing.

Market dynamics in South Korea’s transportation infrastructure sector reflect the complex interplay between government policy, technological innovation, economic development needs, and environmental considerations. The sector demonstrates strong momentum driven by sustained public investment and strategic planning initiatives.

Supply chain integration has become increasingly sophisticated, with domestic companies developing advanced capabilities in construction, technology integration, and project management. This domestic capacity building reduces dependence on foreign expertise while creating export opportunities for Korean infrastructure solutions.

Demand patterns show increasing emphasis on quality, efficiency, and user experience rather than simply expanding capacity. Modern infrastructure projects prioritize passenger comfort, operational reliability, and environmental sustainability alongside traditional performance metrics.

Competitive dynamics involve both domestic and international players, with Korean companies increasingly taking leadership roles in major projects while selectively partnering with foreign firms for specialized technologies and expertise. This approach builds domestic capabilities while accessing global best practices.

Innovation cycles are accelerating as digital technologies enable rapid prototyping, testing, and deployment of new transportation solutions. The integration of artificial intelligence and machine learning creates opportunities for continuous system optimization and predictive maintenance approaches.

Comprehensive research methodology employed for analyzing South Korea’s transportation infrastructure market incorporates multiple data sources, analytical frameworks, and validation approaches to ensure accuracy and reliability of market insights. The methodology combines quantitative analysis with qualitative assessments to provide holistic market understanding.

Primary research activities include structured interviews with government officials, infrastructure company executives, technology providers, and transportation operators to gather firsthand insights about market trends, challenges, and opportunities. These interviews provide valuable perspectives on industry dynamics and future development directions.

Secondary research encompasses analysis of government reports, industry publications, academic studies, and statistical databases to establish market baselines and identify key trends. This research foundation supports quantitative analysis and market sizing activities while providing historical context for current developments.

Data validation processes involve cross-referencing multiple sources, conducting expert reviews, and applying statistical analysis techniques to ensure information accuracy and reliability. MarkWide Research employs rigorous quality control measures to maintain high standards of analytical integrity throughout the research process.

Analytical frameworks include market segmentation analysis, competitive landscape assessment, trend identification, and scenario planning to provide comprehensive market insights. These frameworks enable systematic evaluation of market dynamics and support strategic decision-making for industry participants.

Regional analysis reveals distinct development patterns across South Korea’s transportation infrastructure landscape, with the Seoul Capital Area commanding 45% of total infrastructure investment while secondary regions receive targeted development support through balanced national development policies.

Seoul Metropolitan Area demonstrates the highest concentration of advanced transportation infrastructure, including extensive subway networks, high-speed rail connections, and smart traffic management systems. The region serves as a testing ground for innovative transportation technologies and integrated mobility solutions, with smart infrastructure adoption reaching 65% across major transportation corridors.

Busan and southeastern regions focus heavily on port infrastructure development and logistics connectivity, supporting South Korea’s role as a major maritime trading nation. The region benefits from substantial investment in port modernization, rail-port integration, and automated cargo handling systems that enhance operational efficiency and capacity.

Central and western regions receive targeted investment in high-speed rail expansion and highway network improvements to enhance connectivity with major metropolitan areas. These investments support regional economic development while reducing travel times and improving accessibility for businesses and residents.

Northern border regions present unique opportunities for future infrastructure development, particularly in anticipation of potential inter-Korean cooperation and connectivity projects. Strategic planning for these areas considers long-term reunification scenarios and cross-border transportation possibilities.

Competitive landscape in South Korea’s transportation infrastructure market features a mix of large domestic conglomerates, specialized engineering firms, and international technology providers collaborating on complex infrastructure projects. The market structure supports both competition and collaboration depending on project requirements and expertise needs.

Market competition increasingly focuses on technological capabilities, project delivery efficiency, and sustainability credentials rather than simply cost competitiveness. Companies invest heavily in research and development to maintain competitive advantages in advanced transportation technologies.

International partnerships remain important for accessing specialized technologies and expertise, particularly in areas such as high-speed rail systems, smart traffic management, and automated transportation solutions. These collaborations enable knowledge transfer while building domestic capabilities.

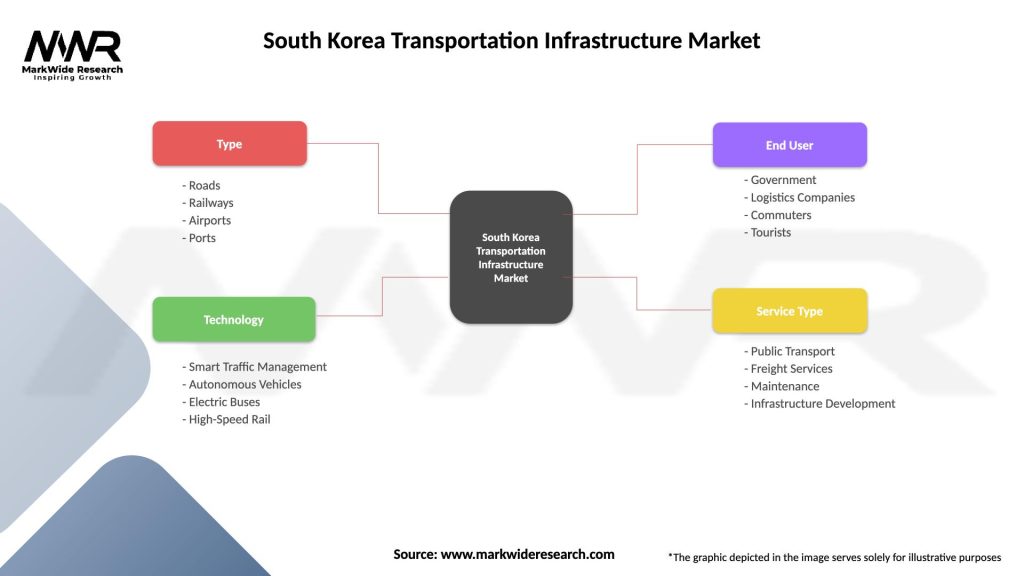

Market segmentation analysis reveals distinct categories within South Korea’s transportation infrastructure market, each with unique characteristics, growth drivers, and development patterns. Understanding these segments enables targeted analysis and strategic planning for market participants.

By Infrastructure Type:

By Technology Level:

By Funding Source:

Road infrastructure development represents the largest segment of South Korea’s transportation infrastructure market, driven by continuous highway network expansion and urban road improvements. The segment benefits from smart highway technology adoption reaching 28% of major corridors, incorporating intelligent traffic management and automated toll collection systems.

Railway infrastructure demonstrates the highest growth potential, particularly in high-speed rail expansion and urban transit development. The KTX high-speed rail network continues expanding to connect additional cities, while metropolitan areas invest heavily in subway system extensions and light rail development to address urban mobility challenges.

Aviation infrastructure focuses on capacity expansion and modernization of existing facilities rather than new airport construction. Incheon International Airport’s ongoing expansion and regional airport improvements support South Korea’s position as a Northeast Asian aviation hub while accommodating growing passenger and cargo volumes.

Maritime infrastructure emphasizes port automation and capacity enhancement to maintain competitiveness in global shipping markets. Major ports implement advanced cargo handling systems and expand container terminal capacity to support South Korea’s export-oriented economy and growing logistics sector.

Digital infrastructure integration across all transportation modes creates new opportunities for system optimization and user experience enhancement. Smart transportation platforms enable integrated mobility services while providing valuable data for infrastructure planning and optimization.

Government agencies benefit from improved transportation infrastructure through enhanced economic competitiveness, regional development support, and improved quality of life for citizens. Modern infrastructure attracts business investment while supporting balanced national development objectives.

Construction companies gain access to substantial project opportunities with long-term revenue potential and opportunities to develop advanced capabilities in smart infrastructure development. These projects enable technology advancement and international market expansion possibilities.

Technology providers find expanding markets for intelligent transportation systems, automation solutions, and digital platform development. The integration of advanced technologies with traditional infrastructure creates new business models and revenue streams.

Transportation operators benefit from improved infrastructure through enhanced operational efficiency, reduced maintenance costs, and improved service quality. Modern infrastructure enables new service offerings and improved customer satisfaction levels.

Citizens and businesses experience improved mobility, reduced travel times, and enhanced connectivity between regions. Better transportation infrastructure supports economic opportunities while improving overall quality of life through more efficient and reliable transportation options.

International partners gain access to South Korea’s advanced transportation market while contributing specialized expertise and technologies. These partnerships facilitate knowledge transfer and create opportunities for global market expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping South Korea’s transportation infrastructure landscape, with artificial intelligence, machine learning, and IoT technologies becoming integral components of modern infrastructure systems. This trend enables predictive maintenance, real-time optimization, and enhanced user experiences across all transportation modes.

Sustainability integration increasingly influences infrastructure design and construction practices, with green building standards, renewable energy integration, and carbon footprint reduction becoming standard requirements for major projects. Sustainable infrastructure adoption has increased by 42% in recent government projects.

Multimodal connectivity emerges as a key planning principle, with new infrastructure projects designed to facilitate seamless transitions between different transportation modes. This approach optimizes overall network efficiency while improving user convenience and reducing total travel times.

Automation advancement accelerates across all infrastructure sectors, from automated toll collection and traffic management to autonomous vehicle infrastructure preparation. These systems reduce operational costs while improving safety and efficiency throughout the transportation network.

Data-driven decision making becomes increasingly important for infrastructure planning and operations, with big data analytics and real-time monitoring systems providing insights for optimization and strategic planning. MWR analysis indicates that data-driven infrastructure management improves operational efficiency by 30% on average.

Recent industry developments highlight South Korea’s commitment to maintaining its position as a global leader in transportation infrastructure innovation and development. Major project announcements and technology deployments demonstrate the market’s dynamic evolution and growth trajectory.

High-speed rail expansion continues with new route announcements connecting additional cities to the KTX network, reducing regional travel times and supporting balanced national development. These expansions incorporate the latest rail technology and smart station facilities to enhance passenger experience.

Smart highway initiatives include the deployment of 5G networks along major corridors, enabling connected and autonomous vehicle testing while providing enhanced traffic management capabilities. These developments position South Korea as a testbed for next-generation transportation technologies.

Port automation projects at major facilities implement advanced cargo handling systems and automated logistics processes, maintaining South Korea’s competitiveness in global shipping markets while improving operational efficiency and reducing environmental impact.

Urban transit modernization programs in major cities focus on system integration, accessibility improvements, and smart payment systems that enhance user convenience while optimizing operational efficiency across multiple transportation modes.

International cooperation agreements with various countries facilitate technology transfer and joint infrastructure development projects, expanding market opportunities while strengthening South Korea’s position in global infrastructure markets.

Strategic recommendations for market participants emphasize the importance of technology integration, sustainability focus, and collaborative approaches to maximize opportunities in South Korea’s evolving transportation infrastructure landscape.

Technology investment should prioritize smart infrastructure capabilities, data analytics platforms, and automation systems that enhance operational efficiency while providing competitive advantages in project bidding and execution. Companies should develop comprehensive digital transformation strategies aligned with market trends.

Sustainability credentials become increasingly important for securing major project contracts, requiring companies to develop expertise in green construction practices, renewable energy integration, and environmental impact mitigation. These capabilities differentiate companies in competitive bidding processes.

Partnership strategies should focus on complementary capabilities and market access, particularly for international expansion opportunities. Domestic companies can leverage their Korean market expertise while accessing global technologies and markets through strategic alliances.

Workforce development initiatives should address the growing demand for skilled professionals in smart infrastructure, digital systems integration, and sustainable construction practices. Investment in training and capability building ensures companies can meet evolving market requirements.

Market diversification across different infrastructure segments and geographic regions reduces risk while maximizing growth opportunities. Companies should develop capabilities across multiple transportation modes and consider international market expansion strategies.

Future market prospects for South Korea’s transportation infrastructure sector remain highly positive, supported by continued government investment, technological advancement, and strategic positioning as a regional transportation hub. MarkWide Research projects sustained growth momentum driven by smart infrastructure development and sustainability initiatives.

Technology integration will accelerate significantly over the next decade, with artificial intelligence, 5G networks, and IoT systems becoming standard components of all major infrastructure projects. This technological evolution will create new market segments while transforming traditional infrastructure development approaches.

Sustainability requirements will become increasingly stringent, driving innovation in green construction materials, renewable energy integration, and carbon-neutral transportation systems. Projects meeting high environmental standards will receive priority in government funding allocation, with green infrastructure representing 55% of planned investments.

Regional connectivity improvements will continue through high-speed rail expansion, highway network enhancements, and integrated transportation hubs that facilitate seamless multimodal travel. These developments support balanced national development while improving overall network efficiency.

International market expansion opportunities will grow as South Korean companies leverage their domestic expertise to compete for global infrastructure projects. The combination of advanced technology capabilities and proven project delivery experience positions Korean companies competitively in international markets.

Long-term growth projections indicate continued market expansion at a compound annual growth rate of 6.8% through 2030, driven by ongoing modernization needs, smart city development, and preparation for future transportation technologies including autonomous vehicles and hyperloop systems.

South Korea’s transportation infrastructure market presents exceptional opportunities for growth and innovation, driven by strong government support, technological advancement, and strategic positioning as a regional hub. The market’s evolution from traditional infrastructure development to smart, sustainable, and integrated transportation systems reflects the country’s commitment to maintaining global leadership in infrastructure innovation.

Key success factors for market participants include embracing digital transformation, developing sustainability expertise, and building collaborative partnerships that leverage complementary capabilities. The integration of advanced technologies with traditional infrastructure creates new business models while improving operational efficiency and user experiences across all transportation modes.

Market fundamentals remain strong, supported by sustained government investment, growing urbanization, and increasing demand for efficient mobility solutions. The combination of domestic market opportunities and international expansion potential provides multiple growth avenues for industry participants willing to invest in capability development and strategic positioning.

Future market leadership will belong to companies that successfully integrate technology innovation with sustainable practices while maintaining excellence in project delivery and customer service. The South Korea transportation infrastructure market continues to evolve as a dynamic sector offering substantial opportunities for growth, innovation, and global market expansion.

What is Transportation Infrastructure?

Transportation infrastructure refers to the physical structures and systems that facilitate the movement of people and goods. This includes roads, bridges, railways, airports, and ports, which are essential for economic development and connectivity.

Who are the key players in the South Korea Transportation Infrastructure Market?

Key players in the South Korea Transportation Infrastructure Market include Hyundai Engineering & Construction, Samsung C&T, and Daewoo Engineering & Construction, among others. These companies are involved in various projects ranging from road construction to urban transit systems.

What are the main drivers of the South Korea Transportation Infrastructure Market?

The main drivers of the South Korea Transportation Infrastructure Market include urbanization, government investment in public transport, and the need for modernization of existing infrastructure. These factors contribute to increased demand for efficient transportation systems.

What challenges does the South Korea Transportation Infrastructure Market face?

Challenges in the South Korea Transportation Infrastructure Market include budget constraints, regulatory hurdles, and environmental concerns. These issues can delay project timelines and increase costs for infrastructure development.

What opportunities exist in the South Korea Transportation Infrastructure Market?

Opportunities in the South Korea Transportation Infrastructure Market include the development of smart transportation systems, investment in green infrastructure, and expansion of high-speed rail networks. These initiatives can enhance efficiency and sustainability in transportation.

What trends are shaping the South Korea Transportation Infrastructure Market?

Trends shaping the South Korea Transportation Infrastructure Market include the integration of technology in transportation systems, increased focus on sustainability, and the rise of public-private partnerships. These trends are driving innovation and improving service delivery.

South Korea Transportation Infrastructure Market

| Segmentation Details | Description |

|---|---|

| Type | Roads, Railways, Airports, Ports |

| Technology | Smart Traffic Management, Autonomous Vehicles, Electric Buses, High-Speed Rail |

| End User | Government, Logistics Companies, Commuters, Tourists |

| Service Type | Public Transport, Freight Services, Maintenance, Infrastructure Development |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Transportation Infrastructure Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at