444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Service Integration and Management (SIAM) market represents a rapidly evolving segment within the broader IT services landscape, characterized by organizations’ increasing need to orchestrate multiple service providers effectively. Service Integration and Management has emerged as a critical capability for enterprises managing complex multi-vendor environments, where traditional single-vendor approaches prove inadequate for modern digital transformation initiatives.

Market dynamics indicate substantial growth momentum driven by the proliferation of cloud services, digital transformation accelerations, and the complexity of managing hybrid IT environments. Organizations across various industries are experiencing significant operational challenges when coordinating services from multiple vendors, leading to increased adoption of SIAM frameworks and methodologies.

Enterprise adoption of Service Integration and Management solutions continues expanding at approximately 12.5% annually, reflecting the critical importance of effective service orchestration in today’s interconnected business environment. The market encompasses various service delivery models, including traditional outsourcing arrangements, cloud-first strategies, and hybrid approaches that combine internal capabilities with external service providers.

Regional market distribution shows North America maintaining approximately 38% market share, followed by Europe at 32%, while Asia-Pacific demonstrates the fastest growth trajectory with increasing digital transformation investments across emerging economies.

The Service Integration and Management market refers to the comprehensive ecosystem of tools, methodologies, and services designed to help organizations effectively coordinate and manage multiple service providers within a unified service delivery framework. SIAM represents a strategic approach to service management that addresses the complexities arising from multi-vendor environments, ensuring seamless integration, consistent service quality, and optimized business outcomes across diverse service portfolios.

Core components of Service Integration and Management include governance frameworks, service orchestration platforms, vendor management systems, and performance monitoring tools that collectively enable organizations to maintain visibility and control over their entire service ecosystem. This approach transcends traditional vendor management by focusing on end-to-end service delivery optimization rather than individual vendor performance alone.

Market evolution in Service Integration and Management reflects the fundamental shift toward multi-vendor service delivery models, driven by organizations’ pursuit of best-of-breed solutions and risk mitigation strategies. The increasing complexity of IT landscapes, accelerated by cloud adoption and digital transformation initiatives, has created unprecedented demand for sophisticated service integration capabilities.

Key market drivers include the growing prevalence of hybrid cloud environments, regulatory compliance requirements, and the need for improved service quality across distributed service delivery models. Organizations report achieving operational efficiency improvements of 25-35% through effective SIAM implementation, demonstrating the tangible value proposition of structured service integration approaches.

Technology advancement continues reshaping the Service Integration and Management landscape, with artificial intelligence, machine learning, and automation technologies enabling more sophisticated service orchestration capabilities. These innovations facilitate predictive service management, automated incident resolution, and enhanced service quality monitoring across complex multi-vendor environments.

Competitive dynamics feature established IT service providers expanding their SIAM capabilities alongside specialized service integration firms and technology vendors developing comprehensive platform solutions. The market demonstrates increasing consolidation as organizations seek integrated solutions rather than point solutions for service management challenges.

Strategic market insights reveal several critical trends shaping the Service Integration and Management landscape:

Digital transformation acceleration serves as the primary catalyst driving Service Integration and Management market expansion. Organizations pursuing comprehensive digital transformation initiatives require sophisticated service integration capabilities to coordinate multiple technology vendors, cloud service providers, and specialized service partners effectively.

Multi-vendor environment proliferation creates increasing demand for structured service integration approaches. Modern enterprises typically engage numerous service providers across different functional areas, necessitating comprehensive coordination mechanisms to ensure consistent service delivery and optimal business outcomes.

Cloud adoption complexity drives significant market growth as organizations navigate hybrid and multi-cloud environments. The integration of cloud services with existing on-premises infrastructure requires sophisticated service management capabilities that traditional approaches cannot adequately address.

Regulatory compliance requirements increasingly influence service integration strategies, particularly in highly regulated industries where service delivery must meet stringent compliance standards across multiple vendor relationships. Organizations require comprehensive visibility and control over their entire service ecosystem to maintain regulatory compliance.

Cost optimization pressures motivate organizations to adopt more efficient service integration approaches. Effective SIAM implementation enables organizations to optimize service costs while maintaining or improving service quality through better vendor coordination and performance management.

Business agility demands require flexible service delivery models that can adapt quickly to changing business requirements. Service Integration and Management frameworks provide the foundation for agile service delivery by enabling rapid reconfiguration of service provider relationships and capabilities.

Implementation complexity represents a significant barrier to Service Integration and Management adoption, particularly for organizations with established vendor relationships and legacy service management processes. The transition to integrated service management approaches requires substantial organizational change management and process reengineering efforts.

High initial investment requirements can deter organizations from pursuing comprehensive SIAM implementations. The costs associated with platform deployment, process redesign, and staff training create financial barriers, particularly for mid-market organizations with limited IT budgets.

Vendor resistance occasionally impedes service integration initiatives, as some service providers may be reluctant to participate in integrated management frameworks that increase transparency and accountability. This resistance can complicate implementation efforts and limit the effectiveness of service integration strategies.

Skills shortage in service integration management creates implementation challenges for many organizations. The specialized expertise required for effective SIAM implementation is relatively scarce, leading to increased implementation costs and extended deployment timelines.

Cultural resistance within organizations can hinder service integration adoption, particularly in environments with strong departmental silos or established vendor relationships. Overcoming internal resistance requires significant change management efforts and executive sponsorship.

Technology integration challenges arise when attempting to integrate diverse service management platforms and tools across multiple vendors. Technical compatibility issues can complicate implementation efforts and limit the effectiveness of integrated service management approaches.

Artificial intelligence integration presents substantial opportunities for Service Integration and Management market expansion. AI-powered service orchestration capabilities enable predictive service management, automated incident resolution, and intelligent resource allocation across multi-vendor environments.

Edge computing proliferation creates new opportunities for service integration solutions as organizations deploy distributed computing resources that require sophisticated coordination and management capabilities. Edge environments introduce additional complexity that SIAM frameworks are well-positioned to address.

Industry-specific solutions represent significant growth opportunities as service integration requirements vary considerably across different sectors. Specialized SIAM solutions tailored to specific industry needs can command premium pricing and establish strong competitive positioning.

Small and medium enterprise adoption offers substantial market expansion potential as SIAM solutions become more accessible and cost-effective. Cloud-based service integration platforms enable smaller organizations to access enterprise-grade service management capabilities without significant infrastructure investments.

Sustainability integration creates opportunities for service integration solutions that incorporate environmental impact considerations into vendor selection and service delivery optimization. Organizations increasingly prioritize sustainability in their service provider relationships.

Security integration enhancement presents opportunities for SIAM solutions that incorporate comprehensive security management across multi-vendor environments. The increasing importance of cybersecurity creates demand for integrated security management capabilities within service integration frameworks.

Competitive dynamics in the Service Integration and Management market reflect the convergence of traditional IT service providers, specialized SIAM consultancies, and technology platform vendors. This convergence creates a complex competitive landscape where organizations must navigate various solution approaches and vendor capabilities.

Technology evolution continues reshaping market dynamics through the introduction of advanced automation, artificial intelligence, and analytics capabilities. These technological advancements enable more sophisticated service integration approaches while reducing the complexity and cost of implementation.

Customer expectations are evolving toward more comprehensive and integrated service delivery models that provide greater visibility, control, and business value. Organizations increasingly expect their service integration solutions to deliver measurable business outcomes rather than simply coordinating vendor activities.

Regulatory influences shape market dynamics through compliance requirements that affect service delivery models and vendor management approaches. Organizations must ensure their service integration strategies support regulatory compliance across all vendor relationships and service delivery activities.

Economic factors influence market dynamics through cost optimization pressures and budget constraints that affect service integration investment decisions. Organizations seek service integration solutions that deliver clear return on investment and support broader cost management objectives.

Innovation cycles in related technology areas create opportunities and challenges for service integration solutions. The rapid pace of technological change requires SIAM frameworks to remain flexible and adaptable to emerging service delivery models and technologies.

Comprehensive market analysis for the Service Integration and Management market employs multiple research methodologies to ensure accurate and reliable insights. Primary research activities include extensive interviews with industry executives, service integration practitioners, and technology vendors across various market segments and geographic regions.

Secondary research encompasses analysis of industry reports, financial statements, regulatory filings, and academic publications related to service integration and management practices. This research provides historical context and validates primary research findings through triangulation of multiple data sources.

Quantitative analysis utilizes statistical modeling and trend analysis to identify market patterns, growth trajectories, and competitive dynamics. Advanced analytics techniques help isolate key market drivers and predict future market developments based on historical data and current market conditions.

Qualitative research focuses on understanding market dynamics, customer requirements, and competitive strategies through in-depth interviews and case study analysis. This approach provides insights into market nuances that quantitative analysis alone cannot capture.

Market validation processes ensure research accuracy through multiple validation checkpoints, including expert reviews, data cross-referencing, and methodology verification. These validation processes help maintain research quality and reliability standards throughout the analysis process.

North American market maintains leadership in Service Integration and Management adoption, driven by mature IT services markets and advanced digital transformation initiatives. The region demonstrates approximately 38% global market share, with strong demand from large enterprises and government organizations seeking to optimize complex multi-vendor environments.

European markets show robust growth in service integration adoption, particularly in the United Kingdom, Germany, and France. European organizations increasingly prioritize SIAM frameworks to address regulatory compliance requirements and optimize service delivery across diverse vendor ecosystems. The region accounts for approximately 32% of global market activity.

Asia-Pacific region demonstrates the fastest growth trajectory in Service Integration and Management adoption, driven by rapid digital transformation initiatives and increasing IT outsourcing activities. Countries including India, China, and Australia lead regional adoption, with growth rates exceeding 15% annually in key markets.

Latin American markets show emerging interest in service integration solutions, particularly in Brazil and Mexico, where organizations are beginning to adopt more sophisticated service management approaches. The region represents a significant growth opportunity as digital transformation initiatives accelerate.

Middle East and Africa markets demonstrate increasing adoption of service integration frameworks, driven by government digitization initiatives and private sector modernization efforts. The region shows particular strength in the financial services and telecommunications sectors.

Market leadership in Service Integration and Management features a diverse ecosystem of established IT service providers, specialized SIAM consultancies, and technology platform vendors. The competitive landscape reflects the multifaceted nature of service integration requirements across different industries and organizational contexts.

Major market participants include:

Competitive strategies focus on developing comprehensive service integration platforms, building industry-specific expertise, and creating strategic partnerships with technology vendors. Market leaders increasingly emphasize outcome-based service delivery models and advanced analytics capabilities.

Innovation focus areas include artificial intelligence integration, automation enhancement, and cloud-native service integration platforms. Companies invest significantly in developing next-generation capabilities that address evolving customer requirements and market dynamics.

By Service Type:

By Deployment Model:

By Organization Size:

By Industry Vertical:

Consulting Services segment demonstrates strong growth as organizations seek expert guidance in developing and implementing effective service integration strategies. This category benefits from the complexity of SIAM implementations and the specialized expertise required for successful deployment.

Integration Services category shows robust demand driven by the technical complexity of coordinating multiple service providers and technology platforms. Organizations require sophisticated integration capabilities to ensure seamless service delivery across diverse vendor ecosystems.

Management Services segment experiences steady growth as organizations seek ongoing support for service coordination and performance optimization. This category provides recurring revenue opportunities for service providers while delivering continuous value to customers.

Platform Services category demonstrates the fastest growth trajectory as organizations increasingly prefer technology-enabled service integration approaches. Cloud-based platforms offer scalability and cost-effectiveness that traditional consulting-heavy approaches cannot match.

Large Enterprise segment continues to drive the majority of market activity due to the complexity of their service environments and available budgets for comprehensive SIAM implementations. These organizations typically require sophisticated, customized solutions.

Financial Services vertical shows particularly strong adoption due to regulatory compliance requirements and the critical nature of service delivery in financial operations. This sector demonstrates willingness to invest in comprehensive service integration capabilities.

For Organizations:

For Service Providers:

For Technology Vendors:

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation Integration represents a dominant trend in Service Integration and Management, with organizations increasingly seeking automated service orchestration capabilities. Advanced automation technologies enable significant efficiency improvements while reducing manual coordination efforts and human error risks.

AI-Powered Analytics emerge as a critical trend, enabling predictive service management and intelligent decision-making across multi-vendor environments. Machine learning algorithms help optimize service delivery and identify potential issues before they impact business operations.

Cloud-Native Platforms gain prominence as organizations prefer scalable, flexible service integration solutions that can adapt to changing business requirements. Cloud-based SIAM platforms offer cost-effectiveness and rapid deployment capabilities that traditional solutions cannot match.

Outcome-Based Service Management shifts focus from activity-based metrics to business outcome optimization. Organizations increasingly expect their service integration initiatives to deliver measurable business value rather than simply coordinating vendor activities.

Security Integration becomes increasingly important as organizations seek comprehensive security management across their entire service ecosystem. Integrated security approaches ensure consistent security standards across all vendor relationships and service delivery activities.

Sustainability Considerations influence service integration strategies as organizations incorporate environmental impact assessments into vendor selection and service delivery optimization processes. Green IT initiatives drive demand for sustainability-focused service integration approaches.

Strategic partnerships between major consulting firms and technology vendors continue reshaping the Service Integration and Management landscape. These partnerships combine consulting expertise with technology capabilities to deliver comprehensive service integration solutions.

Platform acquisitions by established service providers demonstrate the strategic importance of technology-enabled service integration capabilities. Major players invest significantly in acquiring specialized SIAM platforms and technologies to enhance their service offerings.

Industry-specific solutions development accelerates as service providers recognize the unique requirements of different sectors. Specialized SIAM frameworks for healthcare, financial services, and manufacturing address specific regulatory and operational requirements.

Automation advancement continues through investments in artificial intelligence and machine learning capabilities. Service providers develop increasingly sophisticated automation tools that reduce manual service coordination efforts and improve service quality.

Regulatory compliance enhancement drives development of specialized compliance management capabilities within SIAM frameworks. Organizations require comprehensive compliance management across all vendor relationships and service delivery activities.

Global delivery model evolution reflects the increasing importance of service integration in distributed service delivery environments. Service providers develop global capabilities for managing complex multi-vendor, multi-geography service delivery models.

MarkWide Research analysis indicates that organizations should prioritize comprehensive service integration strategies that align with their broader digital transformation initiatives. Successful SIAM implementations require strong executive sponsorship and dedicated change management efforts to overcome organizational resistance and complexity challenges.

Technology investment recommendations emphasize the importance of selecting flexible, scalable service integration platforms that can adapt to evolving business requirements. Organizations should avoid overly complex solutions that may impede implementation success and user adoption.

Vendor selection strategies should focus on service providers with proven SIAM expertise and strong track records in similar organizational contexts. The complexity of service integration implementations requires experienced partners who can navigate technical and organizational challenges effectively.

Implementation approach suggestions favor phased deployment strategies that demonstrate early value while building organizational confidence and expertise. Organizations should start with pilot implementations in less complex environments before expanding to comprehensive enterprise-wide deployments.

Skills development initiatives should accompany service integration implementations to ensure organizations have the internal capabilities required for long-term success. Investment in training and certification programs helps build sustainable service integration competencies.

Performance measurement frameworks should emphasize business outcomes rather than technical metrics alone. Organizations should establish clear success criteria that align service integration initiatives with broader business objectives and value creation goals.

Market evolution in Service Integration and Management points toward increasingly sophisticated, technology-enabled service orchestration capabilities. The integration of artificial intelligence, machine learning, and advanced analytics will transform service integration from reactive coordination to proactive optimization and predictive management.

Growth projections indicate continued market expansion at approximately 13-15% annually over the next five years, driven by accelerating digital transformation initiatives and increasing complexity of multi-vendor service environments. MWR forecasts suggest that cloud-native service integration platforms will capture the largest share of market growth during this period.

Technology advancement will enable more autonomous service integration capabilities, reducing the need for manual coordination while improving service quality and business outcomes. Edge computing proliferation and IoT expansion will create new service integration requirements and opportunities.

Industry adoption patterns suggest that service integration will become standard practice across most industries within the next decade. Organizations that fail to adopt effective service integration strategies may face competitive disadvantages and operational inefficiencies.

Regulatory evolution will likely increase compliance requirements for service integration, particularly in highly regulated industries. Organizations must prepare for more stringent oversight of vendor relationships and service delivery processes.

Market consolidation may accelerate as larger service providers acquire specialized SIAM capabilities and technology platforms. This consolidation could create more comprehensive service integration solutions while potentially reducing competitive diversity in certain market segments.

The Service Integration and Management market represents a critical and rapidly evolving segment of the broader IT services landscape, driven by organizations’ increasing need to effectively coordinate complex multi-vendor environments. As digital transformation initiatives accelerate and cloud adoption proliferates, the demand for sophisticated service integration capabilities continues to grow across industries and geographic regions.

Market fundamentals remain strong, with clear value propositions including improved service quality, cost optimization, and enhanced operational efficiency. The convergence of consulting expertise, technology platforms, and automation capabilities creates comprehensive solutions that address the complex challenges of modern service delivery environments.

Future success in the Service Integration and Management market will depend on organizations’ ability to embrace technology-enabled service integration approaches while building the internal capabilities required for effective implementation and ongoing management. The integration of artificial intelligence, advanced analytics, and automation technologies will continue transforming service integration from manual coordination to intelligent orchestration, creating new opportunities for value creation and competitive advantage.

What is Service Integration and Management?

Service Integration and Management (SIAM) refers to the management approach that integrates multiple service providers to deliver a seamless service to the customer. It focuses on coordinating and managing services from various suppliers to ensure efficiency and effectiveness in service delivery.

What are the key players in the Service Integration and Management Market?

Key players in the Service Integration and Management Market include Accenture, IBM, and Capgemini, which provide comprehensive SIAM solutions to enhance service delivery and integration. These companies focus on improving operational efficiency and customer satisfaction, among others.

What are the main drivers of growth in the Service Integration and Management Market?

The main drivers of growth in the Service Integration and Management Market include the increasing complexity of IT environments, the demand for improved service quality, and the need for cost-effective service delivery. Organizations are seeking integrated solutions to streamline operations and enhance collaboration.

What challenges does the Service Integration and Management Market face?

Challenges in the Service Integration and Management Market include managing diverse service providers, ensuring compliance with service level agreements, and addressing data security concerns. These factors can complicate the integration process and impact service delivery.

What opportunities exist in the Service Integration and Management Market?

Opportunities in the Service Integration and Management Market include the growing adoption of cloud services, the rise of digital transformation initiatives, and the increasing focus on customer experience. Companies can leverage SIAM to enhance their service offerings and improve operational agility.

What trends are shaping the Service Integration and Management Market?

Trends shaping the Service Integration and Management Market include the shift towards automation and AI-driven solutions, the emphasis on agile methodologies, and the integration of DevOps practices. These trends are driving innovation and improving service delivery capabilities.

Service Integration and Management Market

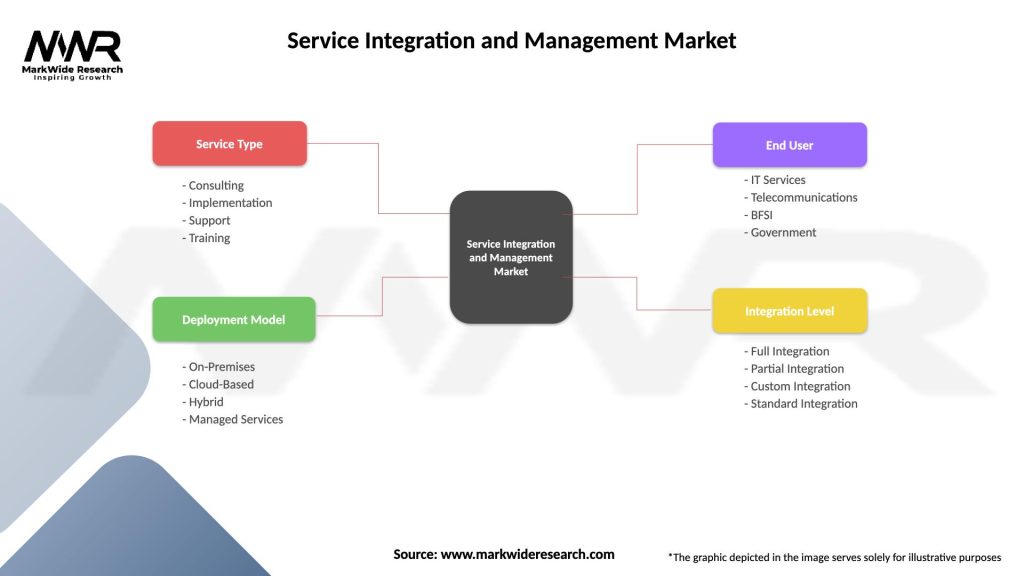

| Segmentation Details | Description |

|---|---|

| Service Type | Consulting, Implementation, Support, Training |

| Deployment Model | On-Premises, Cloud-Based, Hybrid, Managed Services |

| End User | IT Services, Telecommunications, BFSI, Government |

| Integration Level | Full Integration, Partial Integration, Custom Integration, Standard Integration |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Service Integration and Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at