444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Kuwait retail market represents one of the most dynamic and rapidly evolving commercial landscapes in the Gulf Cooperation Council region. Kuwait’s retail sector has experienced remarkable transformation over the past decade, driven by increasing consumer spending power, urbanization trends, and evolving shopping preferences. The market encompasses diverse retail formats including traditional souks, modern shopping malls, hypermarkets, specialty stores, and emerging e-commerce platforms.

Consumer behavior patterns in Kuwait reflect a unique blend of traditional values and modern lifestyle aspirations. The market demonstrates strong growth momentum with retail sales expanding at a compound annual growth rate of 6.2%, significantly outpacing regional averages. Digital transformation has become increasingly prominent, with online retail penetration reaching 18% of total retail sales as consumers embrace omnichannel shopping experiences.

Infrastructure development continues to support market expansion, with new retail destinations and mixed-use developments enhancing the shopping landscape. The market benefits from Kuwait’s strategic location as a regional trading hub, high per capita income levels, and a young demographic profile that drives demand for diverse retail offerings. International brands maintain strong presence alongside local retailers, creating a competitive yet collaborative retail ecosystem.

The Kuwait retail market refers to the comprehensive ecosystem of businesses engaged in selling goods and services directly to consumers through various channels and formats within Kuwait’s borders. This market encompasses traditional brick-and-mortar stores, modern retail chains, shopping centers, e-commerce platforms, and specialized retail segments serving the diverse needs of Kuwait’s population.

Retail market dynamics in Kuwait include the interplay between consumer demand, supply chain management, retail real estate, technology adoption, and regulatory frameworks that shape the commercial landscape. The market represents the final link in the distribution chain, where products and services reach end consumers through multiple touchpoints and shopping experiences.

Market participants range from small family-owned businesses and traditional merchants to large multinational retail corporations and emerging digital-first brands. The Kuwait retail market serves as a crucial economic indicator, reflecting consumer confidence, spending patterns, and overall economic health while contributing significantly to employment and GDP growth.

Kuwait’s retail market demonstrates robust performance characterized by steady growth, technological advancement, and evolving consumer preferences. The market has successfully adapted to changing demographics, with millennials and Gen Z consumers representing approximately 45% of the customer base, driving demand for innovative retail experiences and digital integration.

Key market trends include the rise of experiential retail, sustainability-focused shopping, and the integration of artificial intelligence in customer service and inventory management. Shopping mall occupancy rates remain strong at 92%, indicating healthy demand for retail space despite the growth of online channels. The market benefits from government initiatives supporting economic diversification and private sector development.

Competitive landscape features a mix of established international retailers, regional chains, and emerging local brands. Market consolidation trends are evident in certain segments, while new market entrants continue to find opportunities in niche categories and underserved consumer segments. The retail market’s resilience during recent global challenges demonstrates its fundamental strength and adaptability.

Consumer spending patterns in Kuwait reveal several critical insights that shape retail strategies and market opportunities. The following key insights provide comprehensive understanding of market dynamics:

Economic prosperity serves as the primary driver of Kuwait’s retail market expansion. High per capita income levels, supported by oil revenues and government spending, create strong consumer purchasing power that sustains retail demand across multiple categories. Population growth and urbanization trends contribute to expanding customer bases and increased retail space requirements.

Demographic advantages significantly influence market dynamics, with a young population driving demand for fashion, technology, and lifestyle products. Cultural diversity within Kuwait’s population creates opportunities for specialized retail offerings catering to different ethnic and cultural preferences. The expatriate community, representing a substantial portion of the population, brings diverse shopping habits and brand preferences.

Government initiatives supporting economic diversification and private sector development create favorable conditions for retail market growth. Infrastructure investments in transportation, telecommunications, and urban development enhance retail accessibility and operational efficiency. Tourism promotion efforts attract regional visitors, boosting retail sales in key shopping destinations and entertainment districts.

Technology advancement enables retailers to enhance customer experiences, optimize operations, and develop innovative service offerings. Digital payment systems and fintech solutions facilitate seamless transactions and expand market reach. Social media influence and digital marketing capabilities allow retailers to engage customers more effectively and build brand awareness.

Economic volatility related to oil price fluctuations creates uncertainty in consumer spending patterns and retail investment decisions. Regulatory complexities and bureaucratic processes can slow market entry for new retailers and complicate business operations. High real estate costs in prime retail locations present significant barriers for smaller retailers and startup businesses.

Labor market challenges include skills shortages in retail management and customer service roles, particularly for positions requiring bilingual capabilities and cultural sensitivity. Supply chain dependencies on imports create vulnerabilities to global disruptions and currency fluctuations that can impact product availability and pricing.

Cultural sensitivities require careful navigation of local customs and religious considerations in product offerings, marketing approaches, and store operations. Seasonal demand variations create operational challenges in inventory management and staffing requirements. Competition intensity in established retail segments can limit profitability and market share growth for new entrants.

Technology adoption barriers among certain consumer segments may slow the transition to digital retail channels. Infrastructure limitations in some areas can restrict retail expansion and limit customer accessibility to modern shopping facilities.

E-commerce expansion presents substantial opportunities for retailers to reach broader customer bases and develop innovative service models. Cross-border retail initiatives can leverage Kuwait’s strategic location to serve regional markets and attract international shoppers. Experiential retail concepts combining shopping, dining, and entertainment create differentiated value propositions.

Sustainability initiatives offer opportunities to develop eco-friendly retail practices and appeal to environmentally conscious consumers. Private label development enables retailers to improve margins while offering unique products tailored to local preferences. Technology integration through artificial intelligence, augmented reality, and IoT solutions can enhance customer experiences and operational efficiency.

Niche market segments including health and wellness, organic products, and specialty foods present growth opportunities for focused retailers. Franchise opportunities allow international brands to enter the market with reduced risk while providing local entrepreneurs with proven business models. Real estate development in emerging areas creates opportunities for new retail destinations and formats.

Partnership strategies between retailers, technology providers, and logistics companies can create synergies and competitive advantages. Customer data analytics capabilities enable personalized marketing and improved inventory management. Regional expansion opportunities allow successful Kuwait-based retailers to scale operations across the GCC region.

Supply and demand equilibrium in Kuwait’s retail market reflects the interplay between consumer preferences, economic conditions, and retail capacity. Market forces continuously shape pricing strategies, product assortments, and service levels as retailers compete for market share and customer loyalty. Seasonal fluctuations create dynamic demand patterns that require flexible operational approaches.

Competitive dynamics drive innovation in retail formats, customer service standards, and technology adoption. Market consolidation trends in certain segments contrast with fragmentation in others, creating diverse competitive landscapes across retail categories. Price sensitivity varies significantly among consumer segments, influencing positioning strategies and market targeting approaches.

Regulatory environment evolution affects market operations through licensing requirements, labor laws, and consumer protection measures. Economic cycles influence consumer confidence and spending patterns, requiring retailers to adapt strategies accordingly. Cultural factors continue to shape product preferences, shopping behaviors, and retail format acceptance.

Technology disruption accelerates market transformation through digital channels, automated systems, and data-driven decision making. Global trends in retail innovation find local adaptation in Kuwait’s market context. Investment flows from both domestic and international sources support market expansion and modernization efforts.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Kuwait’s retail market dynamics. Primary research includes structured interviews with retail executives, consumer surveys, and field observations across diverse retail formats and locations throughout Kuwait.

Secondary research incorporates analysis of government statistics, industry reports, financial statements, and market intelligence from various sources. Quantitative analysis utilizes statistical modeling and trend analysis to identify patterns and project future market developments. Qualitative research provides contextual understanding of consumer behaviors, cultural factors, and market nuances.

Data validation processes ensure accuracy through cross-referencing multiple sources and expert verification. Market segmentation analysis examines different retail categories, consumer demographics, and geographic regions to provide granular insights. Competitive intelligence gathering includes analysis of major market players, their strategies, and performance metrics.

Trend analysis identifies emerging patterns in consumer behavior, technology adoption, and market evolution. Economic modeling incorporates macroeconomic factors and their impact on retail market performance. Stakeholder consultation includes input from industry associations, government agencies, and market participants to ensure comprehensive perspective.

Kuwait City dominates the retail landscape, accounting for approximately 55% of total retail activity with its concentration of shopping malls, commercial districts, and high-end retail destinations. Hawalli Governorate represents the second-largest retail market, featuring diverse retail formats serving both local residents and expatriate communities with strong growth in neighborhood shopping centers.

Ahmadi Governorate demonstrates significant retail potential driven by residential development and industrial activity, with emerging retail clusters serving growing suburban populations. Farwaniya Governorate shows robust retail expansion with new shopping destinations and improved infrastructure supporting increased commercial activity.

Jahra Governorate presents opportunities for retail development as urban expansion continues and transportation connectivity improves. Mubarak Al-Kabeer Governorate benefits from planned development projects and growing residential communities that drive demand for retail services and shopping facilities.

Regional retail preferences vary based on demographic composition, income levels, and cultural factors. Shopping center distribution reflects population density patterns and accessibility considerations. E-commerce penetration shows variations across governorates, with urban areas demonstrating higher adoption rates of digital retail channels.

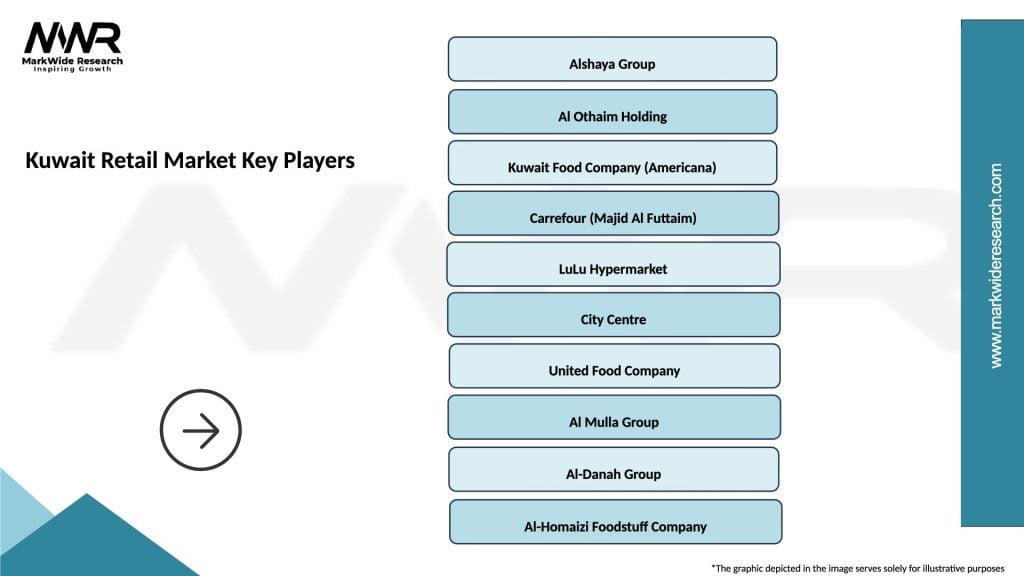

Market leadership in Kuwait’s retail sector is distributed among several key players representing different retail formats and categories. The competitive landscape features both established international retailers and successful local chains that understand market nuances and consumer preferences.

Competitive strategies focus on customer experience enhancement, technology integration, and market expansion. Brand positioning varies from value-oriented offerings to premium luxury experiences. Market share dynamics continue evolving as new entrants challenge established players and consumer preferences shift toward digital channels.

By Retail Format:

By Product Category:

Fashion and Apparel represents the largest retail category, driven by strong consumer interest in international brands and seasonal fashion trends. Premium fashion segments show particularly strong performance, with luxury brands maintaining dedicated boutiques in high-end shopping destinations. Fast fashion retailers attract younger consumers with affordable, trendy options and frequent inventory updates.

Food and Beverage retail demonstrates steady growth supported by population expansion and changing dietary preferences. Organic and health-focused products gain market share as consumer awareness of nutrition and wellness increases. International cuisine ingredients reflect Kuwait’s diverse population and culinary preferences.

Electronics and Technology retail benefits from high consumer adoption of new technologies and regular upgrade cycles. Mobile devices and accessories represent significant sales volumes, while smart home products show emerging growth potential. Gaming and entertainment electronics appeal strongly to younger demographics.

Home and Lifestyle categories experience growth driven by real estate development and home ownership trends. Furniture and home decor retailers benefit from new residential projects and renovation activities. Kitchen and dining products reflect cultural emphasis on hospitality and family gatherings.

Retailers benefit from Kuwait’s stable economic environment, high consumer spending power, and supportive business infrastructure. Market access to affluent consumer segments provides opportunities for premium positioning and higher margins. Strategic location advantages enable retailers to serve regional markets and attract international shoppers.

Consumers enjoy diverse shopping options, competitive pricing, and improving service standards across retail formats. Product variety and brand availability meet diverse preferences and lifestyle needs. Shopping convenience continues improving through extended hours, multiple locations, and digital integration.

Real Estate Developers find strong demand for retail space in well-located developments. Mixed-use projects combining retail, residential, and commercial elements prove particularly successful. Investment returns remain attractive for quality retail properties in prime locations.

Technology Providers discover growing demand for retail technology solutions including point-of-sale systems, inventory management, and customer analytics platforms. E-commerce infrastructure requirements create opportunities for logistics, payment processing, and digital marketing services.

Government Stakeholders benefit from retail sector contributions to employment, tax revenues, and economic diversification objectives. Tourism development receives support from attractive retail destinations that enhance Kuwait’s appeal to visitors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across all retail segments, with omnichannel strategies becoming essential for competitive success. Artificial intelligence and machine learning applications enhance customer personalization, inventory optimization, and demand forecasting capabilities. Mobile-first approaches reflect consumer preferences for smartphone-based shopping and service interactions.

Experiential retail concepts gain prominence as retailers seek to differentiate through unique customer experiences beyond traditional product sales. Pop-up stores and temporary retail activations provide flexibility and create buzz around new brands or seasonal offerings. Social commerce integration leverages social media platforms for product discovery and purchase facilitation.

Sustainability initiatives influence retail operations through eco-friendly packaging, energy-efficient stores, and sustainable product sourcing. Local sourcing trends support domestic suppliers and reduce environmental impact while appealing to patriotic consumer sentiments. Circular economy concepts introduce product recycling and refurbishment programs.

Personalization technologies enable customized shopping experiences, targeted marketing, and individualized product recommendations. Contactless payment systems and self-service options improve convenience while addressing health and safety concerns. Augmented reality applications enhance product visualization and virtual try-on experiences.

Major retail expansions continue with international brands entering the Kuwait market through flagship stores and franchise partnerships. MarkWide Research indicates that retail space expansion projects worth substantial investments are under development across multiple governorates. Technology investments by major retailers focus on digital transformation and customer experience enhancement.

E-commerce platform launches by traditional retailers bridge online and offline channels, creating integrated shopping experiences. Logistics infrastructure improvements support growing online retail demand with faster delivery times and expanded coverage areas. Payment system innovations introduce new digital payment options and financial services integration.

Sustainability certifications and green building standards adoption by retail developers reflect environmental consciousness and regulatory compliance. Partnership agreements between retailers and technology companies accelerate innovation adoption and operational improvements. Market consolidation activities include mergers, acquisitions, and strategic alliances among retail players.

Government initiatives supporting small and medium enterprises create opportunities for local retail entrepreneurs. Tourism promotion efforts enhance retail destinations and attract regional visitors. Infrastructure projects improve retail accessibility and support market expansion into emerging areas.

Market participants should prioritize digital transformation initiatives to remain competitive in evolving retail landscape. Investment in technology infrastructure, particularly customer data analytics and inventory management systems, will provide sustainable competitive advantages. Omnichannel strategies should integrate online and offline touchpoints seamlessly to meet customer expectations.

Customer experience enhancement through personalization, convenience, and service quality improvements should guide retail strategy development. Staff training programs focusing on cultural sensitivity and multilingual capabilities will improve customer satisfaction and loyalty. Sustainability initiatives should be integrated into operations to appeal to environmentally conscious consumers.

Market expansion strategies should consider underserved geographic areas and demographic segments with growth potential. Partnership opportunities with technology providers, logistics companies, and local suppliers can create operational synergies. Brand differentiation through unique value propositions and specialized offerings will help retailers stand out in competitive markets.

Risk management approaches should address supply chain vulnerabilities, economic volatility, and regulatory changes. Financial planning should account for seasonal variations and economic cycles affecting consumer spending patterns. Innovation adoption should balance cutting-edge technology with practical implementation considerations and customer acceptance.

Kuwait’s retail market is positioned for continued growth driven by favorable demographics, economic stability, and ongoing modernization efforts. MWR projections indicate sustained expansion with annual growth rates expected to maintain momentum above regional averages. Digital retail channels will capture increasing market share while traditional retail formats adapt and evolve.

Technology integration will accelerate across all retail segments, with artificial intelligence, augmented reality, and Internet of Things applications becoming standard features. Sustainability practices will transition from optional initiatives to essential business requirements driven by consumer demand and regulatory expectations.

Market consolidation trends will continue in mature segments while new opportunities emerge in niche categories and underserved markets. International retail expansion into Kuwait will intensify as global brands recognize market potential and growth opportunities. Regional integration will create opportunities for successful Kuwait-based retailers to expand across GCC markets.

Consumer expectations will continue evolving toward greater convenience, personalization, and value-added services. Retail innovation will focus on experiential concepts, community engagement, and lifestyle integration. Economic diversification efforts will support retail sector growth while reducing dependency on oil-related economic cycles.

Kuwait’s retail market demonstrates remarkable resilience and growth potential, supported by strong economic fundamentals, favorable demographics, and continuous innovation adoption. The market’s evolution from traditional trading hub to modern retail destination reflects successful adaptation to changing consumer preferences and global retail trends. Digital transformation initiatives and omnichannel strategies position retailers for sustainable competitive advantages in an increasingly connected marketplace.

Strategic opportunities abound for retailers willing to invest in customer experience enhancement, technology integration, and market expansion initiatives. The combination of high consumer spending power, young demographics, and supportive business environment creates favorable conditions for retail success. Sustainability focus and innovation adoption will differentiate market leaders from followers in the coming years.

Future success in Kuwait’s retail market will depend on retailers’ ability to balance global best practices with local market understanding, cultural sensitivity, and customer-centric approaches. The market’s continued evolution toward digitalization, experiential retail, and sustainable practices presents both challenges and opportunities for industry participants committed to long-term growth and market leadership.

What is Kuwait Retail?

Kuwait Retail refers to the sector involved in the sale of goods and services directly to consumers in Kuwait. This includes various segments such as grocery stores, clothing outlets, electronics shops, and online retail platforms.

What are the key players in the Kuwait Retail Market?

Key players in the Kuwait Retail Market include Alshaya Group, Sultan Center, and Carrefour Kuwait. These companies dominate various retail segments, offering a wide range of products from groceries to fashion, among others.

What are the growth factors driving the Kuwait Retail Market?

The Kuwait Retail Market is driven by factors such as increasing consumer spending, a growing expatriate population, and the rise of e-commerce. Additionally, the expansion of shopping malls and retail spaces contributes to market growth.

What challenges does the Kuwait Retail Market face?

Challenges in the Kuwait Retail Market include intense competition among retailers, fluctuating consumer preferences, and economic uncertainties. These factors can impact sales and profitability for retail businesses.

What opportunities exist in the Kuwait Retail Market?

Opportunities in the Kuwait Retail Market include the growth of online shopping, the introduction of new retail technologies, and the potential for expansion into underserved areas. Retailers can leverage these trends to enhance customer engagement and sales.

What trends are shaping the Kuwait Retail Market?

Trends in the Kuwait Retail Market include the increasing popularity of omnichannel retailing, sustainability initiatives, and the integration of technology in shopping experiences. Retailers are focusing on enhancing customer convenience and environmental responsibility.

Kuwait Retail Market

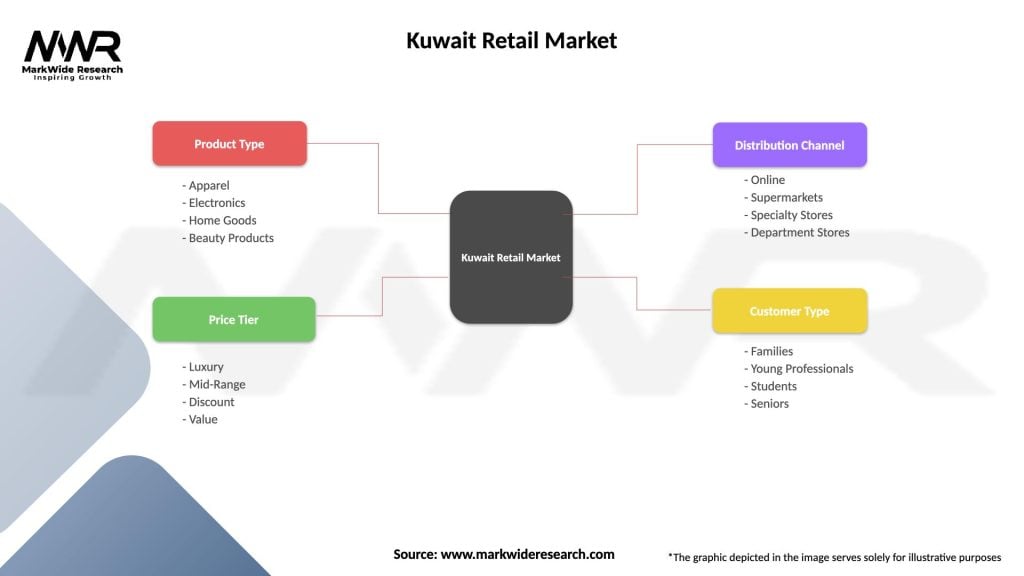

| Segmentation Details | Description |

|---|---|

| Product Type | Apparel, Electronics, Home Goods, Beauty Products |

| Price Tier | Luxury, Mid-Range, Discount, Value |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Department Stores |

| Customer Type | Families, Young Professionals, Students, Seniors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Kuwait Retail Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at