444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK packaging market represents a cornerstone of the nation’s industrial landscape, encompassing diverse materials, technologies, and applications across multiple sectors. Market dynamics indicate robust growth driven by evolving consumer preferences, sustainability mandates, and technological innovations. The sector demonstrates remarkable resilience, adapting to changing regulatory frameworks while maintaining competitive positioning in global markets.

Growth trajectories reflect increasing demand for sustainable packaging solutions, with eco-friendly materials experiencing accelerated adoption rates of 23% annually. The market encompasses traditional materials including paper, cardboard, plastic, metal, and glass, alongside emerging biodegradable alternatives. E-commerce expansion continues driving demand for protective packaging, while food and beverage sectors maintain substantial market share through innovative packaging technologies.

Regional distribution shows concentrated activity in major industrial centers, with London and Southeast England accounting for 35% of market activity. Manufacturing capabilities span from large-scale production facilities to specialized boutique operations serving niche markets. The sector’s evolution reflects broader economic trends, including digitalization, automation, and circular economy principles.

The UK packaging market refers to the comprehensive ecosystem of companies, technologies, and materials involved in designing, manufacturing, and distributing packaging solutions across the United Kingdom. This market encompasses primary packaging that directly contacts products, secondary packaging for distribution and display, and tertiary packaging for bulk transportation and storage.

Market scope includes diverse material categories such as flexible packaging, rigid containers, protective packaging, and specialty applications. The sector serves multiple end-use industries including food and beverages, pharmaceuticals, cosmetics, electronics, automotive, and industrial goods. Value chain integration extends from raw material suppliers through converters, printers, and end-users to recycling and waste management services.

Technological integration encompasses traditional manufacturing processes alongside advanced technologies including digital printing, smart packaging, active and intelligent packaging systems, and sustainable material innovations. The market reflects evolving consumer expectations for convenience, safety, sustainability, and aesthetic appeal while meeting stringent regulatory requirements.

Strategic positioning of the UK packaging market demonstrates strong fundamentals supported by diverse industrial base, advanced manufacturing capabilities, and proximity to major European markets. The sector benefits from established supply chains, skilled workforce, and robust research and development infrastructure supporting continuous innovation.

Key performance indicators reveal sustained growth momentum with packaging automation adoption increasing by 18% annually. Market leaders focus on sustainability initiatives, with recyclable packaging solutions representing growing market segments. Digital transformation accelerates operational efficiency while enabling customization and shorter production runs.

Competitive landscape features established multinational corporations alongside innovative startups developing breakthrough technologies. Market consolidation trends continue as companies seek scale advantages and expanded capabilities. Investment flows target sustainable packaging technologies, automation systems, and digital integration platforms supporting future growth.

Regulatory environment shapes market evolution through extended producer responsibility schemes, plastic reduction targets, and circular economy legislation. These frameworks drive innovation while creating opportunities for companies developing compliant solutions. Export potential remains strong given the UK’s reputation for quality and innovation in packaging technologies.

Market intelligence reveals several critical insights shaping the UK packaging landscape. Consumer behavior shifts toward sustainable products drive demand for eco-friendly packaging solutions, with biodegradable materials experiencing 31% growth rates in adoption.

Market segmentation reveals distinct growth patterns across applications, with pharmaceutical packaging showing particular strength due to aging demographics and healthcare innovation. Food packaging remains the largest segment, driven by convenience trends and extended shelf-life requirements.

Primary growth drivers propelling the UK packaging market include evolving consumer preferences, regulatory mandates, and technological innovations. Sustainability consciousness among consumers creates demand for environmentally responsible packaging solutions, driving investment in alternative materials and circular economy approaches.

E-commerce expansion continues generating substantial packaging demand as online retail penetration increases across all demographic segments. Protective packaging requirements for shipping fragile items drive innovation in cushioning materials and structural design. Convenience packaging solutions address busy lifestyles through easy-open features, portion control, and extended shelf life.

Regulatory frameworks including the UK Plastics Pact and Extended Producer Responsibility schemes mandate sustainable packaging practices. These requirements drive innovation while creating market opportunities for compliant solutions. Food safety regulations necessitate advanced barrier properties and contamination prevention technologies.

Technological advancement enables new packaging functionalities including active packaging that extends product life, intelligent packaging providing information to consumers, and connected packaging enabling supply chain tracking. Manufacturing automation reduces costs while improving quality and consistency. Digital printing technologies enable customization and shorter production runs supporting brand differentiation.

Significant challenges facing the UK packaging market include raw material cost volatility, regulatory complexity, and competitive pressures from international suppliers. Material price fluctuations impact profitability and planning, particularly for petroleum-based plastics and recycled content materials.

Regulatory compliance costs create barriers for smaller companies while requiring ongoing investment in new technologies and processes. Brexit implications affect supply chain logistics and regulatory alignment with European standards. Labor shortages in manufacturing and skilled technical roles constrain capacity expansion and innovation capabilities.

Environmental concerns regarding packaging waste create public pressure and regulatory scrutiny, requiring substantial investment in sustainable alternatives. Consumer price sensitivity limits adoption of premium sustainable packaging solutions despite environmental benefits. Infrastructure limitations for recycling and waste management constrain circular economy implementation.

Technological disruption requires continuous investment in new equipment and capabilities, creating financial pressure on established companies. Supply chain complexity increases with sustainability requirements and traceability demands. International competition from lower-cost producers challenges domestic manufacturing viability in price-sensitive segments.

Emerging opportunities in the UK packaging market center on sustainability innovation, digital integration, and specialized applications. Circular economy initiatives create demand for advanced recycling technologies and closed-loop packaging systems. Bio-based materials offer alternatives to traditional plastics while meeting performance requirements.

Smart packaging technologies enable new value propositions through consumer engagement, supply chain optimization, and product authentication. Internet of Things integration allows real-time monitoring of product conditions and supply chain visibility. Personalization trends drive demand for customizable packaging solutions and short-run production capabilities.

Healthcare packaging presents growth opportunities driven by aging demographics, pharmaceutical innovation, and medical device advancement. Pharmaceutical cold chain requirements create demand for temperature-controlled packaging solutions. Medical device packaging requires specialized sterile barrier systems and regulatory compliance.

Export markets offer expansion opportunities for UK packaging expertise, particularly in sustainable technologies and premium applications. Developing economies seek advanced packaging solutions supporting economic development and consumer goods expansion. Luxury packaging segments value UK design capabilities and manufacturing quality.

Market forces shaping the UK packaging landscape reflect complex interactions between supply and demand factors, regulatory influences, and technological evolution. Supply chain integration increases as companies seek control over material sourcing and quality assurance. Vertical integration strategies enable better cost management and innovation coordination.

Competitive dynamics intensify as traditional boundaries blur between material suppliers, converters, and brand owners. Strategic partnerships become essential for accessing new technologies and markets. Merger and acquisition activity continues as companies seek scale advantages and complementary capabilities.

Innovation cycles accelerate driven by sustainability requirements and consumer expectations. Research and development investment focuses on alternative materials, manufacturing processes, and functional enhancements. Collaboration networks between industry, academia, and government support breakthrough technologies.

Market volatility increases due to raw material price fluctuations, regulatory changes, and economic uncertainty. Risk management strategies become critical for maintaining profitability and competitiveness. Flexibility requirements drive investment in adaptable manufacturing systems and diverse supplier networks.

Comprehensive analysis of the UK packaging market employs multiple research methodologies ensuring accuracy and depth of insights. Primary research includes extensive interviews with industry executives, technical experts, and regulatory officials across the packaging value chain. Survey methodologies capture quantitative data on market trends, adoption rates, and investment priorities.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, and company financial statements. Market intelligence gathering includes monitoring of patent filings, regulatory developments, and technology announcements. Competitive analysis evaluates company strategies, market positioning, and performance metrics.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Statistical analysis identifies trends, correlations, and market patterns supporting strategic insights. Forecasting models incorporate historical data, current trends, and scenario analysis for future projections.

Industry consultation provides context and validation for research findings through engagement with market participants. Regulatory analysis examines current and proposed legislation affecting market development. Technology assessment evaluates emerging innovations and their potential market impact.

Geographic distribution of the UK packaging market reveals distinct regional characteristics and specializations. London and Southeast England dominate market activity with 35% market concentration, benefiting from proximity to major consumer markets, ports, and financial centers. This region hosts numerous multinational headquarters and innovation centers driving market development.

Northwest England maintains strong manufacturing presence with 22% regional market share, leveraging industrial heritage and transportation infrastructure. Manchester and Liverpool serve as key logistics hubs supporting distribution networks. The region specializes in flexible packaging and industrial applications.

Midlands region accounts for 18% of market activity, with Birmingham and surrounding areas hosting major automotive and food packaging operations. Manufacturing clusters benefit from central location and excellent transportation links. The region shows strength in rigid packaging and specialized applications.

Scotland and Northern England represent 15% combined market share, with focus on food and beverage packaging supporting local industries. Whisky packaging represents a specialized high-value segment. Wales and Southwest England contribute 10% market share with emphasis on agricultural and marine product packaging.

Regional specializations reflect local industry concentrations and historical development patterns. Innovation clusters emerge around universities and research institutions supporting technology development. Investment patterns show continued concentration in established regions while emerging opportunities develop in peripheral areas.

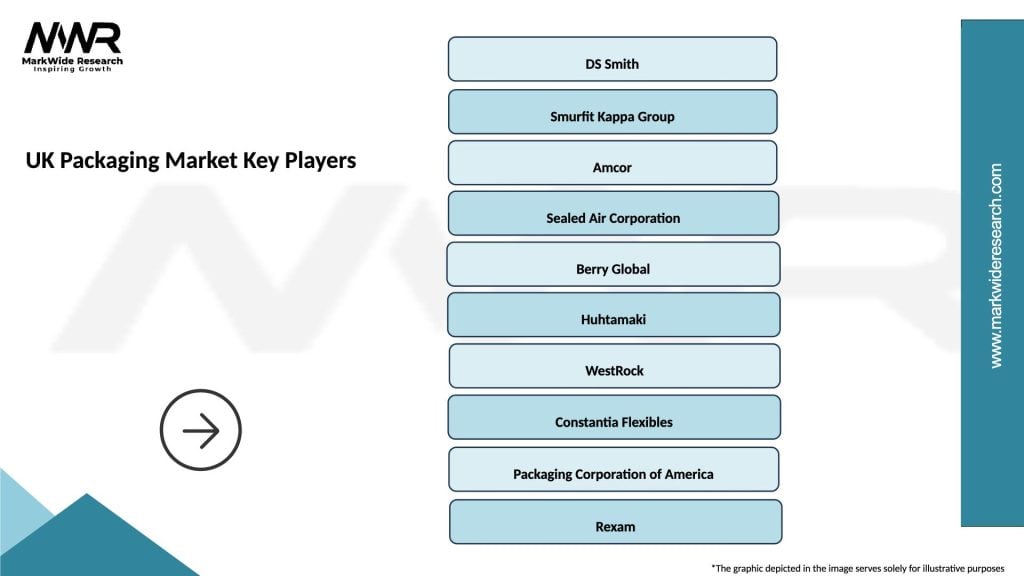

Market leadership in the UK packaging sector features diverse companies ranging from global corporations to specialized regional players. Competitive positioning reflects different strategies including scale advantages, technological innovation, and market specialization.

Competitive strategies emphasize sustainability leadership, technological innovation, and customer partnership development. Market consolidation continues as companies seek scale advantages and expanded capabilities. Investment priorities focus on automation, sustainability technologies, and digital integration.

Innovation leadership drives competitive differentiation through advanced materials, manufacturing processes, and functional enhancements. Strategic partnerships enable access to new technologies and markets while sharing development costs and risks.

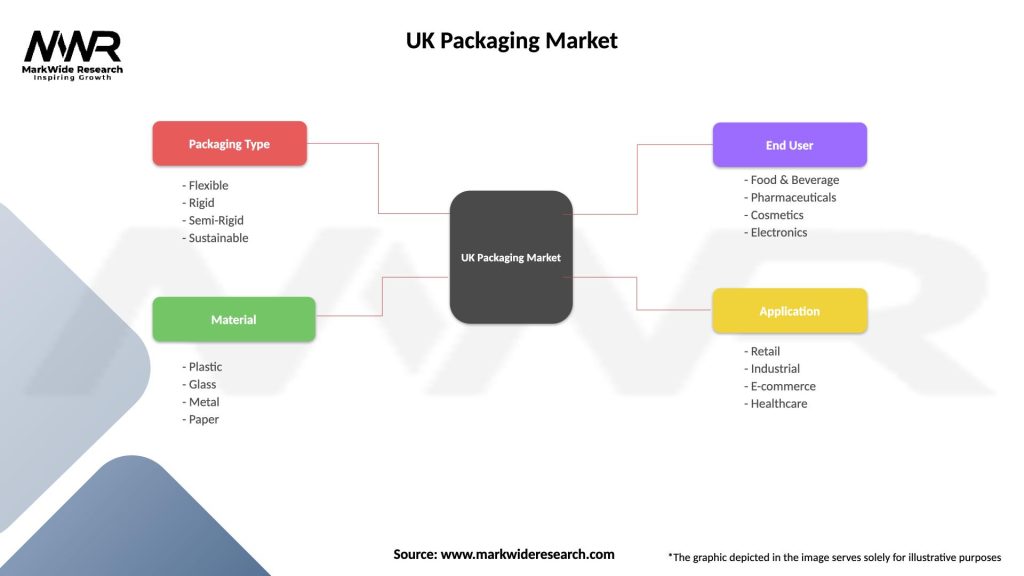

Market segmentation of the UK packaging industry reveals distinct categories based on materials, applications, and end-use industries. Material-based segmentation includes paper and cardboard, plastic, metal, glass, and emerging sustainable alternatives.

By Material Type:

By Application:

By End-Use Industry:

Food packaging represents the largest market category, driven by diverse consumer preferences and regulatory requirements. Fresh food packaging emphasizes extended shelf life and visual appeal, while processed food packaging focuses on convenience and portion control. Beverage packaging shows innovation in lightweight materials and sustainable alternatives.

Pharmaceutical packaging demonstrates strong growth potential with specialized requirements for product protection, tamper evidence, and regulatory compliance. Blister packaging dominates oral solid dosage forms, while parenteral packaging serves injectable medications. Medical device packaging requires sterile barrier systems and validation protocols.

E-commerce packaging emerges as a distinct category with unique requirements for protection during shipping, brand presentation, and sustainability. Protective packaging prevents damage while minimizing material usage. Branded packaging creates positive unboxing experiences supporting customer loyalty.

Industrial packaging serves specialized applications including chemicals, automotive components, and bulk materials. Hazardous material packaging requires regulatory compliance and safety features. Bulk packaging emphasizes efficiency and cost-effectiveness for large-volume shipments.

Luxury packaging represents a premium segment emphasizing aesthetics, tactile experience, and brand differentiation. Cosmetics packaging combines functionality with visual appeal. Premium beverage packaging supports brand positioning and gift-giving occasions.

Industry participants in the UK packaging market benefit from diverse opportunities for growth, innovation, and market expansion. Manufacturers gain access to advanced technologies, skilled workforce, and established supply chains supporting efficient operations and quality production.

Brand owners benefit from packaging innovation that enhances product protection, extends shelf life, and improves consumer experience. Sustainable packaging solutions support corporate environmental commitments while meeting regulatory requirements. Customization capabilities enable brand differentiation and market segmentation.

Retailers advantage from packaging solutions that improve supply chain efficiency, reduce waste, and enhance product presentation. E-commerce packaging supports online retail growth while minimizing shipping costs and damage rates. Smart packaging technologies enable inventory management and consumer engagement.

Consumers benefit from packaging innovations that improve convenience, safety, and environmental sustainability. Extended shelf life reduces food waste while portion control packaging supports healthy lifestyles. Easy-open features improve accessibility for elderly and disabled consumers.

Environmental stakeholders gain from industry commitment to sustainability through reduced material usage, increased recycling, and development of biodegradable alternatives. Circular economy initiatives support waste reduction and resource conservation goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation dominates market trends as companies develop circular economy solutions and reduce environmental impact. Recyclable packaging design becomes standard practice while biodegradable materials gain market acceptance. Packaging reduction strategies minimize material usage without compromising protection or functionality.

Digital integration accelerates across the packaging value chain through smart manufacturing, connected packaging, and data analytics. Industry 4.0 technologies optimize production efficiency while enabling mass customization. Blockchain integration provides supply chain transparency and product authentication.

E-commerce adaptation drives packaging innovation for online retail requirements. Protective packaging solutions minimize damage during shipping while branded unboxing experiences enhance customer engagement. Return packaging systems support circular economy principles.

Personalization trends create demand for customizable packaging solutions and short-run production capabilities. Digital printing technologies enable variable data printing and limited edition packaging. Consumer engagement through interactive packaging features and augmented reality integration.

Health and safety focus intensifies following pandemic experiences, driving demand for antimicrobial packaging and contactless solutions. Hygiene packaging addresses consumer concerns while tamper-evident features ensure product integrity.

Recent developments in the UK packaging market reflect accelerating innovation and strategic repositioning. MarkWide Research analysis indicates significant investment in sustainable packaging technologies with automation adoption increasing by 26% annually across major manufacturers.

Merger and acquisition activity continues reshaping the competitive landscape as companies seek scale advantages and technological capabilities. Strategic partnerships between packaging companies and technology providers accelerate innovation development. Investment flows target circular economy solutions and digital integration platforms.

Regulatory developments include implementation of Extended Producer Responsibility schemes and plastic reduction targets. Government initiatives support packaging innovation through research funding and tax incentives. Industry collaboration increases through trade associations and sustainability coalitions.

Technology breakthroughs include advanced recycling processes, bio-based material development, and smart packaging integration. Manufacturing innovations improve efficiency while reducing environmental impact. Supply chain digitalization enhances traceability and optimization capabilities.

Market expansion initiatives target international opportunities while domestic companies strengthen their competitive positions. Export promotion activities support UK packaging expertise in global markets. Innovation clusters develop around universities and research institutions.

Strategic recommendations for UK packaging market participants emphasize sustainability leadership, technological innovation, and market diversification. Investment priorities should focus on circular economy solutions, automation technologies, and digital integration capabilities.

Sustainability initiatives require comprehensive approaches including material selection, design optimization, and end-of-life management. Circular economy strategies should encompass closed-loop systems, recycling partnerships, and biodegradable alternatives. Carbon footprint reduction becomes essential for competitive positioning and regulatory compliance.

Technology adoption should prioritize smart manufacturing systems, data analytics, and connected packaging solutions. Digital transformation enables operational efficiency while supporting customization and shorter production runs. Automation investment improves quality consistency while addressing labor shortage challenges.

Market diversification strategies should explore high-growth segments including healthcare packaging, e-commerce solutions, and premium applications. Export development leverages UK expertise in sustainable technologies and design innovation. Partnership strategies enable access to new technologies and markets while sharing development costs.

Risk management approaches should address raw material volatility, regulatory changes, and competitive pressures. Supply chain resilience requires diversified sourcing and strategic inventory management. Regulatory compliance systems ensure adherence to evolving environmental and safety requirements.

Long-term prospects for the UK packaging market remain positive despite near-term challenges, with sustainable packaging solutions expected to achieve 42% market penetration by 2030. Growth projections indicate continued expansion driven by innovation, regulatory support, and changing consumer preferences.

Sustainability transformation will accelerate as circular economy principles become mainstream practice. Bio-based materials are projected to capture 15% market share within the next decade. Recycling infrastructure development will support closed-loop packaging systems and waste reduction goals.

Digital integration will revolutionize packaging operations through smart manufacturing, connected products, and data-driven optimization. Industry 4.0 adoption will enable mass customization while improving efficiency and quality. Artificial intelligence applications will optimize design, production, and supply chain management.

Market consolidation will continue as companies seek scale advantages and technological capabilities. Strategic partnerships will become essential for accessing innovation and new markets. International expansion will leverage UK expertise in premium and sustainable packaging solutions.

Regulatory evolution will drive continued innovation in sustainable packaging while creating opportunities for compliant solutions. Consumer expectations will increasingly influence packaging design and material selection. Economic recovery will support investment in new technologies and capacity expansion.

The UK packaging market demonstrates remarkable resilience and innovation capacity, positioning itself for sustained growth despite evolving challenges. Sustainability leadership emerges as a defining characteristic, with companies pioneering circular economy solutions and environmental responsibility. Technological advancement continues driving operational efficiency while enabling new value propositions and market opportunities.

Market fundamentals remain strong, supported by diverse industrial base, skilled workforce, and established supply chains. Strategic positioning in premium and sustainable packaging segments leverages UK expertise while addressing global market demands. Innovation ecosystems foster collaboration between industry, academia, and government supporting breakthrough technologies.

Future success will depend on continued investment in sustainability, technology, and market diversification. Companies that embrace circular economy principles, digital integration, and customer partnership strategies will capture the greatest opportunities. The UK packaging market is well-positioned to maintain its competitive advantages while contributing to environmental sustainability and economic growth.

What is Packaging?

Packaging refers to the technology and process of enclosing or protecting products for distribution, storage, sale, and use. It encompasses various materials and designs tailored to specific products and consumer needs.

What are the key players in the UK Packaging Market?

Key players in the UK Packaging Market include Amcor, DS Smith, and Smurfit Kappa, which are known for their innovative packaging solutions and sustainability initiatives, among others.

What are the main drivers of growth in the UK Packaging Market?

The main drivers of growth in the UK Packaging Market include the increasing demand for sustainable packaging solutions, the rise of e-commerce, and the need for enhanced product protection and shelf appeal.

What challenges does the UK Packaging Market face?

The UK Packaging Market faces challenges such as regulatory pressures regarding sustainability, rising raw material costs, and the need to adapt to changing consumer preferences for eco-friendly packaging.

What opportunities exist in the UK Packaging Market?

Opportunities in the UK Packaging Market include the development of biodegradable materials, the integration of smart packaging technologies, and the expansion of packaging solutions for the food and beverage sector.

What trends are shaping the UK Packaging Market?

Trends shaping the UK Packaging Market include a shift towards minimalistic designs, increased use of recycled materials, and the adoption of digital printing technologies to enhance customization and branding.

UK Packaging Market

| Segmentation Details | Description |

|---|---|

| Packaging Type | Flexible, Rigid, Semi-Rigid, Sustainable |

| Material | Plastic, Glass, Metal, Paper |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Electronics |

| Application | Retail, Industrial, E-commerce, Healthcare |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at