444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Bangladesh lubricants market represents a rapidly expanding sector within the country’s industrial landscape, driven by increasing automotive production, growing manufacturing activities, and rising infrastructure development. Market dynamics indicate substantial growth potential as Bangladesh continues its economic transformation from an agriculture-based economy to a more industrialized nation. The lubricants industry encompasses various product categories including engine oils, hydraulic fluids, gear oils, and specialty lubricants serving diverse applications across automotive, industrial, and marine sectors.

Economic growth in Bangladesh has created favorable conditions for lubricant consumption, with the country experiencing significant expansion in its automotive fleet, manufacturing base, and construction activities. The market demonstrates strong fundamentals with increasing demand from both domestic and industrial consumers. Automotive sector growth particularly drives market expansion, as vehicle ownership rates continue to rise alongside improving living standards and urbanization trends.

Industrial development initiatives supported by government policies have created substantial opportunities for lubricant suppliers. The textile industry, being Bangladesh’s largest manufacturing sector, represents a significant consumer of industrial lubricants for machinery maintenance and operations. Additionally, the growing power generation sector and expanding transportation infrastructure contribute to sustained demand growth at an estimated 8.5% annual growth rate.

The Bangladesh lubricants market refers to the comprehensive ecosystem of lubricating oil products, including engine oils, industrial lubricants, and specialty fluids, distributed and consumed within Bangladesh’s automotive, industrial, and commercial sectors for equipment maintenance, performance optimization, and operational efficiency.

Lubricants serve critical functions in reducing friction, preventing wear, controlling temperature, and protecting mechanical components across various applications. In the Bangladesh context, this market encompasses both imported premium products and locally manufactured lubricants catering to diverse price segments and quality requirements. The market includes distribution networks, retail channels, and service providers supporting lubricant supply chains throughout the country.

Market participants range from international oil companies establishing local presence to domestic manufacturers developing indigenous production capabilities. The sector plays a vital role in supporting Bangladesh’s industrial growth by ensuring reliable lubrication solutions for manufacturing equipment, transportation fleets, and infrastructure projects essential for economic development.

Bangladesh’s lubricants market demonstrates robust growth trajectory supported by expanding automotive ownership, industrial modernization, and infrastructure development initiatives. The market benefits from favorable demographic trends, including urbanization and rising middle-class population, which drive increased vehicle ownership and industrial activity. Government initiatives promoting manufacturing and export-oriented industries create sustained demand for industrial lubricants across various sectors.

Market segmentation reveals automotive lubricants commanding the largest share, followed by industrial applications and marine lubricants. The automotive segment benefits from growing vehicle imports, local assembly operations, and expanding public transportation systems. Industrial lubricants experience strong demand from textile manufacturing, power generation, and construction equipment operations, with approximately 35% market share attributed to industrial applications.

Competitive landscape features both international brands and local manufacturers competing across different price segments. Premium international brands focus on high-performance applications, while local manufacturers serve price-sensitive segments with cost-effective solutions. The market shows increasing preference for synthetic and semi-synthetic lubricants, driven by awareness of performance benefits and equipment protection requirements.

Strategic insights reveal several key factors shaping the Bangladesh lubricants market landscape:

Economic development serves as the primary driver for Bangladesh’s lubricants market expansion. The country’s sustained GDP growth creates favorable conditions for increased industrial activity, automotive ownership, and infrastructure development. Manufacturing sector expansion particularly drives demand for industrial lubricants as factories require reliable lubrication solutions for machinery maintenance and operational efficiency.

Automotive sector growth represents another significant driver, with increasing vehicle imports, local assembly operations, and expanding public transportation systems. The growing middle class demonstrates higher vehicle ownership rates, creating sustained demand for automotive lubricants. Commercial vehicle expansion for logistics and transportation services further amplifies lubricant consumption across the automotive segment.

Infrastructure development initiatives supported by government policies create substantial opportunities for specialty and industrial lubricants. Construction projects, power generation facilities, and transportation infrastructure require specialized lubrication solutions. Industrial modernization trends drive adoption of advanced lubricant technologies as manufacturers seek improved equipment performance and reduced maintenance costs.

Urbanization trends contribute to market growth by increasing vehicle density in urban areas and supporting commercial activities requiring lubrication solutions. The expanding service sector, including logistics and transportation services, creates additional demand for automotive and industrial lubricants across various applications.

Price sensitivity represents a significant restraint in the Bangladesh lubricants market, as cost-conscious consumers often prioritize lower-priced products over premium alternatives. This preference for economical options limits market penetration of high-performance synthetic lubricants and advanced formulations. Import dependency for raw materials and finished products creates vulnerability to international price fluctuations and supply chain disruptions.

Limited awareness about lubricant quality differences and performance benefits constrains premium product adoption. Many consumers, particularly in rural areas, lack understanding of how quality lubricants contribute to equipment longevity and operational efficiency. Counterfeit products in the market create additional challenges by undermining consumer confidence and creating unfair competition for legitimate manufacturers.

Infrastructure limitations in distribution networks affect product availability in remote areas, limiting market reach and growth potential. Inadequate storage facilities and transportation networks create logistical challenges for lubricant suppliers. Regulatory constraints and bureaucratic processes can slow market entry for new products and technologies.

Economic volatility and currency fluctuations impact import costs and pricing strategies, creating uncertainty for market participants. Limited access to financing for small and medium enterprises affects their ability to invest in quality lubricants and maintenance programs.

Industrial expansion presents substantial opportunities as Bangladesh continues developing its manufacturing capabilities across various sectors. The government’s emphasis on export-oriented industries creates demand for high-quality lubricants supporting production efficiency and equipment reliability. Textile industry growth offers particular opportunities given its significance in Bangladesh’s economy and substantial lubricant requirements for machinery operations.

Automotive market development provides opportunities for both automotive lubricants and related services. Expanding vehicle assembly operations and growing aftermarket services create demand for specialized lubricants and maintenance solutions. Commercial transportation growth driven by e-commerce and logistics expansion offers opportunities for fleet-focused lubricant solutions and service programs.

Technology advancement opportunities exist in introducing synthetic and bio-based lubricants catering to environmentally conscious consumers and applications requiring superior performance. Local manufacturing development presents opportunities for establishing production facilities and reducing import dependency while serving regional markets more effectively.

Rural market penetration offers untapped potential as agricultural mechanization increases and rural infrastructure develops. The growing power generation sector, including renewable energy projects, creates opportunities for specialized lubricants supporting equipment operations and maintenance requirements.

Supply chain dynamics in the Bangladesh lubricants market reflect a complex interplay between international suppliers, local manufacturers, and distribution networks. Import relationships with major oil-producing countries influence product availability and pricing structures, while domestic production capabilities continue developing to serve local market needs. The market demonstrates increasing integration between upstream suppliers and downstream distributors to ensure reliable product availability.

Competitive dynamics feature intense competition across different market segments, with international brands competing on quality and performance while local manufacturers focus on cost competitiveness and market accessibility. Brand loyalty varies significantly across consumer segments, with industrial users often prioritizing performance and reliability over price considerations, while individual consumers frequently emphasize cost-effectiveness.

Technological dynamics show gradual adoption of advanced lubricant formulations, with approximately 25% market penetration of synthetic and semi-synthetic products in premium applications. Innovation trends focus on developing products suitable for local climate conditions and equipment requirements while meeting international quality standards.

Regulatory dynamics continue evolving as Bangladesh develops environmental standards and quality regulations affecting lubricant formulations and disposal practices. Market consolidation trends indicate increasing cooperation between international companies and local partners to leverage combined expertise and market access capabilities.

Comprehensive research methodology employed for analyzing the Bangladesh lubricants market incorporates multiple data sources and analytical approaches to ensure accurate market assessment. Primary research includes extensive interviews with industry participants, including manufacturers, distributors, retailers, and end-users across various sectors and geographic regions within Bangladesh.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial information to validate primary findings and establish market trends. Market sizing methodologies combine bottom-up and top-down approaches, analyzing consumption patterns across different application segments and geographic regions.

Data validation processes include cross-referencing multiple sources, conducting expert interviews, and performing statistical analysis to ensure research accuracy and reliability. Quantitative analysis incorporates statistical modeling and trend analysis to project market growth and identify key performance indicators.

Qualitative assessment includes competitive analysis, regulatory review, and technology evaluation to understand market dynamics and future development potential. The research methodology ensures comprehensive coverage of market segments, geographic regions, and industry stakeholders to provide complete market understanding.

Dhaka region dominates the Bangladesh lubricants market, accounting for approximately 40% market share due to its concentration of automotive dealerships, industrial facilities, and commercial activities. The capital region benefits from superior distribution infrastructure, higher consumer purchasing power, and proximity to major ports facilitating product imports. Industrial zones around Dhaka create substantial demand for industrial lubricants supporting manufacturing operations.

Chittagong region represents the second-largest market segment, driven by its status as Bangladesh’s primary port city and industrial center. The region’s concentration of textile manufacturing, pharmaceutical production, and shipping activities creates diverse demand for lubricant products. Port operations generate significant demand for marine lubricants and specialized industrial applications.

Sylhet region shows growing market potential driven by industrial development and increasing commercial activities. The region’s tea industry and emerging manufacturing sectors create demand for specialized lubricants. Northern regions including Rangpur and Rajshahi demonstrate increasing market activity as agricultural mechanization expands and industrial development progresses.

Southern regions including Barisal and Khulna show market growth potential driven by agricultural activities, fishing industry, and emerging industrial development. Rural market penetration remains limited but shows improvement as distribution networks expand and agricultural mechanization increases across these regions.

Market leadership in Bangladesh’s lubricants sector features a mix of international oil companies and domestic manufacturers competing across different segments and price points. The competitive environment demonstrates clear segmentation between premium international brands and cost-competitive local alternatives.

Competitive strategies vary significantly across market participants, with international brands emphasizing product quality, technical support, and brand reputation, while local manufacturers focus on competitive pricing, market accessibility, and customer service. Market positioning reflects clear differentiation between premium performance products and cost-effective alternatives serving different consumer segments.

Product-based segmentation reveals distinct market categories serving different applications and performance requirements:

Application-based segmentation demonstrates market distribution across various end-use sectors:

Technology-based segmentation shows market evolution toward advanced formulations:

Automotive lubricants represent the largest market category, driven by expanding vehicle ownership and increasing awareness of maintenance requirements. Engine oils dominate this segment, with growing preference for multi-grade formulations suitable for local climate conditions. The category benefits from expanding automotive aftermarket services and increasing vehicle complexity requiring specialized lubricants.

Industrial lubricants demonstrate strong growth potential driven by manufacturing sector expansion and industrial modernization initiatives. Hydraulic fluids show particular demand growth from construction equipment and manufacturing machinery applications. The textile industry represents a major consumer within this category, requiring specialized lubricants for high-speed machinery operations.

Marine lubricants benefit from Bangladesh’s significant shipping and fishing industries, with 15% market share attributed to marine applications. Cylinder oils and marine diesel engine oils represent key products within this category, serving both commercial shipping and fishing vessel requirements.

Specialty lubricants show emerging demand from high-performance applications requiring advanced formulations. Food-grade lubricants gain importance as food processing industries expand and quality standards improve. This category demonstrates highest growth potential as industries adopt more sophisticated equipment and performance requirements.

Manufacturers benefit from expanding market opportunities driven by economic growth and industrial development. The growing market provides opportunities for capacity expansion, product diversification, and technology advancement. Local production development offers advantages including reduced import dependency, improved supply chain control, and better market responsiveness.

Distributors and retailers benefit from increasing demand across various market segments and geographic regions. Distribution network expansion creates opportunities for market penetration and revenue growth. The developing market provides advantages for establishing strong customer relationships and building brand loyalty through superior service delivery.

End-users benefit from improved product availability, competitive pricing, and advancing lubricant technologies. Industrial customers gain advantages through reduced equipment maintenance costs, improved operational efficiency, and extended equipment life. Automotive consumers benefit from better engine protection, fuel economy improvements, and reduced maintenance frequency.

Government stakeholders benefit from industrial development, employment generation, and reduced import dependency through local manufacturing development. Economic benefits include tax revenue generation, foreign exchange savings, and technology transfer supporting overall economic development objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Synthetic lubricant adoption represents a significant trend as consumers increasingly recognize performance benefits and cost-effectiveness over extended service intervals. Industrial applications lead this trend, with approximately 30% adoption rate in manufacturing sectors requiring high-performance lubrication solutions. The trend reflects growing awareness of total cost of ownership rather than initial purchase price considerations.

Environmental consciousness drives increasing interest in bio-based and environmentally friendly lubricant formulations. Sustainability initiatives by major industrial users create demand for products with reduced environmental impact. This trend aligns with global environmental standards and corporate responsibility programs adopted by multinational companies operating in Bangladesh.

Digital transformation influences lubricant marketing and distribution strategies, with online platforms gaining importance for product information and purchasing decisions. E-commerce growth creates new distribution channels and customer engagement opportunities. Digital technologies also enable better inventory management and customer service delivery.

Service integration trends show lubricant suppliers expanding beyond product sales to include maintenance services, technical support, and equipment monitoring. Value-added services create competitive differentiation and stronger customer relationships. This trend particularly benefits industrial applications where technical expertise adds significant value.

Manufacturing capacity expansion represents a major industry development as both international and domestic companies invest in local production facilities. MarkWide Research analysis indicates several major players have announced plans for establishing or expanding manufacturing operations in Bangladesh to serve growing domestic and regional demand.

Technology partnerships between international lubricant companies and local manufacturers facilitate knowledge transfer and product development capabilities. These collaborations enable access to advanced formulations while leveraging local market knowledge and distribution networks. Joint ventures provide platforms for combining international expertise with local market access.

Distribution network expansion continues as companies invest in reaching underserved markets and improving product availability. Retail partnerships with automotive service centers and industrial suppliers enhance market penetration and customer access. Modern distribution centers improve supply chain efficiency and product quality maintenance.

Product innovation focuses on developing formulations suitable for local climate conditions and equipment requirements while meeting international quality standards. Research and development investments target specific applications in key industries such as textiles, pharmaceuticals, and power generation.

Market entry strategies should prioritize understanding local consumer preferences and price sensitivity while building strong distribution networks. Successful companies typically combine competitive pricing with reliable product quality and superior customer service. New entrants should consider partnerships with established local distributors to accelerate market penetration.

Product portfolio development should focus on formulations suitable for local climate conditions and equipment types commonly used in Bangladesh. Market research indicates strong demand for products offering good performance at competitive price points rather than premium products with advanced features. Customization for local requirements creates competitive advantages.

Investment priorities should emphasize distribution infrastructure development and local manufacturing capabilities to reduce costs and improve market responsiveness. Supply chain optimization becomes critical for maintaining competitive pricing while ensuring product availability across diverse geographic markets.

Brand building strategies should focus on educating consumers about lubricant quality benefits and total cost of ownership advantages. Technical support services create differentiation opportunities and build customer loyalty, particularly in industrial applications where expertise adds significant value.

Long-term growth prospects for the Bangladesh lubricants market remain highly positive, supported by sustained economic development, industrial expansion, and increasing automotive ownership. Market evolution toward higher-quality products and advanced formulations will continue as consumer awareness improves and industrial applications become more sophisticated.

Technology advancement will drive market transformation, with synthetic and bio-based lubricants gaining increased acceptance across various applications. MWR projections indicate continued growth in premium product segments as total cost of ownership considerations become more important than initial purchase price. Environmental regulations will further accelerate adoption of advanced formulations.

Industrial development initiatives will create sustained demand growth, particularly in manufacturing sectors prioritized by government policies. Export-oriented industries will drive demand for high-quality lubricants meeting international standards. The power generation sector expansion will create opportunities for specialized lubricant applications.

Market consolidation trends may emerge as the industry matures, with successful companies expanding market share through superior distribution networks, product quality, and customer service. Regional expansion opportunities will develop as Bangladesh’s economy integrates more closely with neighboring markets, creating export potential for domestic manufacturers.

Bangladesh’s lubricants market presents compelling growth opportunities driven by robust economic development, expanding industrial base, and increasing automotive ownership. The market demonstrates strong fundamentals with diverse demand sources across automotive, industrial, and marine applications. Competitive dynamics favor companies that successfully balance product quality with competitive pricing while building strong distribution networks and customer relationships.

Strategic success factors include understanding local market requirements, developing appropriate product formulations, and investing in distribution infrastructure to serve diverse geographic markets effectively. Technology trends toward synthetic and environmentally friendly lubricants create opportunities for differentiation and value creation. The market’s evolution from price-focused to value-focused purchasing decisions provides opportunities for premium product positioning.

Future market development will be shaped by continued economic growth, industrial modernization, and increasing quality awareness among consumers. Companies that invest in local manufacturing capabilities, advanced product formulations, and comprehensive customer service will be best positioned to capitalize on the market’s substantial growth potential and establish sustainable competitive advantages in this dynamic and expanding market.

What is Lubricants?

Lubricants are substances used to reduce friction between surfaces in mutual contact, which ultimately reduces the heat generated when the surfaces move. They are essential in various applications, including automotive, industrial machinery, and consumer products.

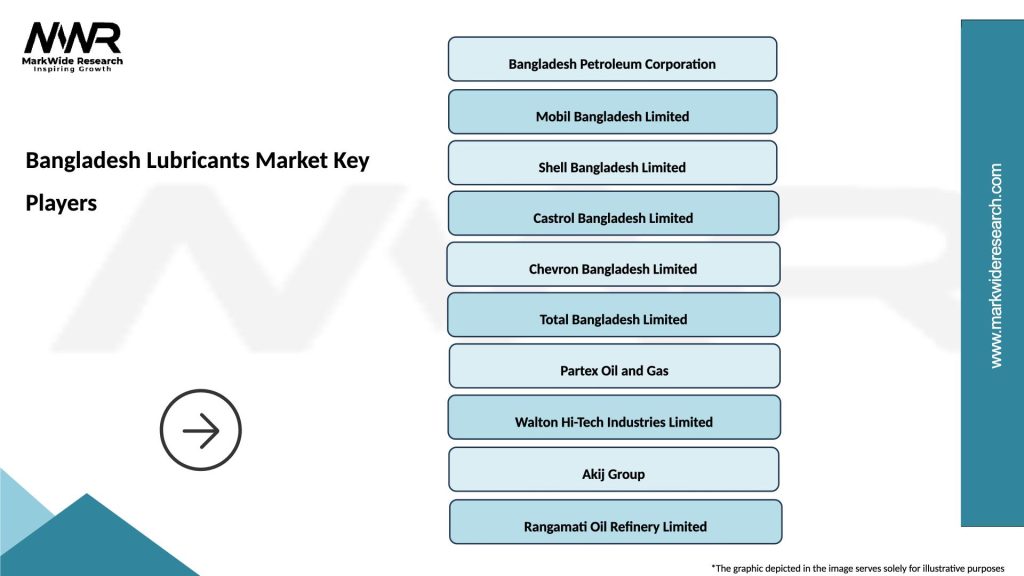

What are the key players in the Bangladesh Lubricants Market?

Key players in the Bangladesh Lubricants Market include Bangladesh Petroleum Corporation, Mobil, and Castrol, among others. These companies are involved in the production and distribution of various lubricant products for automotive and industrial applications.

What are the growth factors driving the Bangladesh Lubricants Market?

The growth of the Bangladesh Lubricants Market is driven by increasing automotive sales, industrial growth, and the rising demand for high-performance lubricants. Additionally, advancements in lubricant formulations are enhancing product efficiency and performance.

What challenges does the Bangladesh Lubricants Market face?

The Bangladesh Lubricants Market faces challenges such as fluctuating raw material prices and environmental regulations. Additionally, competition from unbranded and low-cost products can impact market dynamics.

What opportunities exist in the Bangladesh Lubricants Market?

Opportunities in the Bangladesh Lubricants Market include the growing demand for bio-based lubricants and the expansion of the automotive sector. Furthermore, increasing awareness of the benefits of high-quality lubricants presents potential growth avenues.

What trends are shaping the Bangladesh Lubricants Market?

Trends in the Bangladesh Lubricants Market include the shift towards synthetic lubricants and the adoption of advanced formulations that enhance performance. Additionally, there is a growing focus on sustainability and eco-friendly products in the lubricant industry.

Bangladesh Lubricants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Engine Oil, Gear Oil, Hydraulic Oil, Grease |

| End User | Automotive, Industrial, Marine, Agriculture |

| Packaging Type | Bottles, Drums, Bulk, Pails |

| Grade | Synthetic, Semi-Synthetic, Mineral, Bio-Based |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Bangladesh Lubricants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at