444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam real estate and mortgage market represents one of Southeast Asia’s most dynamic and rapidly evolving property sectors, driven by robust economic growth, urbanization trends, and increasing foreign investment. Vietnam’s property landscape has transformed significantly over the past decade, with major cities like Ho Chi Minh City and Hanoi experiencing unprecedented development activity. The market encompasses residential, commercial, and industrial real estate segments, each contributing to the country’s economic expansion and modernization efforts.

Market dynamics indicate substantial growth potential, with the residential sector experiencing particularly strong demand from both domestic and international buyers. The mortgage market has evolved considerably, with local and international banks expanding their lending portfolios to accommodate growing property financing needs. Government initiatives supporting homeownership and foreign investment have created favorable conditions for market expansion, while infrastructure development projects continue to enhance property values across key regions.

Foreign investment flows have increased significantly, with investors from Japan, South Korea, and Singapore showing particular interest in Vietnam’s real estate opportunities. The market benefits from a young demographic profile, with approximately 65% of the population under 35 years old, creating sustained demand for housing and commercial properties. Urbanization rates continue to accelerate, with projections indicating continued migration from rural to urban areas, further supporting property market growth.

The Vietnam real estate and mortgage market refers to the comprehensive ecosystem of property development, sales, leasing, and financing activities within Vietnam’s borders, encompassing residential, commercial, and industrial real estate transactions alongside the associated mortgage lending and financial services sector. This market includes primary and secondary property sales, rental markets, property development projects, and the full spectrum of mortgage products offered by banks and financial institutions to facilitate property acquisitions.

Real estate components within this market span luxury condominiums, affordable housing projects, office buildings, retail spaces, industrial parks, and land development initiatives. The mortgage segment encompasses various lending products including home loans, commercial property financing, construction loans, and refinancing options provided by domestic banks, foreign financial institutions, and specialized mortgage companies operating within Vietnam’s regulatory framework.

Vietnam’s real estate and mortgage market demonstrates remarkable resilience and growth potential, supported by favorable demographic trends, economic expansion, and progressive government policies. The market has experienced consistent development activity, with major urban centers leading growth in both residential and commercial segments. Mortgage penetration rates have improved substantially, reaching approximately 12% of GDP, indicating significant room for further expansion compared to regional peers.

Key market drivers include rapid urbanization, rising middle-class income levels, and increasing foreign direct investment in property development. The government’s commitment to infrastructure development, including new airports, highways, and urban transit systems, continues to enhance property values and market attractiveness. Digital transformation within the real estate sector has accelerated, with online property platforms and digital mortgage applications becoming increasingly prevalent.

Market challenges include regulatory complexities, foreign ownership restrictions, and periodic policy adjustments that impact investor sentiment. However, the overall trajectory remains positive, with MarkWide Research analysis indicating sustained growth potential across multiple property segments and geographic regions throughout Vietnam.

Strategic market insights reveal several critical trends shaping Vietnam’s real estate and mortgage landscape:

Economic growth momentum serves as the primary catalyst for Vietnam’s real estate and mortgage market expansion. The country’s consistent GDP growth, averaging 6.5% annually over recent years, has created favorable conditions for property investment and homeownership. Rising disposable incomes among urban populations have increased purchasing power, enabling more Vietnamese citizens to enter the property market and seek mortgage financing for home acquisitions.

Urbanization trends continue driving demand across residential and commercial property segments. Rural-to-urban migration patterns create sustained pressure on housing supply in major cities, supporting property values and development activity. Infrastructure development projects, including new highways, airports, and public transportation systems, enhance connectivity and accessibility, making previously underdeveloped areas attractive for property investment.

Foreign direct investment policies have created opportunities for international property investors and developers, bringing capital, expertise, and global best practices to Vietnam’s real estate sector. Government initiatives supporting homeownership, including subsidized mortgage programs and tax incentives for first-time buyers, have expanded market participation and mortgage demand.

Banking sector development has improved mortgage product availability and accessibility, with both domestic and foreign banks expanding their real estate financing portfolios. Digital transformation within the financial services sector has streamlined mortgage application processes, reducing approval times and enhancing customer experience.

Regulatory complexities present significant challenges for both domestic and foreign market participants. Foreign ownership restrictions limit international investors’ ability to acquire certain types of properties, potentially constraining market liquidity and investment flows. Frequent policy changes and unclear regulatory interpretations can create uncertainty for developers and investors, impacting long-term planning and investment decisions.

Mortgage market limitations include relatively high interest rates compared to developed markets and stringent lending criteria that may exclude potential borrowers. Credit assessment challenges arise from limited credit history data for many Vietnamese consumers, making risk evaluation difficult for lenders and potentially restricting mortgage accessibility.

Infrastructure constraints in secondary cities and emerging markets can limit property development potential and investor interest. Land acquisition complexities, including unclear land titles and bureaucratic processes, can delay development projects and increase costs for developers.

Market volatility concerns related to economic cycles and external factors can impact investor confidence and property demand. Currency fluctuation risks may affect foreign investors and developers, particularly those with significant exposure to Vietnamese dong-denominated assets.

Affordable housing development presents substantial opportunities as government initiatives focus on addressing housing shortages for middle and lower-income populations. Public-private partnerships in affordable housing projects offer developers access to government support while addressing critical social needs and market demand.

Secondary city development offers significant growth potential as infrastructure improvements and economic development extend beyond major urban centers. Industrial real estate expansion aligns with Vietnam’s manufacturing growth and foreign investment in production facilities, creating opportunities for specialized developers and investors.

PropTech innovation creates opportunities for technology companies and traditional real estate firms to develop digital solutions for property search, transaction management, and mortgage processing. Green building initiatives and sustainable development practices offer differentiation opportunities for developers targeting environmentally conscious consumers and international tenants.

Mortgage market expansion provides opportunities for financial institutions to develop innovative lending products and expand market penetration. Real estate investment trusts (REITs) development could provide new investment vehicles and improve market liquidity while offering retail investors access to real estate exposure.

Supply and demand dynamics in Vietnam’s real estate market reflect the complex interplay between rapid urbanization, economic growth, and regulatory constraints. Housing supply shortages in major cities continue to support property values, while new development projects struggle to keep pace with growing demand from both domestic and foreign buyers.

Price appreciation trends vary significantly across different property types and geographic locations, with luxury residential properties in prime urban areas experiencing the strongest growth. Rental market dynamics show increasing demand for quality rental properties, particularly in business districts and areas with strong transportation connectivity.

Financing market evolution demonstrates improving accessibility and product diversity, though mortgage penetration rates remain below regional benchmarks. Interest rate environments significantly impact mortgage demand and property affordability, with central bank policies directly influencing market activity levels.

Foreign investment patterns show increasing sophistication, with international investors moving beyond simple property acquisition to participate in development projects and real estate funds. Market cyclicality reflects broader economic conditions, with property markets showing sensitivity to both domestic economic performance and regional market trends.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Vietnam’s real estate and mortgage market. Primary research activities include extensive interviews with key market participants, including property developers, real estate agents, mortgage lenders, government officials, and industry associations.

Secondary research components encompass analysis of government statistics, banking sector reports, property transaction data, and regulatory documentation. Market surveys conducted among property buyers, sellers, and mortgage borrowers provide valuable insights into consumer behavior, preferences, and market perceptions.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Quantitative analysis includes statistical modeling of market trends, price movements, and transaction volumes across different property segments and geographic regions.

Qualitative assessment incorporates expert opinions, industry insights, and forward-looking analysis to provide comprehensive market understanding. Regional analysis examines market conditions across Vietnam’s key cities and provinces, identifying local trends and opportunities that may not be apparent in national-level data.

Ho Chi Minh City dominates Vietnam’s real estate market, accounting for approximately 35% of total property transactions nationwide. The city’s status as the economic center drives strong demand across residential, commercial, and industrial property segments. Luxury residential developments in districts 1, 2, and 7 attract significant foreign investment, while affordable housing projects in outer districts address growing middle-class demand.

Hanoi’s property market represents approximately 25% of national activity, with strong government and diplomatic presence supporting premium residential and office space demand. Infrastructure development projects, including new metro lines and highway connections, continue to enhance property values in previously underdeveloped areas.

Da Nang emerges as a significant secondary market, benefiting from tourism growth and government designation as a special economic zone. Coastal property development attracts both domestic and international buyers seeking vacation homes and investment properties.

Emerging markets including Hai Phong, Can Tho, and Nha Trang show increasing development activity as infrastructure improvements and economic growth extend beyond major urban centers. Industrial zones in these regions attract manufacturing-related real estate investment, supporting broader market development.

MarkWide Research analysis indicates that regional market performance increasingly correlates with infrastructure development and government investment priorities, creating opportunities for investors who can identify emerging growth areas before mainstream market recognition.

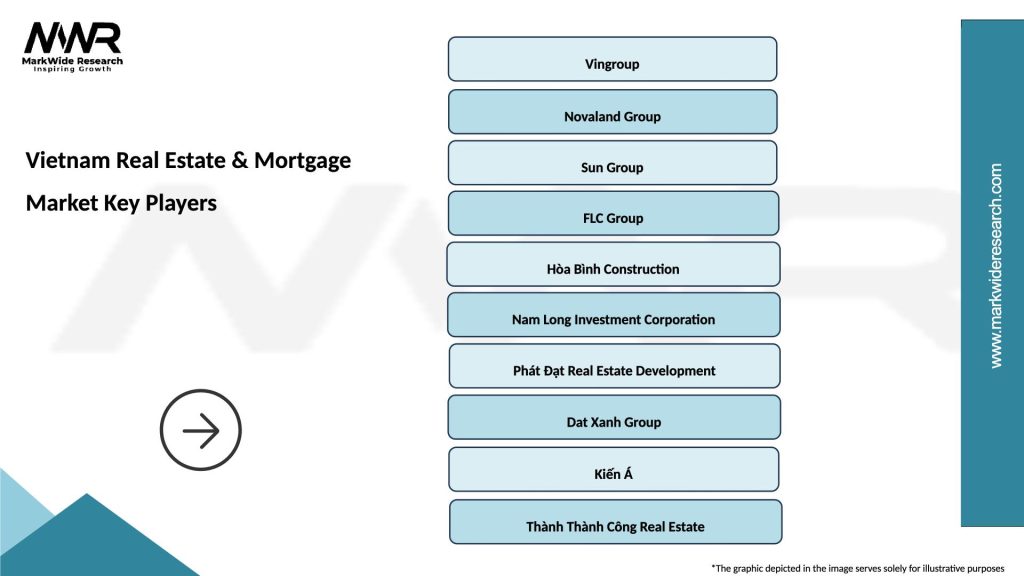

Vietnam’s real estate market features a diverse competitive landscape encompassing domestic developers, international property companies, and joint venture partnerships. Leading market participants include:

Mortgage market competition includes both domestic and foreign banks, with Vietcombank, BIDV, and VietinBank leading in mortgage lending volumes. Foreign banks including HSBC, Standard Chartered, and ANZ target premium segments with specialized mortgage products and services.

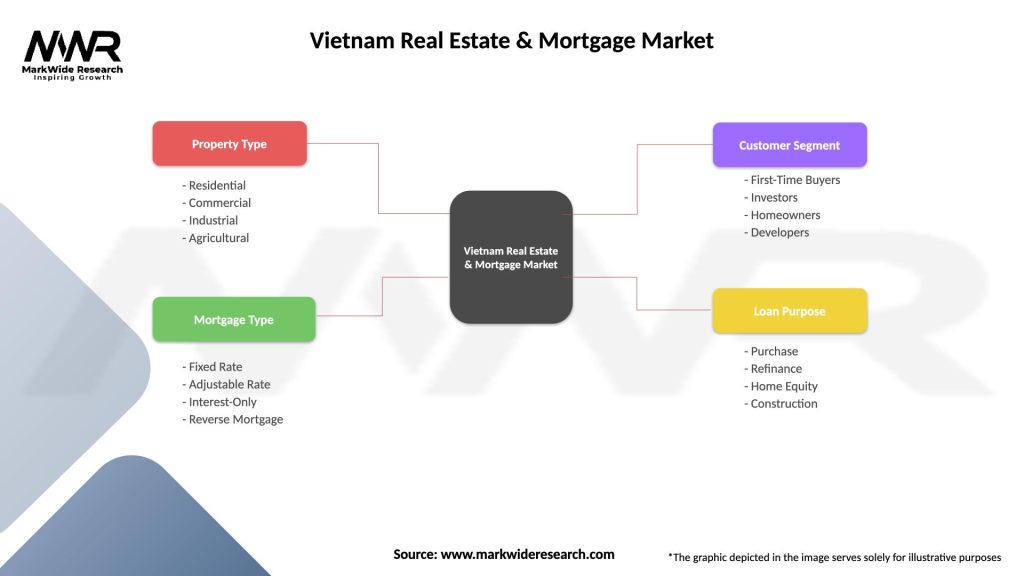

Property type segmentation reveals distinct market dynamics across different real estate categories:

Residential Segment:

Commercial Segment:

Industrial Segment:

Residential market performance shows strong demand across all price segments, with luxury properties experiencing the highest price appreciation rates. Condominium developments dominate urban markets, offering modern amenities and convenient locations that appeal to young professionals and foreign residents. Affordable housing initiatives receive government support through subsidized land costs and tax incentives, creating opportunities for developers focused on social housing.

Commercial real estate dynamics reflect Vietnam’s economic growth and increasing foreign business presence. Office space demand remains strong in central business districts, with Grade A buildings commanding premium rents from multinational corporations and growing domestic companies. Retail property performance varies by location and format, with modern shopping centers outperforming traditional retail spaces.

Industrial real estate growth aligns with Vietnam’s manufacturing expansion and foreign direct investment in production facilities. Logistics and warehouse demand increases alongside e-commerce growth and supply chain optimization efforts by international companies establishing regional distribution centers.

Mortgage market segmentation shows varying product preferences across different borrower categories. First-time homebuyers typically seek longer-term loans with lower down payment requirements, while property investors prefer flexible financing structures that accommodate multiple property acquisitions.

Property developers benefit from strong market demand, government infrastructure investment, and improving access to development financing. Urban planning initiatives create opportunities for large-scale developments that can capture significant market share while contributing to city modernization efforts.

Real estate investors gain exposure to one of Asia’s fastest-growing property markets, with opportunities for both capital appreciation and rental income generation. Portfolio diversification benefits include geographic and currency diversification for international investors seeking emerging market exposure.

Financial institutions expand their lending portfolios through mortgage market participation, benefiting from growing demand for property financing and relatively attractive interest rate spreads. Cross-selling opportunities include insurance products, wealth management services, and other financial products to mortgage customers.

Government stakeholders achieve economic development objectives through real estate market growth, including job creation, tax revenue generation, and urban development. Foreign investment attraction supports broader economic goals while bringing international expertise and capital to domestic markets.

End consumers benefit from improved housing options, competitive mortgage products, and enhanced property management services. Lifestyle improvements result from modern developments offering superior amenities and connectivity compared to older housing stock.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across Vietnam’s real estate sector, with online property platforms, virtual tours, and digital mortgage applications becoming standard practice. PropTech adoption includes artificial intelligence for property valuation, blockchain for transaction security, and mobile applications for property management.

Sustainable development practices gain prominence as developers incorporate green building standards and energy-efficient technologies to attract environmentally conscious buyers and tenants. Smart building integration includes IoT devices, automated systems, and digital infrastructure that enhance property value and operational efficiency.

Mixed-use development becomes increasingly popular as developers create integrated communities combining residential, commercial, and recreational facilities. Transit-oriented development focuses on properties near public transportation hubs, reflecting changing urban mobility preferences.

Co-living and co-working spaces emerge as alternative property formats addressing changing lifestyle and work patterns among younger demographics. Build-to-rent developments cater to growing rental market demand, particularly in urban areas where homeownership may be less accessible.

Foreign investment sophistication increases as international investors move beyond simple property acquisition to participate in development projects, real estate funds, and strategic partnerships with domestic companies.

Regulatory reforms continue to evolve, with government efforts to streamline property registration processes and clarify foreign ownership regulations. Banking sector developments include new mortgage products, improved digital lending platforms, and expanded credit assessment capabilities.

Infrastructure project completions significantly impact property markets, with new metro lines, highways, and airports enhancing connectivity and property values in previously underdeveloped areas. Special economic zone designations create new investment opportunities and development incentives in targeted regions.

International partnerships between Vietnamese developers and foreign companies bring global expertise, financing, and market access to domestic projects. Technology platform launches by major real estate companies improve customer experience and market transparency.

Affordable housing program expansions include new government initiatives, subsidized financing options, and public-private partnerships aimed at addressing housing shortages. Green building certifications become more prevalent as developers seek differentiation and comply with evolving environmental standards.

MWR data indicates that these industry developments collectively contribute to market maturation and increased investor confidence in Vietnam’s real estate sector.

Market entry strategies for new participants should focus on understanding local regulations, establishing strong local partnerships, and identifying underserved market segments. Due diligence processes must thoroughly examine land titles, regulatory compliance, and market positioning before making investment commitments.

Risk management approaches should address regulatory changes, market volatility, and currency fluctuations through diversification and hedging strategies. Local market expertise becomes critical for success, requiring partnerships with experienced domestic companies or hiring of local talent with deep market knowledge.

Technology adoption should be prioritized to improve operational efficiency, customer experience, and competitive positioning. Sustainable development practices offer differentiation opportunities and align with evolving market preferences and regulatory requirements.

Financing strategies should consider multiple funding sources, including domestic banks, international lenders, and alternative financing mechanisms. Market timing considerations require careful analysis of economic cycles, regulatory changes, and supply-demand dynamics.

Portfolio diversification across property types, geographic locations, and price segments can help mitigate risks while capturing broader market opportunities. Exit strategy planning should consider market liquidity, regulatory constraints, and tax implications for different types of investments.

Long-term market prospects for Vietnam’s real estate and mortgage sector remain highly positive, supported by continued economic growth, urbanization trends, and demographic advantages. Market maturation is expected to continue, with improved transparency, regulatory clarity, and institutional development enhancing investor confidence and market efficiency.

Growth projections indicate sustained expansion across all property segments, with residential markets benefiting from rising incomes and mortgage accessibility improvements. Commercial real estate demand should continue growing alongside economic development and foreign business establishment in Vietnam.

Mortgage market evolution will likely include product innovation, improved accessibility, and increased penetration rates as banking sector competition intensifies. Digital transformation will accelerate, with technology platforms becoming essential for market participation and customer engagement.

Infrastructure development will continue supporting property market growth, with major projects enhancing connectivity and unlocking new development opportunities. Regional market development beyond major cities will create new investment opportunities as economic growth spreads throughout the country.

Regulatory environment improvements are expected to enhance market transparency and foreign investor participation while maintaining appropriate oversight and market stability. Sustainable development will become increasingly important, with green building standards and environmental considerations influencing property values and market preferences.

Vietnam’s real estate and mortgage market represents a compelling investment opportunity characterized by strong fundamentals, favorable demographics, and supportive government policies. The market’s evolution from an emerging sector to a more sophisticated and transparent marketplace creates opportunities for both domestic and international participants across multiple property segments and geographic regions.

Market growth drivers including economic expansion, urbanization, and infrastructure development provide a solid foundation for continued expansion. While challenges related to regulatory complexity and market transparency persist, ongoing reforms and industry development initiatives address these concerns and enhance market accessibility.

Future success in Vietnam’s real estate and mortgage market will require careful attention to local market dynamics, regulatory compliance, and customer needs. Companies that can effectively navigate the regulatory environment, leverage technology for competitive advantage, and build strong local partnerships are well-positioned to capture significant market opportunities in this dynamic and rapidly evolving sector.

What is Vietnam Real Estate?

Vietnam Real Estate refers to the buying, selling, and leasing of land and properties in Vietnam, encompassing residential, commercial, and industrial segments. This market is influenced by urbanization, economic growth, and government policies.

What are the key players in the Vietnam Real Estate & Mortgage Market?

Key players in the Vietnam Real Estate & Mortgage Market include Vingroup, Novaland, and FLC Group, which are involved in various real estate developments and projects. Additionally, banks like Vietcombank and BIDV play significant roles in providing mortgage financing, among others.

What are the growth factors driving the Vietnam Real Estate & Mortgage Market?

The Vietnam Real Estate & Mortgage Market is driven by factors such as rapid urbanization, increasing foreign investment, and a growing middle class seeking home ownership. Additionally, government initiatives to improve infrastructure and housing policies contribute to market growth.

What challenges does the Vietnam Real Estate & Mortgage Market face?

Challenges in the Vietnam Real Estate & Mortgage Market include regulatory hurdles, fluctuating property prices, and limited access to financing for some buyers. These factors can hinder market stability and growth potential.

What opportunities exist in the Vietnam Real Estate & Mortgage Market?

Opportunities in the Vietnam Real Estate & Mortgage Market include the development of affordable housing projects, the rise of smart city initiatives, and increasing demand for commercial real estate. These trends present avenues for investment and growth.

What trends are shaping the Vietnam Real Estate & Mortgage Market?

Trends in the Vietnam Real Estate & Mortgage Market include a shift towards sustainable building practices, the integration of technology in property management, and a growing interest in mixed-use developments. These trends reflect changing consumer preferences and market dynamics.

Vietnam Real Estate & Mortgage Market

| Segmentation Details | Description |

|---|---|

| Property Type | Residential, Commercial, Industrial, Agricultural |

| Mortgage Type | Fixed Rate, Adjustable Rate, Interest-Only, Reverse Mortgage |

| Customer Segment | First-Time Buyers, Investors, Homeowners, Developers |

| Loan Purpose | Purchase, Refinance, Home Equity, Construction |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Real Estate & Mortgage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at