444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The aquaculture UAE market represents a rapidly expanding sector within the nation’s diversified economic landscape, driven by increasing demand for sustainable protein sources and food security initiatives. The United Arab Emirates has emerged as a regional leader in innovative aquaculture technologies, with the market experiencing robust growth at a CAGR of 8.2% over recent years. This growth trajectory reflects the country’s strategic commitment to reducing dependence on seafood imports while establishing itself as a hub for advanced aquaculture practices in the Middle East region.

Market dynamics in the UAE aquaculture sector are characterized by substantial government investment in research and development, coupled with private sector participation in large-scale commercial operations. The market encompasses various species cultivation including marine fish, freshwater species, and shellfish production, with particular emphasis on high-value species that cater to both domestic consumption and export markets. The integration of cutting-edge technologies such as recirculating aquaculture systems (RAS) and biofloc technology has positioned the UAE as an innovation leader in sustainable fish farming practices.

Regional positioning plays a crucial role in the market’s development, as the UAE leverages its strategic location to serve as a gateway for aquaculture products throughout the Gulf Cooperation Council (GCC) region. The market benefits from favorable government policies, including the National Food Security Strategy 2051, which prioritizes local food production and sustainable aquaculture development. Current market penetration stands at approximately 35% of total seafood consumption, indicating significant potential for continued expansion and market share growth.

The aquaculture UAE market refers to the comprehensive ecosystem of fish and seafood farming operations, supporting infrastructure, and related services within the United Arab Emirates territory. This market encompasses the cultivation of aquatic organisms including finfish, shellfish, and aquatic plants in controlled environments such as ponds, tanks, cages, and other containment systems designed to optimize production efficiency and sustainability.

Aquaculture operations in the UAE utilize both traditional and advanced farming methodologies, ranging from extensive pond systems to intensive recirculating aquaculture systems that maximize production while minimizing environmental impact. The market includes various stakeholder categories such as commercial fish farmers, technology providers, feed manufacturers, processing facilities, and distribution networks that collectively contribute to the sector’s value chain development.

Technological integration defines much of the modern UAE aquaculture market, with emphasis on smart farming solutions, automated feeding systems, water quality monitoring, and disease management protocols. The market also encompasses research institutions, educational facilities, and government agencies that support industry development through policy formulation, technical assistance, and capacity building initiatives aimed at enhancing sector competitiveness and sustainability.

Strategic positioning of the UAE aquaculture market reflects the nation’s commitment to achieving food security objectives while establishing a competitive advantage in sustainable protein production. The market has demonstrated consistent growth momentum, with domestic production capacity expanding significantly to meet rising consumer demand for fresh, locally-produced seafood products. Government initiatives have catalyzed private sector investment, resulting in the establishment of world-class aquaculture facilities that incorporate international best practices and cutting-edge technologies.

Market segmentation reveals diverse opportunities across multiple species categories, with marine fish farming accounting for the largest production volume, followed by freshwater species and emerging shellfish cultivation operations. The sector benefits from favorable climatic conditions, abundant seawater resources, and strategic geographic positioning that facilitates both domestic market supply and regional export opportunities. Technology adoption rates have reached 78% among commercial operators, indicating strong industry modernization trends.

Investment flows into the UAE aquaculture sector have intensified, driven by both public sector funding and private equity participation in large-scale commercial projects. The market attracts international expertise and technology transfer partnerships, enhancing local capabilities and knowledge base. Sustainability considerations increasingly influence market development, with emphasis on environmentally responsible farming practices and circular economy principles that optimize resource utilization and minimize waste generation.

Production efficiency improvements represent a fundamental driver of UAE aquaculture market expansion, with modern facilities achieving significantly higher yields per unit area compared to traditional farming methods. The following key insights characterize current market dynamics:

Market maturation indicators suggest the UAE aquaculture sector is transitioning from an emerging industry to an established component of the national food production system, with increasing sophistication in operational practices and market positioning strategies.

Food security imperatives constitute the primary driver of UAE aquaculture market expansion, as the nation seeks to reduce dependence on seafood imports while ensuring reliable access to high-quality protein sources for its growing population. Government policy frameworks actively promote local food production capabilities, with aquaculture identified as a strategic sector for achieving national food security objectives through sustainable domestic production capacity development.

Consumer preferences increasingly favor fresh, locally-produced seafood products, driving demand for UAE aquaculture output. Rising health consciousness among consumers has elevated the perceived value of fish and seafood as healthy protein alternatives, while growing awareness of sustainability issues supports preference for responsibly-farmed aquaculture products over wild-caught alternatives that may face supply constraints or environmental concerns.

Technological advancement enables efficient, profitable aquaculture operations in the UAE’s challenging climate conditions through innovations such as climate-controlled facilities, advanced water treatment systems, and precision feeding technologies. These technological solutions address traditional barriers to aquaculture development in arid regions while creating opportunities for year-round production and optimal resource utilization that enhances economic viability.

Economic diversification strategies position aquaculture as a valuable component of the UAE’s non-oil economy development, creating employment opportunities, supporting rural development, and contributing to export revenue generation. The sector aligns with national economic transformation objectives while offering potential for value-added processing and related service industries that multiply economic benefits throughout the value chain.

Capital intensity requirements present significant barriers to entry for potential aquaculture operators, as modern facilities demand substantial upfront investments in infrastructure, equipment, and technology systems. The high initial costs associated with establishing commercial-scale operations, particularly those incorporating advanced recirculating aquaculture systems, can limit market participation to well-capitalized entities and may slow overall sector expansion rates.

Technical expertise limitations constrain market growth potential, as successful aquaculture operations require specialized knowledge in areas such as fish biology, water chemistry, nutrition, and disease management. The relatively nascent state of the UAE aquaculture industry means that local expertise is still developing, necessitating reliance on international consultants and technical advisors that increase operational costs and complexity.

Environmental challenges specific to the UAE’s arid climate and high salinity conditions require specialized solutions that may increase production costs and technical complexity. Water scarcity concerns, extreme temperature variations, and limited freshwater resources create operational constraints that must be addressed through expensive technological solutions, potentially impacting the economic competitiveness of local aquaculture production.

Regulatory complexity surrounding aquaculture licensing, environmental compliance, and food safety requirements can create administrative burdens that delay project implementation and increase operational costs. Navigating multiple regulatory frameworks while ensuring compliance with international standards for export markets requires significant administrative resources and expertise that may challenge smaller operators or new market entrants.

Export market expansion presents substantial growth opportunities for UAE aquaculture producers, as regional demand for high-quality seafood products continues to increase across GCC countries and broader Middle East markets. The UAE’s strategic location and well-developed logistics infrastructure position local producers to capitalize on growing regional seafood consumption while leveraging established trade relationships and distribution networks.

Premium species cultivation offers opportunities for market differentiation and higher profit margins through focus on luxury seafood varieties that command premium prices in both domestic and international markets. Species such as grouper, hammour, and other high-value marine fish present opportunities for specialized production systems that cater to discerning consumers willing to pay premium prices for superior quality products.

Technology integration creates opportunities for UAE aquaculture operations to become global leaders in sustainable, efficient fish farming through adoption of artificial intelligence, Internet of Things (IoT) sensors, and automated management systems. These technological advances can optimize production efficiency while reducing environmental impact, creating competitive advantages that support both domestic market leadership and export competitiveness.

Value-added processing opportunities enable aquaculture producers to capture additional value through development of processed seafood products, ready-to-cook items, and specialty preparations that cater to evolving consumer preferences. Integration of processing capabilities within aquaculture operations can improve profit margins while creating additional employment opportunities and supporting broader economic development objectives.

Supply chain integration dynamics are reshaping the UAE aquaculture market as operators seek to optimize efficiency and quality control through vertical integration strategies. Leading market participants are developing comprehensive value chains that encompass feed production, farming operations, processing facilities, and distribution networks, creating synergies that improve cost competitiveness while ensuring product quality and traceability throughout the supply chain.

Innovation ecosystems are emerging around major aquaculture hubs, fostering collaboration between commercial operators, research institutions, technology providers, and government agencies. These collaborative networks accelerate knowledge transfer, facilitate technology adoption, and support the development of innovative solutions to sector-specific challenges, creating dynamic environments that attract investment and expertise to the UAE aquaculture market.

Market consolidation trends indicate increasing concentration among larger, well-capitalized operators who can achieve economies of scale and invest in advanced technologies. This consolidation dynamic creates opportunities for strategic partnerships, joint ventures, and acquisition activities that can accelerate market development while potentially creating barriers for smaller operators who may struggle to compete with larger, more efficient operations.

Sustainability imperatives are increasingly influencing market dynamics as consumers, regulators, and investors place greater emphasis on environmentally responsible production practices. Operators who successfully implement sustainable farming methods, achieve certification standards, and demonstrate environmental stewardship are gaining competitive advantages in both domestic and export markets, driving industry-wide adoption of best practices and sustainable technologies.

Comprehensive market analysis for the UAE aquaculture sector employs multiple research methodologies to ensure accurate and reliable market insights. Primary research activities include structured interviews with industry stakeholders, facility visits to major aquaculture operations, and surveys of market participants across the value chain. These primary research efforts provide firsthand insights into operational practices, market challenges, and growth opportunities from industry practitioners and decision-makers.

Secondary research components encompass analysis of government statistics, industry reports, academic publications, and regulatory documentation to establish market context and validate primary research findings. Data sources include UAE Ministry of Climate Change and Environment publications, Federal Competitiveness and Statistics Centre reports, and international aquaculture industry databases that provide comparative benchmarks and trend analysis capabilities.

Market modeling techniques integrate quantitative and qualitative research findings to develop comprehensive market assessments and growth projections. Statistical analysis methods include trend analysis, correlation studies, and scenario modeling that account for various market development pathways under different economic and policy conditions. These analytical approaches ensure robust market insights that support strategic decision-making by industry participants and stakeholders.

Validation processes include expert review panels, stakeholder feedback sessions, and cross-referencing with multiple data sources to ensure research accuracy and reliability. Quality assurance measures encompass data verification protocols, methodology peer review, and continuous monitoring of market developments to maintain current and relevant market intelligence that reflects evolving industry conditions and dynamics.

Abu Dhabi emirate leads the UAE aquaculture market with the largest concentration of commercial operations, accounting for approximately 45% of national production capacity. The emirate benefits from extensive coastline, government support through initiatives such as the Abu Dhabi Agriculture and Food Safety Authority programs, and major investments in research and development facilities. Key projects include large-scale marine aquaculture operations and integrated aquaculture-agriculture systems that optimize resource utilization.

Dubai’s contribution to the aquaculture market focuses primarily on high-value species production and innovative farming technologies, representing roughly 25% of market activity. The emirate’s strategic emphasis on technology and innovation has attracted international partnerships and cutting-edge aquaculture projects that serve as demonstration sites for advanced farming methods. Dubai’s well-developed logistics infrastructure also supports efficient distribution of aquaculture products to domestic and regional markets.

Northern emirates including Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively account for approximately 30% of aquaculture production, with particular strength in small-scale and specialized operations. These emirates benefit from diverse coastal environments and lower operational costs, making them attractive locations for emerging aquaculture enterprises and research projects focused on species diversification and sustainable farming practices.

Regional specialization patterns are emerging based on geographic advantages and local expertise, with coastal areas focusing on marine species cultivation while inland regions develop freshwater and brackish water aquaculture systems. According to MarkWide Research analysis, this regional diversification strategy enhances overall market resilience while optimizing resource utilization across different environmental conditions and market segments.

Market leadership in the UAE aquaculture sector is characterized by a mix of large-scale commercial operators, government-supported enterprises, and innovative technology companies that collectively drive industry development. The competitive landscape includes both domestic companies and international partnerships that bring global expertise to local operations.

Competitive strategies increasingly emphasize technology differentiation, sustainability credentials, and value chain integration as key factors for market success. Leading operators invest heavily in research and development, international partnerships, and advanced production systems that create competitive advantages in efficiency, quality, and environmental performance.

Species-based segmentation reveals distinct market dynamics across different aquaculture categories, with marine fish farming representing the largest segment due to consumer preferences and market demand patterns. The following segmentation analysis provides insights into market structure and growth opportunities:

By Species Type:

By Production System:

By Market Application:

Marine aquaculture dominates the UAE market due to abundant seawater resources and strong consumer demand for marine fish species. This category benefits from established production technologies, proven market demand, and export potential to regional markets. Key species include sea bass, sea bream, and grouper, with production systems ranging from offshore cages to land-based recirculating systems that optimize environmental control and biosecurity.

Freshwater aquaculture represents a growing market segment driven by diversification strategies and efforts to optimize limited freshwater resources. Tilapia farming leads this category due to the species’ adaptability to local conditions and strong market acceptance. Innovative approaches include integration with hydroponic systems and utilization of treated wastewater for sustainable production that addresses both food security and environmental objectives.

Integrated aquaculture systems are emerging as a significant category that combines fish farming with other agricultural activities or renewable energy production. These systems optimize resource utilization while creating synergies that improve overall economic viability. Examples include aquaponics systems that combine fish and vegetable production, and solar-powered aquaculture facilities that reduce operational costs while supporting sustainability objectives.

Technology-intensive operations represent the most advanced category within the UAE aquaculture market, featuring automated feeding systems, real-time water quality monitoring, and artificial intelligence applications for optimal production management. These high-tech operations achieve superior efficiency rates while minimizing environmental impact, positioning the UAE as a regional leader in sustainable aquaculture innovation and best practices implementation.

Economic advantages for aquaculture industry participants include access to growing domestic and regional markets, government support through favorable policies and incentives, and opportunities for value-added processing that enhance profit margins. The sector offers attractive returns on investment for well-managed operations while contributing to national economic diversification objectives and reducing dependence on food imports.

Stakeholder benefits extend beyond direct economic returns to include environmental stewardship opportunities, technology leadership positioning, and contribution to food security objectives. Industry participants can leverage the UAE’s strategic location and advanced infrastructure to serve regional markets while building expertise that supports international expansion and technology transfer opportunities.

Innovation opportunities abound for technology providers, research institutions, and equipment suppliers who can develop solutions tailored to the unique challenges of aquaculture in arid environments. The market rewards innovative approaches that improve efficiency, sustainability, and profitability while creating intellectual property and competitive advantages that can be commercialized in similar markets globally.

Supply chain participants benefit from growing market demand, opportunities for vertical integration, and access to premium market segments that value quality and sustainability. Feed suppliers, processing companies, and distribution networks can develop specialized capabilities that serve the aquaculture sector while creating additional revenue streams and market positioning advantages.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping the UAE aquaculture market, with operators increasingly adopting environmentally responsible practices that minimize resource consumption and environmental impact. This trend includes implementation of circular economy principles, waste reduction strategies, and renewable energy integration that appeal to environmentally conscious consumers while reducing operational costs and regulatory compliance risks.

Technology convergence is transforming traditional aquaculture operations through integration of artificial intelligence, Internet of Things sensors, and automated management systems that optimize production efficiency while reducing labor requirements. Smart farming solutions enable real-time monitoring and control of critical parameters such as water quality, feeding schedules, and health management, resulting in improved productivity and reduced operational risks.

Species diversification trends reflect market demand for variety and premium products, driving operators to explore cultivation of high-value species and specialty products that command premium prices. This diversification strategy reduces market risk while creating opportunities for niche market development and product differentiation that can support higher profit margins and competitive positioning.

Vertical integration strategies are becoming increasingly common as operators seek to control quality, reduce costs, and capture additional value throughout the supply chain. Integrated operations encompass feed production, farming, processing, and distribution capabilities that create synergies and competitive advantages while ensuring product traceability and quality control from production to consumer delivery.

Infrastructure expansion projects are significantly increasing UAE aquaculture production capacity through development of large-scale commercial facilities and supporting infrastructure. Recent developments include construction of advanced recirculating aquaculture systems, offshore cage farming installations, and integrated processing facilities that enhance the sector’s capability to serve both domestic and export markets effectively.

Research partnerships between UAE institutions and international aquaculture experts are accelerating technology transfer and knowledge development in areas such as breeding programs, nutrition optimization, and disease management. These collaborations bring global best practices to local operations while developing solutions specifically adapted to regional conditions and market requirements.

Regulatory framework enhancements have streamlined licensing processes, established clear quality standards, and created supportive policy environments that encourage investment and operational excellence. Recent regulatory developments include simplified permitting procedures, environmental compliance guidelines, and food safety standards that align with international best practices while supporting industry growth.

Investment initiatives from both government and private sector sources are providing capital for expansion, technology adoption, and market development activities. Major investment projects include establishment of aquaculture parks, research and development facilities, and export-oriented production systems that position the UAE as a regional aquaculture hub and technology leader.

Strategic positioning recommendations for UAE aquaculture market participants emphasize the importance of technology leadership, sustainability credentials, and regional market development as key success factors. MWR analysis suggests that operators should prioritize advanced production systems, international partnerships, and value chain integration to achieve competitive advantages in both domestic and export markets.

Investment priorities should focus on proven technologies and species with established market demand while gradually expanding into innovative approaches and premium market segments. Analysts recommend balanced portfolios that combine stable, high-volume production with specialized, high-value operations that can optimize returns while managing market risks and operational challenges effectively.

Market development strategies should emphasize quality differentiation, sustainability positioning, and regional expansion opportunities that leverage the UAE’s strategic advantages. Successful operators will likely be those who can effectively combine advanced technology, environmental stewardship, and market-focused production strategies that meet evolving consumer preferences and regulatory requirements.

Risk management approaches should address key vulnerabilities including climate impacts, market volatility, and operational challenges through diversification strategies, insurance coverage, and contingency planning. Analysts recommend comprehensive risk assessment and mitigation strategies that protect investments while maintaining operational flexibility to adapt to changing market conditions and opportunities.

Growth trajectory projections for the UAE aquaculture market indicate continued expansion driven by government support, technology advancement, and growing market demand for locally-produced seafood. The sector is expected to achieve production capacity increases of approximately 12% annually over the next five years, supported by major infrastructure projects and operational efficiency improvements that enhance competitiveness and market reach.

Technology evolution will likely accelerate adoption of artificial intelligence, automation, and sustainable production systems that optimize efficiency while minimizing environmental impact. Future developments may include fully automated aquaculture facilities, precision nutrition systems, and integrated renewable energy solutions that position the UAE as a global leader in sustainable aquaculture innovation and best practices.

Market expansion opportunities are expected to emerge from regional export growth, premium product development, and value-added processing capabilities that capture additional value throughout the supply chain. Export market penetration could reach 40% of total production within the next decade, driven by quality advantages and strategic positioning in high-growth regional markets.

Industry maturation will likely result in increased consolidation, standardization of best practices, and development of specialized market segments that serve diverse consumer preferences and applications. The sector’s evolution toward a mature, technology-driven industry will create opportunities for knowledge export, technology transfer, and international expansion that leverage UAE expertise and innovation capabilities developed through domestic market success.

The aquaculture UAE market represents a dynamic and rapidly evolving sector that combines strategic national objectives with commercial opportunities in sustainable protein production. Government support, technological innovation, and favorable market conditions have created a foundation for continued growth and development that positions the UAE as a regional leader in advanced aquaculture practices and sustainable food production systems.

Market fundamentals remain strong, supported by growing consumer demand, export opportunities, and continued investment in infrastructure and technology that enhance production capabilities and competitive positioning. The sector’s emphasis on sustainability, quality, and innovation aligns with global trends while addressing specific regional challenges and opportunities that create unique competitive advantages for UAE operators.

Future success in the UAE aquaculture market will likely depend on continued technology leadership, effective risk management, and strategic market positioning that leverages the country’s advantages while addressing operational challenges and market competition. Industry participants who can successfully combine advanced production systems with market-focused strategies and sustainable practices are well-positioned to capitalize on the significant growth opportunities that characterize this emerging and strategically important sector.

What is Aquaculture?

Aquaculture refers to the farming of aquatic organisms, including fish, mollusks, crustaceans, and aquatic plants. It involves various practices such as breeding, rearing, and harvesting in controlled environments, contributing significantly to food production and sustainability.

What are the key companies in Aquaculture UAE in Market?

Key companies in the Aquaculture UAE in Market include Emirates Aquatech, Al Ain Fisheries, and Aqua Culture Technologies. These companies are involved in various aspects of aquaculture, from fish farming to technology solutions, among others.

What are the growth factors driving Aquaculture UAE in Market?

The growth of Aquaculture UAE in Market is driven by increasing demand for seafood, advancements in aquaculture technology, and government initiatives promoting sustainable practices. Additionally, the rising awareness of food security plays a crucial role.

What challenges does the Aquaculture UAE in Market face?

The Aquaculture UAE in Market faces challenges such as water scarcity, environmental concerns, and regulatory hurdles. These factors can impact production efficiency and sustainability efforts within the industry.

What opportunities exist in Aquaculture UAE in Market?

Opportunities in Aquaculture UAE in Market include the potential for innovation in sustainable farming practices, expansion into new species cultivation, and increased investment in aquaculture technology. These factors can enhance productivity and market reach.

What trends are shaping the Aquaculture UAE in Market?

Trends shaping the Aquaculture UAE in Market include the rise of integrated multi-trophic aquaculture, increased focus on organic and sustainable seafood, and the adoption of digital technologies for monitoring and management. These trends are influencing consumer preferences and operational efficiencies.

Aquaculture UAE in Market

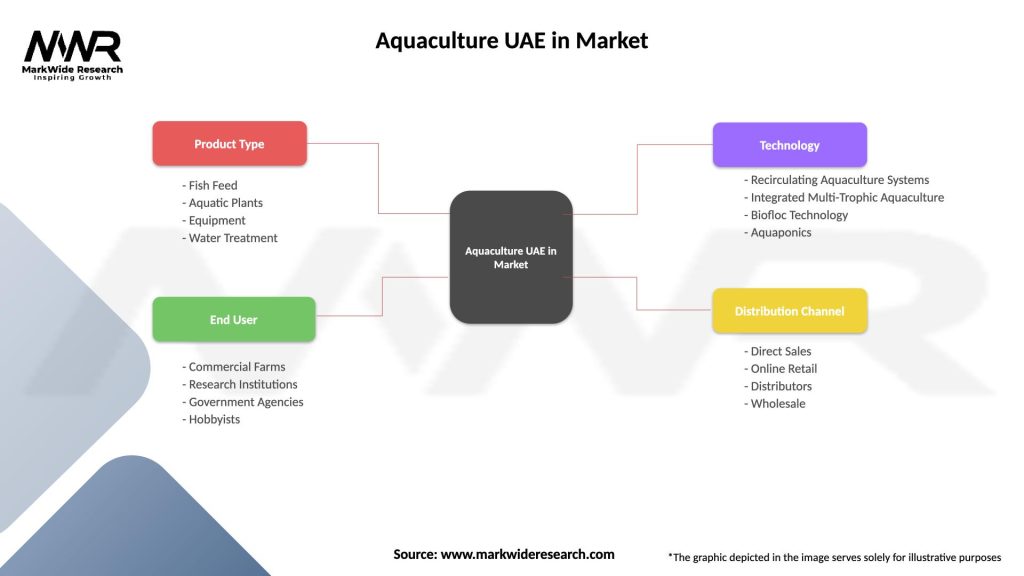

| Segmentation Details | Description |

|---|---|

| Product Type | Fish Feed, Aquatic Plants, Equipment, Water Treatment |

| End User | Commercial Farms, Research Institutions, Government Agencies, Hobbyists |

| Technology | Recirculating Aquaculture Systems, Integrated Multi-Trophic Aquaculture, Biofloc Technology, Aquaponics |

| Distribution Channel | Direct Sales, Online Retail, Distributors, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Aquaculture UAE in Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at