444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Thailand retail market represents one of Southeast Asia’s most dynamic and rapidly evolving commercial landscapes, characterized by a unique blend of traditional shopping experiences and cutting-edge digital transformation. Thailand’s retail sector has demonstrated remarkable resilience and adaptability, particularly in the post-pandemic era, with e-commerce adoption rates reaching unprecedented levels of 78% among urban consumers. The market encompasses diverse retail formats, from bustling street markets and traditional mom-and-pop stores to sophisticated shopping malls and innovative omnichannel platforms.

Digital transformation has become the cornerstone of Thailand’s retail evolution, with mobile commerce experiencing explosive growth of 45% year-over-year. The integration of technology into traditional retail operations has created new opportunities for both domestic and international retailers to engage with Thailand’s increasingly sophisticated consumer base. Consumer behavior patterns have shifted significantly, with younger demographics driving demand for seamless shopping experiences across multiple touchpoints.

Market dynamics indicate strong growth potential across various retail segments, supported by Thailand’s strategic position as a regional hub and its robust tourism industry. The retail landscape continues to evolve with the emergence of new business models, sustainable retail practices, and innovative customer engagement strategies that cater to the diverse needs of Thai consumers.

The Thailand retail market refers to the comprehensive ecosystem of commercial activities involving the sale of goods and services directly to consumers through various channels including physical stores, online platforms, and hybrid retail formats. This market encompasses traditional retail establishments, modern trade formats, e-commerce platforms, and emerging retail technologies that facilitate consumer transactions across Thailand’s diverse geographic and demographic landscape.

Retail market dynamics in Thailand include the complex interplay between consumer preferences, technological adoption, supply chain management, and regulatory frameworks that shape how businesses operate and compete. The market represents both brick-and-mortar establishments and digital commerce platforms, creating a multifaceted retail environment that serves Thailand’s population of over 69 million consumers with varying purchasing behaviors and preferences.

Modern retail concepts in Thailand have evolved to include omnichannel strategies, social commerce integration, and personalized shopping experiences that leverage data analytics and artificial intelligence. The market’s definition continues to expand as new retail formats emerge, including pop-up stores, experiential retail spaces, and subscription-based services that cater to evolving consumer expectations.

Thailand’s retail market stands as a testament to successful digital transformation and consumer adaptation in Southeast Asia. The market has experienced significant structural changes driven by technological innovation, changing consumer behaviors, and the accelerated adoption of digital shopping platforms. E-commerce penetration has reached 12.8% of total retail sales, representing substantial growth from pre-pandemic levels and indicating continued expansion potential.

Key market drivers include the widespread adoption of smartphones, improved digital payment infrastructure, and the growing influence of social media on purchasing decisions. Thai consumers have embraced omnichannel shopping experiences, with 65% of shoppers using multiple channels during their purchase journey. The market benefits from strong domestic consumption, a thriving tourism sector, and government initiatives supporting digital economy development.

Competitive landscape features a mix of established international retailers, domestic market leaders, and emerging digital-native brands. Traditional retail formats continue to play important roles, particularly in rural areas, while urban centers see increasing concentration of modern retail formats and e-commerce fulfillment centers. Market consolidation trends indicate opportunities for strategic partnerships and acquisitions as retailers seek to enhance their market positions and operational capabilities.

Consumer behavior analysis reveals several critical insights shaping Thailand’s retail landscape. The following key insights demonstrate the market’s evolution and future trajectory:

Digital infrastructure development serves as a primary catalyst for Thailand’s retail market expansion. The country’s robust telecommunications network and widespread internet connectivity have created favorable conditions for e-commerce growth and digital retail innovation. Government initiatives supporting digital transformation, including the Thailand 4.0 policy and various e-commerce promotion programs, have accelerated market development and encouraged both domestic and international investment in retail technology.

Demographic trends significantly influence market dynamics, with Thailand’s young, tech-savvy population driving demand for innovative retail experiences. The growing middle class demonstrates increased purchasing power and sophisticated consumer preferences, creating opportunities for premium retail formats and international brands. Urbanization patterns continue to shape retail distribution strategies, with major cities serving as focal points for modern retail development and omnichannel implementation.

Tourism industry recovery provides substantial support for Thailand’s retail sector, particularly in key tourist destinations where retail spending contributes significantly to local economies. The integration of tourism and retail creates unique opportunities for experiential retail formats and duty-free shopping experiences that cater to both domestic and international consumers.

Supply chain optimization and logistics infrastructure improvements have enhanced retail efficiency and enabled new business models. Advanced warehouse management systems, last-mile delivery solutions, and cross-border e-commerce capabilities have expanded market reach and improved customer satisfaction levels across various retail segments.

Economic uncertainties pose challenges to Thailand’s retail market growth, particularly regarding consumer spending patterns and business investment decisions. Fluctuating economic conditions can impact discretionary spending and influence retailer expansion strategies, requiring adaptive approaches to market development and customer engagement.

Regulatory complexities create operational challenges for retailers, especially those involved in cross-border e-commerce and international trade. Compliance requirements, tax regulations, and licensing procedures can increase operational costs and complexity for retail businesses seeking to expand their market presence or introduce new business models.

Infrastructure limitations in rural areas restrict market penetration and limit the effectiveness of certain retail formats. Limited internet connectivity, transportation challenges, and lower purchasing power in rural regions create barriers to comprehensive market coverage and require specialized strategies for rural market development.

Competitive intensity among retailers has led to margin pressure and increased marketing costs. The proliferation of retail options and the ease of price comparison through digital platforms have intensified competition, requiring retailers to differentiate through value-added services, customer experience, and operational efficiency rather than price alone.

Skills shortage in digital retail capabilities affects many traditional retailers’ ability to compete effectively in the evolving market landscape. The need for specialized expertise in e-commerce management, digital marketing, and data analytics creates recruitment challenges and increases operational costs for retailers undergoing digital transformation.

Rural market expansion presents significant untapped potential for Thailand’s retail sector. As infrastructure development progresses and digital connectivity improves in rural areas, retailers have opportunities to serve previously underserved markets through innovative distribution models and localized product offerings. Rural e-commerce adoption is expected to accelerate, creating new channels for market penetration and customer acquisition.

Cross-border e-commerce offers substantial growth opportunities as Thai retailers expand into regional markets and international brands seek entry into Thailand. The development of regional e-commerce platforms and improved logistics networks facilitate cross-border trade, enabling retailers to access larger customer bases and diversify revenue streams.

Sustainable retail practices create differentiation opportunities as environmentally conscious consumers seek eco-friendly shopping options. Retailers implementing sustainable supply chains, packaging solutions, and product offerings can capture market share among environmentally aware consumers while contributing to Thailand’s sustainability goals.

Technology integration continues to offer innovation opportunities across various retail functions. Artificial intelligence, augmented reality, blockchain technology, and Internet of Things applications can enhance customer experiences, optimize operations, and create new business models that drive competitive advantage and market growth.

Health and wellness trends present opportunities for specialized retail formats and product categories. The growing focus on health, fitness, and wellness creates demand for related products and services, enabling retailers to develop targeted offerings and capture emerging market segments.

Supply and demand equilibrium in Thailand’s retail market reflects the complex interplay between consumer preferences, retailer capabilities, and market conditions. Demand patterns show increasing sophistication, with consumers seeking convenience, quality, and value across multiple shopping channels. The supply side has responded with enhanced product assortments, improved service levels, and innovative retail formats that cater to diverse consumer needs.

Pricing dynamics have become increasingly transparent due to digital platforms that enable easy price comparison. This transparency has intensified competition while empowering consumers to make informed purchasing decisions. Retailers have adapted by focusing on value proposition differentiation through service quality, product uniqueness, and customer experience rather than competing solely on price.

Seasonal fluctuations significantly impact retail performance, with traditional festivals, holiday periods, and tourism seasons creating distinct demand patterns. Retailers have developed sophisticated inventory management and marketing strategies to capitalize on seasonal opportunities while maintaining operational efficiency during slower periods.

Technology adoption cycles influence market dynamics as new retail technologies emerge and mature. Early adopters gain competitive advantages, while the broader market eventually adopts successful innovations, creating continuous evolution in retail operations and customer expectations. Digital transformation initiatives have accelerated, with 85% of retailers implementing some form of digital enhancement to their operations.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Thailand’s retail market dynamics. Primary research involves extensive surveys and interviews with key stakeholders including retailers, consumers, industry experts, and technology providers to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research incorporates analysis of government statistics, industry reports, financial statements, and academic studies to provide comprehensive market context and validate primary research findings. Data triangulation methods ensure consistency and reliability across different information sources, enhancing the overall quality of market intelligence.

Quantitative analysis utilizes statistical modeling and trend analysis to identify patterns in consumer behavior, market performance, and competitive dynamics. Advanced analytics techniques help forecast market developments and assess the potential impact of various factors on retail market growth and evolution.

Qualitative research methods include focus groups, expert interviews, and observational studies to understand the underlying motivations and preferences driving consumer behavior and retailer strategies. This approach provides deeper insights into market dynamics that quantitative data alone cannot capture.

Market segmentation analysis employs clustering techniques and demographic analysis to identify distinct consumer groups and retail market segments. This segmentation enables more targeted analysis of market opportunities and competitive positioning strategies across different customer categories and retail formats.

Bangkok metropolitan area dominates Thailand’s retail landscape, accounting for approximately 35% of total retail activity and serving as the primary hub for modern retail formats and e-commerce operations. The capital region benefits from high population density, superior infrastructure, and concentrated purchasing power that attracts both domestic and international retailers. Shopping mall density in Bangkok exceeds regional averages, while e-commerce fulfillment centers are strategically located to serve the metropolitan market efficiently.

Northern regions including Chiang Mai and surrounding provinces represent growing retail markets with unique characteristics shaped by tourism, agriculture, and local culture. These areas show increasing adoption of modern retail formats while maintaining strong traditional retail presence. Tourist-oriented retail plays a significant role in northern market dynamics, creating seasonal fluctuations and opportunities for specialized retail offerings.

Northeastern regions (Isaan) present substantial untapped potential with large rural populations and emerging urban centers. Traditional retail formats remain dominant, but modern retail penetration is increasing as infrastructure develops and consumer purchasing power grows. Rural e-commerce adoption in these regions shows promising growth trends, creating opportunities for innovative distribution models.

Southern regions benefit from tourism, agriculture, and maritime trade, creating diverse retail opportunities across different economic sectors. Coastal areas with high tourist traffic support luxury retail and duty-free shopping, while inland areas focus on agricultural products and local goods. Cross-border trade with Malaysia influences retail dynamics in southernmost provinces, creating unique market characteristics and opportunities.

Eastern regions including Pattaya and industrial zones show rapid retail development driven by economic growth and infrastructure investment. The Eastern Economic Corridor (EEC) development has attracted investment and population growth, creating new retail markets and modernizing existing retail infrastructure.

Market leadership in Thailand’s retail sector is characterized by intense competition among established players and emerging digital-native brands. The competitive landscape includes both domestic market leaders and international retailers who have successfully adapted to local market conditions and consumer preferences.

Competitive strategies focus on omnichannel integration, customer experience enhancement, and operational efficiency improvements. Market leaders invest heavily in technology infrastructure, supply chain optimization, and data analytics capabilities to maintain competitive advantages and respond to evolving consumer expectations.

By Retail Format: Thailand’s retail market encompasses diverse formats serving different consumer needs and preferences. Traditional retail including wet markets, street vendors, and independent stores continues to serve significant portions of the population, particularly in rural areas and for fresh food purchases. Modern trade formats including hypermarkets, supermarkets, and convenience stores have gained substantial market share in urban areas, offering standardized products and shopping experiences.

By Product Category: Market segmentation reveals distinct patterns across various product categories. Food and beverage retail represents the largest segment, driven by daily consumption needs and Thailand’s strong food culture. Fashion and apparel segments show strong growth potential, particularly in premium and fast-fashion categories. Electronics and technology products benefit from increasing digitalization and consumer technology adoption.

By Consumer Demographics: Age-based segmentation shows distinct shopping behaviors and preferences. Generation Z and Millennials drive e-commerce adoption and social commerce engagement, while Generation X consumers prefer omnichannel experiences combining online convenience with in-store service. Baby Boomers maintain preference for traditional retail formats but show increasing digital adoption for specific product categories.

By Geographic Distribution: Urban versus rural segmentation reveals significant differences in retail format preferences and shopping behaviors. Urban markets show higher modern retail penetration and e-commerce adoption, while rural markets maintain stronger traditional retail presence with gradual modern format adoption as infrastructure improves.

Food and Grocery Retail: This category dominates Thailand’s retail landscape with fresh food markets maintaining cultural significance alongside growing modern grocery formats. Online grocery adoption has accelerated significantly, reaching 25% penetration in urban areas. Convenience stores play crucial roles in daily food retail, while hypermarkets serve weekly shopping needs for packaged goods and household items.

Fashion and Apparel: The fashion retail segment shows strong growth driven by both international brands and local designers. Fast fashion retailers have gained significant market share, while luxury fashion benefits from tourism and growing affluent consumer segments. Online fashion retail demonstrates robust growth with social commerce integration driving discovery and purchase decisions.

Electronics and Technology: Consumer electronics retail benefits from Thailand’s position as a regional technology hub and manufacturing center. Smartphone retail remains particularly strong, with frequent product launches and upgrade cycles driving consistent demand. E-commerce platforms have become primary channels for electronics purchases, offering competitive pricing and comprehensive product information.

Health and Beauty: This category shows consistent growth driven by increasing health consciousness and beauty awareness among Thai consumers. Premium beauty products benefit from social media influence and celebrity endorsements, while health supplements gain popularity among health-conscious consumers. Omnichannel strategies prove particularly effective in this category, combining online research with in-store consultation and trial experiences.

Home and Living: Furniture and home improvement retail benefits from urbanization trends and changing lifestyle preferences. Modern furniture retailers gain market share as consumers seek contemporary designs and quality products. DIY and home improvement segments show growth potential as homeownership increases and renovation activities expand.

Retailers benefit from Thailand’s retail market through access to a large, increasingly affluent consumer base with growing digital adoption. The market offers opportunities for both traditional and innovative retail formats, enabling retailers to develop comprehensive strategies that serve diverse consumer segments. Omnichannel capabilities provide competitive advantages and improved customer lifetime value through enhanced engagement and convenience.

Consumers enjoy expanded choice, improved convenience, and competitive pricing through market competition and technological innovation. Digital retail platforms provide access to broader product selections and personalized shopping experiences, while traditional retail formats maintain cultural relevance and social interaction opportunities. Payment innovation and delivery services enhance overall shopping convenience and accessibility.

Technology Providers find substantial opportunities in supporting retail digital transformation through e-commerce platforms, payment systems, inventory management solutions, and customer analytics tools. The growing demand for retail technology creates sustainable business opportunities and partnerships with established retailers seeking competitive advantages.

Suppliers and Manufacturers benefit from expanded market access through multiple retail channels and improved supply chain efficiency. Direct-to-consumer opportunities through e-commerce platforms enable better margins and customer relationships, while traditional retail partnerships provide volume and distribution advantages.

Investors can capitalize on Thailand’s retail market growth through various investment opportunities including retail real estate, technology companies, and established retail operators. The market’s resilience and growth potential provide attractive returns while supporting economic development and job creation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Social Commerce Integration has emerged as a dominant trend reshaping Thailand’s retail landscape. Social media platforms increasingly serve as discovery and purchase channels, with live streaming commerce gaining particular popularity among younger consumers. Retailers integrate social features into their e-commerce platforms while social media companies expand their retail capabilities, creating new hybrid shopping experiences.

Sustainability and Conscious Consumption influence retail strategies as environmentally aware consumers seek eco-friendly products and sustainable shopping options. Retailers respond with green initiatives including sustainable packaging, carbon-neutral delivery options, and environmentally responsible product sourcing. Circular economy principles gain adoption through product recycling programs and second-hand retail platforms.

Personalization and AI Integration enable retailers to deliver customized shopping experiences through advanced data analytics and machine learning algorithms. Recommendation engines improve product discovery while predictive analytics optimize inventory management and pricing strategies. Chatbots and virtual assistants enhance customer service capabilities across multiple touchpoints.

Omnichannel Evolution continues advancing beyond basic integration toward seamless, unified commerce experiences. Buy-online-pickup-in-store services gain popularity while virtual try-on technologies bridge online and offline shopping experiences. Retailers invest in unified inventory systems and customer data platforms to support comprehensive omnichannel strategies.

Health and Wellness Focus drives demand for health-related products and services across various retail categories. Functional foods, fitness equipment, and wellness services show strong growth as consumers prioritize health and well-being. Retailers adapt store layouts and product assortments to accommodate health-conscious shopping behaviors.

Digital Payment Evolution has transformed transaction processes across Thailand’s retail sector. The widespread adoption of QR code payments and mobile wallets has reduced cash dependency while improving transaction efficiency. Government initiatives promoting digital payments have accelerated adoption rates, with cashless transaction growth reaching 40% annually in urban retail environments.

Logistics Infrastructure Expansion supports e-commerce growth through improved last-mile delivery capabilities and fulfillment center development. Major retailers and logistics providers invest in automated warehouses and delivery networks to meet growing online shopping demand. Same-day delivery services become standard expectations in major metropolitan areas.

Retail Technology Adoption accelerates across various operational areas including inventory management, customer analytics, and store operations. Internet of Things implementations improve supply chain visibility while artificial intelligence enhances demand forecasting and pricing optimization. Augmented reality applications create immersive shopping experiences in both physical and digital environments.

Cross-border E-commerce Growth expands market opportunities for Thai retailers and international brands seeking Thailand market entry. Improved customs procedures and international shipping options facilitate cross-border trade while regulatory frameworks adapt to support international e-commerce activities.

Sustainable Retail Initiatives gain momentum as retailers implement environmental responsibility programs and sustainable business practices. Plastic reduction initiatives, renewable energy adoption, and sustainable sourcing programs demonstrate corporate responsibility while appealing to environmentally conscious consumers.

MarkWide Research analysis indicates that retailers should prioritize omnichannel integration as a fundamental strategy for sustainable competitive advantage. Successful retailers must develop seamless connections between online and offline channels while maintaining consistent brand experiences across all customer touchpoints. Investment in unified commerce platforms and customer data integration will prove essential for long-term market success.

Rural market expansion represents the most significant untapped opportunity for retail growth in Thailand. Retailers should develop specialized strategies for rural penetration including mobile-first approaches, localized product assortments, and innovative distribution models that overcome infrastructure limitations. Partnership strategies with local businesses and community organizations can facilitate market entry and build consumer trust.

Technology investment priorities should focus on customer experience enhancement and operational efficiency improvements. Retailers must balance innovation with practical implementation, ensuring that technology investments deliver measurable returns through improved customer satisfaction, increased sales, or reduced operational costs. Data analytics capabilities should receive particular attention as they enable personalization and informed decision-making.

Sustainability integration should become a core component of retail strategy rather than a peripheral consideration. Consumers increasingly evaluate retailers based on environmental responsibility, creating competitive advantages for companies that authentically implement sustainable practices. Supply chain transparency and environmental impact reduction will become essential differentiators in the evolving market landscape.

Talent development in digital retail capabilities requires immediate attention as the skills gap constrains many retailers’ transformation efforts. Companies should invest in employee training programs, strategic hiring initiatives, and partnerships with educational institutions to build necessary expertise in e-commerce management, digital marketing, and data analytics.

Thailand’s retail market is positioned for continued growth and transformation over the next decade, driven by technological innovation, demographic changes, and evolving consumer expectations. E-commerce penetration is projected to reach 20% of total retail sales within five years, supported by improved logistics infrastructure and continued digital adoption across all demographic segments.

Market consolidation trends are expected to accelerate as retailers seek scale advantages and operational efficiencies through strategic partnerships and acquisitions. MWR projections indicate that successful retailers will be those who effectively balance growth investments with operational excellence while maintaining customer-centric approaches to market development.

Technology integration will deepen across all retail functions, with artificial intelligence, machine learning, and automation becoming standard operational tools rather than competitive differentiators. Voice commerce and augmented reality shopping are expected to gain mainstream adoption, creating new opportunities for customer engagement and experience differentiation.

Sustainability requirements will evolve from consumer preferences to regulatory mandates, requiring retailers to implement comprehensive environmental responsibility programs. Circular economy principles will influence product design, packaging decisions, and end-of-life management across various retail categories.

Regional integration within ASEAN will create expanded market opportunities for Thai retailers while increasing competitive pressure from regional players. Cross-border e-commerce will facilitate market expansion while requiring retailers to develop capabilities in international logistics, currency management, and regulatory compliance across multiple jurisdictions.

Thailand’s retail market represents a dynamic and rapidly evolving landscape characterized by successful digital transformation, changing consumer behaviors, and innovative retail formats that serve diverse market segments. The market’s resilience and adaptability have been demonstrated through successful navigation of economic challenges and accelerated adoption of new technologies and business models.

Key success factors for retailers include omnichannel integration, customer experience focus, operational efficiency, and sustainable business practices that align with evolving consumer expectations and regulatory requirements. The market offers substantial opportunities for both established players and new entrants who can effectively combine traditional retail strengths with modern digital capabilities.

Future growth prospects remain positive, supported by favorable demographics, continued urbanization, tourism recovery, and government initiatives promoting digital economy development. Retailers who invest in technology infrastructure, talent development, and customer-centric strategies will be best positioned to capitalize on emerging opportunities while navigating competitive challenges in Thailand’s evolving retail landscape.

What is Thailand Retail?

Thailand Retail refers to the sector involved in the sale of goods and services directly to consumers. This includes various formats such as supermarkets, convenience stores, and online retail platforms.

What are the key players in the Thailand Retail Market?

Key players in the Thailand Retail Market include CP All, Big C Supercenter, and Tesco Lotus, which dominate the grocery segment, along with various e-commerce platforms like Lazada and Shopee, among others.

What are the main drivers of growth in the Thailand Retail Market?

The main drivers of growth in the Thailand Retail Market include increasing urbanization, a growing middle class, and the rise of e-commerce, which is transforming consumer shopping behaviors.

What challenges does the Thailand Retail Market face?

Challenges in the Thailand Retail Market include intense competition among retailers, changing consumer preferences, and the impact of economic fluctuations on consumer spending.

What opportunities exist in the Thailand Retail Market?

Opportunities in the Thailand Retail Market include the expansion of online shopping, the growth of health and wellness products, and the potential for innovative retail technologies to enhance customer experiences.

What trends are shaping the Thailand Retail Market?

Trends shaping the Thailand Retail Market include the increasing adoption of mobile payment solutions, a focus on sustainability in product offerings, and the integration of omnichannel retail strategies.

Thailand Retail Market

| Segmentation Details | Description |

|---|---|

| Product Type | Apparel, Electronics, Groceries, Home Goods |

| Price Tier | Luxury, Mid-range, Discount, Value |

| Distribution Channel | Online, Supermarkets, Convenience Stores, Specialty Shops |

| Customer Type | Millennials, Families, Professionals, Tourists |

Please note: The segmentation can be entirely customized to align with our client’s needs.

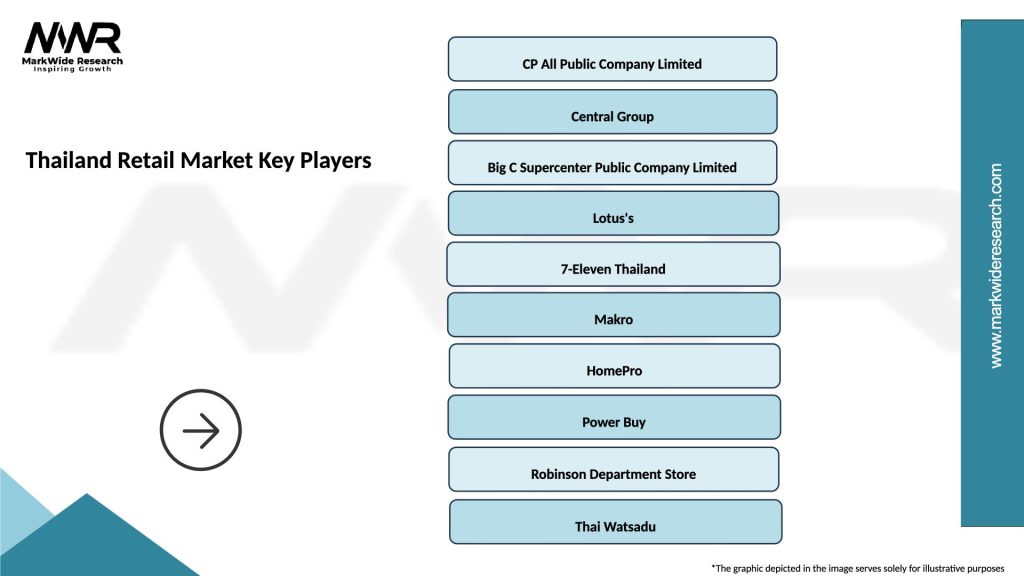

Leading companies in the Thailand Retail Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at