444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Philippines prefabricated buildings market represents a transformative segment within the country’s construction industry, driven by rapid urbanization, infrastructure development, and the growing demand for cost-effective building solutions. Prefabricated construction has gained significant traction across the archipelago as developers, government agencies, and private enterprises seek efficient alternatives to traditional construction methods. The market encompasses various applications including residential housing, commercial structures, industrial facilities, and emergency shelters, with modular construction techniques becoming increasingly sophisticated.

Market dynamics indicate robust growth potential, with the sector experiencing a 12.5% annual growth rate driven by government infrastructure initiatives and private sector adoption. The Build, Build, Build program has particularly accelerated demand for prefabricated solutions in public infrastructure projects, while the private sector increasingly recognizes the benefits of reduced construction timelines and improved quality control. Sustainable construction practices and environmental considerations have further enhanced the appeal of prefabricated buildings, as these structures typically generate less waste and offer better energy efficiency compared to conventional construction methods.

Regional distribution shows concentrated activity in Metro Manila and major urban centers, with approximately 45% market concentration in the National Capital Region. However, emerging opportunities in provincial areas, particularly in Cebu, Davao, and other rapidly developing cities, are reshaping the geographic landscape of the prefabricated buildings market. The integration of advanced manufacturing technologies and improved logistics networks has enabled broader market penetration across the Philippine islands.

The Philippines prefabricated buildings market refers to the comprehensive ecosystem of manufactured building components, modular structures, and pre-engineered construction systems designed, produced, and assembled within the Philippine construction industry. This market encompasses the entire value chain from design and manufacturing to transportation, assembly, and post-construction services for buildings that are partially or entirely constructed off-site before final installation.

Prefabricated construction involves the manufacturing of building elements in controlled factory environments, where standardized processes ensure consistent quality, reduced material waste, and optimized production efficiency. These components range from simple wall panels and roof trusses to complete modular units that can be rapidly assembled on-site. The modular approach allows for significant customization while maintaining the benefits of mass production, making it particularly suitable for the diverse architectural requirements across the Philippines.

Market participants include manufacturers of prefabricated components, modular building specialists, engineering firms, logistics providers, and installation contractors. The ecosystem also encompasses suppliers of raw materials such as steel, concrete, and advanced composite materials, as well as technology providers offering design software and automation solutions for manufacturing processes.

Strategic positioning of the Philippines prefabricated buildings market reflects a sector in rapid transformation, characterized by technological advancement, regulatory support, and increasing market acceptance. The industry has evolved from simple pre-engineered structures to sophisticated modular systems capable of meeting complex architectural and engineering requirements. Government initiatives promoting affordable housing and infrastructure development have created substantial demand, while private sector adoption continues to accelerate across multiple applications.

Key market drivers include the urgent need for affordable housing solutions, with the government targeting 6 million housing units to address the national housing backlog. The construction industry’s labor shortage, estimated at 30% skilled worker deficit, has further accelerated adoption of prefabricated solutions that require fewer on-site workers and shorter construction periods. Disaster resilience considerations have also become increasingly important, with prefabricated buildings offering superior structural integrity and faster reconstruction capabilities following natural disasters.

Market segmentation reveals diverse applications spanning residential, commercial, industrial, and institutional sectors. The residential segment dominates current demand, particularly for affordable housing projects, while commercial applications show the highest growth potential. Technology integration continues to advance, with Building Information Modeling (BIM), automated manufacturing systems, and sustainable materials driving innovation throughout the value chain.

Market penetration analysis reveals several critical insights that define the current landscape and future trajectory of the Philippines prefabricated buildings market:

Government infrastructure initiatives serve as the primary catalyst for market expansion, with the Build, Build, Build program creating unprecedented demand for efficient construction solutions. The program’s emphasis on rapid infrastructure delivery aligns perfectly with the capabilities of prefabricated construction, particularly for bridges, schools, hospitals, and other public facilities. Affordable housing programs represent another significant driver, as government agencies seek cost-effective methods to address the national housing shortage while maintaining quality standards.

Labor market constraints continue to drive adoption of prefabricated solutions across the construction industry. The Philippines faces a critical shortage of skilled construction workers, with many professionals seeking opportunities abroad. Prefabricated construction addresses this challenge by reducing on-site labor requirements and enabling the use of semi-skilled workers for assembly operations. The controlled factory environment also provides better working conditions and safety standards compared to traditional construction sites.

Urbanization pressures in major metropolitan areas create urgent demand for rapid construction solutions that minimize disruption to existing infrastructure and communities. Modular construction techniques enable development in constrained urban environments where traditional construction methods would be impractical or excessively disruptive. The ability to construct buildings with minimal on-site activities particularly benefits dense urban areas where space and access are limited.

Disaster resilience requirements have become increasingly important following recent natural disasters that highlighted the vulnerability of traditional construction methods. Prefabricated buildings offer superior structural integrity and can be designed to meet enhanced seismic and wind resistance standards. The ability to rapidly deploy emergency shelters and reconstruct damaged infrastructure using prefabricated components provides additional strategic value for disaster-prone regions.

Initial capital investment requirements present significant barriers for many potential market participants, particularly smaller construction companies and developers. The establishment of manufacturing facilities, acquisition of specialized equipment, and development of technical expertise require substantial upfront investments that may not be feasible for all market players. Financing challenges compound this issue, as traditional lending institutions may be unfamiliar with prefabricated construction business models and associated risk profiles.

Regulatory complexity continues to pose challenges despite recent improvements in government support for prefabricated construction. Building codes and approval processes were historically designed for traditional construction methods, creating potential delays and complications for prefabricated projects. Local government units may lack familiarity with prefabricated construction techniques, leading to inconsistent application of regulations and approval procedures across different jurisdictions.

Market perception and cultural preferences for traditional construction methods remain significant obstacles in certain market segments. Many Filipino consumers associate prefabricated buildings with temporary or lower-quality structures, despite technological advances that have dramatically improved the performance and aesthetics of modern prefabricated buildings. Educational initiatives and demonstration projects are gradually addressing these perceptions, but cultural change requires sustained effort and time.

Transportation and logistics constraints across the Philippine archipelago create unique challenges for prefabricated construction. The need to transport large building components across multiple islands requires specialized equipment and coordination, potentially increasing costs and complexity. Infrastructure limitations in some regions may restrict the size and weight of prefabricated components that can be practically delivered and installed.

Affordable housing initiatives represent the most significant opportunity for market expansion, with government programs targeting millions of housing units over the coming years. The Pambansang Pabahay para sa Pilipino Program specifically emphasizes cost-effective construction methods, creating ideal conditions for prefabricated housing solutions. Private developers are also recognizing the potential for prefabricated construction to deliver affordable housing projects with improved profit margins and faster turnover.

Infrastructure modernization projects across the Philippines offer substantial opportunities for prefabricated construction applications. Schools, hospitals, bridges, and other public infrastructure can benefit significantly from the speed and quality advantages of prefabricated construction. Public-private partnerships increasingly favor construction methods that can deliver projects on time and within budget, creating favorable conditions for prefabricated solutions.

Industrial and commercial development presents growing opportunities as businesses seek rapid facility deployment and operational flexibility. Manufacturing facilities, warehouses, retail centers, and office buildings can be efficiently constructed using prefabricated methods, particularly in emerging industrial zones and special economic areas. The ability to relocate or expand modular facilities also appeals to businesses operating in dynamic market conditions.

Disaster preparedness and response capabilities create unique market opportunities for specialized prefabricated solutions. Emergency shelters, temporary hospitals, and rapid reconstruction systems are increasingly important for disaster-prone regions. International development organizations and government agencies require reliable suppliers of prefabricated emergency infrastructure, creating potential export opportunities for Philippine manufacturers.

Supply chain evolution continues to reshape the competitive landscape as manufacturers invest in advanced production capabilities and logistics networks. The integration of digital technologies throughout the supply chain enables better coordination between design, manufacturing, and installation phases, resulting in improved project outcomes and customer satisfaction. Vertical integration strategies are becoming more common as companies seek greater control over quality and delivery schedules.

Technology adoption accelerates across all market segments, with Building Information Modeling becoming standard practice for complex projects. Advanced manufacturing techniques, including automated cutting and assembly systems, improve precision and reduce production costs. Sustainable materials and energy-efficient designs are increasingly integrated into prefabricated building systems, responding to growing environmental awareness and regulatory requirements.

Competitive dynamics reflect a market in transition, with traditional construction companies expanding into prefabricated solutions while specialized manufacturers scale their operations. Strategic partnerships between manufacturers, developers, and technology providers create new value propositions and market opportunities. International companies are also establishing local operations or partnerships to access the growing Philippine market.

Customer expectations continue to evolve as awareness of prefabricated construction benefits increases. Demand for customization, aesthetic appeal, and sustainable features drives innovation in design and manufacturing processes. Performance guarantees and comprehensive service offerings become increasingly important competitive differentiators as the market matures.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the Philippines prefabricated buildings market. Primary research included extensive interviews with industry executives, government officials, construction professionals, and end-users across various market segments. Survey data was collected from manufacturers, contractors, developers, and building owners to understand market trends, challenges, and opportunities from multiple perspectives.

Secondary research encompassed analysis of government publications, industry reports, academic studies, and company financial statements to establish market context and validate primary research findings. Statistical analysis of construction permits, building completions, and economic indicators provided quantitative foundation for market assessments. Trade association data and industry publications contributed additional insights into market dynamics and competitive positioning.

Field research included site visits to manufacturing facilities, construction projects, and completed prefabricated buildings to observe operations and assess market conditions firsthand. Expert consultations with architects, engineers, and construction specialists provided technical insights into market trends and future developments. Regulatory analysis examined building codes, approval processes, and policy initiatives affecting the prefabricated construction industry.

Data validation procedures ensured research accuracy through triangulation of multiple sources and cross-verification of key findings. Market modeling techniques incorporated economic indicators, demographic trends, and industry dynamics to project future market conditions and identify emerging opportunities.

Metro Manila dominates the Philippines prefabricated buildings market, accounting for approximately 45% of total market activity due to its concentration of construction projects, manufacturing facilities, and skilled workforce. The National Capital Region benefits from superior infrastructure, logistics networks, and proximity to government agencies that facilitate market development. High-rise residential projects and commercial developments in Metro Manila increasingly incorporate prefabricated components to accelerate construction schedules and manage labor constraints.

Cebu Province represents the second-largest regional market, with growing adoption of prefabricated construction in both urban and rural areas. The region’s strong manufacturing base and strategic location make it an attractive hub for prefabricated building production and distribution. Tourism infrastructure development and expanding business process outsourcing sector drive demand for rapid construction solutions in the Cebu metropolitan area.

Davao Region shows significant growth potential as the area experiences rapid economic development and infrastructure expansion. Government initiatives promoting Mindanao development create opportunities for prefabricated construction in public infrastructure projects. The region’s agricultural and industrial development also generates demand for specialized prefabricated facilities including warehouses, processing plants, and worker housing.

Provincial markets across Luzon, Visayas, and Mindanao demonstrate increasing adoption of prefabricated construction, particularly for government projects and disaster-resilient housing. Improved transportation networks and logistics capabilities enable better market penetration in previously underserved areas. Regional manufacturing hubs are emerging to serve local markets more efficiently while reducing transportation costs and delivery times.

Market leadership in the Philippines prefabricated buildings sector is characterized by a mix of established construction companies, specialized manufacturers, and emerging technology-focused enterprises. The competitive environment continues to evolve as traditional players adapt their business models while new entrants introduce innovative solutions and manufacturing approaches.

Competitive strategies focus on technological innovation, manufacturing efficiency, and comprehensive service offerings. Companies are investing in advanced production equipment, digital design capabilities, and skilled workforce development to differentiate their market positions. Strategic partnerships with international technology providers and local construction companies enable market participants to expand their capabilities and geographic reach.

By Building Type: The Philippines prefabricated buildings market encompasses diverse building categories, each with distinct characteristics and growth patterns. Residential buildings represent the largest segment, driven by affordable housing initiatives and private residential development. Commercial structures including retail centers, offices, and hospitality facilities show strong growth as businesses seek rapid deployment solutions. Industrial buildings such as warehouses, manufacturing facilities, and logistics centers benefit from standardized designs and efficient construction methods.

By Construction Method: Market segmentation by construction approach reveals varying adoption patterns across different techniques. Modular construction dominates high-volume applications where standardization provides maximum benefits. Panelized systems offer flexibility for custom designs while maintaining manufacturing efficiencies. Pre-engineered buildings serve industrial and commercial applications requiring large clear spans and specialized structural requirements.

By Material Type: Material preferences reflect performance requirements, cost considerations, and local availability. Steel-framed systems provide structural efficiency and design flexibility for various applications. Concrete-based solutions offer durability and thermal performance advantages in tropical climates. Hybrid systems combining multiple materials optimize performance characteristics for specific applications.

By End-User: Customer segmentation reveals distinct market dynamics across user categories. Government agencies represent major customers for infrastructure and housing projects. Private developers increasingly adopt prefabricated solutions for residential and commercial projects. Industrial companies utilize prefabricated construction for manufacturing facilities and support infrastructure.

Residential Prefabricated Buildings dominate market volume, driven by government affordable housing programs and private residential development. Single-family homes represent the largest application within this category, with modular designs enabling rapid deployment and cost-effective construction. Multi-family housing projects increasingly utilize prefabricated components to accelerate construction schedules and improve quality consistency. The residential segment benefits from standardized designs that enable economies of scale while allowing customization for local preferences and requirements.

Commercial Prefabricated Buildings show the highest growth potential as businesses recognize the advantages of rapid facility deployment and operational flexibility. Retail facilities particularly benefit from modular construction techniques that enable quick market entry and easy expansion or relocation. Office buildings increasingly incorporate prefabricated components for interior systems and building envelopes, improving construction efficiency and workplace quality.

Industrial Prefabricated Buildings serve specialized applications requiring large clear spans, heavy load capacity, and rapid construction. Manufacturing facilities benefit from standardized designs that can be quickly adapted for different production requirements. Warehouse and logistics facilities represent growing applications as e-commerce and supply chain modernization drive demand for efficient distribution infrastructure.

Institutional Prefabricated Buildings address critical infrastructure needs in education, healthcare, and public services. School buildings constructed using prefabricated methods enable rapid expansion of educational infrastructure while maintaining quality standards. Healthcare facilities benefit from controlled manufacturing environments that ensure compliance with stringent hygiene and safety requirements.

Manufacturers and Suppliers benefit from stable demand patterns and improved profit margins compared to traditional construction supply chains. Controlled production environments enable better quality control, reduced waste, and optimized resource utilization. The ability to manufacture components year-round, independent of weather conditions, provides operational stability and predictable revenue streams. Economies of scale in manufacturing processes create competitive advantages and barriers to entry for new market participants.

Developers and Contractors realize significant advantages through reduced construction timelines, improved project predictability, and enhanced quality outcomes. Faster project delivery enables quicker return on investment and reduced financing costs. The standardization inherent in prefabricated construction reduces design and construction risks while enabling more accurate cost estimation and project scheduling. Labor efficiency improvements address skilled worker shortages and reduce dependency on weather-sensitive construction activities.

End Users and Building Owners benefit from improved building performance, reduced maintenance requirements, and enhanced energy efficiency. Quality consistency achieved through factory production results in fewer defects and longer building lifecycles. The ability to relocate or expand modular buildings provides operational flexibility for businesses operating in dynamic markets. Faster occupancy enables earlier revenue generation for commercial properties and quicker housing delivery for residential applications.

Government Agencies achieve policy objectives more effectively through the adoption of prefabricated construction methods. Affordable housing programs can deliver more units within budget constraints while maintaining quality standards. Infrastructure projects benefit from accelerated delivery schedules that enable faster economic development and improved public services. Disaster response capabilities are enhanced through the availability of rapidly deployable emergency infrastructure and reconstruction solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration represents a dominant trend as environmental consciousness drives demand for eco-friendly construction solutions. Green building certifications increasingly influence project specifications, with prefabricated buildings offering advantages in energy efficiency, waste reduction, and sustainable material utilization. Circular economy principles are being incorporated into prefabricated building design, enabling component reuse and recycling at end-of-life.

Digital Transformation continues to reshape the industry through advanced design tools, manufacturing automation, and project management systems. Building Information Modeling enables precise coordination between design, manufacturing, and installation phases, reducing errors and improving project outcomes. Internet of Things integration allows real-time monitoring of building performance and predictive maintenance capabilities.

Customization Capabilities are expanding as manufacturers develop flexible production systems that accommodate diverse customer requirements while maintaining efficiency benefits. Mass customization techniques enable personalized designs within standardized manufacturing processes. Modular flexibility allows buildings to be easily reconfigured or expanded as user needs evolve over time.

Smart Building Integration incorporates advanced technology systems into prefabricated construction, creating intelligent buildings that optimize energy consumption, security, and user comfort. Automated systems for lighting, climate control, and security are increasingly integrated during the manufacturing process rather than added post-construction.

Regulatory Modernization initiatives by government agencies are streamlining approval processes and updating building codes to better accommodate prefabricated construction methods. The Department of Public Works and Highways has issued guidelines for prefabricated construction in public infrastructure projects, providing clarity and standardization for industry participants. Local government units are increasingly adopting fast-track approval processes for prefabricated building projects that meet specified criteria.

Technology Partnerships between Philippine companies and international technology providers are accelerating innovation and capability development. MarkWide Research analysis indicates that strategic alliances enable local manufacturers to access advanced production technologies and design capabilities while maintaining cost competitiveness. Knowledge transfer programs are developing local expertise in advanced prefabricated construction techniques and project management.

Manufacturing Capacity Expansion across the industry reflects growing market confidence and demand projections. Major players are investing in new production facilities and upgrading existing operations to meet increasing market demand. Regional manufacturing hubs are being established to serve provincial markets more efficiently while reducing transportation costs and delivery times.

International Market Development initiatives are positioning Philippine prefabricated building manufacturers to serve regional export markets. ASEAN integration creates opportunities for cross-border trade in prefabricated building components and complete modular systems. Quality certifications and international standards compliance enable Philippine manufacturers to compete in global markets.

Market Entry Strategies should focus on establishing strong manufacturing capabilities and developing comprehensive service offerings that address customer needs throughout the project lifecycle. New market participants should consider strategic partnerships with established construction companies or real estate developers to access market channels and project opportunities. Technology investment in advanced manufacturing equipment and digital design capabilities will be essential for competitive positioning.

Customer Education Initiatives remain critical for market development, particularly in segments where traditional construction methods dominate. Demonstration projects and case studies showcasing successful prefabricated construction outcomes can help overcome market resistance and build confidence in prefabricated solutions. Professional development programs for architects, engineers, and contractors will expand the pool of qualified professionals capable of designing and implementing prefabricated construction projects.

Supply Chain Optimization should prioritize logistics efficiency and quality control throughout the manufacturing and delivery process. Strategic location of manufacturing facilities near major markets or transportation hubs can reduce costs and improve delivery schedules. Inventory management systems and demand forecasting capabilities will become increasingly important as market volumes grow and customer expectations for delivery reliability increase.

Innovation Focus should emphasize sustainable materials, energy efficiency, and smart building integration to align with evolving market preferences and regulatory requirements. Research and development investments in new materials and construction techniques will create competitive advantages and enable premium pricing for advanced solutions. Collaboration with academic institutions and research organizations can accelerate innovation while developing local technical expertise.

Market expansion projections indicate continued robust growth driven by government infrastructure initiatives, private sector adoption, and evolving customer preferences for efficient construction solutions. MarkWide Research forecasts suggest the market will experience sustained growth at double-digit rates over the next five years, with particular strength in affordable housing and commercial applications. Geographic expansion into provincial markets will accelerate as transportation infrastructure improves and local awareness increases.

Technology evolution will continue to enhance the capabilities and appeal of prefabricated construction through advanced materials, automated manufacturing processes, and integrated building systems. Artificial intelligence and machine learning applications will optimize design processes, manufacturing efficiency, and project management outcomes. Sustainable construction requirements will drive innovation in eco-friendly materials and energy-efficient building systems.

Market maturation will bring increased standardization, improved quality consistency, and more sophisticated customer requirements. Professional specialization will emerge as the industry develops dedicated expertise in prefabricated construction design, manufacturing, and installation. Industry consolidation may occur as successful companies expand their operations while smaller players seek strategic partnerships or exit the market.

International integration will position the Philippines as a regional hub for prefabricated construction, serving both domestic and export markets. ASEAN economic integration creates opportunities for cross-border trade and investment in prefabricated construction capabilities. Global supply chain participation will enable access to advanced materials and technologies while providing export opportunities for Philippine manufacturers.

The Philippines prefabricated buildings market represents a dynamic and rapidly evolving sector with significant growth potential driven by government infrastructure initiatives, private sector adoption, and changing construction industry dynamics. Market fundamentals remain strong, supported by urgent housing needs, infrastructure development requirements, and the compelling advantages of prefabricated construction methods including cost efficiency, quality consistency, and accelerated project delivery.

Strategic opportunities abound for market participants who can effectively navigate the challenges of initial capital investment, regulatory complexity, and market education while capitalizing on the substantial demand for efficient construction solutions. The integration of advanced technologies, sustainable practices, and comprehensive service offerings will differentiate successful companies in an increasingly competitive marketplace. Government support through policy initiatives and infrastructure programs provides a favorable environment for continued market expansion and development.

Future success in the Philippines prefabricated buildings market will depend on the ability to deliver high-quality, cost-effective solutions that meet diverse customer requirements while maintaining operational efficiency and competitive pricing. Companies that invest in manufacturing capabilities, technology integration, and market development will be best positioned to capture the significant opportunities presented by this transformative sector of the Philippine construction industry.

What is Prefabricated Buildings?

Prefabricated buildings are structures that are manufactured off-site in advance, typically in standard sections that can be easily transported and assembled. They are commonly used in residential, commercial, and industrial applications due to their efficiency and cost-effectiveness.

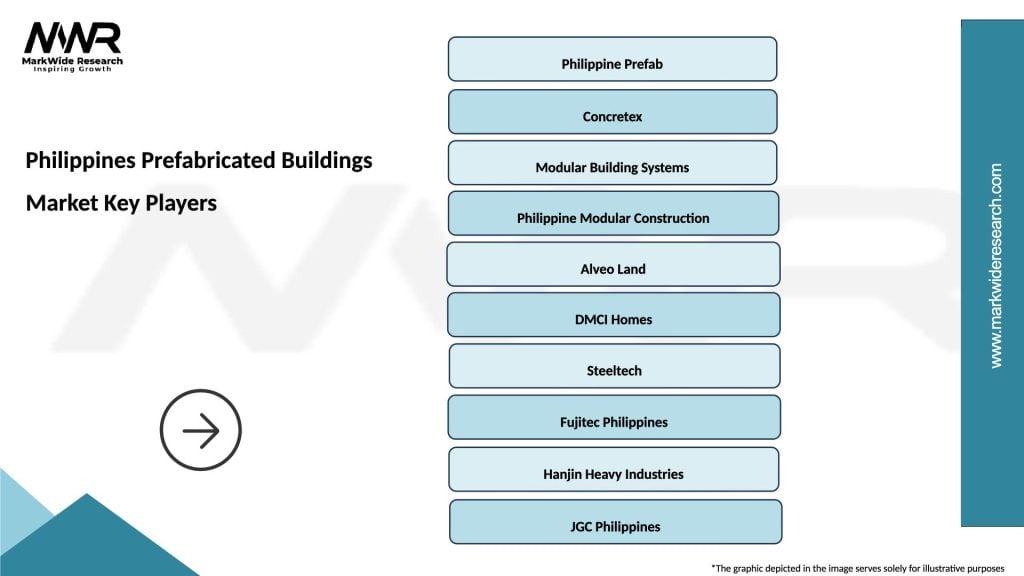

What are the key players in the Philippines Prefabricated Buildings Market?

Key players in the Philippines Prefabricated Buildings Market include companies like Treetop Builders, DMCI Homes, and A. Brown Company, which are known for their innovative designs and construction solutions, among others.

What are the growth factors driving the Philippines Prefabricated Buildings Market?

The growth of the Philippines Prefabricated Buildings Market is driven by factors such as the increasing demand for affordable housing, rapid urbanization, and the need for sustainable construction practices. Additionally, the efficiency of prefabricated methods reduces construction time and labor costs.

What challenges does the Philippines Prefabricated Buildings Market face?

Challenges in the Philippines Prefabricated Buildings Market include regulatory hurdles, limited consumer awareness, and competition from traditional construction methods. These factors can hinder the adoption of prefabricated solutions in certain regions.

What opportunities exist in the Philippines Prefabricated Buildings Market?

Opportunities in the Philippines Prefabricated Buildings Market include the potential for expansion into rural areas, the integration of smart building technologies, and the growing interest in eco-friendly construction materials. These trends can enhance market growth and innovation.

What trends are shaping the Philippines Prefabricated Buildings Market?

Trends shaping the Philippines Prefabricated Buildings Market include the increasing use of modular construction techniques, advancements in building materials, and a focus on energy-efficient designs. These trends are influencing how buildings are constructed and perceived in the market.

Philippines Prefabricated Buildings Market

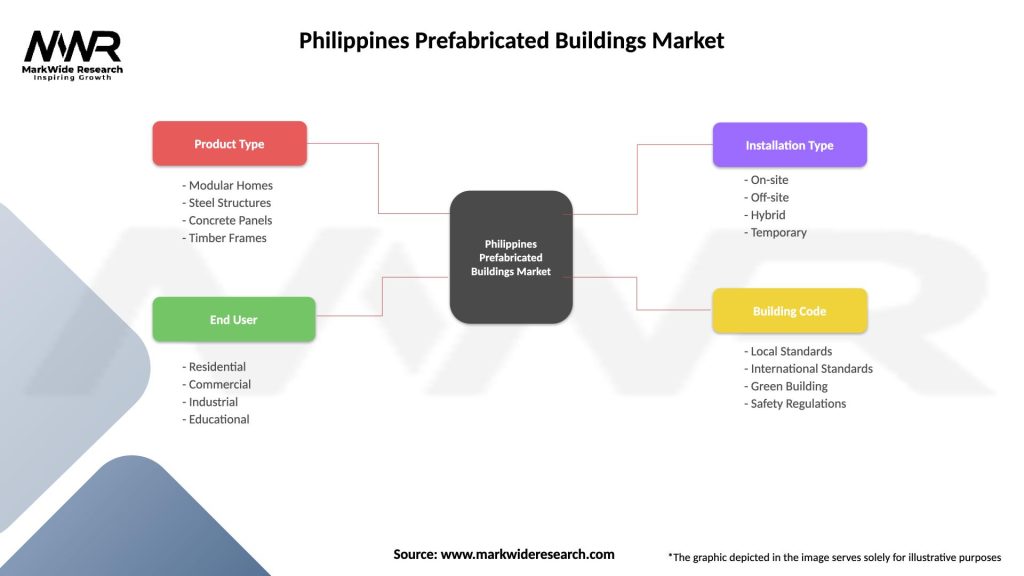

| Segmentation Details | Description |

|---|---|

| Product Type | Modular Homes, Steel Structures, Concrete Panels, Timber Frames |

| End User | Residential, Commercial, Industrial, Educational |

| Installation Type | On-site, Off-site, Hybrid, Temporary |

| Building Code | Local Standards, International Standards, Green Building, Safety Regulations |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Philippines Prefabricated Buildings Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at