444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France cosmetics market stands as one of Europe’s most sophisticated and influential beauty sectors, representing a cornerstone of the global cosmetics industry. French cosmetics have long been synonymous with luxury, innovation, and quality, establishing the nation as a global leader in beauty product development and manufacturing. The market encompasses a comprehensive range of products including skincare, makeup, fragrances, hair care, and personal care items, serving both domestic consumers and international markets through prestigious French beauty brands.

Market dynamics in France reflect a mature yet continuously evolving landscape, driven by consumer demand for premium products, sustainable formulations, and innovative beauty solutions. The French cosmetics sector benefits from a rich heritage of craftsmanship, advanced research and development capabilities, and strong brand recognition worldwide. Growth trends indicate sustained expansion at approximately 4.2% CAGR, supported by increasing consumer spending on personal care products and the rising popularity of French beauty brands in emerging markets.

Industry characteristics include a strong presence of multinational corporations alongside innovative boutique brands, creating a diverse competitive environment. The market demonstrates resilience through economic fluctuations, supported by France’s position as a global beauty destination and the enduring appeal of French luxury cosmetics. Consumer preferences increasingly favor products that combine traditional French elegance with modern sustainability practices and technological innovation.

The France cosmetics market refers to the comprehensive ecosystem of beauty and personal care products manufactured, distributed, and consumed within France, encompassing both domestic consumption and export activities. This market includes traditional cosmetic categories such as skincare formulations, color cosmetics, fragrances, hair care products, and personal hygiene items, all produced or sold within the French territory.

Market definition extends beyond simple product sales to include the entire value chain from raw material sourcing and product development to manufacturing, marketing, and retail distribution. The French cosmetics sector represents a unique blend of luxury heritage brands, innovative startups, and international corporations that have established significant operations within France’s borders.

Scope encompasses both premium luxury segments that France is renowned for globally, as well as mass market and drugstore categories that serve everyday consumer needs. The market includes traditional retail channels, e-commerce platforms, professional beauty services, and direct-to-consumer sales models that collectively serve the diverse preferences of French consumers and international customers seeking authentic French beauty products.

Strategic positioning of the France cosmetics market reveals a sector characterized by strong brand heritage, innovation leadership, and sustainable growth prospects. The market demonstrates remarkable resilience and adaptability, successfully navigating changing consumer preferences while maintaining its reputation for luxury and quality. Key performance indicators show consistent growth across multiple product categories, with skincare and fragrance segments leading market expansion.

Competitive landscape features a balanced mix of established luxury conglomerates, emerging indie brands, and international players seeking to leverage France’s beauty expertise and market access. The sector benefits from robust domestic demand, strong export performance, and increasing penetration in digital commerce channels. Consumer behavior trends indicate growing preference for sustainable, clean beauty products alongside continued appreciation for traditional luxury formulations.

Market outlook remains positive, supported by France’s continued investment in beauty innovation, sustainable packaging solutions, and digital transformation initiatives. The sector’s ability to balance tradition with innovation positions it well for future growth, particularly in emerging markets where French beauty brands command premium positioning and strong consumer loyalty.

Consumer demographics reveal a sophisticated market with high beauty product penetration across age groups, with particular strength in the 25-55 age segment that drives premium product consumption. Purchasing behavior demonstrates strong brand loyalty combined with willingness to experiment with new products, creating opportunities for both established and emerging brands.

Consumer affluence in France supports sustained demand for premium beauty products, with French consumers demonstrating willingness to invest in quality cosmetics that deliver superior performance and luxury experience. Cultural factors deeply embedded in French society emphasize personal grooming, style, and beauty as essential lifestyle elements, creating consistent market demand across economic cycles.

Innovation leadership drives market growth through continuous development of advanced formulations, breakthrough ingredients, and cutting-edge delivery systems. French cosmetics companies invest heavily in research and development, collaborating with leading scientific institutions to create products that set global industry standards. Technological advancement in areas such as personalized beauty, biotechnology, and sustainable manufacturing processes creates new market opportunities and consumer interest.

Global brand recognition of French cosmetics creates strong export demand, supporting domestic manufacturing and employment while reinforcing France’s position as a beauty industry leader. Tourism impact significantly contributes to market growth, with millions of international visitors purchasing French beauty products as authentic luxury experiences and gifts.

Regulatory environment in France and the European Union promotes product safety and quality standards that enhance consumer confidence while encouraging innovation in safer, more effective formulations. Sustainability initiatives drive development of eco-friendly products and packaging solutions that appeal to environmentally conscious consumers.

Economic sensitivity affects consumer spending patterns during periods of economic uncertainty, with some consumers reducing purchases of non-essential beauty products or trading down to lower-priced alternatives. High competition from international brands and emerging markets creates pricing pressure and requires continuous investment in marketing and innovation to maintain market position.

Regulatory complexity in cosmetics formulation and marketing requires significant compliance investments and can slow product development timelines. Raw material costs fluctuations, particularly for premium ingredients and sustainable packaging materials, impact profit margins and pricing strategies across the industry.

Changing consumer preferences toward minimalist beauty routines and multi-functional products challenge traditional product categories and require adaptation of existing product lines. Digital disruption forces traditional retailers to invest heavily in omnichannel capabilities while competing with direct-to-consumer brands that offer more personalized experiences.

Sustainability expectations require substantial investments in reformulation, packaging redesign, and supply chain modifications that increase operational complexity and costs. Counterfeiting concerns particularly affect luxury French brands, requiring ongoing investment in brand protection and authentication technologies.

Digital transformation presents significant opportunities for French cosmetics companies to enhance customer engagement through personalized beauty experiences, virtual try-on technologies, and data-driven product recommendations. E-commerce expansion enables direct consumer relationships and global market access without traditional retail infrastructure investments.

Sustainable beauty trends create opportunities for innovation in clean formulations, refillable packaging, and circular economy business models that appeal to environmentally conscious consumers. Biotechnology advancement opens new possibilities for breakthrough ingredients derived from natural sources and fermentation processes that deliver superior performance.

Emerging markets offer substantial growth potential for French luxury cosmetics brands, particularly in Asia-Pacific and Middle Eastern regions where French beauty heritage commands premium positioning. Men’s grooming represents an expanding category with significant growth potential as male consumers increasingly adopt comprehensive skincare and grooming routines.

Personalization technology enables customized product formulations and beauty solutions tailored to individual consumer needs, creating opportunities for premium pricing and enhanced customer loyalty. Professional beauty services integration allows cosmetics brands to expand into high-margin service offerings while strengthening consumer relationships.

Supply chain evolution in the French cosmetics market reflects increasing emphasis on transparency, sustainability, and local sourcing where possible. Manufacturing capabilities continue to advance through automation, quality control improvements, and flexible production systems that enable both large-scale efficiency and small-batch customization.

Consumer engagement strategies have evolved to emphasize education, authenticity, and community building rather than traditional advertising approaches. Brand differentiation increasingly relies on unique formulations, sustainable practices, and compelling brand narratives that resonate with conscious consumers.

Retail transformation accelerates as traditional beauty retailers adapt to omnichannel expectations while new retail concepts emerge that blend physical and digital experiences. Price positioning strategies become more sophisticated as brands segment offerings across multiple price points to capture diverse consumer segments.

Innovation cycles accelerate driven by consumer demand for novelty and improved performance, requiring companies to balance investment in breakthrough technologies with incremental product improvements. Partnership strategies increasingly involve collaborations between cosmetics companies, technology providers, and sustainability experts to address complex market challenges.

Market analysis employs comprehensive primary and secondary research methodologies to provide accurate insights into the France cosmetics market landscape. Primary research includes consumer surveys, industry expert interviews, and retailer consultations to gather firsthand market intelligence and validate secondary research findings.

Data collection processes utilize multiple sources including industry publications, government statistics, company financial reports, and trade association data to ensure comprehensive market coverage. Consumer behavior analysis incorporates demographic segmentation, purchasing pattern studies, and brand preference research to understand market dynamics.

Quantitative analysis employs statistical modeling and trend analysis to project market growth patterns and identify emerging opportunities. Qualitative assessment includes competitive positioning analysis, regulatory impact evaluation, and technology trend assessment to provide strategic context.

Validation procedures ensure data accuracy through cross-referencing multiple sources, expert review processes, and logical consistency checks. Market sizing methodologies combine top-down and bottom-up approaches to provide reliable growth projections and segment analysis.

Paris metropolitan area dominates the French cosmetics market, serving as the headquarters for major luxury brands and the center of innovation activities. Consumer spending in the capital region significantly exceeds national averages, driven by higher disposable income and strong beauty culture. The region benefits from concentration of flagship stores, beauty services, and international tourism that drives premium product sales.

Lyon and surrounding regions represent important manufacturing and distribution hubs for the cosmetics industry, hosting production facilities for both domestic and international brands. Regional preferences show strong alignment with national trends while maintaining some local characteristics in product preferences and shopping behaviors.

French Riviera markets demonstrate exceptional performance in luxury cosmetics categories, supported by affluent residents and high-spending tourists. Seasonal variations in coastal regions create opportunities for targeted marketing campaigns and product launches aligned with tourism patterns.

Northern France regions show growing adoption of e-commerce channels and value-oriented purchasing behaviors, creating opportunities for mass market brands and digital-first companies. Rural markets increasingly access cosmetics through online channels, supported by improved logistics and digital payment infrastructure.

Market leadership in the French cosmetics sector is characterized by a mix of global luxury conglomerates, innovative French brands, and international companies with significant French operations. Competitive positioning strategies emphasize brand heritage, product innovation, and sustainable practices to differentiate in a crowded marketplace.

Competitive strategies increasingly focus on sustainability initiatives, digital transformation, and personalized customer experiences to maintain market position and drive growth in evolving market conditions.

Product category segmentation reveals distinct market dynamics across different cosmetics categories, with skincare maintaining the largest share followed by fragrance, color cosmetics, and hair care products. Price point segmentation shows strong performance across luxury, prestige, and mass market categories, each serving different consumer needs and occasions.

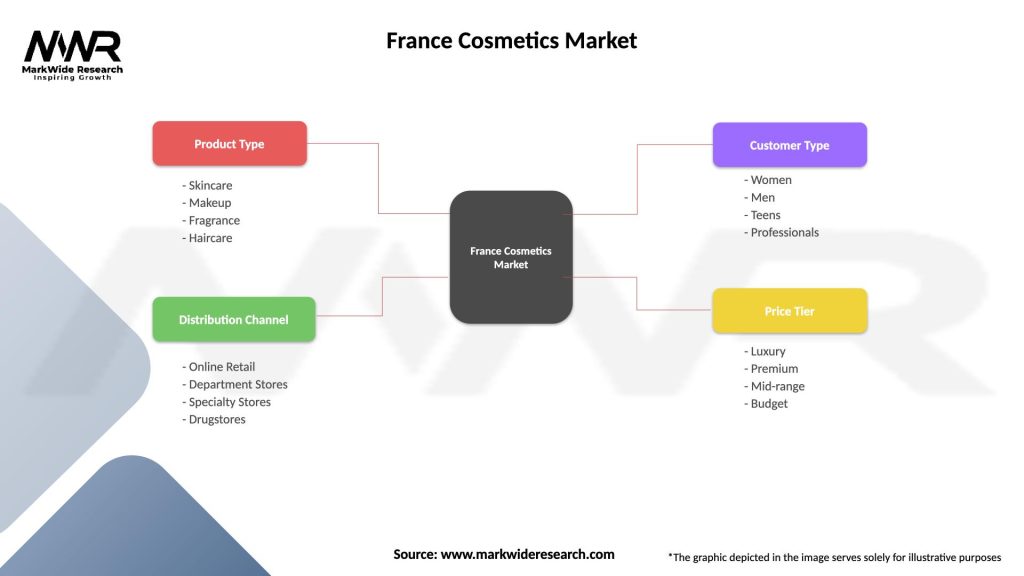

By Product Type:

By Distribution Channel:

Skincare category demonstrates the strongest growth momentum, driven by French consumers’ sophisticated understanding of skincare benefits and willingness to invest in quality products. Anti-aging products perform particularly well, supported by an aging population and preventive skincare trends among younger consumers. Clean beauty formulations gain traction as consumers seek products with natural ingredients and sustainable packaging.

Fragrance segment leverages France’s historical expertise and cultural association with perfume artistry. Niche fragrances show exceptional growth as consumers seek unique, personalized scent experiences beyond mainstream offerings. Unisex fragrances emerge as a growing subcategory, reflecting changing gender perceptions in beauty products.

Color cosmetics category adapts to changing beauty trends including minimalist makeup looks and long-wearing formulations. Lip products maintain strong performance across all price points, while complexion products benefit from increased focus on skin health and natural-looking coverage.

Hair care products show steady growth with increasing demand for professional-quality formulations for home use. Sustainable hair care gains momentum as consumers seek products with minimal environmental impact and refillable packaging options.

Brand owners benefit from France’s strong reputation for beauty innovation and luxury, enabling premium positioning and global market access. Manufacturing advantages include access to skilled workforce, advanced production facilities, and proximity to key European markets that reduce distribution costs and time-to-market.

Retailers gain from strong consumer demand for French cosmetics and the ability to offer authentic luxury experiences that command higher margins. E-commerce platforms benefit from growing online beauty sales and French consumers’ increasing comfort with digital beauty purchases.

Suppliers and ingredient manufacturers enjoy access to innovative cosmetics companies that drive demand for advanced materials and sustainable packaging solutions. Research institutions benefit from industry collaboration opportunities and funding for beauty-related scientific research.

Consumers enjoy access to world-class beauty products, innovative formulations, and diverse shopping experiences across multiple channels. Employment benefits include job creation across the beauty value chain from research and development to manufacturing and retail operations.

Export opportunities enable French companies to leverage domestic success for international expansion, while tourism benefits create additional revenue streams through beauty shopping experiences for international visitors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend reshaping product development, packaging design, and supply chain operations across the French cosmetics industry. Clean beauty formulations gain momentum as consumers seek products with transparent ingredient lists and minimal environmental impact. Refillable packaging systems become increasingly popular, particularly among luxury brands seeking to reduce waste while maintaining premium positioning.

Personalization technology transforms customer experiences through AI-powered product recommendations, custom formulations, and virtual beauty consultations. Skin diagnostics tools enable precise product matching and treatment recommendations, enhancing customer satisfaction and brand loyalty. Augmented reality applications allow virtual product testing and makeup application, bridging online and offline beauty experiences.

Wellness integration connects cosmetics with broader health and wellness trends, emphasizing products that support skin health, stress reduction, and overall well-being. Microbiome-friendly formulations gain attention as consumers become more aware of skin ecosystem balance and the importance of gentle, supportive ingredients.

Gender-neutral beauty products reflect changing social attitudes and create new market opportunities beyond traditional gender-specific categories. Inclusive beauty initiatives expand shade ranges and product offerings to serve diverse consumer needs and preferences more effectively.

Merger and acquisition activity continues to reshape the competitive landscape as companies seek to acquire innovative brands, expand geographic reach, and access new technologies. Strategic partnerships between cosmetics companies and technology firms accelerate digital transformation and personalization capabilities.

Sustainability initiatives drive major investments in renewable energy, sustainable sourcing, and circular economy business models. Carbon neutrality commitments from leading brands create industry-wide pressure to reduce environmental impact across operations and supply chains.

Regulatory developments in the European Union continue to influence product formulation and marketing practices, with increasing focus on ingredient safety and environmental impact. Digital privacy regulations affect customer data collection and personalization strategies in e-commerce and digital marketing.

Innovation investments focus on biotechnology, nanotechnology, and advanced delivery systems that enhance product efficacy and consumer experience. Research collaborations with universities and scientific institutions accelerate breakthrough ingredient development and formulation technologies.

Retail evolution includes new store concepts that blend physical and digital experiences, enhanced customer service training, and omnichannel integration to meet changing consumer expectations.

MarkWide Research analysis indicates that French cosmetics companies should prioritize sustainability initiatives and digital transformation to maintain competitive advantage in evolving market conditions. Investment recommendations emphasize the importance of balancing heritage brand values with innovative technologies and changing consumer preferences.

Strategic focus should include expansion of e-commerce capabilities, development of personalized beauty solutions, and strengthening of sustainable supply chain practices. Market positioning strategies should leverage France’s beauty expertise while adapting to global trends in clean beauty and inclusive product offerings.

Innovation priorities should emphasize biotechnology applications, advanced skincare formulations, and sustainable packaging solutions that appeal to environmentally conscious consumers. Partnership opportunities with technology companies and sustainability experts can accelerate development of next-generation beauty products and services.

Geographic expansion strategies should target high-growth emerging markets while maintaining strong positions in established markets through premium positioning and brand differentiation. Digital marketing investments should focus on authentic storytelling, influencer partnerships, and community building to engage younger consumer demographics.

Long-term prospects for the France cosmetics market remain positive, supported by continued innovation, strong brand heritage, and expanding global demand for French beauty products. Growth projections indicate sustained expansion at approximately 4.5% CAGR over the next five years, driven by digital transformation, sustainability initiatives, and emerging market penetration.

Technology integration will continue to reshape customer experiences and operational efficiency, with artificial intelligence, biotechnology, and sustainable manufacturing processes becoming increasingly important competitive differentiators. Consumer behavior evolution toward conscious consumption and personalized beauty solutions will drive product development and marketing strategies.

Market consolidation may accelerate as companies seek scale advantages and complementary capabilities through strategic acquisitions and partnerships. Regulatory environment will likely become more stringent regarding sustainability claims and ingredient transparency, requiring ongoing compliance investments.

MWR forecasts suggest that companies successfully balancing tradition with innovation while addressing sustainability concerns will achieve the strongest market positions. Emerging opportunities in men’s grooming, senior-focused products, and wellness-beauty convergence offer significant growth potential for forward-thinking companies.

The France cosmetics market represents a dynamic and sophisticated sector that successfully balances rich heritage with continuous innovation to maintain global leadership in beauty products. Market fundamentals remain strong, supported by educated consumers, premium brand positioning, and robust export performance that demonstrates the enduring appeal of French beauty expertise worldwide.

Strategic opportunities abound for companies that can effectively integrate sustainability practices, digital technologies, and personalization capabilities while preserving the authenticity and quality that define French cosmetics. Future success will depend on the ability to adapt to changing consumer preferences while maintaining the luxury positioning and innovation leadership that characterize the French beauty industry.

The market’s resilience through economic challenges and its continued evolution toward more sustainable and inclusive practices position it well for sustained growth and global influence in the beauty sector.

What is Cosmetics?

Cosmetics refer to products applied to the body for cleansing, beautifying, promoting attractiveness, or altering appearance. This includes a wide range of items such as skincare, makeup, haircare, and fragrances.

What are the key players in the France Cosmetics Market?

Key players in the France Cosmetics Market include L’Oréal, Chanel, and Dior, which are known for their extensive product lines and strong brand presence. These companies lead in various segments such as luxury cosmetics, skincare, and fragrances, among others.

What are the growth factors driving the France Cosmetics Market?

The France Cosmetics Market is driven by factors such as increasing consumer awareness about personal grooming, the rise of e-commerce platforms, and a growing demand for organic and natural beauty products. Additionally, the influence of social media on beauty trends plays a significant role.

What challenges does the France Cosmetics Market face?

Challenges in the France Cosmetics Market include stringent regulations regarding product safety and environmental impact, as well as intense competition among brands. Additionally, changing consumer preferences towards sustainability can pose challenges for traditional cosmetic companies.

What opportunities exist in the France Cosmetics Market?

Opportunities in the France Cosmetics Market include the growing trend of personalized beauty products and the expansion of clean beauty brands. Furthermore, the increasing popularity of men’s grooming products presents a new segment for growth.

What trends are shaping the France Cosmetics Market?

Trends in the France Cosmetics Market include the rise of vegan and cruelty-free products, the integration of technology in beauty applications, and a focus on sustainable packaging. Additionally, the influence of social media and beauty influencers continues to shape consumer preferences.

France Cosmetics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Skincare, Makeup, Fragrance, Haircare |

| Distribution Channel | Online Retail, Department Stores, Specialty Stores, Drugstores |

| Customer Type | Women, Men, Teens, Professionals |

| Price Tier | Luxury, Premium, Mid-range, Budget |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Cosmetics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at