444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada cosmetic market represents a dynamic and rapidly evolving sector within the North American beauty industry, characterized by increasing consumer sophistication and growing demand for premium beauty products. Canadian consumers are demonstrating heightened awareness of ingredient transparency, sustainability practices, and personalized beauty solutions, driving significant transformation across the cosmetics landscape. The market encompasses diverse product categories including skincare, makeup, haircare, fragrances, and personal care items, with skincare products commanding the largest market share at approximately 42% of total cosmetic sales.

Market dynamics indicate robust growth driven by demographic shifts, urbanization trends, and evolving beauty standards influenced by social media platforms and digital marketing strategies. The Canadian cosmetic industry benefits from strong regulatory frameworks, high disposable income levels, and cultural diversity that creates demand for inclusive beauty products catering to various skin tones and hair types. E-commerce penetration has accelerated significantly, with online beauty sales growing at 15.2% annually, fundamentally reshaping distribution channels and consumer purchasing behaviors.

Regional variations across provinces reflect distinct consumer preferences, with urban centers like Toronto, Vancouver, and Montreal leading adoption of premium and luxury cosmetic brands. The market demonstrates strong resilience and adaptability, with natural and organic beauty products experiencing particularly robust growth as Canadian consumers increasingly prioritize clean beauty formulations and environmentally conscious packaging solutions.

The Canada cosmetic market refers to the comprehensive ecosystem of beauty and personal care products manufactured, distributed, and sold within Canadian borders, encompassing both domestic and international brands serving Canadian consumers. This market includes traditional cosmetic categories such as color cosmetics, skincare treatments, haircare products, fragrances, and personal hygiene items, alongside emerging segments like men’s grooming products, K-beauty imports, and clean beauty formulations.

Market scope extends beyond product sales to include associated services such as beauty consultations, professional makeup applications, and digital beauty platforms that facilitate product discovery and purchase decisions. The Canadian cosmetic ecosystem encompasses various distribution channels including department stores, specialty beauty retailers, pharmacies, supermarkets, and increasingly prominent e-commerce platforms that serve diverse consumer segments across urban and rural markets.

Industry definition also incorporates the regulatory environment governed by Health Canada, which ensures product safety standards, labeling requirements, and ingredient compliance that distinguishes the Canadian market from other international cosmetic markets. This regulatory framework influences product formulations, marketing claims, and import procedures that shape competitive dynamics within the Canadian beauty landscape.

Strategic analysis reveals the Canada cosmetic market as a mature yet innovative sector experiencing steady growth driven by evolving consumer preferences, technological advancement, and increasing beauty consciousness across demographic segments. Key growth drivers include rising disposable income, urbanization trends, social media influence, and growing demand for premium and sustainable beauty products that align with Canadian values of environmental responsibility and social consciousness.

Market segmentation demonstrates skincare dominance, followed by haircare and color cosmetics, with emerging categories like men’s grooming and clean beauty showing exceptional growth potential. Consumer behavior patterns indicate increasing preference for multi-functional products, personalized beauty solutions, and brands that demonstrate authentic commitment to sustainability and inclusivity initiatives.

Competitive landscape features established international beauty conglomerates alongside emerging Canadian brands that leverage local market knowledge and authentic brand storytelling. Digital transformation continues reshaping the industry, with social commerce adoption growing at 22% annually, creating new opportunities for brand engagement and customer acquisition strategies.

Future outlook suggests continued market expansion supported by demographic trends, technological innovation, and evolving beauty standards that favor authentic, inclusive, and environmentally conscious beauty brands capable of delivering personalized consumer experiences across multiple touchpoints.

Consumer demographics reveal significant insights driving market evolution, with millennials and Gen Z consumers representing the most influential purchasing segments, accounting for approximately 68% of total beauty spending in Canada. These younger demographics prioritize brand authenticity, ingredient transparency, and social responsibility, fundamentally reshaping product development and marketing strategies across the industry.

Regional preferences demonstrate distinct patterns, with Quebec consumers showing strong preference for French beauty brands, while Western provinces exhibit higher adoption rates for Korean and Asian beauty products. Seasonal variations significantly impact product demand, with skincare sales peaking during harsh winter months and color cosmetics experiencing summer surges.

Primary growth catalysts propelling the Canada cosmetic market include evolving lifestyle patterns, increased beauty awareness, and rising disposable income levels that enable consumers to invest in premium beauty products and professional beauty services. Social media influence serves as a powerful driver, with beauty influencers and content creators significantly impacting product discovery, brand perception, and purchase decisions across demographic segments.

Demographic shifts contribute substantially to market expansion, particularly the growing purchasing power of millennial and Gen Z consumers who prioritize self-expression, personal care, and beauty as essential lifestyle components. Urbanization trends concentrate beauty-conscious consumers in metropolitan areas, creating dense markets for premium and luxury cosmetic brands while supporting specialized beauty retail formats.

Innovation acceleration in product formulations, packaging technologies, and application methods continues attracting consumer interest and driving market growth. Regulatory support from Health Canada ensures product safety while enabling innovation, creating a favorable environment for both established brands and emerging cosmetic companies to introduce new products and capture market share.

Significant challenges facing the Canada cosmetic market include economic uncertainties, regulatory complexities, and intense competitive pressures that can limit growth potential for certain market segments and product categories. Economic fluctuations directly impact consumer spending on discretionary beauty products, with premium and luxury segments experiencing heightened sensitivity to economic downturns and reduced disposable income levels.

Regulatory compliance requirements imposed by Health Canada create substantial barriers for new market entrants, particularly smaller brands and international companies seeking to establish Canadian market presence. Ingredient restrictions and labeling requirements can limit product formulation options and increase development costs, potentially slowing innovation cycles and market introduction timelines.

Consumer skepticism regarding marketing claims and ingredient efficacy can limit adoption of new products, particularly in saturated categories where differentiation becomes increasingly difficult. Environmental concerns about packaging waste and ingredient sourcing create additional compliance requirements and operational complexities that can constrain market growth and profitability for cosmetic companies operating in Canada.

Emerging opportunities within the Canada cosmetic market present substantial growth potential, particularly in underserved segments such as men’s grooming, senior-focused beauty products, and specialized formulations for Canada’s diverse climate conditions. Digital innovation creates unprecedented opportunities for personalized beauty experiences, virtual consultations, and direct-to-consumer brand strategies that can capture market share from traditional retail channels.

Clean beauty movement represents a transformative opportunity, with Canadian consumers demonstrating strong preference for natural, organic, and sustainably produced cosmetic products. Market research indicates that clean beauty adoption rates are growing at 18% annually, creating significant opportunities for brands that can authentically deliver on clean beauty promises while maintaining product efficacy and competitive pricing.

Cross-border opportunities exist for Canadian brands to expand into international markets, leveraging Canada’s reputation for quality, safety, and natural ingredients. Partnership opportunities with Canadian retailers, beauty professionals, and influencers can create authentic brand connections and accelerate market penetration across diverse consumer segments and geographic regions.

Complex interactions between consumer behavior, competitive forces, and regulatory environment shape the Canada cosmetic market dynamics, creating both challenges and opportunities for industry participants. Consumer empowerment through digital platforms and social media has fundamentally altered the balance of power, enabling informed purchase decisions while increasing expectations for brand transparency and authentic engagement.

Competitive intensity continues escalating as established beauty conglomerates compete with emerging indie brands, direct-to-consumer startups, and international brands seeking Canadian market entry. Innovation cycles have accelerated significantly, with product development timelines shortening and consumer expectations for novelty and efficacy increasing across all cosmetic categories.

Supply chain dynamics reflect global interconnectedness, with Canadian cosmetic companies sourcing ingredients internationally while serving increasingly sophisticated domestic consumers. Retail evolution demonstrates ongoing transformation from traditional department store dominance toward multi-channel strategies that integrate physical and digital touchpoints for seamless consumer experiences.

Regulatory dynamics continue evolving, with Health Canada implementing updated guidelines for cosmetic safety, labeling, and marketing claims that influence product development and competitive positioning. Economic factors including currency fluctuations, trade policies, and consumer spending patterns create ongoing uncertainty while presenting opportunities for agile companies capable of adapting to changing market conditions.

Comprehensive research approach employed for analyzing the Canada cosmetic market incorporates multiple data sources, analytical frameworks, and validation methodologies to ensure accuracy and reliability of market insights. Primary research includes consumer surveys, industry expert interviews, and retailer consultations that provide direct insights into market trends, consumer preferences, and competitive dynamics affecting the Canadian beauty industry.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial disclosures that provide quantitative foundation for market assessment. Data triangulation methods ensure consistency and accuracy across multiple information sources, while statistical analysis techniques identify significant trends and correlations within the Canadian cosmetic market landscape.

Analytical frameworks include market segmentation analysis, competitive positioning assessment, and trend forecasting models that provide strategic insights for industry stakeholders. Quality assurance procedures ensure data accuracy through multiple validation checkpoints and expert review processes that maintain research integrity and analytical rigor throughout the study development process.

Geographic distribution across Canada reveals distinct regional preferences and market characteristics that influence cosmetic consumption patterns and brand performance. Ontario represents the largest provincial market, accounting for approximately 38% of national cosmetic sales, driven by Toronto’s metropolitan area and high concentration of beauty-conscious consumers with substantial disposable income levels.

Quebec market demonstrates unique characteristics with strong preference for French beauty brands and distinctive cultural influences that shape product selection and brand loyalty patterns. British Columbia shows elevated adoption rates for natural and organic beauty products, reflecting the province’s environmental consciousness and outdoor lifestyle preferences that prioritize clean beauty formulations.

Urban versus rural dynamics create distinct market segments, with metropolitan areas driving premium and luxury beauty adoption while rural markets show preference for accessible, multi-functional products available through diverse retail channels. Regional climate variations significantly impact product demand, with harsh winter conditions driving skincare sales and summer seasons boosting color cosmetics and sun protection product categories.

Distribution networks vary significantly across regions, with major urban centers supporting specialized beauty retailers while smaller markets rely heavily on pharmacy chains and general merchandise stores for cosmetic product access.

Market leadership within the Canada cosmetic market reflects a diverse ecosystem of international beauty conglomerates, established Canadian brands, and emerging indie companies competing across multiple product categories and price segments. Competitive dynamics demonstrate ongoing consolidation among major players while simultaneously witnessing proliferation of niche brands targeting specific consumer segments and unmet market needs.

Emerging competitors include direct-to-consumer brands leveraging digital marketing strategies and social media influence to capture market share from established players. International expansion of Korean beauty brands, indie clean beauty companies, and men’s grooming specialists continues intensifying competitive pressures across traditional market segments.

Strategic positioning varies significantly, with some companies focusing on innovation and premium positioning while others compete on accessibility, value, and broad market appeal through extensive retail distribution networks.

Market segmentation within the Canada cosmetic market reveals distinct categories based on product type, price positioning, distribution channels, and target demographics that enable strategic analysis and competitive positioning. Product-based segmentation demonstrates skincare dominance, followed by haircare, color cosmetics, fragrances, and emerging categories such as men’s grooming and clean beauty products.

By Product Category:

By Price Segment:

Demographic segmentation reveals distinct consumer groups with varying preferences, purchasing behaviors, and brand loyalties that influence product development and marketing strategies across the Canadian cosmetic market landscape.

Skincare category maintains market leadership position driven by increasing consumer awareness of skin health, anti-aging concerns, and preventive care approaches that prioritize long-term skin wellness over purely cosmetic benefits. Premium skincare adoption continues growing, with Canadian consumers willing to invest in clinically-proven formulations and dermatologist-recommended products that deliver measurable results.

Color cosmetics segment demonstrates resilience despite market maturity, with innovation focusing on inclusive shade ranges, long-wearing formulations, and multi-functional products that simplify beauty routines. Social media influence significantly impacts color cosmetics trends, with viral makeup techniques and influencer recommendations driving rapid adoption of new products and brands.

Emerging categories including K-beauty products, CBD-infused cosmetics, and personalized beauty solutions demonstrate significant growth potential as Canadian consumers embrace global beauty trends and innovative formulation approaches. Category convergence creates opportunities for hybrid products that combine skincare benefits with color cosmetics functionality, appealing to time-conscious consumers seeking simplified beauty routines.

Strategic advantages available to Canada cosmetic market participants include access to sophisticated consumer base, stable regulatory environment, and strong retail infrastructure that supports diverse business models and growth strategies. Market participants benefit from Canadian consumers’ willingness to invest in quality beauty products and their openness to trying new brands and innovative formulations.

Regulatory benefits include Health Canada’s clear guidelines and safety standards that provide predictable compliance framework while ensuring consumer protection and market integrity. Distribution advantages encompass well-established retail networks, growing e-commerce infrastructure, and professional beauty channels that enable effective market penetration and consumer reach.

Innovation ecosystem benefits include access to research institutions, ingredient suppliers, and manufacturing capabilities that support product development and market introduction. Brand building opportunities leverage Canada’s positive international reputation for quality, safety, and natural ingredients that can enhance brand credibility and consumer trust in domestic and export markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping the Canada cosmetic market include the accelerating clean beauty movement, personalization revolution, and digital-first consumer behaviors that fundamentally alter how beauty products are developed, marketed, and consumed. Sustainability consciousness drives demand for eco-friendly packaging, ethically sourced ingredients, and cruelty-free formulations that align with Canadian environmental values and social responsibility expectations.

Personalization trend encompasses customized product formulations, AI-powered beauty recommendations, and bespoke beauty experiences that cater to individual skin types, preferences, and lifestyle requirements. MarkWide Research indicates that personalized beauty adoption is growing at 25% annually, creating significant opportunities for brands capable of delivering authentic customization at scale.

Technology integration continues advancing through augmented reality try-on experiences, virtual beauty consultations, and AI-powered skin analysis tools that enhance consumer engagement and purchase confidence. Subscription models gain traction as consumers appreciate convenience and personalized product curation that simplifies beauty shopping and ensures consistent product supply.

Recent developments within the Canada cosmetic market demonstrate ongoing evolution driven by consumer demand, technological advancement, and competitive innovation across multiple industry segments. Major acquisitions and strategic partnerships continue reshaping the competitive landscape as established companies seek to capture emerging market opportunities and expand their product portfolios.

Product launches increasingly focus on clean beauty formulations, inclusive shade ranges, and climate-specific solutions that address unique Canadian market needs. Retail expansion includes new beauty specialty stores, enhanced pharmacy beauty sections, and innovative concept stores that provide immersive beauty experiences and expert consultation services.

Regulatory developments include updated Health Canada guidelines for cosmetic labeling, ingredient safety assessments, and marketing claim substantiation that influence product development and competitive positioning strategies. Innovation investments focus on sustainable packaging solutions, advanced formulation technologies, and digital beauty tools that enhance consumer experiences and brand differentiation.

Strategic recommendations for Canada cosmetic market participants emphasize the importance of embracing clean beauty trends, investing in digital capabilities, and developing authentic brand narratives that resonate with Canadian consumers’ values and preferences. Market entry strategies should prioritize understanding regional differences, regulatory compliance, and building strong retail partnerships that enable effective market penetration and sustainable growth.

Innovation focus should address climate-specific beauty needs, inclusive product development, and sustainable packaging solutions that differentiate brands in increasingly competitive market segments. Digital investment priorities include e-commerce optimization, social media marketing, and virtual beauty experiences that meet evolving consumer expectations for convenience and personalization.

Competitive positioning should leverage unique value propositions, whether through ingredient innovation, cultural relevance, or specialized product benefits that address specific Canadian consumer needs. Long-term success requires continuous adaptation to evolving consumer preferences, regulatory changes, and competitive dynamics while maintaining authentic brand identity and consumer trust.

Future projections for the Canada cosmetic market indicate continued growth driven by demographic trends, technological advancement, and evolving beauty standards that favor authentic, inclusive, and sustainable beauty brands. Market evolution will likely accelerate toward personalized beauty solutions, clean formulations, and integrated wellness approaches that address holistic consumer needs beyond traditional cosmetic benefits.

Growth trajectory suggests sustained expansion across multiple product categories, with particular strength in skincare, men’s grooming, and clean beauty segments that align with Canadian consumer values and lifestyle preferences. MWR analysis projects that the Canadian beauty market will experience robust growth, with digital commerce penetration reaching 35% of total beauty sales within the next five years.

Innovation directions will likely focus on biotechnology applications, sustainable packaging breakthroughs, and personalized formulation technologies that enable mass customization at competitive price points. Market consolidation may continue as established players acquire innovative brands while new entrants leverage digital platforms and direct-to-consumer strategies to capture market share and build consumer loyalty.

The Canada cosmetic market represents a dynamic and evolving sector characterized by sophisticated consumers, strong regulatory frameworks, and diverse opportunities for growth and innovation. Market analysis reveals a resilient industry adapting to changing consumer preferences, technological advancement, and global beauty trends while maintaining distinctly Canadian characteristics that influence product development and competitive strategies.

Key success factors include authentic brand positioning, commitment to sustainability, inclusive product development, and effective digital engagement strategies that resonate with Canadian consumers across demographic segments and geographic regions. Future opportunities exist for companies capable of delivering personalized beauty experiences, clean formulations, and innovative solutions that address specific Canadian market needs and climate considerations.

The competitive landscape will continue evolving as established players compete with emerging brands, international entrants, and direct-to-consumer specialists that leverage digital platforms and social media influence to capture market share. Sustained growth requires continuous adaptation to regulatory changes, consumer preferences, and technological innovations while maintaining focus on quality, safety, and authentic brand values that build lasting consumer relationships in the Canadian beauty market.

What is Cosmetic?

Cosmetics refer to products used to enhance or alter the appearance of the face, body, and hair. This includes makeup, skincare, haircare, and fragrance products, which are widely used in personal grooming and beauty routines.

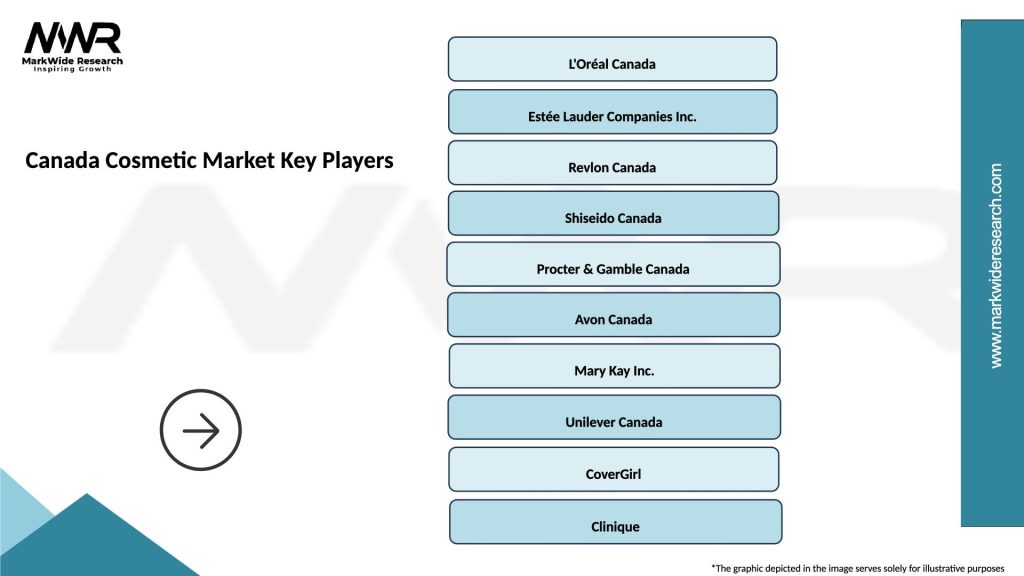

Who are the key players in the Canada Cosmetic Market?

Key players in the Canada Cosmetic Market include L’Oréal, Estée Lauder, Revlon, and Shiseido, among others. These companies offer a wide range of products catering to various consumer preferences and trends.

What are the growth factors driving the Canada Cosmetic Market?

The Canada Cosmetic Market is driven by factors such as increasing consumer awareness about personal grooming, the rise of social media influencing beauty standards, and a growing demand for organic and natural cosmetic products.

What challenges does the Canada Cosmetic Market face?

Challenges in the Canada Cosmetic Market include stringent regulations regarding product safety and labeling, competition from emerging brands, and changing consumer preferences towards sustainability and ethical sourcing.

What opportunities exist in the Canada Cosmetic Market?

Opportunities in the Canada Cosmetic Market include the expansion of e-commerce platforms, the growing trend of personalized beauty products, and the increasing popularity of clean beauty brands that focus on natural ingredients.

What trends are shaping the Canada Cosmetic Market?

Trends in the Canada Cosmetic Market include the rise of vegan and cruelty-free products, the integration of technology in beauty applications, and a focus on inclusivity in product offerings to cater to diverse skin tones and types.

Canada Cosmetic Market

| Segmentation Details | Description |

|---|---|

| Product Type | Skincare, Makeup, Fragrance, Haircare |

| Distribution Channel | Online Retail, Department Stores, Specialty Stores, Drugstores |

| Customer Type | Women, Men, Teens, Professionals |

| Price Tier | Luxury, Premium, Mid-range, Economy |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Cosmetic Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at