444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK skincare market represents one of Europe’s most dynamic and sophisticated beauty segments, characterized by evolving consumer preferences, innovative product formulations, and increasing awareness of skin health. British consumers are demonstrating unprecedented interest in premium skincare solutions, driving demand across multiple product categories including cleansers, moisturizers, serums, and specialized treatments. The market encompasses both established luxury brands and emerging indie labels, creating a diverse landscape that caters to various demographic segments and skin concerns.

Market dynamics indicate robust growth driven by several key factors including rising disposable income, increased social media influence, and growing awareness of skincare as preventive healthcare. The sector has experienced significant transformation with the integration of advanced technologies, sustainable packaging solutions, and personalized product offerings. Consumer behavior patterns show a marked shift toward ingredient transparency, with buyers increasingly scrutinizing product formulations and seeking evidence-based skincare solutions.

Digital transformation has revolutionized how UK consumers discover, research, and purchase skincare products. E-commerce platforms now account for a substantial portion of sales, with online penetration rates reaching approximately 42% of total skincare purchases. This digital shift has enabled direct-to-consumer brands to compete effectively with traditional retail giants while providing consumers with greater access to international brands and niche products.

The UK skincare market refers to the comprehensive ecosystem of facial and body care products designed to maintain, protect, and enhance skin health across the United Kingdom. This market encompasses a wide range of product categories including daily cleansers, moisturizers, anti-aging treatments, sun protection, acne solutions, and specialized therapeutic formulations targeting specific skin conditions and concerns.

Market participants include multinational beauty conglomerates, independent British brands, direct-to-consumer startups, and specialized dermatological companies. The sector operates through multiple distribution channels including department stores, specialty beauty retailers, pharmacies, supermarkets, and increasingly prominent online platforms. Consumer segments span various age groups, income levels, and skin types, each with distinct preferences for product attributes such as natural ingredients, clinical efficacy, and sustainable packaging.

Strategic analysis reveals the UK skincare market as a mature yet rapidly evolving sector experiencing significant transformation driven by changing consumer expectations and technological innovation. The market demonstrates strong resilience with consistent growth patterns despite economic uncertainties, reflecting the essential nature of skincare products in consumers’ daily routines.

Key performance indicators show impressive expansion across multiple segments, with anti-aging products leading growth at approximately 8.2% annually, followed by natural and organic formulations gaining 12.5% market share penetration. The premium segment continues to outperform mass market alternatives, indicating consumers’ willingness to invest in higher-quality skincare solutions. Demographic trends reveal increasing male participation in skincare routines, with men’s skincare products experiencing 15.3% growth in adoption rates.

Competitive landscape analysis indicates market consolidation among major players while simultaneously witnessing the emergence of innovative startup brands leveraging direct-to-consumer models. Traditional retail channels face pressure from digital platforms, with omnichannel strategies becoming essential for sustained market presence and customer engagement.

Consumer behavior analysis reveals several critical insights shaping the UK skincare market trajectory. Modern British consumers demonstrate sophisticated understanding of skincare ingredients and actively seek products with proven efficacy and transparent formulations.

Primary growth drivers propelling the UK skincare market forward encompass both demographic shifts and evolving lifestyle patterns. The aging population represents a fundamental driver, with baby boomers maintaining active lifestyles and seeking products that support healthy aging processes.

Social media influence has emerged as a powerful market catalyst, with beauty influencers and skincare enthusiasts sharing routines, product reviews, and educational content that drives consumer awareness and purchase intent. Platforms like Instagram, TikTok, and YouTube have democratized beauty expertise, enabling consumers to access professional-level skincare knowledge and product recommendations.

Health and wellness trends significantly impact market growth as consumers increasingly view skincare as an extension of overall health maintenance. This holistic approach to beauty has elevated the importance of ingredient quality, product safety, and long-term skin health benefits over purely cosmetic concerns.

Economic factors including rising disposable income and changing spending priorities have enabled consumers to allocate larger portions of their budgets to premium skincare products. The concept of skincare as self-care has gained cultural acceptance, justifying higher expenditures on quality products and professional treatments.

Technological advancement in product formulation has created more effective solutions for various skin concerns, building consumer confidence in skincare efficacy and encouraging continued investment in advanced products. Innovation in delivery systems, active ingredient stability, and personalized formulations continues to drive market expansion.

Economic uncertainties pose significant challenges to UK skincare market growth, with inflation pressures and cost-of-living concerns potentially impacting consumer spending on non-essential beauty products. Brexit implications continue to affect supply chains, import costs, and regulatory frameworks, creating operational complexities for market participants.

Regulatory compliance requirements present ongoing challenges, particularly for smaller brands lacking extensive regulatory expertise. Evolving safety standards, ingredient restrictions, and labeling requirements demand continuous investment in compliance infrastructure and legal consultation.

Market saturation in certain product categories creates intense competition and pricing pressures, making it difficult for new entrants to establish market presence without significant marketing investments. The proliferation of similar products can lead to consumer confusion and decision paralysis.

Supply chain disruptions affecting raw material availability and manufacturing capacity have created inventory challenges and increased production costs. Global supply chain vulnerabilities exposed during recent years continue to impact product availability and pricing strategies.

Consumer skepticism regarding marketing claims and ingredient efficacy has increased demand for clinical evidence and third-party validation, requiring additional investment in research and testing to support product claims and maintain consumer trust.

Emerging opportunities within the UK skincare market present substantial potential for growth and innovation. The increasing focus on men’s skincare represents a significant untapped segment, with traditional barriers to male beauty participation rapidly diminishing and creating space for targeted product development.

Sustainable beauty initiatives offer compelling opportunities for brands willing to invest in eco-friendly formulations, recyclable packaging, and transparent supply chains. Consumers demonstrate increasing willingness to pay premium prices for products aligning with their environmental values and sustainability goals.

Technology integration presents numerous opportunities including AI-powered skin analysis, personalized product recommendations, virtual consultations, and smart packaging solutions that enhance user experience and engagement. Digital tools can create competitive advantages while improving customer satisfaction and loyalty.

Niche market segments including sensitive skin solutions, ethnic skin care, and condition-specific treatments offer opportunities for specialized brands to develop targeted products addressing underserved consumer needs. These segments often command premium pricing and foster strong brand loyalty.

Direct-to-consumer models enable brands to build closer customer relationships, gather valuable consumer data, and maintain higher profit margins while offering personalized experiences and exclusive products unavailable through traditional retail channels.

Competitive dynamics within the UK skincare market reflect a complex interplay between established multinational brands and innovative newcomers challenging traditional market structures. Brand loyalty patterns show increasing fluidity as consumers become more experimental and willing to switch products based on performance, value, and alignment with personal values.

Pricing strategies vary significantly across market segments, with premium brands maintaining high price points through superior formulations and brand prestige, while mass market players compete on accessibility and value. The middle market segment faces particular pressure as consumers increasingly polarize toward either luxury or budget options.

Distribution evolution continues reshaping market dynamics as traditional retail partnerships adapt to omnichannel consumer expectations. E-commerce growth has accelerated, reaching approximately 38% of total skincare sales, forcing brands to develop sophisticated digital marketing strategies and direct-to-consumer capabilities.

Innovation cycles have accelerated with brands launching new products more frequently to maintain consumer interest and market relevance. This rapid product development requires significant investment in research and development while creating opportunities for first-mover advantages in emerging categories.

Consumer education has become a critical competitive factor as informed consumers demand transparency, efficacy evidence, and ingredient education. Brands investing in educational content and professional expertise gain competitive advantages through enhanced consumer trust and loyalty.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into UK skincare market dynamics. Primary research involves extensive consumer surveys, focus groups, and in-depth interviews with industry stakeholders including manufacturers, retailers, and skincare professionals.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and trade publications to validate primary findings and identify market trends. MarkWide Research utilizes proprietary databases and analytical frameworks to process vast amounts of market data and generate actionable insights.

Quantitative analysis includes statistical modeling, trend analysis, and forecasting methodologies to project market growth patterns and identify emerging opportunities. Data collection spans multiple years to establish reliable baseline measurements and track market evolution over time.

Qualitative assessment involves expert interviews with industry leaders, dermatologists, and beauty professionals to understand market nuances, consumer behavior patterns, and future development prospects. This approach provides context and depth to quantitative findings.

Market validation processes ensure research accuracy through cross-referencing multiple data sources, peer review, and continuous monitoring of market developments to maintain current and relevant insights for stakeholders and decision-makers.

Geographic distribution across the UK reveals distinct regional preferences and market characteristics influenced by demographic composition, income levels, and cultural factors. London and Southeast England dominate market consumption, accounting for approximately 35% of total skincare purchases, driven by higher disposable incomes and greater exposure to international beauty trends.

Northern England demonstrates strong growth potential with increasing urbanization and rising consumer sophistication driving demand for premium skincare products. Cities like Manchester, Liverpool, and Leeds show particular promise for market expansion and brand investment.

Scotland presents unique market dynamics with consumers showing preference for natural and organic formulations, influenced by the region’s environmental consciousness and traditional values. The Scottish market represents approximately 8.5% of total UK skincare consumption with steady growth patterns.

Wales and Northern Ireland represent emerging markets with growing consumer awareness and increasing retail infrastructure development. These regions show strong potential for market penetration strategies focused on accessibility and value proposition.

Rural versus urban consumption patterns reveal significant differences in product preferences, purchasing channels, and brand awareness. Urban consumers typically demonstrate higher engagement with premium brands and innovative products, while rural markets show stronger loyalty to established brands and traditional formulations.

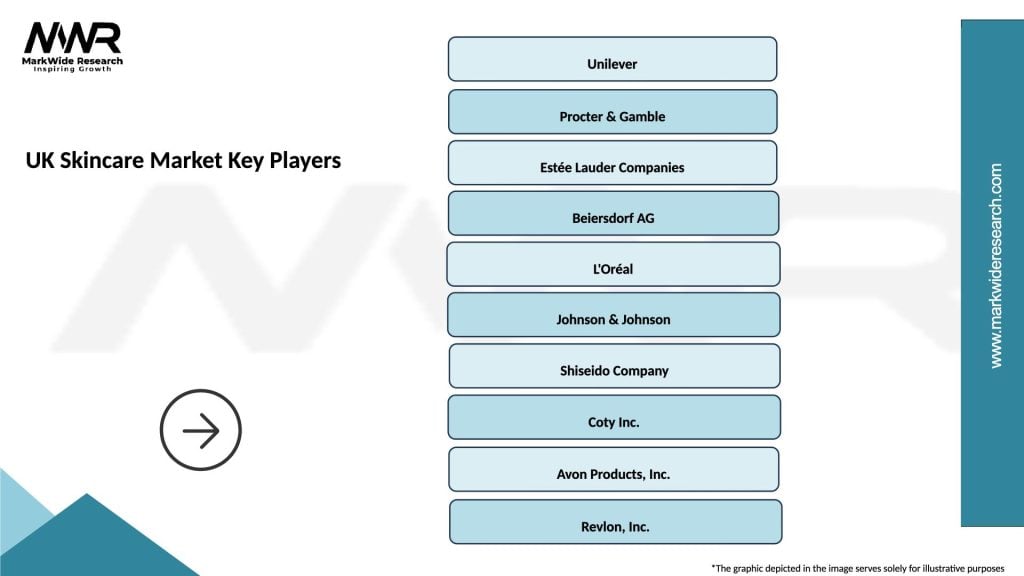

Market leadership in the UK skincare sector is distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment continues evolving as traditional beauty giants face challenges from innovative startups and direct-to-consumer brands.

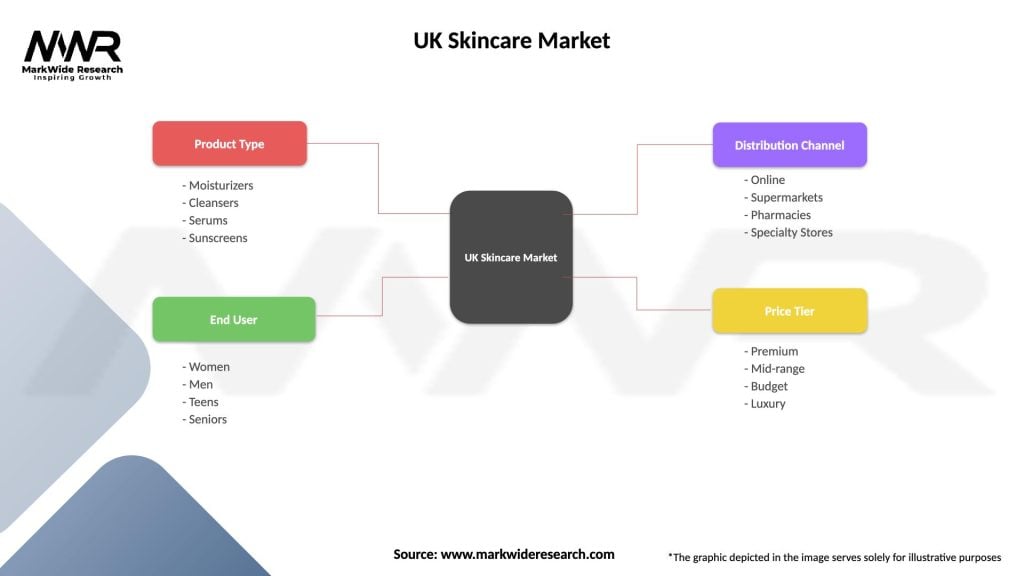

Market segmentation analysis reveals multiple classification approaches that help understand consumer preferences and market dynamics across different product categories and demographic groups.

By Product Type:

By Distribution Channel:

By Demographics:

Anti-aging segment dominates premium skincare categories with consumers increasingly investing in preventive treatments and advanced formulations. Retinol products show particularly strong performance, with adoption rates increasing 22% annually as consumer education improves understanding of ingredient benefits.

Natural and organic skincare categories experience robust growth driven by consumer preference for clean beauty and sustainable formulations. This segment demonstrates 16.8% growth in market penetration as brands respond to demand for transparent ingredient lists and environmentally conscious packaging.

Men’s skincare represents the fastest-growing category with traditional barriers to male beauty participation rapidly diminishing. Product development focuses on simplified routines, masculine packaging, and targeted solutions for men’s specific skin concerns and lifestyle factors.

K-beauty influence continues shaping UK consumer preferences with multi-step routines, innovative ingredients, and unique product formats gaining popularity. Korean skincare philosophy emphasizing prevention and gentle formulations resonates strongly with British consumers seeking effective yet non-irritating solutions.

Sensitive skin formulations represent a significant growth opportunity as consumers become more aware of skin sensitivities and seek gentle yet effective products. This category requires specialized formulation expertise and clinical testing to ensure safety and efficacy for reactive skin types.

Manufacturers benefit from comprehensive market insights enabling strategic product development, optimal resource allocation, and competitive positioning strategies. Understanding consumer preferences and market trends facilitates innovation investments and helps identify emerging opportunities before competitors.

Retailers gain valuable insights into category performance, consumer shopping patterns, and optimal product mix strategies. MWR analysis helps retailers optimize inventory management, pricing strategies, and promotional activities to maximize category profitability and customer satisfaction.

Investors receive critical market intelligence supporting investment decisions, risk assessment, and portfolio optimization strategies. Market growth projections and competitive analysis enable informed capital allocation and strategic partnership evaluations.

Brand managers benefit from detailed consumer behavior analysis, competitive intelligence, and market positioning insights that inform marketing strategies, brand development initiatives, and customer engagement programs.

Suppliers gain understanding of market demand patterns, ingredient trends, and packaging preferences that guide product development and business expansion strategies. Supply chain optimization opportunities become apparent through comprehensive market analysis.

Regulatory bodies benefit from market oversight insights that inform policy development, safety standards, and consumer protection initiatives. Understanding market dynamics helps ensure appropriate regulatory frameworks that balance innovation with consumer safety.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization revolution continues transforming the UK skincare landscape as consumers seek customized solutions tailored to their specific skin types, concerns, and lifestyle factors. Advanced diagnostic tools, AI-powered recommendations, and bespoke formulation services are becoming increasingly mainstream.

Sustainable beauty has evolved from niche interest to mainstream expectation, with consumers actively seeking brands demonstrating environmental responsibility through recyclable packaging, sustainable sourcing, and carbon-neutral operations. This trend influences purchasing decisions across all demographic segments.

Ingredient transparency demands continue intensifying as educated consumers scrutinize product formulations and seek evidence-based skincare solutions. Brands respond by providing detailed ingredient information, clinical study results, and educational content explaining product benefits and usage.

Multi-functional products gain popularity as consumers seek simplified routines without compromising effectiveness. Products combining multiple benefits such as moisturizer-sunscreen combinations or treatment-serum hybrids appeal to time-conscious consumers seeking efficiency.

Wellness integration reflects growing understanding of skincare as part of overall health and wellness routines. Products incorporating stress-reducing ingredients, aromatherapy benefits, and holistic wellness concepts resonate with consumers seeking comprehensive self-care solutions.

Technology integration includes smart packaging, app-connected devices, and virtual consultation services that enhance user experience and provide personalized guidance. These innovations create competitive advantages while improving customer engagement and satisfaction.

Acquisition activity has intensified as major beauty conglomerates seek to expand their skincare portfolios through strategic purchases of innovative brands and emerging technologies. These transactions reshape competitive dynamics and accelerate market consolidation trends.

Regulatory evolution includes updated safety standards, ingredient approval processes, and sustainability requirements that influence product development and marketing strategies. Brands must navigate evolving compliance landscapes while maintaining innovation momentum.

Retail transformation encompasses store format evolution, experiential retail concepts, and enhanced omnichannel integration that improve customer experience and drive sales growth. Traditional retailers adapt to changing consumer shopping preferences and digital expectations.

Ingredient innovation continues advancing with new active compounds, delivery systems, and formulation technologies that enhance product efficacy and create differentiation opportunities. Research investments focus on addressing specific skin concerns and improving user experience.

Sustainability initiatives include packaging innovations, supply chain improvements, and carbon reduction programs that respond to consumer environmental concerns while reducing operational costs and regulatory compliance risks.

Digital marketing evolution encompasses influencer partnerships, social commerce integration, and personalized advertising strategies that improve customer acquisition and retention while building brand awareness and loyalty.

Strategic recommendations for market participants focus on adapting to evolving consumer expectations while maintaining competitive advantages in an increasingly crowded marketplace. MarkWide Research analysis suggests prioritizing innovation investments that address specific consumer pain points and unmet market needs.

Brand positioning strategies should emphasize authenticity, transparency, and consumer education to build trust and loyalty in an environment where consumers have access to extensive product information and reviews. Successful brands will differentiate through superior formulations, clinical evidence, and genuine consumer benefits.

Distribution optimization requires sophisticated omnichannel strategies that seamlessly integrate online and offline customer experiences. Brands should invest in direct-to-consumer capabilities while maintaining strong retail partnerships and exploring emerging distribution channels.

Innovation focus should prioritize sustainable formulations, personalized solutions, and technology integration that enhance user experience and provide measurable benefits. Research and development investments should align with long-term consumer trends rather than short-term market fluctuations.

Market expansion opportunities exist in underserved segments including men’s skincare, ethnic skin care, and condition-specific treatments. Brands should conduct thorough market research and consumer testing before launching products in these specialized categories.

Partnership strategies can accelerate growth through collaborations with dermatologists, wellness brands, and technology companies that enhance product credibility and expand market reach. Strategic alliances should align with brand values and target consumer preferences.

Long-term projections indicate continued robust growth for the UK skincare market, driven by demographic trends, technological advancement, and evolving consumer attitudes toward skin health and wellness. The market is expected to maintain strong momentum with projected growth rates of approximately 6.8% annually over the next five years.

Consumer evolution will continue favoring brands that demonstrate authenticity, sustainability, and genuine efficacy over traditional marketing-driven approaches. Future success will depend on brands’ ability to build meaningful relationships with consumers through education, transparency, and consistent product performance.

Technology integration will accelerate with artificial intelligence, personalization algorithms, and smart packaging becoming standard features rather than premium differentiators. Brands investing early in these technologies will gain competitive advantages and improved customer engagement.

Sustainability requirements will intensify as regulatory frameworks evolve and consumer expectations increase. Future market leaders will be those successfully balancing environmental responsibility with product efficacy and commercial viability.

Market consolidation trends will continue as larger companies acquire innovative brands and technologies, while new entrants will need increasingly sophisticated strategies to establish market presence and compete effectively against established players.

Global influences including K-beauty trends, ingredient innovations, and international brand expansion will continue shaping UK consumer preferences and market dynamics. Successful brands will adapt global trends to local preferences while maintaining authentic brand identity.

The UK skincare market represents a dynamic and sophisticated sector characterized by informed consumers, innovative products, and evolving retail landscapes. Market analysis reveals strong growth potential driven by demographic trends, technological advancement, and increasing consumer awareness of skin health importance.

Success factors for market participants include commitment to innovation, transparency, sustainability, and consumer education. Brands that prioritize authentic consumer benefits over marketing hype will build lasting competitive advantages and customer loyalty in an increasingly crowded marketplace.

Future opportunities exist across multiple segments including men’s skincare, sustainable beauty, personalized solutions, and technology-enhanced products. Market participants should focus on long-term consumer trends while maintaining flexibility to adapt to changing market conditions and consumer preferences.

The UK skincare market outlook remains positive with continued growth expected across most product categories and demographic segments. Brands that successfully navigate evolving consumer expectations, regulatory requirements, and competitive pressures will capture significant opportunities in this vibrant and expanding market.

What is Skincare?

Skincare refers to the range of practices that support skin integrity, enhance its appearance, and relieve skin conditions. This includes the use of products such as moisturizers, cleansers, and treatments for various skin issues.

What are the key players in the UK Skincare Market?

Key players in the UK Skincare Market include brands like The Body Shop, L’Oreal, and Boots, which offer a variety of skincare products ranging from natural to clinical formulations, among others.

What are the main drivers of growth in the UK Skincare Market?

The growth of the UK Skincare Market is driven by increasing consumer awareness of skincare benefits, the rise of social media influencers promoting skincare routines, and a growing demand for natural and organic products.

What challenges does the UK Skincare Market face?

The UK Skincare Market faces challenges such as intense competition among brands, regulatory compliance regarding product safety, and changing consumer preferences towards minimalistic skincare routines.

What opportunities exist in the UK Skincare Market?

Opportunities in the UK Skincare Market include the expansion of e-commerce platforms, the introduction of personalized skincare solutions, and the growing trend of sustainability in product formulations.

What trends are shaping the UK Skincare Market?

Trends in the UK Skincare Market include the rise of clean beauty, increased focus on anti-aging products, and the popularity of multifunctional skincare products that combine several benefits in one application.

UK Skincare Market

| Segmentation Details | Description |

|---|---|

| Product Type | Moisturizers, Cleansers, Serums, Sunscreens |

| End User | Women, Men, Teens, Seniors |

| Distribution Channel | Online, Supermarkets, Pharmacies, Specialty Stores |

| Price Tier | Premium, Mid-range, Budget, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Skincare Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at