444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC concealed cistern market represents a rapidly evolving segment within the region’s construction and sanitary ware industry. This market encompasses innovative toilet systems where the water storage tank is hidden within the wall structure, providing both aesthetic appeal and space optimization. The Gulf Cooperation Council region, comprising Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, and Oman, has witnessed substantial growth in this market segment driven by urbanization, luxury construction projects, and evolving consumer preferences for modern bathroom solutions.

Market dynamics in the GCC region reflect a strong preference for premium bathroom fixtures, with concealed cisterns gaining significant traction among residential and commercial developers. The technology offers superior water efficiency, reduced noise levels, and enhanced bathroom aesthetics, making it particularly attractive in high-end construction projects. Current market trends indicate a 12.5% annual growth rate in adoption across major GCC cities, with the UAE and Saudi Arabia leading market penetration.

Regional construction boom continues to drive demand for concealed cistern systems, particularly in luxury residential developments, commercial complexes, and hospitality projects. The market benefits from increasing awareness of water conservation technologies and growing emphasis on modern, space-efficient bathroom designs that align with contemporary architectural trends across the Gulf region.

The GCC concealed cistern market refers to the commercial ecosystem encompassing the manufacturing, distribution, installation, and maintenance of hidden toilet tank systems across Gulf Cooperation Council countries. These systems feature water storage tanks that are concealed within wall cavities, connected to wall-mounted toilet bowls through specialized mounting frames and flush mechanisms.

Concealed cistern technology represents an advanced approach to bathroom design where traditional visible toilet tanks are replaced with in-wall installations. The system typically includes a robust steel or plastic frame, a compact water tank, dual-flush mechanisms, and specialized mounting hardware. This configuration allows for wall-mounted toilet bowls while maintaining full functionality and often improving water efficiency compared to conventional toilet systems.

Market scope encompasses various product categories including single-flush and dual-flush concealed cisterns, different tank capacities, various mounting frame materials, and associated accessories. The technology serves both new construction and renovation projects, offering solutions for residential apartments, commercial buildings, hotels, and public facilities throughout the GCC region.

Strategic market analysis reveals that the GCC concealed cistern market has emerged as a significant growth segment within the region’s construction industry. The market benefits from robust construction activity, increasing consumer sophistication, and growing emphasis on water conservation technologies. Premium positioning of concealed cistern systems aligns well with the GCC’s focus on luxury developments and modern infrastructure projects.

Key market drivers include rapid urbanization, government initiatives promoting water efficiency, and increasing adoption of contemporary bathroom designs. The market demonstrates strong performance across both residential and commercial segments, with particularly robust growth in hospitality and high-end residential projects. Technology advancement continues to enhance product offerings, with manufacturers introducing smart features and improved water-saving capabilities.

Competitive landscape features both international brands and regional distributors, creating a dynamic market environment. The sector shows 85% preference for European-manufactured systems among premium projects, while cost-effective alternatives gain traction in mid-market segments. Market projections indicate continued expansion driven by ongoing construction activity and evolving consumer preferences for modern bathroom solutions.

Market intelligence reveals several critical insights shaping the GCC concealed cistern landscape:

Construction industry expansion serves as the primary driver for GCC concealed cistern market growth. The region’s ongoing infrastructure development, including residential towers, commercial complexes, and hospitality projects, creates substantial demand for modern bathroom solutions. Mega-projects across the GCC consistently specify concealed cistern systems for their aesthetic and functional advantages.

Water conservation initiatives implemented by GCC governments significantly boost market adoption. Regional authorities promote water-efficient technologies through building codes and sustainability requirements. Dual-flush concealed cisterns align perfectly with these initiatives, offering measurable water savings that support environmental goals while reducing operational costs for building owners.

Consumer preference evolution toward modern, minimalist bathroom designs drives market expansion. Contemporary architectural trends favor clean lines and uncluttered spaces, making concealed cistern systems highly desirable. Space optimization benefits particularly appeal to urban developments where maximizing usable floor area is crucial for project economics.

Hospitality sector growth across the GCC creates significant demand for premium bathroom fixtures. Hotels, resorts, and commercial facilities prioritize concealed cistern systems for their superior aesthetics, reduced maintenance visibility, and enhanced guest experience. Brand positioning requirements in luxury hospitality segments strongly favor concealed cistern installations.

High initial investment requirements represent a significant market restraint, as concealed cistern systems typically cost substantially more than conventional toilet installations. The premium pricing includes not only the cistern unit but also specialized mounting frames, installation labor, and potential wall modifications. Cost sensitivity in mid-market residential projects often leads to selection of traditional alternatives.

Installation complexity creates barriers to market adoption, requiring specialized skills and careful coordination with construction schedules. Concealed cistern installation must occur during early construction phases, limiting retrofit applications and requiring precise planning. Skilled labor shortage in some GCC markets constrains installation capacity and increases project costs.

Maintenance accessibility concerns influence purchasing decisions, as concealed systems require access panels for service and repairs. Building owners worry about potential water damage risks and repair complexity compared to traditional exposed cisterns. Long-term service considerations often favor conventional systems in cost-conscious applications.

Market education needs persist among some consumer segments unfamiliar with concealed cistern benefits and operation. Traditional preferences and limited awareness of water-saving capabilities slow adoption rates in certain market segments. Technical understanding gaps among installers and maintenance personnel also constrain market growth.

Smart technology integration presents substantial opportunities for market expansion through advanced features like sensor-activated flushing, water usage monitoring, and smartphone connectivity. These innovations appeal to tech-savvy consumers and align with smart building trends across the GCC region. IoT-enabled concealed cisterns offer potential for predictive maintenance and water management optimization.

Retrofit market potential remains largely untapped, offering opportunities for specialized products designed for existing building upgrades. As older buildings undergo renovation, concealed cistern systems provide attractive modernization options. Renovation projects in established commercial and residential properties represent significant growth potential.

Government sustainability programs create opportunities for market expansion through incentives and building code requirements. GCC countries increasingly mandate water-efficient fixtures in new construction, potentially making concealed cisterns standard rather than optional. Green building certifications often require advanced water-saving technologies, benefiting concealed cistern adoption.

Regional manufacturing development offers opportunities to reduce costs and improve market accessibility. Local production facilities could address price sensitivity while maintaining quality standards. Supply chain localization would enhance market competitiveness and reduce dependence on imports, particularly for standard product categories.

Supply chain dynamics in the GCC concealed cistern market reflect a complex interaction between international manufacturers, regional distributors, and local installation specialists. European manufacturers dominate premium segments, while Asian producers increasingly compete in cost-sensitive applications. Distribution networks continue evolving to support growing market demand across diverse geographic and application segments.

Competitive dynamics intensify as market growth attracts new entrants and existing players expand their offerings. Product differentiation focuses on water efficiency, installation ease, and smart features. Price competition varies significantly between premium and standard market segments, with quality and brand reputation maintaining importance in high-end applications.

Technology evolution drives continuous product improvement, with manufacturers investing in enhanced water-saving capabilities, noise reduction, and durability improvements. Innovation cycles typically span 3-5 years, with incremental improvements in materials, mechanisms, and smart features maintaining market interest and driving replacement demand.

Regulatory dynamics increasingly influence market development through water efficiency standards and building codes. GCC countries implement varying requirements for water conservation, creating opportunities for compliant products while potentially restricting less efficient alternatives. Certification requirements add complexity but also provide market differentiation opportunities for qualifying products.

Comprehensive market research methodology employed for this analysis combines primary and secondary research approaches to ensure accurate and actionable insights. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, installers, architects, and end users across all GCC countries. This approach provides real-world perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government statistics, construction data, and trade publications. MarkWide Research databases provide historical market data and trend analysis, while construction industry statistics offer context for market sizing and growth projections. Import/export data helps understand supply chain dynamics and competitive positioning.

Market segmentation analysis utilizes both quantitative and qualitative approaches to understand different market segments, applications, and geographic variations. Statistical analysis of construction permits, building completions, and renovation activities provides quantitative foundation for market assessments and growth projections.

Validation processes include cross-referencing multiple data sources, expert interviews, and market participant feedback to ensure accuracy and reliability. Continuous monitoring of market developments, regulatory changes, and competitive activities maintains research currency and relevance for strategic decision-making.

United Arab Emirates leads the GCC concealed cistern market with approximately 35% regional market share, driven by Dubai and Abu Dhabi’s extensive construction activity and luxury development focus. The UAE market demonstrates strong preference for premium European brands and advanced features. Commercial applications dominate, particularly in hospitality, retail, and office developments that prioritize modern aesthetics and water efficiency.

Saudi Arabia represents the second-largest market with 25% regional share, benefiting from Vision 2030 infrastructure projects and growing residential construction. The market shows increasing adoption in both Riyadh and Jeddah, with government buildings and commercial projects driving demand. Water conservation initiatives support market growth, particularly for dual-flush concealed cistern systems.

Qatar maintains 15% market share with strong growth driven by ongoing infrastructure development and hospitality expansion. The market benefits from high construction standards and preference for premium fixtures. World Cup legacy projects continue influencing construction specifications and quality expectations across the market.

Kuwait, Bahrain, and Oman collectively account for the remaining 25% market share, with varying growth patterns reflecting different construction cycles and economic conditions. These markets show increasing awareness of concealed cistern benefits, with gradual adoption in both residential and commercial segments. Regional preferences vary based on local construction practices and cost considerations.

Market leadership in the GCC concealed cistern sector features a mix of established European manufacturers and emerging regional players:

Competitive strategies focus on product differentiation, technical support, and distribution network expansion. European brands emphasize quality, innovation, and comprehensive service support, while Asian manufacturers compete primarily on cost-effectiveness and local market adaptation.

By Product Type:

By Application:

By Installation Type:

Dual-flush concealed cisterns represent the fastest-growing category, driven by water conservation requirements and environmental awareness. These systems typically offer 3-liter and 6-liter flush options, providing significant water savings compared to traditional single-flush systems. Premium positioning of dual-flush systems aligns with GCC sustainability initiatives and green building requirements.

Smart concealed cisterns emerge as a high-growth niche category, incorporating sensor technology, smartphone connectivity, and usage monitoring capabilities. While currently representing a small market share, these products show strong adoption potential in luxury residential and premium commercial applications. Technology integration appeals to tech-savvy consumers and smart building developers.

Commercial-grade concealed cisterns focus on durability, high-frequency usage capability, and maintenance efficiency. These systems typically feature reinforced components, extended warranties, and specialized mounting systems designed for heavy-duty applications. Institutional markets particularly value reliability and long-term performance characteristics.

Compact concealed cisterns address space-constrained applications, offering reduced depth installations suitable for thin wall constructions. These specialized products enable concealed cistern adoption in renovation projects and space-limited new construction. Urban applications particularly benefit from space-efficient design characteristics.

Manufacturers benefit from premium pricing opportunities and growing market demand driven by construction industry expansion. The concealed cistern market offers higher profit margins compared to traditional toilet systems, while product differentiation opportunities support brand positioning. Innovation potential in smart features and water efficiency creates competitive advantages and market expansion possibilities.

Distributors and retailers gain from strong market growth and premium product positioning that supports healthy margins. The technical nature of concealed cistern systems creates opportunities for value-added services including installation support and technical consultation. Market education initiatives help expand customer base and increase average transaction values.

Installers and contractors benefit from specialized skill requirements that command premium pricing and reduced competition. Concealed cistern installation expertise becomes a competitive differentiator in the construction market. Training investments in concealed cistern technology provide long-term business advantages and customer relationship opportunities.

Building developers and architects gain design flexibility, space optimization, and sustainability benefits that enhance project value and marketability. Concealed cistern systems support modern architectural trends while providing practical advantages in space utilization. Premium positioning helps differentiate developments in competitive real estate markets.

End users benefit from improved bathroom aesthetics, water savings, and enhanced functionality compared to traditional toilet systems. Long-term operational savings through water efficiency often offset higher initial costs, while modern design enhances property value and user satisfaction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Water efficiency optimization continues driving product development, with manufacturers introducing advanced dual-flush mechanisms and reduced water consumption technologies. Ultra-low-flow concealed cisterns achieve significant water savings while maintaining performance standards. This trend aligns with regional sustainability initiatives and building certification requirements.

Smart technology integration accelerates across the concealed cistern market, with sensor-activated systems, smartphone connectivity, and usage monitoring becoming standard features in premium segments. IoT-enabled concealed cisterns provide data analytics for water management and predictive maintenance, appealing to smart building developers and facility managers.

Design customization trends reflect growing demand for personalized bathroom solutions, with manufacturers offering various flush plate designs, colors, and finishes. Architectural integration becomes increasingly important as concealed cisterns must complement diverse interior design themes and material palettes.

Installation simplification emerges as a key trend, with manufacturers developing easier installation systems and improved mounting frames. Modular design approaches reduce installation time and complexity, making concealed cisterns more accessible to general contractors and reducing project costs.

Maintenance accessibility improvements address long-standing market concerns through better access panel designs and diagnostic features. Predictive maintenance capabilities help identify potential issues before failures occur, reducing service disruptions and building owner concerns about concealed system reliability.

Product innovation acceleration characterizes recent industry developments, with major manufacturers launching next-generation concealed cistern systems featuring enhanced water efficiency and smart capabilities. European manufacturers continue leading innovation while Asian producers focus on cost-effective alternatives for emerging market segments.

Distribution network expansion across the GCC region improves market accessibility and customer support capabilities. Regional partnerships between international manufacturers and local distributors enhance technical support and installation training programs, supporting market growth and customer satisfaction.

Sustainability certification programs gain importance as building developers seek green building compliance and water efficiency recognition. WaterSense and similar certifications become key product differentiators, influencing specification decisions and market positioning strategies.

Training program development addresses skilled installer shortage through comprehensive education initiatives. Manufacturer-sponsored training programs improve installation quality while expanding the pool of qualified professionals capable of supporting market growth.

Digital marketing initiatives help educate consumers and specifiers about concealed cistern benefits and applications. Virtual reality demonstrations and online configuration tools enhance customer understanding and support purchasing decisions in complex technical products.

Market entry strategies should focus on premium segments where concealed cistern benefits justify higher costs and complex installation requirements. Partnership development with established distributors and installation specialists provides essential market access and technical support capabilities. New entrants should prioritize product differentiation through innovative features or cost optimization rather than competing directly with established premium brands.

Investment priorities should emphasize technical support infrastructure, installer training programs, and customer education initiatives. MarkWide Research analysis indicates that successful market participants invest heavily in market development activities beyond product manufacturing. Service capability development becomes increasingly important as market matures and customer expectations evolve.

Product development focus should address installation simplification, maintenance accessibility, and smart technology integration. Modular design approaches that reduce installation complexity while maintaining performance standards offer significant competitive advantages. Retrofit-specific products represent underserved market opportunities with substantial growth potential.

Geographic expansion should prioritize UAE and Saudi Arabia markets while developing capabilities in secondary markets. Localization strategies including regional manufacturing or assembly operations could provide cost advantages and supply chain resilience. Government relationship development supports specification inclusion in public projects and regulatory compliance.

Market growth trajectory remains positive driven by continued construction activity, sustainability requirements, and evolving consumer preferences. Long-term projections indicate sustained expansion with annual growth rates exceeding 10% through the next five years, supported by ongoing urbanization and infrastructure development across the GCC region.

Technology evolution will continue driving market development through smart features, improved water efficiency, and installation simplification. Next-generation concealed cisterns will likely incorporate artificial intelligence for usage optimization, predictive maintenance, and integration with building management systems. Sustainability focus will intensify with potential regulatory requirements for water-efficient fixtures in new construction.

Market maturation will bring increased competition, price pressure in standard segments, and greater emphasis on service and support capabilities. Premium segments will likely maintain strong margins through continued innovation and brand differentiation, while mid-market segments may experience commoditization pressure from cost-effective alternatives.

Regional manufacturing development appears likely as market size justifies local production investments. Supply chain localization could reduce costs, improve delivery times, and enhance market responsiveness. MWR projections suggest that regional production capacity will expand significantly within the next decade, potentially reshaping competitive dynamics and pricing structures.

The GCC concealed cistern market represents a dynamic and rapidly growing segment within the region’s construction industry, driven by urbanization, sustainability requirements, and evolving consumer preferences for modern bathroom solutions. Market fundamentals remain strong with continued construction activity, government support for water-efficient technologies, and increasing adoption of contemporary architectural designs that favor concealed cistern systems.

Competitive dynamics reflect a maturing market with established European manufacturers maintaining premium positions while emerging players compete through cost optimization and regional adaptation. Technology innovation continues driving product development, with smart features, improved water efficiency, and installation simplification representing key advancement areas that will shape future market evolution.

Strategic opportunities exist across multiple dimensions including product innovation, market education, distribution expansion, and service capability development. Success factors emphasize technical expertise, customer support, and market development investments rather than simple product availability. The market rewards participants who understand regional preferences, provide comprehensive support, and continuously innovate to meet evolving customer needs while maintaining the premium positioning that characterizes this growing segment of the GCC construction industry.

What is Concealed Cistern?

A concealed cistern is a plumbing fixture that is hidden behind a wall or in a cabinet, used to store water for flushing toilets. This design helps to save space and create a more aesthetically pleasing bathroom environment.

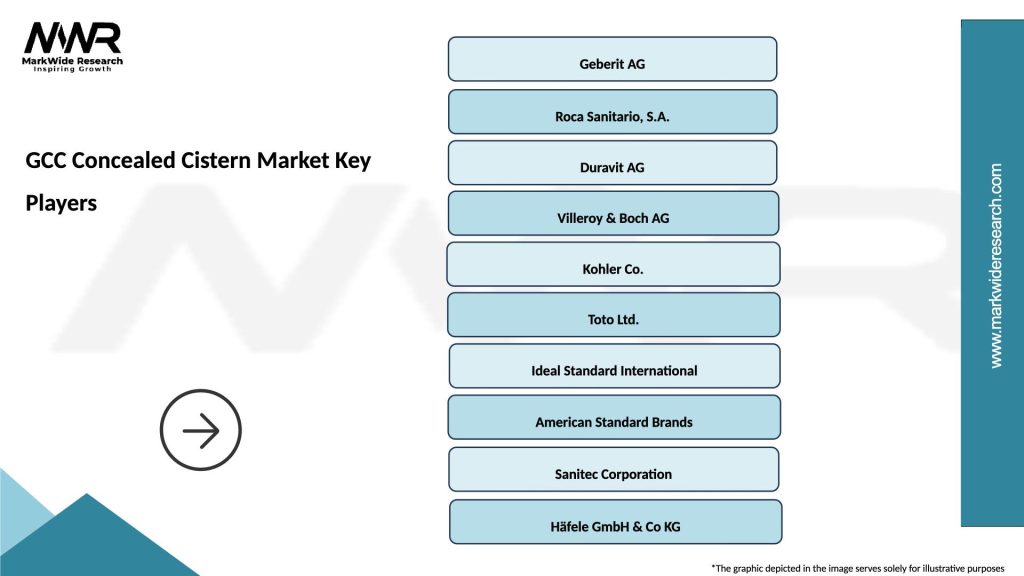

What are the key players in the GCC Concealed Cistern Market?

Key players in the GCC Concealed Cistern Market include Geberit, Roca, Kohler, and Duravit, among others. These companies are known for their innovative designs and high-quality products that cater to various consumer preferences.

What are the growth factors driving the GCC Concealed Cistern Market?

The growth of the GCC Concealed Cistern Market is driven by increasing urbanization, rising demand for modern bathroom solutions, and a growing focus on space-saving designs. Additionally, the trend towards luxury and high-end bathroom fittings is contributing to market expansion.

What challenges does the GCC Concealed Cistern Market face?

The GCC Concealed Cistern Market faces challenges such as high installation costs and the need for specialized plumbing skills. Furthermore, consumer awareness regarding the benefits of concealed cisterns is still developing in some regions.

What opportunities exist in the GCC Concealed Cistern Market?

Opportunities in the GCC Concealed Cistern Market include the potential for growth in the renovation sector and the increasing popularity of eco-friendly products. Additionally, advancements in technology are paving the way for smarter and more efficient cistern designs.

What trends are shaping the GCC Concealed Cistern Market?

Trends in the GCC Concealed Cistern Market include a shift towards minimalist designs and the integration of smart technology in bathroom fixtures. There is also a growing emphasis on water conservation and sustainable materials in product development.

GCC Concealed Cistern Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wall-Mounted, Floor-Mounted, Dual Flush, Single Flush |

| Material | Plastic, Ceramic, Stainless Steel, Composite |

| End User | Residential, Commercial, Institutional, Hospitality |

| Distribution Channel | Online Retail, Specialty Stores, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Concealed Cistern Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at