444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The Fraud Detection and Prevention (FDP) Market refers to the technologies, solutions, and strategies used to detect, prevent, and mitigate fraudulent activities across various industries. FDP solutions aim to identify and analyze patterns, anomalies, and suspicious behavior to safeguard organizations against financial losses, reputational damage, and regulatory non-compliance. With the increasing sophistication of fraudsters and the growing need for robust security measures, the FDP market is witnessing significant growth. This market overview provides insights into the key aspects of the FDP industry, including its meaning, executive summary, key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, Covid-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

Meaning:

Fraud Detection and Prevention (FDP) refers to the processes, technologies, and strategies employed by organizations to detect, prevent, and respond to fraudulent activities. FDP solutions utilize advanced analytics, machine learning, and artificial intelligence to analyze large volumes of data and identify patterns, anomalies, and potential fraud indicators. By leveraging these solutions, organizations can minimize financial losses, protect customer data, maintain regulatory compliance, and safeguard their reputation.

Executive Summary:

The executive summary of the Fraud Detection and Prevention (FDP) market provides a concise overview of the key findings and highlights of the market research. It includes information on market size, growth rate, major trends, and key players. This section offers a quick snapshot of the market landscape and serves as a starting point for understanding the comprehensive analysis presented in the subsequent sections.

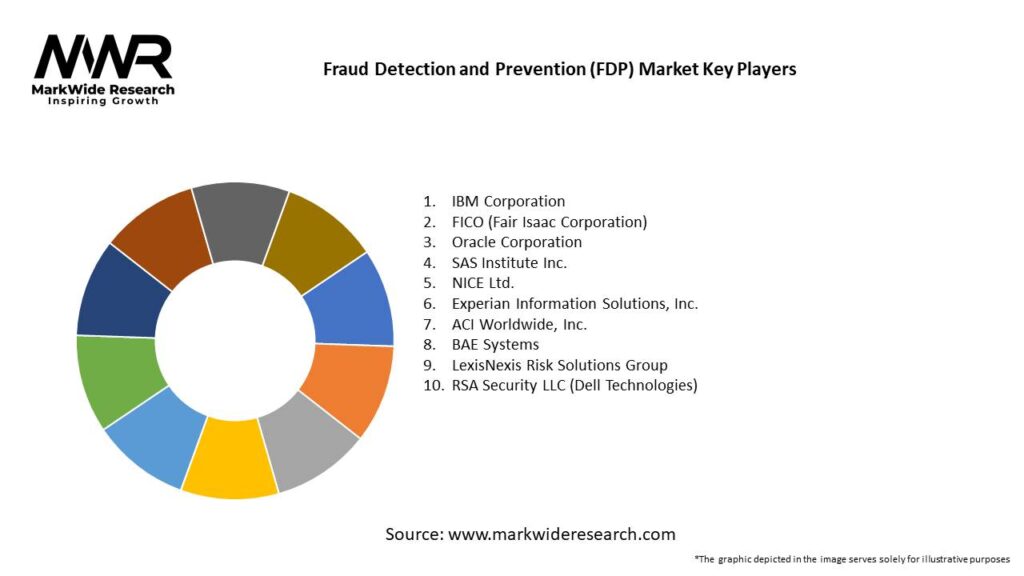

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The Fraud Detection and Prevention (FDP) Market is shaped by several key insights:

Market Drivers

Several factors are driving the growth of the Fraud Detection and Prevention (FDP) Market:

Market Restraints

Despite its growth potential, the Fraud Detection and Prevention (FDP) Market faces several challenges:

Market Opportunities

The Fraud Detection and Prevention (FDP) Market presents several opportunities for growth:

Market Dynamics

The market dynamics of the Fraud Detection and Prevention (FDP) Market are influenced by several factors:

Regional Analysis

The Fraud Detection and Prevention (FDP) Market is analyzed across key regions:

Competitive Landscape

Leading Companies in Fraud Detection and Prevention (FDP) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

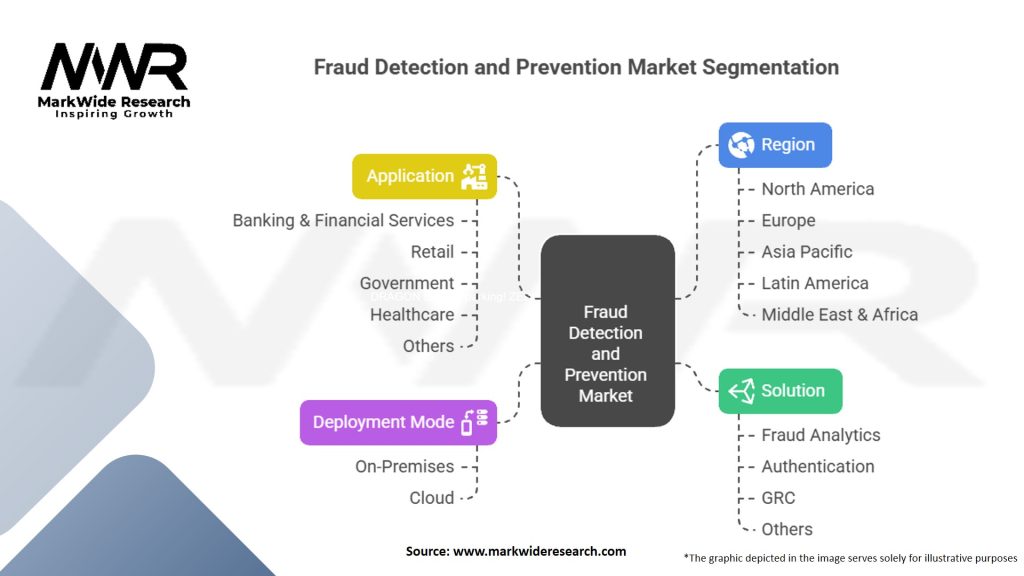

Segmentation

The Fraud Detection and Prevention (FDP) Market is segmented as follows:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Fraud Detection and Prevention (FDP) Market offers several key benefits:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends influencing the Fraud Detection and Prevention (FDP) Market include:

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Fraud Detection and Prevention (FDP) Market:

Key Industry Developments

Key developments in the Fraud Detection and Prevention (FDP) Market include:

Analyst Suggestions

Analysts suggest the following strategies for industry participants:

Future Outlook:

The future outlook section presents a forward-looking perspective on the Fraud Detection and Prevention (FDP) market. It discusses the anticipated market trends, growth opportunities, and challenges that are likely to shape the market in the coming years. This section assists stakeholders in understanding the market’s future prospects and formulating long-term strategies.

Conclusion:

In conclusion, the Fraud Detection and Prevention (FDP) market plays a crucial role in safeguarding organizations against fraudulent activities. With the increasing complexity and sophistication of fraud attacks, organizations need robust FDP solutions to detect, prevent, and respond to fraud incidents effectively. By embracing advanced technologies, leveraging real-time analytics, and adopting proactive measures, industry participants and stakeholders can protect their assets, maintain regulatory compliance, and preserve customer trust in an increasingly digital and interconnected world.

Fraud Detection and Prevention (FDP) Market

| Segmentation Details | Description |

|---|---|

| Solution | Fraud Analytics, Authentication, Governance, Risk, and Compliance (GRC), Others |

| Deployment Mode | On-Premises, Cloud |

| Application | Banking & Financial Services, Retail, Government, Healthcare, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Fraud Detection and Prevention (FDP) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at