444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe energy drinks industry market represents one of the most dynamic and rapidly evolving beverage segments across the continent. Market dynamics indicate sustained growth driven by changing consumer lifestyles, increased health consciousness, and innovative product formulations. The European market demonstrates significant regional variations in consumption patterns, with Nordic countries and Germany leading in per capita consumption rates.

Consumer preferences have shifted dramatically toward premium, natural, and functional energy beverages that offer sustained energy without artificial additives. The market experiences robust growth at approximately 6.2% CAGR, reflecting strong demand across diverse demographic segments. Key market drivers include urbanization, busy lifestyles, fitness culture expansion, and increasing awareness of mental performance enhancement.

Regional distribution shows Western Europe accounting for 68% market share, while Eastern European markets demonstrate the highest growth potential. The industry encompasses traditional energy drinks, natural energy beverages, organic formulations, and specialized sports nutrition products targeting specific consumer needs.

The Europe energy drinks industry market refers to the comprehensive ecosystem of caffeinated and functional beverages designed to provide mental alertness, physical energy, and performance enhancement across European territories. This market encompasses traditional energy drinks containing caffeine, taurine, and B-vitamins, as well as emerging categories including natural energy beverages, organic formulations, and specialized functional drinks targeting specific consumer demographics and use cases.

Market scope includes manufacturing, distribution, retail, and consumption of energy beverages across all European Union member states plus associated territories. The industry covers diverse product categories from mainstream energy drinks to premium natural alternatives, sugar-free formulations, and specialized sports nutrition beverages designed for athletic performance and recovery.

Strategic analysis reveals the European energy drinks market as a mature yet continuously evolving industry characterized by innovation, premiumization, and health-conscious product development. Market leaders including Red Bull, Monster Energy, and Rockstar maintain strong positions while facing increasing competition from emerging brands focusing on natural ingredients and functional benefits.

Consumer behavior trends indicate growing preference for clean-label products, with 42% of consumers actively seeking energy drinks with natural ingredients. The market demonstrates strong growth in the premium segment, driven by health-conscious millennials and Generation Z consumers who prioritize ingredient transparency and functional benefits over traditional energy drink formulations.

Regulatory environment across Europe continues evolving, with stricter labeling requirements and caffeine content regulations influencing product development strategies. Innovation focus centers on plant-based energy sources, adaptogenic ingredients, and sustainable packaging solutions responding to environmental consciousness among European consumers.

Critical market insights reveal fundamental shifts in European energy drink consumption patterns and preferences:

Primary market drivers propelling European energy drinks industry growth encompass lifestyle, demographic, and economic factors creating sustained demand for energy-enhancing beverages. Urbanization trends across major European cities contribute to increased consumption as busy professionals seek convenient energy solutions for demanding work schedules and active lifestyles.

Fitness culture expansion represents a significant growth driver, with 38% of European adults regularly participating in fitness activities requiring energy support. The growing popularity of gym memberships, outdoor sports, and fitness challenges creates consistent demand for pre-workout and recovery beverages designed to enhance athletic performance and endurance.

Workplace productivity demands drive consumption among professionals seeking mental alertness and focus enhancement. The rise of flexible working arrangements, extended work hours, and competitive business environments increases reliance on functional beverages that support cognitive performance and sustained energy levels throughout demanding workdays.

Youth demographics continue driving market expansion, with Generation Z consumers embracing energy drinks as lifestyle beverages associated with gaming, social activities, and academic performance. Social media influence and celebrity endorsements significantly impact brand preferences and consumption patterns among younger European consumers.

Regulatory challenges present significant constraints across European markets, with varying national regulations regarding caffeine content, labeling requirements, and marketing restrictions. Health concerns related to high caffeine consumption, sugar content, and artificial ingredients create consumer hesitation and regulatory scrutiny affecting market growth potential.

Price sensitivity among certain consumer segments limits market expansion, particularly in Eastern European countries where disposable income levels affect premium product adoption. Economic uncertainty and inflation pressures influence consumer spending patterns, potentially shifting preferences toward lower-priced alternatives or reduced consumption frequency.

Negative health perceptions associated with traditional energy drinks create barriers to market penetration among health-conscious consumers. Medical community concerns regarding cardiovascular effects, sleep disruption, and dependency issues contribute to consumer skepticism and regulatory restrictions in certain European territories.

Competition from alternatives including coffee, tea, and natural energy sources presents ongoing challenges to market share expansion. The growing popularity of specialty coffee, matcha, and other traditional energy sources provides consumers with perceived healthier alternatives to commercial energy drinks.

Emerging opportunities in the European energy drinks market center on innovation, health-conscious formulations, and untapped demographic segments. Natural ingredient integration presents substantial growth potential as consumers increasingly seek plant-based energy sources, adaptogens, and functional ingredients that provide sustained energy without artificial additives or excessive sugar content.

Female consumer segment represents significant untapped potential, with targeted formulations addressing women’s specific energy needs, hormonal balance, and wellness preferences. Product development opportunities include beauty-enhancing ingredients, mood-supporting compounds, and formulations designed for different life stages and lifestyle requirements.

Premiumization trends create opportunities for high-value products featuring organic certification, sustainable sourcing, and innovative packaging solutions. Craft energy drink segment shows promising growth potential as consumers seek unique flavors, local ingredients, and artisanal production methods similar to trends observed in craft beer and specialty coffee markets.

Digital commerce expansion offers direct-to-consumer opportunities, subscription models, and personalized nutrition approaches. E-commerce growth enables brands to reach niche markets, offer customized formulations, and build direct relationships with consumers while bypassing traditional retail limitations.

Market dynamics in the European energy drinks industry reflect complex interactions between consumer preferences, regulatory environments, competitive pressures, and innovation cycles. Supply chain considerations include ingredient sourcing, manufacturing capacity, and distribution network optimization across diverse European markets with varying infrastructure and regulatory requirements.

Competitive intensity continues escalating as established brands defend market positions while emerging companies introduce innovative products targeting specific consumer niches. Brand differentiation increasingly relies on ingredient transparency, functional benefits, and authentic brand storytelling rather than traditional marketing approaches focused solely on energy enhancement claims.

Consumer education plays a crucial role in market development, with brands investing in educational content about ingredient benefits, proper consumption practices, and integration into healthy lifestyle routines. Scientific research supporting functional ingredient efficacy becomes increasingly important for credible marketing claims and consumer trust building.

Seasonal consumption patterns influence market dynamics, with peak demand during summer months, exam periods, and fitness seasons. Economic cycles affect consumer spending patterns, with premium products showing resilience during economic growth periods while value segments gain importance during economic uncertainty.

Comprehensive research methodology employed for European energy drinks market analysis incorporates multiple data collection approaches ensuring accuracy, reliability, and market representation. Primary research includes consumer surveys, industry expert interviews, and retail partner consultations across major European markets to capture current trends, preferences, and purchasing behaviors.

Secondary research encompasses industry reports, regulatory filings, company financial statements, and trade association data providing quantitative market insights and competitive landscape analysis. Market observation through retail audits, online monitoring, and social media analysis offers real-time insights into consumer sentiment, brand performance, and emerging trends.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert verification, and statistical analysis techniques. Regional analysis methodology accounts for cultural differences, regulatory variations, and economic disparities across European territories to provide nuanced market understanding.

Forecasting models incorporate historical data, current market indicators, and predictive analytics to project future market trends and growth trajectories. Scenario analysis considers various market conditions, regulatory changes, and competitive developments to provide comprehensive market outlook perspectives.

Western Europe dominates the regional landscape, accounting for 68% of total market share with mature markets in Germany, United Kingdom, France, and Netherlands showing steady consumption patterns. Germany represents the largest single market, driven by strong fitness culture, premium product acceptance, and established distribution networks across retail and foodservice channels.

Nordic countries demonstrate the highest per capita consumption rates, with Sweden and Norway leading in premium and natural energy drink adoption. Cultural acceptance of functional beverages and high disposable income levels support sustained market growth and innovation adoption in these territories.

Eastern Europe shows the highest growth potential, with Poland, Czech Republic, and Hungary experiencing rapid market expansion driven by economic development, urbanization, and changing lifestyle patterns. Market penetration remains relatively low compared to Western European levels, indicating substantial growth opportunities for both mainstream and premium brands.

Southern Europe including Spain, Italy, and Portugal demonstrates growing acceptance of energy drinks, particularly among younger demographics and urban populations. Traditional beverage preferences create unique challenges requiring localized marketing approaches and flavor adaptations to suit regional taste preferences.

MarkWide Research analysis indicates Central Europe as an emerging growth region with increasing consumer awareness and expanding retail availability driving market development across previously underserved territories.

Market leadership remains concentrated among established global brands while emerging companies gain traction through innovation and niche positioning. Competitive dynamics reflect ongoing battles for shelf space, consumer attention, and market share across diverse European territories with varying competitive intensities.

Innovation competition intensifies as brands invest in research and development, seeking differentiation through functional ingredients, unique flavors, and specialized formulations targeting specific consumer needs and preferences.

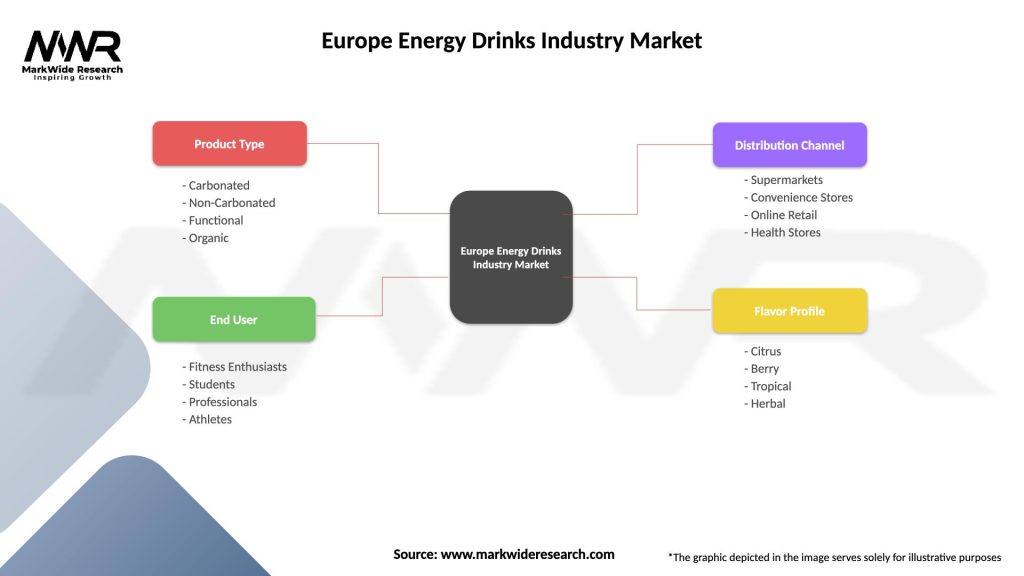

Product segmentation reveals diverse categories serving different consumer needs and preferences across the European energy drinks market:

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Traditional energy drinks maintain market dominance while facing pressure from health-conscious alternatives. Consumer loyalty remains strong for established brands, though younger demographics show increasing openness to trying new formulations and brands offering perceived health benefits and ingredient transparency.

Natural energy drinks represent the fastest-growing category, with annual growth rates exceeding 12% across European markets. Key success factors include authentic ingredient sourcing, transparent labeling, and effective communication of functional benefits without artificial additives or excessive sugar content.

Organic segment shows premium pricing acceptance among environmentally conscious consumers willing to pay higher prices for certified organic ingredients and sustainable packaging. Market penetration remains limited but demonstrates strong growth potential as organic food and beverage consumption continues expanding across European territories.

Sugar-free formulations gain traction among health-conscious consumers and diabetic populations seeking energy enhancement without blood sugar impact. Taste improvement in artificial and natural sweeteners drives increased acceptance and repeat purchase behavior among previously resistant consumer segments.

Functional energy drinks incorporating nootropics, adaptogens, and specialized ingredients target specific consumer needs including cognitive enhancement, stress management, and athletic performance optimization. Scientific validation of ingredient efficacy becomes increasingly important for credible marketing claims and consumer trust.

Manufacturers benefit from sustained market growth, innovation opportunities, and expanding consumer demographics creating multiple revenue streams and market expansion possibilities. Product diversification enables risk mitigation while capturing different consumer segments through targeted formulations and marketing approaches.

Retailers enjoy high-margin products with strong consumer demand and consistent inventory turnover. Category management opportunities include premium shelf placement, promotional partnerships, and exclusive product launches driving foot traffic and customer loyalty.

Distributors capitalize on expanding market reach, diverse product portfolios, and growing demand across multiple channels. Logistics efficiency improvements through technology integration and route optimization enhance profitability while supporting market expansion initiatives.

Consumers access diverse product options meeting specific energy needs, lifestyle preferences, and health considerations. Innovation benefits include improved taste profiles, functional ingredients, and convenient packaging formats enhancing user experience and satisfaction.

Investors find attractive growth opportunities in established markets with innovation potential and emerging segments. Market stability combined with growth potential creates favorable investment conditions for both established companies and emerging brands.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement drives demand for transparent ingredient lists, natural formulations, and organic certifications. Consumer education about ingredient benefits and proper consumption practices becomes increasingly important for brand credibility and market acceptance.

Personalization trends emerge through customized formulations, targeted nutrition approaches, and direct-to-consumer models offering tailored energy solutions. Technology integration enables personalized recommendations based on individual health data, lifestyle patterns, and performance goals.

Sustainability focus influences packaging innovations, ingredient sourcing practices, and corporate responsibility initiatives. Environmental consciousness among European consumers drives demand for recyclable packaging, carbon-neutral production, and ethical sourcing practices.

Functional convergence sees energy drinks incorporating beauty, wellness, and cognitive enhancement benefits beyond traditional energy provision. Multi-benefit formulations appeal to time-conscious consumers seeking comprehensive solutions in convenient beverage formats.

Digital marketing evolution emphasizes social media engagement, influencer partnerships, and content marketing over traditional advertising approaches. Community building around lifestyle brands creates stronger consumer connections and brand loyalty among target demographics.

Recent industry developments reflect ongoing innovation, market consolidation, and strategic positioning initiatives across the European energy drinks landscape. Merger and acquisition activity continues as established companies seek to expand product portfolios and geographic reach while emerging brands look for growth capital and distribution partnerships.

Product launches focus on natural ingredients, functional benefits, and sustainable packaging solutions responding to evolving consumer preferences. Flavor innovation includes exotic fruit combinations, botanical extracts, and regional taste preferences catering to diverse European markets and cultural preferences.

Regulatory developments across European Union territories influence product formulations, labeling requirements, and marketing practices. Industry collaboration with regulatory bodies aims to establish consistent standards while maintaining innovation flexibility and consumer choice.

Technology integration includes smart packaging, QR code information systems, and mobile app connectivity enhancing consumer engagement and brand interaction. Supply chain innovations focus on sustainability, traceability, and efficiency improvements supporting market expansion and cost optimization.

Partnership developments between energy drink brands and sports organizations, gaming communities, and lifestyle influencers create authentic marketing opportunities and consumer engagement platforms driving brand awareness and preference.

Strategic recommendations for European energy drinks market participants emphasize innovation, differentiation, and consumer-centric approaches. Product development priorities should focus on natural ingredients, functional benefits, and clean label formulations addressing health-conscious consumer preferences while maintaining energy efficacy.

Market expansion strategies should target underserved demographics including women, older adults, and health-conscious consumers through specialized formulations and targeted marketing approaches. Geographic expansion opportunities exist in Eastern European markets showing strong growth potential and relatively low market penetration.

Digital transformation initiatives should prioritize e-commerce capabilities, direct-to-consumer models, and data-driven personalization approaches. Technology investment in supply chain optimization, consumer insights, and marketing automation can drive efficiency and competitive advantage.

Sustainability initiatives including packaging innovation, carbon footprint reduction, and ethical sourcing practices will become increasingly important for brand differentiation and consumer preference. Regulatory compliance strategies should anticipate evolving requirements while maintaining innovation flexibility.

MWR analysis suggests focusing on premium segment development, natural ingredient integration, and multi-channel distribution strategies to capture emerging opportunities while defending existing market positions against increasing competition.

Future market trajectory indicates continued growth driven by innovation, demographic expansion, and evolving consumer preferences toward healthier energy solutions. Market evolution will likely favor brands successfully balancing energy efficacy with health consciousness, ingredient transparency, and sustainable practices.

Growth projections suggest the market will maintain steady expansion at approximately 5.8% CAGR over the next five years, with natural and functional segments showing accelerated growth rates. Premium segment expansion will likely outpace overall market growth as consumers demonstrate willingness to pay higher prices for perceived quality and health benefits.

Innovation trends will focus on personalized nutrition, functional ingredients, and sustainable packaging solutions. Technology integration including smart packaging, mobile connectivity, and data-driven personalization will become standard features rather than competitive differentiators.

Regulatory landscape evolution will likely result in stricter labeling requirements, caffeine content limitations, and marketing restrictions requiring industry adaptation and compliance strategies. Consumer education about proper consumption practices and ingredient benefits will become increasingly important for market acceptance and growth.

Competitive dynamics will intensify as market maturity increases, requiring brands to focus on differentiation, innovation, and authentic consumer connections rather than traditional marketing approaches. Market consolidation may accelerate as smaller brands seek partnerships or acquisition opportunities to compete effectively against established market leaders.

The Europe energy drinks industry market represents a dynamic and evolving landscape characterized by sustained growth, innovation opportunities, and changing consumer preferences. Market fundamentals remain strong, supported by urbanization trends, busy lifestyles, and expanding fitness culture across European territories creating consistent demand for energy-enhancing beverages.

Strategic success factors include innovation capability, brand differentiation, and consumer-centric approaches addressing health consciousness while maintaining energy efficacy. Future growth will likely favor companies successfully navigating regulatory requirements, sustainability expectations, and evolving consumer preferences toward natural, functional, and transparent products.

Market opportunities exist across multiple dimensions including product innovation, demographic expansion, geographic penetration, and channel diversification. Industry participants who invest in research and development, sustainable practices, and authentic consumer engagement will be best positioned to capture emerging opportunities while defending existing market positions in this competitive and rapidly evolving industry landscape.

What is Energy Drinks?

Energy drinks are beverages that contain stimulants, primarily caffeine, along with other ingredients such as vitamins, amino acids, and herbal extracts, designed to boost energy and mental alertness.

What are the key players in the Europe Energy Drinks Industry Market?

Key players in the Europe Energy Drinks Industry Market include Red Bull GmbH, Monster Beverage Corporation, PepsiCo, and The Coca-Cola Company, among others.

What are the main drivers of growth in the Europe Energy Drinks Industry Market?

The main drivers of growth in the Europe Energy Drinks Industry Market include increasing consumer demand for functional beverages, rising health consciousness, and the growing trend of on-the-go lifestyles.

What challenges does the Europe Energy Drinks Industry Market face?

The Europe Energy Drinks Industry Market faces challenges such as regulatory scrutiny regarding health claims, concerns over the health effects of high caffeine consumption, and competition from alternative beverages like natural juices and teas.

What opportunities exist in the Europe Energy Drinks Industry Market?

Opportunities in the Europe Energy Drinks Industry Market include the development of organic and natural energy drinks, expansion into emerging markets, and the introduction of innovative flavors and formulations to attract health-conscious consumers.

What trends are shaping the Europe Energy Drinks Industry Market?

Trends shaping the Europe Energy Drinks Industry Market include the rise of sugar-free and low-calorie options, the incorporation of functional ingredients like electrolytes and adaptogens, and the increasing popularity of energy drinks among younger demographics.

Europe Energy Drinks Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Carbonated, Non-Carbonated, Functional, Organic |

| End User | Fitness Enthusiasts, Students, Professionals, Athletes |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Health Stores |

| Flavor Profile | Citrus, Berry, Tropical, Herbal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Energy Drinks Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at