444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India online gaming industry market represents one of the most dynamic and rapidly expanding digital entertainment sectors in the Asia-Pacific region. Digital gaming platforms have transformed from niche entertainment options to mainstream cultural phenomena, capturing the attention of millions of Indian consumers across diverse demographic segments. The market encompasses various gaming categories including mobile gaming, PC gaming, console gaming, and emerging technologies like cloud gaming and virtual reality experiences.

Market dynamics indicate unprecedented growth driven by increasing smartphone penetration, affordable internet connectivity, and changing consumer preferences toward digital entertainment. The industry has witnessed remarkable expansion with mobile gaming dominating the landscape, accounting for approximately 85% of total gaming revenue in the country. Competitive gaming and esports have emerged as significant growth drivers, attracting substantial investments from both domestic and international stakeholders.

Technological advancement continues to reshape the gaming ecosystem, with 5G network deployment, improved payment systems, and sophisticated game development tools enabling more immersive and accessible gaming experiences. The market demonstrates strong potential for sustained growth, supported by favorable demographic trends, increasing disposable income, and growing acceptance of gaming as a legitimate form of entertainment and professional pursuit.

The India online gaming industry market refers to the comprehensive ecosystem of digital gaming platforms, services, and related technologies that enable interactive entertainment experiences through internet-connected devices including smartphones, computers, and gaming consoles within the Indian subcontinent.

Online gaming encompasses various formats including casual mobile games, multiplayer online battle arena games, real money gaming, fantasy sports, and competitive esports tournaments. The industry includes game developers, publishers, platform operators, payment service providers, and supporting infrastructure companies that collectively create and maintain the digital gaming environment.

Market participants range from individual gamers and content creators to large-scale gaming companies and technology platforms. The ecosystem supports multiple revenue models including in-app purchases, subscription services, advertising revenue, tournament prize pools, and merchandise sales, creating diverse monetization opportunities for stakeholders across the value chain.

India’s online gaming industry has emerged as a transformative force in the country’s digital economy, demonstrating exceptional growth momentum and market potential. The sector benefits from a unique combination of demographic advantages, technological infrastructure development, and evolving consumer behavior patterns that position it for sustained expansion.

Key market drivers include widespread smartphone adoption reaching 78% of the urban population, declining data costs, and increasing acceptance of digital payments. The industry has successfully attracted significant venture capital investment, with funding levels increasing by 42% year-over-year as investors recognize the sector’s long-term growth prospects.

Mobile gaming dominates the market landscape, supported by locally developed games that resonate with Indian cultural preferences and gaming habits. The emergence of professional esports leagues and tournaments has created new revenue streams while elevating gaming’s social status and mainstream acceptance across different age groups and socioeconomic segments.

Strategic market analysis reveals several critical insights that define the current state and future trajectory of India’s online gaming industry:

Smartphone penetration serves as the primary catalyst for market expansion, with affordable devices making gaming accessible to previously underserved population segments. The availability of feature-rich smartphones under various price points has democratized gaming access, enabling developers to target diverse consumer groups with tailored gaming experiences.

Internet infrastructure development has significantly improved gaming accessibility and quality. The rollout of 4G networks across urban and rural areas, combined with competitive data pricing, has created an environment conducive to online gaming growth. 5G network deployment promises to further enhance gaming experiences through reduced latency and improved connectivity.

Demographic advantages position India favorably for sustained gaming industry growth. The country’s young population, with 65% of citizens under 35 years, represents a tech-savvy demographic naturally inclined toward digital entertainment. This demographic dividend, combined with increasing disposable income and urbanization trends, creates a robust foundation for market expansion.

Government initiatives supporting digital transformation and the startup ecosystem have indirectly benefited the gaming industry. Policies promoting digital payments, internet connectivity, and technology innovation have created a favorable regulatory environment for gaming companies to establish and scale their operations.

Regulatory uncertainty remains a significant challenge for industry participants, particularly regarding real money gaming and skill-based gaming classifications. Varying state-level regulations create compliance complexities for companies operating across multiple jurisdictions, potentially limiting market expansion strategies and investment decisions.

Infrastructure limitations in rural and semi-urban areas continue to restrict market penetration. Despite improvements in internet connectivity, inconsistent network quality and limited broadband access in certain regions prevent gaming companies from fully capitalizing on India’s vast population base.

Payment system challenges affect monetization capabilities, particularly for smaller gaming companies. While digital payment adoption has increased, concerns about transaction security, payment gateway fees, and banking integration complexity can limit revenue optimization opportunities for game developers and publishers.

Content localization costs present financial barriers for international gaming companies seeking to enter the Indian market. Developing culturally relevant content, translating games into multiple regional languages, and adapting gameplay mechanics to local preferences require substantial investment and market expertise.

Emerging technologies present substantial growth opportunities for innovative gaming companies. Cloud gaming services can eliminate hardware limitations and make high-quality gaming experiences accessible to users with basic devices, potentially expanding the addressable market significantly.

Esports monetization offers multiple revenue streams including sponsorship deals, media rights, merchandise sales, and tournament organization. The growing popularity of competitive gaming creates opportunities for companies to develop specialized platforms, training programs, and professional league management services.

Educational gaming represents an underexplored market segment with significant potential. Gamification of learning experiences, skill development programs, and educational content delivery through gaming platforms can attract institutional customers and create sustainable revenue models.

Rural market penetration offers substantial growth potential as internet infrastructure improves and smartphone adoption increases in smaller cities and villages. Companies that successfully develop culturally relevant content and affordable gaming solutions for rural audiences can capture significant market share in underserved segments.

Competitive intensity has increased substantially as both domestic and international companies recognize India’s market potential. Market consolidation through mergers and acquisitions has become common as companies seek to achieve scale economies and expand their user bases rapidly.

User acquisition costs have risen due to increased competition, forcing companies to develop more sophisticated marketing strategies and focus on user retention rather than purely growth-focused approaches. Lifetime value optimization has become crucial for maintaining profitability in the competitive landscape.

Technology evolution continues to reshape market dynamics, with companies investing heavily in artificial intelligence, machine learning, and data analytics to improve user experiences and operational efficiency. Personalization capabilities have become key differentiators in attracting and retaining users.

Partnership strategies have emerged as critical success factors, with gaming companies collaborating with telecom operators, device manufacturers, and content platforms to expand their reach and improve user acquisition efficiency. These strategic alliances enable companies to leverage existing customer bases and distribution channels.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into India’s online gaming industry. Primary research includes extensive surveys of gaming industry stakeholders, including developers, publishers, platform operators, and end users across different demographic segments and geographic regions.

Secondary research incorporates analysis of industry reports, financial statements, regulatory filings, and market intelligence from various sources. Data triangulation techniques ensure consistency and accuracy across different information sources, providing a robust foundation for market assessment and forecasting.

Quantitative analysis utilizes statistical modeling and trend analysis to identify market patterns, growth trajectories, and correlation factors affecting industry performance. Qualitative research includes in-depth interviews with industry experts, thought leaders, and key decision-makers to gain insights into market dynamics and future trends.

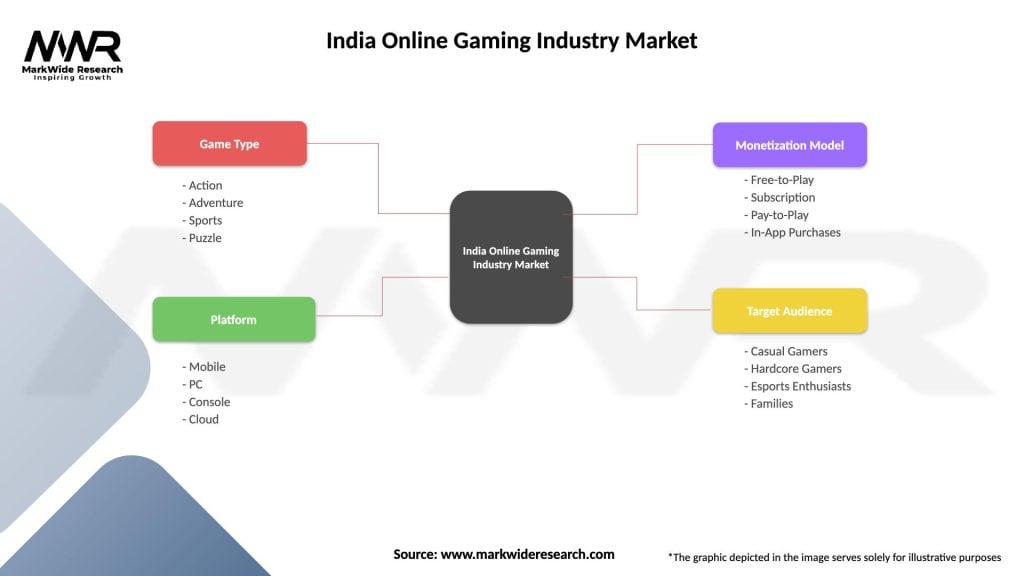

Market segmentation analysis examines various categories including game types, platform preferences, user demographics, and regional variations. This comprehensive approach enables detailed understanding of market structure and identification of growth opportunities across different segments and geographic areas.

Metropolitan markets including Mumbai, Delhi, Bangalore, and Chennai represent the highest concentration of gaming activity, accounting for approximately 45% of total gaming revenue. These cities benefit from superior internet infrastructure, higher disposable income levels, and greater technology adoption rates among consumers.

Tier-2 cities demonstrate the fastest growth rates in gaming adoption, with cities like Pune, Hyderabad, Ahmedabad, and Kolkata showing 35% year-over-year growth in active gaming users. Improved connectivity and increasing smartphone penetration drive expansion in these markets.

Northern regions including Punjab, Haryana, and Uttar Pradesh show strong preference for skill-based gaming and fantasy sports platforms. Regional cultural preferences influence game selection, with cricket-based games and traditional card games showing higher engagement rates in these areas.

Southern states particularly Karnataka, Tamil Nadu, and Andhra Pradesh demonstrate higher adoption of technology-intensive games and esports participation. The presence of major technology companies and educational institutions in these regions correlates with increased gaming sophistication and spending patterns.

Western regions including Maharashtra and Gujarat show balanced adoption across different gaming categories, with mobile gaming maintaining dominance while PC and console gaming segments show steady growth among urban populations.

Market leadership is distributed among several key players, each specializing in different gaming segments and user demographics. The competitive environment continues to evolve as companies adapt to changing consumer preferences and technological advancement.

Strategic positioning varies among competitors, with some focusing on specific game categories while others pursue diversified platform approaches. User acquisition strategies include celebrity endorsements, cricket team sponsorships, and digital marketing campaigns targeting specific demographic segments.

By Platform:

By Game Type:

By Revenue Model:

Mobile Gaming Category demonstrates the strongest growth trajectory, benefiting from widespread smartphone adoption and improved mobile internet connectivity. Casual mobile games attract the broadest user base, while competitive mobile games generate higher per-user revenue through in-app purchases and tournament participation.

Fantasy Sports Segment has achieved mainstream acceptance, particularly cricket-based platforms that capitalize on India’s sports culture. User engagement peaks during major cricket tournaments, creating seasonal revenue opportunities and driving user acquisition campaigns.

Skill-based Gaming benefits from cultural familiarity with traditional card games like rummy and teen patti. These games demonstrate strong user retention rates and consistent monetization patterns, making them attractive for both developers and investors.

Esports Category shows exceptional growth potential, with tournament viewership increasing by 55% annually. Professional gaming leagues and collegiate competitions create new revenue streams while elevating gaming’s social status and mainstream acceptance.

Educational Gaming represents an emerging category with significant potential for growth. Gamification of learning experiences and skill development programs appeal to parents and educational institutions, creating opportunities for B2B revenue models alongside traditional consumer gaming approaches.

Game Developers benefit from access to a large and growing user base with increasing willingness to spend on digital entertainment. The market offers multiple monetization opportunities and relatively lower user acquisition costs compared to mature gaming markets in developed countries.

Platform Operators can leverage India’s digital payment infrastructure and smartphone ecosystem to create scalable gaming businesses. Network effects and user-generated content opportunities enable sustainable competitive advantages and long-term value creation.

Investors gain exposure to a high-growth market with favorable demographic trends and increasing digital adoption. The gaming industry offers diversification benefits and potential for significant returns as the market matures and consolidates.

Technology Providers including cloud services, payment processors, and analytics companies benefit from increased demand for gaming infrastructure and support services. B2B opportunities in the gaming ecosystem provide stable revenue streams and growth potential.

Content Creators and influencers can monetize their gaming skills and audience engagement through streaming platforms, sponsorship deals, and tournament participation. The growing creator economy provides new career opportunities and income sources.

Strengths:

Weaknesses:

Opportunities:

Threats:

Vernacular Gaming has emerged as a critical trend, with games developed in regional languages showing significantly higher engagement rates. Local language content resonates better with users from non-metropolitan areas, driving expansion beyond English-speaking urban markets.

Social Gaming Integration continues to gain momentum as platforms incorporate social media features, friend networks, and community building elements. Multiplayer experiences and social competition enhance user retention and create viral growth opportunities through word-of-mouth marketing.

Cross-platform Gaming enables seamless experiences across mobile, PC, and console devices, increasing user engagement and session duration. Cloud gaming technology supports this trend by reducing hardware requirements and enabling consistent gaming experiences across different devices.

Influencer Marketing has become a dominant user acquisition strategy, with gaming influencers and content creators driving significant user growth for gaming platforms. Streaming integration and live gaming content create new engagement models and revenue opportunities.

Blockchain Gaming and NFT integration represent emerging trends with potential for significant market impact. Play-to-earn models and digital asset ownership concepts are gaining traction among tech-savvy gaming communities.

Investment Activity has reached unprecedented levels, with venture capital firms and strategic investors committing substantial resources to gaming startups and established companies. Funding rounds have enabled rapid scaling and market expansion for successful gaming platforms.

Strategic Partnerships between gaming companies and telecom operators have created bundled offerings and improved user acquisition efficiency. Device manufacturer collaborations enable pre-installed gaming apps and optimized gaming experiences on smartphones.

Regulatory Developments continue to evolve, with various state governments implementing frameworks for online gaming operations. Industry self-regulation initiatives aim to establish best practices and maintain consumer trust while avoiding restrictive government intervention.

Technology Acquisitions have accelerated as companies seek to enhance their technical capabilities and expand their service offerings. Talent acquisition from global gaming companies has strengthened local development capabilities and industry expertise.

International Expansion by Indian gaming companies demonstrates the sector’s growing maturity and competitiveness. Export opportunities in Southeast Asian and Middle Eastern markets provide additional growth avenues for successful domestic platforms.

MarkWide Research analysis suggests that gaming companies should prioritize regional language content development and cultural localization to maximize market penetration. Investment in vernacular gaming capabilities will be crucial for accessing non-English speaking user segments and achieving sustainable growth.

Technology infrastructure investments should focus on cloud gaming capabilities and cross-platform integration to future-proof gaming platforms against evolving user expectations. 5G optimization will become increasingly important as network deployment accelerates across major cities.

Regulatory compliance strategies must be proactive and comprehensive, with companies establishing robust legal frameworks and government relations capabilities. Industry collaboration on self-regulation initiatives can help maintain favorable regulatory environments.

User acquisition strategies should emphasize retention and lifetime value optimization rather than purely growth-focused approaches. Data analytics and personalization capabilities will be critical for maintaining competitive advantages in user engagement and monetization.

Partnership development with telecom operators, payment providers, and content platforms can accelerate market expansion while reducing customer acquisition costs. Strategic alliances enable access to established user bases and distribution channels.

Long-term growth prospects for India’s online gaming industry remain exceptionally positive, supported by favorable demographic trends, improving technology infrastructure, and increasing cultural acceptance of gaming as mainstream entertainment. Market maturation is expected to drive consolidation and the emergence of dominant platform players.

Technology evolution will continue reshaping the gaming landscape, with artificial intelligence, virtual reality, and cloud gaming creating new user experiences and business models. 5G network deployment will enable more sophisticated gaming applications and reduce latency issues that currently limit certain game categories.

Esports development is projected to accelerate significantly, with professional leagues, collegiate competitions, and international tournaments creating substantial revenue opportunities. Gaming career paths will become more established and socially accepted, driving further market growth and investment.

Regulatory frameworks are expected to stabilize as governments develop comprehensive policies balancing consumer protection with industry growth objectives. MWR projections indicate that clear regulatory guidelines will reduce uncertainty and encourage additional investment in the sector.

International expansion opportunities will increase as Indian gaming companies develop competitive capabilities and seek growth beyond domestic markets. Export potential in gaming services and content creation represents significant long-term value creation opportunities for successful companies.

India’s online gaming industry stands at a pivotal moment in its evolution, with unprecedented growth opportunities driven by favorable demographic trends, technological advancement, and changing consumer preferences. The market has demonstrated remarkable resilience and adaptability, successfully navigating regulatory challenges while maintaining strong growth momentum across multiple segments.

Strategic success factors for industry participants include cultural localization, technology innovation, regulatory compliance, and sustainable monetization models. Companies that effectively combine these elements while maintaining focus on user experience and community building are positioned to capture significant market share and create long-term value.

Future market development will be shaped by continued technology evolution, regulatory stabilization, and the maturation of esports and competitive gaming ecosystems. The industry’s transformation from niche entertainment to mainstream cultural phenomenon creates substantial opportunities for stakeholders across the entire gaming value chain, positioning India as a major force in the global gaming industry.

What is Online Gaming?

Online gaming refers to playing video games over the internet, encompassing various genres such as multiplayer online battle arenas, role-playing games, and casual games. It has gained immense popularity due to its accessibility and social interaction features.

What are the key players in the India Online Gaming Industry Market?

Key players in the India Online Gaming Industry Market include companies like Dream11, MPL (Mobile Premier League), and Nazara Technologies, which offer a range of gaming experiences from fantasy sports to casual gaming, among others.

What are the growth factors driving the India Online Gaming Industry Market?

The growth of the India Online Gaming Industry Market is driven by increasing smartphone penetration, rising internet accessibility, and a growing youth population interested in gaming. Additionally, the rise of esports and online tournaments has further fueled this growth.

What challenges does the India Online Gaming Industry Market face?

The India Online Gaming Industry Market faces challenges such as regulatory hurdles, concerns over gambling addiction, and competition from international gaming platforms. These factors can impact market growth and player engagement.

What opportunities exist in the India Online Gaming Industry Market?

Opportunities in the India Online Gaming Industry Market include the potential for innovative game development, expansion into augmented and virtual reality gaming, and the increasing popularity of mobile gaming. These trends can attract a broader audience and enhance user engagement.

What trends are shaping the India Online Gaming Industry Market?

Trends shaping the India Online Gaming Industry Market include the rise of live streaming platforms, the integration of social features in games, and the growing interest in competitive gaming. These trends are transforming how players interact and engage with games.

India Online Gaming Industry Market

| Segmentation Details | Description |

|---|---|

| Game Type | Action, Adventure, Sports, Puzzle |

| Platform | Mobile, PC, Console, Cloud |

| Monetization Model | Free-to-Play, Subscription, Pay-to-Play, In-App Purchases |

| Target Audience | Casual Gamers, Hardcore Gamers, Esports Enthusiasts, Families |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Online Gaming Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at