444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European military aviation market represents a critical component of the continent’s defense infrastructure, encompassing advanced fighter aircraft, transport planes, helicopters, and unmanned aerial systems. European nations continue to invest substantially in modernizing their air forces to address evolving security challenges and maintain technological superiority. The market demonstrates robust growth driven by geopolitical tensions, NATO commitments, and the need for next-generation military capabilities.

Defense spending across European countries has increased significantly, with military aviation receiving a substantial portion of these investments. The market benefits from strong collaboration between European defense manufacturers and government agencies, fostering innovation in areas such as stealth technology, advanced avionics, and multi-role combat aircraft. Growth rates in the sector indicate a 6.2% CAGR over the forecast period, reflecting sustained demand for military aviation solutions.

Key market participants include established aerospace giants and emerging technology companies that contribute to the development of cutting-edge military aircraft systems. The European market’s emphasis on indigenous capabilities and reduced dependence on foreign suppliers has accelerated domestic production and technological advancement. Regional cooperation through programs like the Future Combat Air System demonstrates the collaborative approach to military aviation development.

The European military aviation market refers to the comprehensive ecosystem of military aircraft development, manufacturing, procurement, and maintenance activities across European nations. This market encompasses all aspects of military air power, including combat aircraft, transport vehicles, reconnaissance platforms, and support systems designed for defense and security operations.

Military aviation in the European context involves sophisticated aircraft systems that serve multiple roles, from air superiority and ground attack missions to strategic transport and intelligence gathering. The market includes both manned and unmanned platforms, reflecting the evolution toward hybrid operational capabilities that combine traditional piloted aircraft with autonomous systems.

European military aviation encompasses the entire value chain from research and development to operational deployment, including advanced manufacturing processes, cutting-edge avionics integration, and comprehensive maintenance services. The market represents a strategic sector that supports national security objectives while driving technological innovation and economic growth across the region.

Market dynamics in European military aviation reflect a complex interplay of security requirements, technological advancement, and budgetary considerations. The sector experiences sustained growth driven by modernization programs, replacement of aging aircraft fleets, and emerging threats that require advanced military capabilities. European governments prioritize military aviation investments as essential components of national defense strategies.

Technology integration remains a primary focus, with emphasis on developing next-generation fighter aircraft, advanced helicopter systems, and unmanned aerial vehicles. The market benefits from substantial research and development investments, with innovation spending representing approximately 12% of total market activity. Collaborative programs between European nations enhance cost-effectiveness while accelerating technological development.

Competitive landscape features both established aerospace manufacturers and specialized technology providers that contribute to the military aviation ecosystem. The market demonstrates resilience through diversified product portfolios and strong government partnerships. Export opportunities complement domestic demand, with European military aircraft systems gaining recognition in international markets for their advanced capabilities and reliability.

Strategic insights reveal several critical factors shaping the European military aviation market landscape:

Geopolitical tensions serve as a primary driver for European military aviation investments, with nations recognizing the critical importance of maintaining advanced air power capabilities. Regional security challenges and evolving threat landscapes necessitate continuous modernization of military aircraft fleets to ensure operational readiness and strategic deterrence.

NATO commitments significantly influence European military aviation spending, with member nations required to meet specific defense spending targets and capability requirements. These obligations drive sustained investment in advanced military aircraft systems and related technologies. Alliance interoperability requirements further encourage standardization and collaborative development programs.

Technological advancement creates opportunities for enhanced military capabilities through next-generation aircraft systems. The integration of artificial intelligence, advanced sensors, and network-centric warfare capabilities drives demand for sophisticated military aviation platforms. Digital transformation in military operations requires aircraft systems that can seamlessly integrate with modern command and control networks.

Economic factors also contribute to market growth, with military aviation representing a strategic industrial sector that supports employment and technological innovation. Government policies that prioritize domestic defense manufacturing capabilities encourage investment in European military aviation companies and technologies.

Budget constraints represent a significant challenge for European military aviation markets, with governments balancing defense spending against other fiscal priorities. Economic pressures and competing budget demands can delay or reduce military aviation procurement programs, impacting market growth potential.

Development complexity and extended timelines for advanced military aircraft programs create market uncertainties. Technical challenges associated with next-generation military aviation systems can lead to cost overruns and schedule delays, affecting overall market dynamics. Regulatory requirements and certification processes add complexity to military aircraft development and deployment.

Political considerations can influence military aviation procurement decisions, with changes in government priorities potentially affecting long-term program commitments. International relations and diplomatic factors may impact collaborative development programs and export opportunities for European military aviation manufacturers.

Technology risks associated with cutting-edge military aviation systems can create development challenges and market uncertainties. Cybersecurity threats require substantial investments in protective measures, adding costs to military aircraft programs while potentially limiting certain technological implementations.

Emerging technologies create substantial opportunities for European military aviation market expansion, particularly in areas such as artificial intelligence, autonomous systems, and advanced materials. These technological developments enable new military capabilities while opening markets for innovative aviation solutions.

International partnerships offer significant growth potential through collaborative development programs and export opportunities. European military aircraft manufacturers can leverage their technological expertise to compete in global markets while building strategic relationships with international customers.

Modernization programs across European air forces present substantial market opportunities as aging aircraft fleets require replacement with advanced systems. Upgrade programs for existing military aircraft also create opportunities for technology integration and capability enhancement services.

Dual-use technologies developed for military aviation applications can find commercial applications, creating additional revenue streams and market opportunities. Research and development investments in military aviation often yield innovations that benefit both defense and civilian aerospace sectors.

Maintenance and support services represent growing market opportunities as military aircraft fleets require comprehensive lifecycle support. Digital maintenance solutions and predictive analytics create new service models that enhance aircraft availability while generating recurring revenue streams.

Supply chain dynamics in European military aviation reflect complex relationships between prime contractors, suppliers, and government customers. Integration challenges require sophisticated coordination to ensure timely delivery of advanced military aircraft systems while maintaining quality standards and cost effectiveness.

Technology evolution drives continuous change in market dynamics, with rapid advancement in areas such as sensor technology, communications systems, and propulsion technologies. Innovation cycles in military aviation typically span decades, requiring sustained investment and long-term strategic planning from market participants.

Competitive dynamics involve both collaboration and competition among European aerospace companies, with joint programs coexisting alongside competitive bidding for national contracts. Market consolidation trends create larger, more capable organizations while potentially reducing competitive intensity in certain market segments.

Customer relationships in military aviation markets are characterized by long-term partnerships between manufacturers and government customers. Program lifecycles often extend over multiple decades, creating stable revenue streams while requiring sustained technical support and capability enhancement services.

Comprehensive analysis of the European military aviation market employs multiple research methodologies to ensure accurate and reliable insights. Primary research involves direct engagement with industry participants, including aerospace manufacturers, government officials, and military aviation experts to gather firsthand market intelligence.

Secondary research incorporates analysis of government defense budgets, procurement announcements, and industry reports to understand market trends and dynamics. Data triangulation methods ensure consistency and accuracy across multiple information sources, providing robust market insights and projections.

Market modeling techniques incorporate various factors including defense spending patterns, aircraft replacement cycles, and technology adoption rates to develop comprehensive market forecasts. Scenario analysis considers different potential outcomes based on geopolitical developments and economic conditions.

Expert interviews with industry leaders, military officials, and technology specialists provide qualitative insights that complement quantitative market data. MarkWide Research methodology emphasizes thorough validation of market information through multiple independent sources to ensure reliability and accuracy of market intelligence.

Western Europe dominates the regional military aviation landscape, with countries like France, Germany, and the United Kingdom maintaining substantial defense aerospace capabilities. These nations account for approximately 68% of regional military aviation activity, driven by large defense budgets and established aerospace industries.

France leads in military aviation innovation through companies like Dassault Aviation and Airbus Defence and Space, with strong government support for indigenous military aircraft development. German military aviation focuses on collaborative European programs while maintaining significant domestic capabilities in helicopter and transport aircraft systems.

United Kingdom maintains advanced military aviation capabilities despite Brexit-related changes, with continued participation in European collaborative programs and strong domestic aerospace industry. BAE Systems and Rolls-Royce represent key players in the UK military aviation sector.

Eastern Europe demonstrates growing military aviation investments, with countries like Poland and Czech Republic modernizing their air forces through both domestic procurement and international partnerships. Regional market share for Eastern Europe represents approximately 18% of total European military aviation activity.

Nordic countries including Sweden, Norway, and Finland maintain specialized military aviation capabilities, with Saab representing a significant regional player in fighter aircraft and defense systems. These nations emphasize interoperability with NATO standards while maintaining some indigenous capabilities.

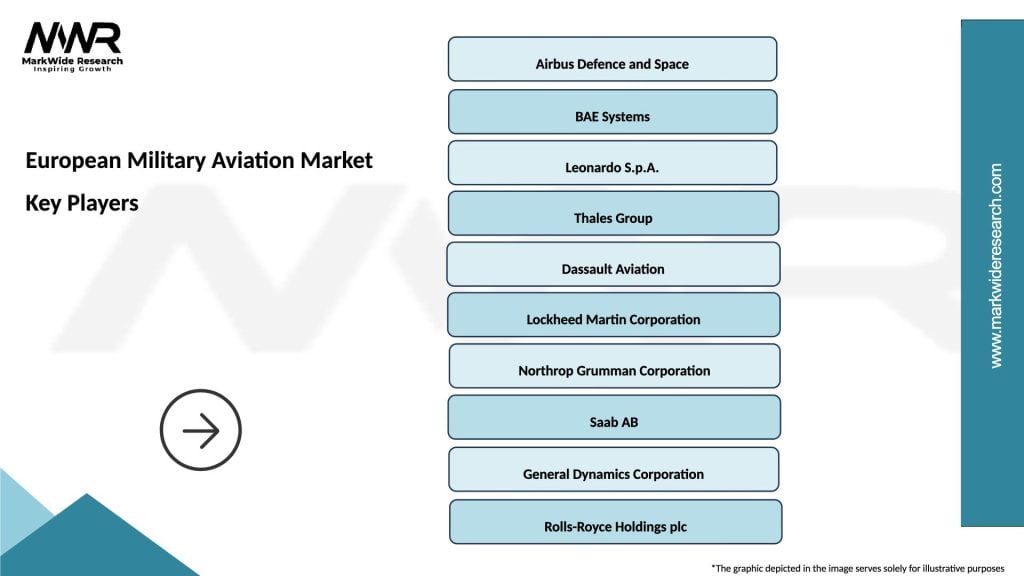

Market leadership in European military aviation involves several major aerospace companies that compete across different market segments:

Competitive strategies focus on technological innovation, international partnerships, and comprehensive lifecycle support services. Market differentiation occurs through advanced capabilities, cost-effectiveness, and ability to meet specific customer requirements across diverse military aviation applications.

By Aircraft Type:

By Technology:

By Application:

Fighter Aircraft segment represents the largest category within European military aviation, driven by ongoing modernization programs and replacement of aging combat aircraft fleets. Multi-role capabilities are increasingly important, with modern fighter aircraft required to perform air superiority, ground attack, and reconnaissance missions effectively.

Transport Aircraft category demonstrates steady growth as European militaries require enhanced strategic mobility capabilities. Tactical transport aircraft serve critical roles in military operations, while strategic transport platforms enable global deployment capabilities for European armed forces.

Military Helicopters represent a significant market segment with diverse applications including attack, transport, and utility missions. Technology advancement in helicopter systems focuses on improved survivability, enhanced mission capabilities, and reduced maintenance requirements.

Unmanned Aerial Vehicles constitute the fastest-growing category, with adoption rates increasing by approximately 15% annually across European military forces. Drone technology integration complements manned aircraft capabilities while providing cost-effective solutions for various military missions.

Training Aircraft maintain importance for developing military pilot capabilities, with emphasis on advanced simulation systems and cost-effective training solutions. Synthetic training technologies increasingly complement traditional flight training methods.

Aerospace Manufacturers benefit from sustained demand for military aviation systems, providing stable revenue streams and opportunities for technological innovation. Long-term contracts offer predictable business models while collaborative programs enable cost sharing and risk mitigation.

Government Customers gain access to advanced military capabilities that enhance national security and defense readiness. European collaboration programs provide cost-effective solutions while maintaining technological sovereignty and reducing dependence on non-European suppliers.

Technology Suppliers find opportunities to integrate cutting-edge technologies into military aviation systems, driving innovation and creating new market segments. Dual-use applications enable technology transfer between military and civilian aerospace sectors.

Service Providers benefit from growing demand for maintenance, training, and support services throughout military aircraft lifecycles. Digital services and predictive maintenance create new revenue opportunities while improving aircraft availability and operational efficiency.

Economic Benefits extend to broader European economies through high-value employment, technology development, and export opportunities. Supply chain participation provides opportunities for small and medium enterprises to contribute to military aviation programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation represents a fundamental trend reshaping European military aviation, with integration of artificial intelligence, machine learning, and advanced data analytics into aircraft systems. Connected aircraft capabilities enable real-time data sharing and enhanced situational awareness for military operations.

Autonomous Systems integration continues expanding, with unmanned aircraft increasingly complementing manned platforms in military operations. Human-machine teaming concepts develop new operational paradigms that combine human decision-making with autonomous system capabilities.

Sustainability Focus drives development of more environmentally friendly military aircraft, with emphasis on fuel efficiency and reduced environmental impact. Alternative fuels and hybrid propulsion systems represent emerging areas of military aviation development.

Modular Design approaches enable more flexible and cost-effective military aircraft development, with open architecture systems allowing easier integration of new technologies and capabilities. Upgrade pathways become increasingly important for extending aircraft service lives.

Cybersecurity Integration becomes critical as military aircraft systems become more connected and dependent on digital technologies. Cyber resilience requirements influence aircraft design and development processes from initial conception through operational deployment.

Future Combat Air System program represents the most significant European military aviation development, bringing together France, Germany, and Spain in developing next-generation fighter aircraft capabilities. This collaborative program demonstrates European commitment to maintaining technological sovereignty in military aviation.

Tempest Program led by the United Kingdom with international partners develops advanced fighter aircraft technology for future operational requirements. Technology demonstration activities advance key capabilities including advanced sensors, artificial intelligence, and human-machine interfaces.

European drone development accelerates through programs like the European MALE RPAS initiative, developing indigenous unmanned aircraft capabilities. Autonomous systems integration becomes increasingly important for European military aviation strategies.

Helicopter modernization programs across European nations drive development of advanced rotary-wing capabilities, with emphasis on multi-role platforms and enhanced survivability features. Next-generation helicopters incorporate advanced avionics and reduced maintenance requirements.

Training system evolution incorporates advanced simulation technologies and virtual reality systems to enhance pilot training effectiveness while reducing costs. Synthetic training environments increasingly complement traditional flight training methods.

Strategic recommendations for European military aviation market participants emphasize the importance of continued investment in advanced technologies and international collaboration. MarkWide Research analysis indicates that companies focusing on digital integration and autonomous systems will be best positioned for future growth opportunities.

Technology investment priorities should focus on areas such as artificial intelligence, advanced materials, and cybersecurity capabilities that will differentiate European military aviation systems in competitive markets. Research and development spending should maintain focus on breakthrough technologies that enable next-generation military capabilities.

Partnership strategies become increasingly important for managing development costs and risks associated with advanced military aviation programs. International collaboration enables access to larger markets while sharing development expenses across multiple participants.

Market diversification through both military and civilian applications helps companies manage risks while leveraging technology investments across broader market opportunities. Export focus enables European companies to compete in global markets and achieve economies of scale.

Service expansion represents a key growth opportunity, with lifecycle support services providing recurring revenue streams and closer customer relationships. Digital services and predictive maintenance capabilities create competitive advantages while improving customer value propositions.

Long-term prospects for the European military aviation market remain positive, driven by sustained defense spending commitments and ongoing modernization requirements. Technology evolution will continue creating opportunities for enhanced military capabilities and new market segments.

Growth projections indicate continued expansion at a 6.8% CAGR through the forecast period, with particular strength in unmanned systems and advanced avionics segments. Modernization cycles will drive sustained demand for new military aircraft systems while creating opportunities for upgrade and enhancement programs.

Collaborative programs will become increasingly important for European military aviation development, enabling cost sharing and technology advancement while maintaining strategic autonomy. International partnerships will expand market opportunities while fostering technology transfer and capability development.

Technology integration will accelerate, with artificial intelligence, autonomous systems, and advanced sensors becoming standard features in military aircraft systems. Digital transformation will reshape operational concepts and create new requirements for military aviation capabilities.

Market evolution will favor companies that successfully integrate advanced technologies while maintaining cost competitiveness and operational effectiveness. Service-oriented business models will become increasingly important as customers seek comprehensive lifecycle support for complex military aviation systems.

European military aviation market demonstrates robust fundamentals with strong growth prospects driven by modernization requirements, technological advancement, and sustained defense spending commitments. The market benefits from established aerospace industrial capabilities, government support, and collaborative development programs that enhance competitiveness while managing costs and risks.

Technology trends including artificial intelligence, autonomous systems, and digital integration create opportunities for enhanced military capabilities while opening new market segments. International collaboration through programs like the Future Combat Air System demonstrates European commitment to maintaining technological sovereignty while achieving cost-effective development outcomes.

Market participants that successfully navigate the complex landscape of government requirements, technology integration, and international competition will be well-positioned for sustained growth. Strategic focus on advanced technologies, service expansion, and collaborative partnerships will be critical for success in this dynamic and evolving market environment.

What is European Military Aviation?

European Military Aviation refers to the sector involved in the design, production, and operation of military aircraft and related systems within Europe. This includes fighter jets, transport aircraft, and unmanned aerial vehicles used by various armed forces across the continent.

What are the key players in the European Military Aviation Market?

Key players in the European Military Aviation Market include Airbus, BAE Systems, Leonardo, and Dassault Aviation, among others. These companies are involved in various aspects of military aviation, from manufacturing aircraft to providing advanced technologies and systems.

What are the main drivers of growth in the European Military Aviation Market?

The main drivers of growth in the European Military Aviation Market include increasing defense budgets, the need for modernization of aging fleets, and rising geopolitical tensions. Additionally, advancements in technology and the demand for enhanced capabilities are also contributing to market expansion.

What challenges does the European Military Aviation Market face?

The European Military Aviation Market faces challenges such as budget constraints, regulatory hurdles, and the complexity of international collaborations. Additionally, the rapid pace of technological change can create difficulties in keeping up with advancements.

What opportunities exist in the European Military Aviation Market?

Opportunities in the European Military Aviation Market include the development of next-generation aircraft, increased investment in unmanned systems, and the integration of advanced technologies like artificial intelligence and cybersecurity. These areas present significant potential for growth and innovation.

What trends are shaping the European Military Aviation Market?

Trends shaping the European Military Aviation Market include a shift towards more sustainable aviation practices, increased collaboration among European nations for joint defense projects, and the growing importance of digital transformation in military operations. These trends are influencing how military aviation is approached and developed.

European Military Aviation Market

| Segmentation Details | Description |

|---|---|

| Type | Fighter Jets, Transport Aircraft, Helicopters, Drones |

| Technology | Avionics, Navigation Systems, Propulsion Systems, Communication Systems |

| End User | Air Forces, Defense Contractors, Government Agencies, Private Security Firms |

| Application | Surveillance, Reconnaissance, Combat Operations, Training |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Military Aviation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at