444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa beer market represents a complex and evolving landscape characterized by diverse cultural, religious, and regulatory factors that significantly influence consumption patterns and market dynamics. This region encompasses countries with varying degrees of alcohol acceptance, from more liberal markets in South Africa and certain Gulf states to conservative territories where alcohol consumption faces strict regulations or complete prohibition.

Market dynamics in this region are shaped by a growing expatriate population, increasing tourism, urbanization trends, and evolving consumer preferences among younger demographics. The market experiences significant variation across different countries, with South Africa leading consumption volumes, followed by emerging markets in Kenya, Nigeria, and select Middle Eastern countries where alcohol is legally available.

Growth trajectories indicate that the market is expanding at a moderate but steady pace, driven primarily by premium beer segments and craft brewing innovations. The region’s beer market benefits from increasing disposable income in key urban centers, growing acceptance of Western lifestyle products, and the establishment of local brewing facilities that cater to regional taste preferences.

Regional variations create distinct market segments, with North African countries showing different consumption patterns compared to Sub-Saharan Africa, while Middle Eastern markets remain highly regulated but show potential for growth in tourism-focused areas and expatriate communities.

The Middle East & Africa beer market refers to the comprehensive ecosystem of beer production, distribution, and consumption across the diverse geographical regions of the Middle East and African continent. This market encompasses all aspects of the beer industry, including local brewing operations, international brand presence, distribution networks, retail channels, and consumer consumption patterns within the cultural and regulatory frameworks of each respective country.

Market scope includes various beer categories such as lagers, ales, stouts, premium beers, craft beers, and non-alcoholic alternatives. The market operates within a complex regulatory environment where alcohol laws vary significantly from country to country, creating unique challenges and opportunities for industry participants.

Geographical coverage spans from Morocco in the northwest to South Africa in the south, and from Egypt in the northeast to Nigeria in the west, encompassing both established markets and emerging territories with growing beer consumption potential.

The Middle East & Africa beer market demonstrates resilient growth despite facing unique regional challenges including regulatory restrictions, cultural considerations, and economic volatility. The market is characterized by a growing preference for premium and craft beer segments, with consumers increasingly seeking quality over quantity in their beer consumption choices.

Key market drivers include urbanization trends affecting approximately 65% of the target demographic, rising disposable incomes in major metropolitan areas, and increasing exposure to international beer brands through tourism and expatriate communities. The market benefits from a young population base that shows greater openness to beer consumption compared to previous generations.

South Africa maintains its position as the dominant market in the region, accounting for a significant portion of total beer consumption, while emerging markets in East and West Africa show promising growth potential. The market faces challenges from regulatory restrictions in certain countries, economic instability, and competition from traditional alcoholic beverages.

Future prospects remain positive for markets with favorable regulatory environments, with industry analysts projecting continued expansion driven by demographic trends, economic development, and evolving consumer preferences toward premium beer products.

Strategic market insights reveal several critical trends shaping the Middle East & Africa beer market landscape:

Demographic transformation serves as a primary driver for the Middle East & Africa beer market, with rapid urbanization creating concentrated consumer bases in major cities where beer consumption is more socially acceptable and accessible. The region’s young population, with over 60% under age 25, demonstrates greater openness to beer consumption and international lifestyle products.

Economic development in key markets has led to increased disposable income and changing consumption patterns. Growing middle-class populations in countries like Nigeria, Kenya, and Ghana are driving demand for premium beer products and international brands that were previously considered luxury items.

Tourism expansion significantly impacts beer consumption, particularly in destinations like Morocco, Egypt, South Africa, and emerging tourism markets in East Africa. International visitors create demand for familiar beer brands and contribute to local consumption growth in hospitality sectors.

Cultural evolution among urban populations, particularly in cosmopolitan cities, has led to greater acceptance of beer consumption as part of social and business activities. This cultural shift is most pronounced among educated, urban professionals and younger demographics.

Infrastructure development has improved distribution networks and cold chain capabilities, making beer more widely available in previously underserved markets. Modern retail formats and improved logistics support market expansion into secondary cities and emerging consumer segments.

Regulatory restrictions represent the most significant constraint for the Middle East & Africa beer market, with several countries maintaining strict prohibitions or heavy restrictions on alcohol production, distribution, and consumption. These regulatory barriers limit market access and create compliance complexities for industry participants.

Cultural and religious factors continue to influence beer consumption patterns, with traditional and religious communities maintaining resistance to alcohol consumption. These cultural barriers affect market penetration and limit growth potential in certain demographic segments and geographical areas.

Economic volatility in many regional markets creates challenges for consistent market growth, with currency fluctuations, inflation, and economic instability affecting consumer purchasing power and import costs for international beer brands.

Infrastructure limitations in rural and remote areas restrict distribution capabilities and market reach. Inadequate cold storage facilities, transportation networks, and retail infrastructure limit beer availability and quality maintenance in emerging markets.

High taxation on alcoholic beverages in many countries increases product costs and reduces affordability for price-sensitive consumer segments. Excise taxes and import duties significantly impact pricing strategies and market competitiveness.

Competition from traditional beverages remains strong, with local alcoholic and non-alcoholic drinks maintaining cultural significance and consumer loyalty. Traditional beverages often benefit from lower costs and deeper cultural connections.

Craft beer segment presents substantial growth opportunities as consumer preferences shift toward unique, artisanal products with distinctive flavors and brewing stories. Local craft breweries can capitalize on regional ingredients and cultural themes to create differentiated products that appeal to sophisticated consumers.

Non-alcoholic beer market offers significant potential in regions with strict alcohol regulations or strong religious considerations. These products can capture market share while respecting cultural and regulatory constraints, providing entry points for brand establishment.

Premium positioning strategies can capitalize on growing affluence and status-conscious consumption patterns. Premium and super-premium beer segments show resilience during economic challenges and offer higher profit margins for industry participants.

Tourism-focused markets provide opportunities for targeted marketing and distribution strategies. Partnerships with hospitality sectors, resorts, and entertainment venues can drive consumption growth in key tourist destinations.

E-commerce expansion enables direct-to-consumer sales in markets where legally permitted, providing new distribution channels and customer engagement opportunities. Digital platforms can overcome traditional retail limitations and reach underserved consumer segments.

Local partnership strategies with established regional players can facilitate market entry and navigate regulatory complexities. Joint ventures and licensing agreements provide pathways for international brands to establish presence while leveraging local expertise.

Supply chain dynamics in the Middle East & Africa beer market are characterized by complex logistics requirements, varying regulatory environments, and infrastructure challenges that influence product availability and pricing strategies. Local production facilities are increasingly important for cost management and market responsiveness.

Consumer behavior patterns show significant variation across different countries and demographic segments, with urban consumers demonstrating higher beer consumption rates and preference for international brands. MarkWide Research analysis indicates that consumer preferences are evolving toward premium products, with quality perception driving 45% of purchase decisions.

Competitive dynamics involve both international brewing giants and local players competing for market share through different strategies. International brands focus on premium positioning and marketing sophistication, while local players compete on price accessibility and cultural relevance.

Regulatory dynamics continue to evolve, with some countries gradually liberalizing alcohol policies to support economic development and tourism growth. These regulatory changes create new market opportunities while requiring adaptive business strategies.

Technology integration is transforming brewing processes, distribution efficiency, and consumer engagement. Digital marketing, e-commerce platforms, and supply chain optimization technologies are becoming increasingly important for market success.

Comprehensive market research for the Middle East & Africa beer market employs multiple methodological approaches to ensure accurate and reliable market intelligence. Primary research involves direct engagement with industry stakeholders, including brewers, distributors, retailers, and consumers across different market segments and geographical regions.

Data collection methods include structured surveys, in-depth interviews, focus group discussions, and observational studies conducted in key markets. Research covers both quantitative metrics such as consumption volumes, pricing trends, and market share data, as well as qualitative insights into consumer preferences, cultural factors, and regulatory impacts.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and regulatory documentation from relevant authorities across the region. This approach ensures comprehensive coverage of market dynamics and regulatory environments.

Market segmentation analysis examines different product categories, price segments, distribution channels, and consumer demographics to provide detailed insights into market structure and growth opportunities. Geographic analysis covers country-level and regional trends to identify market variations and opportunities.

Validation processes include cross-referencing multiple data sources, expert consultations, and market participant feedback to ensure research accuracy and reliability. Continuous monitoring and updates maintain research relevance in this dynamic market environment.

South Africa dominates the regional beer market, representing the largest consumption base with well-established brewing infrastructure and relatively liberal alcohol policies. The market benefits from strong local brewing traditions, international brand presence, and sophisticated distribution networks that serve both urban and rural populations effectively.

West Africa shows promising growth potential, with Nigeria leading regional consumption trends despite regulatory challenges. The region benefits from large population bases, growing urbanization, and increasing disposable income among middle-class consumers. Ghana and Côte d’Ivoire represent emerging markets with favorable growth trajectories.

East Africa demonstrates strong market potential, particularly in Kenya and Ethiopia, where local brewing industries are expanding and consumer acceptance is growing. The region’s young demographics and economic development create favorable conditions for beer market expansion.

North Africa presents a mixed market landscape, with Morocco and Egypt showing growth in tourism-related consumption, while other markets face significant regulatory restrictions. Tourism development drives consumption in key destinations and resort areas.

Middle East markets remain highly regulated, with consumption primarily concentrated in expatriate communities and tourism sectors. UAE and certain other Gulf states allow controlled alcohol sales, creating niche market opportunities for premium beer products.

Market share distribution shows South Africa accounting for approximately 55% of regional consumption, with West Africa representing 25%, East Africa 12%, and North Africa and Middle East combining for 8% of total market activity.

The competitive landscape in the Middle East & Africa beer market features a mix of international brewing conglomerates and strong regional players who compete through different strategies and market positioning approaches.

Competitive strategies focus on local market adaptation, premium positioning, distribution network expansion, and strategic partnerships with local players. International brands emphasize quality and sophistication, while local players compete on price accessibility and cultural relevance.

By Product Type:

By Price Segment:

By Distribution Channel:

By Geography:

Lager Category maintains dominance across the Middle East & Africa beer market, representing the preferred beer style for most consumers due to its light, refreshing characteristics that suit the region’s climate. This category benefits from established consumer preferences and broad market acceptance across different demographic segments.

Premium Beer Segment shows accelerating growth as consumers increasingly seek quality and brand prestige. This category commands higher margins and demonstrates resilience during economic challenges, with premium products showing 15% higher growth rates compared to economy segments.

Craft Beer Category represents the fastest-growing segment, particularly in urban markets where consumers appreciate unique flavors, local ingredients, and artisanal brewing stories. Local craft breweries are emerging across the region, creating products that reflect regional tastes and cultural themes.

Non-Alcoholic Beer presents significant opportunities in markets with regulatory restrictions or strong religious considerations. This category allows brands to establish presence and build consumer relationships while respecting cultural and legal constraints.

Flavored Beer Variants are gaining popularity among younger consumers who seek innovative taste experiences. Fruit-flavored and specialty beers create differentiation opportunities and appeal to consumers transitioning from other beverage categories.

Packaging Innovation across categories focuses on convenience, portability, and climate suitability. Smaller package sizes and resealable options cater to consumption patterns and storage limitations in certain markets.

Brewers and Manufacturers benefit from expanding market opportunities, growing consumer bases, and increasing acceptance of beer consumption in key regional markets. Local production facilities provide cost advantages and market responsiveness while reducing import dependencies and currency risks.

Distributors and Retailers gain from expanding product portfolios and growing consumer demand for premium beer products. Modern retail formats and improved distribution networks create opportunities for market expansion and customer engagement.

Investors and Financial Stakeholders benefit from market growth potential and demographic trends that support long-term consumption growth. The beer industry offers relatively stable returns and growth opportunities in emerging markets with favorable regulatory environments.

Government and Regulatory Bodies benefit from tax revenues, employment creation, and economic development through the beer industry. Tourism promotion and hospitality sector development are supported by vibrant beer markets in key destinations.

Consumers benefit from increasing product variety, quality improvements, and competitive pricing as market competition intensifies. Access to international brands and local craft options provides diverse consumption choices and experiences.

Tourism and Hospitality Sectors benefit from beer availability and variety that enhances visitor experiences and supports revenue generation. Quality beer offerings contribute to destination attractiveness and customer satisfaction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization trend continues to shape the Middle East & Africa beer market, with consumers increasingly willing to pay higher prices for quality products, unique brewing experiences, and international brand prestige. This trend is particularly pronounced in urban markets and among younger demographics.

Local craft brewing is experiencing rapid expansion as entrepreneurs and established brewers create products that reflect regional tastes, ingredients, and cultural themes. Craft breweries are emerging in major cities across the region, offering unique alternatives to mass-produced beers.

Health-conscious consumption is driving demand for low-alcohol and non-alcoholic beer alternatives. Consumers are seeking products that allow social participation while maintaining health and religious considerations, creating opportunities for innovative product development.

Digital engagement is transforming how beer brands connect with consumers, particularly younger demographics who are active on social media platforms. Digital marketing strategies and e-commerce platforms are becoming essential for brand building and customer acquisition.

Sustainability focus is gaining importance as consumers and regulators emphasize environmental responsibility. Brewers are adopting sustainable packaging, local sourcing, and environmentally friendly production processes to meet growing sustainability expectations.

Tourism integration is creating specialized beer experiences and products designed for international visitors. Beer tourism, brewery visits, and destination-specific products are emerging as important market segments in key tourist destinations.

Brewing capacity expansion continues across the region as international and local players invest in production facilities to serve growing markets and reduce import dependencies. New breweries and facility upgrades are particularly notable in Nigeria, Kenya, and South Africa.

Strategic partnerships between international brewing companies and local players are facilitating market entry and expansion. These partnerships combine international expertise with local market knowledge and distribution capabilities.

Product innovation is accelerating with the introduction of new beer styles, flavors, and packaging formats designed to meet regional preferences and consumption patterns. MWR data indicates that new product launches increased by 25% over recent periods.

Distribution network modernization is improving product availability and quality maintenance through cold chain investments and logistics optimization. Modern retail partnerships and e-commerce capabilities are expanding market reach.

Regulatory engagement by industry participants is helping to shape policy development and promote responsible consumption practices. Industry associations are working with governments to develop balanced regulatory frameworks that support economic development while addressing social concerns.

Technology adoption in brewing processes, quality control, and customer engagement is enhancing operational efficiency and product quality. Digital platforms for marketing, sales, and customer relationship management are becoming standard industry practices.

Market entry strategies should prioritize countries with favorable regulatory environments and growing urban populations. MarkWide Research recommends focusing initial investments on markets with established alcohol acceptance and strong economic growth trajectories.

Product portfolio development should emphasize premium and craft beer segments while maintaining affordable options for price-sensitive consumers. Non-alcoholic alternatives provide important opportunities in regulated markets and among health-conscious consumers.

Local partnership approaches are essential for navigating regulatory complexities and cultural considerations. Joint ventures with established regional players provide market access and local expertise while sharing investment risks and regulatory responsibilities.

Distribution strategy optimization should focus on urban markets initially, with gradual expansion to secondary cities as infrastructure and market acceptance develop. E-commerce capabilities provide important supplementary distribution channels where legally permitted.

Brand positioning strategies should emphasize quality, authenticity, and cultural relevance while respecting local sensitivities. Premium positioning can command higher margins and build brand loyalty among affluent consumer segments.

Regulatory compliance must remain a top priority with dedicated resources for monitoring policy changes and maintaining compliance across multiple jurisdictions. Proactive engagement with regulatory authorities helps shape favorable policy development.

Long-term growth prospects for the Middle East & Africa beer market remain positive, driven by favorable demographic trends, urbanization, and economic development in key markets. The market is expected to benefit from continued premiumization trends and growing acceptance of beer consumption among younger urban populations.

Market expansion is anticipated in countries with evolving regulatory environments and growing tourism industries. East and West African markets show particularly strong potential for sustained growth, with projected growth rates of 8-12% annually in favorable market conditions.

Product innovation will continue to drive market development, with craft beer, premium segments, and non-alcoholic alternatives leading growth. Local brewing capabilities will expand to serve regional markets and reduce import dependencies.

Technology integration will enhance operational efficiency, product quality, and customer engagement. Digital platforms for marketing, sales, and distribution will become increasingly important for market success and customer relationship management.

Sustainability initiatives will gain prominence as environmental concerns and regulatory requirements drive adoption of sustainable practices throughout the value chain. Companies that proactively address sustainability will gain competitive advantages.

Regional integration may create opportunities for cross-border trade and market expansion as economic cooperation and infrastructure development facilitate product movement and market access across the region.

The Middle East & Africa beer market presents a complex but promising landscape for industry participants willing to navigate regulatory challenges and cultural considerations while capitalizing on favorable demographic and economic trends. The market’s diversity creates multiple opportunities for different strategies and product positioning approaches.

Success factors include understanding local market dynamics, building strong partnerships, maintaining regulatory compliance, and developing products that meet regional preferences and cultural requirements. Companies that invest in local production capabilities and distribution networks will be best positioned for long-term success.

Growth potential remains substantial in key markets with favorable regulatory environments and growing urban populations. The premiumization trend and craft beer segment development provide opportunities for higher margins and brand differentiation in competitive markets.

Strategic focus on quality, innovation, and cultural sensitivity will be essential for building sustainable market positions. The Middle East & Africa beer market offers significant opportunities for companies that approach it with appropriate strategies, local partnerships, and long-term commitment to market development and consumer satisfaction.

What is Beer?

Beer is an alcoholic beverage made from the fermentation of sugars, primarily derived from cereal grains such as barley, wheat, and corn. It is one of the oldest and most widely consumed drinks in the world, with various styles and flavors influenced by regional ingredients and brewing techniques.

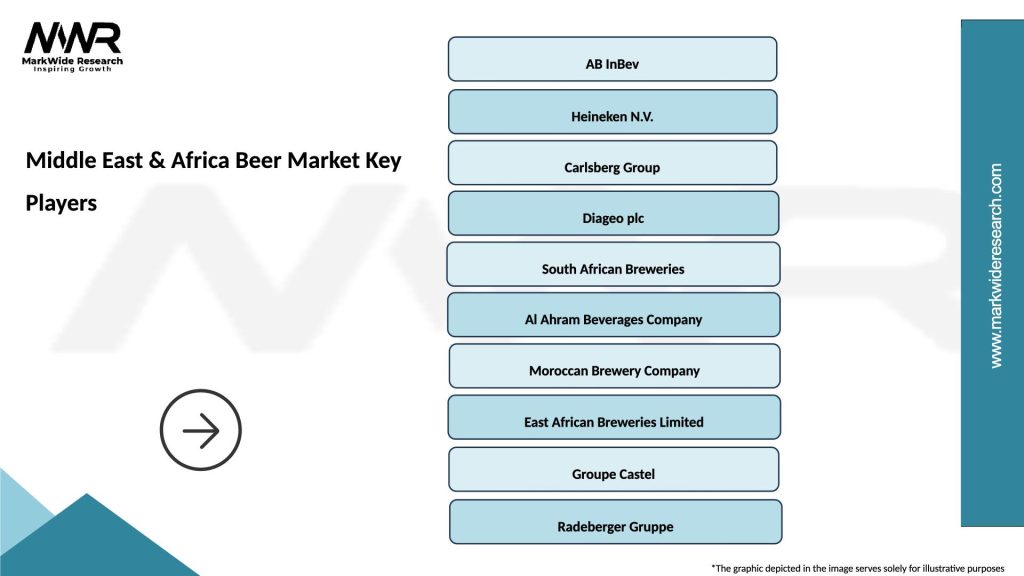

What are the key players in the Middle East & Africa Beer Market?

Key players in the Middle East & Africa Beer Market include Anheuser-Busch InBev, Heineken N.V., and Carlsberg Group, among others. These companies dominate the market through a diverse portfolio of beer brands and strategic partnerships.

What are the growth factors driving the Middle East & Africa Beer Market?

The growth of the Middle East & Africa Beer Market is driven by increasing urbanization, a growing young population, and rising disposable incomes. Additionally, the expanding craft beer segment and changing consumer preferences towards premium products are contributing to market growth.

What challenges does the Middle East & Africa Beer Market face?

The Middle East & Africa Beer Market faces challenges such as regulatory restrictions on alcohol sales, cultural attitudes towards drinking, and competition from non-alcoholic beverages. These factors can limit market expansion and consumer access.

What opportunities exist in the Middle East & Africa Beer Market?

Opportunities in the Middle East & Africa Beer Market include the potential for growth in the craft beer segment and the introduction of innovative flavors and products. Additionally, expanding distribution channels and e-commerce platforms present new avenues for reaching consumers.

What trends are shaping the Middle East & Africa Beer Market?

Trends shaping the Middle East & Africa Beer Market include the rise of craft breweries, increased focus on sustainability in production, and the popularity of low-alcohol and non-alcoholic beer options. These trends reflect changing consumer preferences and a shift towards healthier drinking habits.

Middle East & Africa Beer Market

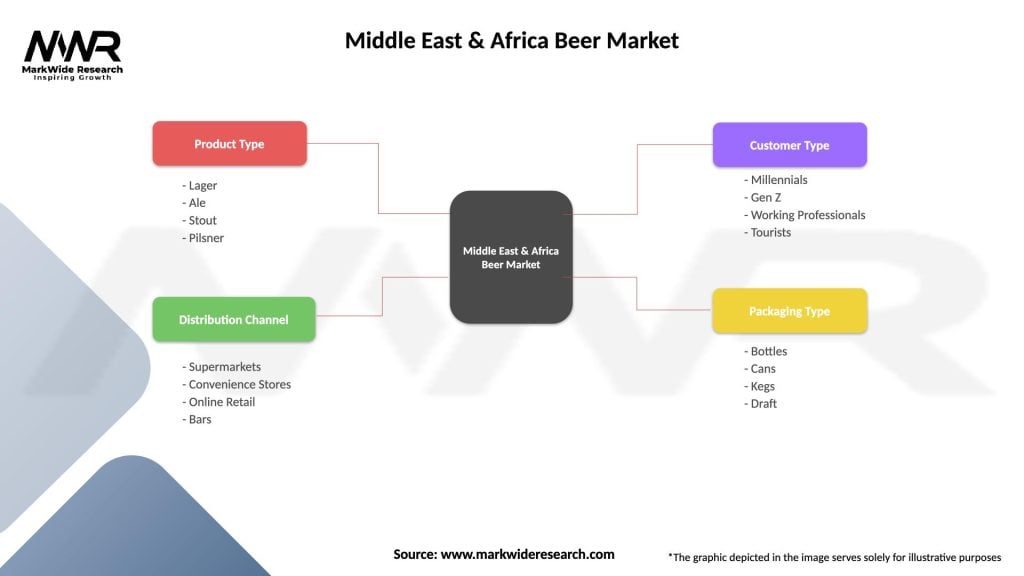

| Segmentation Details | Description |

|---|---|

| Product Type | Lager, Ale, Stout, Pilsner |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Bars |

| Customer Type | Millennials, Gen Z, Working Professionals, Tourists |

| Packaging Type | Bottles, Cans, Kegs, Draft |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Beer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at