444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific computed tomography (CT) market represents one of the most dynamic and rapidly expanding segments within the global medical imaging industry. This region has emerged as a critical hub for advanced diagnostic imaging technologies, driven by increasing healthcare investments, rising disease prevalence, and growing awareness of early disease detection. The market encompasses a comprehensive range of CT scanner technologies, including conventional CT systems, multi-slice CT scanners, and advanced cone-beam CT equipment across diverse healthcare settings.

Healthcare infrastructure development across Asia Pacific nations has accelerated significantly, with governments prioritizing medical technology adoption to improve patient outcomes. The region’s diverse healthcare landscape spans from highly developed markets like Japan and South Korea to rapidly emerging economies such as India, China, and Southeast Asian countries. This diversity creates unique opportunities for CT technology providers to address varying market needs and price points.

Technological advancement in CT imaging has revolutionized diagnostic capabilities, with the Asia Pacific region experiencing robust growth rates of approximately 8.5% CAGR in CT system adoption. The integration of artificial intelligence, dose reduction technologies, and enhanced imaging protocols has positioned the region as a significant contributor to global CT market expansion. Market penetration varies considerably across countries, with developed markets achieving 75% adoption rates in major hospitals while emerging markets present substantial growth potential.

The Asia Pacific computed tomography market refers to the comprehensive ecosystem encompassing the development, manufacturing, distribution, and utilization of CT imaging systems across the Asia Pacific region. This market includes various CT scanner types, associated software solutions, maintenance services, and consumables required for diagnostic imaging operations in healthcare facilities ranging from large hospitals to specialized imaging centers.

Computed tomography technology utilizes X-ray measurements taken from multiple angles around the body to create detailed cross-sectional images of internal structures. In the Asia Pacific context, this market represents the regional adoption and implementation of CT systems to address diverse healthcare challenges, including cancer detection, cardiovascular disease diagnosis, trauma assessment, and routine health screening programs.

Market scope encompasses both hardware components such as CT scanners, workstations, and imaging accessories, as well as software solutions including image reconstruction algorithms, analysis tools, and patient management systems. The regional market also includes service components such as installation, training, maintenance, and technical support provided by manufacturers and third-party service providers across different Asia Pacific countries.

Strategic market positioning in the Asia Pacific CT market reveals significant growth momentum driven by demographic transitions, healthcare modernization initiatives, and increasing diagnostic imaging demand. The region’s aging population, particularly in developed markets like Japan and South Korea, has created sustained demand for advanced diagnostic capabilities, while emerging economies focus on expanding basic healthcare infrastructure.

Technology adoption patterns show a clear preference for multi-slice CT systems, which account for approximately 68% of new installations across the region. Healthcare providers increasingly prioritize systems offering enhanced image quality, reduced radiation exposure, and improved workflow efficiency. The integration of AI-powered diagnostic tools has gained significant traction, with 42% of new CT installations incorporating some form of artificial intelligence enhancement.

Competitive dynamics feature both established global manufacturers and emerging regional players competing across different market segments. Price sensitivity varies significantly between developed and emerging markets, creating opportunities for diverse product positioning strategies. Government healthcare policies and reimbursement frameworks play crucial roles in shaping market access and adoption rates across different countries.

Future growth prospects remain robust, supported by continued healthcare investment, technological innovation, and expanding diagnostic imaging applications. The market demonstrates resilience and adaptability, with manufacturers developing region-specific solutions to address local healthcare needs and economic conditions.

Market segmentation analysis reveals distinct patterns across the Asia Pacific CT market, with several key insights driving strategic decision-making:

Demographic transformation across Asia Pacific countries serves as a primary market driver, with rapidly aging populations requiring increased diagnostic imaging services. Countries like Japan, South Korea, and Singapore face significant demographic shifts, with elderly populations exceeding 25% of total demographics in some regions. This demographic transition directly correlates with higher incidence rates of chronic diseases requiring regular CT imaging for diagnosis and monitoring.

Healthcare infrastructure expansion represents another crucial driver, particularly in emerging economies where governments prioritize medical facility development. China’s healthcare reform initiatives, India’s Ayushman Bharat program, and Southeast Asian healthcare modernization efforts have accelerated CT system procurement and installation. These infrastructure investments create substantial market opportunities for CT manufacturers and service providers.

Disease prevalence increases across the region, particularly for cancer, cardiovascular diseases, and trauma cases, drive consistent demand for advanced diagnostic imaging. The World Health Organization reports rising cancer incidence rates across Asia Pacific countries, with early detection programs increasingly relying on CT screening protocols. Additionally, urbanization and lifestyle changes contribute to higher cardiovascular disease rates, requiring sophisticated imaging capabilities.

Technological advancement adoption accelerates market growth as healthcare providers seek improved diagnostic accuracy and operational efficiency. AI-enhanced imaging, dose reduction technologies, and advanced reconstruction algorithms attract healthcare facilities looking to enhance patient care while managing operational costs. The integration of these technologies creates competitive advantages for early adopters.

Government healthcare initiatives and policy support provide significant market momentum through increased healthcare spending, reimbursement improvements, and regulatory frameworks supporting advanced medical technology adoption. Many Asia Pacific governments have established specific targets for healthcare infrastructure development, creating predictable demand patterns for CT equipment suppliers.

High capital investment requirements present significant barriers for many healthcare facilities, particularly in emerging markets where budget constraints limit advanced CT system procurement. The substantial upfront costs associated with CT scanner acquisition, installation, and facility preparation can delay or prevent adoption, especially for smaller hospitals and clinics with limited financial resources.

Skilled personnel shortages across the region create operational challenges for CT system utilization. The complex nature of modern CT technology requires specialized training for radiologists, technologists, and maintenance personnel. Many Asia Pacific countries face shortages of qualified imaging professionals, limiting the effective utilization of installed CT systems and constraining market growth potential.

Regulatory compliance complexity varies significantly across different Asia Pacific countries, creating challenges for manufacturers and healthcare providers. Varying approval processes, safety standards, and quality requirements across different markets increase operational complexity and costs. These regulatory differences can delay product launches and limit market access for certain CT technologies.

Infrastructure limitations in some regions constrain CT system deployment, particularly regarding power supply reliability, facility space requirements, and technical support availability. Rural and remote areas often lack the necessary infrastructure to support advanced CT installations, limiting market penetration in these geographic segments.

Reimbursement challenges in certain markets affect CT utilization rates and investment decisions. Inconsistent or limited insurance coverage for CT procedures can reduce demand and impact the financial viability of CT system investments for healthcare providers. These reimbursement constraints particularly affect elective and screening applications.

Emerging market expansion presents substantial growth opportunities as developing Asia Pacific countries invest in healthcare infrastructure modernization. Countries like Vietnam, Indonesia, and the Philippines demonstrate increasing healthcare spending and growing demand for advanced diagnostic capabilities. These markets offer significant potential for CT manufacturers willing to develop appropriate product offerings and market entry strategies.

Artificial intelligence integration creates new value propositions and market differentiation opportunities. AI-powered diagnostic assistance, automated workflow optimization, and predictive maintenance capabilities represent growing market segments. Healthcare providers increasingly seek CT systems incorporating AI features to improve diagnostic accuracy and operational efficiency, creating premium market opportunities.

Mobile and portable CT solutions address specific market needs in regions with limited infrastructure or specialized applications. Emergency response, rural healthcare delivery, and temporary facility support represent niche but growing market segments. The development of more compact and portable CT systems opens new application areas and geographic markets.

Preventive healthcare emphasis across Asia Pacific countries creates opportunities for CT screening programs and early detection initiatives. Government health policies increasingly focus on preventive care, creating demand for CT systems optimized for screening applications. This trend particularly benefits low-dose CT technologies and specialized screening protocols.

Public-private partnerships offer alternative market entry and expansion strategies, particularly in countries with significant government healthcare involvement. Collaborative approaches to healthcare infrastructure development can accelerate CT system deployment while sharing investment risks and leveraging local market knowledge.

Supply chain evolution within the Asia Pacific CT market reflects changing manufacturing patterns and regional sourcing strategies. Many global CT manufacturers have established regional production facilities to reduce costs, improve delivery times, and better serve local markets. This localization trend has enhanced supply chain resilience while creating opportunities for regional component suppliers and service providers.

Competitive intensity varies across different market segments and geographic regions, with established global players competing alongside emerging regional manufacturers. Price competition remains significant in cost-sensitive markets, while technology differentiation drives competition in premium segments. The market demonstrates ongoing consolidation trends as smaller players seek partnerships or acquisition opportunities.

Technology convergence influences market dynamics as CT systems increasingly integrate with other imaging modalities and healthcare IT systems. The development of hybrid imaging systems, cloud-based image management, and interoperable diagnostic platforms creates new market categories and competitive dynamics. These convergence trends require manufacturers to develop broader technology capabilities and partnerships.

Customer relationship evolution shifts from traditional equipment sales toward comprehensive service partnerships and outcome-based contracts. Healthcare providers increasingly seek long-term partnerships offering equipment, maintenance, training, and performance guarantees. This evolution requires CT manufacturers to develop enhanced service capabilities and alternative business models.

Regulatory harmonization efforts across some Asia Pacific regions aim to streamline approval processes and reduce market entry barriers. Regional cooperation initiatives and mutual recognition agreements can accelerate product approvals and market access, benefiting both manufacturers and healthcare providers seeking advanced CT technologies.

Comprehensive market analysis for the Asia Pacific CT market employs multiple research methodologies to ensure accuracy and reliability. Primary research involves direct engagement with key market participants, including CT manufacturers, healthcare providers, distributors, and industry experts across different Asia Pacific countries. This approach provides firsthand insights into market trends, challenges, and opportunities.

Secondary research integration incorporates data from government healthcare statistics, industry associations, medical device regulatory bodies, and published academic research. This comprehensive approach ensures market analysis reflects both quantitative trends and qualitative insights from authoritative sources. MarkWide Research methodology emphasizes cross-validation of data sources to enhance reliability and accuracy.

Geographic coverage spans major Asia Pacific markets including China, Japan, South Korea, India, Australia, Singapore, Thailand, Malaysia, Indonesia, and the Philippines. Each country analysis considers unique healthcare systems, regulatory environments, and market characteristics to provide nuanced regional insights.

Market segmentation analysis examines multiple dimensions including technology type, application area, end-user category, and price segments. This multi-dimensional approach enables comprehensive understanding of market dynamics and identification of specific growth opportunities and challenges within different market segments.

Trend analysis methodology combines historical data analysis with forward-looking projections based on identified market drivers and emerging technologies. The research approach considers both cyclical patterns and structural changes affecting the CT market to provide balanced and realistic market assessments.

China dominates the Asia Pacific CT market with the largest installed base and highest annual procurement volumes. The country’s healthcare reform initiatives and massive hospital construction programs have created sustained demand for CT systems across all market segments. Market share in China represents approximately 38% of regional CT installations, driven by both public hospital expansion and private healthcare facility growth.

Japan maintains a mature and sophisticated CT market characterized by high technology adoption rates and frequent equipment upgrades. The country’s aging population and advanced healthcare system create consistent demand for premium CT systems with latest technological features. Japanese healthcare facilities demonstrate strong preference for high-end multi-slice CT systems with AI integration capabilities.

South Korea exhibits rapid market growth driven by healthcare digitization initiatives and increasing medical tourism. The country’s focus on advanced medical technology adoption and government support for healthcare innovation creates favorable conditions for CT market expansion. Technology penetration rates in South Korea exceed 85% for multi-slice CT systems in major hospitals.

India represents the fastest-growing CT market in the region, with expanding healthcare infrastructure and increasing diagnostic imaging demand. The country’s large population, growing middle class, and government healthcare initiatives create substantial market opportunities. However, price sensitivity remains a significant factor influencing product selection and market penetration strategies.

Southeast Asian markets including Thailand, Malaysia, Indonesia, and the Philippines demonstrate strong growth potential driven by healthcare modernization efforts and increasing healthcare spending. These markets show preference for mid-range CT systems offering good performance-to-price ratios while gradually adopting more advanced technologies.

Australia and New Zealand represent mature markets with high technology adoption rates and strong regulatory frameworks. These countries demonstrate consistent replacement demand and early adoption of innovative CT technologies, making them important markets for premium product launches and technology validation.

Market leadership in the Asia Pacific CT market features several global manufacturers competing across different segments and price points. The competitive landscape demonstrates both established market positions and emerging competitive dynamics as regional players gain market share.

Competitive strategies vary across different market segments, with premium manufacturers focusing on technology differentiation and comprehensive service offerings, while value-oriented competitors emphasize cost-effectiveness and local market adaptation. Strategic partnerships, local manufacturing, and regional service capabilities increasingly influence competitive positioning.

Innovation focus areas include artificial intelligence integration, dose reduction technologies, workflow optimization, and specialized applications. Manufacturers invest heavily in R&D to maintain competitive advantages and address evolving customer needs across different Asia Pacific markets.

Technology-based segmentation reveals distinct market preferences and growth patterns across different CT system categories:

By Technology Type:

By Application Area:

By End User:

By Price Segment:

Multi-slice CT systems demonstrate the strongest growth trajectory across Asia Pacific markets, driven by their versatility and superior diagnostic capabilities. These systems offer excellent image quality, fast scanning times, and comprehensive clinical applications, making them preferred choices for most healthcare facilities. Adoption rates for multi-slice CT systems reach 85% in developed markets and continue growing in emerging economies.

AI-integrated CT systems represent the fastest-growing technology category, with 42% of new installations incorporating artificial intelligence features. These systems offer automated image analysis, workflow optimization, and diagnostic assistance capabilities that improve efficiency and accuracy. Healthcare providers increasingly prioritize AI features when making CT system procurement decisions.

Low-dose CT technologies gain significant traction across the region, addressing radiation safety concerns and enabling screening applications. Advanced dose reduction algorithms and iterative reconstruction techniques allow significant radiation exposure reduction while maintaining image quality. This category particularly appeals to facilities performing high-volume screening programs.

Mobile CT solutions address specific market needs in emergency response, rural healthcare, and temporary facility applications. While representing a smaller market segment, mobile CT systems demonstrate strong growth potential in regions with infrastructure limitations or specialized requirements. These systems offer flexibility and accessibility advantages in challenging deployment environments.

Cardiac CT systems emerge as a specialized high-growth category, driven by increasing cardiovascular disease prevalence and advancing imaging protocols. Dedicated cardiac CT systems offer specialized features for coronary artery imaging, cardiac function assessment, and structural heart disease evaluation. This category attracts premium pricing and demonstrates strong adoption in cardiology-focused facilities.

Healthcare providers benefit from advanced CT technologies through improved diagnostic accuracy, enhanced workflow efficiency, and better patient outcomes. Modern CT systems enable faster scanning times, reduced radiation exposure, and comprehensive imaging capabilities that support diverse clinical applications. These benefits translate into improved patient satisfaction, operational efficiency, and competitive positioning in healthcare markets.

Patients experience significant advantages from CT technology advancement, including reduced examination times, lower radiation exposure, and improved diagnostic accuracy. Advanced CT systems provide more comfortable examination experiences while delivering superior image quality for accurate diagnosis and treatment planning. Early disease detection capabilities enabled by CT screening programs contribute to improved health outcomes and survival rates.

CT manufacturers gain access to substantial market opportunities across diverse Asia Pacific countries with varying needs and preferences. The region’s growth potential, technology adoption trends, and expanding healthcare infrastructure create favorable conditions for business expansion and revenue growth. Manufacturers benefit from opportunities to develop region-specific products and establish long-term customer relationships.

Healthcare systems achieve improved population health outcomes through enhanced diagnostic capabilities and early disease detection programs. CT technology adoption supports healthcare system efficiency, reduces diagnostic delays, and enables more effective treatment planning. These benefits contribute to overall healthcare system performance and patient satisfaction metrics.

Technology partners including software developers, AI companies, and component suppliers benefit from growing demand for advanced CT system features and capabilities. The integration of artificial intelligence, cloud computing, and advanced imaging algorithms creates opportunities for technology partnerships and collaborative innovation initiatives.

Service providers gain from increasing demand for CT system maintenance, training, and technical support services. The growing installed base and technology complexity create sustainable revenue opportunities for companies offering comprehensive service solutions across the CT system lifecycle.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the Asia Pacific CT market. AI-powered diagnostic assistance, automated image analysis, and workflow optimization features are becoming standard expectations rather than premium options. Healthcare providers increasingly prioritize CT systems offering AI capabilities to improve diagnostic accuracy and operational efficiency. This trend drives product development priorities and competitive positioning strategies across the market.

Dose reduction emphasis continues gaining momentum as healthcare providers prioritize patient safety and regulatory compliance. Advanced reconstruction algorithms, iterative techniques, and optimized scanning protocols enable significant radiation dose reduction while maintaining or improving image quality. This trend particularly influences screening applications and pediatric imaging protocols, creating market opportunities for specialized low-dose CT technologies.

Cloud-based solutions adoption accelerates across the region as healthcare facilities seek improved image management, remote access capabilities, and collaborative diagnostic workflows. Cloud integration enables advanced analytics, AI processing, and multi-site image sharing while reducing local IT infrastructure requirements. This trend creates new business models and partnership opportunities for CT manufacturers and technology providers.

Mobile and portable CT systems gain traction in response to specific market needs including emergency response, rural healthcare delivery, and temporary facility support. These systems address infrastructure limitations and accessibility challenges while providing advanced diagnostic capabilities in challenging environments. The trend toward mobility creates niche market opportunities and specialized application segments.

Preventive healthcare focus drives demand for CT screening programs and early detection initiatives across Asia Pacific countries. Government health policies increasingly emphasize preventive care, creating sustained demand for CT systems optimized for screening applications. This trend benefits low-dose CT technologies and specialized screening protocols while expanding market applications beyond traditional diagnostic imaging.

Regional manufacturing expansion continues as global CT manufacturers establish local production facilities to reduce costs, improve delivery times, and better serve regional markets. This localization trend enhances supply chain resilience while creating opportunities for regional component suppliers and service providers. Manufacturing proximity also enables better customization for local market requirements and preferences.

Technology innovation acceleration has characterized recent industry developments, with major manufacturers launching advanced CT systems featuring enhanced AI capabilities, improved dose reduction, and specialized imaging protocols. These innovations address evolving clinical needs while differentiating products in competitive markets. Recent launches emphasize user-friendly interfaces, automated workflows, and comprehensive diagnostic capabilities.

Strategic partnerships between CT manufacturers and technology companies have expanded, particularly in artificial intelligence, cloud computing, and healthcare IT integration. These collaborations enable manufacturers to incorporate advanced software capabilities while technology partners gain access to medical imaging markets. Partnership strategies accelerate innovation cycles and enhance product competitiveness.

Regulatory approvals for advanced CT technologies have accelerated across Asia Pacific countries, with streamlined approval processes and mutual recognition agreements facilitating market access. Recent approvals include AI-integrated CT systems, specialized imaging protocols, and advanced reconstruction algorithms. These regulatory developments reduce time-to-market and enable faster technology adoption.

Market consolidation activities include acquisitions, mergers, and strategic alliances as companies seek to strengthen market positions and expand capabilities. Recent transactions focus on technology acquisition, regional market access, and service capability enhancement. Consolidation trends create opportunities for market leadership while potentially reducing competitive intensity in certain segments.

Healthcare infrastructure projects across the region have accelerated CT system procurement and installation. Major hospital construction programs, healthcare system modernization initiatives, and public-private partnerships create substantial market opportunities. These infrastructure developments provide predictable demand patterns and long-term growth prospects for CT manufacturers and service providers.

Market entry strategies should consider the diverse economic and regulatory environments across Asia Pacific countries. MarkWide Research analysis suggests that successful market penetration requires tailored approaches addressing local healthcare needs, pricing sensitivities, and regulatory requirements. Companies should prioritize establishing strong local partnerships and service capabilities to support long-term market success.

Product portfolio optimization should address the full spectrum of market segments from premium to entry-level systems. Manufacturers should develop region-specific products that balance advanced features with cost-effectiveness to address diverse market needs. AI integration and dose reduction capabilities should be prioritized across all product categories to meet evolving customer expectations.

Service capability development represents a critical success factor given the importance of maintenance, training, and technical support in CT system lifecycle management. Companies should invest in regional service networks, local technical expertise, and comprehensive training programs to support customer success and build long-term relationships.

Technology investment priorities should focus on artificial intelligence, dose reduction, and workflow optimization capabilities that address key customer needs and market trends. Companies should also consider emerging technologies such as spectral imaging, photon-counting detectors, and advanced reconstruction algorithms to maintain competitive advantages.

Partnership strategies should encompass technology collaborations, distribution agreements, and service partnerships to enhance market reach and capability development. Strategic alliances with local companies, technology providers, and healthcare organizations can accelerate market penetration and reduce entry barriers.

Regulatory compliance requires comprehensive understanding of varying requirements across different Asia Pacific countries. Companies should establish robust regulatory affairs capabilities and maintain close relationships with regulatory authorities to ensure smooth product approvals and market access.

Long-term growth prospects for the Asia Pacific CT market remain highly favorable, supported by demographic trends, healthcare infrastructure development, and technology advancement. The region’s aging population, increasing disease prevalence, and expanding healthcare access create sustained demand for advanced diagnostic imaging capabilities. Market growth rates are projected to maintain momentum at approximately 8.2% CAGR over the next five years.

Technology evolution will continue driving market transformation through artificial intelligence advancement, dose reduction improvements, and specialized imaging applications. Next-generation CT systems will offer enhanced diagnostic capabilities, improved workflow efficiency, and better patient experiences. AI integration will become standard across all market segments, while emerging technologies like spectral imaging and photon-counting detectors will create new premium market categories.

Market expansion into emerging Asia Pacific countries will accelerate as healthcare infrastructure development continues and economic conditions improve. Countries like Vietnam, Indonesia, and the Philippines represent significant growth opportunities as healthcare spending increases and diagnostic imaging demand expands. These markets will drive volume growth while developed markets focus on technology upgrades and replacement cycles.

Competitive landscape evolution will feature continued innovation competition, regional manufacturer emergence, and potential market consolidation. Global manufacturers will maintain technology leadership while regional players gain market share through cost advantages and local market adaptation. Competition will intensify across all market segments, driving innovation and customer value creation.

Healthcare system integration will deepen as CT systems become more connected with electronic health records, AI diagnostic platforms, and comprehensive imaging networks. This integration will enhance diagnostic workflows, improve patient outcomes, and create new value propositions for healthcare providers. Cloud-based solutions and remote diagnostic capabilities will expand access to advanced imaging expertise across the region.

The Asia Pacific computed tomography market represents one of the most dynamic and promising segments within the global medical imaging industry. With robust growth drivers including demographic transitions, healthcare infrastructure expansion, and technology advancement, the region offers substantial opportunities for CT manufacturers, service providers, and healthcare stakeholders. The market’s diversity across developed and emerging economies creates multiple growth pathways and strategic approaches for market participants.

Technology innovation continues reshaping market dynamics, with artificial intelligence integration, dose reduction capabilities, and workflow optimization becoming critical differentiators. Healthcare providers increasingly prioritize CT systems offering advanced features that improve diagnostic accuracy while enhancing operational efficiency. This technology focus creates opportunities for premium positioning and value-based partnerships between manufacturers and healthcare facilities.

Regional market characteristics require nuanced strategies addressing varying economic conditions, regulatory environments, and healthcare system structures across different Asia Pacific countries. Successful market participation demands comprehensive understanding of local needs, appropriate product positioning, and strong service capabilities to support long-term customer relationships and market growth.

Future market evolution will be characterized by continued growth, technology advancement, and expanding applications across diverse healthcare settings. The Asia Pacific CT market’s trajectory remains positive, supported by fundamental demographic and healthcare trends that create sustained demand for advanced diagnostic imaging capabilities. Market participants positioned to address regional needs while delivering innovative solutions will benefit from the region’s substantial growth potential and evolving healthcare landscape.

What is Computed Tomography (CT)?

Computed Tomography (CT) is a medical imaging technique that uses X-rays to create detailed cross-sectional images of the body. It is widely used for diagnosing various conditions, including tumors, internal injuries, and diseases.

What are the key players in the Asia Pacific Computed Tomography (CT) Market?

Key players in the Asia Pacific Computed Tomography (CT) Market include Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems, among others.

What are the growth factors driving the Asia Pacific Computed Tomography (CT) Market?

The growth of the Asia Pacific Computed Tomography (CT) Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in imaging technology, and the rising demand for early diagnosis and treatment.

What challenges does the Asia Pacific Computed Tomography (CT) Market face?

Challenges in the Asia Pacific Computed Tomography (CT) Market include high equipment costs, concerns regarding radiation exposure, and the need for skilled professionals to operate CT machines.

What opportunities exist in the Asia Pacific Computed Tomography (CT) Market?

Opportunities in the Asia Pacific Computed Tomography (CT) Market include the development of portable CT scanners, increasing investments in healthcare infrastructure, and the growing trend of telemedicine.

What trends are shaping the Asia Pacific Computed Tomography (CT) Market?

Trends in the Asia Pacific Computed Tomography (CT) Market include the integration of artificial intelligence for image analysis, the shift towards hybrid imaging systems, and the focus on patient-centered care.

Asia Pacific Computed Tomography (CT) Market

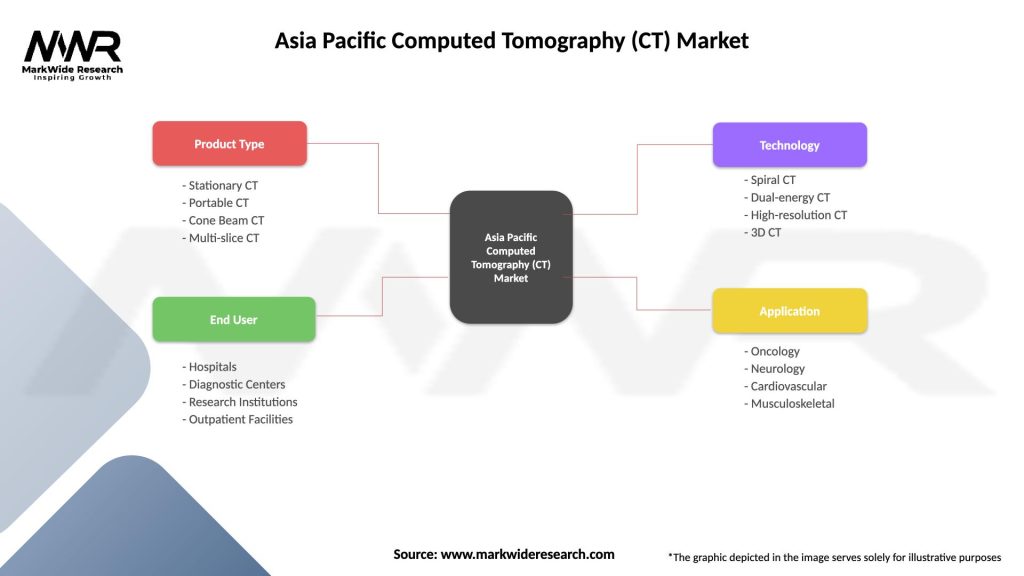

| Segmentation Details | Description |

|---|---|

| Product Type | Stationary CT, Portable CT, Cone Beam CT, Multi-slice CT |

| End User | Hospitals, Diagnostic Centers, Research Institutions, Outpatient Facilities |

| Technology | Spiral CT, Dual-energy CT, High-resolution CT, 3D CT |

| Application | Oncology, Neurology, Cardiovascular, Musculoskeletal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Computed Tomography (CT) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at