444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC polyurethane hot-melt adhesives market represents a dynamic and rapidly expanding segment within the broader adhesives industry across the Asia-Pacific region. This specialized market encompasses advanced bonding solutions that combine the versatility of polyurethane chemistry with the convenience of hot-melt application technology. Market dynamics indicate robust growth driven by increasing industrialization, expanding manufacturing capabilities, and rising demand for high-performance adhesive solutions across diverse applications.

Regional development across APAC countries has accelerated the adoption of polyurethane hot-melt adhesives, with significant growth observed in automotive, packaging, textiles, and construction sectors. The market demonstrates strong momentum with a projected CAGR of 8.2% through the forecast period, reflecting the region’s manufacturing expansion and technological advancement initiatives.

Key applications driving market growth include automotive interior assembly, flexible packaging solutions, textile lamination, and construction material bonding. The Asia-Pacific region’s position as a global manufacturing hub has created substantial demand for efficient, high-performance adhesive solutions that can meet stringent quality requirements while supporting rapid production cycles.

The APAC polyurethane hot-melt adhesives market refers to the regional trade and consumption of thermoplastic adhesive products that combine polyurethane polymer technology with hot-melt application methods across Asia-Pacific countries. These advanced adhesives are applied in molten state and form strong, flexible bonds upon cooling, offering superior performance characteristics compared to traditional adhesive solutions.

Polyurethane hot-melt adhesives represent a sophisticated category of bonding agents that provide excellent adhesion to diverse substrates, outstanding flexibility, superior chemical resistance, and enhanced durability. The hot-melt application process enables rapid processing, reduced solvent emissions, and improved manufacturing efficiency, making these products particularly valuable in high-volume production environments.

Market scope encompasses various product formulations, application technologies, and end-use industries throughout the APAC region, including major manufacturing centers in China, Japan, South Korea, India, Southeast Asia, and Australia. The market serves diverse industrial sectors requiring reliable, high-performance bonding solutions for critical applications.

Strategic analysis reveals the APAC polyurethane hot-melt adhesives market as a high-growth segment benefiting from regional industrialization trends, technological advancement, and increasing demand for sustainable manufacturing solutions. The market demonstrates strong fundamentals with expanding applications across key industries and growing adoption of advanced adhesive technologies.

Growth drivers include rapid automotive industry expansion, increasing packaging industry sophistication, growing textile manufacturing capabilities, and rising construction activity across APAC countries. Market penetration has reached approximately 42% in automotive applications and 38% in packaging sectors, indicating substantial room for continued expansion.

Competitive landscape features both global adhesive manufacturers and regional specialists competing through product innovation, application development, and strategic partnerships with end-users. Technology advancement focuses on improving bond strength, processing efficiency, environmental compliance, and cost-effectiveness to meet evolving market requirements.

Future prospects remain highly favorable, supported by ongoing industrialization, infrastructure development, and increasing emphasis on high-performance manufacturing solutions throughout the Asia-Pacific region. Market expansion is expected to accelerate as industries adopt more sophisticated adhesive technologies to enhance product quality and manufacturing efficiency.

Market intelligence reveals several critical insights shaping the APAC polyurethane hot-melt adhesives landscape:

Primary growth drivers propelling the APAC polyurethane hot-melt adhesives market include robust industrial expansion, technological advancement, and increasing demand for high-performance bonding solutions across key manufacturing sectors.

Automotive industry growth represents a major market driver, with expanding vehicle production throughout APAC countries creating substantial demand for advanced adhesive solutions. The automotive sector’s shift toward lightweight materials, electric vehicles, and enhanced interior comfort features requires sophisticated bonding technologies that polyurethane hot-melt adhesives effectively provide.

Packaging industry evolution drives significant market expansion as manufacturers seek adhesive solutions that support flexible packaging innovations, improved barrier properties, and enhanced consumer convenience features. The growth of e-commerce and changing consumer preferences create ongoing demand for advanced packaging adhesive technologies.

Manufacturing efficiency requirements across industries favor hot-melt adhesive technologies due to their rapid processing capabilities, reduced energy consumption, and elimination of solvent-related environmental concerns. These operational advantages support broader market adoption and increased penetration rates.

Infrastructure development throughout APAC countries creates substantial opportunities for construction-related adhesive applications, including flooring systems, insulation materials, and structural bonding solutions that benefit from polyurethane hot-melt technology advantages.

Market challenges facing the APAC polyurethane hot-melt adhesives industry include raw material cost volatility, technical complexity, and competitive pressure from alternative adhesive technologies.

Raw material costs present ongoing challenges as polyurethane precursors and specialty additives experience price fluctuations related to petroleum markets, supply chain disruptions, and global economic conditions. These cost pressures impact manufacturer margins and pricing strategies throughout the value chain.

Technical complexity associated with polyurethane hot-melt adhesive formulation and application requires specialized knowledge, equipment, and process control capabilities that may limit adoption among smaller manufacturers or cost-sensitive applications.

Competition from alternatives includes traditional solvent-based adhesives, water-based formulations, and other hot-melt technologies that may offer cost advantages or specific performance characteristics for certain applications, creating ongoing competitive pressure.

Regulatory compliance requirements across different APAC countries create complexity for manufacturers serving multiple markets, requiring investment in regulatory expertise and product adaptation to meet varying standards and environmental regulations.

Processing requirements for hot-melt application technology necessitate specialized equipment and temperature control systems that represent additional capital investment for end-users, potentially slowing adoption rates in price-sensitive market segments.

Significant opportunities exist within the APAC polyurethane hot-melt adhesives market through technological innovation, application expansion, and strategic market development initiatives.

Emerging applications in electronics manufacturing, renewable energy systems, and advanced packaging solutions create new revenue streams for polyurethane hot-melt adhesive suppliers. The growing electronics industry throughout APAC presents particularly attractive opportunities for specialized adhesive formulations.

Sustainability initiatives drive demand for eco-friendly adhesive solutions, creating opportunities for manufacturers developing bio-based polyurethane formulations, recyclable products, and low-emission technologies that align with environmental regulations and corporate sustainability goals.

Market penetration opportunities exist in developing APAC countries where industrialization and manufacturing capacity expansion create growing demand for advanced adhesive technologies. These markets offer substantial growth potential as local industries adopt more sophisticated manufacturing processes.

Technology partnerships between adhesive manufacturers and equipment suppliers create opportunities for integrated solutions that optimize performance, reduce costs, and simplify adoption for end-users seeking comprehensive bonding technology packages.

Customization services represent growing opportunities as manufacturers seek adhesive solutions tailored to specific applications, performance requirements, and processing conditions, enabling premium pricing and enhanced customer relationships.

Market dynamics within the APAC polyurethane hot-melt adhesives sector reflect complex interactions between supply-side capabilities, demand-side requirements, and external factors influencing industry development.

Supply chain evolution shows increasing localization of production capabilities throughout APAC countries, reducing dependence on imports and improving responsiveness to regional market requirements. Local manufacturing development has achieved approximately 65% regional self-sufficiency in key market segments.

Demand patterns demonstrate strong correlation with broader industrial activity, particularly in automotive and packaging sectors that represent primary consumption drivers. Seasonal variations and economic cycles influence demand timing and volume requirements across different applications.

Technology advancement continues driving market evolution through improved formulations, enhanced processing capabilities, and expanded application possibilities. Research and development investments focus on performance optimization, cost reduction, and environmental compliance improvements.

Competitive intensity varies across market segments, with premium applications supporting higher margins while commodity segments experience price pressure. Market leaders maintain advantages through technology leadership, customer relationships, and operational efficiency.

Regulatory environment increasingly influences market development through environmental standards, safety requirements, and quality specifications that drive innovation and may create barriers for smaller participants lacking compliance capabilities.

Comprehensive research methodology employed for analyzing the APAC polyurethane hot-melt adhesives market combines primary research, secondary data analysis, and industry expert insights to provide accurate market intelligence and strategic recommendations.

Primary research activities include structured interviews with industry participants, including adhesive manufacturers, equipment suppliers, end-users, and distribution partners across major APAC markets. Survey methodologies capture quantitative data on market trends, pricing dynamics, and growth projections.

Secondary research encompasses analysis of industry publications, company reports, trade statistics, regulatory documents, and technical literature to establish market context and validate primary research findings. Data triangulation ensures accuracy and reliability of market insights.

Market modeling utilizes statistical analysis, trend extrapolation, and scenario planning to develop market forecasts and identify key growth drivers. Analytical frameworks consider multiple variables including economic indicators, industry trends, and technological developments.

Expert validation involves consultation with industry specialists, technical experts, and market analysts to verify research conclusions and ensure practical relevance of findings. This validation process enhances the credibility and actionability of market intelligence.

Regional market dynamics across the Asia-Pacific polyurethane hot-melt adhesives market demonstrate significant variation in growth patterns, application preferences, and competitive landscapes among different countries and sub-regions.

China dominates the regional market with approximately 45% market share, driven by massive manufacturing capacity, automotive industry expansion, and growing packaging sector sophistication. Chinese market growth benefits from both domestic consumption and export-oriented manufacturing activities requiring advanced adhesive solutions.

Japan maintains technological leadership with 18% market share, focusing on high-performance applications in automotive, electronics, and precision manufacturing sectors. Japanese companies emphasize innovation, quality, and specialized formulations for demanding applications.

South Korea represents approximately 12% market share with strong growth in automotive and electronics applications. The country’s advanced manufacturing capabilities and technology focus drive demand for sophisticated adhesive solutions supporting high-value production activities.

India shows rapid expansion with 11% market share and the highest growth rate in the region, supported by industrialization initiatives, automotive sector development, and increasing manufacturing sophistication across multiple industries.

Southeast Asian countries collectively account for 10% market share with strong growth potential driven by manufacturing capacity expansion, foreign investment, and increasing adoption of advanced production technologies across key industries.

Australia and other markets represent the remaining 4% market share with stable demand patterns focused on construction, automotive, and specialized industrial applications requiring high-performance adhesive solutions.

Competitive environment within the APAC polyurethane hot-melt adhesives market features diverse participants ranging from global chemical companies to regional specialists, each competing through different strategies and market positioning approaches.

Market leaders include:

Competitive strategies emphasize technology innovation, customer service excellence, supply chain optimization, and strategic partnerships to maintain market position and drive growth in this dynamic market environment.

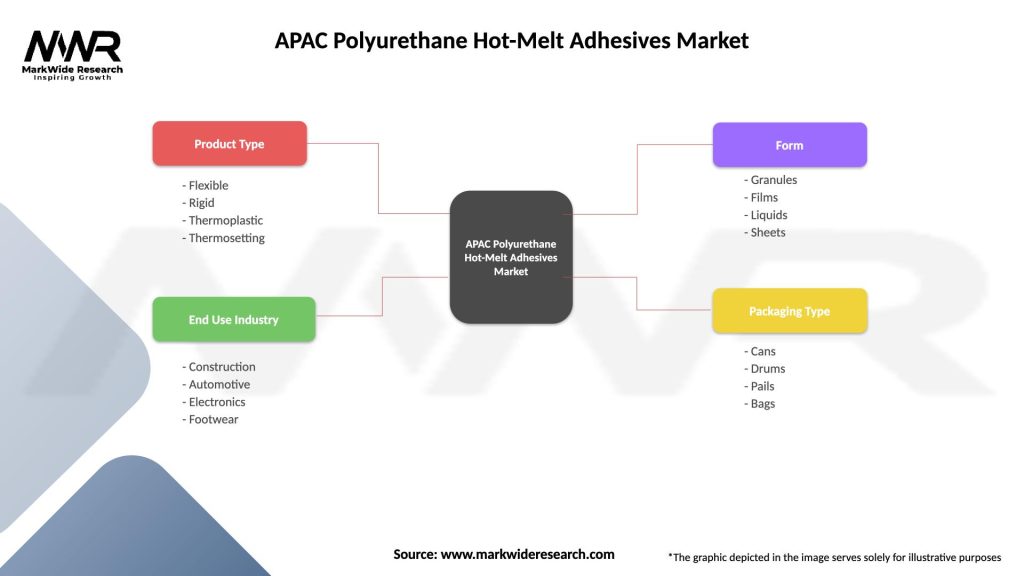

Market segmentation analysis reveals distinct categories within the APAC polyurethane hot-melt adhesives market based on product type, application, end-use industry, and geographic distribution.

By Product Type:

By Application Method:

By End-Use Industry:

Automotive applications represent the largest market category, driven by increasing vehicle production and growing adoption of advanced interior systems requiring high-performance bonding solutions. Market penetration in automotive applications has reached 78% adoption rate among major manufacturers, reflecting the technology’s proven benefits.

Packaging applications demonstrate strong growth momentum as manufacturers seek adhesive solutions supporting flexible packaging innovations, improved barrier properties, and enhanced processing efficiency. The shift toward sustainable packaging drives demand for environmentally compliant formulations.

Textile applications benefit from growing technical textile markets and increasing sophistication in garment manufacturing processes. Polyurethane hot-melt adhesives enable innovative fabric constructions and improved manufacturing efficiency in textile production.

Construction applications show steady expansion supported by infrastructure development and increasing adoption of advanced building materials requiring specialized bonding solutions. Market growth correlates with construction industry activity across APAC countries.

Electronics applications represent emerging opportunities as the sector adopts more sophisticated assembly processes and miniaturization trends require precise, reliable bonding solutions for critical component applications.

Performance characteristics vary significantly across categories, with automotive applications emphasizing durability and temperature resistance, packaging focusing on food safety and processing speed, and construction prioritizing structural integrity and environmental resistance.

Manufacturers benefit from polyurethane hot-melt adhesives through improved production efficiency, reduced processing costs, and enhanced product quality capabilities that support competitive advantage in demanding market environments.

Processing advantages include rapid application speeds, elimination of solvent emissions, reduced energy consumption, and simplified equipment requirements compared to alternative adhesive technologies. These operational benefits translate directly into cost savings and improved manufacturing flexibility.

End-users gain superior product performance through enhanced bond strength, improved durability, better chemical resistance, and extended service life compared to conventional adhesive solutions. These performance advantages justify premium pricing and support customer loyalty.

Supply chain participants benefit from growing market demand, technology advancement opportunities, and expanding application possibilities that create new revenue streams and business development prospects throughout the value chain.

Environmental benefits include reduced volatile organic compound emissions, improved recyclability options, and energy-efficient processing that align with sustainability goals and regulatory compliance requirements across APAC markets.

Innovation opportunities enable stakeholders to develop specialized formulations, application technologies, and integrated solutions that address specific market needs and create competitive differentiation in this dynamic industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus represents a dominant trend driving development of bio-based polyurethane formulations, recyclable products, and low-emission technologies that align with environmental regulations and corporate sustainability initiatives across APAC markets.

Customization demand increases as manufacturers seek adhesive solutions tailored to specific applications, performance requirements, and processing conditions. This trend supports premium pricing and enhanced customer relationships through specialized product offerings.

Automation integration grows as manufacturers adopt automated application systems, precision dispensing equipment, and process control technologies that optimize adhesive performance and reduce labor requirements in production environments.

Performance enhancement continues through advanced formulation chemistry, improved temperature resistance, enhanced chemical compatibility, and extended service life characteristics that support demanding application requirements.

Supply chain localization accelerates as manufacturers establish regional production capabilities, reduce import dependencies, and improve responsiveness to local market requirements throughout APAC countries.

Digital integration emerges through smart adhesive systems, process monitoring technologies, and data analytics capabilities that optimize application parameters and predict maintenance requirements for enhanced operational efficiency.

Recent industry developments highlight significant advancement in polyurethane hot-melt adhesive technology, market expansion initiatives, and strategic partnerships shaping the APAC market landscape.

Technology innovations include development of faster-curing formulations, improved temperature resistance capabilities, and enhanced substrate compatibility that expand application possibilities and improve processing efficiency for end-users.

Manufacturing expansion across APAC countries includes new production facilities, capacity increases, and technology upgrades that improve supply chain reliability and reduce costs for regional customers seeking advanced adhesive solutions.

Strategic partnerships between adhesive manufacturers and equipment suppliers create integrated solutions that optimize performance, simplify adoption, and provide comprehensive support for customers implementing polyurethane hot-melt technology.

Regulatory developments include updated environmental standards, safety requirements, and quality specifications that drive innovation and may create competitive advantages for companies with advanced compliance capabilities.

Market consolidation activities include acquisitions, joint ventures, and strategic alliances that strengthen market positions, expand geographic coverage, and enhance technology capabilities among industry participants.

Strategic recommendations for market participants focus on technology leadership, customer relationship development, and operational excellence to capitalize on growth opportunities within the APAC polyurethane hot-melt adhesives market.

Investment priorities should emphasize research and development capabilities, manufacturing efficiency improvements, and customer service enhancement to maintain competitive advantage in this rapidly evolving market environment. MarkWide Research analysis indicates that companies investing 6-8% of revenue in R&D achieve superior market performance.

Market entry strategies for new participants should focus on specialized applications, regional partnerships, and technology differentiation rather than competing directly with established players in commodity segments where price competition is intense.

Customer relationship management becomes increasingly critical as markets mature and competition intensifies. Companies should invest in technical support capabilities, application development services, and customization capabilities that create customer loyalty and support premium pricing.

Supply chain optimization requires balancing cost efficiency with reliability and responsiveness. Regional manufacturing capabilities, strategic inventory management, and supplier diversification strategies help mitigate risks while supporting growth objectives.

Sustainability initiatives should be integrated into product development, manufacturing processes, and marketing strategies to align with customer requirements and regulatory trends driving market evolution throughout the APAC region.

Market prospects for the APAC polyurethane hot-melt adhesives industry remain highly favorable, supported by continued industrialization, technological advancement, and growing demand for high-performance manufacturing solutions across the region.

Growth projections indicate sustained expansion with the market expected to maintain robust momentum through the forecast period. MWR projections suggest the market will achieve 8.5% compound annual growth over the next five years, driven by automotive industry expansion and packaging sector sophistication.

Technology evolution will continue driving market development through improved formulations, enhanced processing capabilities, and expanded application possibilities. Innovation focus areas include bio-based materials, smart adhesive systems, and integrated application technologies.

Regional development patterns suggest accelerating growth in emerging APAC markets as industrialization advances and manufacturing sophistication increases. Infrastructure development and foreign investment will support market expansion in developing countries throughout the region.

Application expansion into electronics, renewable energy, and advanced materials sectors creates new growth opportunities beyond traditional automotive and packaging markets. These emerging applications often support premium pricing and enhanced profitability.

Competitive dynamics will likely intensify as markets mature, requiring companies to focus on differentiation through technology leadership, customer service excellence, and operational efficiency to maintain market position and profitability.

The APAC polyurethane hot-melt adhesives market represents a dynamic and rapidly expanding industry segment with strong fundamentals and favorable growth prospects. Market development is driven by robust industrialization trends, technological advancement, and increasing demand for high-performance bonding solutions across diverse applications.

Key success factors for market participants include technology leadership, customer relationship excellence, operational efficiency, and strategic positioning in high-growth applications and geographic markets. Companies that invest in innovation, manufacturing capabilities, and customer service will be best positioned to capitalize on market opportunities.

Market evolution will continue through technology advancement, application expansion, and geographic development that create new opportunities for growth and differentiation. Sustainability trends, automation integration, and customization demand will shape future market development patterns.

Strategic outlook remains positive for the APAC polyurethane hot-melt adhesives market, with sustained growth expected across key applications and geographic regions. Market participants should focus on building competitive advantages through innovation, customer relationships, and operational excellence to succeed in this dynamic industry environment.

What is Polyurethane Hot-Melt Adhesives?

Polyurethane hot-melt adhesives are thermoplastic adhesives that are used for bonding various materials, including plastics, wood, and textiles. They are known for their strong adhesion, flexibility, and resistance to moisture and heat.

What are the key players in the APAC Polyurethane Hot-Melt Adhesives Market?

Key players in the APAC polyurethane hot-melt adhesives market include Henkel AG, H.B. Fuller, and BASF SE. These companies are recognized for their innovative adhesive solutions and extensive product portfolios, among others.

What are the growth factors driving the APAC Polyurethane Hot-Melt Adhesives Market?

The growth of the APAC polyurethane hot-melt adhesives market is driven by increasing demand from the packaging and automotive industries. Additionally, the rise in e-commerce and the need for efficient bonding solutions in manufacturing processes contribute to market expansion.

What challenges does the APAC Polyurethane Hot-Melt Adhesives Market face?

Challenges in the APAC polyurethane hot-melt adhesives market include fluctuating raw material prices and stringent environmental regulations. These factors can impact production costs and limit market growth.

What opportunities exist in the APAC Polyurethane Hot-Melt Adhesives Market?

Opportunities in the APAC polyurethane hot-melt adhesives market include the development of bio-based adhesives and advancements in adhesive technologies. These innovations can cater to the growing demand for sustainable and high-performance bonding solutions.

What trends are shaping the APAC Polyurethane Hot-Melt Adhesives Market?

Current trends in the APAC polyurethane hot-melt adhesives market include the increasing use of automation in manufacturing and the growing preference for eco-friendly products. Additionally, the expansion of the automotive and construction sectors is influencing adhesive application methods.

APAC Polyurethane Hot-Melt Adhesives Market

| Segmentation Details | Description |

|---|---|

| Product Type | Flexible, Rigid, Thermoplastic, Thermosetting |

| End Use Industry | Construction, Automotive, Electronics, Footwear |

| Form | Granules, Films, Liquids, Sheets |

| Packaging Type | Cans, Drums, Pails, Bags |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Polyurethane Hot-Melt Adhesives Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at