444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa food starch market represents a dynamic and rapidly evolving sector within the broader food ingredients industry. This market encompasses a diverse range of starch-based products derived from various sources including corn, wheat, potato, cassava, and rice, serving multiple applications across food processing, beverage manufacturing, and industrial sectors. The region’s unique geographical position, diverse agricultural landscape, and growing population create substantial opportunities for food starch manufacturers and suppliers.

Market dynamics in the Middle East & Africa are characterized by increasing urbanization, changing dietary preferences, and expanding food processing industries. The market experiences robust growth driven by rising demand for convenience foods, processed beverages, and bakery products. Regional growth rates demonstrate significant expansion potential, with the market projected to grow at a compound annual growth rate of 6.2% over the forecast period.

Key market characteristics include diverse starch sources, varying regulatory frameworks across countries, and increasing adoption of modified starches for specialized applications. The region’s food starch market benefits from both local agricultural production and strategic imports, creating a balanced supply ecosystem that supports consistent market growth and product availability.

The Middle East & Africa food starch market refers to the comprehensive ecosystem encompassing production, processing, distribution, and consumption of starch-based ingredients used in food and beverage applications across the Middle East and African regions. This market includes native starches, modified starches, and specialty starch derivatives that serve as functional ingredients in various food processing applications.

Food starch represents a crucial carbohydrate polymer extracted from agricultural sources, serving multiple functional roles including thickening, binding, stabilizing, and texturizing in food products. The market encompasses both traditional starch applications and innovative modified starch solutions designed to meet specific processing requirements and consumer preferences in the regional food industry.

Market scope extends beyond basic starch supply to include value-added services, technical support, and customized starch solutions tailored to regional food processing needs. This comprehensive approach ensures that food manufacturers across the Middle East and Africa have access to appropriate starch ingredients that enhance product quality, shelf life, and consumer appeal.

The Middle East & Africa food starch market demonstrates remarkable resilience and growth potential, driven by expanding food processing industries, increasing consumer demand for processed foods, and growing awareness of functional ingredients. The market landscape features diverse starch sources, innovative product developments, and strategic partnerships between international suppliers and regional food manufacturers.

Key growth drivers include rapid urbanization, changing lifestyle patterns, and increasing disposable income across the region. The market benefits from substantial investment in food processing infrastructure, government initiatives supporting agricultural development, and growing export opportunities for processed food products. Regional food starch consumption patterns show increasing adoption rates of 8.5% for modified starches in premium food applications.

Market segmentation reveals strong performance across multiple categories, with corn starch maintaining dominant market position, followed by wheat starch and potato starch. The beverage industry represents the largest application segment, accounting for approximately 35% of total consumption, while bakery and confectionery applications continue expanding rapidly.

Competitive dynamics feature both international starch manufacturers and emerging regional players, creating a balanced market structure that promotes innovation, competitive pricing, and improved product availability. Strategic partnerships and joint ventures facilitate technology transfer and market expansion across the region.

Market intelligence reveals several critical insights that shape the Middle East & Africa food starch landscape. The following key insights provide comprehensive understanding of market dynamics and growth opportunities:

Primary market drivers propelling growth in the Middle East & Africa food starch market encompass demographic, economic, and technological factors that create sustained demand for starch-based ingredients. These drivers work synergistically to expand market opportunities and drive innovation across the value chain.

Population growth represents the fundamental driver, with the region experiencing rapid demographic expansion that increases overall food consumption and drives demand for processed food products. Urban population growth rates of approximately 3.2% annually create concentrated markets for convenience foods and processed beverages that rely heavily on starch ingredients.

Economic development across the region supports increased consumer spending on processed foods, premium food products, and diverse dietary options. Rising disposable income levels enable consumers to purchase higher-value food products that incorporate advanced starch technologies for improved taste, texture, and nutritional profiles.

Food processing industry expansion creates direct demand for food starch ingredients as manufacturers establish new production facilities and expand existing operations. Government initiatives supporting food security and local production capabilities drive investment in food processing infrastructure that requires reliable starch ingredient supplies.

Technological advancement in food processing enables more sophisticated applications of starch ingredients, creating demand for specialized modified starches and custom starch solutions. These technological capabilities allow food manufacturers to develop innovative products that meet evolving consumer preferences and market requirements.

Market restraints in the Middle East & Africa food starch sector present challenges that require strategic navigation and innovative solutions. Understanding these constraints enables market participants to develop effective mitigation strategies and identify alternative growth pathways.

Raw material availability represents a significant constraint, particularly for regions dependent on agricultural imports or experiencing climate-related production challenges. Seasonal variations in crop yields and quality can impact starch production consistency and pricing stability, affecting overall market predictability.

Infrastructure limitations in certain regions create logistical challenges for starch distribution and storage. Inadequate cold storage facilities, transportation networks, and processing capabilities can limit market reach and product quality maintenance, particularly for temperature-sensitive modified starch products.

Regulatory complexity across different countries within the region creates compliance challenges for manufacturers seeking to serve multiple markets. Varying food safety standards, labeling requirements, and import regulations increase operational complexity and market entry costs for starch suppliers.

Price volatility in agricultural commodities affects starch production costs and market pricing strategies. Fluctuations in raw material prices, energy costs, and currency exchange rates create uncertainty that impacts long-term planning and investment decisions in the starch market.

Competition from alternatives includes other binding and thickening agents that may offer cost advantages or specific functional benefits in certain applications. The availability of alternative ingredients can limit starch market expansion in price-sensitive segments or specialized applications.

Emerging opportunities in the Middle East & Africa food starch market present significant potential for growth and innovation. These opportunities span across product development, market expansion, and technological advancement, creating multiple pathways for market participants to achieve sustainable growth.

Clean-label product development represents a substantial opportunity as consumers increasingly demand natural, minimally processed ingredients. The development of organic starches, non-GMO alternatives, and naturally modified starch products addresses growing consumer preferences for transparent ingredient lists and sustainable food choices.

Functional food applications offer expanding opportunities as health-conscious consumers seek products with added nutritional benefits. Resistant starches, prebiotic starches, and fortified starch ingredients enable food manufacturers to develop products that support digestive health, blood sugar management, and overall wellness.

Regional agricultural development creates opportunities for local starch production from indigenous crops such as cassava, sweet potato, and plantain. These locally-sourced starches can reduce import dependence, support agricultural communities, and provide cost-effective alternatives to traditional starch sources.

Industrial diversification beyond food applications presents growth opportunities in pharmaceuticals, cosmetics, and biodegradable packaging. These emerging applications leverage starch properties for non-food uses, creating additional revenue streams and market expansion possibilities.

Technology partnerships with international starch manufacturers enable knowledge transfer, capacity building, and access to advanced starch modification technologies. These collaborations facilitate market development and enhance competitive positioning for regional players.

Market dynamics in the Middle East & Africa food starch sector reflect complex interactions between supply-side factors, demand patterns, competitive forces, and external influences. These dynamics create a constantly evolving market environment that requires adaptive strategies and continuous monitoring.

Supply chain dynamics demonstrate increasing sophistication as regional infrastructure develops and international trade relationships strengthen. Improved logistics capabilities enable better product distribution, reduced transportation costs, and enhanced supply reliability. Regional starch production capacity shows steady expansion of 5.8% annually, supporting market growth and reducing import dependence.

Demand patterns evolve in response to changing consumer preferences, economic conditions, and food industry trends. Seasonal variations in food production create cyclical demand patterns, while long-term trends toward processed foods and convenience products drive sustained growth in starch consumption.

Competitive dynamics feature both collaboration and competition among market participants. Strategic partnerships between international suppliers and regional distributors create value-added services and improved market coverage. Price competition remains significant in commodity starch segments, while innovation and technical service differentiate premium product offerings.

External influences including government policies, trade regulations, and economic conditions significantly impact market dynamics. Currency fluctuations affect import costs and pricing strategies, while regulatory changes can create new opportunities or constraints for market participants.

Comprehensive research methodology employed in analyzing the Middle East & Africa food starch market combines multiple data collection approaches, analytical techniques, and validation processes to ensure accuracy and reliability of market insights. The methodology encompasses both primary and secondary research components to provide holistic market understanding.

Primary research activities include extensive interviews with industry stakeholders, including starch manufacturers, food processors, distributors, and end-users across the region. These interviews provide firsthand insights into market trends, challenges, opportunities, and competitive dynamics that shape the food starch landscape.

Secondary research involves comprehensive analysis of industry reports, trade publications, government statistics, and academic research to establish market baselines and identify emerging trends. This research component provides historical context and quantitative foundations for market analysis and forecasting.

Data validation processes ensure information accuracy through cross-referencing multiple sources, statistical analysis, and expert review. Market data undergoes rigorous verification to eliminate inconsistencies and provide reliable foundations for strategic decision-making.

Analytical frameworks applied include market segmentation analysis, competitive benchmarking, trend analysis, and scenario modeling. These analytical approaches provide comprehensive understanding of market structure, competitive positioning, and future growth potential across different market segments and geographical regions.

Regional analysis of the Middle East & Africa food starch market reveals distinct characteristics, growth patterns, and market opportunities across different geographical areas. This analysis provides detailed insights into regional market dynamics and strategic considerations for market participants.

Gulf Cooperation Council countries represent the most mature and sophisticated segment of the regional market, characterized by high per-capita consumption, premium product preferences, and advanced food processing industries. These markets show strong growth rates of 7.1% in specialty starch applications, driven by expanding food service sectors and increasing consumer affluence.

North African markets demonstrate significant growth potential, supported by large populations, developing food processing industries, and increasing urbanization. Egypt, Morocco, and Algeria lead regional consumption, with wheat starch applications particularly strong due to established grain processing industries and traditional food preferences.

Sub-Saharan Africa presents emerging opportunities characterized by rapid population growth, increasing urbanization, and expanding food processing capabilities. South Africa leads the regional market with established food industries, while Nigeria, Kenya, and Ghana show strong growth potential in basic starch applications.

East African markets benefit from agricultural diversity and growing food processing investments. The region shows particular strength in cassava-based starch production and consumption, with market share of 28% for cassava starch in local food applications, reflecting indigenous crop utilization and traditional food preferences.

The competitive landscape in the Middle East & Africa food starch market features a diverse mix of international corporations, regional manufacturers, and emerging local players. This competitive environment promotes innovation, competitive pricing, and improved customer service across the market.

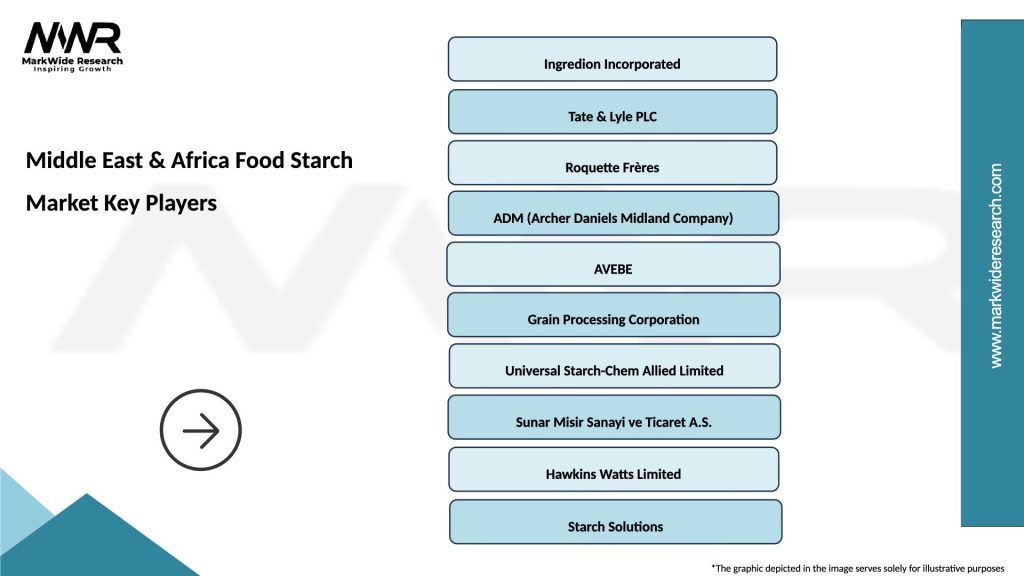

Leading market participants include established international starch manufacturers with strong regional presence and comprehensive product portfolios:

Regional players contribute significantly to market dynamics through local production capabilities, cost-effective solutions, and specialized regional knowledge. These companies often focus on specific geographical markets or product niches, providing competitive alternatives to international suppliers.

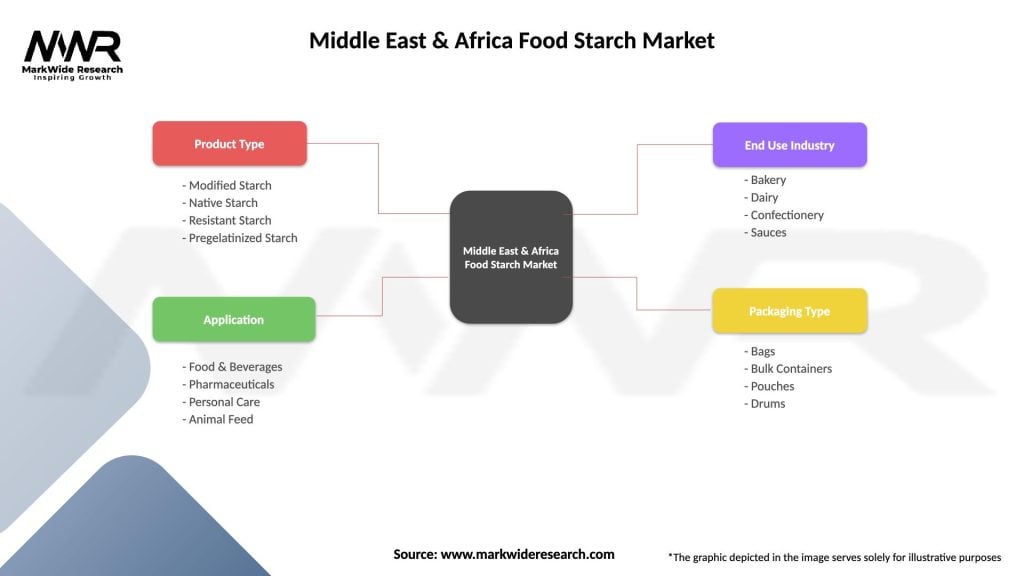

Market segmentation analysis reveals distinct categories within the Middle East & Africa food starch market, each characterized by specific growth patterns, competitive dynamics, and customer requirements. This segmentation provides strategic insights for market positioning and product development.

By Source Material:

By Product Type:

By Application:

Category-wise analysis provides detailed insights into specific market segments, revealing unique characteristics, growth drivers, and competitive dynamics within each category of the Middle East & Africa food starch market.

Corn Starch Category maintains market leadership through versatility, availability, and cost-effectiveness. This category benefits from established supply chains, consistent quality standards, and broad application compatibility. Growth drivers include expanding beverage production and increasing demand for processed foods across the region.

Modified Starch Category demonstrates the highest growth potential, driven by food manufacturers’ needs for enhanced functionality, improved product quality, and specialized performance characteristics. This category shows growth rates exceeding 9.2% as food processors adopt more sophisticated ingredient solutions.

Specialty Starch Category serves niche applications requiring specific properties such as cold-water solubility, freeze-thaw stability, or clean-label characteristics. This category commands premium pricing and offers higher margins for suppliers capable of providing technical expertise and customized solutions.

Organic Starch Category represents an emerging segment responding to consumer demand for natural, sustainably-produced ingredients. While currently small, this category shows significant growth potential as organic food markets expand across the region.

Industrial Starch Category extends beyond food applications to serve pharmaceutical, cosmetic, and packaging industries. This diversification provides additional growth opportunities and reduces dependence on food market fluctuations.

Industry participants and stakeholders in the Middle East & Africa food starch market realize multiple benefits through strategic engagement and market participation. These benefits span across operational efficiency, market access, and competitive positioning advantages.

For Starch Manufacturers:

For Food Processors:

For Distributors and Suppliers:

SWOT analysis provides comprehensive evaluation of the Middle East & Africa food starch market’s internal strengths and weaknesses, along with external opportunities and threats that influence market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Middle East & Africa food starch market reflect evolving consumer preferences, technological advancement, and industry innovation. These trends provide strategic insights for market participants and indicate future market directions.

Clean Label Movement represents the most significant trend, with consumers increasingly demanding transparent ingredient lists and natural food products. This trend drives demand for organic starches, non-GMO alternatives, and minimally processed starch ingredients. MarkWide Research indicates that clean-label starch products show adoption rates of 12.3% among premium food manufacturers.

Functional Ingredient Integration demonstrates growing importance as food manufacturers seek ingredients that provide multiple benefits beyond basic functionality. Resistant starches, prebiotic starches, and nutritionally enhanced starch products address consumer health concerns while maintaining processing performance.

Sustainability Focus influences sourcing decisions and product development, with emphasis on environmentally responsible production methods, reduced packaging waste, and sustainable agricultural practices. This trend creates opportunities for locally-sourced starches and eco-friendly processing technologies.

Customization and Specialization trends reflect food manufacturers’ needs for tailored starch solutions that address specific processing requirements and product characteristics. Custom starch modifications and application-specific formulations become increasingly important for competitive differentiation.

Digital Integration transforms supply chain management, customer service, and technical support through digital platforms, online ordering systems, and remote technical assistance capabilities.

Recent industry developments in the Middle East & Africa food starch market demonstrate dynamic evolution and strategic positioning by market participants. These developments reflect market maturation, technological advancement, and expanding regional capabilities.

Production Capacity Expansion represents a major development trend, with several international manufacturers establishing or expanding regional production facilities. These investments improve supply reliability, reduce logistics costs, and enhance customer service capabilities across the region.

Technology Transfer Initiatives facilitate knowledge sharing between international starch manufacturers and regional partners. These collaborations enable local production of advanced starch products and build regional technical expertise in starch modification and application.

Strategic Partnerships between starch suppliers and major food manufacturers create long-term supply relationships and drive product innovation. These partnerships often involve joint product development, technical collaboration, and market expansion initiatives.

Regulatory Harmonization efforts across the region create more consistent standards for food ingredients and facilitate cross-border trade. These developments reduce compliance complexity and enable more efficient market serving strategies.

Sustainability Initiatives include investments in renewable energy, water conservation, and waste reduction in starch production facilities. These initiatives respond to environmental concerns and support corporate sustainability objectives.

Research and Development investments focus on developing region-specific starch solutions, improving processing efficiency, and creating innovative applications for traditional and emerging starch sources.

Strategic recommendations for market participants in the Middle East & Africa food starch market emphasize sustainable growth, market differentiation, and operational excellence. These suggestions address key success factors and strategic priorities for different types of market participants.

For International Manufacturers: Focus on regional production capabilities and local partnerships to improve market responsiveness and cost competitiveness. Invest in technical service capabilities and customer education to drive adoption of advanced starch technologies. Develop region-specific product formulations that address local taste preferences and processing requirements.

For Regional Players: Leverage local market knowledge and cost advantages while building technical capabilities through strategic partnerships. Focus on specific market niches or geographical areas where local presence provides competitive advantages. Invest in quality systems and certifications to compete effectively with international suppliers.

For Food Processors: Develop strategic supplier relationships that provide reliable supply, technical support, and innovation collaboration. Consider long-term contracts to ensure supply security and price stability. Invest in technical knowledge to optimize starch utilization and explore advanced applications.

Market Entry Strategies should emphasize gradual expansion, local partnerships, and customer education. New entrants should focus on specific product categories or geographical regions to establish market presence before broader expansion.

Innovation Priorities include clean-label products, functional ingredients, and sustainable production methods. Companies should align product development with regional consumer trends and regulatory requirements.

The future outlook for the Middle East & Africa food starch market indicates continued growth, innovation, and market evolution driven by demographic trends, economic development, and technological advancement. This outlook provides strategic guidance for long-term planning and investment decisions.

Market growth projections suggest sustained expansion over the forecast period, with growth rates expected to maintain strong momentum of 6.8% annually. This growth reflects continued urbanization, increasing food processing activities, and expanding consumer markets across the region.

Technology evolution will drive market sophistication through advanced starch modification techniques, improved processing efficiency, and innovative applications. MWR analysis indicates that modified starch adoption rates will reach 45% of total consumption by the end of the forecast period.

Regional integration trends suggest improved trade relationships, harmonized regulations, and enhanced supply chain connectivity across Middle Eastern and African markets. These developments will facilitate market expansion and operational efficiency improvements.

Sustainability initiatives will become increasingly important, with emphasis on environmental responsibility, sustainable sourcing, and circular economy principles. Companies that proactively address sustainability concerns will gain competitive advantages in the evolving market landscape.

Innovation opportunities include development of novel starch sources, advanced functional properties, and specialized applications in emerging industries. The convergence of food technology and health science creates new possibilities for starch ingredient applications.

The Middle East & Africa food starch market represents a dynamic and promising sector characterized by robust growth potential, diverse opportunities, and evolving market dynamics. The market benefits from favorable demographic trends, expanding food processing industries, and increasing consumer demand for processed food products across the region.

Key success factors for market participants include strategic regional positioning, technical innovation, customer relationship development, and operational excellence. Companies that effectively combine global expertise with local market knowledge will achieve sustainable competitive advantages in this growing market.

Market evolution toward more sophisticated applications, clean-label products, and functional ingredients creates opportunities for value creation and differentiation. The increasing adoption of modified starches and specialty products indicates market maturation and growing technical sophistication among regional food processors.

Strategic priorities should focus on building regional capabilities, developing customer partnerships, and investing in innovation that addresses specific regional needs and preferences. The market’s diversity requires flexible approaches that can adapt to varying local conditions and requirements across different countries and regions.

Long-term prospects remain highly positive, supported by continued economic development, population growth, and food industry expansion across the Middle East and Africa. Market participants who establish strong regional positions and develop comprehensive service capabilities will be well-positioned to capitalize on the substantial growth opportunities in this evolving market landscape.

What is Food Starch?

Food starch is a carbohydrate derived from various plants, primarily used as a thickening agent, stabilizer, or texturizer in food products. It plays a crucial role in the food industry, particularly in sauces, soups, and processed foods.

What are the key players in the Middle East & Africa Food Starch Market?

Key players in the Middle East & Africa Food Starch Market include companies like Ingredion, Cargill, and Tate & Lyle, which are known for their extensive range of starch products and innovations in food applications, among others.

What are the growth factors driving the Middle East & Africa Food Starch Market?

The growth of the Middle East & Africa Food Starch Market is driven by increasing demand for processed foods, the rise in convenience food consumption, and the expanding bakery and confectionery sectors.

What challenges does the Middle East & Africa Food Starch Market face?

Challenges in the Middle East & Africa Food Starch Market include fluctuating raw material prices, competition from alternative thickeners, and regulatory hurdles related to food safety and labeling.

What opportunities exist in the Middle East & Africa Food Starch Market?

Opportunities in the Middle East & Africa Food Starch Market include the growing trend towards clean label products, innovations in starch modification technologies, and the increasing use of starch in non-food applications such as biodegradable packaging.

What trends are shaping the Middle East & Africa Food Starch Market?

Trends in the Middle East & Africa Food Starch Market include a shift towards natural and organic starches, the development of functional starches for health-oriented products, and the rising popularity of plant-based food alternatives.

Middle East & Africa Food Starch Market

| Segmentation Details | Description |

|---|---|

| Product Type | Modified Starch, Native Starch, Resistant Starch, Pregelatinized Starch |

| Application | Food & Beverages, Pharmaceuticals, Personal Care, Animal Feed |

| End Use Industry | Bakery, Dairy, Confectionery, Sauces |

| Packaging Type | Bags, Bulk Containers, Pouches, Drums |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Food Starch Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at