444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC industrial sensors market represents one of the most dynamic and rapidly evolving segments within the global industrial automation landscape. This comprehensive market encompasses a diverse range of sensing technologies designed to monitor, measure, and control various industrial processes across manufacturing, automotive, aerospace, oil and gas, and chemical industries. The region’s robust industrial growth, coupled with increasing adoption of Industry 4.0 technologies, has positioned APAC as a leading hub for industrial sensor innovation and deployment.

Market dynamics in the Asia-Pacific region are characterized by substantial investments in smart manufacturing initiatives, with countries like China, Japan, South Korea, and India driving significant demand for advanced sensing solutions. The market is experiencing remarkable growth at a CAGR of 8.2%, reflecting the region’s commitment to industrial modernization and automation. Manufacturing sectors across APAC are increasingly integrating sophisticated sensor technologies to enhance operational efficiency, reduce downtime, and improve product quality.

Technological advancement remains a key catalyst for market expansion, with emerging technologies such as wireless sensors, IoT-enabled devices, and AI-powered analytics transforming traditional industrial operations. The region’s strong electronics manufacturing base and growing emphasis on smart factory implementations continue to fuel demand for innovative sensor solutions across diverse industrial applications.

The APAC industrial sensors market refers to the comprehensive ecosystem of sensing devices, technologies, and solutions deployed across industrial facilities throughout the Asia-Pacific region to monitor, measure, and control various operational parameters including temperature, pressure, flow, level, proximity, and motion.

Industrial sensors serve as critical components in modern manufacturing and process industries, enabling real-time data collection, process optimization, and automated decision-making. These sophisticated devices convert physical phenomena into electrical signals that can be processed by control systems, facilitating enhanced operational visibility and control. The APAC market encompasses various sensor types including temperature sensors, pressure sensors, flow sensors, level sensors, proximity sensors, and motion sensors, each designed for specific industrial applications.

Market scope extends beyond traditional manufacturing to include emerging applications in renewable energy, smart cities, and environmental monitoring. The integration of IoT connectivity and advanced analytics capabilities has transformed these devices from simple measurement tools into intelligent components of comprehensive industrial automation systems.

Strategic positioning of the APAC industrial sensors market reflects the region’s leadership in global manufacturing and industrial automation adoption. The market demonstrates exceptional growth potential driven by rapid industrialization, government initiatives supporting smart manufacturing, and increasing focus on operational efficiency across diverse sectors. Key growth drivers include the expansion of automotive manufacturing, rising demand for process automation, and growing emphasis on predictive maintenance strategies.

Technology evolution continues to reshape market dynamics, with wireless sensor networks achieving 35% adoption rate in new installations across major manufacturing hubs. The integration of artificial intelligence and machine learning capabilities into sensor systems is enabling more sophisticated data analysis and predictive capabilities. Market segmentation reveals strong demand across temperature sensing applications, which account for the largest market share, followed by pressure and flow sensing solutions.

Regional distribution shows China maintaining its position as the dominant market, representing approximately 42% of total regional demand, while emerging markets including India, Southeast Asia, and Australia demonstrate accelerating adoption rates. The competitive landscape features both established global players and innovative regional manufacturers, creating a dynamic ecosystem that drives continuous technological advancement and cost optimization.

Market intelligence reveals several critical insights that define the current state and future trajectory of the APAC industrial sensors market:

Technology trends indicate a shift toward more intelligent, autonomous sensor systems capable of self-calibration, fault detection, and adaptive operation. The convergence of sensing technology with edge computing and cloud analytics is creating new opportunities for comprehensive industrial monitoring and control solutions.

Industrial automation expansion serves as the primary driver for the APAC industrial sensors market, with manufacturers across the region investing heavily in automated systems to improve productivity and competitiveness. The growing adoption of Industry 4.0 principles is creating unprecedented demand for sophisticated sensing solutions that enable real-time monitoring and control of industrial processes.

Government initiatives supporting smart manufacturing and digital transformation are providing significant momentum for market growth. Countries including China, Japan, and South Korea have launched comprehensive programs to modernize their industrial sectors, creating substantial opportunities for sensor technology providers. These initiatives often include financial incentives and regulatory support for companies adopting advanced automation technologies.

Quality control requirements are becoming increasingly stringent across various industries, driving demand for precision sensors that can ensure consistent product quality and compliance with international standards. The automotive sector, in particular, is implementing more sophisticated sensor systems to meet evolving safety and performance requirements.

Operational efficiency focus continues to drive sensor adoption as manufacturers seek to optimize energy consumption, reduce waste, and minimize downtime. Advanced sensor systems enable predictive maintenance strategies that can significantly reduce operational costs and improve equipment reliability. Environmental monitoring requirements are also contributing to market growth as industries face increasing pressure to monitor and control their environmental impact.

High implementation costs represent a significant barrier to sensor adoption, particularly for small and medium-sized enterprises that may lack the capital resources for comprehensive sensor system deployments. The total cost of ownership, including installation, integration, and ongoing maintenance, can be substantial, especially for complex multi-sensor networks.

Technical complexity associated with advanced sensor systems can pose challenges for organizations with limited technical expertise. The integration of sensors with existing industrial systems often requires specialized knowledge and skills that may not be readily available in all markets. This complexity can lead to extended implementation timelines and increased project risks.

Cybersecurity concerns are becoming increasingly prominent as industrial sensors become more connected and integrated with enterprise networks. The potential for cyber attacks on critical industrial infrastructure has led some organizations to be cautious about adopting connected sensor technologies. Data privacy and security requirements add additional layers of complexity to sensor system implementations.

Standardization challenges across different sensor technologies and communication protocols can create compatibility issues and limit interoperability between systems from different vendors. The lack of universal standards can increase integration costs and complexity, particularly in multi-vendor environments. Regulatory compliance requirements vary significantly across different countries and industries, creating additional challenges for sensor manufacturers and users.

Emerging applications in renewable energy, smart cities, and environmental monitoring present substantial growth opportunities for industrial sensor providers. The expansion of solar and wind energy installations across APAC is creating demand for specialized monitoring sensors that can optimize energy generation and ensure system reliability.

Digital transformation initiatives across traditional industries are opening new markets for advanced sensor technologies. Industries such as agriculture, mining, and construction are beginning to adopt sophisticated sensor systems to improve operational efficiency and safety. The integration of artificial intelligence and machine learning capabilities into sensor systems is creating opportunities for more intelligent and autonomous monitoring solutions.

Edge computing integration represents a significant opportunity for sensor manufacturers to develop more sophisticated, locally intelligent sensor systems. The ability to process data at the sensor level can reduce network bandwidth requirements and enable faster response times for critical applications. 5G connectivity is expected to enable new applications and use cases that were previously not feasible with existing communication technologies.

Sustainability focus is driving demand for sensors that can monitor and optimize energy consumption, waste generation, and environmental impact. Organizations are increasingly seeking sensor solutions that can support their sustainability goals and regulatory compliance requirements. Predictive analytics capabilities integrated with sensor systems offer opportunities to provide value-added services beyond basic monitoring and measurement.

Supply chain evolution within the APAC industrial sensors market reflects the region’s growing technological sophistication and manufacturing capabilities. Local sensor manufacturers are increasingly competing with established global players by offering cost-effective solutions tailored to regional requirements. This competitive dynamic is driving innovation and helping to reduce overall market costs.

Technology convergence is reshaping market dynamics as traditional sensor boundaries blur with the integration of computing, communication, and analytics capabilities. Sensors are evolving from simple measurement devices to intelligent edge computing nodes capable of autonomous decision-making. This transformation is creating new value propositions and business models within the market.

Customer expectations are evolving toward more comprehensive solutions that include not just sensors but also analytics, visualization, and actionable insights. End users are seeking partners who can provide complete sensing solutions rather than individual components. This shift is driving sensor manufacturers to develop more integrated offerings and establish strategic partnerships with software and analytics providers.

Market consolidation trends are evident as larger players acquire specialized sensor companies to expand their technology portfolios and market reach. This consolidation is creating more comprehensive solution providers while also fostering innovation through the combination of complementary technologies. Investment patterns show increasing focus on research and development, with companies allocating significant resources to develop next-generation sensor technologies.

Comprehensive analysis of the APAC industrial sensors market employs a multi-faceted research approach combining primary and secondary research methodologies to ensure accuracy and depth of insights. The research framework incorporates quantitative data analysis, qualitative assessments, and expert interviews to provide a holistic view of market dynamics and trends.

Primary research activities include structured interviews with industry executives, technology leaders, and end-user organizations across key markets within the APAC region. These interviews provide valuable insights into market challenges, opportunities, and future requirements from both supply and demand perspectives. Survey methodologies are employed to gather quantitative data on adoption rates, spending patterns, and technology preferences.

Secondary research encompasses comprehensive analysis of industry reports, company financial statements, patent filings, and regulatory documents to understand market structure and competitive dynamics. Market modeling techniques are applied to analyze historical trends and project future market scenarios based on various economic and technological factors.

Data validation processes ensure the accuracy and reliability of research findings through cross-verification of information from multiple sources and expert review of analytical conclusions. The research methodology adheres to established industry standards for market research and analysis, providing stakeholders with confidence in the findings and recommendations.

China dominates the APAC industrial sensors market, accounting for approximately 42% of regional demand, driven by its massive manufacturing sector and government initiatives supporting industrial modernization. The country’s focus on becoming a global leader in advanced manufacturing technologies has created substantial opportunities for sensor technology providers. Chinese manufacturers are increasingly adopting sophisticated sensor systems to improve product quality and operational efficiency.

Japan represents a mature and technologically advanced market with strong emphasis on precision manufacturing and automation. Japanese companies are leaders in developing innovative sensor technologies, particularly in automotive and electronics applications. The country’s aging workforce is driving increased adoption of automated systems that rely heavily on advanced sensor technologies.

South Korea demonstrates strong growth in industrial sensor adoption, particularly in semiconductor manufacturing, automotive, and shipbuilding industries. The government’s commitment to Industry 4.0 initiatives and smart manufacturing is creating favorable conditions for sensor market expansion. Technology innovation remains a key focus area for Korean manufacturers.

India shows exceptional growth potential with rapidly expanding manufacturing sector and increasing foreign investment in industrial facilities. The government’s “Make in India” initiative is driving demand for advanced manufacturing technologies, including industrial sensors. Cost sensitivity in the Indian market is creating opportunities for value-engineered sensor solutions.

Southeast Asian markets including Thailand, Malaysia, and Vietnam are experiencing accelerating industrial sensor adoption as manufacturing activities expand in these regions. The shift of manufacturing operations from higher-cost locations is creating new opportunities for sensor technology providers. Australia and New Zealand represent smaller but important markets with focus on mining, agriculture, and process industries.

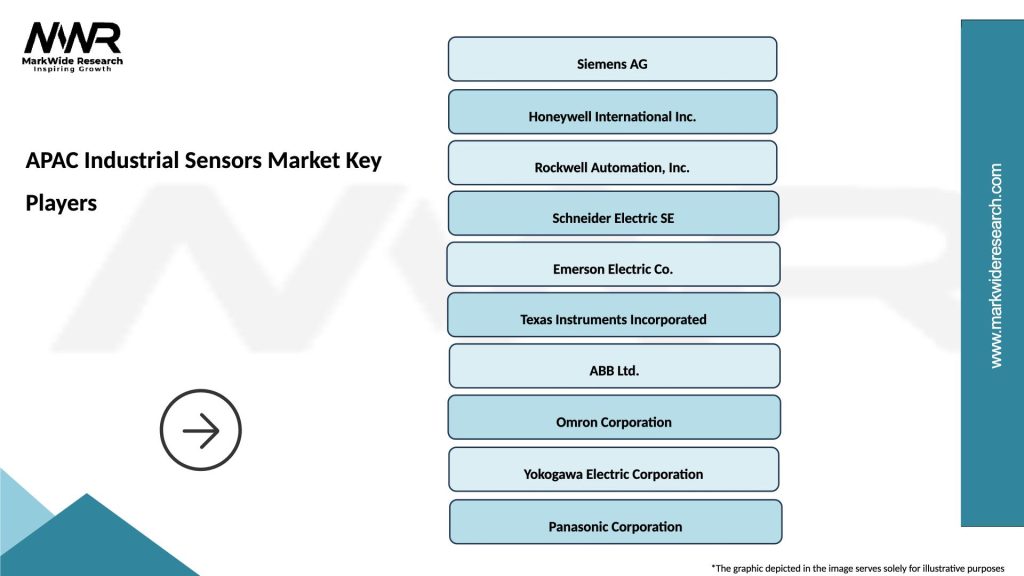

Market leadership in the APAC industrial sensors market is characterized by a diverse mix of global technology giants and specialized regional players, each bringing unique strengths and capabilities to the market:

Competitive strategies focus on technology innovation, regional partnerships, and comprehensive solution offerings. Companies are investing heavily in research and development to maintain technological leadership while also establishing local manufacturing and support capabilities to better serve regional markets. Strategic acquisitions and partnerships are common as companies seek to expand their technology portfolios and market reach.

Innovation focus areas include wireless sensor technologies, IoT integration, artificial intelligence capabilities, and energy-efficient designs. Companies are also developing industry-specific solutions tailored to the unique requirements of different sectors within the APAC region.

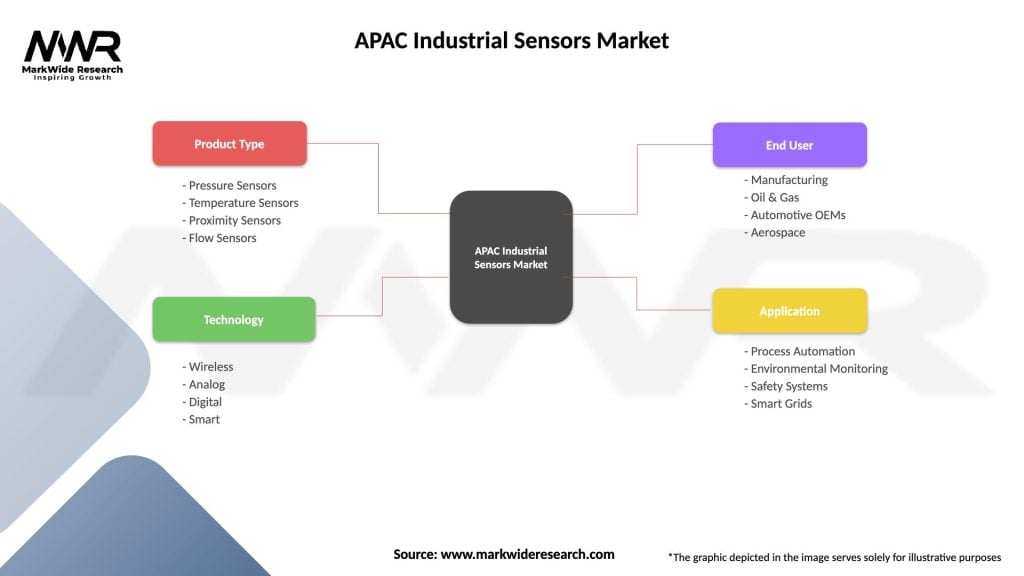

Technology-based segmentation reveals diverse sensor categories serving different industrial applications and requirements:

By Sensor Type:

By Technology:

By End-Use Industry:

Temperature sensing dominates the market with widespread applications across virtually all industrial sectors. These sensors are essential for process control, equipment monitoring, and safety systems. The segment benefits from continuous technology improvements including wireless capabilities and enhanced accuracy. Digital temperature sensors are gaining popularity due to their superior accuracy and integration capabilities.

Pressure sensing applications are critical in process industries where accurate pressure measurement is essential for safety and efficiency. The segment is experiencing growth in wireless pressure sensors that eliminate the need for complex wiring in hazardous environments. Smart pressure transmitters with diagnostic capabilities are becoming increasingly popular for predictive maintenance applications.

Flow measurement technologies are evolving with the introduction of non-invasive ultrasonic sensors and advanced signal processing capabilities. The segment serves diverse applications from water treatment to chemical processing. Mass flow sensors are gaining traction in applications requiring precise measurement of gas and liquid flows.

Level sensing solutions are becoming more sophisticated with radar and ultrasonic technologies offering improved accuracy and reliability. The segment benefits from growing demand for inventory management and process optimization. Guided wave radar sensors are increasingly popular for challenging applications involving foam, vapor, or extreme temperatures.

Proximity and motion sensing categories are experiencing rapid growth driven by factory automation and robotics applications. These sensors enable precise positioning, object detection, and safety monitoring in automated systems. Vision-based sensors are emerging as a significant trend, offering advanced detection and measurement capabilities.

Operational efficiency gains represent the primary benefit for industrial sensor adopters, with organizations typically achieving 15-25% improvement in overall equipment effectiveness through advanced monitoring and control systems. These improvements result from reduced downtime, optimized maintenance schedules, and enhanced process control capabilities.

Cost reduction opportunities emerge through predictive maintenance strategies enabled by advanced sensor systems. Organizations can reduce maintenance costs by up to 30% while extending equipment life and improving reliability. Energy optimization through intelligent sensor systems can deliver additional cost savings of 10-20% in energy-intensive operations.

Quality improvements are achieved through real-time monitoring and control of critical process parameters. Sensor systems enable consistent product quality, reduced waste, and improved compliance with quality standards. Data-driven insights from sensor systems support continuous improvement initiatives and process optimization efforts.

Safety enhancements through advanced monitoring and alarm systems help prevent accidents and ensure compliance with safety regulations. Sensor systems can detect hazardous conditions and trigger appropriate safety responses automatically. Environmental compliance is supported through continuous monitoring of emissions, waste streams, and resource consumption.

Competitive advantages are realized through improved responsiveness to market demands, enhanced product quality, and reduced operational costs. Organizations with advanced sensor systems can adapt more quickly to changing market conditions and customer requirements. Innovation opportunities emerge as sensor data enables new business models and service offerings.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wireless sensor networks are transforming industrial monitoring by eliminating complex wiring requirements and enabling flexible sensor placement. This trend is particularly significant in retrofit applications where traditional wired sensors would be costly or impractical to install. Battery life improvements and energy harvesting technologies are making wireless sensors more viable for long-term deployments.

Artificial intelligence integration is enabling sensors to become more intelligent and autonomous. AI-powered sensors can perform self-calibration, detect anomalies, and provide predictive insights without human intervention. This trend is creating new value propositions and enabling more sophisticated monitoring applications.

Edge computing capabilities are being integrated into sensor systems to enable local data processing and reduce network bandwidth requirements. This trend supports real-time decision-making and reduces dependence on cloud connectivity. Fog computing architectures are emerging as a way to distribute intelligence across sensor networks.

Miniaturization trends continue to drive the development of smaller, more integrated sensor solutions. Micro-electromechanical systems (MEMS) technology is enabling sensors to be embedded in previously inaccessible locations. System-on-chip designs are integrating multiple sensing functions into single devices.

Sustainability focus is driving demand for energy-efficient sensors and environmentally friendly manufacturing processes. Sensor manufacturers are developing low-power designs and exploring renewable energy sources for sensor operation. Circular economy principles are influencing sensor design and lifecycle management approaches.

Technology partnerships between sensor manufacturers and software companies are creating more comprehensive industrial monitoring solutions. These collaborations combine hardware expertise with advanced analytics capabilities to deliver greater value to end users. Platform integration initiatives are simplifying sensor deployment and management across diverse industrial environments.

Manufacturing investments in regional production facilities are reducing costs and improving supply chain resilience. Several global sensor manufacturers have established or expanded manufacturing operations in APAC to better serve local markets. Localization strategies include adapting products to meet specific regional requirements and standards.

Research and development activities are intensifying as companies invest in next-generation sensor technologies. Focus areas include quantum sensors, bio-inspired sensing, and advanced materials for harsh environment applications. University partnerships are fostering innovation and developing the next generation of sensor technologies.

Acquisition activities continue as larger companies seek to expand their sensor portfolios and market presence. Recent acquisitions have focused on specialized sensor technologies and regional market leaders. Strategic investments in startups are providing access to emerging technologies and innovative approaches.

Standardization efforts are progressing to improve interoperability and reduce integration complexity. Industry organizations are working to establish common communication protocols and data formats for industrial sensors. Certification programs are being developed to ensure sensor quality and reliability in critical applications.

MarkWide Research analysis indicates that organizations should prioritize sensor investments that align with their digital transformation strategies and provide clear return on investment. Companies should focus on applications where sensors can deliver immediate operational benefits while building foundation for future advanced capabilities.

Technology selection should consider long-term compatibility and scalability rather than just initial cost considerations. Organizations should evaluate sensor solutions based on total cost of ownership, including installation, maintenance, and upgrade costs. Vendor partnerships should emphasize companies with strong regional presence and comprehensive support capabilities.

Implementation strategies should adopt phased approaches that allow for learning and optimization before large-scale deployments. Pilot projects can help organizations understand sensor capabilities and requirements while minimizing risk. Change management initiatives should address workforce training and process modifications required for sensor system success.

Data management capabilities should be developed in parallel with sensor deployments to ensure organizations can effectively utilize the information generated by sensor systems. Investment in analytics platforms and skilled personnel is essential for realizing sensor system benefits. Cybersecurity measures must be integrated from the beginning of sensor system planning and implementation.

Future planning should consider emerging technologies and evolving industry requirements to ensure sensor investments remain relevant and valuable over time. Organizations should maintain flexibility to adapt to new technologies and changing market conditions.

Market trajectory for the APAC industrial sensors market remains strongly positive, with continued growth expected across all major segments and applications. The convergence of multiple technology trends including IoT, AI, and edge computing will create new opportunities and applications for industrial sensors. Growth acceleration is anticipated as organizations increasingly recognize the strategic value of comprehensive sensor systems.

Technology evolution will continue to drive market expansion with developments in quantum sensing, bio-inspired technologies, and advanced materials creating new possibilities for industrial monitoring and control. The integration of 5G connectivity will enable new applications requiring high-speed, low-latency communication capabilities.

Application expansion into new industries and use cases will broaden the market beyond traditional manufacturing and process industries. Smart cities, renewable energy, and environmental monitoring applications will create additional demand for specialized sensor solutions. Service-based models will become more prevalent as sensor manufacturers develop comprehensive monitoring and analytics services.

Regional dynamics will continue to evolve with emerging markets in Southeast Asia and India showing accelerating adoption rates. China will maintain its dominant position while also becoming a major source of sensor innovation and manufacturing. MWR projections indicate that the market will experience sustained growth with increasing emphasis on intelligent, connected sensor systems.

Investment patterns will shift toward more comprehensive solutions that combine sensors with analytics, visualization, and actionable insights. Organizations will increasingly seek partners who can provide complete sensing solutions rather than individual components. Sustainability considerations will become more important in sensor selection and deployment decisions.

The APAC industrial sensors market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by industrial modernization, technological advancement, and increasing focus on operational efficiency. The market’s strong foundation, built on the region’s robust manufacturing base and supportive government policies, provides a solid platform for continued expansion and innovation.

Technology convergence trends including IoT integration, artificial intelligence, and edge computing are transforming traditional sensors into intelligent, connected devices capable of autonomous operation and predictive insights. These developments are creating new value propositions and enabling applications that were previously not feasible with conventional sensor technologies.

Market opportunities abound across diverse industries and applications, from traditional manufacturing and process industries to emerging sectors such as renewable energy and smart cities. The growing emphasis on sustainability and environmental monitoring is creating additional demand for specialized sensor solutions that can support organizations’ environmental goals and regulatory compliance requirements.

Success factors for market participants include continuous technology innovation, strong regional presence, comprehensive solution offerings, and the ability to provide ongoing support and services. Organizations that can combine hardware excellence with software capabilities and domain expertise will be best positioned to capitalize on market opportunities and deliver value to customers across the diverse APAC industrial landscape.

What is Industrial Sensors?

Industrial sensors are devices used to detect and measure physical properties such as temperature, pressure, and humidity in various industrial applications. They play a crucial role in automation, monitoring, and control processes across different sectors.

What are the key players in the APAC Industrial Sensors Market?

Key players in the APAC Industrial Sensors Market include Siemens AG, Honeywell International Inc., and Schneider Electric, among others. These companies are known for their innovative sensor technologies and extensive product portfolios.

What are the main drivers of the APAC Industrial Sensors Market?

The main drivers of the APAC Industrial Sensors Market include the increasing demand for automation in manufacturing, the growth of the Internet of Things (IoT), and the rising need for real-time monitoring in various industries such as automotive and healthcare.

What challenges does the APAC Industrial Sensors Market face?

Challenges in the APAC Industrial Sensors Market include the high cost of advanced sensor technologies and the complexity of integrating these sensors into existing systems. Additionally, concerns regarding data security and interoperability can hinder market growth.

What opportunities exist in the APAC Industrial Sensors Market?

Opportunities in the APAC Industrial Sensors Market include the expansion of smart manufacturing initiatives and the increasing adoption of Industry Four Point Zero technologies. Furthermore, the growing focus on sustainability and energy efficiency presents new avenues for sensor applications.

What trends are shaping the APAC Industrial Sensors Market?

Trends shaping the APAC Industrial Sensors Market include the rise of wireless sensor networks, advancements in sensor miniaturization, and the integration of artificial intelligence for predictive maintenance. These trends are enhancing the functionality and efficiency of industrial processes.

APAC Industrial Sensors Market

| Segmentation Details | Description |

|---|---|

| Product Type | Pressure Sensors, Temperature Sensors, Proximity Sensors, Flow Sensors |

| Technology | Wireless, Analog, Digital, Smart |

| End User | Manufacturing, Oil & Gas, Automotive OEMs, Aerospace |

| Application | Process Automation, Environmental Monitoring, Safety Systems, Smart Grids |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Industrial Sensors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at