444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America automated insulin delivery systems market represents a transformative segment within the diabetes management landscape, experiencing unprecedented growth driven by technological innovation and increasing diabetes prevalence. This sophisticated healthcare technology combines continuous glucose monitoring with automated insulin delivery, creating closed-loop systems that significantly improve patient outcomes and quality of life. Market dynamics indicate robust expansion across the United States and Canada, with adoption rates accelerating at approximately 12.5% annually among eligible diabetes patients.

Technological advancement serves as the primary catalyst for market evolution, with artificial intelligence and machine learning algorithms enhancing system accuracy and reliability. The integration of smartphone connectivity and cloud-based data management has revolutionized diabetes care, enabling real-time monitoring and remote healthcare provider oversight. Patient acceptance rates have reached approximately 78% among Type 1 diabetes patients who have been introduced to automated insulin delivery systems, reflecting growing confidence in these innovative solutions.

Healthcare infrastructure across North America provides an ideal foundation for automated insulin delivery system deployment, with established endocrinology networks and comprehensive insurance coverage frameworks supporting widespread adoption. The region’s emphasis on preventive healthcare and chronic disease management aligns perfectly with the proactive approach offered by these advanced diabetes management systems.

The automated insulin delivery systems market refers to the comprehensive ecosystem of medical devices, software platforms, and healthcare services that enable continuous, algorithm-driven insulin administration for diabetes patients. These systems integrate continuous glucose monitoring sensors, insulin pumps, and sophisticated control algorithms to create closed-loop or hybrid closed-loop systems that automatically adjust insulin delivery based on real-time glucose readings and predictive analytics.

Core components of automated insulin delivery systems include glucose sensors that provide continuous monitoring, insulin pumps capable of precise dosing adjustments, and control algorithms that process glucose data to determine optimal insulin delivery patterns. The systems operate through wireless communication protocols, enabling seamless data exchange between components while providing patients and healthcare providers with comprehensive diabetes management insights.

Clinical significance extends beyond simple glucose control, encompassing improved time-in-range metrics, reduced hypoglycemic episodes, and enhanced patient quality of life. These systems represent the evolution from reactive diabetes management to proactive, predictive care that anticipates glucose fluctuations and responds automatically to maintain optimal glycemic control.

Market transformation within the North America automated insulin delivery systems sector reflects a paradigm shift toward precision diabetes management, driven by technological innovation and increasing patient demand for convenient, effective treatment solutions. The convergence of advanced sensor technology, artificial intelligence, and mobile health platforms has created unprecedented opportunities for improved diabetes care delivery across diverse patient populations.

Growth trajectories indicate sustained expansion, with penetration rates among eligible patients expected to reach 35% by 2028, representing significant advancement from current adoption levels. Key market drivers include rising diabetes prevalence, technological maturation, expanding insurance coverage, and growing awareness of automated system benefits among healthcare providers and patients alike.

Competitive dynamics feature established medical device manufacturers alongside innovative technology companies, creating a diverse ecosystem of solution providers. Market leaders continue investing heavily in research and development, focusing on algorithm refinement, sensor accuracy improvements, and user experience enhancement to maintain competitive positioning.

Regulatory landscape supports market growth through streamlined approval processes and clear guidance frameworks for automated insulin delivery system development and commercialization. The FDA’s continued collaboration with manufacturers has accelerated time-to-market for innovative solutions while maintaining rigorous safety and efficacy standards.

Patient demographics reveal significant adoption variations across age groups, with younger diabetes patients demonstrating higher acceptance rates and technology engagement levels. The following key insights shape market understanding:

Diabetes prevalence escalation across North America serves as the fundamental market driver, with Type 1 and Type 2 diabetes cases continuing to rise across all demographic segments. The increasing recognition of diabetes as a major public health challenge has intensified focus on innovative management solutions that can improve patient outcomes while reducing healthcare system burden.

Technological maturation has reached a critical inflection point where automated insulin delivery systems demonstrate consistent reliability and clinical efficacy. Advanced sensor accuracy, improved algorithm sophistication, and enhanced user interfaces have addressed historical barriers to adoption, creating compelling value propositions for patients and healthcare providers.

Healthcare cost containment initiatives drive interest in automated systems due to their potential for reducing long-term diabetes complications and associated healthcare expenditures. Health economic studies demonstrate favorable cost-effectiveness profiles for automated insulin delivery systems, particularly when considering reduced hospitalization rates and improved quality-adjusted life years.

Patient empowerment trends align with automated system capabilities, as individuals increasingly seek active roles in managing their health conditions. The integration of mobile health technologies and real-time data access appeals to patients who desire greater control and insight into their diabetes management while maintaining clinical oversight.

Clinical evidence accumulation continues supporting automated insulin delivery system adoption, with peer-reviewed research demonstrating superior outcomes compared to traditional management approaches. Healthcare providers increasingly recognize these systems as standard-of-care options for appropriate patients, driving prescription patterns and market growth.

Cost considerations remain significant barriers for many patients, despite expanding insurance coverage and manufacturer assistance programs. The initial investment required for automated insulin delivery systems, combined with ongoing supply costs, creates financial challenges that limit accessibility for certain patient populations, particularly those with limited insurance coverage or high deductible health plans.

Technical complexity associated with automated systems can overwhelm some patients, particularly older adults or those with limited technology experience. The learning curve required for effective system utilization, including calibration procedures, troubleshooting, and data interpretation, may discourage adoption among certain demographic segments.

Healthcare provider education gaps persist in some regions, where endocrinologists and diabetes educators lack comprehensive training on automated insulin delivery systems. This knowledge deficit can result in hesitant recommendations or suboptimal patient support, limiting market penetration in affected areas.

Regulatory considerations continue evolving as automated systems become more sophisticated, creating uncertainty around future compliance requirements and approval processes. Manufacturers must navigate complex regulatory landscapes while ensuring continued innovation and market responsiveness.

Infrastructure dependencies in rural or underserved areas may limit automated system effectiveness, where reliable internet connectivity or proximity to specialized healthcare providers creates implementation challenges. These geographic disparities can restrict market expansion in certain regions.

Artificial intelligence integration presents transformative opportunities for automated insulin delivery system enhancement, with machine learning algorithms capable of personalizing treatment approaches based on individual patient patterns and preferences. Advanced AI capabilities can improve prediction accuracy, reduce false alarms, and optimize insulin delivery timing for superior glycemic control.

Pediatric market expansion offers substantial growth potential as automated systems receive approvals for younger age groups and demonstrate safety and efficacy in pediatric populations. Parents increasingly seek advanced diabetes management solutions for their children, creating demand for age-appropriate automated insulin delivery systems with enhanced safety features.

Type 2 diabetes applications represent significant untapped opportunities, as automated systems traditionally focused on Type 1 diabetes patients begin demonstrating value for insulin-dependent Type 2 diabetes management. This expanded indication could dramatically increase the addressable patient population and market size.

Integration with digital health ecosystems enables comprehensive chronic disease management platforms that extend beyond diabetes to include related conditions and wellness monitoring. These holistic approaches appeal to patients managing multiple health conditions while providing healthcare systems with integrated care coordination tools.

International expansion from the established North American market base offers growth opportunities as regulatory frameworks develop in other regions and healthcare systems recognize automated insulin delivery system benefits. Technology transfer and market development strategies can leverage North American success to accelerate global adoption.

Competitive intensity continues escalating as established medical device manufacturers face challenges from innovative technology companies entering the automated insulin delivery systems market. This dynamic environment drives rapid innovation cycles, with companies investing heavily in research and development to maintain competitive advantages and market positioning.

Supply chain evolution reflects the complex manufacturing requirements for automated insulin delivery systems, involving precision sensors, advanced electronics, and sophisticated software platforms. Manufacturers must balance cost optimization with quality assurance while ensuring reliable component sourcing and production scalability.

Reimbursement landscape changes significantly impact market dynamics, as insurance coverage decisions directly influence patient access and adoption rates. MarkWide Research analysis indicates that favorable reimbursement policies correlate strongly with regional market penetration rates and growth trajectories.

Healthcare provider relationships remain critical for market success, requiring ongoing education, training, and support programs to ensure effective system implementation and patient outcomes. Companies that invest in comprehensive healthcare provider partnerships typically achieve higher market penetration and patient satisfaction rates.

Patient advocacy influence shapes market dynamics through grassroots awareness campaigns, insurance coverage advocacy, and technology adoption promotion. Diabetes advocacy organizations play increasingly important roles in market development by educating patients about automated system benefits and supporting access initiatives.

Primary research approaches encompass comprehensive stakeholder interviews with healthcare providers, patients, insurance representatives, and industry experts to gather firsthand insights into market dynamics, adoption patterns, and future trends. These qualitative research methods provide nuanced understanding of market drivers, barriers, and opportunities that quantitative data alone cannot capture.

Secondary research analysis involves systematic review of clinical literature, regulatory filings, company reports, and industry publications to establish comprehensive market understanding. This research foundation ensures accurate market characterization and trend identification while validating primary research findings through multiple data sources.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project market growth trajectories, adoption patterns, and competitive dynamics. These analytical approaches incorporate multiple variables including demographic trends, technology advancement rates, and regulatory environment changes to generate robust market projections.

Data validation processes ensure research accuracy through triangulation of multiple information sources, expert review panels, and statistical verification methods. This rigorous approach maintains research integrity while providing stakeholders with reliable market intelligence for strategic decision-making.

Continuous monitoring systems track market developments, regulatory changes, and competitive activities to maintain current market understanding and identify emerging trends. This ongoing research approach enables timely market intelligence updates and strategic recommendation refinements.

United States market dominance reflects the country’s advanced healthcare infrastructure, favorable regulatory environment, and high diabetes prevalence rates. The U.S. represents approximately 85% of North American market activity, driven by established endocrinology networks, comprehensive insurance coverage, and strong patient advocacy organizations supporting automated insulin delivery system adoption.

California and Texas lead state-level adoption due to large diabetes populations, advanced healthcare systems, and technology-forward patient demographics. These states demonstrate higher-than-average penetration rates and serve as important market development indicators for national trends and adoption patterns.

Canadian market characteristics differ from the U.S. due to universal healthcare coverage and centralized procurement processes, creating unique opportunities and challenges for automated insulin delivery system manufacturers. Provincial health systems increasingly recognize these technologies’ value, leading to expanded coverage and access programs.

Urban versus rural dynamics create significant regional variations within both countries, with metropolitan areas showing substantially higher adoption rates due to healthcare provider availability, technology infrastructure, and patient education resources. Rural market development requires specialized strategies addressing unique geographic and demographic challenges.

Regional healthcare partnerships play crucial roles in market development, with integrated health systems and accountable care organizations increasingly incorporating automated insulin delivery systems into diabetes management protocols. These institutional relationships drive market penetration and establish sustainable growth foundations.

Market leadership remains concentrated among several key players who have established strong positions through innovation, clinical evidence development, and healthcare provider relationships. The competitive environment continues evolving as new entrants introduce disruptive technologies and business models.

Strategic partnerships between component manufacturers, software developers, and healthcare providers create complex competitive dynamics that extend beyond traditional device manufacturing. These collaborations enable comprehensive solution development while sharing development costs and market risks.

Innovation focus areas include algorithm sophistication, sensor accuracy improvement, user interface enhancement, and integration with broader digital health platforms. Companies that successfully balance technological advancement with practical usability typically achieve stronger market positions.

By Technology Type:

By Patient Type:

By Distribution Channel:

Hybrid closed-loop systems dominate current market activity due to their balance of automation benefits and user control retention. These systems appeal to patients seeking improved glucose management while maintaining involvement in their diabetes care decisions. Clinical outcomes demonstrate significant improvements in time-in-range and reduced hypoglycemic episodes compared to traditional pump therapy.

Continuous glucose monitoring integration serves as a critical differentiator among automated insulin delivery systems, with sensor accuracy and reliability directly impacting system performance and patient satisfaction. Advanced CGM technologies enable more sophisticated algorithms and improved glucose prediction capabilities.

Mobile application interfaces increasingly influence patient preferences and adoption decisions, with intuitive design and comprehensive data visualization becoming essential features. Patients value systems that provide clear insights into their diabetes management while enabling easy sharing with healthcare providers and family members.

Algorithm sophistication varies significantly among available systems, with machine learning capabilities and personalization features representing key competitive advantages. Systems that adapt to individual patient patterns and preferences typically achieve better clinical outcomes and higher patient satisfaction rates.

Integration capabilities with electronic health records and other digital health platforms create additional value for healthcare providers and health systems. These connectivity features enable comprehensive chronic disease management and support population health initiatives.

Patients experience transformative improvements in quality of life through reduced diabetes management burden, improved glucose control, and decreased fear of hypoglycemic episodes. Automated systems provide peace of mind for patients and families while enabling more flexible lifestyles and improved sleep quality.

Healthcare providers benefit from enhanced patient monitoring capabilities, improved clinical outcomes, and more efficient diabetes management workflows. Remote monitoring features enable proactive intervention and reduce the need for frequent office visits while maintaining high-quality care standards.

Health systems realize cost savings through reduced diabetes-related complications, emergency department visits, and hospitalizations. Automated insulin delivery systems support value-based care initiatives by improving patient outcomes while controlling long-term healthcare costs.

Insurance companies benefit from favorable health economics associated with automated systems, including reduced claims for diabetes complications and improved member satisfaction. Long-term cost savings often offset initial technology investment costs.

Manufacturers gain opportunities for sustainable revenue growth through recurring supply sales, software licensing, and value-added services. The chronic nature of diabetes creates long-term customer relationships and predictable revenue streams.

Caregivers and families experience reduced anxiety and improved quality of life through enhanced diabetes management visibility and automated safety features. Remote monitoring capabilities provide reassurance while supporting patient independence.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence advancement represents the most significant trend shaping automated insulin delivery system evolution, with machine learning algorithms enabling increasingly sophisticated glucose prediction and insulin dosing optimization. These AI capabilities promise more personalized diabetes management approaches that adapt to individual patient patterns and preferences.

Smartphone integration continues expanding, with mobile applications becoming central control hubs for automated systems. Patients increasingly expect seamless connectivity, intuitive interfaces, and comprehensive data visualization capabilities that enable active participation in their diabetes management.

Miniaturization trends drive development of smaller, more discreet automated insulin delivery system components that appeal to patients seeking less conspicuous diabetes management solutions. Advanced manufacturing techniques enable significant size reductions without compromising functionality or reliability.

Interoperability focus grows as patients and healthcare providers demand systems that work seamlessly with existing diabetes management tools and electronic health records. Open protocol development and standardized communication interfaces become increasingly important competitive factors.

Personalization capabilities expand through advanced data analytics and machine learning, enabling systems that adapt to individual lifestyle patterns, exercise routines, and dietary preferences. This trend toward customized diabetes management appeals to patients seeking tailored healthcare solutions.

Remote monitoring enhancement accelerates, particularly following increased telehealth adoption during recent healthcare challenges. MWR data indicates that remote monitoring features influence 73% of patient adoption decisions, highlighting this trend’s importance for market development.

Regulatory milestone achievements continue advancing automated insulin delivery system accessibility, with recent FDA approvals for expanded age ranges and simplified prescription processes. These regulatory developments reduce barriers to adoption while maintaining safety and efficacy standards.

Clinical trial completions provide additional evidence supporting automated system benefits across diverse patient populations, including pediatric patients and Type 2 diabetes applications. Ongoing research continues expanding the clinical evidence base supporting broader adoption recommendations.

Technology partnerships between traditional medical device manufacturers and technology companies create innovative solution combinations that leverage complementary expertise. These collaborations accelerate development timelines while reducing individual company risks and investment requirements.

Insurance coverage expansions reflect growing recognition of automated insulin delivery system value, with major insurers adding coverage for previously excluded patient populations. These policy changes significantly impact market accessibility and adoption potential.

Manufacturing capacity investments by leading companies indicate confidence in long-term market growth and commitment to meeting increasing demand. These facility expansions and production line additions support market scaling and cost optimization initiatives.

International regulatory approvals enable North American companies to expand globally while validating technology approaches and clinical evidence. These approvals create additional revenue opportunities while supporting continued innovation investment.

Market participants should prioritize artificial intelligence integration and algorithm sophistication to maintain competitive positioning as automated insulin delivery systems evolve toward more autonomous operation. Companies that successfully implement advanced AI capabilities while maintaining user-friendly interfaces will likely achieve stronger market positions.

Healthcare providers benefit from comprehensive training programs and ongoing education initiatives that ensure effective automated system implementation and patient support. Investing in staff education and establishing clear protocols for automated insulin delivery system management creates competitive advantages for healthcare organizations.

Patients considering automated insulin delivery systems should evaluate total cost of ownership, including initial investment, ongoing supplies, and potential insurance coverage changes. Working closely with healthcare providers and diabetes educators ensures optimal system selection and implementation success.

Insurance companies should consider long-term health economic benefits when developing coverage policies for automated insulin delivery systems. Comprehensive coverage that includes patient education and ongoing support typically results in better outcomes and cost-effectiveness compared to limited coverage approaches.

Investors evaluating automated insulin delivery system companies should focus on clinical evidence strength, regulatory approval status, and healthcare provider adoption rates as key indicators of long-term success potential. Companies with strong clinical validation and established healthcare relationships typically demonstrate more sustainable growth trajectories.

Market evolution toward fully automated insulin delivery systems appears inevitable as technology continues advancing and clinical evidence accumulates supporting autonomous diabetes management approaches. The next decade will likely witness significant progress toward artificial pancreas systems that require minimal user intervention while maintaining superior clinical outcomes.

Adoption acceleration is expected to continue, with penetration rates among eligible patients projected to reach 45% by 2030, representing substantial growth from current levels. This expansion will be driven by technology improvements, cost reductions, expanded insurance coverage, and growing healthcare provider confidence in automated systems.

Technology convergence with other digital health platforms will create comprehensive chronic disease management ecosystems that extend beyond diabetes to include related conditions and overall wellness monitoring. These integrated approaches appeal to patients managing multiple health conditions while providing healthcare systems with holistic care coordination tools.

Global market expansion from the North American base will accelerate as regulatory frameworks develop in other regions and healthcare systems recognize automated insulin delivery system benefits. Technology transfer and market development strategies will leverage North American success to drive international adoption.

Cost optimization through manufacturing scale, technology advancement, and competitive pressure will improve automated system accessibility for broader patient populations. These cost reductions, combined with expanding insurance coverage, will democratize access to advanced diabetes management technology.

Clinical applications will expand beyond current indications to include gestational diabetes, hospital-based glucose management, and other specialized use cases. These expanded applications represent significant market opportunities while advancing the overall goal of comprehensive automated glucose management.

The North America automated insulin delivery systems market stands at a transformative inflection point, where technological maturation, clinical validation, and growing patient demand converge to create unprecedented opportunities for improved diabetes management. This dynamic market environment reflects the successful evolution from experimental artificial pancreas concepts to commercially viable, clinically proven automated systems that deliver measurable benefits for patients, healthcare providers, and health systems alike.

Market fundamentals remain exceptionally strong, supported by rising diabetes prevalence, advancing technology capabilities, expanding insurance coverage, and growing healthcare provider confidence in automated solutions. The combination of robust clinical evidence, improving cost-effectiveness profiles, and enhanced patient quality of life outcomes creates compelling value propositions that drive sustained market growth and adoption acceleration.

Future prospects indicate continued market expansion and technology advancement, with artificial intelligence integration, personalization capabilities, and comprehensive digital health platform development representing key growth drivers. As automated insulin delivery systems become increasingly sophisticated and accessible, they will likely transition from specialized diabetes management tools to standard-of-care solutions for appropriate patient populations across North America and beyond.

What is Automated Insulin Delivery Systems?

Automated Insulin Delivery Systems are advanced medical devices designed to automatically deliver insulin to individuals with diabetes, helping to maintain optimal blood glucose levels. These systems often include continuous glucose monitors and insulin pumps that work together to adjust insulin delivery based on real-time glucose readings.

What are the key players in the North America Automated Insulin Delivery Systems Market?

Key players in the North America Automated Insulin Delivery Systems Market include Medtronic, Insulet Corporation, and Tandem Diabetes Care. These companies are known for their innovative products and technologies that enhance diabetes management, among others.

What are the growth factors driving the North America Automated Insulin Delivery Systems Market?

The North America Automated Insulin Delivery Systems Market is driven by factors such as the increasing prevalence of diabetes, advancements in technology, and the growing demand for personalized diabetes management solutions. Additionally, rising awareness about the benefits of automated systems contributes to market growth.

What challenges does the North America Automated Insulin Delivery Systems Market face?

Challenges in the North America Automated Insulin Delivery Systems Market include high costs of devices, regulatory hurdles, and the need for continuous patient education. These factors can limit accessibility and adoption among potential users.

What opportunities exist in the North America Automated Insulin Delivery Systems Market?

Opportunities in the North America Automated Insulin Delivery Systems Market include the development of more affordable and user-friendly devices, integration with mobile health applications, and potential partnerships with healthcare providers. These advancements can enhance patient engagement and improve health outcomes.

What trends are shaping the North America Automated Insulin Delivery Systems Market?

Trends in the North America Automated Insulin Delivery Systems Market include the rise of artificial intelligence in diabetes management, the increasing use of telehealth services, and the development of hybrid closed-loop systems. These innovations aim to improve the efficiency and effectiveness of insulin delivery.

North America Automated Insulin Delivery Systems Market

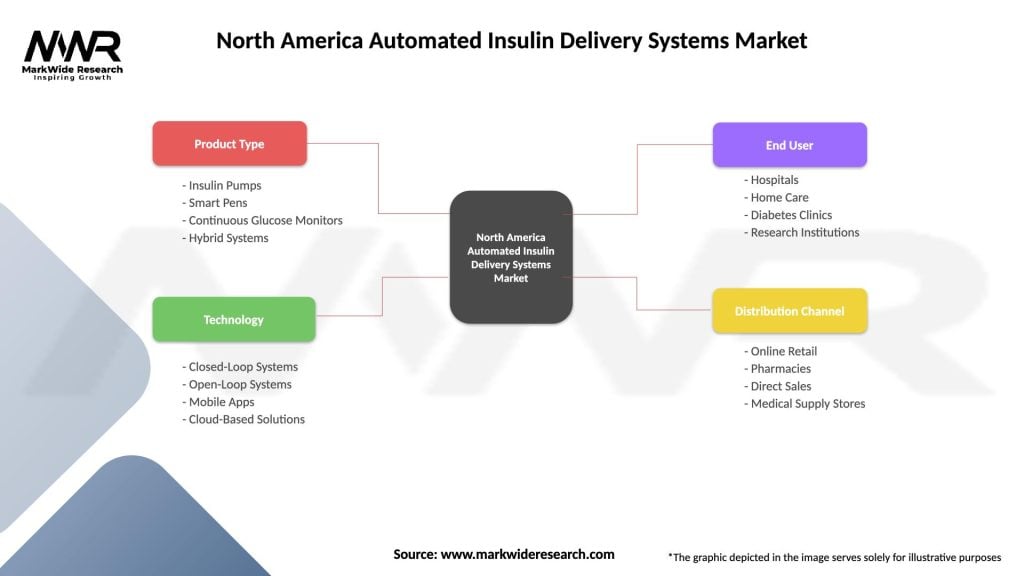

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin Pumps, Smart Pens, Continuous Glucose Monitors, Hybrid Systems |

| Technology | Closed-Loop Systems, Open-Loop Systems, Mobile Apps, Cloud-Based Solutions |

| End User | Hospitals, Home Care, Diabetes Clinics, Research Institutions |

| Distribution Channel | Online Retail, Pharmacies, Direct Sales, Medical Supply Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Automated Insulin Delivery Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at