444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe nuclear imaging devices market represents a sophisticated and rapidly evolving healthcare technology sector that plays a crucial role in modern diagnostic medicine. This market encompasses advanced medical imaging equipment including gamma cameras, SPECT systems, PET scanners, and hybrid imaging devices that utilize radioactive tracers to visualize organ function and detect various medical conditions. European healthcare systems have demonstrated strong adoption rates for nuclear imaging technologies, with the market experiencing robust growth driven by increasing prevalence of cardiovascular diseases, cancer, and neurological disorders.

Market dynamics indicate that Europe maintains a leading position in nuclear imaging innovation, with countries like Germany, France, and the United Kingdom serving as key technology hubs. The region benefits from well-established healthcare infrastructure, favorable reimbursement policies, and strong research and development capabilities. Growth projections suggest the market will expand at a 6.2% CAGR over the forecast period, supported by technological advancements in hybrid imaging systems and increasing demand for personalized medicine approaches.

Healthcare providers across Europe are increasingly investing in next-generation nuclear imaging devices that offer enhanced image quality, reduced radiation exposure, and improved patient comfort. The integration of artificial intelligence and machine learning technologies is transforming diagnostic capabilities, enabling more precise disease detection and treatment monitoring. Regulatory frameworks in Europe support innovation while maintaining strict safety standards, creating a conducive environment for market growth and technological advancement.

The Europe nuclear imaging devices market refers to the comprehensive ecosystem of medical imaging equipment, radiopharmaceuticals, and associated technologies used for diagnostic and therapeutic procedures across European healthcare systems. These sophisticated devices utilize radioactive isotopes to create detailed images of internal organs and tissues, providing critical information about physiological processes and disease states that cannot be obtained through conventional imaging methods.

Nuclear imaging technology encompasses various modalities including Single Photon Emission Computed Tomography (SPECT), Positron Emission Tomography (PET), gamma cameras, and hybrid systems that combine nuclear imaging with CT or MRI capabilities. These devices enable healthcare professionals to diagnose conditions such as cancer, heart disease, bone disorders, and neurological conditions with exceptional accuracy and precision.

Market participants include medical device manufacturers, radiopharmaceutical companies, healthcare providers, research institutions, and regulatory bodies that collectively contribute to the development, production, distribution, and utilization of nuclear imaging technologies throughout Europe. The market serves diverse applications ranging from oncology and cardiology to neurology and orthopedics, supporting evidence-based medical decision-making and improved patient outcomes.

Strategic analysis reveals that the Europe nuclear imaging devices market is positioned for sustained growth, driven by demographic trends, technological innovations, and evolving healthcare delivery models. The market benefits from strong government support for healthcare modernization initiatives and increasing recognition of nuclear imaging’s value in precision medicine approaches. Key growth drivers include the aging European population, rising cancer incidence rates, and growing demand for early disease detection capabilities.

Technology advancement represents a primary catalyst for market expansion, with manufacturers developing next-generation systems that offer improved sensitivity, reduced scan times, and enhanced patient safety features. The integration of digital technologies and artificial intelligence is creating new opportunities for automated image analysis and clinical decision support. Market penetration of hybrid imaging systems has reached approximately 38% adoption rate among major European healthcare facilities, indicating strong acceptance of advanced diagnostic capabilities.

Competitive landscape analysis shows a concentrated market structure with several multinational corporations maintaining dominant positions through continuous innovation and strategic partnerships. European manufacturers are leveraging regional expertise in precision engineering and medical technology to compete effectively with global players. Investment trends indicate increasing focus on research and development activities, with healthcare technology companies allocating significant resources to nuclear imaging innovation projects.

Market intelligence reveals several critical insights that shape the Europe nuclear imaging devices landscape. The following key findings provide strategic direction for industry stakeholders:

Demographic transformation across Europe serves as a fundamental driver for nuclear imaging device demand, with aging populations experiencing higher incidence rates of chronic diseases requiring advanced diagnostic capabilities. The increasing prevalence of cancer, cardiovascular disorders, and neurological conditions creates sustained demand for nuclear imaging procedures. Healthcare systems recognize nuclear imaging as essential for accurate diagnosis, treatment planning, and therapy monitoring, supporting continued investment in advanced imaging technologies.

Technological innovation drives market expansion through the development of more efficient, accurate, and patient-friendly imaging systems. Advances in detector technology, image reconstruction algorithms, and radiopharmaceutical development enhance diagnostic capabilities while reducing radiation exposure and examination times. Digital transformation initiatives in healthcare create opportunities for integrated imaging solutions that support clinical workflow optimization and improved patient care coordination.

Clinical evidence supporting the value of nuclear imaging in precision medicine approaches strengthens adoption rates among healthcare providers. Growing recognition of nuclear imaging’s role in personalized treatment strategies, particularly in oncology and cardiology, drives investment in advanced imaging capabilities. Reimbursement policies in many European countries provide favorable coverage for nuclear imaging procedures, supporting market growth and technology adoption. Research activities in academic and clinical settings continue to expand applications for nuclear imaging, creating new market opportunities and driving innovation in device development.

High capital costs associated with nuclear imaging equipment represent a significant barrier to market expansion, particularly for smaller healthcare facilities and emerging markets within Europe. The substantial investment required for device acquisition, installation, and facility modifications can limit adoption rates and slow market penetration. Operational expenses including maintenance, radiopharmaceutical procurement, and specialized staffing requirements add to the total cost of ownership, influencing purchasing decisions and utilization patterns.

Regulatory complexity surrounding radioactive materials handling, transportation, and disposal creates operational challenges for healthcare providers. Strict safety requirements and licensing procedures can extend implementation timelines and increase administrative burdens. Radiation safety concerns among patients and healthcare workers may limit procedure volumes and influence technology adoption decisions, despite continuous improvements in dose reduction technologies.

Technical limitations of current nuclear imaging technologies, including relatively long examination times and limited spatial resolution compared to other imaging modalities, may restrict certain clinical applications. Skilled workforce shortages in nuclear medicine specialties across several European countries constrain market growth and limit the utilization of available imaging capacity. Competition from alternative imaging modalities such as MRI and advanced CT systems may impact market share in certain clinical applications, requiring continuous innovation to maintain competitive advantages.

Emerging applications in theranostics represent significant growth opportunities for the Europe nuclear imaging devices market, combining diagnostic imaging with targeted therapeutic capabilities. This integrated approach enables personalized treatment strategies and real-time therapy monitoring, creating new revenue streams for device manufacturers and healthcare providers. Molecular imaging applications continue to expand, offering opportunities for early disease detection and treatment response assessment across various medical specialties.

Artificial intelligence integration presents transformative opportunities for nuclear imaging workflow optimization, automated image analysis, and clinical decision support. AI-powered solutions can enhance diagnostic accuracy, reduce interpretation times, and support less experienced practitioners in complex cases. Digital health initiatives across European healthcare systems create opportunities for connected imaging solutions that support remote consultation, image sharing, and integrated care delivery models.

Market expansion opportunities exist in Eastern European countries where healthcare infrastructure modernization programs are driving investment in advanced medical technologies. Public-private partnerships and healthcare financing initiatives support technology adoption in emerging markets within the region. Research collaborations between academic institutions, healthcare providers, and technology companies create opportunities for innovation and new product development. Hybrid imaging systems represent a particularly promising opportunity, with market penetration rates expected to reach 55% adoption among European healthcare facilities over the next five years.

Supply chain dynamics in the Europe nuclear imaging devices market reflect complex interactions between device manufacturers, radiopharmaceutical suppliers, healthcare providers, and regulatory authorities. The market operates within a highly regulated environment that ensures product quality and patient safety while supporting innovation and competition. Technology evolution drives continuous market transformation, with manufacturers investing heavily in research and development to maintain competitive positions and address evolving clinical needs.

Demand patterns vary significantly across European regions, influenced by healthcare system structures, reimbursement policies, and clinical practice patterns. Western European markets demonstrate higher technology adoption rates and procedure volumes, while Eastern European markets show strong growth potential driven by healthcare modernization initiatives. Competitive dynamics involve both established multinational corporations and specialized regional players, creating a diverse ecosystem of technology providers and service organizations.

Innovation cycles in nuclear imaging technology typically span several years, requiring substantial investment in research, development, and regulatory approval processes. Market consolidation trends reflect the high costs of technology development and the need for scale to compete effectively in global markets. Partnership strategies between device manufacturers, software companies, and healthcare providers are becoming increasingly important for delivering comprehensive imaging solutions. Efficiency improvements of up to 42% reduction in examination times have been achieved through recent technological advances, enhancing patient throughput and operational effectiveness.

Comprehensive market analysis for the Europe nuclear imaging devices market employs a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and reliability. The methodology incorporates quantitative and qualitative research techniques to provide detailed insights into market dynamics, competitive landscapes, and future growth prospects. Primary research activities include structured interviews with industry executives, healthcare professionals, and technology experts across major European markets.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and academic publications to establish market baselines and identify key trends. Data validation processes involve cross-referencing multiple sources and conducting expert consultations to ensure information accuracy and relevance. Market sizing and forecasting methodologies utilize statistical modeling techniques and scenario analysis to project future market developments under various conditions.

Regional analysis incorporates country-specific research to account for variations in healthcare systems, regulatory environments, and market conditions across Europe. Technology assessment involves evaluation of current and emerging nuclear imaging technologies, including performance characteristics, clinical applications, and market adoption patterns. Competitive intelligence gathering includes analysis of company strategies, product portfolios, and market positioning to provide comprehensive competitive landscape insights. Market segmentation analysis examines various dimensions including technology type, application area, end-user category, and geographic distribution to identify specific growth opportunities and market dynamics.

Germany represents the largest market for nuclear imaging devices in Europe, driven by advanced healthcare infrastructure, strong research capabilities, and favorable reimbursement policies. The country maintains approximately 28% market share of the European nuclear imaging devices market, supported by high procedure volumes and continuous technology adoption. German healthcare systems demonstrate strong preference for hybrid imaging technologies and advanced diagnostic capabilities, creating opportunities for premium device manufacturers.

France holds a significant market position with well-established nuclear medicine programs and strong government support for healthcare technology modernization. The French market emphasizes cost-effectiveness and clinical outcomes, driving adoption of innovative imaging solutions that demonstrate clear value propositions. United Kingdom maintains a substantial market presence despite healthcare budget constraints, with NHS initiatives supporting strategic investments in advanced diagnostic technologies.

Italy and Spain represent important growth markets within Southern Europe, with increasing investments in healthcare infrastructure and nuclear imaging capabilities. These markets show strong potential for technology upgrades and capacity expansion. Eastern European markets including Poland, Czech Republic, and Hungary demonstrate rapid growth rates as healthcare systems modernize and adopt advanced diagnostic technologies. Nordic countries including Sweden, Denmark, and Norway maintain high technology adoption rates and serve as early adopters for innovative nuclear imaging solutions. Regional growth rates vary significantly, with Eastern European markets experiencing 8.5% annual growth compared to 4.2% growth in mature Western European markets.

Market leadership in the Europe nuclear imaging devices sector is characterized by intense competition among established multinational corporations and specialized technology providers. The competitive landscape reflects continuous innovation, strategic partnerships, and market consolidation trends that shape industry dynamics and growth patterns.

Strategic initiatives among leading competitors include research and development investments, acquisition activities, and partnership agreements to strengthen market positions and expand technology portfolios. Innovation focus areas include artificial intelligence integration, dose reduction technologies, and hybrid imaging capabilities that address evolving clinical needs and regulatory requirements.

Technology-based segmentation of the Europe nuclear imaging devices market reveals distinct categories with varying growth patterns and market dynamics. Each technology segment serves specific clinical applications and demonstrates unique competitive characteristics and adoption trends.

By Technology:

By Application:

By End User:

SPECT systems maintain the largest market share within the Europe nuclear imaging devices market, benefiting from established clinical protocols, broad application ranges, and cost-effective operation characteristics. These systems demonstrate particular strength in cardiac imaging applications and routine nuclear medicine procedures. Technology improvements in SPECT systems focus on enhanced image quality, reduced acquisition times, and improved patient comfort features.

PET scanning technology represents the fastest-growing category, driven by expanding oncology applications and increasing recognition of PET’s diagnostic value in cancer management. The integration of PET with CT and MRI technologies creates comprehensive imaging solutions that support precision medicine approaches. Market adoption of PET systems shows 12.3% annual growth across European healthcare facilities, reflecting strong clinical demand and favorable reimbursement conditions.

Hybrid imaging systems demonstrate exceptional growth potential, combining multiple imaging modalities to provide comprehensive diagnostic information in single examinations. These systems offer significant advantages in clinical workflow efficiency and diagnostic accuracy, supporting their rapid adoption among European healthcare providers. Gamma camera systems continue to serve essential roles in nuclear medicine departments, with manufacturers focusing on digital upgrades and enhanced functionality to maintain market relevance. Technology convergence trends indicate increasing integration between nuclear imaging and other diagnostic modalities, creating new opportunities for comprehensive imaging solutions.

Healthcare providers benefit significantly from advanced nuclear imaging technologies through improved diagnostic capabilities, enhanced patient care quality, and operational efficiency gains. Nuclear imaging devices enable early disease detection, accurate treatment planning, and effective therapy monitoring, supporting better patient outcomes and reduced healthcare costs. Clinical advantages include non-invasive diagnostic procedures, functional imaging capabilities, and comprehensive disease assessment tools that complement other imaging modalities.

Device manufacturers gain competitive advantages through continuous innovation, market expansion opportunities, and strategic partnerships with healthcare providers. The growing demand for nuclear imaging creates sustained revenue opportunities and supports long-term business growth. Technology developers benefit from increasing investment in research and development activities, creating opportunities for breakthrough innovations and market leadership positions.

Patients receive significant benefits through access to advanced diagnostic technologies that enable early disease detection, personalized treatment approaches, and improved therapeutic outcomes. Nuclear imaging procedures provide critical diagnostic information that supports informed medical decision-making and optimal treatment selection. Healthcare systems benefit from cost-effective diagnostic solutions that reduce unnecessary procedures, support evidence-based medicine, and improve resource utilization efficiency. Economic benefits include reduced healthcare costs through early intervention, improved treatment success rates, and enhanced operational efficiency across healthcare delivery networks.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents a dominant trend in the Europe nuclear imaging devices market, with manufacturers integrating advanced digital technologies, artificial intelligence, and machine learning capabilities into imaging systems. These innovations enhance diagnostic accuracy, reduce interpretation times, and support clinical decision-making processes. AI-powered solutions are becoming increasingly sophisticated, offering automated image analysis, quality control, and clinical workflow optimization features.

Hybrid imaging technologies continue to gain momentum, with adoption rates reaching 45% penetration among major European healthcare facilities. These systems combine nuclear imaging with CT, MRI, or other modalities to provide comprehensive diagnostic information in single examinations. Personalized medicine approaches drive demand for advanced imaging capabilities that support individualized treatment strategies and precision therapeutic interventions.

Dose reduction initiatives focus on minimizing radiation exposure while maintaining diagnostic image quality, addressing safety concerns and regulatory requirements. Compact system designs enable nuclear imaging capabilities in smaller healthcare facilities and specialized clinical settings. Connectivity solutions support remote consultation, image sharing, and integrated healthcare delivery models across European healthcare networks. Sustainability considerations influence device design and operational practices, with manufacturers developing environmentally responsible imaging solutions and waste reduction strategies.

Recent technological breakthroughs in nuclear imaging include the development of next-generation detector technologies that significantly improve image quality and reduce examination times. Semiconductor detector systems are replacing traditional scintillation detectors in many applications, offering superior performance characteristics and enhanced diagnostic capabilities. Software innovations include advanced reconstruction algorithms and AI-powered image enhancement tools that optimize diagnostic information extraction.

Strategic partnerships between device manufacturers and healthcare providers are creating comprehensive imaging solutions that address specific clinical needs and operational requirements. Acquisition activities in the industry reflect consolidation trends and the need for scale to compete effectively in global markets. Regulatory approvals for new imaging technologies and radiopharmaceuticals expand clinical applications and market opportunities.

Research initiatives focus on emerging applications including theranostics, molecular imaging, and precision medicine approaches that leverage nuclear imaging capabilities. Clinical trials demonstrate the value of nuclear imaging in various therapeutic areas, supporting adoption and reimbursement decisions. Infrastructure investments by healthcare systems across Europe support technology upgrades and capacity expansion initiatives. Training programs and educational initiatives address workforce development needs and support optimal technology utilization across healthcare facilities.

Strategic recommendations for market participants include focusing on hybrid imaging technologies that combine nuclear imaging with other modalities to provide comprehensive diagnostic solutions. MarkWide Research analysis indicates that healthcare providers increasingly prefer integrated systems that optimize clinical workflows and enhance diagnostic capabilities. Investment priorities should emphasize artificial intelligence integration, dose reduction technologies, and user-friendly interfaces that support clinical adoption and operational efficiency.

Market entry strategies for new participants should consider regional variations in healthcare systems, regulatory requirements, and clinical practice patterns across European markets. Partnership approaches with established healthcare providers and technology integrators can accelerate market penetration and reduce implementation risks. Innovation focus areas should address emerging clinical applications, particularly in oncology and neurology, where nuclear imaging demonstrates clear diagnostic value.

Competitive positioning strategies should emphasize unique value propositions, clinical evidence, and total cost of ownership advantages that differentiate products in crowded markets. Service capabilities including training, maintenance, and technical support become increasingly important for customer retention and market success. Regulatory compliance and quality assurance programs are essential for maintaining market access and customer confidence. Technology roadmaps should anticipate future clinical needs and regulatory requirements to ensure long-term competitiveness and market relevance.

Long-term projections for the Europe nuclear imaging devices market indicate sustained growth driven by demographic trends, technological innovations, and expanding clinical applications. Market evolution will be characterized by increasing integration of artificial intelligence, enhanced imaging capabilities, and comprehensive diagnostic solutions that support precision medicine approaches. Growth forecasts suggest the market will maintain a 6.8% compound annual growth rate over the next decade, supported by continuous technology advancement and clinical adoption.

Technology development trends point toward more sophisticated imaging systems with improved sensitivity, reduced radiation exposure, and enhanced patient comfort features. Clinical applications will expand beyond traditional nuclear medicine procedures to include emerging areas such as theranostics, molecular imaging, and personalized therapeutic monitoring. Market consolidation is expected to continue as companies seek scale advantages and comprehensive technology portfolios.

Regional growth patterns will likely favor Eastern European markets where healthcare modernization initiatives drive technology adoption and infrastructure development. MWR projections indicate that hybrid imaging systems will represent approximately 65% market share by 2030, reflecting strong clinical preference for integrated diagnostic capabilities. Innovation cycles will accelerate as digital technologies and AI capabilities mature, creating new opportunities for diagnostic enhancement and clinical workflow optimization. Healthcare integration trends will support connected imaging solutions that enable remote consultation, collaborative diagnosis, and comprehensive patient care coordination across European healthcare networks.

The Europe nuclear imaging devices market represents a dynamic and rapidly evolving sector that plays a critical role in modern healthcare delivery across the region. Market analysis reveals strong growth potential driven by demographic trends, technological innovations, and expanding clinical applications that support precision medicine approaches. Key success factors include continuous innovation, strategic partnerships, and comprehensive solutions that address evolving healthcare needs and operational requirements.

Strategic opportunities exist in hybrid imaging technologies, artificial intelligence integration, and emerging clinical applications that leverage advanced nuclear imaging capabilities. Market participants who focus on value-based solutions, clinical evidence, and customer-centric approaches are well-positioned to capitalize on growth opportunities and maintain competitive advantages. Future success will depend on the ability to navigate regulatory requirements, address workforce development needs, and deliver innovative solutions that improve patient outcomes while optimizing healthcare economics across European markets.

What is Nuclear Imaging Devices?

Nuclear Imaging Devices are medical imaging technologies that utilize radioactive materials to visualize the structure and function of organs and tissues in the body. These devices are commonly used in diagnostics, treatment planning, and monitoring of various diseases, particularly in oncology and cardiology.

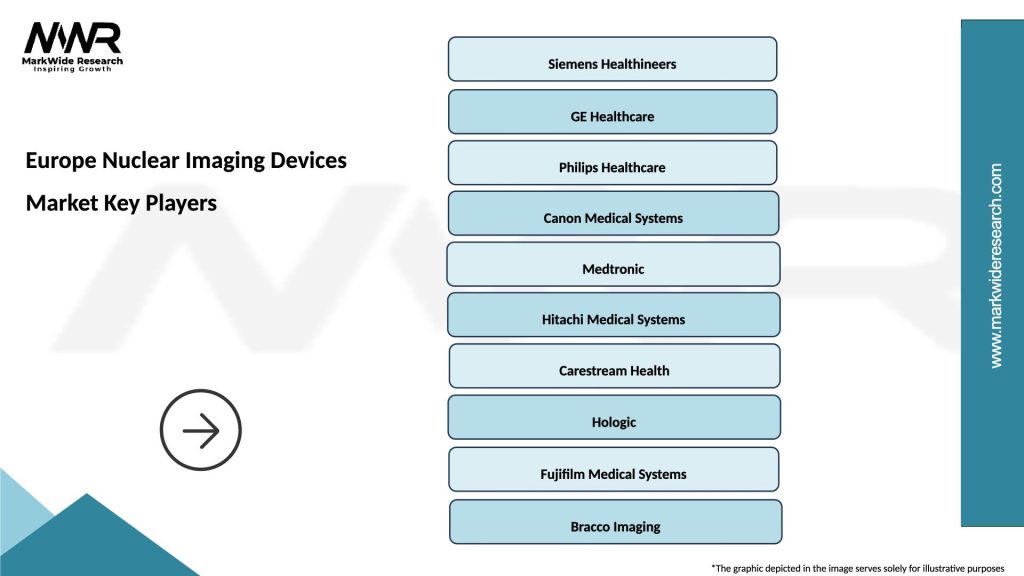

What are the key players in the Europe Nuclear Imaging Devices Market?

Key players in the Europe Nuclear Imaging Devices Market include Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems, among others. These companies are known for their innovative technologies and comprehensive product offerings in nuclear imaging.

What are the growth factors driving the Europe Nuclear Imaging Devices Market?

The growth of the Europe Nuclear Imaging Devices Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in imaging technologies, and the rising demand for early diagnosis and personalized medicine. Additionally, the growing geriatric population contributes to the market expansion.

What challenges does the Europe Nuclear Imaging Devices Market face?

The Europe Nuclear Imaging Devices Market faces challenges such as high costs associated with nuclear imaging procedures, regulatory hurdles, and the need for skilled professionals to operate complex imaging equipment. These factors can limit accessibility and adoption in certain healthcare settings.

What opportunities exist in the Europe Nuclear Imaging Devices Market?

Opportunities in the Europe Nuclear Imaging Devices Market include the development of hybrid imaging technologies, increasing investments in healthcare infrastructure, and the potential for growth in emerging markets. Additionally, advancements in radiopharmaceuticals present new avenues for innovation.

What trends are shaping the Europe Nuclear Imaging Devices Market?

Trends shaping the Europe Nuclear Imaging Devices Market include the integration of artificial intelligence in imaging analysis, the shift towards outpatient imaging services, and the growing emphasis on patient safety and radiation dose reduction. These trends are influencing how nuclear imaging is utilized in clinical practice.

Europe Nuclear Imaging Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Hybrid Imaging Systems, Gamma Cameras, Single-Photon Emission Computed Tomography, Positron Emission Tomography |

| Technology | Digital Imaging, Analog Imaging, 3D Imaging, 4D Imaging |

| End User | Hospitals, Diagnostic Centers, Research Institutions, Outpatient Clinics |

| Application | Oncology, Cardiology, Neurology, Thyroid Imaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Nuclear Imaging Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at