444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe fingerprint sensors market represents a dynamic and rapidly evolving technological landscape that has transformed security and authentication protocols across multiple industries. Biometric authentication has emerged as a cornerstone of modern security infrastructure, with fingerprint sensors leading the charge in providing reliable, user-friendly identification solutions. The European market demonstrates exceptional growth potential, driven by increasing security concerns, regulatory compliance requirements, and widespread adoption of smart devices across consumer and enterprise segments.

Market dynamics indicate robust expansion across key European nations, with Germany, the United Kingdom, France, and the Nordic countries serving as primary growth drivers. The integration of fingerprint sensor technology spans diverse applications including smartphones, laptops, access control systems, automotive security, and banking authentication. Current market trends show a 12.5% CAGR projected through the forecast period, reflecting strong demand for advanced biometric solutions.

Technological advancement continues to reshape the European fingerprint sensors landscape, with innovations in capacitive, optical, and ultrasonic sensor technologies enhancing accuracy and reliability. The market benefits from Europe’s strong emphasis on data privacy and security regulations, creating favorable conditions for biometric authentication adoption. Industry adoption rates have reached approximately 68% penetration in smartphone applications, while enterprise security implementations show 45% adoption across major European corporations.

The Europe fingerprint sensors market refers to the comprehensive ecosystem of biometric authentication technologies, devices, and solutions that utilize unique fingerprint patterns for identity verification across European territories. This market encompasses the development, manufacturing, distribution, and implementation of various fingerprint sensing technologies including capacitive, optical, thermal, and ultrasonic sensors designed for consumer electronics, enterprise security, automotive applications, and government identification systems.

Fingerprint sensor technology operates by capturing and analyzing the unique ridge patterns, minutiae points, and distinctive characteristics of human fingerprints to create digital templates for authentication purposes. The European market specifically addresses regional compliance requirements, privacy regulations such as GDPR, and localized security standards that govern biometric data collection and processing across EU member states.

Market scope includes hardware components, software algorithms, integration services, and complete biometric authentication solutions tailored for European regulatory environments. The technology serves as a critical component in digital transformation initiatives, enabling secure access control, financial transactions, device unlocking, and identity verification processes across various industry verticals throughout Europe.

Strategic market analysis reveals that the Europe fingerprint sensors market has established itself as a fundamental component of the region’s digital security infrastructure. The market demonstrates exceptional resilience and growth potential, supported by increasing cybersecurity threats, regulatory mandates, and consumer demand for convenient yet secure authentication methods. Key market drivers include the proliferation of smart devices, digital banking expansion, and enterprise security modernization initiatives.

Technology segmentation shows capacitive sensors maintaining market leadership with approximately 55% market share, followed by optical sensors and emerging ultrasonic technologies. The consumer electronics segment dominates application areas, while enterprise security and automotive sectors show the highest growth rates. Regional distribution indicates Western Europe accounts for 62% of market activity, with Eastern European markets demonstrating accelerated adoption rates.

Competitive landscape features established technology leaders alongside innovative startups, creating a dynamic environment for technological advancement and market expansion. The market benefits from strong research and development investments, strategic partnerships, and increasing integration with artificial intelligence and machine learning technologies. Future projections suggest continued growth driven by IoT expansion, smart city initiatives, and evolving security requirements across European markets.

Market intelligence reveals several critical insights that define the Europe fingerprint sensors landscape. The following key insights provide strategic understanding of market dynamics and growth opportunities:

Primary growth drivers propelling the Europe fingerprint sensors market encompass technological, regulatory, and consumer-driven factors that create sustained demand for biometric authentication solutions. The increasing frequency and sophistication of cyber attacks have elevated security concerns across all sectors, making fingerprint authentication an essential component of comprehensive security strategies.

Digital transformation initiatives across European enterprises have accelerated the adoption of biometric authentication systems. Organizations are replacing traditional password-based security with more robust fingerprint authentication to enhance security while improving user experience. The rise of remote work and digital collaboration has further emphasized the need for secure, convenient authentication methods that fingerprint sensors provide.

Regulatory compliance requirements serve as significant market drivers, with European data protection laws mandating stronger authentication mechanisms for sensitive data access. The implementation of PSD2 (Payment Services Directive 2) has specifically driven adoption in financial services, requiring strong customer authentication that fingerprint sensors effectively provide. Consumer electronics proliferation continues to drive market growth, with smartphones, tablets, and laptops increasingly incorporating fingerprint sensors as standard security features.

Smart city initiatives across European urban centers are creating new opportunities for fingerprint sensor deployment in public services, transportation systems, and citizen identification programs. The growing emphasis on contactless interactions, accelerated by health concerns, has increased demand for touchless biometric solutions that modern fingerprint sensors can accommodate.

Market challenges facing the Europe fingerprint sensors industry include technical limitations, privacy concerns, and implementation complexities that may constrain growth in certain segments. Privacy apprehensions among consumers regarding biometric data collection and storage continue to create resistance in some market segments, despite regulatory protections and security improvements.

Technical limitations of current fingerprint sensor technologies present ongoing challenges, including difficulties with wet or damaged fingers, environmental factors affecting sensor performance, and potential security vulnerabilities to sophisticated spoofing attempts. These limitations require continuous technological advancement and may limit adoption in certain applications or environments.

Implementation costs associated with enterprise-wide biometric authentication systems can be substantial, particularly for small and medium-sized businesses. The complexity of integrating fingerprint sensors with existing security infrastructure, employee training requirements, and ongoing maintenance costs may deter some organizations from adoption. Interoperability challenges between different biometric systems and legacy security infrastructure can create additional implementation barriers.

Regulatory complexity across different European jurisdictions can create compliance challenges for multinational deployments. Varying interpretations of data protection laws and biometric data handling requirements may complicate market expansion strategies. Cultural resistance to biometric authentication in certain European regions or demographic segments may limit market penetration in specific areas.

Emerging opportunities in the Europe fingerprint sensors market present significant potential for growth and innovation across multiple industry verticals. The expansion of Internet of Things (IoT) applications creates new use cases for fingerprint authentication in smart home systems, connected vehicles, and industrial automation platforms. These applications require secure, user-friendly authentication methods that fingerprint sensors can effectively provide.

Healthcare digitization presents substantial opportunities for fingerprint sensor deployment in patient identification, medical device access control, and pharmaceutical security applications. The growing emphasis on patient data security and regulatory compliance in healthcare creates favorable conditions for biometric authentication adoption. Financial technology innovation continues to drive demand for secure authentication solutions, with digital banking, cryptocurrency platforms, and fintech applications requiring robust identity verification.

Automotive industry transformation toward connected and autonomous vehicles creates new opportunities for fingerprint sensor integration in vehicle access, driver identification, and personalized vehicle settings. The growing emphasis on automotive cybersecurity makes biometric authentication increasingly valuable for vehicle manufacturers. Government modernization initiatives across European nations present opportunities for large-scale biometric system deployments in citizen services, border control, and national identification programs.

Technological convergence with artificial intelligence, machine learning, and edge computing creates opportunities for enhanced fingerprint recognition capabilities, improved accuracy, and new application possibilities. The development of flexible and transparent sensor technologies opens opportunities for integration in new form factors and applications.

Market dynamics in the Europe fingerprint sensors industry reflect complex interactions between technological advancement, regulatory evolution, and changing consumer expectations. The competitive landscape demonstrates continuous innovation as companies strive to differentiate their offerings through improved accuracy, enhanced security features, and broader application compatibility.

Supply chain dynamics have evolved to support the growing demand for fingerprint sensors, with European manufacturers and technology companies establishing strategic partnerships with Asian component suppliers while maintaining local assembly and integration capabilities. This approach balances cost efficiency with regional compliance requirements and supply chain security concerns.

Technology adoption patterns show varying rates across different European markets, with Nordic countries and Germany leading in enterprise adoption while Southern European markets demonstrate strong growth in consumer applications. The market benefits from Europe’s strong technology infrastructure and high smartphone penetration rates, which facilitate rapid adoption of new biometric technologies.

Investment flows into fingerprint sensor technology companies have increased significantly, with venture capital and corporate investment supporting innovation in advanced sensor technologies, artificial intelligence integration, and new application development. Research collaboration between European universities, technology companies, and government institutions continues to drive technological advancement and market growth. The market shows 85% satisfaction rates among enterprise users, indicating strong acceptance and potential for continued expansion.

Comprehensive research methodology employed in analyzing the Europe fingerprint sensors market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research activities include extensive interviews with industry executives, technology developers, system integrators, and end-users across various European markets to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, regulatory documents, and academic publications related to fingerprint sensor technology and biometric authentication markets. This approach provides comprehensive coverage of market dynamics, competitive positioning, and technological developments across the European region.

Market sizing methodology utilizes bottom-up and top-down approaches to validate market estimates and growth projections. Bottom-up analysis examines individual market segments, application areas, and regional markets to build comprehensive market understanding. Top-down analysis validates findings through macroeconomic indicators, industry trends, and comparative analysis with related technology markets.

Data validation processes include triangulation of information sources, expert review panels, and statistical analysis to ensure research accuracy and reliability. MarkWide Research analytical frameworks incorporate quantitative modeling, trend analysis, and scenario planning to provide robust market forecasts and strategic insights for stakeholders across the fingerprint sensors value chain.

Regional market analysis reveals distinct patterns of fingerprint sensor adoption and growth across European territories, with Western European markets leading in terms of market maturity and technology adoption. Germany represents the largest single market, accounting for approximately 28% of European demand, driven by strong automotive, industrial automation, and enterprise security sectors.

United Kingdom maintains significant market presence despite Brexit implications, with particular strength in financial services and government applications. The UK market demonstrates 15% annual growth in enterprise biometric deployments, supported by increasing cybersecurity investments and digital transformation initiatives across various industries.

France shows robust growth in consumer electronics and smart city applications, with government initiatives supporting biometric authentication adoption in public services. The French market benefits from strong domestic technology companies and research institutions driving innovation in fingerprint sensor technology. Nordic countries including Sweden, Norway, and Denmark demonstrate the highest per-capita adoption rates, with 78% smartphone fingerprint sensor penetration and leading positions in contactless authentication solutions.

Eastern European markets including Poland, Czech Republic, and Hungary show accelerated growth rates as digital infrastructure modernization drives demand for secure authentication solutions. These markets benefit from lower implementation costs and increasing foreign investment in technology infrastructure. Southern European markets including Italy and Spain demonstrate strong growth in mobile payment applications and consumer electronics, supported by increasing digital banking adoption and e-commerce expansion.

Competitive dynamics in the Europe fingerprint sensors market feature a diverse ecosystem of established technology leaders, innovative startups, and specialized solution providers. The market structure supports both horizontal competition across technology platforms and vertical specialization in specific application areas or industry segments.

Strategic partnerships and technology licensing agreements play crucial roles in competitive positioning, enabling companies to expand their technology portfolios and market reach. Innovation focus areas include under-display fingerprint sensors, flexible sensor technologies, and integration with artificial intelligence for enhanced recognition accuracy.

Market segmentation analysis provides detailed insights into the diverse components and applications that comprise the Europe fingerprint sensors market. Segmentation by technology type reveals the relative market positions and growth trajectories of different sensor technologies.

By Technology:

By Application:

By End-User Industry:

Consumer Electronics Category represents the largest and most dynamic segment of the Europe fingerprint sensors market, driven by widespread smartphone adoption and increasing integration in laptops, tablets, and wearable devices. This category benefits from continuous technological advancement, with manufacturers implementing increasingly sophisticated sensor technologies to enhance user experience and security. Market penetration in premium smartphones has reached 95% adoption rates, while mid-range devices show rapidly increasing integration.

Enterprise Security Category demonstrates strong growth potential as organizations prioritize cybersecurity and access control modernization. This segment encompasses access control systems, time attendance solutions, and secure authentication for enterprise applications. The category benefits from increasing regulatory compliance requirements and growing awareness of security threats. Implementation rates show 35% annual growth in enterprise deployments across European markets.

Automotive Category represents an emerging high-growth segment as vehicle manufacturers integrate biometric authentication for enhanced security and personalization. Applications include keyless entry, driver identification, and personalized vehicle settings. The category benefits from increasing vehicle connectivity and autonomous driving development. Technology adoption in premium vehicles shows 42% integration rates with projected expansion to mainstream vehicles.

Financial Services Category focuses on secure authentication for banking, payment processing, and financial transaction verification. This category demonstrates strong growth driven by digital banking expansion and regulatory requirements for strong customer authentication. Deployment rates in European banks show 58% implementation for customer-facing applications and internal security systems.

Technology Providers benefit from expanding market opportunities across multiple industry verticals, enabling diversified revenue streams and reduced market concentration risk. The growing demand for biometric authentication creates sustainable competitive advantages for companies with advanced sensor technologies and comprehensive solution portfolios. Innovation opportunities in emerging technologies such as under-display sensors and flexible biometrics provide pathways for market differentiation and premium pricing.

System Integrators gain access to high-value projects as organizations implement comprehensive biometric authentication systems. The complexity of modern fingerprint sensor deployments creates opportunities for specialized integration services, ongoing maintenance contracts, and system optimization consulting. Market expansion into new industry verticals provides growth opportunities and relationship development with enterprise customers.

End-User Organizations benefit from enhanced security, improved user experience, and regulatory compliance through fingerprint sensor implementation. The technology provides cost-effective authentication solutions that reduce password-related support costs while improving security posture. Operational efficiency improvements include streamlined access control, reduced authentication time, and enhanced user satisfaction.

Government Agencies benefit from improved citizen services, enhanced security capabilities, and modernized identification systems through fingerprint sensor deployment. The technology supports digital transformation initiatives while maintaining high security standards for sensitive applications. Cost savings result from reduced manual processing, improved accuracy, and streamlined identity verification processes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Under-Display Technology represents a significant trend transforming smartphone fingerprint sensor implementation, with manufacturers developing sensors that function beneath device displays without compromising screen real estate. This technology trend enhances device aesthetics while maintaining security functionality, driving adoption in premium consumer electronics. Implementation rates in flagship smartphones show 67% adoption of under-display fingerprint sensors.

Multi-Modal Biometric Integration emerges as a key trend combining fingerprint sensors with other biometric technologies such as facial recognition and voice authentication. This approach enhances security while providing backup authentication methods, particularly valuable in enterprise and government applications. The trend supports comprehensive identity verification systems that address various use cases and security requirements.

Artificial Intelligence Integration transforms fingerprint recognition capabilities through machine learning algorithms that improve accuracy, reduce false rejection rates, and enhance anti-spoofing capabilities. AI-powered fingerprint sensors adapt to user behavior patterns and environmental conditions, providing more reliable authentication experiences. Performance improvements show 25% accuracy enhancement through AI integration.

Contactless Authentication gains momentum as health concerns and hygiene considerations drive demand for touchless biometric solutions. Advanced fingerprint sensors capable of contactless operation address these concerns while maintaining security effectiveness. This trend particularly impacts access control and public-facing applications where hygiene is a priority consideration.

Edge Computing Integration enables fingerprint processing at the device level, reducing latency, improving privacy, and enhancing system reliability. This trend supports real-time authentication requirements while addressing data privacy concerns through local processing capabilities.

Recent industry developments demonstrate the dynamic nature of the Europe fingerprint sensors market, with significant technological advances and strategic initiatives shaping market evolution. Product launches of next-generation sensor technologies have introduced enhanced security features, improved environmental resistance, and expanded application compatibility across various industry segments.

Strategic partnerships between sensor manufacturers and system integrators have created comprehensive solution offerings that address complex enterprise requirements. These collaborations combine hardware capabilities with software expertise and industry knowledge to deliver integrated biometric authentication systems. Acquisition activities have consolidated market capabilities, with larger technology companies acquiring specialized biometric firms to expand their solution portfolios.

Research breakthroughs in flexible sensor technologies and transparent fingerprint sensors have opened new application possibilities in wearable devices, smart cards, and innovative form factors. European research institutions and technology companies continue to lead in developing advanced sensor materials and manufacturing processes. Standardization efforts across European markets have improved interoperability and reduced implementation complexity for multi-vendor deployments.

Investment announcements in European manufacturing facilities and research centers demonstrate continued confidence in market growth potential. Companies are expanding local production capabilities to serve growing demand while maintaining supply chain security and regulatory compliance. Government initiatives supporting biometric technology development through research grants and public-private partnerships have accelerated innovation and market development.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing current market challenges. Technology companies should prioritize investment in advanced sensor technologies including ultrasonic and 3D fingerprint recognition to maintain competitive differentiation. Focus on artificial intelligence integration and edge computing capabilities will enhance product value propositions and market positioning.

System integrators should develop specialized expertise in vertical market applications such as healthcare, automotive, and smart cities to capture high-value implementation projects. Building comprehensive solution portfolios that combine hardware, software, and services will create sustainable competitive advantages and recurring revenue opportunities. Partnership strategies with technology providers and industry specialists will enhance market reach and solution capabilities.

End-user organizations should adopt phased implementation approaches that begin with high-impact use cases and expand systematically across their operations. Prioritizing user experience and change management will ensure successful adoption and maximize return on investment. Security considerations should include comprehensive risk assessment and multi-layered authentication strategies that combine fingerprint sensors with complementary security technologies.

Investment strategies should focus on companies with strong intellectual property portfolios, diversified application focus, and proven ability to adapt to evolving market requirements. MWR analysis suggests that companies with comprehensive solution offerings and strong European market presence are positioned for sustained growth in the evolving biometric authentication landscape.

Future market projections indicate continued robust growth for the Europe fingerprint sensors market, driven by expanding application areas, technological advancement, and increasing security requirements across all industry sectors. The market is expected to benefit from broader digital transformation initiatives, IoT expansion, and evolving consumer expectations for secure yet convenient authentication methods.

Technology evolution will focus on enhanced accuracy, improved environmental resistance, and expanded form factor possibilities through flexible and transparent sensor technologies. The integration of artificial intelligence and machine learning will create more sophisticated authentication systems capable of adaptive learning and enhanced security features. Growth projections suggest the market will maintain 11.8% CAGR through the next five years, with emerging applications driving incremental demand.

Application expansion into new industry verticals including healthcare, automotive, and smart infrastructure will create additional growth opportunities beyond traditional consumer electronics and enterprise security markets. The development of industry-specific solutions and compliance frameworks will facilitate adoption in regulated sectors with stringent security requirements.

Regional development patterns suggest continued Western European market leadership while Eastern European markets demonstrate accelerated growth rates. The harmonization of regulatory frameworks across European Union member states will facilitate market expansion and reduce implementation complexity for multinational deployments. MarkWide Research projects that emerging technologies and new application areas will contribute 40% of market growth over the forecast period, highlighting the importance of innovation and market diversification strategies.

The Europe fingerprint sensors market represents a dynamic and rapidly evolving technology sector with substantial growth potential across multiple industry verticals and application areas. The market benefits from strong technological foundations, favorable regulatory environments, and increasing demand for secure authentication solutions in an increasingly digital economy. Market fundamentals including technological advancement, regulatory support, and growing security awareness create favorable conditions for sustained growth and innovation.

Strategic opportunities exist across the value chain, from technology development and manufacturing to system integration and end-user implementation. The market’s evolution toward more sophisticated sensor technologies, artificial intelligence integration, and expanded application areas provides multiple pathways for growth and differentiation. Industry participants who focus on innovation, vertical market specialization, and comprehensive solution development are positioned to capture significant market opportunities.

Future success in the Europe fingerprint sensors market will depend on the ability to address evolving security requirements, regulatory compliance needs, and user experience expectations while maintaining cost-effectiveness and reliability. The market’s continued growth trajectory reflects the fundamental importance of secure authentication in digital transformation initiatives across European economies, making fingerprint sensors an essential component of modern security infrastructure and digital identity management systems.

What is Fingerprint Sensors?

Fingerprint sensors are biometric devices that capture and analyze the unique patterns of an individual’s fingerprints for identification and authentication purposes. They are widely used in security systems, mobile devices, and access control applications.

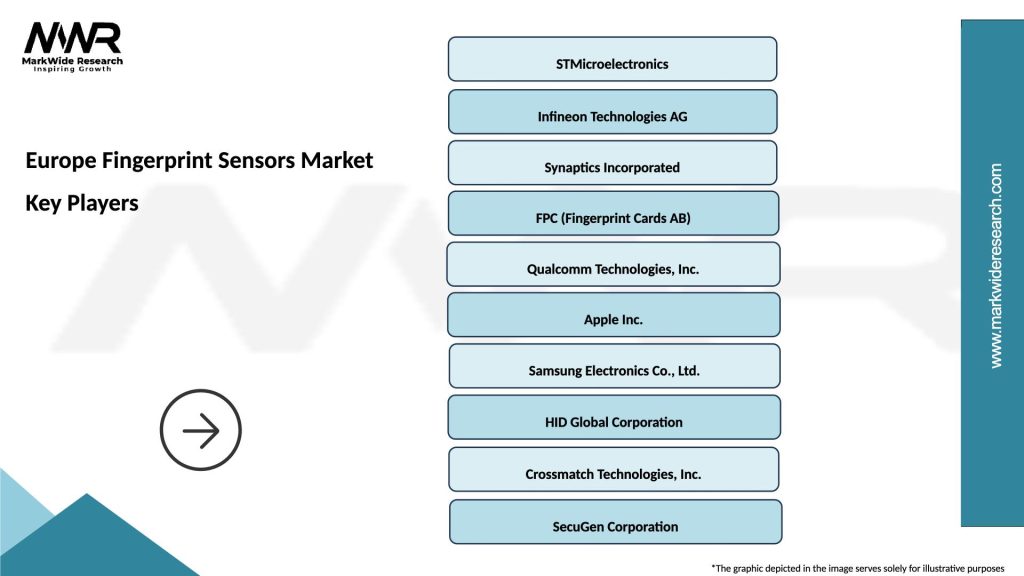

What are the key players in the Europe Fingerprint Sensors Market?

Key players in the Europe Fingerprint Sensors Market include companies like Synaptics, Fingerprint Cards AB, and HID Global, which are known for their innovative biometric solutions and technologies, among others.

What are the main drivers of the Europe Fingerprint Sensors Market?

The main drivers of the Europe Fingerprint Sensors Market include the increasing demand for secure authentication methods, the rise in mobile payment solutions, and the growing adoption of biometric technology in various sectors such as banking and healthcare.

What challenges does the Europe Fingerprint Sensors Market face?

The Europe Fingerprint Sensors Market faces challenges such as concerns over privacy and data security, the high cost of advanced biometric systems, and the potential for false acceptance or rejection rates in fingerprint recognition.

What opportunities exist in the Europe Fingerprint Sensors Market?

Opportunities in the Europe Fingerprint Sensors Market include the expansion of smart home devices, the integration of fingerprint sensors in wearables, and advancements in artificial intelligence that enhance biometric recognition capabilities.

What trends are shaping the Europe Fingerprint Sensors Market?

Trends shaping the Europe Fingerprint Sensors Market include the development of under-display fingerprint sensors for smartphones, the increasing use of multi-modal biometric systems, and the growing focus on contactless authentication methods.

Europe Fingerprint Sensors Market

| Segmentation Details | Description |

|---|---|

| Product Type | Optical Sensors, Capacitive Sensors, Ultrasonic Sensors, Thermal Sensors |

| Technology | 2D Imaging, 3D Imaging, Multispectral Imaging, Liveness Detection |

| End User | Consumer Electronics, Banking, Healthcare, Government |

| Application | Access Control, Time & Attendance, Mobile Payments, Identity Verification |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Fingerprint Sensors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at