444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe offshore helicopters market represents a critical component of the continent’s energy infrastructure, supporting offshore oil and gas operations, wind farm installations, and search and rescue missions across European waters. Market dynamics indicate robust growth driven by expanding offshore renewable energy projects, particularly wind farms in the North Sea, Baltic Sea, and Atlantic coastal regions. The sector demonstrates significant expansion with helicopter services experiencing a 6.2% annual growth rate as offshore activities intensify across European territorial waters.

European operators are increasingly investing in advanced helicopter technologies to meet stringent safety requirements and environmental regulations. The market encompasses various helicopter types, from light utility aircraft for personnel transport to heavy-lift helicopters for equipment installation and maintenance operations. Offshore wind energy development has emerged as a primary growth driver, with helicopter services essential for turbine installation, maintenance, and crew transportation to remote offshore installations.

Regional distribution shows the United Kingdom, Norway, Netherlands, and Denmark commanding approximately 75% market share due to their extensive offshore energy operations. The integration of sustainable aviation fuels and electric helicopter technologies reflects the industry’s commitment to reducing carbon emissions while maintaining operational efficiency in challenging offshore environments.

The Europe offshore helicopters market refers to the comprehensive ecosystem of helicopter services, aircraft manufacturing, maintenance, and support operations specifically designed for offshore activities across European waters. This specialized market encompasses helicopter transportation services for offshore oil and gas platforms, renewable energy installations, search and rescue operations, and marine support activities throughout European territorial and international waters.

Market scope includes various helicopter categories ranging from light single-engine aircraft to heavy twin-engine helicopters capable of long-range offshore operations. The sector integrates advanced avionics, safety systems, and specialized equipment designed for maritime environments, including emergency flotation systems, weather radar, and satellite communication technologies essential for safe offshore operations.

Service categories within this market encompass personnel transportation, cargo lifting, emergency medical services, search and rescue operations, and specialized missions such as offshore wind turbine maintenance and marine survey support. The market also includes helicopter leasing, maintenance services, pilot training, and ground support infrastructure specifically tailored for offshore operations.

Strategic analysis reveals the Europe offshore helicopters market experiencing unprecedented transformation driven by the continent’s energy transition toward renewable sources. Offshore wind development has become the dominant growth catalyst, with helicopter services essential for supporting the installation and maintenance of thousands of wind turbines across European waters. The market demonstrates resilient growth patterns despite challenges in traditional oil and gas sectors.

Technology advancement plays a crucial role in market evolution, with operators investing in next-generation helicopters featuring enhanced safety systems, improved fuel efficiency, and reduced environmental impact. The adoption of digital technologies including predictive maintenance, flight data monitoring, and automated flight systems contributes to operational efficiency improvements of approximately 25% over traditional systems.

Regulatory frameworks across European nations continue strengthening safety requirements while promoting sustainable aviation practices. The market benefits from coordinated European Aviation Safety Agency standards that facilitate cross-border operations and equipment standardization. Investment trends indicate significant capital allocation toward fleet modernization and infrastructure development to support expanding offshore activities.

Primary market drivers shaping the Europe offshore helicopters landscape include accelerating offshore wind farm development, aging oil and gas infrastructure requiring increased maintenance, and growing emphasis on search and rescue capabilities. The following key insights define current market dynamics:

Offshore wind energy expansion serves as the primary catalyst driving helicopter service demand across European waters. The continent’s commitment to achieving carbon neutrality by 2050 has accelerated offshore wind farm development, with projects requiring extensive helicopter support for installation, maintenance, and crew transportation. Wind farm operations typically require regular helicopter access for turbine maintenance, emergency repairs, and personnel transfers, creating sustained demand for specialized helicopter services.

Aging offshore infrastructure in traditional oil and gas sectors necessitates increased maintenance activities, driving demand for heavy-lift helicopters capable of transporting equipment and personnel to remote platforms. The complexity of maintaining decades-old installations requires specialized helicopter services with advanced lifting capabilities and extended range performance. Decommissioning activities for end-of-life offshore platforms also contribute to helicopter service demand.

Enhanced safety regulations across European jurisdictions mandate improved emergency response capabilities, driving investment in search and rescue helicopter services. Regulatory requirements for offshore operators to maintain emergency response readiness create consistent demand for specialized helicopter services equipped with medical facilities and rescue equipment. Maritime safety initiatives further strengthen the regulatory foundation supporting helicopter service growth.

Technological advancement in helicopter design and avionics systems enables operators to access previously challenging offshore locations while improving operational efficiency. Modern helicopters offer extended range, enhanced payload capacity, and superior weather performance, expanding the scope of offshore operations accessible by helicopter. Digital integration improves flight planning, maintenance scheduling, and operational coordination.

High operational costs associated with offshore helicopter operations present significant challenges for market expansion. The specialized nature of offshore helicopters requires substantial investment in aircraft acquisition, maintenance, insurance, and crew training, creating barriers for new market entrants. Fuel costs represent a major operational expense, particularly for long-range offshore missions requiring extended flight times and heavy fuel consumption.

Weather dependency significantly impacts offshore helicopter operations, with adverse weather conditions frequently causing flight cancellations and operational delays. European waters experience challenging weather patterns including high winds, fog, and storms that limit helicopter accessibility to offshore installations. Seasonal variations in weather conditions create operational planning challenges and revenue fluctuations for helicopter service providers.

Regulatory complexity across different European jurisdictions creates operational challenges for helicopter operators serving multiple countries. Varying national regulations, certification requirements, and operational procedures increase compliance costs and administrative burden. Cross-border operations require navigation of multiple regulatory frameworks, potentially limiting operational efficiency and market access.

Skilled pilot shortage affects the helicopter industry globally, with offshore operations requiring highly trained pilots with specialized certifications and extensive experience. The demanding nature of offshore flying, combined with stringent training requirements, limits the available pilot pool. Training costs and time requirements for offshore helicopter pilots create workforce development challenges for operators.

Offshore wind expansion presents unprecedented opportunities for helicopter service providers as European nations accelerate renewable energy development. Planned offshore wind projects across the North Sea, Baltic Sea, and Atlantic regions will require extensive helicopter support for construction, maintenance, and operations. Floating wind technology development opens new market segments in deeper waters previously inaccessible to traditional offshore installations.

Electric helicopter development offers opportunities for operators to reduce operational costs and environmental impact while accessing new market segments. Advanced electric and hybrid helicopter technologies promise lower operating costs, reduced noise levels, and zero-emission operations for shorter offshore missions. Sustainable aviation initiatives create competitive advantages for operators adopting clean technologies.

Service diversification enables helicopter operators to expand beyond traditional transportation services into specialized areas such as offshore survey support, marine research, and environmental monitoring. The growing emphasis on marine ecosystem protection and offshore environmental compliance creates demand for specialized helicopter services. Multi-service integration allows operators to offer comprehensive offshore support packages.

Emerging offshore markets in Southern and Eastern Europe present expansion opportunities as these regions develop offshore energy resources. Countries such as Greece, Italy, and Poland are increasing offshore activities, creating demand for helicopter services. Market penetration in underserved regions offers growth potential for established operators with appropriate resources and capabilities.

Supply and demand equilibrium in the Europe offshore helicopters market reflects the complex interplay between expanding offshore activities and helicopter service capacity. Demand fluctuations correlate closely with offshore energy project timelines, weather patterns, and regulatory changes affecting offshore operations. The market demonstrates cyclical characteristics aligned with energy sector investment cycles and seasonal operational patterns.

Competitive dynamics involve established helicopter operators competing on service quality, safety records, and operational efficiency rather than price alone. Market consolidation trends show larger operators acquiring smaller regional providers to achieve economies of scale and expand geographic coverage. The emphasis on safety and reliability creates barriers to entry while rewarding operators with proven track records.

Technology integration drives market evolution as operators adopt advanced helicopter models, digital flight systems, and predictive maintenance technologies. Innovation cycles in helicopter design and avionics systems create opportunities for operators to differentiate services and improve operational efficiency. The integration of artificial intelligence and machine learning enhances flight planning and maintenance optimization.

Regulatory influence shapes market dynamics through safety requirements, environmental standards, and operational procedures. Policy changes regarding offshore energy development, aviation safety, and environmental protection directly impact helicopter service demand and operational parameters. Harmonization of European aviation regulations facilitates cross-border operations and market integration.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Europe offshore helicopters market. Primary research involves direct engagement with helicopter operators, offshore energy companies, regulatory authorities, and industry associations across European markets. In-depth interviews with key stakeholders provide qualitative insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and government statistics related to offshore activities and helicopter operations. Data triangulation methods verify information accuracy by cross-referencing multiple sources and validating findings through industry expert consultations. Statistical analysis techniques identify market patterns and growth trends.

Market segmentation analysis examines helicopter types, service categories, end-user industries, and geographic regions to provide detailed market insights. Quantitative modeling techniques forecast market growth trajectories based on historical data, current trends, and identified market drivers. Scenario analysis evaluates potential market outcomes under different economic and regulatory conditions.

Industry validation processes involve presenting preliminary findings to industry experts for review and feedback. Peer review mechanisms ensure research quality and accuracy while incorporating diverse perspectives from market participants. Continuous monitoring of market developments enables real-time updates to research findings and market assessments.

United Kingdom maintains the largest share of the European offshore helicopters market, accounting for approximately 35% of regional activity due to extensive North Sea oil and gas operations and growing offshore wind development. Scottish waters host significant offshore energy infrastructure requiring comprehensive helicopter support services. The UK’s mature regulatory framework and established helicopter operator base provide competitive advantages in serving offshore markets.

Norway represents the second-largest market segment with 25% market share, driven by extensive offshore oil and gas operations in the North Sea and Norwegian Sea. Norwegian operators demonstrate advanced safety standards and operational expertise in challenging offshore environments. The country’s focus on offshore wind development and petroleum sector maintenance sustains helicopter service demand.

Netherlands captures approximately 20% market share through strategic positioning as a hub for North Sea offshore operations and growing offshore wind development. Dutch helicopter operators benefit from the country’s central location and advanced aviation infrastructure supporting cross-border offshore operations. The Netherlands’ commitment to offshore wind energy creates sustained growth opportunities.

Denmark holds 15% market share with strong focus on offshore wind energy development and North Sea operations. Danish expertise in offshore wind technology translates into specialized helicopter service requirements for turbine installation and maintenance. The country’s environmental leadership drives adoption of sustainable helicopter technologies and practices.

Other European markets including Germany, France, Italy, and emerging Eastern European countries collectively represent 5% market share with growing potential as offshore activities expand. Regional development in Baltic Sea and Mediterranean offshore projects creates new opportunities for helicopter service providers.

Market leadership in the Europe offshore helicopters sector is characterized by established operators with extensive experience, comprehensive safety records, and advanced helicopter fleets. The competitive environment emphasizes operational excellence, safety performance, and service reliability over price competition alone.

Competitive strategies include fleet modernization, safety system enhancement, service diversification, and geographic expansion. Market differentiation occurs through specialized capabilities, safety records, and operational efficiency rather than price competition. Strategic partnerships between helicopter operators and offshore energy companies create long-term service relationships.

By Helicopter Type:

By Service Type:

By End-User Industry:

By Geographic Region:

Light Helicopter Segment demonstrates steady growth driven by personnel transportation requirements for offshore wind farms and smaller oil and gas installations. These aircraft offer cost-effective solutions for routine crew changes and light cargo transport, with operational efficiency improvements of approximately 15% through advanced avionics systems. The segment benefits from lower operating costs and reduced environmental impact compared to larger aircraft.

Medium Helicopter Category represents the largest market segment due to versatility in serving various offshore applications. These twin-engine helicopters provide optimal balance between payload capacity, range, and operational costs for most offshore operations. Safety enhancements in modern medium helicopters include advanced weather radar, terrain awareness systems, and emergency flotation equipment.

Heavy Helicopter Segment experiences strong demand from offshore wind development projects requiring transportation of large components and equipment. These aircraft enable access to remote offshore locations and support complex installation operations. Technological advancement in heavy helicopter design improves lifting capacity and fuel efficiency for demanding offshore missions.

Personnel Transportation Services maintain consistent demand across all offshore sectors, with crew change operations representing the most frequent helicopter missions. Service reliability and safety performance are critical factors in this segment, with operators investing in advanced scheduling systems and weather monitoring capabilities. Regular personnel transport creates predictable revenue streams for helicopter operators.

Emergency Medical Services segment grows in importance as offshore activities expand and regulatory requirements strengthen. Specialized medical helicopters equipped with advanced life support systems serve offshore installations across European waters. Response time requirements drive strategic positioning of medical helicopters near major offshore activity areas.

Helicopter Operators benefit from expanding market opportunities driven by offshore wind development and sustained oil and gas activities. Revenue diversification across multiple offshore sectors reduces dependence on single industry segments while providing stable income streams. Advanced helicopter technologies enable operators to improve efficiency, reduce costs, and enhance safety performance, creating competitive advantages in the market.

Offshore Energy Companies gain access to reliable transportation and logistics support essential for offshore operations. Helicopter services enable efficient crew changes, equipment transport, and emergency response capabilities that are critical for offshore project success. Specialized helicopter operators provide expertise and resources that offshore companies cannot economically maintain internally.

Equipment Manufacturers benefit from sustained demand for advanced helicopters, avionics systems, and specialized offshore equipment. Technology development opportunities arise from industry requirements for improved safety, efficiency, and environmental performance. The growing offshore helicopter market supports research and development investments in next-generation aircraft technologies.

Regional Economies benefit from helicopter industry employment, infrastructure development, and support services. Economic multiplier effects include maintenance facilities, pilot training centers, and aviation support industries that contribute to regional economic development. Helicopter operations support broader offshore energy sectors that are significant economic contributors.

Safety and Regulatory Authorities benefit from industry investment in advanced safety systems and operational procedures that enhance overall maritime safety. Collaborative relationships between helicopter operators and regulatory agencies improve safety standards and emergency response capabilities across European offshore waters.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable Aviation Transition represents a fundamental trend reshaping the offshore helicopter industry as operators adopt sustainable aviation fuels, electric propulsion systems, and carbon offset programs. Environmental responsibility becomes increasingly important for securing contracts with environmentally conscious offshore energy companies. The trend toward zero-emission aviation drives investment in electric and hydrogen-powered helicopter technologies.

Digital Transformation accelerates across helicopter operations with implementation of advanced flight management systems, predictive maintenance technologies, and real-time operational monitoring. Data analytics enable operators to optimize flight routes, predict maintenance requirements, and improve overall operational efficiency. Digital integration enhances safety through improved weather monitoring and flight planning capabilities.

Service Consolidation trend shows helicopter operators expanding service offerings to provide comprehensive offshore support packages including transportation, maintenance, emergency response, and specialized services. One-stop solutions appeal to offshore energy companies seeking simplified vendor relationships and integrated service delivery. This trend drives market consolidation as operators acquire complementary capabilities.

Safety Technology Integration continues advancing with implementation of artificial intelligence, enhanced vision systems, and automated flight controls designed to improve safety in challenging offshore environments. Predictive safety systems analyze flight data to identify potential risks before they become incidents. Advanced training simulators and virtual reality systems enhance pilot training effectiveness.

Fleet Modernization accelerates as operators replace aging helicopters with advanced aircraft featuring improved fuel efficiency, enhanced safety systems, and reduced maintenance requirements. Next-generation helicopters offer 30-40% improved operational efficiency compared to older aircraft models. Modern avionics and flight systems enable operations in previously challenging weather conditions.

Major fleet expansion announcements from leading helicopter operators reflect confidence in long-term market growth, particularly in offshore wind support services. Investment commitments totaling hundreds of millions of euros demonstrate industry confidence in European offshore helicopter market potential. These expansions focus on acquiring advanced helicopter models optimized for offshore operations.

Strategic partnerships between helicopter operators and offshore wind developers create long-term service agreements supporting project development and operations. Collaborative arrangements provide helicopter operators with revenue certainty while ensuring offshore developers have reliable transportation services. These partnerships often include shared investment in specialized equipment and infrastructure.

Technology partnerships between helicopter manufacturers and operators accelerate development of next-generation aircraft optimized for offshore applications. Joint development programs focus on electric propulsion systems, advanced avionics, and specialized offshore equipment. These collaborations aim to address specific operational challenges in European offshore environments.

Regulatory harmonization initiatives across European aviation authorities streamline operational requirements for cross-border helicopter services. Standardization efforts reduce regulatory complexity while maintaining high safety standards. These developments facilitate market integration and operational efficiency for helicopter operators serving multiple European markets.

Infrastructure investments in helicopter bases, maintenance facilities, and support services expand across European coastal regions to support growing offshore activities. Facility upgrades include advanced maintenance capabilities, fuel storage systems, and emergency response equipment. These investments enhance operational capability and service reliability for offshore helicopter operations.

MarkWide Research analysis indicates helicopter operators should prioritize fleet modernization and service diversification to capitalize on expanding offshore wind opportunities while maintaining traditional oil and gas service capabilities. Strategic recommendations emphasize the importance of investing in advanced helicopter technologies that offer improved fuel efficiency, enhanced safety systems, and reduced environmental impact to meet evolving market requirements.

Market positioning strategies should focus on developing specialized capabilities for offshore wind support services while maintaining core competencies in traditional offshore operations. Service integration opportunities enable operators to provide comprehensive offshore support packages that create competitive advantages and improve customer relationships. Operators should consider strategic partnerships with offshore energy developers to secure long-term service contracts.

Technology adoption priorities include digital flight management systems, predictive maintenance technologies, and sustainable aviation solutions that improve operational efficiency and reduce environmental impact. Investment focus should emphasize technologies that enhance safety performance while reducing operational costs. Early adoption of electric and hybrid helicopter technologies may provide competitive advantages as these systems mature.

Geographic expansion strategies should consider emerging offshore markets in Southern and Eastern Europe where offshore energy development is accelerating. Market entry approaches should leverage existing European operations and regulatory expertise while adapting to local market requirements. Strategic acquisitions of regional operators may provide efficient market access and local expertise.

Regulatory compliance strategies must anticipate evolving safety and environmental requirements while maintaining operational flexibility. Proactive engagement with regulatory authorities and industry associations helps shape regulatory development while ensuring compliance readiness. Investment in safety management systems and environmental technologies supports regulatory compliance and market competitiveness.

Long-term growth prospects for the Europe offshore helicopters market remain highly positive, driven by accelerating offshore wind development and sustained offshore energy activities. Market expansion is expected to continue at a robust pace of 5-7% annually through the next decade as European nations advance renewable energy goals and maintain offshore infrastructure investments. The transition toward sustainable energy sources creates fundamental demand drivers that support sustained market growth.

Technology evolution will significantly impact market dynamics as electric and hybrid helicopter technologies mature and become commercially viable for offshore operations. Sustainable aviation solutions are projected to capture increasing market share as environmental regulations strengthen and operational costs decrease. Advanced automation and artificial intelligence integration will enhance safety and operational efficiency while reducing pilot workload in challenging offshore environments.

Market structure evolution indicates continued consolidation as operators seek economies of scale and comprehensive service capabilities. Strategic partnerships between helicopter operators and offshore energy companies will become more prevalent, creating integrated service delivery models. The emphasis on safety, reliability, and environmental performance will favor established operators with proven track records and advanced capabilities.

Regional development patterns suggest expansion of offshore helicopter services into previously underserved European markets as offshore energy development spreads beyond traditional North Sea operations. MWR projections indicate emerging markets in the Baltic Sea, Mediterranean, and Atlantic regions will contribute increasing proportions of total European offshore helicopter activity. This geographic diversification will create new opportunities while reducing dependence on traditional offshore energy regions.

Innovation drivers including digitalization, sustainability, and safety enhancement will continue shaping market evolution. Investment priorities will focus on technologies that improve operational efficiency, reduce environmental impact, and enhance safety performance. The integration of renewable energy support services with traditional offshore operations will create comprehensive service platforms serving diverse offshore energy sectors.

The Europe offshore helicopters market stands at a pivotal transformation point, driven by the continent’s ambitious renewable energy transition and sustained offshore energy activities. Market fundamentals demonstrate strong growth potential supported by expanding offshore wind development, technological advancement, and comprehensive regulatory frameworks that prioritize safety and environmental responsibility. The sector’s evolution from traditional oil and gas support toward integrated offshore energy services reflects broader energy industry transformation.

Strategic opportunities abound for helicopter operators willing to invest in advanced technologies, service diversification, and geographic expansion. The emphasis on sustainability, safety, and operational efficiency creates competitive advantages for operators adopting next-generation helicopter technologies and comprehensive service delivery models. Market leaders will be those organizations that successfully balance traditional offshore capabilities with emerging renewable energy requirements while maintaining exceptional safety standards.

Future success in the European offshore helicopters market will depend on operators’ ability to adapt to evolving customer requirements, regulatory changes, and technological advancement while maintaining operational excellence in challenging offshore environments. The market’s long-term prospects remain highly favorable, supported by fundamental drivers that ensure sustained demand for specialized helicopter services across European offshore waters. Industry participants positioned to capitalize on these opportunities through strategic investment and operational excellence will benefit from the market’s continued expansion and evolution.

What is Offshore Helicopters?

Offshore helicopters are specialized aircraft designed for transporting personnel and cargo to and from offshore facilities, such as oil rigs and wind farms. They play a crucial role in the energy sector, ensuring safe and efficient access to remote locations.

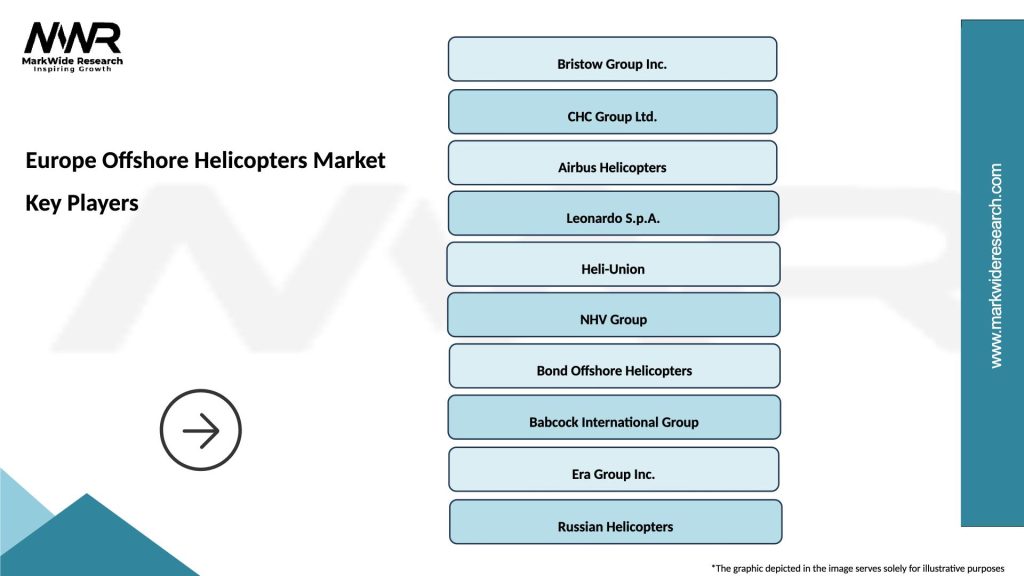

What are the key players in the Europe Offshore Helicopters Market?

Key players in the Europe Offshore Helicopters Market include companies like Bristow Group, CHC Helicopter, and Babcock International. These companies provide a range of services, including crew transportation and emergency medical services, among others.

What are the growth factors driving the Europe Offshore Helicopters Market?

The Europe Offshore Helicopters Market is driven by the increasing demand for energy resources, particularly in the oil and gas sector, and the expansion of offshore wind farms. Additionally, advancements in helicopter technology and safety features are contributing to market growth.

What challenges does the Europe Offshore Helicopters Market face?

The Europe Offshore Helicopters Market faces challenges such as high operational costs and regulatory compliance issues. Additionally, fluctuations in oil prices can impact demand for offshore transportation services.

What opportunities exist in the Europe Offshore Helicopters Market?

Opportunities in the Europe Offshore Helicopters Market include the growing investment in renewable energy projects and the potential for technological innovations in helicopter design. These factors may lead to increased demand for offshore transportation services.

What trends are shaping the Europe Offshore Helicopters Market?

Trends in the Europe Offshore Helicopters Market include the adoption of more fuel-efficient helicopters and the integration of advanced navigation systems. Additionally, there is a growing focus on sustainability and reducing the environmental impact of offshore operations.

Europe Offshore Helicopters Market

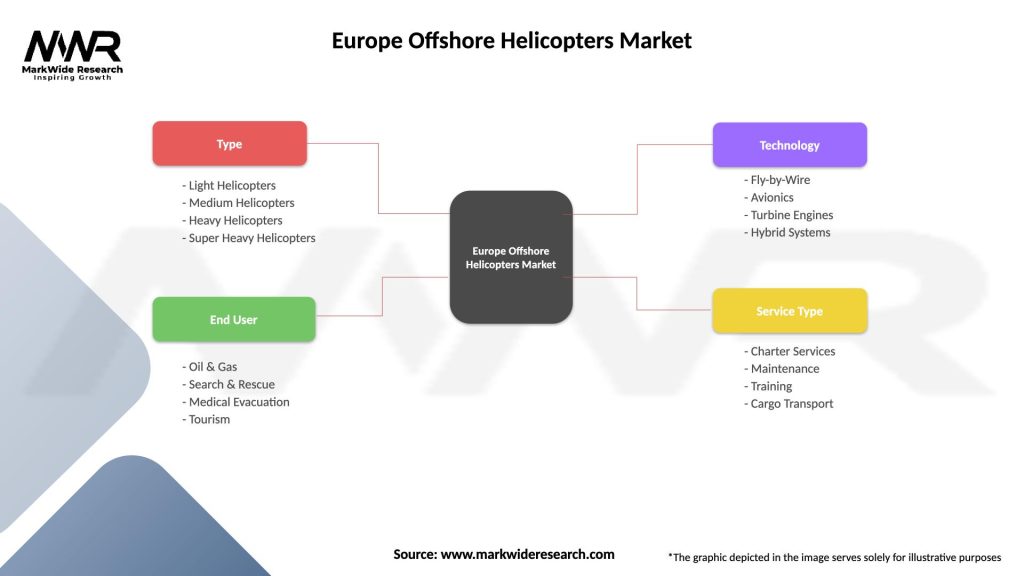

| Segmentation Details | Description |

|---|---|

| Type | Light Helicopters, Medium Helicopters, Heavy Helicopters, Super Heavy Helicopters |

| End User | Oil & Gas, Search & Rescue, Medical Evacuation, Tourism |

| Technology | Fly-by-Wire, Avionics, Turbine Engines, Hybrid Systems |

| Service Type | Charter Services, Maintenance, Training, Cargo Transport |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Offshore Helicopters Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at