444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific fingerprint sensors market represents one of the most dynamic and rapidly evolving segments within the global biometric technology landscape. This region has emerged as a powerhouse for fingerprint sensor adoption, driven by increasing security concerns, widespread smartphone penetration, and growing government initiatives for digital identity verification. The market encompasses various technologies including capacitive, optical, thermal, and ultrasonic fingerprint sensors across multiple applications ranging from consumer electronics to access control systems.

Market dynamics in the Asia Pacific region are characterized by robust growth patterns, with the fingerprint sensors market experiencing a compound annual growth rate (CAGR) of 12.8% over the forecast period. This growth trajectory is supported by the region’s massive consumer base, rapid technological advancement, and increasing adoption of biometric authentication across various sectors. Countries like China, India, Japan, and South Korea are leading the charge in fingerprint sensor integration, particularly in smartphones, tablets, and security applications.

Regional adoption patterns reveal significant variations across different Asia Pacific markets, with developed economies focusing on advanced sensor technologies while emerging markets prioritize cost-effective solutions. The integration of fingerprint sensors in government identification programs, banking applications, and consumer devices has created a multi-billion-dollar ecosystem that continues to expand rapidly across the region.

The Asia Pacific fingerprint sensors market refers to the comprehensive ecosystem of biometric sensing technologies, devices, and solutions specifically designed to capture, analyze, and authenticate human fingerprint patterns across the Asia Pacific geographical region. These sensors utilize various technological approaches including capacitive sensing, optical imaging, thermal detection, and ultrasonic scanning to create unique digital representations of fingerprint ridges and valleys for identity verification purposes.

Fingerprint sensor technology encompasses both hardware components and software algorithms that work together to provide secure authentication solutions. The market includes standalone sensor modules, integrated sensor systems, and complete biometric authentication platforms designed for diverse applications ranging from smartphone unlocking to high-security access control systems. This technology has become fundamental to modern security infrastructure across the Asia Pacific region.

Market scope extends beyond traditional security applications to include emerging use cases in healthcare, automotive, smart home systems, and Internet of Things (IoT) devices. The definition encompasses all forms of fingerprint sensing technology deployed across consumer, commercial, and government sectors throughout the Asia Pacific region, representing a critical component of the broader digital transformation landscape.

Strategic market positioning of fingerprint sensors in the Asia Pacific region reflects a mature yet rapidly evolving landscape characterized by intense competition, technological innovation, and diverse application scenarios. The market has transitioned from niche security applications to mainstream consumer adoption, with smartphone integration representing the largest volume segment while specialized security applications command premium pricing.

Key growth drivers include the region’s massive smartphone market, government digitization initiatives, increasing cybersecurity awareness, and the growing adoption of contactless authentication solutions. The COVID-19 pandemic has accelerated demand for touchless biometric solutions, creating new opportunities for advanced fingerprint sensor technologies that can operate effectively in hygiene-conscious environments.

Market segmentation reveals distinct patterns across technology types, with capacitive sensors dominating the consumer electronics segment while optical sensors maintain strong positions in access control and time attendance applications. The competitive landscape features both established global players and emerging regional manufacturers, creating a dynamic ecosystem that drives continuous innovation and cost optimization.

Regional leadership is distributed across multiple countries, with China leading in manufacturing volume, South Korea excelling in advanced sensor technology development, Japan focusing on precision applications, and India emerging as a significant market for cost-effective solutions. This distributed leadership creates opportunities for specialized market positioning and technological differentiation.

Technology evolution in the Asia Pacific fingerprint sensors market demonstrates several critical insights that shape current and future market dynamics:

Smartphone proliferation serves as the primary catalyst for fingerprint sensor adoption across the Asia Pacific region. The massive smartphone user base, exceeding two billion devices, creates unprecedented demand for convenient and secure authentication solutions. Manufacturers continue to integrate advanced fingerprint sensors as standard features, driving volume growth and technological advancement throughout the supply chain.

Government digitization initiatives represent another significant driver, with multiple countries implementing comprehensive biometric identification programs. These initiatives require millions of fingerprint sensors for enrollment stations, verification terminals, and mobile authentication devices. The scale of these programs creates substantial market opportunities while driving standardization and interoperability requirements.

Security consciousness among consumers and enterprises has increased dramatically, particularly following high-profile data breaches and identity theft incidents. This heightened awareness drives demand for robust authentication solutions that can replace traditional password-based systems with more secure biometric alternatives. Financial institutions, healthcare providers, and government agencies are leading this adoption trend.

Technological advancement in sensor miniaturization, power efficiency, and processing capabilities enables new application scenarios previously considered impractical. Advanced sensors can now operate effectively in challenging environments while consuming minimal power, making them suitable for battery-powered devices and always-on authentication systems.

Cost reduction trends have made fingerprint sensors accessible to broader market segments, including mid-range smartphones, entry-level security systems, and consumer IoT devices. Manufacturing scale economies and technological improvements continue to drive costs lower while maintaining or improving performance characteristics.

Privacy concerns represent a significant challenge for fingerprint sensor adoption, particularly in markets with strong data protection regulations and consumer privacy awareness. Users express concerns about biometric data storage, potential misuse, and the irreversible nature of compromised biometric information. These concerns can slow adoption rates and require additional security measures that increase implementation costs.

Technical limitations of current fingerprint sensor technologies create barriers in certain applications and environments. Factors such as finger moisture, skin conditions, age-related changes, and environmental conditions can affect sensor reliability and user experience. These limitations require backup authentication methods and can impact user satisfaction in critical applications.

Regulatory complexity across different Asia Pacific markets creates challenges for manufacturers and solution providers. Varying standards, certification requirements, and data protection regulations require significant compliance investments and can delay market entry for new products and technologies.

Competition intensity in the fingerprint sensor market has led to aggressive pricing pressures that can impact profitability and limit investment in research and development. The commoditization of basic sensor technologies forces companies to differentiate through advanced features or specialized applications, increasing development costs and market complexity.

Integration challenges with existing systems and infrastructure can create barriers to adoption, particularly in enterprise and government applications. Legacy system compatibility, software integration requirements, and user training needs can extend implementation timelines and increase total cost of ownership.

Emerging application sectors present substantial growth opportunities for fingerprint sensor manufacturers and solution providers. The automotive industry is increasingly adopting biometric authentication for vehicle access, ignition systems, and personalized settings. Healthcare applications including patient identification, medication dispensing, and medical record access create new market segments with specific requirements and premium pricing potential.

Internet of Things integration offers vast opportunities as smart home devices, industrial equipment, and consumer electronics incorporate fingerprint authentication. The growing IoT ecosystem requires secure, convenient authentication methods that can operate reliably in diverse environments while maintaining low power consumption and cost-effectiveness.

Advanced sensor technologies including ultrasonic, optical, and multi-modal biometric sensors create opportunities for premium positioning and differentiation. These technologies address limitations of traditional capacitive sensors while enabling new applications in challenging environments or high-security scenarios.

Government modernization programs across the Asia Pacific region continue to create substantial procurement opportunities for fingerprint sensor systems. Digital identity initiatives, border control modernization, and law enforcement technology upgrades require large-scale sensor deployments with long-term support and maintenance contracts.

Financial services digitization drives demand for secure authentication solutions that can support mobile banking, digital payments, and customer onboarding processes. The growing fintech sector requires scalable, reliable biometric solutions that can handle high transaction volumes while maintaining security and regulatory compliance.

Competitive dynamics in the Asia Pacific fingerprint sensors market are characterized by intense rivalry among established global players and emerging regional manufacturers. Market leaders focus on technological innovation, manufacturing efficiency, and strategic partnerships to maintain competitive advantages. The dynamic nature of the market requires continuous investment in research and development while managing cost pressures from commoditization trends.

Supply chain evolution reflects the region’s manufacturing dominance, with integrated supply chains spanning component production, sensor assembly, and system integration. This concentration creates both advantages in terms of cost efficiency and risks related to supply chain disruption. Companies are increasingly diversifying their supply sources and developing regional manufacturing capabilities to mitigate these risks.

Technology convergence trends are reshaping market dynamics as fingerprint sensors integrate with other biometric modalities, artificial intelligence capabilities, and edge computing technologies. This convergence creates opportunities for system-level solutions while requiring broader technical expertise and increased development investments.

Customer expectations continue to evolve, demanding higher performance, better user experience, and enhanced security features. According to MarkWide Research analysis, user satisfaction metrics show increasing expectations for sub-second authentication times and 99.9% accuracy rates across diverse operating conditions. These expectations drive continuous improvement in sensor design and algorithm development.

Market consolidation trends are evident as larger companies acquire specialized technology providers and smaller manufacturers seek partnerships with established players. This consolidation creates opportunities for scale economies while potentially reducing innovation diversity in the long term.

Comprehensive market analysis for the Asia Pacific fingerprint sensors market employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. The research approach combines quantitative data collection with qualitative analysis to provide a complete understanding of market dynamics, competitive landscape, and future trends.

Primary research activities include extensive interviews with industry executives, technology developers, system integrators, and end-users across major Asia Pacific markets. These interviews provide insights into market trends, technology preferences, adoption barriers, and future requirements that cannot be captured through secondary sources alone.

Secondary research encompasses analysis of company financial reports, patent filings, government procurement data, trade statistics, and industry publications. This data provides quantitative foundations for market sizing, growth projections, and competitive analysis while identifying emerging trends and technology developments.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop accurate market forecasts and identify key growth drivers. The modeling approach considers multiple variables including economic conditions, technology adoption rates, regulatory changes, and competitive dynamics.

Data validation processes ensure research accuracy through triangulation of multiple sources, expert review panels, and continuous monitoring of market developments. This validation approach helps identify and correct potential biases while maintaining research objectivity and reliability.

China dominates the Asia Pacific fingerprint sensors market with 45% regional market share, driven by massive smartphone production, government digitization initiatives, and growing security consciousness among consumers and enterprises. The country’s manufacturing ecosystem supports both high-volume consumer applications and specialized security solutions, creating a comprehensive market environment.

India represents the fastest-growing market segment with 18.5% annual growth rate, fueled by the world’s largest biometric identification program, increasing smartphone adoption, and growing digital payment systems. The market emphasizes cost-effective solutions while gradually adopting more advanced sensor technologies for premium applications.

Japan maintains a 15% market share with focus on precision applications, advanced sensor technologies, and integration with robotics and automation systems. The market is characterized by high-quality requirements, premium pricing, and strong emphasis on reliability and durability in industrial and commercial applications.

South Korea accounts for 12% of regional demand, driven by advanced smartphone technologies, government e-governance initiatives, and strong consumer electronics manufacturing base. The market leads in technological innovation, particularly in ultrasonic and advanced capacitive sensor technologies.

Southeast Asian markets collectively represent 20% market share, with rapid growth in countries like Thailand, Malaysia, Singapore, and Vietnam. These markets focus on cost-effective solutions for consumer electronics while gradually adopting advanced sensors for government and commercial applications.

Australia and New Zealand comprise the remaining 8% market share, emphasizing high-security applications, government compliance requirements, and premium consumer electronics. These markets prioritize advanced features, privacy protection, and integration with existing security infrastructure.

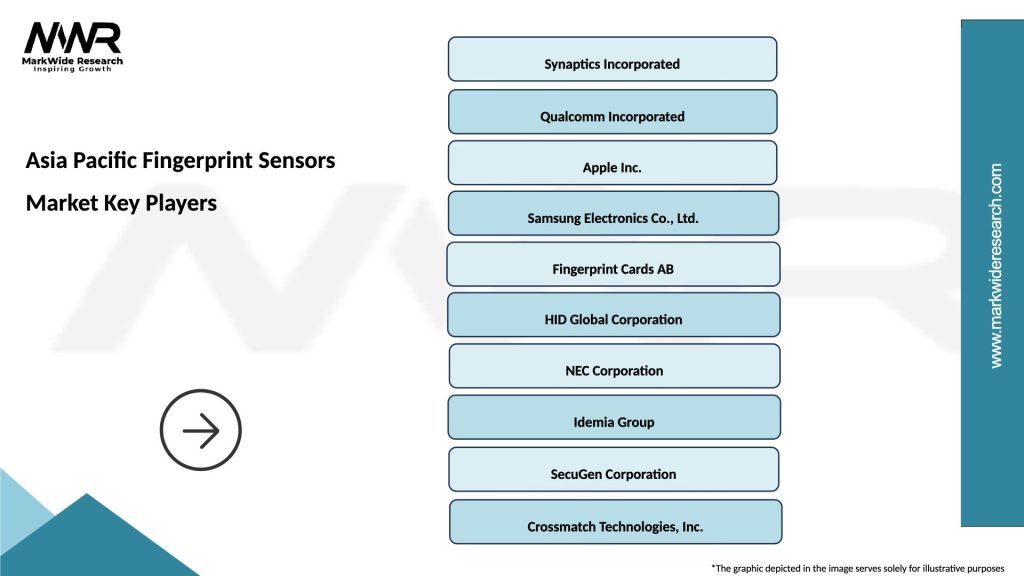

Market leadership in the Asia Pacific fingerprint sensors market is distributed among several key players, each with distinct competitive advantages and market positioning strategies:

Competitive strategies focus on technological differentiation, cost optimization, strategic partnerships, and vertical integration. Companies are investing heavily in research and development to address emerging requirements for enhanced security, improved user experience, and new application scenarios.

By Technology:

By Application:

By End User:

Consumer Electronics Category dominates the Asia Pacific fingerprint sensors market, driven by smartphone integration and expanding adoption in laptops, tablets, and wearable devices. This category emphasizes cost optimization, miniaturization, and power efficiency while maintaining acceptable performance levels. The integration of fingerprint sensors has become a standard feature across device categories, creating substantial volume opportunities.

Security and Access Control represents a mature but stable market segment with emphasis on reliability, durability, and advanced security features. This category requires sensors capable of operating in diverse environmental conditions while providing consistent performance over extended periods. Premium pricing is supported by specialized requirements and lower volume production.

Government and Public Sector applications create significant opportunities for large-scale deployments with specific compliance and security requirements. This category often requires customized solutions, extensive testing, and long-term support commitments. The procurement processes are typically complex but result in substantial contract values and stable revenue streams.

Financial Services category focuses on high-security applications with stringent authentication requirements and regulatory compliance needs. This segment values advanced anti-spoofing capabilities, high accuracy rates, and integration with existing banking infrastructure. The category supports premium pricing due to security criticality and compliance requirements.

Healthcare Applications represent an emerging category with unique requirements for hygiene, reliability, and patient safety. This segment requires sensors that can operate effectively in clinical environments while meeting medical device regulations and privacy requirements. The category offers growth potential as healthcare digitization accelerates.

For Manufacturers:

For System Integrators:

For End Users:

Strengths:

Weaknesses:

Opportunities:

Threats:

Under-display Integration represents a major trend in smartphone fingerprint sensors, with manufacturers developing technologies that can operate through OLED displays without compromising screen real estate. This trend requires advanced optical and ultrasonic sensor technologies capable of penetrating display layers while maintaining accuracy and speed.

Multi-modal Biometrics is gaining traction as organizations seek enhanced security through combination of fingerprint sensors with facial recognition, iris scanning, or voice authentication. This trend creates opportunities for integrated sensor solutions and sophisticated authentication algorithms that can leverage multiple biometric modalities.

Edge Computing Integration enables fingerprint sensors to perform local processing and authentication without relying on cloud connectivity. This trend addresses privacy concerns while improving response times and reducing bandwidth requirements for biometric systems.

Contactless Authentication has accelerated due to hygiene concerns, driving development of sensors that can capture fingerprint data without direct contact. This trend requires advanced imaging technologies and sophisticated algorithms to maintain accuracy while enabling touchless operation.

Artificial Intelligence Enhancement is being integrated into fingerprint sensor systems to improve accuracy, reduce false positives, and adapt to changing user characteristics over time. MWR data indicates that AI-enhanced sensors demonstrate 25% improvement in accuracy rates compared to traditional algorithms.

Miniaturization Advancement continues as manufacturers develop smaller, thinner sensors suitable for wearable devices, smart cards, and IoT applications. This trend enables new application scenarios while maintaining or improving performance characteristics.

Technology Partnerships between sensor manufacturers and smartphone brands have intensified, with companies forming strategic alliances to develop customized solutions for specific device requirements. These partnerships enable closer integration between hardware and software while accelerating time-to-market for new technologies.

Manufacturing Capacity Expansion across the Asia Pacific region reflects growing demand and supply chain localization trends. Major manufacturers are investing in new production facilities and advanced manufacturing equipment to meet increasing volume requirements while improving cost efficiency.

Standards Development initiatives are progressing to establish common specifications for fingerprint sensor performance, security, and interoperability. Industry organizations and government agencies are collaborating to develop standards that facilitate broader adoption while ensuring security and privacy protection.

Acquisition Activities have increased as larger companies seek to acquire specialized technologies, intellectual property, and market access. These acquisitions enable rapid capability expansion while consolidating the competitive landscape around key technology platforms.

Government Procurement Programs continue to drive large-scale deployments across multiple countries, with national identification systems, border control modernization, and law enforcement technology upgrades creating substantial market opportunities for fingerprint sensor providers.

Research and Development Investments in next-generation sensor technologies are accelerating, with companies focusing on ultrasonic sensors, advanced materials, and novel sensing approaches that can address current technology limitations while enabling new applications.

Technology Investment Priorities should focus on developing sensors capable of operating effectively in challenging conditions while maintaining high accuracy and user experience standards. Companies should prioritize research into advanced materials, novel sensing approaches, and AI-enhanced algorithms that can differentiate their offerings in competitive markets.

Market Diversification Strategies are essential for reducing dependency on smartphone applications and creating more stable revenue streams. Companies should explore opportunities in automotive, healthcare, IoT, and industrial applications where specialized requirements can support premium pricing and longer product lifecycles.

Partnership Development with system integrators, software developers, and end-user organizations can accelerate market penetration while reducing go-to-market costs. Strategic partnerships enable access to specialized expertise, customer relationships, and distribution channels that would be difficult to develop independently.

Regulatory Compliance Planning should be integrated into product development processes to ensure solutions can meet evolving privacy and security requirements across different markets. Companies should invest in compliance expertise and develop products with built-in privacy protection and data security features.

Supply Chain Resilience initiatives are critical for managing risks associated with component availability, cost volatility, and geopolitical tensions. Companies should diversify supplier bases, develop alternative sourcing strategies, and invest in supply chain visibility and management capabilities.

Customer Experience Focus should drive product development decisions, with emphasis on authentication speed, accuracy, and reliability across diverse user scenarios. Companies should invest in user research, usability testing, and continuous improvement processes to maintain competitive advantages in user experience.

Market evolution in the Asia Pacific fingerprint sensors market points toward continued growth driven by expanding applications, technological advancement, and increasing security requirements. The market is expected to maintain robust growth rates as fingerprint sensors become integral components of digital infrastructure across consumer, commercial, and government sectors.

Technology roadmap indicates significant advancement in sensor capabilities, with next-generation technologies offering improved performance, enhanced security features, and new application possibilities. According to MarkWide Research projections, advanced sensor technologies will achieve 95% accuracy rates in challenging conditions while reducing power consumption by 30% over the next five years.

Application expansion will drive market growth as fingerprint sensors integrate into new device categories and use cases. The automotive sector is expected to become a significant growth driver, with biometric authentication for vehicle access, personalization, and security systems. Healthcare applications will expand as patient identification and medication management systems adopt biometric technologies.

Geographic distribution of market growth will shift as emerging economies increase adoption rates while developed markets focus on advanced applications and premium technologies. India and Southeast Asian countries are expected to drive volume growth, while Japan and South Korea will lead in technology innovation and premium applications.

Competitive landscape evolution will likely result in further consolidation as companies seek scale advantages and technological capabilities. Strategic partnerships and acquisitions will reshape the market structure while driving innovation and cost optimization across the industry.

Regulatory environment development will continue to influence market dynamics, with privacy protection requirements and security standards shaping product development and market adoption patterns. Companies that proactively address regulatory requirements will gain competitive advantages in compliance-sensitive markets.

The Asia Pacific fingerprint sensors market represents a dynamic and rapidly evolving ecosystem that combines massive scale opportunities with intense competitive pressures and continuous technological advancement. The region’s dominance in manufacturing, combined with diverse application requirements and varying market maturity levels, creates a complex but rewarding market environment for industry participants.

Key success factors for companies operating in this market include technological innovation, cost competitiveness, strategic partnerships, and the ability to adapt to diverse regional requirements. The market rewards companies that can balance volume production capabilities with specialized technology development while maintaining high quality and reliability standards.

Future growth prospects remain strong despite challenges related to privacy concerns, regulatory complexity, and competitive intensity. The expanding application landscape, continued government digitization initiatives, and growing security consciousness create sustainable demand drivers that support long-term market growth.

Strategic positioning in the Asia Pacific fingerprint sensors market requires careful consideration of technology choices, target applications, and regional focus areas. Companies must balance the opportunities presented by high-volume consumer applications with the premium pricing potential of specialized security and government applications.

Market participants who successfully navigate the complexities of this market while delivering innovative, cost-effective solutions will be well-positioned to capitalize on the substantial growth opportunities that lie ahead in the Asia Pacific fingerprint sensors market.

What is Fingerprint Sensors?

Fingerprint sensors are biometric devices that capture and analyze the unique patterns of an individual’s fingerprints for identification and authentication purposes. They are widely used in security systems, mobile devices, and access control applications.

What are the key players in the Asia Pacific Fingerprint Sensors Market?

Key players in the Asia Pacific Fingerprint Sensors Market include companies like Synaptics, Fingerprint Cards AB, and NEC Corporation, which are known for their innovative biometric solutions and technologies, among others.

What are the growth factors driving the Asia Pacific Fingerprint Sensors Market?

The growth of the Asia Pacific Fingerprint Sensors Market is driven by increasing demand for secure authentication methods, rising adoption of biometric systems in smartphones, and the expansion of smart home technologies.

What challenges does the Asia Pacific Fingerprint Sensors Market face?

Challenges in the Asia Pacific Fingerprint Sensors Market include concerns over data privacy and security, the high cost of advanced biometric systems, and the potential for false acceptance or rejection rates in fingerprint recognition.

What opportunities exist in the Asia Pacific Fingerprint Sensors Market?

Opportunities in the Asia Pacific Fingerprint Sensors Market include the integration of fingerprint sensors in emerging technologies such as IoT devices, advancements in artificial intelligence for improved accuracy, and the growing trend of contactless payment systems.

What trends are shaping the Asia Pacific Fingerprint Sensors Market?

Trends in the Asia Pacific Fingerprint Sensors Market include the development of under-display fingerprint sensors for smartphones, the increasing use of multi-modal biometric systems, and the rising focus on enhancing user experience through faster and more reliable authentication methods.

Asia Pacific Fingerprint Sensors Market

| Segmentation Details | Description |

|---|---|

| Product Type | Optical Sensors, Capacitive Sensors, Ultrasonic Sensors, Thermal Sensors |

| Technology | 2D Imaging, 3D Imaging, Multispectral Imaging, Liveness Detection |

| End User | Consumer Electronics, Banking, Government, Healthcare |

| Application | Access Control, Time & Attendance, Mobile Payments, Identity Verification |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Fingerprint Sensors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at