444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific chemical sensors market represents one of the most dynamic and rapidly expanding segments within the global sensor technology landscape. This region has emerged as a powerhouse for sensor manufacturing and deployment, driven by robust industrialization, stringent environmental regulations, and increasing safety consciousness across various sectors. The market encompasses a diverse range of chemical sensing technologies designed to detect, measure, and monitor chemical compounds in industrial, environmental, and consumer applications.

Market growth in the Asia Pacific region is being propelled by significant investments in smart manufacturing, environmental monitoring systems, and safety infrastructure. Countries like China, Japan, South Korea, and India are leading the charge with substantial adoption rates across automotive, healthcare, food processing, and petrochemical industries. The region’s chemical sensors market is experiencing a compound annual growth rate (CAGR) of 8.2%, reflecting the strong demand for advanced sensing solutions.

Technological advancement and manufacturing capabilities in the region have positioned Asia Pacific as both a major producer and consumer of chemical sensors. The integration of Internet of Things (IoT) technologies, artificial intelligence, and wireless communication systems has enhanced the functionality and appeal of modern chemical sensors, creating new opportunities for market expansion and innovation.

The Asia Pacific chemical sensors market refers to the comprehensive ecosystem of devices, technologies, and solutions designed to detect, identify, and quantify chemical substances across various applications within the Asia Pacific geographical region. These sophisticated sensing devices convert chemical information into measurable signals, enabling real-time monitoring and analysis of chemical compositions in gases, liquids, and solid materials.

Chemical sensors in this market context encompass electrochemical sensors, optical sensors, semiconductor sensors, and biosensors that serve critical functions in industrial process control, environmental monitoring, healthcare diagnostics, and safety applications. The market includes both hardware components and integrated software solutions that enable data collection, analysis, and decision-making based on chemical detection capabilities.

Regional significance of this market extends beyond mere geographical boundaries, representing a convergence of advanced manufacturing capabilities, technological innovation, and diverse application requirements that characterize the Asia Pacific region’s industrial and economic landscape.

Strategic positioning of the Asia Pacific chemical sensors market reflects the region’s emergence as a global leader in sensor technology adoption and manufacturing excellence. The market demonstrates exceptional growth potential driven by increasing industrial automation, environmental consciousness, and regulatory compliance requirements across multiple sectors.

Key market drivers include rapid industrialization, growing environmental monitoring needs, and expanding applications in healthcare and food safety. The automotive sector alone accounts for approximately 28% of market demand, while environmental monitoring applications represent 22% of total market share. Manufacturing and process industries contribute significantly to market growth through increased adoption of smart sensing technologies.

Technological innovation continues to reshape market dynamics, with wireless sensor networks, miniaturization, and enhanced sensitivity driving new application possibilities. The integration of artificial intelligence and machine learning capabilities has improved sensor accuracy and predictive maintenance capabilities, creating additional value propositions for end users.

Regional leadership is evident through substantial investments in research and development, manufacturing infrastructure, and talent development programs that support continued market expansion and technological advancement across the Asia Pacific region.

Market dynamics in the Asia Pacific chemical sensors sector reveal several critical insights that shape industry development and strategic planning:

Industrial modernization across the Asia Pacific region serves as the primary catalyst for chemical sensor market expansion. Manufacturing facilities are increasingly adopting automated monitoring systems to ensure product quality, worker safety, and environmental compliance. The transition toward smart manufacturing creates substantial demand for integrated sensor solutions that provide real-time chemical analysis and process optimization capabilities.

Environmental regulations implemented by governments throughout the region mandate continuous monitoring of air quality, water pollution, and industrial emissions. These regulatory requirements create consistent demand for sophisticated chemical sensors capable of detecting trace amounts of pollutants and hazardous substances. Countries like China and India have implemented comprehensive environmental monitoring programs that rely heavily on advanced sensor technologies.

Healthcare sector growth drives significant demand for medical-grade chemical sensors used in diagnostic equipment, patient monitoring systems, and laboratory analysis. The aging population across developed Asia Pacific countries increases the need for continuous health monitoring solutions, while emerging economies invest in healthcare infrastructure development that incorporates modern sensing technologies.

Safety consciousness in industrial and commercial applications has elevated the importance of chemical sensors for detecting hazardous gases, toxic substances, and explosive materials. Workplace safety regulations and insurance requirements mandate the installation of comprehensive chemical monitoring systems across various industries.

High implementation costs associated with advanced chemical sensor systems present significant barriers for small and medium-sized enterprises across the region. The initial investment required for comprehensive sensor networks, including installation, calibration, and maintenance, can be prohibitive for organizations with limited capital resources. This cost factor particularly affects adoption rates in developing economies where budget constraints limit technology investments.

Technical complexity of modern chemical sensors requires specialized expertise for proper installation, operation, and maintenance. The shortage of skilled technicians and engineers familiar with advanced sensor technologies creates implementation challenges and increases operational costs. Training requirements and ongoing technical support needs can deter potential adopters from investing in sophisticated sensor solutions.

Calibration and maintenance requirements for chemical sensors demand regular attention and specialized procedures to ensure accurate performance. Sensor drift, environmental interference, and component degradation necessitate ongoing maintenance programs that add to total ownership costs. These operational requirements can be particularly challenging in remote locations or harsh industrial environments.

Standardization challenges across different countries and applications create compatibility issues and limit interoperability between sensor systems from different manufacturers. The lack of unified standards can complicate system integration and increase complexity for organizations operating across multiple jurisdictions within the Asia Pacific region.

Smart city initiatives across major Asia Pacific metropolitan areas create substantial opportunities for chemical sensor deployment in urban environmental monitoring, traffic management, and public safety applications. Cities like Singapore, Seoul, and Tokyo are implementing comprehensive sensor networks that monitor air quality, detect hazardous materials, and support emergency response systems.

Internet of Things integration opens new possibilities for wireless chemical sensor networks that provide real-time data collection and analysis capabilities. The convergence of sensor technology with IoT platforms enables remote monitoring, predictive maintenance, and automated response systems that enhance operational efficiency and reduce costs.

Emerging applications in agriculture, aquaculture, and food processing create new market segments for specialized chemical sensors. Precision agriculture techniques require soil chemistry monitoring, while aquaculture operations need water quality sensors to optimize production and ensure product safety. Food processing facilities increasingly rely on chemical sensors for quality control and contamination detection.

Miniaturization trends enable integration of chemical sensors into consumer electronics, wearable devices, and portable equipment. This technological advancement opens opportunities for mass market applications that were previously limited by size and power consumption constraints.

Supply chain evolution in the Asia Pacific chemical sensors market reflects the region’s manufacturing strengths and technological capabilities. Local production facilities have reduced dependence on imports while improving cost competitiveness and delivery times. The establishment of regional supply chains has enhanced market responsiveness and enabled customization for specific regional requirements.

Technology transfer and collaboration between international companies and regional manufacturers have accelerated innovation and market development. Joint ventures, licensing agreements, and research partnerships have facilitated knowledge sharing and technological advancement throughout the region. This collaborative approach has strengthened local capabilities while maintaining access to global expertise.

Market consolidation trends show increasing cooperation between sensor manufacturers, system integrators, and end-user industries. Strategic partnerships and vertical integration initiatives are creating more comprehensive solution offerings that address complete application requirements rather than individual component needs.

Competitive dynamics continue to evolve as new entrants challenge established players through innovative technologies, competitive pricing, and specialized application focus. The market demonstrates healthy competition that drives continuous improvement and innovation while maintaining reasonable pricing levels for end users.

Comprehensive market analysis for the Asia Pacific chemical sensors market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves direct engagement with industry participants, including manufacturers, distributors, system integrators, and end users across various application sectors and geographical regions.

Data collection methods include structured interviews with industry executives, technical experts, and procurement professionals to gather insights on market trends, technology developments, and purchasing decisions. Survey methodologies capture quantitative data on market size, growth rates, and competitive positioning from representative sample groups across different market segments.

Secondary research incorporates analysis of industry reports, government publications, trade association data, and company financial statements to validate primary research findings and provide comprehensive market context. Technical literature review ensures understanding of emerging technologies and their potential market impact.

Market modeling techniques combine quantitative analysis with qualitative insights to develop accurate market projections and identify growth opportunities. Statistical analysis methods validate data consistency and reliability while scenario planning explores potential market development paths under different economic and technological conditions.

China dominates the Asia Pacific chemical sensors market with approximately 42% market share, driven by massive industrial production, environmental monitoring requirements, and government initiatives supporting sensor technology adoption. The country’s manufacturing sector creates substantial demand for process monitoring and quality control applications, while environmental regulations mandate extensive pollution monitoring systems.

Japan maintains a strong position with 18% market share, leveraging advanced technology capabilities and high-quality manufacturing standards. Japanese companies excel in automotive sensor applications and precision instrumentation, while the country’s aging population drives healthcare sensor demand. Industrial automation and robotics applications create additional market opportunities.

South Korea accounts for 12% of regional market share, with significant strength in semiconductor manufacturing, automotive production, and consumer electronics. The country’s focus on technological innovation and smart manufacturing creates demand for advanced chemical sensing solutions across multiple industries.

India represents 11% market share with rapid growth potential driven by industrial development, environmental monitoring needs, and healthcare infrastructure expansion. Government initiatives supporting manufacturing and environmental protection create substantial opportunities for chemical sensor deployment across various applications.

Southeast Asian countries collectively contribute 10% market share, with growing industrial sectors and increasing environmental awareness driving market expansion. Countries like Thailand, Malaysia, and Indonesia show strong growth potential in automotive, petrochemical, and food processing applications.

Market leadership in the Asia Pacific chemical sensors sector is characterized by a mix of international technology companies and regional manufacturers that serve diverse application requirements across the region.

Competitive strategies include technology innovation, strategic partnerships, regional manufacturing expansion, and application-specific solution development to address diverse market requirements across the Asia Pacific region.

By Technology:

By Application:

By End-User Industry:

Gas Sensors represent the largest category within the Asia Pacific chemical sensors market, accounting for approximately 45% of total market demand. These sensors serve critical functions in industrial safety, environmental monitoring, and automotive applications. The category benefits from stringent safety regulations and increasing awareness of air quality issues across the region.

Liquid Sensors constitute a significant category focusing on water quality monitoring, industrial process control, and healthcare applications. This segment shows strong growth potential driven by environmental regulations and increasing demand for water treatment solutions across developing economies in the region.

Biosensors emerge as a high-growth category with applications in healthcare diagnostics, food safety, and environmental monitoring. The integration of biological recognition elements with electronic transduction systems creates opportunities for highly specific and sensitive chemical detection capabilities.

Smart Sensors represent an emerging category that combines traditional chemical sensing with digital processing, wireless communication, and data analytics capabilities. This category addresses the growing demand for IoT-enabled monitoring solutions that provide real-time data and predictive analytics.

Manufacturers benefit from the expanding Asia Pacific chemical sensors market through increased production volumes, economies of scale, and opportunities for technological innovation. The region’s manufacturing capabilities enable cost-effective production while maintaining quality standards required for diverse applications.

End Users gain significant advantages through improved process control, enhanced safety measures, and regulatory compliance capabilities. Chemical sensors enable real-time monitoring and automated response systems that reduce operational risks and improve efficiency across various industrial applications.

System Integrators find substantial opportunities in providing comprehensive solutions that combine sensors with data analytics, communication systems, and user interfaces. The complexity of modern applications creates demand for integrated solutions that address complete monitoring requirements.

Technology Providers benefit from the region’s strong demand for innovation and willingness to adopt advanced technologies. The diverse application requirements create opportunities for specialized sensor technologies and customized solutions that address specific market needs.

Investors can capitalize on the market’s strong growth potential and technological advancement opportunities. The combination of established markets and emerging applications provides balanced investment opportunities with varying risk and return profiles.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wireless Sensor Networks are transforming chemical monitoring applications by eliminating wiring requirements and enabling flexible deployment configurations. This trend reduces installation costs and enables monitoring in previously inaccessible locations while providing real-time data transmission capabilities.

Artificial Intelligence Integration enhances sensor capabilities through machine learning algorithms that improve accuracy, reduce false alarms, and enable predictive maintenance. AI-powered sensors can adapt to changing environmental conditions and provide more reliable performance over extended periods.

Miniaturization Advances continue to reduce sensor size while maintaining or improving performance characteristics. This trend enables integration into consumer electronics, wearable devices, and portable equipment that were previously limited by size constraints.

Multi-Parameter Sensing combines multiple detection capabilities into single sensor platforms, reducing system complexity and costs while providing comprehensive monitoring solutions. This approach addresses the need for simultaneous monitoring of multiple chemical parameters in complex applications.

Energy Efficiency Improvements focus on reducing power consumption to enable battery-powered and energy-harvesting applications. Low-power sensor designs extend operational life and reduce maintenance requirements in remote or inaccessible installations.

Strategic partnerships between sensor manufacturers and technology companies are accelerating innovation and market development. Recent collaborations focus on integrating chemical sensors with IoT platforms, cloud analytics, and mobile applications to create comprehensive monitoring solutions.

Manufacturing expansion initiatives across the region include new production facilities and capacity increases to meet growing demand. Companies are investing in automated production lines and quality control systems to improve efficiency and maintain competitive pricing.

Technology acquisitions enable established companies to expand their sensor portfolios and enter new application markets. These strategic moves consolidate expertise and accelerate time-to-market for innovative sensor solutions.

Regulatory developments continue to shape market requirements through updated environmental standards, safety regulations, and quality requirements. These changes create opportunities for advanced sensor technologies while ensuring market stability through consistent demand drivers.

Research initiatives supported by government funding and industry collaboration are advancing sensor technologies and exploring new application possibilities. University partnerships and research consortiums contribute to long-term technological development and market growth.

MarkWide Research analysis indicates that companies should focus on developing integrated solutions that combine sensors with data analytics and communication capabilities. The market trend toward comprehensive monitoring systems creates opportunities for companies that can provide complete solutions rather than individual components.

Investment priorities should emphasize wireless technologies, artificial intelligence integration, and energy-efficient designs that address emerging market requirements. Companies that successfully combine these technologies will gain competitive advantages in the evolving market landscape.

Market entry strategies for new participants should consider partnerships with established regional players to leverage local market knowledge and distribution networks. The complexity of the Asia Pacific market requires understanding of diverse regulatory requirements and customer preferences across different countries.

Product development should focus on application-specific solutions that address unique requirements in key market segments. Customization capabilities and technical support services become increasingly important as applications become more sophisticated and demanding.

Geographic expansion opportunities exist in emerging economies where industrial development and environmental awareness are driving sensor adoption. Companies should consider the balance between market potential and infrastructure requirements when planning regional expansion strategies.

Market trajectory for the Asia Pacific chemical sensors market remains strongly positive, with continued growth expected across all major application segments. The combination of industrial development, environmental consciousness, and technological advancement creates a favorable environment for sustained market expansion over the next decade.

Technology evolution will continue to drive market development through improved performance, reduced costs, and new application possibilities. The integration of artificial intelligence, wireless communication, and miniaturization technologies will create next-generation sensor solutions that address previously unmet market needs.

Application expansion into consumer electronics, wearable devices, and smart home systems will create new market segments with substantial growth potential. These emerging applications will complement traditional industrial and environmental monitoring markets while driving innovation and volume production.

Regional development patterns suggest continued leadership by established markets like China and Japan, while emerging economies in Southeast Asia and India show strong growth potential. The market is expected to achieve a projected CAGR of 8.5% over the next five years, driven by sustained industrial investment and environmental monitoring requirements.

MWR projections indicate that the market will benefit from increasing integration with digital technologies and IoT platforms, creating opportunities for data-driven services and predictive analytics that enhance the value proposition of chemical sensor solutions.

The Asia Pacific chemical sensors market represents a dynamic and rapidly evolving sector that combines technological innovation with diverse application requirements across the world’s most economically vibrant region. The market demonstrates strong fundamentals driven by industrial development, environmental consciousness, and regulatory requirements that create consistent demand for advanced sensing solutions.

Growth prospects remain highly favorable, supported by continued industrialization, smart city initiatives, and emerging applications in healthcare, consumer electronics, and agriculture. The region’s manufacturing capabilities and technological expertise position it well to capitalize on global market opportunities while serving diverse local requirements.

Success factors for market participants include technological innovation, application-specific solutions, and strategic partnerships that leverage regional strengths and market knowledge. Companies that can effectively combine sensor technologies with digital platforms and data analytics will be best positioned to capture emerging opportunities and maintain competitive advantages in this evolving market landscape.

What is Chemical Sensors?

Chemical sensors are devices that detect and measure chemical substances, converting their presence into an electrical signal. They are widely used in various applications, including environmental monitoring, industrial processes, and healthcare diagnostics.

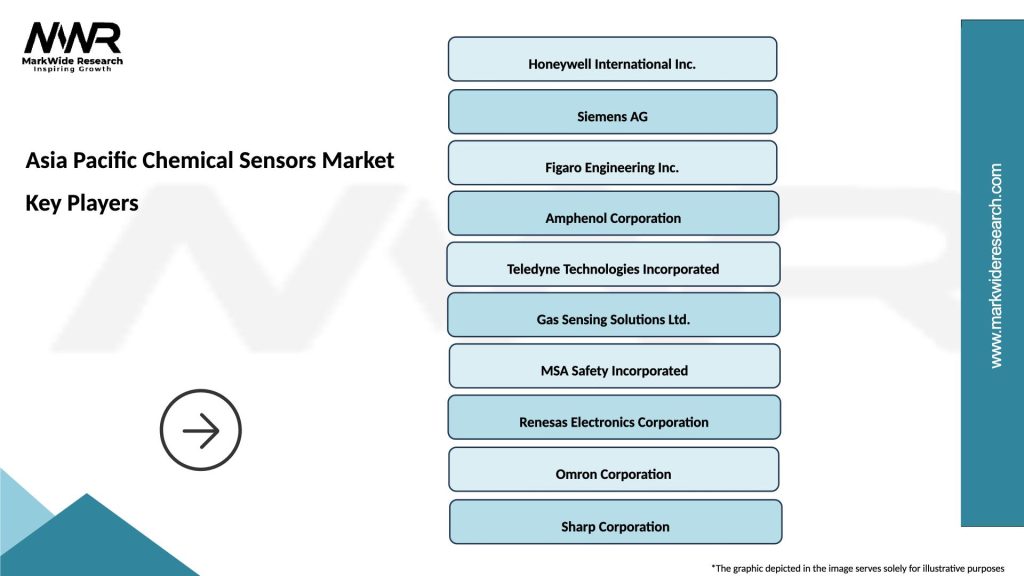

What are the key players in the Asia Pacific Chemical Sensors Market?

Key players in the Asia Pacific Chemical Sensors Market include Honeywell International Inc., Siemens AG, and Figaro Engineering Inc., among others. These companies are known for their innovative sensor technologies and extensive product portfolios.

What are the main drivers of the Asia Pacific Chemical Sensors Market?

The main drivers of the Asia Pacific Chemical Sensors Market include the increasing demand for environmental monitoring, the growth of the automotive industry, and advancements in healthcare technologies. These factors contribute to the rising adoption of chemical sensors across various sectors.

What challenges does the Asia Pacific Chemical Sensors Market face?

The Asia Pacific Chemical Sensors Market faces challenges such as the high cost of advanced sensors and the need for regular calibration and maintenance. Additionally, competition from alternative sensing technologies can hinder market growth.

What opportunities exist in the Asia Pacific Chemical Sensors Market?

Opportunities in the Asia Pacific Chemical Sensors Market include the development of smart sensors and the integration of IoT technologies. These advancements can enhance sensor capabilities and expand their applications in various industries.

What trends are shaping the Asia Pacific Chemical Sensors Market?

Trends shaping the Asia Pacific Chemical Sensors Market include the increasing focus on sustainability and environmental protection, as well as the rise of miniaturized sensors for portable applications. Innovations in nanotechnology are also driving the development of more sensitive and selective sensors.

Asia Pacific Chemical Sensors Market

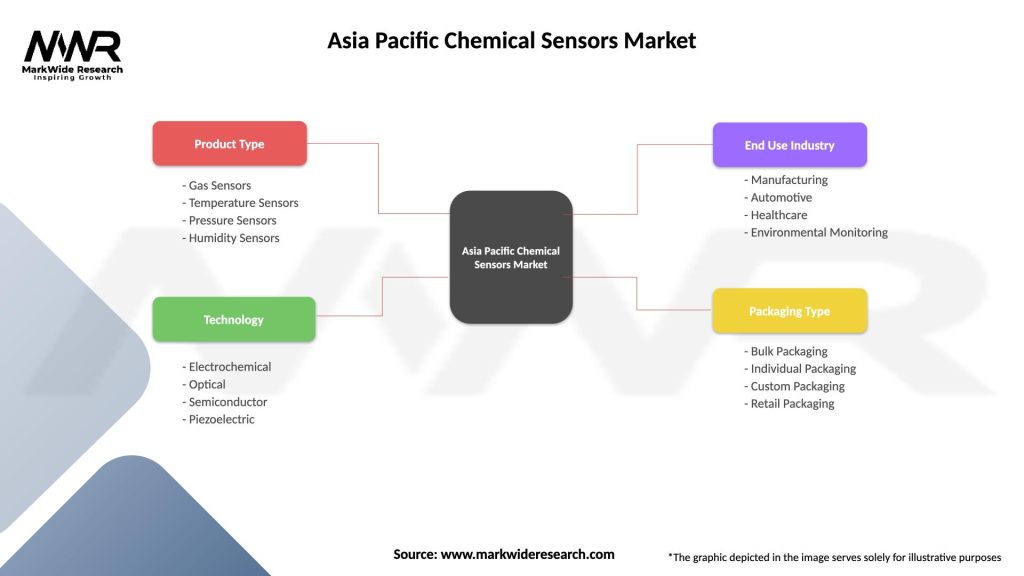

| Segmentation Details | Description |

|---|---|

| Product Type | Gas Sensors, Temperature Sensors, Pressure Sensors, Humidity Sensors |

| Technology | Electrochemical, Optical, Semiconductor, Piezoelectric |

| End Use Industry | Manufacturing, Automotive, Healthcare, Environmental Monitoring |

| Packaging Type | Bulk Packaging, Individual Packaging, Custom Packaging, Retail Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Chemical Sensors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at