444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa centrifugal pump market represents a dynamic and rapidly expanding sector driven by extensive infrastructure development, industrial growth, and increasing water management requirements across the region. This market encompasses a diverse range of applications spanning oil and gas operations, water treatment facilities, construction projects, and manufacturing industries throughout countries including Saudi Arabia, UAE, South Africa, Nigeria, and Egypt.

Regional dynamics indicate that the market is experiencing robust growth, with the sector expanding at a compound annual growth rate (CAGR) of 6.2% driven by substantial investments in infrastructure projects and industrial modernization initiatives. The oil and gas sector remains the largest consumer of centrifugal pumps, accounting for approximately 35% of total market demand, while water and wastewater treatment applications represent another 28% market share.

Technological advancement continues to shape market evolution, with smart pump technologies and energy-efficient solutions gaining significant traction among end-users seeking to optimize operational costs and environmental performance. The integration of Internet of Things (IoT) capabilities and predictive maintenance features has become increasingly important for industrial applications across the region.

Market penetration varies significantly across different countries, with the Gulf Cooperation Council (GCC) nations leading adoption rates due to their advanced industrial infrastructure and substantial capital investments in mega-projects. Meanwhile, African markets present substantial growth opportunities driven by urbanization trends and infrastructure development initiatives.

The Middle East & Africa centrifugal pump market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, installation, and maintenance of centrifugal pumping systems across the Middle Eastern and African regions, serving diverse industrial, commercial, and municipal applications.

Centrifugal pumps utilize rotational kinetic energy to move fluids by converting mechanical energy from motors into hydraulic energy through impeller rotation. These systems are characterized by their ability to handle large volumes of liquids efficiently, making them essential components in various industrial processes including petroleum refining, chemical processing, water treatment, and HVAC systems.

Market scope encompasses multiple pump configurations including single-stage and multi-stage designs, horizontal and vertical orientations, and specialized variants for specific applications such as corrosion-resistant pumps for chemical processing and high-temperature pumps for oil and gas operations. The market also includes associated components, control systems, and aftermarket services.

Regional characteristics influence market dynamics significantly, with Middle Eastern markets typically focusing on high-capacity pumps for oil and gas applications, while African markets emphasize water management and mining applications. This geographical diversity creates distinct market segments with varying technical requirements and performance specifications.

Market performance across the Middle East & Africa centrifugal pump sector demonstrates consistent growth momentum, supported by ongoing industrial expansion and infrastructure development initiatives. The market benefits from substantial government investments in water infrastructure, renewable energy projects, and industrial diversification programs throughout the region.

Key growth drivers include increasing demand for water treatment solutions, expansion of manufacturing capabilities, and modernization of existing industrial facilities. The construction sector growth contributes approximately 18% to overall market demand, while mining operations account for another 15% market share, particularly in African markets rich in mineral resources.

Technological innovation remains a central theme, with manufacturers introducing advanced materials, improved efficiency ratings, and smart monitoring capabilities. Energy efficiency improvements of up to 25% compared to conventional systems are driving replacement cycles and new installations across various industries.

Competitive landscape features a mix of international manufacturers and regional suppliers, with market consolidation trends evident as companies seek to expand their geographical presence and technical capabilities. Strategic partnerships and local manufacturing initiatives are becoming increasingly important for market success.

Future prospects remain positive, with emerging applications in renewable energy, desalination projects, and smart city initiatives expected to create new growth opportunities. The market’s evolution toward digitalization and sustainability will continue shaping investment priorities and technology development.

Market segmentation reveals distinct patterns across different application areas and geographical regions. The following key insights highlight critical market dynamics:

Market maturity varies significantly across the region, with established markets in the Gulf states contrasting with emerging opportunities in sub-Saharan Africa. This diversity creates multiple growth trajectories and investment opportunities for market participants.

Customer preferences increasingly favor comprehensive solutions including installation, commissioning, and long-term maintenance contracts rather than standalone equipment purchases. This trend is driving service-oriented business models and creating opportunities for value-added offerings.

Infrastructure development serves as the primary catalyst for centrifugal pump market growth across the Middle East & Africa region. Massive investments in transportation networks, urban development projects, and industrial complexes create substantial demand for pumping systems across various applications.

Water scarcity challenges throughout the region drive significant investments in desalination plants, water treatment facilities, and distribution networks. Countries like Saudi Arabia, UAE, and South Africa are implementing comprehensive water management strategies that require extensive pumping infrastructure to ensure reliable water supply for growing populations and industrial needs.

Oil and gas sector expansion continues to fuel market demand, particularly in Gulf countries where upstream and downstream operations require sophisticated pumping systems for crude oil extraction, refining processes, and petrochemical production. Enhanced oil recovery techniques and offshore drilling activities create additional demand for specialized high-performance pumps.

Industrial diversification initiatives across the region are creating new market opportunities as countries seek to reduce dependence on oil revenues. Manufacturing sector growth in automotive, pharmaceuticals, food processing, and chemicals requires reliable pumping systems for various production processes and facility operations.

Urbanization trends in African markets drive demand for municipal water supply systems, sewage treatment facilities, and building services applications. Rapid population growth in major cities creates pressure on existing infrastructure and necessitates expansion of pumping capacity for water distribution and wastewater management.

Mining sector growth particularly in African countries rich in mineral resources creates demand for dewatering pumps, slurry handling systems, and process water circulation pumps. Expansion of mining operations and development of new mineral extraction projects contribute to sustained market growth.

Economic volatility in several regional markets creates uncertainty for capital investment decisions, particularly in oil-dependent economies where fluctuating commodity prices impact infrastructure spending and industrial expansion plans. This volatility can delay project implementations and reduce market growth rates.

High initial capital costs associated with advanced centrifugal pump systems can limit adoption, particularly among smaller industrial operators and in price-sensitive market segments. The substantial investment required for high-quality pumping systems may deter some potential customers from upgrading existing equipment or implementing new installations.

Technical complexity of modern pump systems requires specialized knowledge for proper selection, installation, and maintenance. The shortage of skilled technicians and engineers in some regional markets can limit the adoption of advanced pumping technologies and create challenges for optimal system performance.

Supply chain disruptions can impact equipment availability and project timelines, particularly for specialized pump configurations that require longer lead times. Global supply chain challenges and regional logistics constraints can affect market growth and customer satisfaction.

Regulatory compliance requirements vary significantly across different countries in the region, creating complexity for manufacturers and end-users. Varying standards for safety, environmental performance, and energy efficiency can complicate product development and market entry strategies.

Competition from alternative technologies such as positive displacement pumps and other fluid handling solutions can limit market share in specific applications. The availability of alternative pumping technologies may constrain growth in certain market segments where centrifugal pumps face technical or economic disadvantages.

Renewable energy projects across the region present significant growth opportunities for centrifugal pump applications in solar thermal power plants, geothermal systems, and hydroelectric facilities. The increasing focus on clean energy sources creates demand for specialized pumping solutions designed for renewable energy applications.

Smart city initiatives in major urban centers offer opportunities for advanced pumping systems integrated with digital monitoring and control technologies. Cities like Dubai, Riyadh, and Cape Town are implementing comprehensive smart infrastructure projects that require intelligent pumping solutions for water management and building services.

Desalination market expansion driven by water security concerns creates substantial opportunities for high-pressure pumps and specialized seawater handling systems. The growing number of desalination projects across the Gulf region and North Africa represents a significant market opportunity for pump manufacturers.

Industrial automation trends create demand for pumps with advanced control capabilities and integration with manufacturing execution systems. The adoption of Industry 4.0 concepts across regional manufacturing facilities drives requirements for smart pumping solutions with predictive maintenance capabilities.

Aftermarket services expansion offers opportunities for recurring revenue through maintenance contracts, spare parts supply, and system optimization services. The growing installed base of pumping systems creates a substantial aftermarket opportunity for service-oriented business models.

Local manufacturing development presents opportunities for establishing regional production facilities to serve local markets more effectively while reducing costs and improving supply chain reliability. Government initiatives supporting local manufacturing create favorable conditions for investment in regional production capabilities.

Supply and demand dynamics in the Middle East & Africa centrifugal pump market reflect the complex interplay between industrial growth, infrastructure development, and economic conditions across diverse regional markets. Demand patterns vary significantly between oil-rich Gulf states and resource-diverse African economies.

Price sensitivity varies considerably across different market segments and geographical regions. While premium applications in oil and gas operations prioritize performance and reliability over cost, municipal and smaller industrial applications demonstrate higher price sensitivity, creating distinct market tiers with different value propositions.

Technology adoption rates differ markedly between established markets in the Gulf region and emerging markets in sub-Saharan Africa. Advanced features such as variable frequency drives and smart monitoring systems show adoption rates of 45% in GCC countries compared to 15% in emerging African markets.

Seasonal demand patterns influence market dynamics, particularly for construction and agricultural applications. Peak construction activity during cooler months in Gulf countries creates cyclical demand patterns, while agricultural pumping requirements in African markets align with seasonal rainfall patterns and irrigation needs.

Competitive intensity varies across different market segments, with high-end applications featuring fewer competitors but intense competition on technical specifications and service capabilities. Commodity market segments experience price-based competition with multiple suppliers competing for market share.

Innovation cycles drive market evolution as manufacturers introduce new technologies to address evolving customer requirements. The integration of digital technologies and energy efficiency improvements creates differentiation opportunities while potentially disrupting traditional market relationships.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Middle East & Africa centrifugal pump market. The research approach combines quantitative data analysis with qualitative insights from industry experts and market participants.

Primary research activities include structured interviews with key market participants including manufacturers, distributors, end-users, and industry associations. These interviews provide insights into market trends, competitive dynamics, and future growth prospects from various stakeholder perspectives.

Secondary research sources encompass industry publications, government statistics, trade association reports, and company financial statements to validate market data and identify emerging trends. This comprehensive approach ensures data accuracy and provides multiple perspectives on market developments.

Market sizing methodology utilizes bottom-up and top-down approaches to validate market estimates and growth projections. Regional market analysis considers country-specific factors including economic conditions, industrial development, and infrastructure investment patterns.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure research reliability. Quality assurance procedures verify data consistency and identify potential discrepancies for further investigation.

Forecasting models incorporate historical trends, economic indicators, and industry-specific factors to project future market development. Scenario analysis considers various growth trajectories based on different economic and industry conditions.

Gulf Cooperation Council (GCC) markets represent the most mature and technologically advanced segment of the regional centrifugal pump market. Saudi Arabia leads regional demand with 32% market share, driven by extensive oil and gas operations, petrochemical facilities, and mega-infrastructure projects including NEOM and other Vision 2030 initiatives.

United Arab Emirates demonstrates strong market growth supported by diversified industrial base, construction sector expansion, and significant investments in water infrastructure and renewable energy projects. The country’s focus on smart city development and industrial automation drives demand for advanced pumping solutions.

North African markets including Egypt, Algeria, and Morocco show substantial growth potential driven by infrastructure development, industrial expansion, and water management requirements. Egypt’s market represents approximately 18% of regional demand, supported by construction projects and industrial development along the Suez Canal corridor.

Sub-Saharan African markets present significant long-term growth opportunities despite current infrastructure challenges. South Africa leads the region with established industrial base and mining operations, while Nigeria, Kenya, and Ghana show emerging market potential driven by urbanization and industrial development.

Market penetration rates vary significantly across the region, with GCC countries achieving 85% modern pump technology adoption compared to 35% in emerging African markets. This disparity creates opportunities for market expansion and technology transfer initiatives.

Regional manufacturing capabilities are concentrated primarily in GCC countries and South Africa, with growing interest in establishing local production facilities to serve regional markets more effectively and reduce dependency on imports.

Market leadership in the Middle East & Africa centrifugal pump sector features a combination of global manufacturers and regional specialists, each leveraging distinct competitive advantages to serve diverse market segments and applications.

Competitive strategies focus on local manufacturing, comprehensive service offerings, and technology innovation to differentiate market positions. Companies are increasingly establishing regional facilities and partnerships to improve customer service and reduce costs.

Market consolidation trends are evident as larger companies acquire regional specialists and smaller manufacturers to expand geographical coverage and technical capabilities. This consolidation creates opportunities for improved market coverage and enhanced service delivery.

By Product Type:

By Application:

By End-User Industry:

Industrial segment analysis reveals that oil and gas applications continue to drive premium pump demand, with requirements for high-reliability systems capable of handling challenging operating conditions including high temperatures, corrosive fluids, and continuous operation requirements.

Municipal water applications represent the fastest-growing segment, driven by urbanization trends and infrastructure development across the region. Water treatment facilities require reliable pumping systems with energy-efficient operation and minimal maintenance requirements to ensure sustainable water supply.

Mining applications particularly in African markets demand robust pumping solutions capable of handling abrasive slurries and providing reliable dewatering capabilities. The growth of mineral extraction operations creates sustained demand for specialized mining pumps with enhanced wear resistance.

Construction sector demand fluctuates with economic cycles and major project developments, but represents significant volume opportunities for standard pump configurations. Temporary dewatering applications and building services installations drive substantial pump sales across the region.

Power generation applications require high-reliability pumps for cooling systems, boiler feed water, and condensate handling. The expansion of power generation capacity across the region creates opportunities for specialized power plant pumping solutions.

Chemical processing segment demands specialized materials and designs to handle corrosive and hazardous fluids safely and reliably. The growth of petrochemical industries in Gulf countries drives demand for advanced chemical-resistant pumping systems.

Manufacturers benefit from expanding market opportunities driven by infrastructure development and industrial growth across diverse regional markets. The ability to serve multiple application segments provides revenue diversification and reduces dependence on single market sectors.

End-users gain access to advanced pumping technologies that improve operational efficiency, reduce energy consumption, and minimize maintenance requirements. Modern centrifugal pumps offer energy efficiency improvements of up to 30% compared to older systems, resulting in significant operational cost savings.

Service providers benefit from growing aftermarket opportunities as the installed base of pumping systems expands. Comprehensive service offerings including predictive maintenance, spare parts supply, and system optimization create recurring revenue streams and strengthen customer relationships.

Distributors and dealers gain from market expansion and increasing demand for local support services. The complexity of modern pumping systems creates opportunities for value-added services including system design, installation support, and technical training.

Technology suppliers benefit from increasing demand for advanced control systems, monitoring equipment, and digital integration capabilities. The trend toward smart pumping solutions creates opportunities for suppliers of sensors, controllers, and software platforms.

Regional economies benefit from improved infrastructure reliability, enhanced industrial capabilities, and job creation in manufacturing and service sectors. Local manufacturing initiatives contribute to economic development and technology transfer.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the centrifugal pump market, with IoT integration, predictive maintenance capabilities, and remote monitoring becoming standard requirements for new installations. Smart pump technologies enable maintenance cost reductions of up to 25% through predictive analytics and condition monitoring.

Energy efficiency focus continues to drive product development and customer purchasing decisions as organizations seek to reduce operational costs and environmental impact. Advanced motor technologies, optimized hydraulic designs, and variable frequency drive integration contribute to significant energy savings.

Sustainability requirements increasingly influence pump selection criteria, with customers prioritizing products manufactured using environmentally responsible processes and designed for long service life. Recyclable materials and reduced environmental impact during operation become important selection factors.

Modular design approaches gain popularity as customers seek flexible solutions that can be easily modified or expanded to meet changing operational requirements. Standardized components and interfaces enable cost-effective customization and simplified maintenance procedures.

Service-oriented business models become more prevalent as customers prefer comprehensive solutions including equipment, installation, commissioning, and long-term maintenance contracts. This trend creates opportunities for recurring revenue and strengthened customer relationships.

Local manufacturing expansion accelerates as companies establish regional production facilities to serve local markets more effectively while reducing costs and improving supply chain reliability. Government initiatives supporting local manufacturing create favorable investment conditions.

Technology innovations continue to advance pump performance and reliability, with recent developments including advanced materials for corrosion resistance, improved impeller designs for enhanced efficiency, and integrated control systems for optimized operation. These innovations address evolving customer requirements for higher performance and lower operating costs.

Strategic partnerships between international manufacturers and regional companies facilitate market expansion and technology transfer. These collaborations enable global companies to leverage local market knowledge while providing regional partners access to advanced technologies and manufacturing capabilities.

Manufacturing facility investments across the region demonstrate industry commitment to serving local markets effectively. Recent facility expansions and new plant constructions indicate confidence in long-term market growth and the benefits of regional manufacturing capabilities.

Digital platform development enables enhanced customer service through online configuration tools, remote monitoring capabilities, and digital maintenance platforms. These developments improve customer experience while reducing service costs and response times.

Sustainability initiatives drive product development toward more environmentally friendly solutions including energy-efficient designs, recyclable materials, and reduced environmental impact during manufacturing and operation. These initiatives align with growing customer and regulatory requirements for sustainable solutions.

Market consolidation activities including acquisitions and strategic alliances reshape competitive dynamics while creating opportunities for improved market coverage and enhanced technical capabilities. These developments enable companies to offer more comprehensive solutions and better serve diverse customer requirements.

MarkWide Research analysis indicates that market participants should prioritize digital transformation initiatives to remain competitive in evolving market conditions. Companies investing in smart pump technologies and digital service platforms are better positioned to capture emerging opportunities and strengthen customer relationships.

Regional manufacturing strategies should be evaluated carefully, considering factors including market size, logistics costs, and government incentives. Establishing local production capabilities can provide significant competitive advantages through reduced costs, improved supply chain reliability, and enhanced customer service.

Service capability development represents a critical success factor as customers increasingly prefer comprehensive solutions rather than standalone equipment purchases. Companies should invest in service infrastructure, technical training, and digital service platforms to capture aftermarket opportunities.

Technology partnerships can accelerate innovation and market entry, particularly for companies seeking to expand their geographical presence or technical capabilities. Strategic alliances with local partners provide market knowledge and customer relationships while enabling technology transfer.

Sustainability focus should be integrated into product development and marketing strategies as environmental considerations become increasingly important for customer purchasing decisions. Energy efficiency, recyclable materials, and reduced environmental impact create competitive differentiation opportunities.

Market segmentation strategies should recognize the diverse requirements across different applications and geographical regions. Tailored solutions for specific market segments can provide competitive advantages and improve customer satisfaction while optimizing resource allocation.

Long-term growth prospects for the Middle East & Africa centrifugal pump market remain positive, supported by continued infrastructure development, industrial expansion, and increasing focus on water security across the region. The market is expected to maintain steady growth momentum driven by diverse application requirements and technological advancement.

Technology evolution will continue shaping market development, with artificial intelligence, machine learning, and advanced materials creating new possibilities for pump performance and reliability. Smart pump technologies are projected to achieve 60% market penetration within the next five years as digital transformation accelerates.

Regional market development will likely see continued growth in GCC countries driven by economic diversification initiatives, while African markets present substantial long-term opportunities as infrastructure development accelerates and industrial capabilities expand.

Application diversification will create new growth opportunities as renewable energy projects, smart city initiatives, and industrial automation drive demand for specialized pumping solutions. These emerging applications may represent 25% of total market demand within the next decade.

Competitive landscape evolution will likely feature continued consolidation as companies seek to expand their geographical presence and technical capabilities. Market leaders will be those companies successfully combining technological innovation with comprehensive service capabilities and regional market presence.

Sustainability requirements will become increasingly important, driving demand for energy-efficient solutions and environmentally responsible manufacturing processes. Companies prioritizing sustainability initiatives are expected to gain competitive advantages in customer selection processes.

The Middle East & Africa centrifugal pump market represents a dynamic and growing sector with substantial opportunities driven by infrastructure development, industrial expansion, and technological advancement across diverse regional markets. The market’s evolution reflects the complex interplay between established industrial economies in the Gulf region and emerging opportunities in African markets.

Market fundamentals remain strong, supported by continued investments in oil and gas infrastructure, water management systems, and industrial facilities throughout the region. The diversity of applications and geographical markets provides multiple growth trajectories while reducing dependence on single market segments or economic conditions.

Technological innovation continues to reshape market dynamics, with smart pump technologies, energy efficiency improvements, and digital integration creating new value propositions for customers while enabling manufacturers to differentiate their offerings. The successful integration of these technologies will determine competitive success in evolving market conditions.

Strategic positioning for market success requires careful consideration of regional market characteristics, customer requirements, and competitive dynamics. Companies that successfully combine technological innovation with comprehensive service capabilities and regional market presence are best positioned to capture emerging opportunities and achieve sustainable growth in this expanding market.

What is Centrifugal Pump?

Centrifugal pumps are mechanical devices that use rotational energy to move fluids through a system. They are widely used in various applications, including water supply, irrigation, and industrial processes.

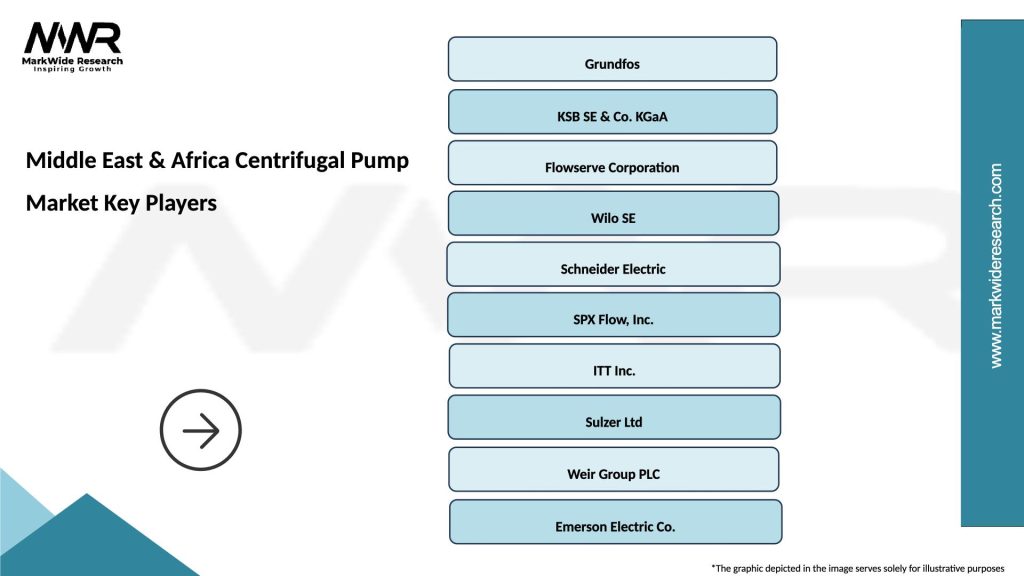

What are the key players in the Middle East & Africa Centrifugal Pump Market?

Key players in the Middle East & Africa Centrifugal Pump Market include Grundfos, KSB, Sulzer, and Flowserve, among others. These companies are known for their innovative solutions and extensive product ranges.

What are the growth factors driving the Middle East & Africa Centrifugal Pump Market?

The growth of the Middle East & Africa Centrifugal Pump Market is driven by increasing industrialization, rising demand for water supply and wastewater management, and the expansion of the oil and gas sector.

What challenges does the Middle East & Africa Centrifugal Pump Market face?

Challenges in the Middle East & Africa Centrifugal Pump Market include fluctuating oil prices, regulatory hurdles, and the need for skilled labor in maintenance and operation.

What opportunities exist in the Middle East & Africa Centrifugal Pump Market?

Opportunities in the Middle East & Africa Centrifugal Pump Market include advancements in pump technology, increasing investments in infrastructure projects, and a growing focus on energy-efficient solutions.

What trends are shaping the Middle East & Africa Centrifugal Pump Market?

Trends in the Middle East & Africa Centrifugal Pump Market include the adoption of smart pump technologies, integration of IoT for monitoring and control, and a shift towards sustainable and eco-friendly pumping solutions.

Middle East & Africa Centrifugal Pump Market

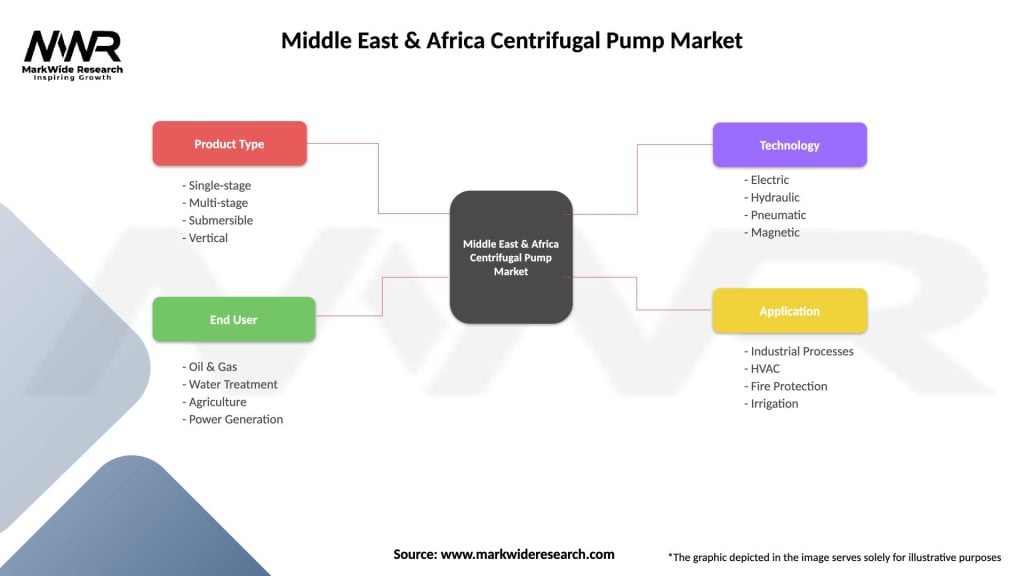

| Segmentation Details | Description |

|---|---|

| Product Type | Single-stage, Multi-stage, Submersible, Vertical |

| End User | Oil & Gas, Water Treatment, Agriculture, Power Generation |

| Technology | Electric, Hydraulic, Pneumatic, Magnetic |

| Application | Industrial Processes, HVAC, Fire Protection, Irrigation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Centrifugal Pump Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at