444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC banking market represents one of the most dynamic and rapidly evolving financial sectors globally, encompassing diverse economies from developed nations like Japan and Australia to emerging markets including India, Vietnam, and Indonesia. Digital transformation has become the cornerstone of banking evolution across the Asia-Pacific region, with financial institutions investing heavily in fintech solutions, mobile banking platforms, and artificial intelligence-driven services. The region’s banking landscape is characterized by a unique blend of traditional banking practices and cutting-edge technological innovations, creating unprecedented opportunities for growth and expansion.

Market dynamics in the APAC region are influenced by varying regulatory frameworks, economic development stages, and consumer preferences across different countries. China’s banking sector leads in terms of digital adoption with mobile payment penetration reaching 86% of the population, while countries like Singapore and Hong Kong serve as regional financial hubs driving innovation in wealth management and corporate banking services. The increasing smartphone penetration, growing middle-class population, and supportive government initiatives for financial inclusion are collectively propelling the market forward at an impressive CAGR of 8.2% across various banking segments.

Regulatory harmonization efforts and cross-border banking initiatives are creating new avenues for expansion, particularly in areas such as trade finance, remittances, and investment banking. The market encompasses traditional commercial banking, investment banking, retail banking, and emerging sectors like digital-only banks and cryptocurrency-related financial services, reflecting the region’s commitment to financial innovation and inclusion.

The APAC banking market refers to the comprehensive financial services ecosystem operating across the Asia-Pacific region, encompassing commercial banks, investment banks, digital banks, and specialized financial institutions that provide lending, deposit-taking, payment processing, and investment services to individuals, businesses, and governments throughout Asian and Pacific countries.

This market definition includes both traditional brick-and-mortar banking institutions and emerging digital-first financial service providers that leverage technology to deliver innovative banking solutions. The scope extends beyond conventional banking to include fintech partnerships, blockchain-based financial services, and integrated financial ecosystems that combine banking with e-commerce, telecommunications, and other digital services.

Geographic coverage spans major economies including China, Japan, India, South Korea, Australia, Singapore, Hong Kong, Thailand, Malaysia, Indonesia, Philippines, Vietnam, and other emerging markets in the region. The market encompasses various banking models, from state-owned banks and multinational financial institutions to local community banks and neobanks that operate exclusively through digital channels.

The APAC banking market stands at the forefront of global financial innovation, driven by rapid digitalization, increasing financial inclusion initiatives, and robust economic growth across key regional economies. Digital banking adoption has accelerated significantly, with 73% of consumers in major APAC markets now using mobile banking services regularly, representing a fundamental shift in how financial services are delivered and consumed.

Key market drivers include the region’s young, tech-savvy population, supportive regulatory frameworks for fintech innovation, and increasing demand for seamless, omnichannel banking experiences. China and India emerge as the largest markets by transaction volume and customer base, while Singapore, Hong Kong, and Australia lead in terms of banking technology sophistication and regulatory innovation.

Investment flows into banking technology and infrastructure have reached unprecedented levels, with artificial intelligence, blockchain technology, and open banking platforms becoming standard components of modern banking operations. The market is witnessing increased consolidation among traditional players while simultaneously experiencing disruption from agile fintech startups and tech giants entering the financial services space.

Future growth prospects remain robust, supported by expanding middle-class populations, increasing cross-border trade, and ongoing digital transformation initiatives across both developed and emerging economies in the region.

Market intelligence reveals several critical insights that define the current and future trajectory of the APAC banking sector:

Digital transformation initiatives represent the primary catalyst driving APAC banking market expansion, with financial institutions investing heavily in cloud infrastructure, artificial intelligence, and mobile banking platforms to meet evolving customer expectations. The proliferation of smartphones and improved internet connectivity across the region has created an environment where digital banking services can reach previously underserved populations, particularly in rural and remote areas.

Government support for financial inclusion and digitalization has been instrumental in market growth, with initiatives like India’s Digital India program and China’s fintech-friendly regulations creating favorable conditions for banking innovation. Regulatory sandboxes in countries like Singapore, Australia, and Hong Kong have enabled banks to experiment with new technologies and business models while maintaining appropriate oversight and consumer protection.

Demographic advantages across the region, including large young populations with high digital literacy rates, are driving demand for innovative banking solutions. The growing middle-class segment in emerging markets is creating substantial opportunities for retail banking, wealth management, and investment services, while established markets are focusing on premium banking experiences and sophisticated financial products.

Economic integration and increasing trade volumes within the APAC region are generating demand for efficient cross-border payment solutions, trade finance services, and multi-currency banking products that can support regional business expansion and international commerce.

Regulatory complexity across different APAC jurisdictions presents significant challenges for banks seeking regional expansion, with varying compliance requirements, capital adequacy norms, and operational restrictions creating barriers to seamless cross-border banking services. Legacy system integration remains a persistent challenge for established banks attempting to modernize their technology infrastructure while maintaining operational continuity and regulatory compliance.

Cybersecurity concerns have intensified as digital banking adoption increases, with financial institutions facing sophisticated cyber threats that require substantial investments in security infrastructure and risk management systems. The cost of implementing robust cybersecurity measures can be particularly challenging for smaller regional banks and emerging market institutions with limited resources.

Economic volatility and currency fluctuations across different APAC markets create uncertainty for banking operations, particularly affecting cross-border lending, foreign exchange services, and international investment banking activities. Political risks and changing regulatory environments in some markets can impact long-term strategic planning and investment decisions.

Talent shortage in specialized areas such as fintech development, data analytics, and digital banking expertise creates competitive pressures and increases operational costs for banks seeking to build internal capabilities for digital transformation initiatives.

Fintech partnerships present unprecedented opportunities for traditional banks to accelerate innovation and expand service offerings without developing all capabilities in-house. Strategic alliances with technology companies, payment processors, and specialized financial service providers enable banks to offer comprehensive digital ecosystems that meet diverse customer needs across multiple touchpoints.

Emerging market penetration offers substantial growth potential, particularly in countries like Vietnam, Indonesia, and Philippines where banking penetration rates remain below regional averages. Digital-only banking models can effectively serve these markets by reducing operational costs and providing accessible financial services through mobile platforms.

Wealth management expansion represents a significant opportunity as APAC’s affluent population continues to grow, creating demand for sophisticated investment products, private banking services, and cross-border wealth planning solutions. The region’s increasing integration with global financial markets opens opportunities for international investment banking and capital markets services.

Sustainable finance and green banking initiatives are emerging as key differentiators, with opportunities to develop specialized lending products for renewable energy projects, sustainable infrastructure, and environmentally responsible businesses. Islamic banking services also present growth opportunities in markets with significant Muslim populations.

Competitive dynamics in the APAC banking market are characterized by intense rivalry between traditional banks, emerging fintech companies, and technology giants entering the financial services space. Market consolidation trends are evident in mature markets, while emerging economies are experiencing rapid expansion of new banking entrants and innovative service providers.

Technology adoption cycles vary significantly across different markets, with developed economies like Japan and Australia focusing on advanced analytics and artificial intelligence applications, while emerging markets prioritize basic digital banking infrastructure and mobile payment systems. This creates diverse opportunities for technology vendors and service providers across different market segments.

Customer behavior evolution is driving banks to reimagine their service delivery models, with omnichannel experiences becoming essential for customer retention and acquisition. Personalization capabilities powered by data analytics are becoming key competitive advantages, enabling banks to offer tailored products and services that meet individual customer needs.

Regulatory evolution continues to shape market dynamics, with authorities balancing innovation encouragement with consumer protection and financial stability requirements. Open banking regulations and data privacy frameworks are creating new operational requirements while simultaneously enabling innovative business models and partnerships.

Comprehensive market analysis was conducted using a multi-faceted research approach combining primary and secondary research methodologies to ensure accuracy and reliability of market insights. Primary research involved extensive interviews with banking executives, fintech leaders, regulatory officials, and industry experts across major APAC markets to gather firsthand insights on market trends, challenges, and opportunities.

Secondary research encompassed analysis of regulatory filings, annual reports, industry publications, and government statistics from banking authorities across the region. Quantitative analysis was performed on banking sector data including transaction volumes, customer adoption rates, and technology investment patterns to identify key market trends and growth drivers.

Market segmentation analysis was conducted across multiple dimensions including geography, banking services, customer segments, and technology adoption levels. Competitive landscape mapping involved detailed analysis of major banking institutions, fintech companies, and emerging market players to understand competitive positioning and strategic initiatives.

Trend analysis incorporated examination of regulatory developments, technology innovations, and consumer behavior changes to project future market evolution. Cross-validation of findings was performed through multiple data sources and expert consultations to ensure research accuracy and reliability.

China dominates the APAC banking landscape with the world’s largest banking sector by assets and the most advanced mobile payment ecosystem, holding approximately 42% of regional market share. Chinese banks are leading digital transformation initiatives with comprehensive super-app ecosystems that integrate banking, payments, e-commerce, and lifestyle services. The country’s central bank digital currency pilot programs and supportive fintech regulations position it as a regional innovation leader.

Japan maintains its position as a mature banking market focused on technological sophistication and operational efficiency, representing 18% of regional banking assets. Japanese banks are investing heavily in artificial intelligence, robotics, and blockchain technologies while addressing challenges related to aging population demographics and low interest rate environments.

India emerges as the fastest-growing banking market with digital payment adoption reaching 78% of urban population, driven by government initiatives like Unified Payments Interface and Jan Dhan Yojana financial inclusion programs. The country’s fintech ecosystem is among the world’s most vibrant, with numerous unicorn companies disrupting traditional banking services.

Southeast Asian markets including Singapore, Malaysia, Thailand, and Indonesia collectively represent 15% of regional banking activity, with Singapore serving as the regional financial hub and other markets showing rapid digital banking adoption rates. Australia and South Korea complete the major market segments with advanced banking technologies and sophisticated regulatory frameworks supporting innovation.

Market leadership in the APAC banking sector is distributed among several categories of institutions, each bringing unique strengths and competitive advantages:

By Banking Type:

By Service Category:

By Customer Segment:

Digital Banking Transformation has emerged as the most dynamic category, with neobanks and digital-first institutions gaining significant market traction. Mobile banking adoption rates have reached 85% in developed APAC markets, while emerging economies are experiencing rapid growth in digital financial service usage. Artificial intelligence and machine learning applications are becoming standard features in digital banking platforms, enabling personalized customer experiences and improved risk management.

Cross-Border Banking Services represent a high-growth category driven by increasing regional trade and investment flows. Trade finance digitization is streamlining international commerce, while multi-currency accounts and foreign exchange services are becoming essential offerings for businesses operating across multiple APAC markets. Blockchain technology adoption in trade finance is reducing transaction times and costs significantly.

Sustainable Finance is gaining momentum as a distinct category, with banks developing specialized green lending products and ESG investment solutions. Climate risk assessment is becoming integral to lending decisions, while sustainable banking practices are increasingly important for customer acquisition and retention, particularly among younger demographics.

Wealth Management Services are experiencing robust growth driven by increasing affluent populations across the region. Robo-advisory services are democratizing investment advice, while private banking services are expanding to serve growing numbers of high-net-worth individuals in emerging markets.

Financial Institutions benefit from expanded market opportunities, improved operational efficiency through digital transformation, and enhanced customer engagement capabilities. Technology partnerships enable banks to accelerate innovation while reducing development costs and time-to-market for new services. Data analytics capabilities provide deeper customer insights, enabling more effective risk management and personalized product offerings.

Customers gain access to more convenient, accessible, and affordable banking services through digital channels and innovative financial products. Financial inclusion initiatives are bringing banking services to previously underserved populations, while competitive market dynamics are driving improvements in service quality and cost-effectiveness.

Technology Providers find substantial opportunities in supplying banking software, cybersecurity solutions, and digital infrastructure to financial institutions undergoing digital transformation. Fintech companies can leverage partnerships with traditional banks to scale their innovations and reach broader customer bases.

Regulatory Authorities benefit from improved financial system stability through better risk management technologies and enhanced transparency in banking operations. Digital banking platforms provide better data for regulatory oversight while supporting financial inclusion and economic development objectives.

Economic Development is supported through improved access to credit, more efficient payment systems, and enhanced capital allocation mechanisms that support business growth and innovation across the region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is transforming banking operations across the APAC region, with AI-powered chatbots, predictive analytics, and automated decision-making systems becoming standard features in modern banking platforms. Machine learning algorithms are enhancing fraud detection capabilities while improving customer service efficiency and personalization.

Open Banking Evolution is accelerating across multiple markets, with API-driven ecosystems enabling third-party integrations and innovative financial products. Banking-as-a-Service models are emerging, allowing non-financial companies to offer banking services while traditional banks focus on core competencies and regulatory compliance.

Embedded Finance is gaining traction as banks partner with e-commerce platforms, ride-sharing services, and other digital ecosystems to provide seamless financial services within customer journey touchpoints. This trend is particularly strong in markets like China and Southeast Asia where super-app ecosystems dominate digital interactions.

Central Bank Digital Currencies are moving from pilot programs to potential implementation, with several APAC central banks exploring digital currency frameworks that could reshape payment systems and monetary policy implementation. Cryptocurrency services are also being integrated into traditional banking offerings in markets with supportive regulatory frameworks.

Sustainability Focus is becoming integral to banking strategies, with ESG criteria influencing lending decisions and investment products. Climate risk assessment and green finance initiatives are becoming competitive differentiators, particularly among younger customer segments and institutional investors.

Strategic partnerships between traditional banks and fintech companies have accelerated, with major institutions acquiring or investing in innovative technology providers to enhance their digital capabilities. DBS Bank’s acquisition of fintech startups and Commonwealth Bank’s investment in artificial intelligence companies exemplify this trend toward technology-driven growth strategies.

Regulatory sandbox programs have expanded across the region, with countries like Singapore, Australia, and Hong Kong creating frameworks for testing innovative financial services. MarkWide Research analysis indicates that these regulatory initiatives have led to 45% faster time-to-market for new banking products and services.

Cross-border banking alliances are forming to facilitate regional trade and investment, with initiatives like the ASEAN Banking Integration Framework promoting greater financial market connectivity. Digital payment corridors between major economies are reducing transaction costs and settlement times for international transfers.

Cybersecurity investments have intensified following high-profile security incidents, with banks implementing zero-trust security models and advanced threat detection systems. Biometric authentication and behavioral analytics are becoming standard security features in digital banking platforms.

Sustainable finance initiatives are expanding, with major banks committing to net-zero emissions targets and developing comprehensive ESG lending frameworks. Green bond issuances and sustainability-linked loans are becoming significant revenue sources for investment banking divisions.

Digital transformation acceleration should remain the top strategic priority for banks across all market segments, with particular focus on mobile-first customer experiences and AI-driven personalization. Investment in cloud infrastructure and data analytics capabilities will be essential for maintaining competitive positioning in increasingly digital markets.

Partnership strategies should be expanded to include collaborations with fintech companies, technology providers, and non-financial ecosystem players. Banking-as-a-Service models present opportunities for revenue diversification while embedded finance partnerships can expand customer touchpoints and engagement.

Regulatory compliance capabilities should be strengthened through RegTech investments and automated compliance monitoring systems. Cross-border regulatory expertise will become increasingly valuable as regional banking integration continues to evolve.

Cybersecurity infrastructure requires continuous investment and updating to address evolving threat landscapes. Zero-trust security models and advanced threat detection systems should be implemented across all digital banking channels and customer touchpoints.

Talent development programs should focus on building internal capabilities in digital banking, data science, and customer experience design. Cultural transformation initiatives will be necessary to support agile, customer-centric operating models.

Market growth prospects remain robust across the APAC banking sector, with digital banking services expected to achieve penetration rates exceeding 90% in developed markets within the next five years. Emerging economies will continue to drive overall market expansion through financial inclusion initiatives and rapid smartphone adoption.

Technology integration will deepen, with artificial intelligence, blockchain, and quantum computing becoming integral to banking operations. Central bank digital currencies may reshape payment systems and monetary policy implementation, while decentralized finance concepts could influence traditional banking service delivery models.

Regulatory evolution will continue to balance innovation encouragement with consumer protection and financial stability requirements. Open banking frameworks will expand across more markets, enabling greater competition and innovation in financial services delivery.

Sustainable finance will become mainstream, with ESG considerations integral to all banking decisions and climate risk assessment standard practice in lending and investment activities. Green finance products will represent significant growth opportunities across both retail and corporate banking segments.

Customer expectations will continue evolving toward seamless, personalized, and socially responsible banking experiences. MWR projections indicate that banks successfully adapting to these changing expectations will capture disproportionate market share growth in the coming decade.

The APAC banking market represents one of the world’s most dynamic and opportunity-rich financial sectors, characterized by rapid digital transformation, robust economic growth, and innovative regulatory frameworks that support financial inclusion and technological advancement. Digital banking adoption has reached unprecedented levels across the region, fundamentally reshaping how financial services are delivered and consumed by millions of customers.

Market leaders are successfully leveraging technology partnerships, artificial intelligence, and data analytics to create competitive advantages while addressing evolving customer expectations for seamless, personalized banking experiences. Emerging markets continue to drive overall sector growth through expanding middle-class populations and government-supported financial inclusion initiatives that are bringing banking services to previously underserved communities.

Future success in the APAC banking market will depend on institutions’ ability to balance innovation with regulatory compliance, cybersecurity with customer convenience, and growth with sustainability. The banks that can effectively navigate these challenges while maintaining focus on customer-centric service delivery will be best positioned to capture the substantial opportunities that lie ahead in this rapidly evolving market landscape.

What is Banking?

Banking refers to the business of accepting deposits, providing loans, and offering financial services to individuals and businesses. It plays a crucial role in the economy by facilitating transactions and providing liquidity.

What are the key players in the APAC Banking Market?

Key players in the APAC Banking Market include HSBC, DBS Bank, and Bank of China, among others. These institutions offer a range of services including retail banking, investment banking, and wealth management.

What are the main drivers of growth in the APAC Banking Market?

The main drivers of growth in the APAC Banking Market include increasing digitalization, rising consumer demand for financial services, and the expansion of the middle class in the region. Additionally, regulatory reforms are also contributing to market growth.

What challenges does the APAC Banking Market face?

The APAC Banking Market faces challenges such as regulatory compliance, cybersecurity threats, and competition from fintech companies. These factors can impact traditional banks’ ability to innovate and retain customers.

What opportunities exist in the APAC Banking Market?

Opportunities in the APAC Banking Market include the adoption of advanced technologies like AI and blockchain, which can enhance customer experience and operational efficiency. Additionally, the growing demand for sustainable finance presents new avenues for growth.

What trends are shaping the APAC Banking Market?

Trends shaping the APAC Banking Market include the rise of digital banking, increased focus on customer-centric services, and the integration of fintech solutions. These trends are transforming how banks operate and engage with customers.

APAC Banking Market

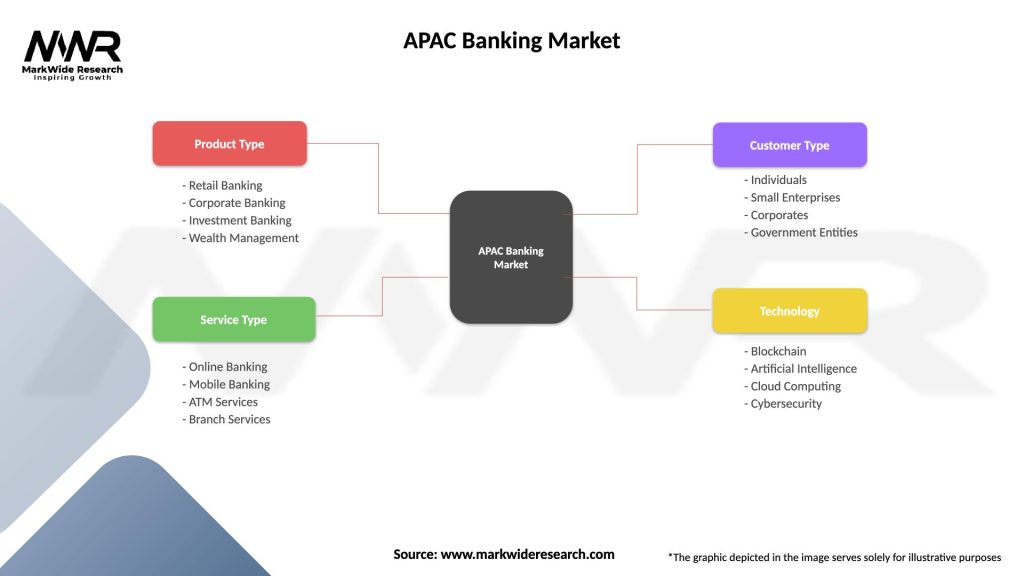

| Segmentation Details | Description |

|---|---|

| Product Type | Retail Banking, Corporate Banking, Investment Banking, Wealth Management |

| Service Type | Online Banking, Mobile Banking, ATM Services, Branch Services |

| Customer Type | Individuals, Small Enterprises, Corporates, Government Entities |

| Technology | Blockchain, Artificial Intelligence, Cloud Computing, Cybersecurity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Banking Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at