444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European automotive engine oils market represents a mature yet evolving sector that continues to demonstrate resilience and innovation in response to changing automotive technologies and environmental regulations. This comprehensive market encompasses a diverse range of lubricant products designed specifically for passenger vehicles, commercial trucks, motorcycles, and specialty automotive applications across European Union member states and associated territories.

Market dynamics in the European region are primarily driven by stringent environmental standards, the transition toward electric and hybrid vehicles, and increasing consumer awareness regarding engine performance optimization. The market has experienced steady growth at a CAGR of 3.2% over recent years, with synthetic and semi-synthetic formulations gaining significant traction among both commercial fleet operators and individual consumers.

Regional distribution shows that Germany, France, United Kingdom, Italy, and Spain collectively account for approximately 68% of total market consumption, reflecting their substantial automotive manufacturing bases and large vehicle populations. The market structure includes established multinational corporations, regional specialists, and emerging private label brands competing across various price segments and performance categories.

Technological advancement remains a cornerstone of market evolution, with manufacturers investing heavily in research and development to create formulations that meet increasingly complex engine requirements while supporting extended drain intervals and improved fuel economy performance.

The European automotive engine oils market refers to the comprehensive commercial ecosystem encompassing the production, distribution, and consumption of specialized lubricating fluids designed to protect, clean, and optimize the performance of internal combustion engines in passenger cars, commercial vehicles, motorcycles, and other automotive applications throughout European territories.

Engine oils serve multiple critical functions including friction reduction between moving engine components, heat dissipation, contaminant suspension and removal, corrosion protection, and sealing enhancement between pistons and cylinder walls. These sophisticated chemical formulations combine base oils derived from petroleum refining or synthetic manufacturing processes with carefully selected additive packages that provide specific performance characteristics.

Market scope encompasses various viscosity grades, performance specifications, and application-specific formulations ranging from conventional mineral oils to advanced full synthetic products. The European market operates under strict regulatory frameworks established by organizations such as the European Automobile Manufacturers Association and various national standards bodies that ensure product quality and environmental compliance.

Strategic positioning within the European automotive engine oils market reveals a landscape characterized by intense competition, technological innovation, and evolving consumer preferences toward premium synthetic formulations. The market demonstrates remarkable adaptability to regulatory changes while maintaining steady growth trajectories across multiple product segments and geographic regions.

Key market drivers include the increasing average age of vehicle fleets, which extends to approximately 11.8 years across European markets, creating sustained demand for maintenance products including engine oils. Additionally, the growing adoption of turbocharged engines and direct injection technologies requires specialized lubricants with enhanced performance capabilities.

Competitive dynamics show established global brands maintaining market leadership while regional players and private label manufacturers capture increasing market share through competitive pricing strategies and targeted product development. The market structure supports both premium positioning and value-oriented approaches, creating opportunities for diverse business models and customer segments.

Future outlook indicates continued market evolution driven by electrification trends, sustainability initiatives, and advancing engine technologies that demand increasingly sophisticated lubricant solutions. Despite the gradual transition toward electric vehicles, internal combustion engines are expected to remain prevalent for the foreseeable future, sustaining market demand.

Market segmentation analysis reveals distinct patterns in consumer behavior and product preferences across different European regions and vehicle categories. Understanding these insights provides valuable guidance for market participants seeking to optimize their strategic positioning and resource allocation.

Regulatory compliance serves as a fundamental market driver, with European Union emissions standards and environmental regulations creating continuous demand for advanced lubricant formulations. The implementation of Euro 6 standards and upcoming Euro 7 requirements necessitate engine oils that support sophisticated emission control systems while maintaining optimal engine performance.

Technological advancement in automotive engineering drives demand for specialized lubricants capable of protecting increasingly complex engine designs. Modern engines featuring turbocharging, direct injection, variable valve timing, and start-stop systems require oils with enhanced thermal stability, oxidation resistance, and deposit control properties.

Fleet modernization across European commercial transportation sectors creates substantial demand for high-performance engine oils that support extended service intervals and improved fuel economy. Fleet operators increasingly recognize that premium lubricants can reduce total cost of ownership through enhanced engine protection and reduced maintenance requirements.

Consumer awareness regarding engine maintenance and performance optimization continues expanding, driven by digital information access and automotive education initiatives. Informed consumers increasingly understand the relationship between oil quality and engine longevity, supporting market growth for premium product segments.

Economic factors including fuel price volatility and environmental consciousness encourage consumers to seek engine oils that provide measurable fuel economy benefits. Manufacturers respond by developing low-friction formulations that can demonstrate quantifiable efficiency improvements.

Electric vehicle adoption represents the most significant long-term restraint facing the European automotive engine oils market. As governments implement aggressive electrification targets and consumers increasingly embrace electric mobility, the installed base of internal combustion engines will gradually decline, reducing overall market demand.

Extended drain intervals supported by advanced synthetic formulations create a paradoxical challenge for market growth. While premium products command higher prices, their extended service life reduces consumption frequency, potentially limiting volume growth despite value improvements.

Economic uncertainty and periodic downturns affect consumer spending patterns and commercial fleet investment decisions. During challenging economic periods, price-sensitive consumers may defer maintenance or choose lower-cost alternatives, impacting premium product segments.

Raw material volatility in base oil and additive pricing creates margin pressure and supply chain challenges for manufacturers. Fluctuations in crude oil prices and specialty chemical costs can significantly impact production economics and market pricing strategies.

Regulatory complexity across different European markets creates compliance challenges and increased costs for manufacturers serving multiple countries. Varying national standards and certification requirements can complicate product development and market entry strategies.

Premium product positioning offers substantial opportunities for manufacturers capable of demonstrating clear performance advantages and value propositions. Consumers increasingly recognize the benefits of high-quality lubricants, creating market space for innovative formulations that command premium pricing.

Sustainability initiatives present opportunities for companies developing environmentally friendly products and packaging solutions. Bio-based formulations, recyclable containers, and carbon-neutral manufacturing processes can differentiate brands and appeal to environmentally conscious consumers.

Digital transformation enables new business models including direct-to-consumer sales, subscription services, and data-driven maintenance recommendations. Companies leveraging digital technologies can create competitive advantages and improve customer relationships.

Commercial fleet services represent growing opportunities for integrated lubricant supply and maintenance programs. Fleet operators value comprehensive solutions that simplify procurement, reduce administrative burden, and optimize total cost of ownership.

Emerging markets within Eastern Europe continue developing automotive infrastructure and consumer purchasing power, creating expansion opportunities for established brands and innovative products. These markets often demonstrate strong growth potential and less saturated competitive landscapes.

Supply chain integration continues evolving as manufacturers seek greater control over raw material sourcing, production efficiency, and distribution networks. Vertical integration strategies help companies manage costs, ensure quality consistency, and respond more effectively to market changes.

Innovation cycles in the European automotive engine oils market typically span 3-5 years, driven by automotive manufacturer specifications, regulatory changes, and competitive pressures. Companies must balance research and development investments with market timing to achieve optimal returns on innovation efforts.

Price competition remains intense across all market segments, with manufacturers employing various strategies including premium positioning, value engineering, and private label partnerships. Successful companies differentiate through performance benefits, brand reputation, and customer service excellence.

Channel partnerships play crucial roles in market access and customer relationships. Manufacturers must navigate complex distribution networks including automotive dealerships, independent service centers, retail chains, and online platforms while maintaining brand consistency and pricing discipline.

According to MarkWide Research, market dynamics indicate that companies successfully adapting to electrification trends while maintaining strong positions in traditional segments achieve the most sustainable competitive advantages. This dual approach enables revenue diversification and risk mitigation during the automotive industry transition period.

Comprehensive analysis of the European automotive engine oils market employs multiple research methodologies to ensure accuracy, reliability, and actionable insights. The research framework combines quantitative data collection with qualitative market intelligence to provide a complete understanding of market dynamics and future trends.

Primary research includes structured interviews with industry executives, technical specialists, distribution partners, and end-users across major European markets. These conversations provide firsthand insights into market challenges, opportunities, and strategic priorities that shape industry direction.

Secondary research encompasses analysis of industry publications, regulatory documents, company financial reports, and technical literature to establish market context and validate primary findings. This comprehensive approach ensures research conclusions are well-supported by multiple information sources.

Market modeling utilizes statistical analysis and forecasting techniques to project future market trends based on historical data, identified drivers, and anticipated changes in automotive technology and consumer behavior. These models provide quantitative foundations for strategic planning and investment decisions.

Data validation processes include cross-referencing multiple sources, expert review panels, and sensitivity analysis to ensure research accuracy and reliability. Quality assurance measures help maintain the integrity of findings and recommendations throughout the research process.

Germany maintains its position as the largest European automotive engine oils market, representing approximately 22% of regional consumption. The German market is characterized by strong preference for premium synthetic products, extensive automotive manufacturing presence, and sophisticated consumer awareness regarding lubricant performance benefits.

France demonstrates steady market growth with particular strength in commercial vehicle applications and agricultural equipment segments. French consumers show increasing adoption of extended drain interval products, with synthetic and semi-synthetic formulations gaining 38% market share over recent years.

United Kingdom presents unique market dynamics influenced by Brexit implications, changing automotive preferences, and evolving distribution channels. Despite political uncertainties, the UK market maintains robust demand for high-performance engine oils across passenger and commercial vehicle segments.

Italy and Spain collectively represent significant market opportunities with growing automotive aftermarket sectors and increasing consumer sophistication. These Southern European markets show particular strength in motorcycle and small engine applications, reflecting regional transportation preferences and climate considerations.

Nordic countries including Sweden, Norway, Denmark, and Finland demonstrate strong preference for environmentally friendly products and advanced synthetic formulations designed for extreme temperature performance. These markets often serve as testing grounds for innovative products and sustainable packaging solutions.

Eastern European markets including Poland, Czech Republic, and Hungary continue expanding rapidly, driven by economic development, automotive industry growth, and increasing consumer purchasing power. These markets present substantial growth opportunities for both established brands and emerging competitors.

Market leadership in the European automotive engine oils sector is shared among several multinational corporations that have established strong brand recognition, extensive distribution networks, and comprehensive product portfolios serving diverse customer segments and applications.

Competitive strategies vary significantly among market participants, with some companies emphasizing premium positioning and technical innovation while others focus on cost leadership and broad market coverage. Successful companies typically combine strong brand recognition with effective distribution partnerships and customer service excellence.

By Product Type:

By Viscosity Grade:

By Application:

Passenger car segment represents the largest category within the European automotive engine oils market, driven by the substantial installed base of personal vehicles and regular maintenance requirements. This segment shows increasing preference for synthetic formulations, with adoption rates reaching 45% in premium vehicle categories.

Commercial vehicle applications demonstrate strong demand for extended drain interval products that reduce maintenance costs and vehicle downtime. Fleet operators increasingly recognize that premium lubricants can provide total cost of ownership benefits despite higher initial purchase prices.

Motorcycle segment presents unique opportunities due to specialized performance requirements and strong brand loyalty among enthusiasts. European motorcycle markets show particular strength in premium formulations designed for high-performance engines and extreme operating conditions.

High mileage category continues expanding as European vehicle fleets age, creating demand for specialized formulations that address seal deterioration, oil consumption, and deposit formation in older engines. This segment often provides attractive margins due to specialized additive packages and targeted marketing approaches.

Performance and racing applications represent niche but profitable segments where technical excellence and brand reputation command premium pricing. These categories often serve as technology showcases that support broader brand positioning and consumer perception.

Manufacturers benefit from stable demand patterns, opportunities for premium positioning, and potential for technological differentiation. The European market rewards innovation and quality, enabling companies with strong research capabilities to achieve sustainable competitive advantages.

Distributors and retailers enjoy consistent product turnover, attractive margin structures, and opportunities for value-added services. Engine oils represent essential maintenance products with predictable replacement cycles, supporting reliable business planning and inventory management.

Service providers including quick-lube centers and automotive dealerships can leverage engine oil services as customer acquisition and retention tools. These businesses benefit from recurring revenue streams and opportunities to build long-term customer relationships through quality service delivery.

Fleet operators achieve significant benefits through optimized lubricant programs including reduced maintenance costs, extended equipment life, improved fuel economy, and enhanced operational reliability. Professional fleet management increasingly recognizes lubricants as strategic cost management tools.

End consumers benefit from improved engine performance, extended equipment life, enhanced fuel economy, and reduced environmental impact through advanced formulations. Quality engine oils provide measurable value through protection and performance benefits that justify premium pricing.

Strengths:

Weaknesses:

Opportunities:

Threats:

Synthetic oil adoption continues accelerating across European markets, driven by consumer recognition of performance benefits and automotive manufacturer recommendations. This trend supports market value growth despite potential volume constraints from extended service intervals.

Low-viscosity formulations gain increasing market share as automotive manufacturers specify thinner oils to improve fuel economy and reduce emissions. The transition toward 0W-20 and 5W-20 grades reflects industry-wide efficiency optimization efforts.

Sustainability initiatives influence product development and packaging decisions as companies respond to environmental consciousness and regulatory requirements. Bio-based formulations and recyclable containers become increasingly important competitive factors.

Digital transformation enables new customer engagement models including online sales, subscription services, and data-driven maintenance recommendations. Companies leveraging digital technologies create competitive advantages and improve customer relationships.

Service integration trends show increasing collaboration between lubricant manufacturers and service providers to create comprehensive maintenance solutions. These partnerships enhance customer convenience while building stronger business relationships.

MWR analysis indicates that successful companies are those adapting their strategies to embrace both traditional market strengths and emerging trends, creating balanced portfolios that serve evolving customer needs while maintaining competitive positioning.

Product innovation continues driving industry evolution with manufacturers introducing advanced formulations that meet increasingly stringent automotive specifications while providing enhanced performance benefits. Recent developments include ultra-low viscosity grades and extended drain interval capabilities.

Strategic partnerships between lubricant manufacturers and automotive OEMs create opportunities for co-developed products and preferred supplier relationships. These collaborations often result in factory-fill contracts and aftermarket recommendations that provide significant competitive advantages.

Sustainability investments include development of bio-based formulations, renewable energy adoption in manufacturing facilities, and circular economy initiatives focused on packaging and waste reduction. These efforts respond to regulatory requirements and consumer preferences.

Digital platform development enables enhanced customer engagement through mobile applications, online ordering systems, and data analytics capabilities. Companies investing in digital transformation create new revenue streams and improve operational efficiency.

Market consolidation activities include strategic acquisitions, joint ventures, and distribution partnerships that reshape competitive dynamics and market access. These developments often focus on geographic expansion, technology acquisition, or supply chain optimization.

Strategic positioning recommendations emphasize the importance of balancing traditional market strengths with adaptation to emerging trends and technologies. Companies should develop comprehensive strategies that address both current market opportunities and long-term industry evolution.

Innovation investment should focus on sustainable formulations, digital integration capabilities, and advanced performance characteristics that provide measurable customer benefits. Research and development priorities should align with automotive industry trends and regulatory requirements.

Market expansion opportunities exist in Eastern European markets, premium product segments, and integrated service offerings. Companies should evaluate expansion strategies based on competitive positioning, resource capabilities, and market timing considerations.

Partnership development with automotive manufacturers, service providers, and technology companies can create competitive advantages and market access opportunities. Strategic alliances should focus on mutual value creation and long-term relationship building.

Sustainability integration should become a core component of business strategy, encompassing product development, manufacturing processes, and supply chain management. Companies that proactively address environmental concerns will be better positioned for long-term success.

Market evolution over the next decade will be shaped by the gradual transition toward electric vehicles, continued advancement in internal combustion engine technology, and evolving consumer preferences regarding sustainability and performance. Despite electrification trends, internal combustion engines will remain prevalent for the foreseeable future, sustaining market demand.

Growth projections indicate continued market expansion at a moderate CAGR of 2.8% through 2030, driven by premium product adoption, emerging market development, and commercial fleet growth. Value growth is expected to outpace volume growth due to increasing synthetic oil penetration and premium positioning strategies.

Technology advancement will continue driving product innovation with focus on extreme performance capabilities, extended service intervals, and environmental compatibility. Manufacturers investing in research and development will be best positioned to capture emerging opportunities and maintain competitive advantages.

Regulatory evolution will likely introduce additional environmental standards and performance requirements that create opportunities for advanced formulations while potentially challenging traditional products. Companies must maintain flexibility to adapt to changing regulatory landscapes.

MarkWide Research projects that successful market participants will be those combining strong traditional market positions with innovative approaches to sustainability, digitalization, and customer engagement. The future market will reward companies that can effectively balance heritage strengths with forward-looking strategies.

The European automotive engine oils market represents a mature yet dynamic sector that continues demonstrating resilience and adaptation capabilities in response to evolving automotive technologies, environmental regulations, and consumer preferences. Despite challenges posed by electric vehicle adoption and market saturation, the industry maintains substantial opportunities for growth and innovation.

Strategic success in this market requires companies to balance traditional strengths with forward-looking approaches that address sustainability, digitalization, and changing customer needs. Organizations that effectively combine heritage market positions with innovative product development and customer engagement strategies will be best positioned for long-term prosperity.

Market fundamentals remain strong, supported by substantial vehicle populations, regular maintenance requirements, and increasing consumer awareness regarding lubricant performance benefits. The transition toward premium synthetic formulations and integrated service offerings creates value growth opportunities despite potential volume constraints from extended drain intervals.

Future market leadership will belong to companies that successfully navigate the industry transformation while maintaining competitive positioning across traditional and emerging segments. The European automotive engine oils market will continue evolving, rewarding innovation, sustainability, and customer-focused strategies that create measurable value for all stakeholders involved in this essential automotive sector.

What is Automotive Engine Oils?

Automotive engine oils are lubricants specifically formulated for use in internal combustion engines. They help reduce friction, prevent wear, and enhance engine performance and longevity.

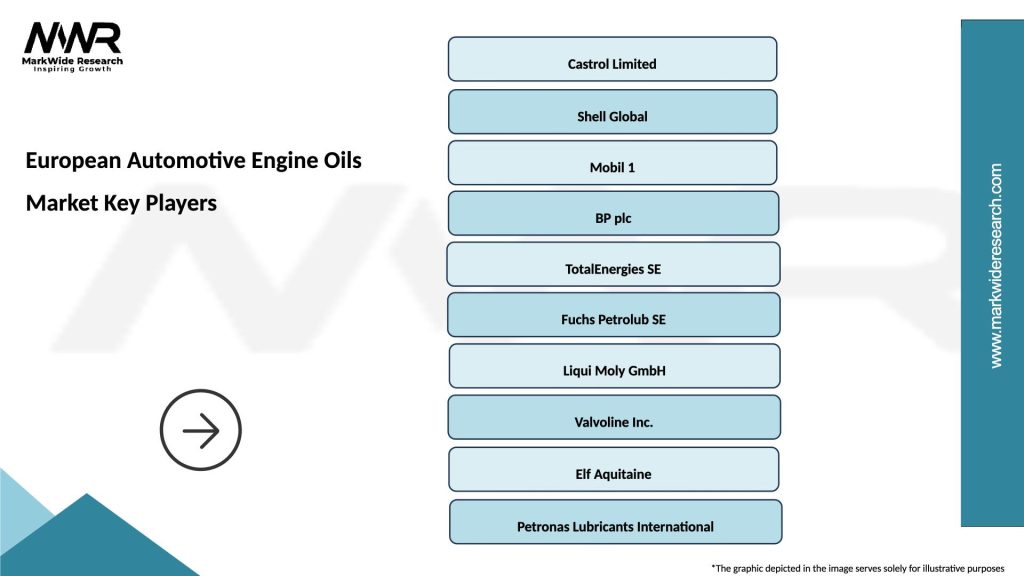

What are the key players in the European Automotive Engine Oils Market?

Key players in the European Automotive Engine Oils Market include companies like Castrol, Mobil, and TotalEnergies, which offer a range of products for various vehicle types and performance requirements, among others.

What are the main drivers of the European Automotive Engine Oils Market?

The main drivers of the European Automotive Engine Oils Market include the increasing vehicle production, rising consumer awareness about engine maintenance, and advancements in oil formulation technologies that enhance performance.

What challenges does the European Automotive Engine Oils Market face?

Challenges in the European Automotive Engine Oils Market include stringent environmental regulations, the shift towards electric vehicles, and the need for continuous innovation to meet changing consumer demands.

What opportunities exist in the European Automotive Engine Oils Market?

Opportunities in the European Automotive Engine Oils Market include the growing demand for high-performance synthetic oils, the expansion of the automotive aftermarket, and the potential for bio-based engine oils as sustainability becomes a priority.

What trends are shaping the European Automotive Engine Oils Market?

Trends shaping the European Automotive Engine Oils Market include the increasing adoption of low-viscosity oils, the rise of smart oil monitoring systems, and a focus on environmentally friendly formulations to meet consumer preferences.

European Automotive Engine Oils Market

| Segmentation Details | Description |

|---|---|

| Product Type | Synthetic, Semi-Synthetic, Mineral, Bio-Based |

| Grade | SAE 0W-20, SAE 5W-30, SAE 10W-40, SAE 15W-50 |

| End User | OEMs, Aftermarket Providers, Dealerships, Fleet Operators |

| Packaging Type | Drum, Bottle, Pail, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Automotive Engine Oils Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at