444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA travel retail market represents a dynamic and rapidly evolving sector that encompasses duty-free shopping, airport retail, and travel-related commerce across the Middle East and Africa regions. This market has experienced remarkable transformation in recent years, driven by increasing international travel, expanding airport infrastructure, and growing consumer spending power among travelers. The region’s strategic position as a global transit hub has positioned it as a critical player in the international travel retail landscape.

Market dynamics indicate that the MEA travel retail sector is experiencing robust growth, with industry analysts projecting a compound annual growth rate (CAGR) of 8.2% over the forecast period. This growth trajectory is supported by significant investments in airport modernization, the expansion of duty-free retail spaces, and the increasing popularity of luxury goods among Middle Eastern and African travelers. The market encompasses various product categories including perfumes and cosmetics, alcohol and tobacco, confectionery, fashion accessories, and electronics.

Regional characteristics play a crucial role in shaping market dynamics, with the Middle East serving as a major transit hub connecting Asia, Europe, and Africa. Countries like the United Arab Emirates, Qatar, and Saudi Arabia have emerged as key markets, while African nations are showing increasing potential for travel retail development. The market benefits from a diverse customer base including business travelers, leisure tourists, and transit passengers, each contributing to different consumption patterns and preferences.

The MEA travel retail market refers to the comprehensive ecosystem of retail operations specifically designed to serve travelers within airports, seaports, border crossings, and other travel-related venues across the Middle East and Africa regions. This specialized retail environment operates under unique regulatory frameworks that allow for duty-free and tax-free shopping, creating distinctive value propositions for international travelers.

Travel retail operations encompass a wide range of commercial activities including duty-free shops, specialty boutiques, food and beverage outlets, and service providers located within travel terminals. These establishments cater to the specific needs and preferences of travelers, offering everything from last-minute travel essentials to luxury goods and local specialties. The market operates under special customs and taxation arrangements that enable competitive pricing and exclusive product offerings.

Operational characteristics of the MEA travel retail market include extended operating hours to accommodate international flight schedules, multilingual customer service capabilities, and specialized inventory management systems designed to handle high-volume, fast-turnover retail environments. The market serves as a crucial revenue generator for airport operators and contributes significantly to the overall travel experience for millions of passengers annually.

Strategic positioning of the MEA travel retail market reflects its critical role in the global travel retail ecosystem, with the region serving as a major connecting point for international travelers. The market has demonstrated resilience and adaptability, particularly in response to changing travel patterns and consumer preferences. Key performance indicators show consistent growth in passenger traffic, with international passenger volumes increasing by 12.5% annually in major regional hubs.

Market segmentation reveals diverse opportunities across product categories, with luxury goods and cosmetics representing the largest revenue segments. The market benefits from a affluent customer base, particularly in Gulf Cooperation Council countries, where high disposable income levels drive premium product sales. Technology integration has become increasingly important, with digital payment systems and mobile shopping platforms gaining 35% adoption rates among travelers.

Competitive landscape features a mix of international travel retail operators, local retailers, and brand-specific boutiques. Major players have established strong partnerships with airport authorities and airlines to secure prime retail locations and develop integrated shopping experiences. The market continues to evolve with changing consumer preferences, sustainability concerns, and technological advancements shaping future development strategies.

Consumer behavior patterns in the MEA travel retail market reveal several distinctive characteristics that differentiate this region from other global markets. Understanding these patterns is essential for retailers and stakeholders looking to optimize their market presence and revenue generation strategies.

Infrastructure development serves as a primary catalyst for MEA travel retail market expansion, with governments across the region investing heavily in airport modernization and capacity expansion projects. These investments create new retail opportunities and enhance the overall shopping experience for travelers. Major airport expansion projects in Dubai, Doha, Riyadh, and other regional hubs are incorporating state-of-the-art retail facilities designed to maximize commercial revenue potential.

Tourism growth initiatives implemented by regional governments are driving increased international visitor arrivals and transit passenger volumes. Countries like the UAE, Qatar, and Saudi Arabia have launched ambitious tourism development programs that include visa liberalization, cultural attractions, and business event hosting. These initiatives directly translate into higher passenger throughput and increased travel retail opportunities.

Economic diversification strategies across oil-dependent economies are promoting service sector development, including travel and tourism industries. This strategic shift creates supportive policy environments for travel retail development and encourages private sector investment in retail infrastructure. The focus on creating world-class travel experiences supports premium retail positioning and luxury brand partnerships.

Demographic advantages in many MEA countries, including young populations with increasing disposable income and international exposure, create favorable conditions for travel retail growth. Rising middle-class populations in countries like Egypt, Morocco, and South Africa are contributing to domestic and regional travel demand, expanding the customer base for travel retail operations.

Economic volatility in certain regional markets poses challenges for consistent travel retail performance, with currency fluctuations and economic uncertainty affecting consumer spending patterns. Oil price volatility particularly impacts Gulf economies, creating periods of reduced discretionary spending that affect luxury goods sales in travel retail environments.

Regulatory complexities across different countries within the MEA region create operational challenges for travel retail operators. Varying customs regulations, import restrictions, and taxation policies require sophisticated compliance management and can limit product availability or pricing flexibility. These regulatory differences also complicate regional expansion strategies for retail operators.

Security concerns and geopolitical tensions in certain areas can impact travel patterns and passenger confidence, leading to reduced traffic volumes in affected regions. Security measures, while necessary, can also create operational constraints and affect the shopping experience through increased processing times and restrictions on certain product categories.

Infrastructure limitations in some markets, particularly in parts of Africa, constrain travel retail development opportunities. Limited airport facilities, inadequate storage and logistics capabilities, and insufficient retail space allocation can restrict market growth potential and operational efficiency.

Digital transformation initiatives present significant opportunities for enhancing customer experience and operational efficiency in MEA travel retail markets. Implementation of advanced technologies including artificial intelligence, augmented reality, and mobile commerce platforms can create differentiated shopping experiences and improve customer engagement. MarkWide Research analysis indicates that digital integration could improve customer satisfaction rates by up to 42% while increasing average transaction values.

Luxury market expansion opportunities exist as regional wealth continues to grow and luxury consumption patterns evolve. The increasing presence of high-net-worth individuals and growing appreciation for premium brands create opportunities for exclusive retail partnerships and limited-edition product launches. Luxury travel retail concepts can command premium pricing and generate higher profit margins.

Sustainable retail concepts are gaining traction as environmental consciousness increases among travelers. Opportunities exist for retailers to develop eco-friendly product lines, implement sustainable packaging solutions, and create carbon-neutral shopping experiences. These initiatives can appeal to environmentally conscious consumers while supporting corporate sustainability goals.

Regional brand development presents opportunities to showcase local products and cultural heritage through travel retail channels. Authentic regional products, artisanal goods, and cultural experiences can differentiate MEA travel retail offerings from other global markets while supporting local economies and preserving cultural traditions.

Supply chain evolution in the MEA travel retail market reflects changing global trade patterns and regional economic development. Retailers are increasingly focusing on supply chain optimization to ensure product availability while managing costs and maintaining quality standards. Advanced inventory management systems and predictive analytics are being deployed to optimize stock levels and reduce waste.

Customer experience enhancement has become a critical competitive factor, with retailers investing in personalized service delivery, multilingual support, and cultural sensitivity training for staff. The integration of digital technologies with traditional retail approaches creates omnichannel experiences that cater to diverse customer preferences and shopping behaviors.

Partnership strategies between travel retail operators, airport authorities, airlines, and brand partners are evolving to create more integrated and seamless shopping experiences. These collaborations often involve revenue-sharing arrangements, joint marketing initiatives, and coordinated customer service delivery that benefits all stakeholders.

Market consolidation trends are evident as larger operators acquire smaller players to achieve economies of scale and expand market coverage. This consolidation enables more efficient operations, better negotiating power with suppliers, and the ability to implement consistent service standards across multiple locations.

Comprehensive market analysis for the MEA travel retail market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research activities include structured interviews with industry executives, retail operators, airport authorities, and key stakeholders across the region. These interviews provide insights into market trends, operational challenges, and strategic priorities that shape market development.

Secondary research components involve analysis of industry reports, government publications, trade association data, and company financial statements. This research provides quantitative data on market performance, passenger traffic statistics, retail sales figures, and competitive positioning. Cross-referencing multiple data sources ensures validation and accuracy of market assessments.

Field research activities include site visits to major airports and travel retail locations across the MEA region to observe operational practices, customer behavior patterns, and retail environment characteristics. These observations provide valuable context for understanding market dynamics and identifying emerging trends that may not be captured through traditional research methods.

Data analysis techniques employ statistical modeling, trend analysis, and comparative assessment methodologies to identify market patterns and project future developments. Advanced analytics tools are used to process large datasets and extract meaningful insights that inform market forecasts and strategic recommendations.

Gulf Cooperation Council countries dominate the MEA travel retail landscape, with the United Arab Emirates leading in terms of passenger volume and retail revenue generation. Dubai International Airport serves as a major global hub, capturing 28% of regional travel retail market share through its extensive duty-free operations and luxury retail offerings. Qatar and Saudi Arabia are rapidly expanding their travel retail capabilities through major airport development projects and tourism promotion initiatives.

North African markets present emerging opportunities, with Egypt and Morocco showing strong growth potential driven by increasing tourism and business travel. These markets benefit from strategic geographic positioning and growing international connectivity. However, economic challenges and infrastructure limitations continue to constrain full market potential in some areas.

Sub-Saharan African markets represent the fastest-growing segment of the regional travel retail landscape, with countries like South Africa, Kenya, and Nigeria leading development efforts. These markets are characterized by rapidly expanding middle-class populations and increasing international travel participation. MWR data suggests that Sub-Saharan Africa could achieve 15% annual growth rates in travel retail revenues over the next five years.

Regional connectivity improvements through new airline routes, visa facilitation programs, and airport partnerships are creating integrated travel retail opportunities. Cross-border shopping patterns and regional tourism flows are contributing to market expansion and creating opportunities for specialized retail concepts targeting regional travelers.

Market leadership in the MEA travel retail sector is characterized by a mix of international operators and regional specialists who have developed strong relationships with airport authorities and established comprehensive retail networks. The competitive environment continues to evolve as new players enter the market and existing operators expand their presence.

Competitive strategies focus on securing prime retail locations, developing exclusive brand partnerships, and creating differentiated customer experiences. Operators are investing in technology integration, staff training, and inventory optimization to maintain competitive advantages in an increasingly sophisticated market environment.

Product category segmentation reveals distinct performance patterns and growth opportunities across different retail segments within the MEA travel retail market. Understanding these segments is crucial for retailers and suppliers developing targeted market strategies.

By Product Category:

By Location Type:

By Customer Segment:

Perfumes and cosmetics dominate the MEA travel retail landscape, benefiting from strong cultural appreciation for fragrances and beauty products across the region. This category shows consistent performance with average transaction values 45% higher than other product categories. Premium and luxury brands perform particularly well, with customers willing to pay premium prices for exclusive or limited-edition products.

Fashion and luxury goods represent a rapidly growing segment, driven by increasing wealth and fashion consciousness among regional travelers. International luxury brands are expanding their travel retail presence, often offering exclusive products or special editions not available in regular retail channels. This category benefits from the aspirational shopping behavior common among Middle Eastern consumers.

Electronics and technology products appeal particularly to business travelers and younger demographics, with smartphones, accessories, and travel gadgets showing strong sales performance. The category benefits from duty-free pricing advantages and the convenience of purchasing technology products while traveling.

Food and confectionery serve both impulse purchase and gift-giving needs, with local specialties and international brands both performing well. This category shows strong seasonal variations and benefits from attractive packaging and presentation that appeals to travelers seeking gifts or souvenirs.

Cultural and artisanal products are gaining importance as travelers increasingly seek authentic local experiences and unique products that reflect regional heritage. These products often command premium prices and contribute to destination branding efforts while supporting local artisans and cultural preservation.

Airport operators benefit significantly from travel retail operations through non-aeronautical revenue generation that can account for up to 40% of total airport revenues. These retail operations provide stable income streams that are less dependent on airline operations and can help offset infrastructure development costs. Additionally, quality retail offerings enhance passenger satisfaction and airport competitiveness.

Retail operators gain access to captive customer bases with high disposable income and limited shopping alternatives. The travel retail environment allows for premium pricing strategies and exclusive product offerings that generate higher profit margins than traditional retail operations. Operators also benefit from extended operating hours and year-round customer traffic.

Brand partners achieve global market access and brand exposure through travel retail channels, often reaching customers who may not visit traditional retail locations. Travel retail provides opportunities for product launches, brand building, and customer acquisition in international markets. The environment also allows for experiential marketing and customer engagement activities.

Government stakeholders benefit from increased tourism revenue, job creation, and economic diversification through travel retail development. These operations contribute to national branding efforts and help position countries as attractive travel destinations. Tax revenues and economic multiplier effects provide additional benefits to local economies.

Travelers and consumers enjoy convenient access to duty-free shopping, exclusive products, and competitive pricing. The travel retail environment provides entertainment and shopping opportunities during travel delays or layovers, enhancing the overall travel experience. Access to local products and cultural items also enriches travel experiences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Experiential retail concepts are transforming the MEA travel retail landscape, with operators moving beyond traditional product sales to create immersive shopping experiences. These concepts include interactive product demonstrations, cultural exhibitions, and personalized service offerings that engage customers and create memorable experiences. Virtual reality and augmented reality technologies are being integrated to showcase products and destinations.

Sustainability initiatives are gaining momentum as environmental consciousness increases among travelers and operators. Retailers are implementing eco-friendly packaging, reducing plastic usage, and sourcing sustainable products. Carbon-neutral shopping experiences and environmental impact reduction programs are becoming competitive differentiators in the market.

Personalization and customization services are expanding, with retailers offering engraving, monogramming, and bespoke product creation services. These value-added services command premium pricing and create unique customer experiences that cannot be replicated in online shopping environments.

Local product integration is increasing as travelers seek authentic cultural experiences and unique regional products. Retailers are partnering with local artisans, designers, and producers to offer exclusive products that reflect regional heritage and craftsmanship. These products often generate higher profit margins and contribute to destination branding efforts.

Omnichannel integration is developing as retailers create seamless connections between physical stores, online platforms, and mobile applications. Customers can research products online, reserve items for airport pickup, and access exclusive travel retail offers through digital channels. This integration enhances convenience and expands sales opportunities.

Major airport expansion projects across the MEA region are creating new travel retail opportunities and driving market growth. Dubai’s Al Maktoum International Airport development, Saudi Arabia’s NEOM airport project, and Qatar’s Hamad International Airport expansion are incorporating state-of-the-art retail facilities designed to maximize commercial revenue potential.

Technology partnerships between travel retail operators and technology companies are advancing digital transformation initiatives. Implementation of artificial intelligence for inventory management, mobile payment solutions, and customer analytics platforms are improving operational efficiency and customer experience quality.

Brand partnership expansions are evident as luxury and premium brands increase their travel retail presence in the MEA region. Exclusive store openings, limited-edition product launches, and brand experience centers are becoming common features in major airport retail environments.

Sustainability certifications and environmental responsibility programs are being implemented by major travel retail operators. These initiatives include waste reduction programs, sustainable sourcing policies, and carbon footprint reduction targets that align with global sustainability trends and customer expectations.

Regional cooperation initiatives are facilitating travel retail development through visa facilitation programs, airport partnership agreements, and joint marketing campaigns. These collaborative efforts are creating integrated travel experiences and expanding market opportunities across national boundaries.

Strategic positioning recommendations for MEA travel retail market participants emphasize the importance of understanding local cultural preferences while maintaining international appeal. MarkWide Research analysis suggests that successful operators should focus on creating culturally sensitive retail environments that respect regional values while offering globally recognized brands and products.

Investment priorities should focus on technology integration, staff training, and customer experience enhancement initiatives. Operators investing in digital transformation and personalized service delivery are likely to achieve competitive advantages and higher customer satisfaction rates. Priority should be given to mobile commerce platforms and data analytics capabilities.

Partnership development strategies should emphasize building strong relationships with airport authorities, airlines, and local stakeholders. Collaborative approaches that benefit all parties are more likely to secure favorable lease terms, prime retail locations, and operational support. Long-term partnership agreements provide stability and growth opportunities.

Product portfolio optimization should balance international brand appeal with local product offerings and cultural authenticity. Retailers should regularly assess product performance and customer preferences to optimize inventory mix and maximize sales potential. Seasonal adjustments and special event promotions can enhance revenue generation.

Operational efficiency improvements through supply chain optimization, inventory management systems, and staff productivity enhancement can significantly impact profitability. Operators should invest in training programs, technology solutions, and process improvements that reduce costs while maintaining service quality standards.

Market expansion prospects for the MEA travel retail sector remain highly positive, with continued infrastructure development and tourism growth initiatives supporting long-term market development. Regional governments’ commitment to economic diversification and tourism promotion creates favorable conditions for sustained market expansion over the forecast period.

Technology integration acceleration will continue transforming the travel retail landscape, with artificial intelligence, machine learning, and Internet of Things technologies becoming standard operational tools. These technologies will enable more personalized customer experiences, optimized inventory management, and improved operational efficiency. Digital payment adoption rates are expected to reach 75% by 2028.

Sustainability focus intensification will drive product development, operational practices, and customer engagement strategies. Retailers adopting comprehensive sustainability programs are likely to achieve competitive advantages and appeal to environmentally conscious consumers. Circular economy principles and waste reduction initiatives will become standard practices.

Regional market integration will create expanded opportunities for travel retail operators through improved connectivity, visa facilitation, and cross-border cooperation initiatives. These developments will enable more efficient operations, broader customer reach, and enhanced economies of scale for regional operators.

Customer experience evolution will continue emphasizing personalization, convenience, and cultural authenticity. Successful operators will create seamless omnichannel experiences that combine digital convenience with physical retail advantages. Cultural sensitivity and local market knowledge will become increasingly important competitive factors.

The MEA travel retail market represents a dynamic and rapidly evolving sector with significant growth potential driven by infrastructure development, tourism expansion, and increasing consumer sophistication. The region’s strategic geographic position, combined with substantial government investments in aviation and tourism infrastructure, creates favorable conditions for sustained market development.

Market opportunities are particularly strong in luxury goods, experiential retail concepts, and culturally authentic products that appeal to the region’s affluent and diverse traveler base. Technology integration and sustainability initiatives are becoming critical success factors, while operational excellence and cultural sensitivity remain fundamental requirements for market success.

Strategic success in the MEA travel retail market requires understanding of local cultural preferences, investment in technology and customer experience enhancement, and development of strong partnerships with key stakeholders. Operators who can balance international appeal with regional authenticity while maintaining operational efficiency are best positioned for long-term success in this growing market.

What is MEA Travel Retail?

MEA Travel Retail refers to the sale of goods to travelers in the Middle East and Africa region, typically occurring in airports, hotels, and other travel-related venues. This sector includes a variety of products such as cosmetics, electronics, and luxury goods.

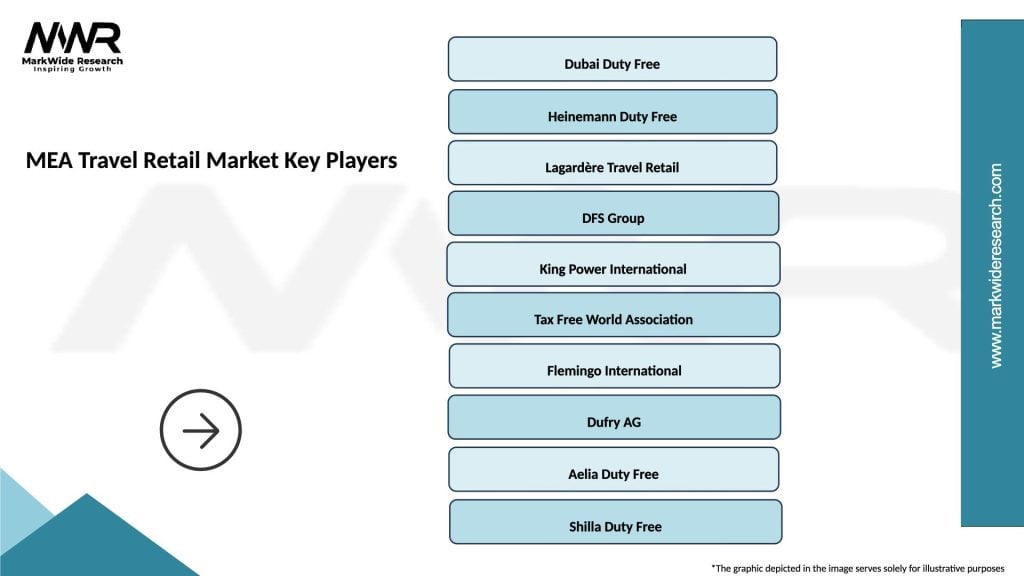

What are the key players in the MEA Travel Retail Market?

Key players in the MEA Travel Retail Market include Dufry AG, Lagardère Travel Retail, and Dubai Duty Free, among others. These companies dominate the market by offering a wide range of products and services tailored to travelers.

What are the growth factors driving the MEA Travel Retail Market?

The MEA Travel Retail Market is driven by increasing air travel, a growing middle class, and the rise of tourism in the region. Additionally, the expansion of airport infrastructure and the introduction of new retail concepts contribute to market growth.

What challenges does the MEA Travel Retail Market face?

The MEA Travel Retail Market faces challenges such as fluctuating currency exchange rates, regulatory hurdles, and competition from online retail. These factors can impact pricing strategies and consumer purchasing behavior.

What opportunities exist in the MEA Travel Retail Market?

Opportunities in the MEA Travel Retail Market include the expansion of e-commerce platforms, the introduction of personalized shopping experiences, and the potential for growth in emerging markets. These trends can enhance customer engagement and drive sales.

What trends are shaping the MEA Travel Retail Market?

Trends in the MEA Travel Retail Market include a focus on sustainability, the integration of technology in shopping experiences, and the rise of local brands. These trends reflect changing consumer preferences and the need for retailers to adapt to new market dynamics.

MEA Travel Retail Market

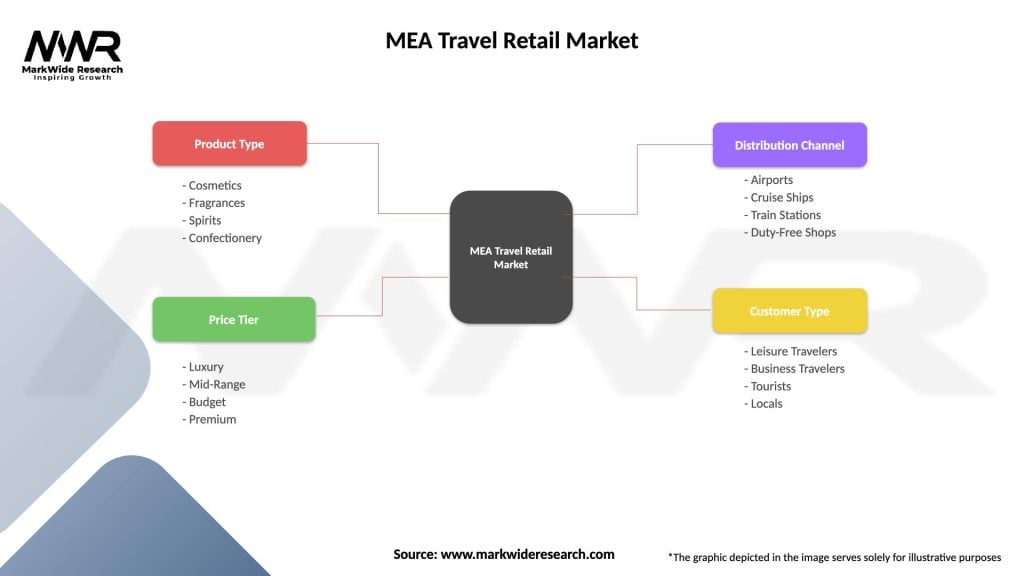

| Segmentation Details | Description |

|---|---|

| Product Type | Cosmetics, Fragrances, Spirits, Confectionery |

| Price Tier | Luxury, Mid-Range, Budget, Premium |

| Distribution Channel | Airports, Cruise Ships, Train Stations, Duty-Free Shops |

| Customer Type | Leisure Travelers, Business Travelers, Tourists, Locals |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Travel Retail Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at